Pastpapers 2011 2013

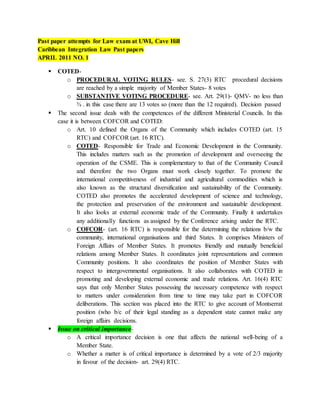

- 1. Past paper attempts for Law exam at UWI, Cave Hill Caribbean Integration Law Past papers APRIL 2011 NO. 1 COTED-o PROCEDURAL VOTING RULES- see. S. 27(3) RTC procedural decisions are reached by a simple majority of Member States- 8 votes o SUBSTANTIVE VOTING PROCEDURE- see. Art. 29(1)- QMV- no less than ¾ . in this case there are 13 votes so (more than the 12 required). Decision passed The second issue deals with the competences of the different Ministerial Councils. In this case it is between COFCOR and COTED: o Art. 10 defined the Organs of the Community which includes COTED (art. 15 RTC) and COFCOR (art. 16 RTC). o COTED- Responsible for Trade and Economic Development in the Community. This includes matters such as the promotion of development and overseeing the operation of the CSME. This is complementary to that of the Community Council and therefore the two Organs must work closely together. To promote the international competitiveness of industrial and agricultural commodities which is also known as the structural diversification and sustainability of the Community. COTED also promotes the accelerated development of science and technology, the protection and preservation of the environment and sustainable development. It also looks at external economic trade of the Community. Finally it undertakes any additionally functions as assigned by the Conference arising under the RTC. o COFCOR- (art. 16 RTC) is responsible for the determining the relations b/w the community, international organisations and third States. It comprises Ministers of Foreign Affairs of Member States. It promotes friendly and mutually beneficial relations among Member States. It coordinates joint representations and common Community positions. It also coordinates the position of Member States with respect to intergovernmental organisations. It also collaborates with COTED in promoting and developing external economic and trade relations. Art. 16(4) RTC says that only Member States possessing the necessary competence with respect to matters under consideration from time to time may take part in COFCOR deliberations. This section was placed into the RTC to give account of Montserrat position (who b/c of their legal standing as a dependent state cannot make any foreign affairs decisions. Issue on critical importance-o A critical importance decision is one that affects the national well-being of a Member State. o Whether a matter is of critical importance is determined by a vote of 2/3 majority in favour of the decision- art. 29(4) RTC.

- 2. o Seeing that only 8 Members have voted- then it does the threshold set by art. 29(4) of 2/3 majoirty. (Remember 2/3 majority is 10 Members voting). therefore the critical importance vote does not succeed. Issue on the voting procedures of Community Council-o This is governed by art. 29(1) RTC- which says that all decisions by the Community Council shall be binding upon attainment of qualified majority vote which is defined in subsection 2 as a no less than ¾ Membership of the Community o Since 13 members voted then this is binding on all Member States- the proposal for the abolition of the tax and the 2 year derogation for Jameeca is approved. Whether Carib Airlines can bring an action against the Comptroller of Customs in Jameeca in the High Court of Jameeca-o Having identified that according to the VCLT art. 26 (pacta sunt servanda) that Community law takes precedence over national law, and whereby art 214 RTC identifies the referral procedure which states that ‘where a national court of a Member State is seized of an issue whose resolution involves a question concerning the interpretation or application of the treaty the national court shall if it considers that decision on the question is necessary to enable it deliver judgment refer the question to the Court for determination before delivering judgment’. o Art. 240 RTC requires implementation of community decisions. There was no transformation in this case. o Supremacy of CARICOM Law- it appears that the argument by the Comptroller appears to follow EU precedent where EU law is supreme and directly applicable. (Costa v ENEL). Because of this the domestic court would throw out that argument since decisions made at CARICOM need to be transformed into local law. (Art. 240 RTC) o See International Tin Council case- “…except to the extent that a treaty becomes incorporated into the laws of the UK by statute, the courts of the UK have no power to enforce treaty rights and obligations at the behest of a sovereign government or at the behest of a private individual”. o See Myrie [2013] CCJ 3 (OJ) at [52] – art 240 RTC is not concerned with the creation of rights and obligations at the community level, it speaks to giving effect to rights at the domestic level. Further at paragraph 53 the court combined art. 9 and art. 240(1) RTC to say that Member States were required to honour and carry out obligations arising out of the RTC as well as those resulting from decisions taken by the Organs and Bodies of the Community. In this scenario the State of Jameeca needed to implement the legislation at the domestic level.

- 3. o Therefore Jameeca High Court, in complying with this provision of the RTC as well as its obligations to act in good faith shall refer the matter to the CCJ for determination. o Conclusion- Yes but it should be referred to the CCJ per art. 214 RTC Whether Carib Airlines can have standing before the CCJ-o Refer to art. 222 RTC-o YES they have standing Whether the challenge of the Community Council’s decision is in violation of the RTC- On the substance of the challenge, the Community Council’s decision to replace an earlier decision of COTED would appear to be ultra vires. The Community Council has a duty of cooperation under Art. 20 RTC, and under Art. 13(3)(b) is only empowered to amend proposals of Ministerial Councils subject to this duty of cooperation. Further, Art. 20(5) only allows the Community Council to “modify the proposal [of the Ministerial Council] to the extent and in the manner agreed with the originating Organ.” e) This duty of cooperation may be interpreted strictly by the CCJ, which has given life to a similar obligation – the duty of consultation – in the decision of TCL v. CARICOM. If so, the decision of the Community Council may be declared invalid. APRIL 2011 NO 3 A number of headings need to be addressed in this question: 10% charge on sale of tamarind balls & Note the tamarind balls produced in St. Katts which are in competition with Tamarind Ball Company in the St. Katts market. Requirement of certificate of origin Note the purpose of the Reduction of Obesity Law 10% charge on sale of tamarind balls Whether the 10% charge is contrary to the provisions of the RTC (art. 90 RTC)- o Art. 90(1) RTC prohibits the imposition of fiscal charges on all community origin products. o The fact that the charge is imposed on all products whether domestic or international in origin is indicative that it is a tax and not for e.g. an import duty (pursuant to art. 87 RTC). Also the purpose of the charge is not on the crossing of any frontier (another clue that it is part of internal taxation). o From the EU jurisprudence a tax is defined as a genuine tax is a measure relating to a system of internal dues applied systematically to categories of products in accordance with objective criteria irrespective of the origin of the products (Case 90/79 Commission v France).

- 4. o Since the charge is imposed regardless of origin of the products in the scenario given then it falls under the prohibition under art. 90(1) RTC. We need to see what happens to goods in competition. The facts tell us that the candies made in St Katts are in competition with Tamarind Ball’s goods-o Note the provision in the RTC- art. 90 RTC- Taxation falls under art. 90 RTC – art. 90 (1) (a) – (b) RTC will likely be read as mutually exclusive. Either a good must be classified as being (1) a like domestic good, or (2) a substitute which enters into direct competition with a domestic good. In both cases in order for a fiscal charge to contravene art. 90 RTC it must protect the domestic product. o What does the equivalent EU provisions say on this? In the TFEU at art. 110, paragraph 1 deals with similar products while paragraph 2 deals with products in competition. In the present case we see they say that the goods are in competition. o Note the case law on products in competition- (from the ECJ)- Case 170/78 Commission v UK- (Re Tax on Wine and Beer) the ECJ explained the scope of the application of art. 110(2) in respect of products in competition. In this case the UK maintained different levels of internal taxation on beer and wine. Wine was mostly imported while beer was a predominantly domestic product. The Commission decided that this tax difference amounted to discrimination against imported wine and that by increasing the tax on wine the UK government was encouraging consumers to buy beer. The UK argued the two products were not interchangeable and there was no breach of art. 110 TFEU. The ECJ held however that beer and wine were to a certain extent substitutable as they were capable of meeting the same needs of consumers. They were products in competition and the ECJ found the UK in breach of art. 110(2) TFEU. Relating back to the RTC art 90(1)(b) there is a likelihood that the imposition of the tax is in fact in contravention of the article. We now need to determine the type of taxation this is- whether it is direct discrimination or indirect discrimination (because the facts said that St. katts did not produce tamarind candies but some other form of candy – therefore it would not be subject to the tax) o Indirect discrimination is discrimination based on factors other than the nationality of the product. In EU law this is prohibited. o Note the ECJ cases on indirect discrimination- Case 112/84 Humblot where under French law annual tax on cars differentiated between cars below 16hp and above 16hp. France did not manufacture cars above 16hp so all French cars were subject to a lower tax than non-French cars. Humblot challenged this and the ECJ held that French law was in breach of art. 110 TFEU as it was discriminatory in terms of cars imported from other Member States.

- 5. o From the fact pattern we see that no one in St. Katts produce tamarind candies so they would not be subject to the 10% charge. o Result- indirectly discriminatory on Tamarind Ball Company products. We now need to know whether that tax can be justified under art. 226 RTC-o We see that the imposition of the Obesity Law was for health reasons-o Note art. 226 (1)(b) RTC- to protect human, animal or plant life or health. This means that the health concern by the government may justify the imposition of the tax. It may also be argued that the imposition of the tax is to protect the domestic market. Also note that art. 90(2) RTC does not require the Member State to notify COTED on any imposition of fiscal charges, it only seems to apply to those imposed under art. 90 (1)(a) RTC. It is also nice to mention Case 140/79 Chemial v DAF where the ECJ spoke about objective justification of taxes. “… such differentiation is compatible with community law if it pursues economic policy objectives which themselves are compatible with the requirements of the treaty…” Requirement of certificate of origin Whether the imposition of the requirement for a certificate of origin is contrary to the provisions of the RTC-o We first need to determine whether this is an import duty (see art. 87 RTC), a tax (see art. 90 RTC) or a quantitative restriction (see art. 91 RTC). o The main clue in determining whether it is a import duty, tax or quantitative restriction is the nature of the charge. What type of charge is it? Is it a fiscal charge or non-fiscal? If it is a fiscal charge it will fall under art 87 RTC or art. 90 RTC. If non-fiscal charge, then it will most likely be a quantitative restriction thereby falling under art. 91 RTC1. 1 ARTICLE 91 Quantitative Restrictions 1. Save as otherwise provided in this Treaty, and in particular Articles 88, 89 and 90, and in Schedules II, III and IV, a Member State shall not apply any quantitative restrictions on the importation of goods which are of Community origin. 2. Except as otherwise provided in this Treaty, and particularly in Articles 89 and 90, and in Schedule III, a Member State shall not apply any quantitative restrictions on exports to any other Member State. 3. This Article shall not prevent any Member State from taking such measures as are necessary to prevent evasion of any prohibitions or restrictions which it applies to imports from or exports to third States provided that less favourable treatment is not granted to Member States than to countries outside the Community. 4. "Quantitative restrictions" means prohibitions or restrictions on imports into, or exports from, any other Member State, as the case may be, whether made effective through quotas, import licences or other measures with equivalent effect, including administrative measures and requirements restricting imports or exports.

- 6. o Art. 91(4) RTC gives a list of quantitative restrictions- quotas; import licenses and measures having equivalent effect to a quantitative restriction(MEQR) o What type of quantitative restriction is it? From the facts we see that it is not an import license required nor is ir a quota. It therefore is a MEQR. What does the ECJ say on MEQRs? Note the equivalent provision in the TFEU on quantitative restrictions- Art. 34 TFEU (deals with imports) and art. 35 TFEU (deals with exports). The ECJ defined a MEQR in Case 8/74 Dassonville as ‘all trading rules enacted by a Member State which are capable of hindering directly or indirectly, actually or potentially, trade between Member States’. This is known as the Dassonville formula. What happened in the Dassonville case? In this case the Belgian authorities required a certificate of origin and none were obtained by the traders in question because it could only be obtained from the British customs. The defendants argued that the requirement of a certificate of origin was a MEQR and prohibited by art. 34 TFEU. The ECJ held that the requirement for a certificate of origin was in fact a MEQR as it potentially discriminated against parallel importers who would be unlikely to be in possession of the requisite documentation. Applying the decision of Dassonville in the fact pattern presently, it would appear that the requirement for a certificate of origin was a MEQR since it has the effect of impeding the free movement of goods. Also, the goods are Community origin goods and imposition of quantitative restriction on those goods would be breach of art. 91(1) RTC. Also see the International Fruit Company case- As established in the International Fruit Company case, a license requirement, even if a pure formality, violates the rule against quantitative restrictions on imports o Whether the MEQR can be justified under art. 226 RTC- It may be justified under art. 226 (1)(b) RTC (health reasons). However subject to art. 226(2) RTC Member States taking such measures must notify COTED- something which St. katts did not do here. o Conclusion- the requirement is in breach of art. 91 RTC. No notification made to COTED for adopting measures so breach of art. 226 (2) RTC. As established in the International Fruit Company case, a license requirement, even if a pure formality, violates the rule against quantitative restrictions on imports APRIL 2012 #3

- 7. 3. Answer BOTH questions (A) and (B). (A) The State of Barbarous decides to impose a new 20% tax on the sale of fruit wine for the purposes of combating alcohol abuse by certain segments of its population. Fruit wine in Barbarous is mainly imported from the neighbouring State of Trini, and only about 5% of sales are of locally produced fruit wine. One rum distillery in Barbarous has started to produce 'light fruit rum' and this does not attract any sales tax. You are an expert of EU and CARICOM law. The Minister of Trade of the State of Trini seeks your advice about the legality of Barbarous' new sales tax. Whether the tax imposed can be seen as having a directly or indirectly discriminatory effect within the Community-o According to art. 90 RTC, imposed prohibition on the imposition of fiscal charges on community origin goods. In this case given, the goods are of Community origin pursuant to art. 84 RTC (since the goods are produced within the Community). o On a reading of art. 90(1)(b) RTC it seems that there is a prohibition on imported Community origin goods which are not produced in the Member State or which they do produce but not in substantial qualities in such a way to protect the domestic production. It appears from the fact pattern that the purpose of the imposition of the tax on the fruit wine from Trini is to protect the local producer that produces ‘light fruit rum’. o Discuss art. 110 TFEU (the EU equivalent to art. 90 RTC)- In art. 110 TFEU there are two paragraphs which include taxation on similar products (art. 110(1) TFEU) and products in competition (art. 110(2) TFEU). In Case 170/78 Commission v UK (Re Tax on Wine and Beer) the ECJ explained the scope of the application of art. 110(2) in respect of products in competition. In this case the UK maintained different levels of internal taxation on beer and wine. Wine was mostly imported while beer was a predominantly domestic product. The Commission decided that this tax difference amounted to discrimination against imported wine and that by increasing the tax on wine the UK government was encouraging consumers to buy beer. The UK argued the two products were not interchangeable and there was no breach of art. 110 TFEU. The ECJ held however that beer and wine were to a certain extent substitutable as they were capable of meeting the same needs of consumers. They were products in competition and the ECJ found the UK in breach of art. 110(2) TFEU. It can be seen therefore, that by looking at the consumer needs of the fruit wine and that of the local fruit rum, they can both be interchangeable and be considered as products in competition. Thus they are likely to fall under art. 90(1)(b) RTC and would be in breach of this provision. o Also, since the tax is imposed directly on fruit wine alone it has the effect of being a directly discriminatory tax.

- 8. o The next issue would be whether this tax can be justified under art. 226 RTC- There are no provisions under art. 226 RTC which may justify the purpose of the tax imposed. The only exception which may be applicable is art. 226 (1)(a) RTC which seeks to protect public morals and safety but this is debatable. o Art. 90(2) RTC places an obligation on the Member State to notify COTED on any additional fiscal charges which they may impose. The State of Trini did not notify COTED so they will be in breach of this provision. o Conclusion- 1) Tax on imported fruit wine is discriminatory taxation contrary to art. 90 (1)(b) RTC and; 2) failure to notify COTED results in breach of art. 90(2) RTC. (B) The port of Jameeca is so heavily used that traffic congestion in the neighbourhoods around it has become unbearable. The Jameecan Minister of Trade decides to modernize the port and authorizes the imposition of a new 'freight processing fee' to raise funds. The freight processing fee is assessed at 15% of the value of all goods passing through the port. No other changes are made to any customs processes. After having to pay $300,000 USD in freight processing fees, Super Shipping Inc, a company incorporated in the State of Trini, brings a claim against Jameeca before the Caribbean Court of Justice in its original jurisdiction and is granted special leave to do so. You are the attorney for Super Shipping Inc. Write submissions for your clients on the merits of its case, being certain to refer to appropriate EU authorities for comparative purposes. Whether the ‘freight processing fee’ can be classified as an import duty pursuant to art. 87 RTC in breach of the RTC-o Note the definition of an import duty in art. 1 RTC- ‘any tax or surtax or customs and any other charge of equivalent effect whether fiscal, monetary or exchange which are levied on imports except those notified under art. 85 RTC and the other charges which fall within that article’. o Imposition of import duties are prohibited by Member States o The next issue would be what kind of import duty is it- is it a customs duty or any charge of equivalent effect? EU law helps us in this regard In Case 24/68 Commission v Italy the ECJ defined what is meant by a charge having equivalent effect (CEE) (which is prohibited under art. 30 TFEU). The ECJ in this case held that a CEE was any pecuniary charge, however small and whatever its designation and mode of application, which is not a custom duty in the strict sense… even if it is not imposed for the benefit of the State, is not discriminatory or protective in effect and if the product on which the charge is imposed is not in competition with any domestic product. What the previous case gives us is certain characteristics of a CEE which can aid us in determining whether a charge is a CEE.

- 9. An important clue in knowing whether there is the imposition of a CEE is that the charge is imposed on the crossing of a frontier and that the charge does not have as its effect, the protection of a domestic product. Since the charge is imposed when the ships reach at the border this means that they are charged on the crossing of a frontier which is indicative of a CEE. o Having established that it is a charge of equivalent effect and in breach of art. 87 RTC we now need to know whether this charge can be justified under art. 226 RTC- Nothing in art. 226 RTC can justify the charge imposed. At its meeting on January 6, 2013 the Council for Finance and Planning (COFAP) considers a proposal from the Secretariat for a Caribbean Community (CARICOM) Fiscal Discipline Policy (Policy). The Policy requires all Member States to maintain a balanced budget and temporarily withdraws voting privileges on all CARICOM organs for any state found not to have done so. The state of St. Katts, which is currently building a new airport, argues that the Policy is inappropriate at this time. The Chairman of COFAP ignores the comments of St. Katts and suggests that the matter should go to vote. St. Katts objects, declaring that the Policy is related to an issue of critical importance to its national development. The representative from Jameeca says that a vote must be held on the matter of critical importance first. Nine Member States vote to recognize the matter as being of critical importance to St. Katts. The Chairman then moves for a vote on the Policy. Twelve Member States vote in favour of the Policy, two abstain, and St. Katts votes against it. The representative from St. Katts immediately storms out of the meeting in anger. Eight months later St. Katts is unable to balance its budget and the matter comes up at a meeting of the Conference. Before deciding whether to sanction St. Katts under the Policy, the Chairman of the Conference asks the Prime Minister of St. Katts for his views. The Prime Minister states that the Policy 'has always been, and is, morally and economically unsound and should be terminated immediately.' The Chairman places the issue of whether St. Katts should be excluded from voting before the Conference for its decision. Twelve Member States vote in favour of the exclusion, two abstain, and St. Katts votes against it. Later in the same meeting the Conference decides that all airlines which are owned by CARICOM nationals have the right to land in any CARICOM airport without being charged any landing fees. The last sentence of the decision provides that the 'decision is immediately and directly effective.' No state modifies its laws following this decision. An Air Jameeca flight lands in St. Katts and the Airport Authority imposes its usual $5000 USD landing fee. Air Jameeca, a

- 10. CARICOM company, refuses to pay it and St. Katts bars its planes from using its airport. Air Jameeca brings the matter to the Caribbean Court of Justice and argues that its rights under the Conference decision are being violated. You are the Clerk to the President of the Caribbean Court of Justice. Critically advise the President on all of the legal issues raised in the above facts as well as whether the Court can take jurisdiction over the case. CONCLUSION-St. Katts in contravention of the Conference Decision. APRIL 2013 NO 3 PART A: IMPORT DUTIES- art 1 RTC- means any tax or surtax of customs and any other charges of equivalent effect whether fiscal, monetary or exchange, which are levied on imports except those notified under Article 85 and other charges which fall within that Article; Whether the Environmental Levy is considered as an import duty or part of internal taxation-o Import duties are under art. 87 RTC o Hints to know whether it is an import duty or tax? Since it applies to all fruits and vegetables then it is not only restricted to imported goods but also domestic goods. Therefore it is a tax under art. 90 RTC. o Taxation falls under art. 90 RTC – art. 90 (1) (a) – (b) RTC will likely be read as mutually exclusive. Either a good must be classified as being (1) a like domestic good, or (2) a substitute which enters into direct competition with a domestic good. In both cases in order for a fiscal charge to contravene art. 90 RTC it must protect the domestic product. Does the Environmental levy fall under art. 90 RTC (a) or (b). The facts does not tell us what type of product it is. It just gives the term “products”. It can be assumed that these may or may not be substitutes. o What type of tax is it? Is it direct or indirect tax? Firstly, discuss whether it is a Community origin product. Yes it is a COmmuity origin product because it is produced in St Lucea (pursuant to art. 84 (1) RTC). Since art. 90 RTC says that Member States shall not impose any fiscal charges in imported goods of community origin then the tax placed on St Lucea’s goods are unlawful. Discriminatory taxes are imposed by reason of nationality. This may be in in contravention of art 7 RTC Indirect discrimination are imposed for reasons other than nationality. In the present scenario, it may be indirect discrimination since only the products from St. Lucea have any packaging. Therefore it can be said that domestic goods of Trinee will not the affected by the taxation since most of the fruits and vegetables sold in Trinee are sold in open shelves or bins. Borrowing from jurisprudence of

- 11. the ECJ, the Case 112/84 Humblot. In this case, one level of tax was imposed on cars w/ engines 16 hp and another level of tax was imposed with those with engines 16hp and above. Such a tax scheme was origin neutral and not directly discriminatory. However, since all French cars fell below the 16 hp rating and the majority of import vehicles fell above it the result was disproportionate and therefore indirectly discriminatory to the importer Humblot. Therefore it was in contravention of ar. 110 TFEU. In the present case , the Member State of Trinee did not inform COTED of any additional fiscal charge it applied. This therefore is a breach of its obligation under art. 90(2) RTC. o Whether the Environmental Levy can be justified under art. 226 RTC- It may be- under art. 226 (1)(j) RTC which provides for conservation of natural resources of the preservation of the environment. It may be argued by Trinee that the purpose of the Levy is for environmental purposes and therefore may be justified under art. 226 RTC. o Conclusion- not in breach of art. 90 (1) RTC; but failed to notify COTED of the additional charge so breach of art. 90 (2) RTC. PART B- Whether the meeting of Mighty Cells and Cheapy Cells can be classified as an agreement or concerted practices in contravention of art. 177(1)(a) RTC-o EU Competition law (art. 101 TFEU and art 102 TFEU governs competition law in the EU)defines an agreement as informal, gentlemen’s agreements (ACF v Commission). Concerted practices extends to situations where w/o any formal agreement parties knowingly substitute practical cooperation for the risks of competition (ICI v Commission [Dyestuffs]). Concerted practices may be proved by parallel conduct which cannot be justified on the basis of normal market forces. In ICI v Commission the ECJ first examined the concept of a concerted practice. The Court said that concerted practices refer to a form of co-operation between undertakings which, without having been taken to the stage where an agreement properly so called has been concluded, knowingly substitutes for the risk of competition practical cooperation between them. o Based on the facts presented the dinner meeting can be classified as a concerted practice. This is made evident further by the result of the meeting- the fact that the cell phone prices were identical and also because the meeting at dinner did not come to a definite conclusion to become an agreement. o Therefore, in breach of art. 177(1)(a) RTC. Whether the concerted practice has as its object the prevention, restriction or distortion of competition within the Common Market-(STM) o The aim of the parties was to increase their joint market share in St. Katts and with this in mind they reduced cell phone prices to 45% and 50% respectively. This, according to the ECJ case Societe Technique Miniere must be possible to foresee with a sufficient degree of probability on the basis of a set of objective factors of law or fact that the agreement in question may have an influence, direct or indirect, actual or potential, on the pattern of trade b/w Member States.

- 12. o From this, we can conclude that the effect of the concerted practice b/w Mighty Cells and Cheapy Cells had the potential effect of distorting competition within the market. Whether the concerted practice can be justified - o One way in which a concerted practice can be justified is by proving that the concertation is not the only reason for the parallel conduct between the parties. This was made clear in the ECJ case of Ahlstrom v Commission. However, in the present case, the only reason for the parallel conduct , based on the evidence given, is the meeting. APRIL/MAY 2013 #1 The following issues arise in the given scenario: Whether Gold Is Us Ltd has standing to bring the matter before the CCJ The issue here deals with the interpretation of art. 222 RTC which deals with locus standi of private entities. This issue of locus standi by private entities has been brought up in a number of original jurisdiction decisions before the CCJ in the past. In TCL Ltd. and TGI Inc. v Guyana (grant of special leave) the CCJ established the grounds for standing for private entities before the CCJ. In this case it was argued by Guyana, inter alia, that the claimants, companies registered in Trinidad and Guyana respectively were not considered ‘persons, natural or juridical’ within the meaning of art. 222 RTC. The CCJ in this case went to great lengths to set out the basis for standing for private entities in matters before the Court. Firstly, the Court said that private parties were intended to be part of the regime of the RTC and referred to art. 211 (d) RTC which confers jurisdiction on the court in contentious proceedings for the interpretation and application of the RTC which included, inter alia, applications by persons in accordance with art. 222 RTC concerning interpretation and application of the RTC.2 The Court did adopt the restrictive meaning of ‘national’ in art. 222 RTC based on the literal interpretation but rather adopted a teleological approach interpreting it in light of its object and purpose and said that it was enough that the company was registered or incorporated in the country.3 The Court in the TCL v Guyana case mentioned above also introduced revolutionary concepts such as the doctrine of correlative rights when they said that the obligations set out in the RTC are imposed on Member States collectively- capable of yielding a correlative right that enures directly to the benefit of private entities.4 In this case the CCJ set out the test for bringing a claim before the Court and they said that there were two requirements which needed to be satisfied. They included: 2 TCL Ltd and TGI Inc v Guyana [2009] CCJ 1 (OJ), paragraph 18. 3 Ibid, paragraph 28. 4 Ibid, paragraph 32.

- 13. 1. The treaty intended that a right conferred on a Contracting Party shall fall to the benefit of such person; 2. Such person was prejudiced in respect of enjoyment of that benefit. With respect to the standard of proof the court said that the claimant merely needed to show an arguable case. To prevent Gold Is Us Ltd from bringing an action before the AG of Barbarous and the Commissioner of Police would frustrate the achievement of the goals of the RTC; and it would go contrary to the meaning of art. 7 RTC against non-discrimination.5 The factual scenario indicated that Gold Is Us Ltd is incorporated in Barbarous and that is sufficient to ground them standing as a private entity in the matter at hand. Whether the owner can bring the matter before the CCJ in his personal capacity Of relevance here is art. 214 RTC6 which is titled ‘referral to the Court’. It has the effect of allowing nationals to refer matters involving the interpretation and application of the Treaty to the CCJ. Mention should be made on the case Johnson v CARICAD7, a case which, while the facts are not of relevance here, the principle is. In this case the CCJ said that the defendant could not be a proper party to be sued in the CCJ since it did not act for the Community and was not its alter ego with the result that it had no jurisdiction. In order for the CCJ to hear his matter, there firstly needs to be a matter of dispute arising from his rights under the RTC. If the case of Maharaj Furniture and Appliances Ltd v The Comptroller of Customs and Excise8were to come before the courts again, this provision, art. 214 RTC could be invoked so his issue can be dealt with at the CCJ level. Presently, the owner of the company can bring the matter before the CCJ in his individual capacity by using the referral procedure of the court. Whether there has been a breach of any rights conferred on persons (private entity or individual) by the implementation of the Conference Decision 5 Ibid, paragraph 40. 6 Art. 214 RTC- Where a national court or tribunal of a Member State is seised of an issue whose resolution involves a question concerning the interpretation or application of this Treaty, the court or tribunal concerned shall, if it considers that a decision on the question is necessary to enable it to deliver judgment, refer the question to the Court for determination before delivering judgment. 7 [2009] CCJ 3 (OJ). 8 TT 1994 HC 146.

- 14. The claimant argues that the new legislation is unconstitutional since it interferes with both his and his company’s right not to be subject to arbitrary search. According to art. 240(1) RTC the decisions of the competent Organ need to be subject to the constitutional procedures of the Member States firstly before they can be legally binding upon nationals of such Member States. Looking at the fact pattern, the Conference Decision did not have the vote of St. Vincy. From this, there is need to interpret art. 28(1) RTC which says that decisions that the Conference shall take decisions by an affirmative vote of all its members. This means that there needs to be unanimity for the decision to be binding however, that section is subject to, inter alia, section 28(2) abstentions are not to be construed as impairing the validity of the conference decisions. In the case Shanique Myrie v Barbados9, Barbados argued, inter alia that since there was no unanimous vote by the Conference, then the Conference decision could not be binding but the Court rejected this. This leads to the conclusion that the Conference Decision is valid and legally binding on nationals of Barbarous. The ability of the Court to judicially review decisions was raised in previous original jurisdiction cases before the CCJ- TCL v CARICOM [2009] CCJ 4 (OJ) (Merits) and in Hummingbird Rice Mills v Suriname and CARICOM [2012] CCJ 1 (OJ) (merits). In TCL v CARICOM the CCJ said that based on the provisions of the RTC it has the power to scrutinize the acts of Member States and the Community and to determine whether they are in accordance with the rule of law.10 Similarly in the Hummingbird case the CCJ reiterated the point mentioned in their earlier case that the transformation of the CSME into a rule based system created a regional regime under the rule of law.11 From the case law therefore, there seems to be a right to judicially review the acts of Member States as well as the Community to determine whether they are in accordance with the rule of law. If there are breaches of rights as claimed by the company and the owner thereof, then given the fact that the CSME is based on a regime founded on the rule of law, those acts should be struck out by the Court. In Joined Cases C-402/05P and C-415/05P Kadi, the ECJ said that the respect for human rights is a condition of the lawfulness of Community acts and that measures incompatible with respect for human rights are not acceptable in the Community. (Remember the Court also said in TCL v CARICOM [2009] CCJ 4 (OJ) at paragraph [40] that it has to strike a balance when judicially reviewing acts of Member States). However, given the nature of the criminal activity which the State is trying to suppress, then by giving notice when a search will be conducted will make the entire process a waste since illegal traders in gold will have time to shred documents and hide all evidence of any traces of illegal activities. This seems to be in accordance with the 9 [2013] CCJ 3 (OJ), paragraphs [43] – [48]. 10 [2009] CCJ 4 (OJ), paragraph 38. 11 [2012] CCJ 1 (OJ), paragraph 30.

- 15. principle of proportionality. The CCJ alluded to this principle of proportionality in the Myrie decision when commenting on the exceptions to right of definite entry into Member States and they said that such measures must not be disproportionate to the objectives sought.12 Therefore, it is my opinion that given the nature of the activities aimed at preventing, the State of Barbarous did not act in breach of any rights conferred on the company nor its owner. Other issues worth mentioning: Whether the decision made by COTED is legally binding COTED is a community organ and is mentioned at art. 15 RTC. Common voting procedures in Community Organs and Bodies are mentioned in art. 27 RTC. Any recommendation made by COTED must be made by a 2/3 majority would not be legally binding (art. 27(6) RTC). Whether the decision made by Community Council is binding The Community Council is mentioned in art. 13 RTC. Voting in the Community Council is laid down in art. 29 RTC. Art. 29(1) RTC provide that decisions made by the Community Council must be by a qualified majority vote (QMV) which is defined in art.29(2) as no less than ¾. From the fact pattern only eleven of the 15 Members voted and this is less than the ¾ limit placed in art. 29(1) RTC. Therefore the decision is void since the ¾ majority was not met. Whether the Conference Decision is binding and whether the lack of support by St. Vincy annuls that decision. Pursuant to art. 28(1) RTC decisions made by the Conference are binding and abstentions shall not be construed as impairing the validity of decisions of the Conference. Therefore the abstention of St. Vincy would not affect the nature of the decision because it would still give effect to the Conference Decision and make it binding on Member States.13 12 [2013] CCJ 3 (OJ), paragraph 70. 13 See Shanique Myrie v Barbados [2013] CCJ 3 (OJ), paragraphs [43]-[48]- where the Court was of the view that an abstention or an omission to vote was not to be construed as impairing the validity of a Conference Decision providing that Member States making up ¾ of the Member ship of the Community vote in favour of the decision.