Risk, Return & Portfolio Theory

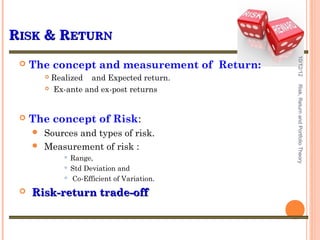

- 1. RISK & RETURN 10/12/12 The concept and measurement of Return: Realized and Expected return. Ex-ante and ex-post returns Risk, Return and Portfolio Theory The concept of Risk: Sources and types of risk. Measurement of risk : Range, Std Deviation and Co-Efficient of Variation. Risk-return trade-off

- 2. Risk, Return &Portfolio Theory Friday, October 12, 2012

- 3. LEARNING OBJECTIVES The difference among the most important types of Risk, Return and Portfolio Theory returns How to estimate expected returns and risk for individual securities What happens to risk and return when securities are combined in a portfolio

- 4. Friday, October 12, 2012 Risk, Return and Portfolio Theory INTRODUCTION TO RISK AND RETURN

- 5. INTRODUCTION TO RISK AND RETURN Risk and return are the two most important attributes of an investment. Risk, Return and Portfolio Theory Research has shown that the two are linked in the capital markets Return and that generally, higher % returns can only be achieved by taking on greater risk. Risk Premium Risk isn’t just the potential loss of return, it is the potential loss of the entire investment itself (loss RF Real Return of both principal and interest). Expected Inflation Rate Consequently, taking on additional Risk risk in search of higher returns is a decision that should not be taking lightly.

- 6. RISK RETURN TRADE OFF The concept of investment return is widely understood. For example, a 10% per annum return on a capital sum of $100,000 would result in $10,000 increase in value for the year. However, what exactly is ‘risk?’. Risk is for the most part unavoidable – in life generally as much as in investing! In investments, the term ‘risk’ is often expressed as ‘volatility’ or variations in returns. In investment terms, the concept of ‘volatility’ is the measurement of fluctuation in the market values of various asset classes as they rise and fall over time. The greater the volatility the more rises and falls are recorded by an individual asset class. The reward for accepting greater volatility is the likely hood of higher investment returns over mid to longer term. The disadvantage can mean lower returns in the shorter term. It must also be remembered that it can mean an increase or decrease in capital. All investments involve some risk. In general terms the higher the risk, the higher the potential return, or loss. Conversely the lower the risk the lower the potential return, or loss. The long-term risk/return trade off between different asset classes is illustrated in the following graph: Risk, Return and Portfolio Theory 10/12/12

- 7. 10/12/12 Risk, Return and Portfolio Theory

- 8. Friday, October 12, 2012 Risk, Return and Portfolio Theory MEASURING RETURNS Risk, Return and Portfolio Theory

- 9. MANY DIFFERENT MATHEMATICAL DEFINITIONS OF "RETURNS"...

- 10. 10/12/12 Risk, Return and Portfolio Theory

- 11. CHAPTER 9 LECTURE. QUANTIFYING & MEASURING INVESTMENT PERFORMANCE: "RETURNS"

- 12. RETURNS RETURNS = PROFITS (IN THE INVESTMENT GAME) RETURNS = OBJECTIVE TO MAXIMIZE (CET.PAR.) RETURNS = WHAT YOU'VE GOT WHAT YOU HAD TO BEGIN WITH, AS A PROPORTION OF WHAT YOU HAD TO BEGIN WITH.

- 13. QUANTITATIVE RETURN MEASURES NECESSARY TO: MEASURE PAST PERFORMANCE => "EX POST" OR HISTORICAL RETURNS; MEASURE EXPECTED FUTURE PERFORMANCE => "EX ANTE" OR EXPECTED RETURNS.

- 14. MANY DIFFERENT MATHEMATICAL DEFINITIONS OF "RETURNS"...

- 15. TYPE 1: PERIOD-BY-PERIOD RETURNS . . . "PERIODIC" RETURNS SIMPLE "HOLDING PERIOD RETURN" (HPR) MEASURES WHAT THE INVESTMENT GROWS TO WITHIN EACH SINGLE PERIOD OF TIME, ASSUMING ALL CASH FLOW (OR VALUATION) IS ONLY AT BEGINNING AND END OF THE PERIOD OF TIME (NO INTERMEDIATE CASH FLOWS).

- 16. TYPE 1: PERIOD-BY-PERIOD RETURNS (CONT’D) RETURNS MEASURED SEPARATELY OVER EACH OF A SEQUENCE OF REGULAR AND CONSECUTIVE (RELATIVELY SHORT) PERIODS OF TIME. SUCH AS: DAILY, MONTHLY, QUARTERLY, OR ANNUAL RETURNS SERIES. E.G.: RETURN TO IBM STOCK IN: 1990, 1991, 1992, ... PERIODIC RETURNS CAN BE AVERAGED ACROSS TIME TO DETERMINE THE "TIME- WEIGHTED" MULTI-PERIOD RETURN.

- 17. TYPE 1: PERIOD-BY-PERIOD RETURNS (CONT’D) THE PERIODS USED TO DEFINE PERIODIC RETURNS SHOULD BE SHORT ENOUGH THAT THE ASSUMPTION OF NO INTERMEDIATE CASH FLOWS DOES NOT MATTER.

- 18. TYPE 2: MULTIPERIOD RETURN MEASURES PROBLEM: WHEN CASH FLOWS OCCUR AT MORE THAN TWO POINTS IN TIME, THERE IS NO SINGLE NUMBER WHICH UNAMBIGUOUSLY MEASURES THE RETURN ON THE INVESTMENT.

- 19. TYPE 2: MULTIPERIOD RETURN MEASURES (CONT’D) NEVERTHELESS,MULTI-PERIOD RETURN MEASURES GIVE A SINGLE RETURN NUMBER (TYPICALLY QUOTED PER ANNUM) MEASURING THE INVESTMENT PERFORMANCE OF A LONG-TERM (MULTI-YEAR) INVESTMENT WHICH MAY HAVE CASH FLOWS AT INTERMEDIATE POINTS IN TIME THROUGHOUT THE "LIFE" OF THE INVESTMENT.

- 20. TYPE 2: MULTIPERIOD RETURN MEASURES (CONT’D) THERE ARE MANY DIFFERENT MULTI-PERIOD RETURN MEASURES, BUT THE MOST FAMOUS AND WIDELY USED (BY FAR) IS:

- 21. THE "INTERNAL RATE OF RETURN" (IRR). THE IRR IS A "DOLLAR-WEIGHTED" RETURN BECAUSE IT REFLECTS THE EFFECT OF HAVING DIFFERENT AMOUNTS OF DOLLARS INVESTED AT DIFFERENT PERIODS IN TIME DURING THE OVERALL LIFETIME OF THE INVESTMENT.

- 22. ADVANTAGES OF PERIOD-BY-PERIOD (TIME-WEIGHTED) RETURNS: 1)ALLOW YOU TO TRACK PERFORMANCE OVER TIME, SEEING WHEN INVESTMENT IS DOING WELL AND WHEN POORLY.

- 23. ADVANTAGES OF PERIOD-BY-PERIOD (TIME-WEIGHTED) RETURNS (CONT’D) 2)ALLOW YOU TO QUANTIFY RISK (VOLATILITY) AND CORRELATION (CO-MOVEMENT) WITH OTHER INVESTMENTS AND OTHER PHENOMENA.

- 24. ADVANTAGES OF PERIOD-BY-PERIOD (TIME-WEIGHTED) RETURNS (CONT’D) 3) ARE FAIRER FOR JUDGING INVESTMENT PERFORMANCE WHEN THE INVESTMENT MANAGER DOES NOT HAVE CONTROL OVER THE TIMING OF CASH FLOW INTO OR OUT OF THE INVESTMENT FUND (E.G., A PENSION FUND).

- 25. ADVANTAGES OF MULTI-PERIOD RETURNS: 1)DO NOT REQUIRE KNOWLEDGE OF MARKET VALUES OF THE INVESTMENT ASSET AT INTERMEDIATE POINTS IN TIME (MAY BE DIFFICULT TO KNOW FOR REAL ESTATE).

- 26. ADVANTAGES OF MULTI-PERIOD RETURNS (CONT’D) 2) GIVES A FAIRER (MORE COMPLETE) MEASURE OF INVESTMENT PERFORMANCE WHEN THE INVESTMENT MANAGER HAS CONTROL OVER THE TIMING AND AMOUNTS OF CASH FLOW INTO AND OUT OF THE INVESTMENT VEHICLE (E.G., PERHAPS SOME "SEPARATE ACCOUNTS" WHERE MGR HAS CONTROL OVER CAPITAL FLOW TIMING, OR A STAGED DEVELOPMENT PROJECT).

- 27. ADVANTAGES OF MULTI-PERIOD RETURNS (CONT’D) NOTE: BOTH HPRs AND IRRs ARE WIDELY USED IN REAL ESTATE INVESTMENT ANALYSIS

- 28. PERIOD-BY-PERIOD RETURNS... "TOTAL RETURN" ("r"): rt=(CFt+Vt-Vt-1)/ Vt-1=((CFt+Vt)/Vt-1) -1 where: CFt= Cash Flow (net) in period "t"; Vt=Asset Value ("ex dividend") at end of period "t". "INCOME RETURN" ("y", AKA "CURRENT YIELD", OR JUST "YIELD"): yt = CFt / Vt-1 "APPRECIATION RETURN" ("g", AKA "CAPITAL GAIN", OR "CAPITAL RETURN", OR "GROWTH"): gt = ( Vt-Vt-1 ) / Vt-1 = Vt / Vt-1 - 1 NOTE: rt = yt + gt

- 29. TOTAL RETURN IS MOST IMPORTANT: To convert y into g, reinvest the cash flow back into the asset. To convert g into y, sell part of the holding in the asset. NOTE: This type of conversion is not so easy to do with most real estate investments as it is with investments in stocks and bonds.

- 30. EXAMPLE: PROPERTY VALUE AT END OF 1994: = $100,000 PROPERTY NET RENT DURING 1995: = $10,000 PROPERTY VALUE AT END OF 1995: = $101,000

- 31. WHAT IS 1995 R, G, Y ?... y1995 = $10,000/$100,000 = 10% g1995 = ($101,000 - $100,000)/$100,000 = 1% r1995 = 10% + 1% = 11%

- 32. A NOTE ON RETURN TERMINOLOGY "INCOME RETURN" - YIELD, CURRENT YIELD, DIVIDEND YIELD. IS IT CASH FLOW BASED OR ACCRUAL INCOME BASED? SIMILAR TO "CAP RATE". IS A RESERVE FOR CAPITAL EXPENDITURES TAKEN OUT? CI TYPICALLY 1% - 2% /YR OF V. EXAMPLE: V=1000, NOI=100, CI=10: yt = (100-10)/1000 = 9%, “cap rate” = 100/1000 = 10%

- 33. "YIELD" CAN ALSO MEAN: "TOTAL YIELD", "YIELD TO MATURITY" THESE ARE IRRs, WHICH ARE TOTAL RETURNS, NOT JUST INCOME. "BASIS POINT" = 1 / 100th PERCENT = .0001

- 34. CONTINUOUSLY COMPOUNDED RETURNS: THE PER ANNUM CONTINUOUSLY COMPOUNDED TOTAL RETURN IS: WHERE "Y" IS THE NUMBER (OR FRACTION) OF = ( LN( BETWEEN TIME )) Y ⇔ V + CF r tYEARSV t + CF t ) - LN( V t - 1"t-1" AND t"t". t = V t - 1 * EXP( Yr t )

- 35. EXAMPLE: 01/01/98 V = 1000 03/31/99 V = 1100 & CF = 50 PER ANNUM r = (LN(1150) – LN(1000)) / 1.25 = 7.04752 – 6.90776 = 11.18%

- 36. "REAL" VS. "NOMINAL" RETURNS NOMINAL RETURNS ARE THE "ORDINARY" RETURNS YOU NORMALLY SEE QUOTED OR EMPIRICALLY MEASURED. UNLESS IT IS EXPLICITLY STATED OTHERWISE, RETURNS ARE ALWAYS QUOTED AND MEASURED IN NOMINAL TERMS. The NOMINAL Return is the Return in Current Dollars (dollars of the time when the return is generated). REAL RETURNS ARE NET OF INFLATION. The REAL Return is the Return measured in constant purchasing power dollars ("constant dollars").

- 37. EXAMPLE: Suppose INFLATION=5% in 1992 (i.e., need $1.05 in 1992 to buy what $1.00 purchased in 1991). So: $1.00 in "1992$" = 1.00/1.05 = $0.95 in "1991$“ Ifrt = Nominal Total Return, year t it = Inflation, year t Rt = Real Total Return, year t Then: Rt = (1+rt)/(1+it) - 1 = rt - (it + it Rt ) rt - it , Thus: NOMINAL Return = REAL Return + Inflation Premium Inflation Premium = it + it Rt It

- 38. IN THE CASE OF THE CURRENT YIELD (Real yt)=(Nominal yt)/(1+it) (Nominal yt)

- 39. EXAMPLE: 1991 PROPERTY VALUE = $100,000 1992 NET RENT = $10,000 1992 PROPERTY VALUE = $101,000 1992 INFLATION = 5% WHAT IS THE REAL r, y, and g for 1992?

- 40. ANSWER: Real g = (101,000/1.05)/100,000-1= -3.81% -4% (versus Nominal g=+1%) Real y = (10,000/1.05)/100,000 = +9.52% 10% (versus Nominal y=10% exactly) Real r = (111,000/1.05)/100,000-1=+5.71% 6% (versus Nominal r = 11%) = g + y =+9.52%+(-3.81%) 10% - 4%

- 41. RISK INTUITIVE MEANING... THE POSSIBILITY OF NOT MAKING THE EXPECTED RETURN: rt ≠ Et-j[rt]

- 42. MEASURED BY THE RANGE OR STD.DEV. IN THE EX ANTE PROBABILITY DISTRIBUTION OF THE EX POST RETURN . . . 100% A 75% Probability 50% B 25% C 0% -10% -5% 0% 5% 10% 15% 20% 25% 30% Returns Figure 1 C RISKER THAN B. B RISKIER THAN A. A RISKLESS.

- 43. WHAT IS THE EXPECTED RETURN? . . .

- 44. EXAMPLE OF RETURN RISK QUANTIFICATION: SUPPOSE 2 POSSIBLE FUTURE RETURN SCENARIOS. THE RETURN WILL EITHER BE: +20%, WITH 50% PROBABILITY OR: -10%, WITH 50% PROBABILITY

- 45. "EXPECTED" (EX ANTE) RETURN = (50% CHANCE)(+20%) + (50% CHANCE)(-10%) = +5%

- 46. RISK (STD.DEV.) IN THE RETURN = SQRT{(0.5)(20-5)2 + (0.5)(-10-5)2} = 15%

- 47. THE RISK/RETURN TRADEOFF.. INVESTORS DON'T LIKE RISK!

- 48. COMPENSATE THEM BY PROVIDING HIGHER RETURNS (EX ANTE) ON MORE RISKY ASSETS . . . Expected Return rf Risk

- 49. RISK & RETURN: TOTAL RETURN = RISKFREE RATE + RISK PREMIUM rt = rf,t + RPt

- 50. RISK FREE RATE RISKFREE RATE (rf,t) = Compensation for TIME = "Time Value of Money" US Treasury Bill Return (For Real Estate, usually use Long Bond)

- 51. RISK PREMIUM RISK PREMIUM (RPt): EX ANTE: E[RPt] = E[rt] - rf,t = Compensation for RISK EX POST: RPt = rt - rf,t = Realization of Risk ("Throw of Dice")

- 52. RELATION BETWEEN RISK & RETURN: GREATER RISK <===> GREATER RISK PREMIUM (THIS IS EX ANTE, OR ON AVG. EX POST, BUT NOT NECESSARILY IN ANY GIVEN YEAR OR ANY GIVEN INVESTMENT EX POST)

- 53. EXAMPLE OF RISK IN REAL ESTATE: PROPERTY "A" (OFFICE): VALUE END 1998 = $100,000 POSSIBLE VALUES END 1999 $110,000 (50% PROB.) $90,000 (50% PROB.) STD.DEV. OF g99 = 10%

- 54. EXAMPLE (CONT’D) PROPERTY "B" (BOWLING ALLEY): VALUE END 1998 = $100,000 POSSIBLE VALUES END 1999 $120,000 (50% PROB.) $80,000 (50% PROB.) STD.DEV. OF g99 = 20%

- 55. EXAMPLE (CONT’D) B IS MORE RISKY THAN A. T-BILL RETURN = 7%

- 56. EXAMPLE (CONT’D) A: Office Building B: Bowling Alley Known as of end 1998 Known as of end 1998 Value = $100,000 Value = $100,000 Expected value end 99 Expected value end 99 = $100,000 = $100,000 Expected net rent 99 Expected net rent 99 = $11,000 = $15,000 Ex ante risk premium Ex ante risk premium = 11% - 7% = 4% = 15% - 7% = 8%

- 57. EXAMPLE (CONT’D) – SUPPOSE THE FOLLOWING OCCURRED IN 1999 A: Office Building B: Bowling Alley Not known until end Not known until end 1999 1999 End 99 Value = End 99 Value = $110,000 $80,000 99 net rent = $11,000 99 net rent = $15,000 99 Ex post risk 99 Ex post risk premium = 21% - 7% = premium = -5% - 7% = 14% -12% (“The Dice Rolled (“The Dice Rolled Favorably”) Unfavorably”)

- 58. SUMMARY: THREE USEFUL WAYS TO BREAK TOTAL RETURN INTO TWO COMPONENTS... 1) TOTAL RETURN = CURRENT YIELD + GROWTH r=y+g 2) TOTAL RETURN = RISKFREE RATE + RISK PREMIUM r = rf + RP 3) TOTAL RETURN = REAL RETURN + INFLATION PREMIUM r = R + (i+iR) R + I

- 59. "TIME-WEIGHTED INVESTMENT". . . SUPPOSE THERE ARE CFs AT INTERMEDIATE POINTS IN TIME WITHIN EACH “PERIOD” (E.G., MONTHLY CFs WITHIN QUARTERLY RETURN PERIODS). THEN THE SIMPLE HPR FORMULAS ARE NO LONGER EXACTLY ACCURATE.

- 60. "TIME-WEIGHTED INVESTMENT". . . A WIDELY USED SIMPLE ADJUSTMENT IS TO APPROXIMATE THE IRR OF THE PERIOD ASSUMING THE ASSET WAS BOUGHT AT THE BEGINNING OF THE PERIOD AND SOLD AT THE END, WITH OTHER CFs OCCURRING AT INTERMEDIATE POINTS WITHIN THE PERIOD. THIS APPROXIMATION IS DONE BY SUBSTITUTING A “TIME-WEIGHTED” INVESTMENT IN THE DENOMINATOR INSTEAD OF THE SIMPLE BEGINNING-OF- PERIOD ASSET VALUE IN THE DENOMINATOR.

- 61. "TIME-WEIGHTED INVESTMENT". . . EndVal − BegVal + ∑ CFi r= where: BegVal − ∑ wi CFi = sum of all net cash flows occurring inCF ∑ period t, i wi = proportion of period t remaining at the time when net cash flow "i" was received by the investor. (Note: cash flow from the investor to the investment is negative; cash flow from the investment to the investor is positive.)

- 62. EXAMPLE . . . CF: Date: - 100 12/31/98 + 10 01/31/99 +100 12/31/99 Simple HPR: (10 + 100-100) / 100 = 10 / 100 = 10.00% TWD HPR: (10 + 100-100) / (100 – (11/12)10) = 10 / 90.83 = 11.01% IRR: = 11.00% . . .

- 63. EXAMPLE (CONT’D) 11 10 0 100 0 = − 100 + +∑ + ⇒ IRR / mo = 0.87387% 1 + IRR / mo j = 2 (1 + IRR / mo ) j (1 + IRR / mo ) 12 ⇒ IRR / yr = (1.0087387)12 − 1 = 11.00%

- 64. THE DEFINITION OF THE "NCREIF" PERIODIC RETURN FORMULA . . . THE MOST WIDELY USED INDEX OF PERIODIC RETURNS IN COMMERCIAL REAL ESTATE IN THE US IS THE "NCREIF PROPERTY INDEX" (NPI). NCREIF = "NATIONAL COUNCIL OF REAL ESTATE INVESTMENT FIDUCIARIES“ “INSTITUTIONAL QUALITY R.E.” QUARTERLY INDEX OF TOTAL RETURNS PROPERTY-LEVEL APPRAISAL-BASED

- 65. NCREIF FORMULA A TIME-WEIGHTED FORMULA INCLUDES INVESTMENT DENOMINATOR, ASSUMING: ONE-THIRD OF THE QUARTERLY PROPERTY NOI IS RECEIVED AT THE END OF EACH CALENDAR MONTH; PARTIAL SALES RECEIPTS MINUS CAPITAL IMPROVEMENT EXPENDITURES ARE RECEIVED MIDWAY THROUGH THE QUARTER... EndVal − BegVal + ( PS − CI ) + NOI rNPI = [Note: (1/3)NOI =−(2/3)(1/3)NOI+(1/3) 3) NOI BegVal (1 2 )( PS − CI ) − (1 (1/3)NOI+(0)(1/3)NOI ]

- 66. MULTI-PERIOD RETURNS… SUPPOSE YOU WANT TO KNOW WHAT IS THE RETURN EARNED OVER A MULTI-PERIOD SPAN OF TIME, EXPRESSED AS A SINGLE AVERAGE ANNUAL RATE?... YOU COULD COMPUTE THE AVERAGE OF THE HPRs ACROSS THAT SPAN OF TIME. THIS WOULD BE A "TIME- WEIGHTED" AVERAGE RETURN.

- 67. MULTI-PERIOD RETURNS (CONT’D) IT WILL: =>Weight a given rate of return more if it occurs over a longer interval or more frequently in the time sample. =>Be independent of the magnitude of capital invested at each point in time; Not affected by the timing of capital flows into or out of the investment.

- 68. MULTI-PERIOD RETURNS (CONT’D) YOU CAN COMPUTE THIS AVERAGE USING EITHER THE ARITHMETIC OR GEOMETRIC MEAN... Arithmetic average return over 1992-94: = (r 92+ r93+ r94)/3 Geometric average return over 1992-94: = [(1+r 92)(1+r93)(1+r94)](1/3) – 1

- 69. ARITHMETIC VS. GEOMETRIC MEAN… Arithmetic Mean: => Always greater than geometric mean. => Superior statistical properties: * Best "estimator" or "forecast" of "true" return. => Mean return components sum to the mean total return => Most widely used in forecasts & portfolio analysis.

- 70. ARITHMETIC VS. GEOMETRIC MEAN (CONT’D) Geometric Mean: => Reflects compounding ("chain-linking") of returns: * Earning of "return on return". => Mean return components do not sum to mean total return * Cross-product is left out. => Most widely used in performance evaluation.

- 71. ARITHMETIC VS. GEOMETRIC MEAN (CONT’D) The two are more similar: - The less volatility in returns across time - The more frequent the return interval Note: "continuously compounded" returns (log differences) side-steps around this issue. (There is only one continuously- compounded mean annual rate: arithmetic & geometric distinctions do not exist).

- 72. TIME-WEIGHTED RETURNS: NUMERICAL EXAMPLES An asset that pays no dividends . . . Year: End of year asset value: HPR: 1992 $100,000 1993 $110,000 (110,000 - 100,000) / 100,000 = 10.00% 1994 $121,000 (121,000 - 110,000) / 110,000 = 10.00% 1995 $136,730 (136,730 - 121,000) / 121,000 = 13.00%

- 73. THREE-YEAR AVERAGE ANNUAL RETURN (1993-95): Arithmetic mean: = (10.00 + 10.00 + 13.00) / 3 = 11.00% Geometric mean: = (136,730 / 100,000)(1/3) - 1 = ((1.1000)(1.1000)(1.1300))(1/3) - 1 = 10.99% Continuously compounded: = LN(136,730 / 100,000) / 3 = (LN(1.1)+LN(1.1)+LN(1.13)) / 3 = 10.47%

- 74. ANOTHER EXAMPLE End of year asset value: HPR: Year: 1992 $100,000 1993 $110,000 (110,000 - 100,000) / 100,000 = 10.00% 1994 $124,300 (124,300 - 110,000) / 110,000 = 13.00% 1995 $140,459 (140,459 - 124,300) / 124,300 = 13.00%

- 75. THREE-YEAR AVERAGE ANNUAL RETURN (1993-95): Arithmetic mean: = (10.00 + 13.00 + 13.00) / 3 = 12.00% Geometric mean: = (140,459 / 100,000)(1/3) - 1 = ((1.1000)(1.1300)(1.1300))(1/3) - 1 = 11.99% Continuously compounded: = LN(140,459 / 100,000) / 3 = (LN(1.1)+LN(1.13)+LN(1.13)) / 3 = 11.32%

- 76. ANOTHER EXAMPLE Year: End of year asset value: HPR: 1992 $100,000 1993 $110,000 (110,000 - 100,000) / 100,000 = 10.00% 1994 $121,000 (121,000 - 110,000) / 110,000 = 10.00% 1995 $133,100 (133,100 - 121,000) / 121,000 = 10.00%

- 77. THREE-YEAR AVERAGE ANNUAL RETURN (1993-95): Arithmetic mean: = (10.00 + 10.00 + 10.00) / 3 = 10.00% Geometric mean: = (133,100 / 100,000)(1/3) - 1 = ((1.1000)(1.1000)(1.1000))(1/3) - 1 = 10.00% Continuously comp'd: = LN(133,100 / 100,000) / 3 = (LN(1.1)+LN(1.1)+LN(1.1)) / 3 = 9.53%

- 78. ANOTHER MULTI-PERIOD RETURN MEASURE: THE IRR... CAN’T COMPUTE HPRs IF YOU DON’T KNOW ASSET VALUE AT INTERMEDIATE POINTS IN TIME (AS IN REAL ESTATE WITHOUT REGULAR APPRAISALS) SO YOU CAN’T COMPUTE TIME- WEIGHTED AVERAGE RETURNS. You need the “IRR”.

- 79. IRR SUPPOSE YOU WANT A RETURN MEASURE THAT REFLECTS THE EFFECT OF THE TIMING OF WHEN (INSIDE OF THE OVERALL TIME SPAN COVERED) THE INVESTOR HAS DECIDED TO PUT MORE CAPITAL INTO THE INVESTMENT AND/OR TAKE CAPITAL OUT OF THE INVESTMENT. You need the “IRR”.

- 80. IRR FORMAL DEFINITION OF IRR "IRR" (INTERNAL RATE OF RETURN) IS THAT SINGLE RATE THAT DISCOUNTS ALL THE NET CASH FLOWS OBTAINED FROM THE INVESTMENT TO A PRESENT VALUE EQUAL TO WHAT YOU PAID FOR THE INVESTMENT AT THE BEGINNING:

- 81. IRR CF 1 CF 2 CF N 0 = CF 0 + + + ... + (1 + IRR) (1 + IRR )2 (1 + IRR )N CFt = Net Cash Flow to Investor in Period "t“ CF0 is usually negative (capital outlay). Note: CFt is signed according to the convention: cash flow from investor to investment is negative, cash flow from investment to investor is positive. Note also: Last cash flow (CFN) includes two components: The last operating cash flow plus The (ex dividend) terminal value of the asset ("reversion").

- 82. WHAT IS THE IRR?... (TRYING TO GET SOME INTUITION HERE . . .) A SINGLE ("BLENDED") INTEREST RATE, WHICH IF ALL THE CASH IN THE INVESTMENT EARNED THAT RATE ALL THE TIME IT IS IN THE INVESTMENT, THEN THE INVESTOR WOULD END UP WITH THE TERMINAL VALUE OF THE INVESTMENT (AFTER REMOVAL OF CASH TAKEN OUT DURING THE INVESTMENT):

- 83. WHAT IS THE IRR? (CONT’D) PV (1 + IRR ) − CF1 (1 + IRR ) − − CFN (1 + IRR ) = CF N ( N −1) where PV = -CF0, the initial cash−1"deposit" N in the "account" (outlay to purchase the investment). IRR is "internal" because it includes only the returns earned on capital while it is invested in the project. Once capital (i.e., cash) is withdrawn from the investment, it no longer influences the IRR. This makes the IRR a "dollar-weighted" average return across time for the investment, because returns earned when

- 84. THE IRR INCLUDES THE EFFECT OF: 1. THE INITIAL CASH YIELD RATE (INITIAL LEVEL OF CASH PAYOUT AS A FRACTION OF THE INITIAL INVESTMENT; 2. THE EFFECT OF CHANGE OVER TIME IN THE NET CASH FLOW LEVELS (E.G., GROWTH IN THE OPERATING CASH FLOW); 3. THE TERMINAL VALUE OF THE ASSET AT THE END OF THE INVESTMENT HORIZON (INCLUDING ANY NET CHANGE IN CAPITAL VALUE SINCE THE INITIAL

- 85. IRR THE IRR IS THUS A TOTAL RETURN MEASURE (CURRENT YIELD PLUS GROWTH & GAIN).

- 86. NOTE ALSO: THE IRR IS A CASH FLOW BASED RETURN MEASURE... • DOES NOT DIFFERENTIATE BETWEEN "INVESTMENT" AND "RETURN ON OR RETURN OF INVESTMENT". • INCLUDES THE EFFECT OF CAPITAL INVESTMENTS AFTER THE INITIAL OUTLAY. • DISTINGUISHES CASH FLOWS ONLY BY THEIR DIRECTION: POSITIVE IF FROM INVESTMENT TO INVESTOR, NEGATIVE IF FROM INVESTOR TO

- 87. IRR In general, it is not possible to algebraically determine the IRR for any given set of cash flows. It is necessary to solve numerically for the IRR, in effect, solving the IRR equation by "trial & error". Calculators and computers do this automatically.

- 88. ADDITIONAL NOTES ON THE IRR . . . TECHNICAL PROBLEMS: IRR MAY NOT EXIST OR NOT BE UNIQUE (OR GIVE MISLEADING RESULTS) WHEN CASH FLOW PATTERNS INCLUDE NEGATIVE CFs AFTER POSITIVE CFs. BEST TO USE NPV IN THESE CASES. (SOMETIMES “FMRR” IS USED.)

- 89. ADDITIONAL NOTES ON THE IRR (CONT’D) THE IRR AND TIME-WEIGHTED RETURNS: IRR = TIME-WTD GEOMEAN HPR IF (AND ONLY IF) THERE ARE NO INTERMEDIATE CASH FLOWS (NO CASH PUT IN OR TAKEN OUT BETWEEN THE BEGINNING AND END OF THE INVESTMENT).

- 90. ADDITIONAL NOTES ON THE IRR (CONT’D) THE IRR AND RETURN COMPONENTS: IRR IS A "TOTAL RETURN" IRR DOES NOT GENERALLY BREAK OUT EXACTLY INTO A SUM OF: y + g: INITIAL CASH YIELD + CAPITAL VALUE GROWTH COMPONENTS. DIFFERENCE BETWEEN THE IRR AND THE INITIAL CASH YIELD IS DUE TO A COMBINATION OF GROWTH IN THE OPERATING CASH FLOWS AND/OR GROWTH IN THE

- 91. THE IRR AND RETURN COMPONENTS (CONT’D) IF THE OPERATING CASH FLOWS GROW AT A CONSTANT RATE, AND IF THE ASSET VALUE REMAINS A CONSTANT MULTIPLE OF THE CURRENT OPERATING CASH FLOWS, THEN THE IRR WILL INDEED EXACTLY EQUAL THE SUM OF THE INITIAL CASH YIELD RATE PLUS THE GROWTH RATE (IN BOTH THE CASH FLOWS AND THE ASSET CAPITAL VALUE), AND IN THIS CASE THE IRR WILL ALSO EXACTLY EQUAL BOTH THE ARITHMETIC AND GEOMETRIC TIME- WEIGHTED MEAN (CONSTANT

- 92. ADDITIONAL NOTES ON THE IRR (CONT’D) THE IRR AND TERMINOLOGY: IRR OFTEN CALLED "TOTAL YIELD" (APPRAISAL) "YIELD TO MATURITY" (BONDS) EX-ANTE IRR = "GOING-IN IRR".

- 93. DOLLAR-WEIGHTED & TIME-WEIGHTED RETURNS:A NUMERICAL EXAMPLE . . . "OPEN-END" (PUT) OR (CREF). INVESTORS BUY AND SELL "UNITS" ON THE BASIS OF THE APPRAISED VALUE OF THE PROPERTIES IN THE FUND AT THE END OF EACH PERIOD. SUPPOSE THE FUND DOESN'T PAY OUT ANY CASH, BUT REINVESTS ALL PROPERTY INCOME. CONSIDER 3 CONSECUTIVE PERIODS. . .

- 94. INVESTMENT PERIODIC RETURNS: HIGH, LOW, HIGH . . . 1996 1997 1998 1999 YR END UNIT VALUE $1000 $1100 $990 $1089 GEOM MEAN TIME-WTD RETURN = (1.089)+10.00% PERIODIC RETURN +10.00% -10.00% (1/3) - 1 = 2.88%

- 95. INVESTOR #1, "MR. SMART" (OR LUCKY): GOOD TIMING . . . END OF YEAR: 1996 1997 1998 1999 UNITS BOUGHT 2 UNITS SOLD 1 1 IRR = IRR(-2000,1100,0,1089) = 4.68% CASH FLOW -$2000 +$1100 0 $1089

- 96. INVESTOR #2, "MR. DUMB" (OR UNLUCKY): BAD TIMING . . . END OF YEAR: 1996 1997 1998 1999 UNITS BOUGHT 1 1 UNITS SOLD 1 1 IRR = IRR(-1000,-1100,990,1089) = -0.50% CASH FLOW -$1000 -$1100 +$990 $1089

- 97. EXAMPLE (CONT’D) DOLLAR-WTD RETURN BEST FOR MEASURING INVESTOR PERFORMANCE IF INVESTOR CONTROLLED TIMING OF CAP. FLOW. TIME-WTD RETURN BEST FOR MEASURING PERFORMANCE OF THE UNDERLYING INVESTMENT (IN THIS CASE THE PUT OR CREF), AND THEREFORE FOR MEASURING INVESTOR PERFORMANCE IF INVESTOR ONLY CONTROLS WHAT TO INVEST IN BUT NOT WHEN.

- 98. MEASURING RETURNS INTRODUCTION Ex Ante Returns Return calculations may be done ‘before-the-fact,’ Risk, Return and Portfolio Theory in which case, assumptions must be made about the future Ex Post Returns Return calculations done ‘after-the-fact,’ in order to analyze what rate of return was earned.

- 99. MEASURING RETURNS INTRODUCTION According to the constant growth DDM can be decomposed into the two forms of income that equity investors may receive, dividends and capital gains. D1 kc = + [ g ] = [ Income / Dividend Yield] + [ Capital Gain (or loss) Yield] P0 WHEREAS Fixed-income investors (bond investors for example) can expect to earn interest income as well as (depending on the movement of interest rates) either capital gains or capital losses. Risk, Return and Portfolio Theory

- 100. MEASURING RETURNS INCOME YIELD Income yield is the return earned in the form of a periodic cash flow received by investors. Risk, Return and Portfolio Theory The income yield return is calculated by the periodic cash flow divided by the purchase price. CF1 [8-1] Income yield = P0 Where CF1 = the expected cash flow to be received P0 = the purchase price

- 101. INCOME YIELD STOCKS VERSUS BONDS Figure 8-1 illustrates the income yields for both bonds and stock in Canada from the 1950s to 2005 The dividend yield is calculated using trailing rather than Risk, Return and Portfolio Theory forecast earns (because next year’s dividends cannot be predicted in aggregate), nevertheless dividend yields have exceeded income yields on bonds. Reason – risk The risk of earning bond income is much less than the risk incurred in earning dividend income. (Remember, bond investors, as secured creditors of the first have a legally-enforceable contractual claim to interest.) (See Figure 8 -1 on the following slide)

- 102. EX POST VERSUS EX ANTE RETURNS MARKET INCOME YIELDS 8-1 FIGURE Risk, Return and Portfolio Theory Insert Figure 8 - 1

- 103. MEASURING RETURNS COMMON SHARE AND LONG CANADA BOND YIELD GAP Table 8 – 1 illustrates the income yield gap between stocks and bonds over recent decades The main reason that this yield gap has varied so much over time is that the Risk, Return and Portfolio Theory return to investors is not just the income yield but also the capital gain (or loss) yield as well. Table 8-1 Average Yield Gap Average Yield Gap (%) 1950s 0.82 1960s 2.35 1970s 4.54 1980s 8.14 1990s 5.51 2000s 3.55 Overall 4.58

- 104. MEASURING RETURNS DOLLAR RETURNS Investors in market-traded securities (bonds or stock) receive investment returns in two different form: Income yield Risk, Return and Portfolio Theory Capital gain (or loss) yield The investor will receive dollar returns, for example: $1.00 of dividends Share price rise of $2.00 To be useful, dollar returns must be converted to percentage returns as a function of the original investment. (Because a $3.00 return on a $30 investment might be good, but a $3.00 return on a $300 investment would be unsatisfactory!)

- 105. MEASURING RETURNS CONVERTING DOLLAR RETURNS TO PERCENTAGE RETURNS An investor receives the following dollar returns a stock investment of $25: $1.00 of dividends Risk, Return and Portfolio Theory Share price rise of $2.00 The capital gain (or loss) return component of total return is calculated: ending price – minus beginning price, divided by beginning price P − P0 $27 - $25 [8-2] Capital gain (loss) return = 1 = = .08 = 8% P0 $25

- 106. MEASURING RETURNS TOTAL PERCENTAGE RETURN The investor’s total return (holding period return) is: Risk, Return and Portfolio Theory Total return = Income yield + Capital gain (or loss) yield CF + P − P = 1 1 0 [8-3] P0 CF P − P = 1+ 1 0 P0 P0 $1.00 $27 − $25 = + $25 = 0.04 + 0.08 = 0.12 = 12% $25

- 107. MEASURING RETURNS TOTAL PERCENTAGE RETURN – GENERAL FORMULA The general formula for holding period return is: Risk, Return and Portfolio Theory Total return = Income yield + Capital gain (or loss) yield CF1 + P − P0 = 1 [8-3] P0 CF1 P − P0 = + 1 P0 P0

- 108. MEASURING AVERAGE RETURNS EX POST RETURNS Measurement of historical rates of return that have been earned on a security or a class of securities allows Risk, Return and Portfolio Theory us to identify trends or tendencies that may be useful in predicting the future. There are two different types of ex post mean or average returns used: Arithmeticaverage Geometric mean

- 109. MEASURING AVERAGE RETURNS ARITHMETIC AVERAGE n ∑r Risk, Return and Portfolio Theory [8-4] i Arithmetic Average (AM) = i =1 n Where: ri = the individual returns n = the total number of observations Most commonly used value in statistics Sum of all returns divided by the total number of observations

- 110. MEASURING AVERAGE RETURNS GEOMETRIC MEAN 1 Risk, Return and Portfolio Theory [8-5] Geometric Mean (GM) = [( 1 + r1 )( 1 + r2 )( 1 + r3 )...( 1 + rn )] -1 n Measures the average or compound growth rate over multiple periods.

- 111. MEASURING AVERAGE RETURNS GEOMETRIC MEAN VERSUS ARITHMETIC AVERAGE If all returns (values) are identical the geometric mean = arithmetic average. Risk, Return and Portfolio Theory If the return values are volatile the geometric mean < arithmetic average The greater the volatility of returns, the greater the difference between geometric mean and arithmetic average. (Table 8 – 2 illustrates this principle on major asset classes 1938 – 2005)

- 112. MEASURING AVERAGE RETURNS AVERAGE INVESTMENT RETURNS AND STANDARD DEVIATIONS Table 8 - 2 Average Investment Returns and Standard Deviations, 1938-2005 Risk, Return and Portfolio Theory Annual Annual Standard Deviation Arithmetic Geometric of Annual Returns Average (%) Mean (%) (%) Government of Canada treasury bills 5.20 5.11 4.32 Government of Canada bonds 6.62 6.24 9.32 Canadian stocks 11.79 10.60 16.22 U.S. stocks 13.15 11.76 17.54 So urce: Data are fro m the Canadian Institute o f A ctuaries The greater the difference, the greater the volatility of annual returns.

- 113. MEASURING EXPECTED (EX ANTE) RETURNS While past returns might be interesting, investor’s are most concerned with future returns. Risk, Return and Portfolio Theory Sometimes, historical average returns will not be realized in the future. Developing an independent estimate of ex ante returns usually involves use of forecasting discrete scenarios with outcomes and probabilities of occurrence.

- 114. ESTIMATING EXPECTED RETURNS ESTIMATING EX ANTE (FORECAST) RETURNS The general formula Risk, Return and Portfolio Theory n [8-6] Expected Return (ER) = ∑ (ri × Prob i ) i =1 Where: ER = the expected return on an investment Ri = the estimated return in scenario i Probi = the probability of state i occurring

- 115. ESTIMATING EXPECTED RETURNS ESTIMATING EX ANTE (FORECAST) RETURNS Example: This is type of forecast data that are required to make an ex ante estimate of expected return. Possible Returns on Probability of Stock A in that State of the Economy Occurrence State Economic Expansion 25.0% 30% Normal Economy 50.0% 12% Recession 25.0% -25% Risk, Return and Portfolio Theory

- 116. ESTIMATING EXPECTED RETURNS ESTIMATING EX ANTE (FORECAST) RETURNS USING A SPREADSHEET APPROACH Example Solution: Sum the products of the probabilities and possible returns in each state of the economy. (1) (2) (3) (4)=(2)×(1) Possible Weighted Returns on Possible Probability of Stock A in that Returns on State of the Economy Occurrence State the Stock Economic Expansion 25.0% 30% 7.50% Normal Economy 50.0% 12% 6.00% Recession 25.0% -25% -6.25% Expected Return on the Stock = 7.25% Risk, Return and Portfolio Theory

- 117. ESTIMATING EXPECTED RETURNS ESTIMATING EX ANTE (FORECAST) RETURNS USING A FORMULA APPROACH Example Solution: Sum the products of the probabilities and possible returns in each state of the economy. n Expected Return (ER) = ∑ (ri × Prob i ) i =1 = (r1 × Prob1 ) + (r2 × Prob 2 ) + (r3 × Prob 3 ) = (30% × 0.25) + (12% × 0.5) + (-25% × 0.25) = 7.25% Risk, Return and Portfolio Theory

- 118. Friday, October 12, 2012 Risk, Return and Portfolio Theory Risk, Return and Portfolio Theory MEASURING RISK

- 119. RISK Probability of incurring harm Risk, Return and Portfolio Theory For investors, risk is the probability of earning an inadequate return. Ifinvestors require a 10% rate of return on a given investment, then any return less than 10% is considered harmful.

- 120. RISK ILLUSTRATED The range of total possible returns on the stock A runs from -30% to Probability more than +40%. If the required Risk, Return and Portfolio Theory return on the stock is 10%, then those outcomes less than 10% Outcomes that produce harm represent risk to the investor. A -30% -20% -10% 0% 10% 20% 30% 40% Possible Returns on the Stock

- 121. RANGE The difference between the maximum and minimum Risk, Return and Portfolio Theory values is called the range Canadian common stocks have had a range of annual returns of 74.36 % over the 1938-2005 period Treasury bills had a range of 21.07% over the same period. As a rough measure of risk, range tells us that common stock is more risky than treasury bills.

- 122. DIFFERENCES IN LEVELS OF RISK ILLUSTRATED Outcomes that produce harm The wider the range of probable outcomes the greater the risk of the Probability investment. Risk, Return and Portfolio Theory B A is a much riskier investment than B A -30% -20% -10% 0% 10% 20% 30% 40% Possible Returns on the Stock

- 123. HISTORICAL RETURNS ON DIFFERENT ASSET CLASSES Figure 8-2 illustrates the volatility in annual returns on Risk, Return and Portfolio Theory three different assets classes from 1938 – 2005. Note: Treasury bills always yielded returns greater than 0% Long Canadian bond returns have been less than 0% in some years (when prices fall because of rising interest rates), and the range of returns has been greater than T-bills but less than stocks Common stock returns have experienced the greatest range of returns (See Figure 8-2 on the following slide)

- 124. MEASURING RISK ANNUAL RETURNS BY ASSET CLASS, 1938 - 2005 FIGURE 8-2 Risk, Return and Portfolio Theory

- 125. REFINING THE MEASUREMENT OF RISK STANDARD DEVIATION (Σ) Range measures risk based on only two observations Risk, Return and Portfolio Theory (minimum and maximum value) Standard deviation uses all observations. Standard deviation can be calculated on forecast or possible returns as well as historical or ex post returns. (The following two slides show the two different formula used for Standard Deviation)

- 126. MEASURING RISK EX POST STANDARD DEVIATION n _ ∑ ( ri − r ) 2 [8-7] Ex post σ = i =1 n −1 Where : σ = the standard deviation _ r = the average return ri = the return in year i n = the number of observations Risk, Return and Portfolio Theory

- 127. MEASURING RISK EXAMPLE USING THE EX POST STANDARD DEVIATION Problem Estimate the standard deviation of the historical returns on investment A that were: 10%, 24%, -12%, 8% and 10%. Step 1 – Calculate the Historical Average Return n ∑r i 10 + 24 - 12 + 8 + 10 40 Arithmetic Average (AM) = i =1 = = = 8.0% n 5 5 Step 2 – Calculate the Standard Deviation n _ ∑ (r − r ) i 2 (10 - 8) 2 + (24 − 8) 2 + (−12 − 8) 2 + (8 − 8) 2 + (14 − 8) 2 Ex post σ = i =1 = n −1 5 −1 2 2 + 16 2 − 20 2 + 0 2 + 2 2 4 + 256 + 400 + 0 + 4 664 = = = = 166 = 12.88% 4 4 4 Risk, Return and Portfolio Theory

- 128. EX POST RISK STABILITY OF RISK OVER TIME Figure 8-3 (on the next slide) demonstrates that the relative riskiness of equities and bonds has changed over time. Until the 1960s, the annual returns on common shares were about four times more variable than those on bonds. Over the past 20 years, they have only been twice as variable. Consequently, scenario-based estimates of risk (standard deviation) is required when seeking to measure risk in the future. (We cannot safely assume the future is going to be like the past!) Scenario-based estimates of risk is done through ex ante estimates and calculations. Risk, Return and Portfolio Theory

- 129. RELATIVE UNCERTAINTY EQUITIES VERSUS BONDS FIGURE 8-3 Risk, Return and Portfolio Theory

- 130. MEASURING RISK EX ANTE STANDARD DEVIATION A Scenario-Based Estimate of Risk Risk, Return and Portfolio Theory n [8-8] Ex ante σ = ∑ (Prob i ) × (ri − ERi ) 2 i =1

- 131. SCENARIO-BASED ESTIMATE OF RISK EXAMPLE USING THE EX ANTE STANDARD DEVIATION – RAW DATA GIVEN INFORMATION INCLUDES: - Possible returns on the investment for different discrete states - Associated probabilities for those possible returns Possible State of the Returns on Economy Probability Security A Recession 25.0% -22.0% Normal 50.0% 14.0% Economic Boom 25.0% 35.0% Risk, Return and Portfolio Theory

- 132. SCENARIO-BASED ESTIMATE OF RISK EX ANTE STANDARD DEVIATION – SPREADSHEET APPROACH Risk, Return and Portfolio Theory The following two slides illustrate an approach to solving for standard deviation using a spreadsheet model.

- 133. SCENARIO-BASED ESTIMATE OF RISK FIRST STEP – CALCULATE THE EXPECTED RETURN Determined by multiplying the probability times the possible return. Possible Weighted State of the Returns on Possible Economy Probability Security A Returns Recession 25.0% -22.0% -5.5% Normal 50.0% 14.0% 7.0% Economic Boom 25.0% 35.0% 8.8% Expected Return = 10.3% Expected return equals the sum of the weighted possible returns. Risk, Return and Portfolio Theory

- 134. SCENARIO-BASED ESTIMATE OF RISK SECOND STEP – MEASURE THE WEIGHTED AND SQUARED DEVIATIONS Now multiply the square deviations by First calculate the deviation of their probability of occurrence. possible returns from the expected. Deviation of Weighted Possible Weighted Possible and State of the Returns on Possible Return from Squared Squared Economy Probability Security A Returns Expected Deviations Deviations Recession 25.0% -22.0% -5.5% -32.3% 0.10401 0.02600 Normal 50.0% 14.0% 7.0% 3.8% 0.00141 0.00070 Economic Boom 25.0% 35.0% 8.8% 24.8% 0.06126 0.01531 Expected Return = 10.3% Variance = 0.0420 Standard Deviation = 20.50% Second, square those deviations The sum of the weighted and square deviations The standardthe mean. is the square root from deviation is the variance in percent (in percent terms). of the variance squared terms. Risk, Return and Portfolio Theory

- 135. SCENARIO-BASED ESTIMATE OF RISK EXAMPLE USING THE EX ANTE STANDARD DEVIATION FORMULA Possible Weighted State of the Returns on Possible Economy Probability Security A Returns Risk, Return and Portfolio Theory Recession 25.0% -22.0% -5.5% Normal 50.0% 14.0% 7.0% Economic Boom 25.0% 35.0% 8.8% Expected Return = 10.3% n Ex ante σ = ∑ (Prob ) × (r − ER ) i =1 i i i 2 = P (r1 − ER1 ) 2 + P2 (r2 − ER2 ) 2 + P (r3 − ER3 ) 2 1 1 = .25(−22 − 10.3) 2 + .5(14 − 10.3) 2 + .25(35 − 10.3) 2 = .25(−32.3) 2 + .5(3.8) 2 + .25(24.8) 2 = .25(.10401) + .5(.00141) + .25(.06126) = .0420 = .205 = 20.5%

- 136. Friday, October 12, 2012 Risk, Return and Portfolio Theory MODERN PORTFOLIO Risk, Return and Portfolio Theory THEORY

- 137. PORTFOLIOS A portfolio is a collection of different securities such as stocks and bonds, that are combined and considered a single asset Risk, Return and Portfolio Theory The risk-return characteristics of the portfolio is demonstrably different than the characteristics of the assets that make up that portfolio, especially with regard to risk. Combining different securities into portfolios is done to achieve diversification.

- 138. DIVERSIFICATION Diversification has two faces: Diversification results in an overall reduction in Risk, Return and Portfolio Theory 1. portfolio risk (return volatility over time) with little sacrifice in returns, and 2. Diversification helps to immunize the portfolio from potentially catastrophic events such as the outright failure of one of the constituent investments. (If only one investment is held, and the issuing firm goes bankrupt, the entire portfolio value and returns are lost. If a portfolio is made up of many different investments, the outright failure of one is more than likely to be offset by gains on others, helping to make the portfolio immune to such events.)

- 139. EXPECTED RETURN OF A PORTFOLIO MODERN PORTFOLIO THEORY The Expected Return on a Portfolio is simply the weighted average of the returns of the individual assets that make up the portfolio: Risk, Return and Portfolio Theory n [8-9] ER p = ∑ ( wi × ERi ) i =1 The portfolio weight of a particular security is the percentage of the portfolio’s total value that is invested in that security.

- 140. EXPECTED RETURN OF A PORTFOLIO EXAMPLE Portfolio value = $2,000 + $5,000 = $7,000 rA = 14%, rB = 6%, wA = weight of security A = $2,000 / $7,000 = 28.6% Risk, Return and Portfolio Theory wB = weight of security B = $5,000 / $7,000 = (1-28.6%)= 71.4% n ER p = ∑ ( wi × ERi ) = (.286 ×14%) + (.714 × 6% ) i =1 = 4.004% + 4.284% = 8.288%

- 141. RANGE OF RETURNS IN A TWO ASSET PORTFOLIO In a two asset portfolio, simply by changing the weight of the Risk, Return and Portfolio Theory constituent assets, different portfolio returns can be achieved. Because the expected return on the portfolio is a simple weighted average of the individual returns of the assets, you can achieve portfolio returns bounded by the highest and the lowest individual asset returns.

- 142. RANGE OF RETURNS IN A TWO ASSET PORTFOLIO Example 1: Risk, Return and Portfolio Theory Assume ERA = 8% and ERB = 10% (See the following 6 slides based on Figure 8-4)

- 143. EXPECTED PORTFOLIO RETURN AFFECT ON PORTFOLIO RETURN OF CHANGING RELATIVE WEIGHTS IN A AND B 8 - 4 FIGURE 10.50 10.00 ERB= 10% 9.50 9.00 8.50 8.00 ERA=8% %n u e R de ce px E 7.50 t 7.00 0 0.2 0.4 0.6 0.8 1.0 1.2 r t Portfolio Weight Risk, Return and Portfolio Theory

- 144. EXPECTED PORTFOLIO RETURN AFFECT ON PORTFOLIO RETURN OF CHANGING RELATIVE WEIGHTS IN A AND B 8 - 4 FIGURE A portfolio manager can select the relative weights of the two assets in the portfolio to get a desired return between 8% (100% invested in A) and 10% (100% invested in B) 10.50 10.00 ERB= 10% 9.50 9.00 8.50 8.00 ERA=8% %n u e R de ce px E 7.50 t 7.00 0 0.2 0.4 0.6 0.8 1.0 1.2 r t Portfolio Weight Risk, Return and Portfolio Theory

- 145. EXPECTED PORTFOLIO RETURN AFFECT ON PORTFOLIO RETURN OF CHANGING RELATIVE WEIGHTS IN A AND B 8 - 4 FIGURE 10.50 ERB= 10% 10.00 9.50 The potential returns of the portfolio are bounded by the highest 9.00 and lowest returns of the individual assets 8.50 that make up the portfolio. 8.00 %n u e R de ce px E ERA=8% 7.50 t 7.00 0 0.2 0.4 0.6 0.8 1.0 1.2 r t Portfolio Weight Risk, Return and Portfolio Theory

- 146. EXPECTED PORTFOLIO RETURN AFFECT ON PORTFOLIO RETURN OF CHANGING RELATIVE WEIGHTS IN A AND B 8 - 4 FIGURE 10.50 ERB= 10% 10.00 9.50 9.00 The expected return on the portfolio if 100% is 8.50 invested in Asset A is 8%. 8.00 ER p = wA ER A + wB ERB = (1.0)(8%) + (0)(10%) = 8% %n u e R de ce px E ERA=8% 7.50 t 7.00 0 0.2 0.4 0.6 0.8 1.0 1.2 r t Portfolio Weight Risk, Return and Portfolio Theory

- 147. EXPECTED PORTFOLIO RETURN AFFECT ON PORTFOLIO RETURN OF CHANGING RELATIVE WEIGHTS IN A AND B 8 - 4 FIGURE 10.50 The expected return on the portfolio if 100% is invested in Asset B is ERB= 10% 10.00 10%. 9.50 9.00 8.50 ER p = wA ER A + wB ERB = (0)(8%) + (1.0)(10%) = 10% 8.00 %n u e R de ce px E ERA=8% 7.50 t 7.00 0 0.2 0.4 0.6 0.8 1.0 1.2 r t Portfolio Weight Risk, Return and Portfolio Theory

- 148. EXPECTED PORTFOLIO RETURN AFFECT ON PORTFOLIO RETURN OF CHANGING RELATIVE WEIGHTS IN A AND B 8 - 4 FIGURE 10.50 The expected return on the portfolio if 50% is invested in Asset A and ERB= 10% 10.00 50% in B is 9%. 9.50 ER p = wA ERA + wB ERB 9.00 = (0.5)(8%) + (0.5)(10%) 8.50 = 4% + 5% = 9% 8.00 %n u e R de ce px E ERA=8% 7.50 t 7.00 0 0.2 0.4 0.6 0.8 1.0 1.2 r t Portfolio Weight Risk, Return and Portfolio Theory

- 149. RANGE OF RETURNS IN A TWO ASSET PORTFOLIO Example 1: Risk, Return and Portfolio Theory Assume ERA = 14% and ERB = 6% (See the following 2 slides )

- 150. RANGE OF RETURNS IN A TWO ASSET PORTFOLIO E(R)A= 14%, E(R)B= 6% Expected return on Asset A = 14.0% Expected return on Asset B = 6.0% Risk, Return and Portfolio Theory Expected Weight of Weight of Return on the Asset A Asset B Portfolio 0.0% 100.0% 6.0% 10.0% 90.0% 6.8% 20.0% 80.0% 7.6% 30.0% 70.0% 8.4% 40.0% 60.0% 9.2% A graph of this 50.0% 50.0% 10.0% relationship is 60.0% 40.0% 10.8% found on the 70.0% 30.0% 11.6% following slide. 80.0% 20.0% 12.4% 90.0% 10.0% 13.2% 100.0% 0.0% 14.0%

- 151. RANGE OF RETURNS IN A TWO ASSET PORTFOLIO E(R)A= 14%, E(R)B= 6% Range of Portfolio Returns Risk, Return and Portfolio Theory Expected Return on Two 16.00% 14.00% Asset Portfolio 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% % % % % % % % % % % 0% 0 .0 .0 .0 .0 .0 .0 .0 .0 .0 0. 0. 10 20 30 40 50 60 70 80 90 10 Weight Invested in Asset A

- 152. EXPECTED PORTFOLIO RETURNS EXAMPLE OF A THREE ASSET PORTFOLIO Risk, Return and Portfolio Theory Relative Expected Weighted Weight Return Return Stock X 0.400 8.0% 0.03 Stock Y 0.350 15.0% 0.05 Stock Z 0.250 25.0% 0.06 Expected Portfolio Return = 14.70% K. Hartviksen

- 153. Friday, October 12, 2012 Risk, Return and Portfolio Theory RISK IN PORTFOLIOS Risk, Return and Portfolio Theory

- 154. MODERN PORTFOLIO THEORY - MPT Prior to the establishment of Modern Portfolio Theory (MPT), Risk, Return and Portfolio Theory most people only focused upon investment returns…they ignored risk. With MPT, investors had a tool that they could use to dramatically reduce the risk of the portfolio without a significant reduction in the expected return of the portfolio.

- 155. EXPECTED RETURN AND RISK FOR PORTFOLIOS STANDARD DEVIATION OF A TWO-ASSET PORTFOLIO USING COVARIANCE Risk, Return and Portfolio Theory [8-11] σ p = ( wA ) 2 (σ A ) 2 + ( wB ) 2 (σ B ) 2 + 2( wA )( wB )(COVA, B ) Risk of Asset A Risk of Asset B Factor to take into adjusted for weight adjusted for weight account comovement in the portfolio in the portfolio of returns. This factor can be negative.

- 156. EXPECTED RETURN AND RISK FOR PORTFOLIOS STANDARD DEVIATION OF A TWO-ASSET PORTFOLIO USING CORRELATION COEFFICIENT Risk, Return and Portfolio Theory [8-15] σ p = ( wA ) 2 (σ A ) 2 + ( wB ) 2 (σ B ) 2 + 2( wA )( wB )( ρ A, B )(σ A )(σ B ) Factor that takes into account the degree of comovement of returns. It can have a negative value if correlation is negative.

- 157. GROUPING INDIVIDUAL ASSETS INTO PORTFOLIOS The riskiness of a portfolio that is made of different risky assets is a function of three different factors: the riskiness of the individual assets that make up the Risk, Return and Portfolio Theory portfolio the relative weights of the assets in the portfolio the degree of comovement of returns of the assets making up the portfolio The standard deviation of a two-asset portfolio may be measured using the Markowitz model: σ p = σ w + σ w + 2 wA wB ρ A, Bσ Aσ B 2 A 2 A 2 B 2 B

- 158. RISK OF A THREE-ASSET PORTFOLIO The data requirements for a three-asset portfolio grows dramatically if we are using Markowitz Portfolio selection formulae. Risk, Return and Portfolio Theory We need 3 (three) correlation coefficients between A and B; A and C; and B and C. A ρa,b ρa,c B C ρb,c σ p = σ A wA + σ B wB + σ C wC + 2wA wB ρ A, Bσ Aσ B + 2 wB wC ρ B ,Cσ Bσ C + 2 wA wC ρ A,Cσ Aσ C 2 2 2 2 2 2

- 159. RISK OF A FOUR-ASSET PORTFOLIO The data requirements for a four-asset portfolio grows dramatically Risk, Return and Portfolio Theory if we are using Markowitz Portfolio selection formulae. We need 6 correlation coefficients between A and B; A and C; A and D; B and C; C and D; and B and D. A ρa,b ρa,d ρa,c B D ρb,d ρb,c ρc,d C

- 160. COVARIANCE A statistical measure of the correlation of the fluctuations of the annual rates of return of Risk, Return and Portfolio Theory different investments. n _ _ [8-12] COV AB = ∑ Prob i (k A,i − ki )(k B ,i - k B ) i =1

- 161. CORRELATION The degree to which the returns of two stocks co- move is measured by the correlation coefficient (ρ). Risk, Return and Portfolio Theory The correlation coefficient (ρ) between the returns on two securities will lie in the range of +1 through - 1. +1 is perfect positive correlation -1 is perfect negative correlation COV AB [8-13] ρ AB = σ Aσ B

- 162. COVARIANCE AND CORRELATION COEFFICIENT Solving for covariance given the correlation coefficient and standard deviation of the two assets: Risk, Return and Portfolio Theory [8-14] COV AB = ρ ABσ Aσ B

- 163. IMPORTANCE OF CORRELATION Correlation is important because it affects the Risk, Return and Portfolio Theory degree to which diversification can be achieved using various assets. Theoretically, if two assets returns are perfectly positively correlated, it is possible to build a riskless portfolio with a return that is greater than the risk-free rate.

- 164. AFFECT OF PERFECTLY NEGATIVELY CORRELATED RETURNS ELIMINATION OF PORTFOLIO RISK Returns If returns of A and B are % 20% perfectly negatively correlated, a two-asset portfolio made up of Risk, Return and Portfolio Theory equal parts of Stock A and B would be riskless. There would 15% be no variability of the portfolios returns over time. 10% Returns on Stock A Returns on Stock B 5% Returns on Portfolio Time 0 1 2

- 165. EXAMPLE OF PERFECTLY POSITIVELY CORRELATED RETURNS NO DIVERSIFICATION OF PORTFOLIO RISK Returns If returns of A and B are % 20% perfectly positively correlated, a two-asset portfolio made up of Risk, Return and Portfolio Theory equal parts of Stock A and B would be risky. There would be 15% no diversification (reduction of portfolio risk). 10% Returns on Stock A Returns on Stock B 5% Returns on Portfolio Time 0 1 2

- 166. AFFECT OF PERFECTLY NEGATIVELY CORRELATED RETURNS ELIMINATION OF PORTFOLIO RISK Returns If returns of A and B are % 20% perfectly negatively correlated, a two-asset portfolio made up of Risk, Return and Portfolio Theory equal parts of Stock A and B would be riskless. There would 15% be no variability of the portfolios returns over time. 10% Returns on Stock A Returns on Stock B 5% Returns on Portfolio Time 0 1 2

- 167. AFFECT OF PERFECTLY NEGATIVELY CORRELATED RETURNS NUMERICAL EXAMPLE Weight of Asset A = 50.0% Weight of Asset B = 50.0% Risk, Return and Portfolio Theory n Expected ER p = ∑ ( wi × ERi ) = (.5 × 5%) + (.5 ×15% ) i =1 Return on Return on Return on the = 2.5% + 7.5% = 10% Year Asset A Asset B Portfolio n xx07 = ∑ (wi5.0% = (.5 ×15%) 15.0% ) ER p × ERi ) + (.5 × 5% 10.0% i =1 xx08 = 7.5% + 2.5% = 10% 10.0% 10.0% 10.0% xx09 15.0% 5.0% 10.0% Perfectly Negatively Correlated Returns over time

- 168. DIVERSIFICATION POTENTIAL The potential of an asset to diversify a portfolio is dependent Risk, Return and Portfolio Theory upon the degree of co-movement of returns of the asset with those other assets that make up the portfolio. In a simple, two-asset case, if the returns of the two assets are perfectly negatively correlated it is possible (depending on the relative weighting) to eliminate all portfolio risk. This is demonstrated through the following series of spreadsheets, and then summarized in graph format.

- 169. EXAMPLE OF PORTFOLIO COMBINATIONS AND CORRELATION Perfect Positive Correlation – no Risk, Return and Portfolio Theory Expected Standard Correlation Asset Return Deviation Coefficient diversification A 5.0% 15.0% 1 B 14.0% 40.0% Portfolio Components Portfolio Characteristics Both Expected Standard Weight of A Weight of B Return Deviation portfolio 100.00% 0.00% 5.00% 15.0% returns and 90.00% 10.00% 5.90% 17.5% 80.00% 20.00% 6.80% 20.0% risk are 70.00% 30.00% 7.70% 22.5% bounded by 60.00% 40.00% 8.60% 25.0% 50.00% 50.00% 9.50% 27.5% the range set 40.00% 60.00% 10.40% 30.0% by the 30.00% 70.00% 11.30% 32.5% 20.00% 80.00% 12.20% 35.0% constituent 10.00% 90.00% 13.10% 37.5% assets when 0.00% 100.00% 14.00% 40.0% ρ=+1

- 170. EXAMPLE OF PORTFOLIO COMBINATIONS AND CORRELATION Positive Correlation – weak diversification Risk, Return and Portfolio Theory Expected Standard Correlation Asset Return Deviation Coefficient potential A 5.0% 15.0% 0.5 B 14.0% 40.0% Portfolio Components Portfolio Characteristics Expected Standard When ρ=+0.5 Weight of A Weight of B Return Deviation 100.00% 0.00% 5.00% 15.0% these portfolio 90.00% 10.00% 5.90% 15.9% combinations 80.00% 20.00% 6.80% 17.4% 70.00% 30.00% 7.70% 19.5% have lower 60.00% 40.00% 8.60% 21.9% risk – 50.00% 50.00% 9.50% 24.6% expected 40.00% 60.00% 10.40% 27.5% 30.00% 70.00% 11.30% 30.5% portfolio return 20.00% 80.00% 12.20% 33.6% is unaffected. 10.00% 90.00% 13.10% 36.8% 0.00% 100.00% 14.00% 40.0%

- 171. EXAMPLE OF PORTFOLIO COMBINATIONS AND CORRELATION No Correlation – some diversification Risk, Return and Portfolio Theory Expected Standard Correlation Asset Return Deviation Coefficient potential A 5.0% 15.0% 0 B 14.0% 40.0% Portfolio Components Portfolio Characteristics Expected Standard Weight of A Weight of B Return Deviation Portfolio 100.00% 0.00% 5.00% 15.0% 90.00% 10.00% 5.90% 14.1% risk is 80.00% 20.00% 6.80% 14.4% lower than 70.00% 30.00% 7.70% 15.9% 60.00% 40.00% 8.60% 18.4% the risk of 50.00% 50.00% 9.50% 21.4% either 40.00% 60.00% 10.40% 24.7% asset A or 30.00% 70.00% 11.30% 28.4% 20.00% 80.00% 12.20% 32.1% B. 10.00% 90.00% 13.10% 36.0% 0.00% 100.00% 14.00% 40.0%

- 172. EXAMPLE OF PORTFOLIO COMBINATIONS AND CORRELATION Negative Correlation – greater diversification Risk, Return and Portfolio Theory Expected Standard Correlation Asset Return Deviation Coefficient potential A 5.0% 15.0% -0.5 B 14.0% 40.0% Portfolio Components Portfolio Characteristics Expected Standard Weight of A Weight of B Return Deviation Portfolio risk 100.00% 0.00% 5.00% 15.0% for more 90.00% 10.00% 5.90% 12.0% combinations 80.00% 20.00% 6.80% 10.6% 70.00% 30.00% 7.70% 11.3% is lower than 60.00% 40.00% 8.60% 13.9% the risk of 50.00% 50.00% 9.50% 17.5% 40.00% 60.00% 10.40% 21.6% either asset 30.00% 70.00% 11.30% 26.0% 20.00% 80.00% 12.20% 30.6% 10.00% 90.00% 13.10% 35.3% 0.00% 100.00% 14.00% 40.0%

- 173. EXAMPLE OF PORTFOLIO COMBINATIONS AND CORRELATION Perfect Negative Correlation – greatest diversification Risk, Return and Portfolio Theory Expected Standard Correlation Asset Return Deviation Coefficient potential A 5.0% 15.0% -1 B 14.0% 40.0% Portfolio Components Portfolio Characteristics Expected Standard Weight of A Weight of B Return Deviation 100.00% 0.00% 5.00% 15.0% 90.00% 10.00% 5.90% 9.5% 80.00% 20.00% 6.80% 4.0% Risk of the 70.00% 30.00% 7.70% 1.5% portfolio is 60.00% 40.00% 8.60% 7.0% almost 50.00% 50.00% 9.50% 12.5% eliminated at 40.00% 60.00% 10.40% 18.0% 30.00% 70.00% 11.30% 23.5% 70% invested in 20.00% 80.00% 12.20% 29.0% asset A 10.00% 90.00% 13.10% 34.5% 0.00% 100.00% 14.00% 40.0%

- 174. Diversification of a Two Asset Portfolio Demonstrated Graphically The Effect of Correlation on Portfolio Risk: The Two-Asset Case Risk, Return and Portfolio Theory Expected Return B ρAB = -0.5 12% ρAB = -1 8% ρAB = 0 ρAB= +1 A 4% 0% 0% 10% 20% 30% 40% Standard Deviation

- 175. IMPACT OF THE CORRELATION COEFFICIENT Figure 8-7 (see the next slide) illustrates the relationship between portfolio risk (σ) and the Risk, Return and Portfolio Theory correlation coefficient The slope is not linear a significant amount of diversification is possible with assets with no correlation (it is not necessary, nor is it possible to find, perfectly negatively correlated securities in the real world) With perfect negative correlation, the variability of portfolio returns is reduced to nearly zero.

- 176. EXPECTED PORTFOLIO RETURN IMPACT OF THE CORRELATION COEFFICIENT 8 - 7 FIGURE 15 10 5 ) % not a ve D d a dna S s n u e R ol o t r o Pf o t i f r 0 -1 -0.5 0 0.5 1 ( i i r t Correlation Coefficient (ρ) Risk, Return and Portfolio Theory

- 177. ZERO RISK PORTFOLIO We can calculate the portfolio that removes all risk. When ρ = -1, then Risk, Return and Portfolio Theory [8-15] σ p = ( wA ) 2 (σ A ) 2 + ( wB ) 2 (σ B ) 2 + 2( wA )( wB )( ρ A, B )(σ A )(σ B ) Becomes: [8-16] σ p = wσ A − (1 − w)σ B

- 178. Friday, October 12, 2012 Risk, Return and Portfolio Theory AN EXERCISE TO PRODUCE THE EFFICIENT FRONTIER USING THREE ASSETS Risk, Return and Portfolio Theory

Notes de l'éditeur

- 5