Final accounts exercise

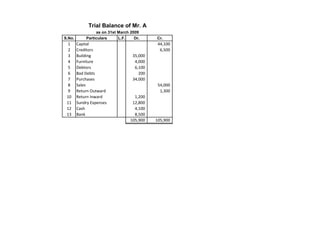

- 1. Trial Balance of Mr. A as on 31st March 2009 S.No. Particulars L.F. Dr. Cr. 1 Capital 44,100 2 Creditors 6,500 3 Building 35,000 4 Furniture 4,000 5 Debtors 6,100 6 Bad Debts 200 7 Purchases 34,000 8 Sales 54,000 9 Return Outward 1,300 10 Return Inward 1,200 11 Sundry Expenses 12,800 12 Cash 4,100 13 Bank 8,500 105,900 105,900

- 2. Worksheet Trial Balance Profit & Loss A/C Balnce Sheet Account Title L.F. Dr. Cr. Dr. Cr. Assets Liabilities Capital 44,100 Creditors 6,500 Building 35,000 Furniture 4,000 Debtors 6,100 Bad Debts 200 Purchases 34,000 Sales 54,000 Return Outward 1,300 Return Inward 1,200 Sundry Expenses 12,800 Cash 4,100 Bank 8,500 105,900 105,900 Profit

- 3. Worksheet Trial Balance Profit & Loss A/C Balnce Sheet Account Title L.F. Dr. Cr. Dr. Cr. Assets Liabilities Capital 44,100 44,100 Creditors 6,500 6,500 Building 35,000 35,000 Furniture 4,000 4,000 Debtors 6,100 6,100 Bad Debts 200 200 Purchases 34,000 34,000 Sales 54,000 54,000 Return Outward 1,300 1,300 Return Inward 1,200 1,200 Sundry Expenses 12,800 12,800 Cash 4,100 4,100 Bank 8,500 8,500 105,900 105,900 Profit 7,100 7,100 55,300 55,300 57,700 57,700

- 4. Trial Balance of Mr. A as on 31st March 2009 S.No. Particulars L.F. Dr. Cr. 1 Capital 44,100 2 Creditors 6,500 3 Building 35,000 4 Furniture 4,000 5 Debtors 6,100 6 Bad Debts 200 7 Purchases 34,000 8 Sales 54,000 9 Return Outward 1,300 10 Return Inward 1,200 11 Sundry Expenses 12,800 12 Cash 4,100 13 Bank 8,500 105,900 105,900 i Stock in trade was valued at Rs. 11,000. ii Included in the sundry expenses account are: Prepaid taxes for the next year for Rs. 400 and a part of the advertisement terrif paid for the first quarter of the next year amounting to Rs. 600. iii Building and furniture will be depreciated @5% and 10% respectively. iv A reserve for bad & doubtful debts will be created @3% v Rent shown with sundry expenses was outstanding for the month of March 2008 for Rs. 500.

- 5. Date Particulars LF i Stock A/C Dr. To Purchases A/C ( being closing stock valued) ii Prepaid Taxes A/C Dr. Prepaid Adverisement A/C Dr. To Sundry Expenses A/C (being adjusted for Prepayments) iii Depreciation A/C Dr. To Buildings A/C To Furnitures A/C (being provided for depreciation) iv Profit & Loss A/C Dr. To Provision for bad debts A/C (being provided for Debtors realisation) v Sundary Expenses A/C Dr. To Rent Outstanding A/C (being adjusted for accrued rent)

- 6. Workshee Dr Cr Account Title Trial Balance Adjustments 11,000 Dr. Cr. Dr. 11,000 Capital 44,100 Creditors 6,500 Building 35,000 400 Furniture 4,000 600 Debtors 6,100 1,000 Bad Debts 200 Purchases 34,000 Sales 54,000 2,150 Return Outward 1,300 1,750 Return Inward 1,200 400 Sundry Expenses 12,800 500 Cash 4,100 Bank 8,500 183 105,900 105,900 183 Stock A/C 11,000 Prepaid Taxes A/C 400 Prepaid Advt. A/C 600 500 Depreciation A/C 2,150 500 Profit & Loss A/C 183 Provision for bad Debts A/C Rent Outstanding A/C 14,833 Profit

- 7. Worksheet Adjustments Adj. Trial Balance Profit & Loss A/C Balance Sheet Cr. Dr. Cr. Dr. Cr. Assets Liabilities 44,100 44,100 6,500 6,500 1,750 33,250 33,250 400 3,600 3,600 6,100 6,100 200 200 11,000 23,000 23,000 54,000 54,000 1,300 1,300 1,200 1,200 1,000 12,300 12,300 4,100 4,100 8,500 8,500 11,000 11,000 400 400 600 600 2,150 2,150 183 183 183 183 183 500 500 500 14,833 106,583 106,583 16,267 39,033 55,300 67,550 67,550

- 8. Trial Balance of Mr. A Date as on 31st March 2009 S.No. Particulars L.F. Dr. Cr. i 1 Purchases 15,000 ii 2 Debtors 20,000 3 Interest earned 400 4 Salaries 3,000 iii 5 Sales 32,100 6 Purchase Returns 500 7 Wages 2,000 8 Rent 1,500 iv 9 Sales Returns 1,000 10 Bad Debts 700 11 Creditors 12,000 12 Capital 10,000 v 13 Drawings 2,400 14 Provision for Bad Debts 600 15 Printing & Stationery 800 16 Insurance 1,200 vi 17 Opening Stock 5,000 18 Office Expenses 1,200 19 Furniture & Fittings 2,000 20 Provision for Depreciation 200 vii 55,800 55,800 i Depreciate Furniture & Fittings by 10% on Original Cost ii Make a provision for bad debts equal to 5% of Debtors viii iii Salaries for the month of March amounting to Rs. 300 were unpaid which must be provided for. iv The balance in the Salaries Account include Rs. 200 paid in advance. v Insurance is prepaid to the extent of Rs. 200 vi Provide Rs. 800 for Office Expenses. vii Stock worth Rs. 600 was put by A to his personal use, the cost of which has not been adjusted. viii Closing Stock was valued at Rs. 6,000.

- 10. Particulars LF Dr Cr Profit & Loss A/C 600 To Provision for Depreciation 200 Account Title To Provision for Doubtful Debts 400 Purchases (being provided for Dep. & bad debts) Debtors Salaries A/C 300 Interest earned To Salaries Outstanding A/C 300 Salaries Sales (being salaries unpaid for March) Purchase Returns Salaries Prepaid A/C 200 Wages To Salaries A/C 200 Rent Sales Returns (being salaries paid in advance) Bad Debts Insurance Prepaid A/C 200 Creditors To Insurance A/C 200 Capital Drawings (being insurance prepaid) Provision for Bad Debts Office Expenses A/C 800 Printing & Stationery To Provision for office expenses 800 Insurance Opening Stock (being provided for Office expenses) Office Expenses Drawings A/C 600 Furniture & Fittings To Purchases A/C 600 Provision for Depreciation (being goods used by the proprietor) Profit & Loss A/C Stock A/C 6,000 Salaries Outstanding A/C To Trading A/C 6,000 Salaries Prepaid A/C Insurance Prepaid A/C (being closing stock valued) Provision for office expenses Closing Stock A/C Trading A/C

- 11. Profit

- 12. Worksheet Trial Balance Adjustments Adj. Trial Balance Profit & Loss A/C Balance Sheet Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Assets Liabilities 15,000 600 14,400 14,400 20,000 20,000 20,000 400 400 400 3,000 300 200 3,100 3,100 32,100 32,100 32,100 500 500 500 2,000 2,000 2,000 1,500 1,500 1,500 1,000 1,000 1,000 700 700 700 12,000 12,000 12,000 10,000 10,000 10,000 2,400 600 3,000 3,000 600 400 1,000 1,000 800 800 800 1,200 200 1,000 1,000 5,000 5,000 5,000 1,200 800 2,000 2,000 2,000 2,000 2,000 200 200 400 400 55,800 55,800 600 600 600 300 300 300 200 200 200 200 200 200 800 800 800 6,000 6,000 6,000 6,000 6,000 6,000 8,700 8,700 63,500 63,500

- 13. 6,900 6,900 39,000 39,000 31,400 31,400

- 14. Trading and Profit & Loss A/C for the year ending 31 Mar. 08 Particulars Amount Particulars Amount Opening stock 5,000 Sales 32,100 Purchases 14,400 Purchase Return 500 wages 2,000 Closing Stock 6,000 Sales Return 1,000 Gross Profit 16,200 38,600 38,600 Salaries 3,100 Gross Profit 16,200 Office Expenses 2,000 Interest 400 Rent 1,500 Insurance 1,000 Printing & Stationery 800 Bad Debts 700 Provision for Bad Debt 400 Provision for depreciation 200 Net Profit 6,900 16,600 16,600 Net Profit 6,900

- 15. Trial Balance of Mr. A as on 31st March 2009 S.No. Particulars L.F. Dr. Cr. 1 Purchases 15,000 2 Debtors 20,000 3 Interest earned 400 4 Salaries 3,000 5 Sales 32,100 6 Purchase Returns 500 7 Wages 2,000 8 Rent 1,500 9 Sales Returns 1,000 10 Bad Debts 700 11 Creditors 12,000 12 Capital 10,000 13 Drawings 2,400 14 Provision for Bad Debts 600 15 Printing & Stationery 800 16 Insurance 1,200 17 Opening Stock 5,000 18 Office Expenses 1,200 19 Furniture & Fittings 2,000 20 Provision for Depreciation 200 55,800 55,800 i Depreciate Furniture & Fittings by 10% on Original Cost ii Make a provision for bad debts equal to 5% of Debtors iii Salaries for the month of March amounting to Rs. 300 were unpaid which must be provided for. iv The balance in the Salaries Account include Rs. 200 paid in advance. v Insurance is prepaid to the extent of Rs. 200 vi Provide Rs. 800 for Office Expenses. vii Stock worth Rs. 600 was put by A to his personal use, the cost of which has not been adjusted. viii Closing Stock was valued at Rs. 6,000.

- 16. Date Particulars LF Dr Cr Profit & Loss A/C 600 i To Provision for Depreciation 200 ii To Provision for Doubtful Debts 400 (being provided for Dep. & bad debts) iii Salaries A/C 300 To Salaries Outstanding A/C 300 (being salaries unpaid for March) iv Salaries Prepaid A/C 200 To Salaries A/C 200 (being salaries paid in advance) v Insurance Prepaid A/C 200 To Insurance A/C 200 (being insurance prepaid) vi Office Expenses A/C 800 To Provision for office expenses 800 (being provided for Office expenses) vii Drawings A/C 600 To Purchases A/C 600 (being goods used by the proprietor) viii Stock A/C 6,000 To Trading A/C 6,000 (being closing stock valued)

- 17. Trading and Profit & Loss A/C for the year ending 31 Mar. 08 Particulars Amount Particulars Amount Opening stock 5,000 Sales 32,100 Purchases 14,400 Purchase Return 500 wages 2,000 Closing Stock 6,000 Sales Return 1,000 Gross Profit 16,200 38,600 38,600 Salaries 3,100 Gross Profit 16,200 Office Expenses 2,000 Interest 400 Rent 1,500 Insurance 1,000 Printing & Stationery 800 Bad Debts 700 Provision for Bad Debt 400 Provision for depreciation 200 Net Profit 6,900 16,600 16,600 Net Profit 6,900

- 18. 3/31/2009 3/31/2008 Profit & Loss Statement Liabilities for the year ending 31-03-09 Equity Share Capital 60,000 50,000 Profit before tax Profit & Loss A/c 5,000 4,000 Taxation Creditors 4,000 2,500 Profit after tax Taxation 1,500 1,000 Proposed dividend Proposed Dividend 2,000 1,000 Profit Retained 72,500 58,500 Assets Land 10,000 10,000 Additional Information : Furniture 17,000 11,000 Vehicles 12,500 8,000 Depreciation for the year Short-term Investments 2,000 1,000 Disposals Stock 17,000 14,000 Proceeds on disposal Debtors 8,000 6,000 Written down value Bank & Cash 6,000 8,500 Profit on disposal 72,500 58,500

- 19. oss Statement Cash Flow Statement ending 31-03-09 for the year ending 31-03-2009 4,500 cash flow from operations 1,500 Net profit before taxation 4,500 3,000 Ajustment for 2,000 Depreciation 3,500 1,000 Profit on sale of Vehicle 700 operating profit before WC changes 7,300 increase in Debtors 2,000 increase in Inventories 3,000 Furniture Vehicles increase in Creditors 1,500 1,000 2,500 cash generated from operations 3,800 Income tax paid 1,000 1,700 Net cash inflow from operations 2,800 1,000 Cash flow from investing activities 700 sale of vehicles 1,700 purchase of vehicles 8,000 purchase of furnitures 7,000 Net cash outflow from investing activities 13,300 Cash flow from financing activities issue of share capital 10,000 dividend paid 1,000 Net cash inflow from financing activities 9,000 Net decrease in cash & cash eq. 1,500 Cash & cash eq. at the beginning 9,500 Cash & cash eq. at the end 8,500

- 20. Comaparative Balance Sheet as on 31st March … Liabilities 2008 2009 Assets 2008 2009 Share Capital 315,000 465,000 Plant 505,000 715,000 Reserves & Surplus 132,000 140,000 Less: Accumulated Dep. 68,000 103,000 Bonds 245,000 295,000 437,000 612,000 Current Liabilities Long Term Investments 127,000 115,000 Account Payable 43,000 50,000 Current Assets Accrued Liabilities 9,000 12,000 Inventory 110,000 144,000 Income Tax Payable 5,000 3,000 Account Receivable 55,000 47,000 Cash 15,000 46,000 Prepaid Expenses 5,000 1,000 749,000 965,000 749,000 965,000 Analysis of selected accounts & transactions during 2008-09: 1 Investment purchased for Rs. 78,000. 2 Investments costing Rs. 90,000 sold for Rs. 102,000. 3 Plant purchased for Rs. 120,000. 4 Plant costing Rs. 10,000 with accumulated depreciation of Rs. 2,000 was sold for Rs. 5,000. 5 Bonds with face value of Rs. 100,000 was issued in exchange of Plant bought on 31st Mar. 09 6 Repaid Rs. 50,000 of bonds at face value at maturity. 7 Issued 15,000 shares of Rs. 10 each. 8 Paid cash dividends Rs. 8,000.

- 21. Profit & Loss Account for the year ending on 31st March 2009 Cost of goods sold 520,000 Sales 698,000 Gross Profit 178,000 698,000 698,000 Depreciation 37,000 Gross Profit 178,000 Adminstration expenses 110,000 Interest received 6,000 Interest paid 23,000 Gain on sale of Investment 12,000 Loss on sale of Plant 3,000 Income tax 7,000 Net Profit 16,000 196,000 196,000 N C C

- 22. Cash Flow Statement for the year ending 31-03-2009 cash flow from operations Net profit before taxation 23,000 Ajustment for: Depreciation 37,000 Profit on sale of Investments 12,000 Loss on sale of Plant 3,000 Interest paid 23,000 Interest received 6,000 operating profit before WC changes 68,000 decrease in account receivables 8,000 increase in Inventories 34,000 decrease in prepaid expenses 4,000 increase in account payable 7,000 increase in accrued liabilities 3,000 cash generated from operations 56,000 Income tax paid 9,000 Net cash inflow from operations 47,000 Cash flow from investing activities sale of Plant 5,000 purchase of Plant 120,000 purchase of Investments 78,000 sale of Investments 102,000 Interest received 6,000 Net cash outflow from investing activities 85,000 Cash flow from financing activities issue of share capital 150,000 Repayment of bond 50,000 Interest paid 23,000 dividend paid 8,000 Net cash inflow from financing activities 69,000 Net increase in cash & cash eq. 31,000 Cash & cash eq. at the beginning 15,000 Cash & cash eq. at the end 46,000