Model.risk.management2015

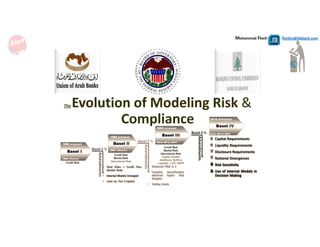

- 1. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Evolution of Modeling Risk & Compliance

- 2. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Mohammad Fheili “Over 30 years of Experience in Banking. Contact Details: mifheili@gmail.com (961) 3 337175 Mohammad has successfully delivered over 1,500 hours of training to professional bankers. He served as an Economist at ABL, and Senior Manager at BankMed and Fransabank: and he currently serves in the capacity of an Executive at JTB Bank in Lebanon. In addition, He worked as an Advisor to the Union of Arab Banks. Mohammad also served as Basel II Project Implementation Advisor to CAB and HBTF Banks in Jordan. Mohammad received his college education (undergraduate & graduate) at Louisiana State University (LSU), and has been teaching Economics and Finance for over 25 continuous years at reputable universities in the USA (LSU) and Lebanon (LAU). Finally, Mohammad published over 25 articles, of those many are in refereed Journals (e.g., Journal of Money Laundering & Control; Journal of Operational Risk; Journal of Law & Economics; etc.) and Bulletins.”

- 3. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Model Risk Management….The Yesteryears! G.I.G.O. • Garbage In, Garbage Out G.I.G.O.

- 4. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Birth of An Early Model • Model: A Simple mapping of the Assets to their corresponding Risk Weights, which is given by the Supervisor. … • No crisis was born out of Modeling Errors at the time, the BCBS dropped Model Risk Management from Consideration. < Basel I, or Standardized Approach >

- 5. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Regulator’s Perspective at the Time. • Local Supervisors looked at the Regulated Financial Institution as: Assets – Liabilities = Net Worth (Cushion) Should the Bank encounter a run‐on‐deposits, there is the Central Bank as lender of last resort to save the day. Should the Bank encounter a Large Scale Default, Deposit Insurance will save the day. The more Capital the Bank has, the more it is cushioned against a possible fall in the value of its assets. This is how THE REGULATOR intended to deal with Financial Crisis since “Deposit Insurance” and “Lender of Last Resort” have clear implications on Financial Stability (Needless to mention facilitating Financial Intermediation) Capital Adequacy is a “Maintenance Factor;” However, introduced under the illusion of an otherwise: Safety (All Financial Crisis proved else), Solvency (Purely Accounting), etc.

- 6. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Asymmetric World MAXIMIZE PROFIT subject to: RISK (Basically Credit), REGULATIONS (Simple Computation of the Cook Ratio) The Banking Model…. Early Years • Banks equipped with Technological advancements, endowed with Financial Innovations, started to search for ways to capitalize on Imperfections in Regulations: Capital Arbitrage. • Banks Ventured into “Internal Models” in the 1990s: These models allowed banks to align the amount of risk they undertook on a loan with the overall goals of the bank. Internal models allowed banks to more finely differentiate risks of individual loans than is possible under The Basel Accord If a loan is calculated to have an internal capital charge that is low compared to 8% standard, the bank has a strong incentive to undertake Regulatory Capital Arbitrage Securitization is the main means used especially by U.S. banks to engage in regulatory capital arbitrage • For Banks, The Balance Sheet: [A + CA] – [L + CL] = Net Worth (Not a Cushion!) • Driven by a Desire to Free‐Up Capital, boost up their Liquidity, and Profitability Banks re‐invented the Banking Model. • Regulators were well aware of where banks were going and Blessed the Move: Securitization was, to a certain extent, encouraged by regulators. • Regulators Approved Internal Models without the Proper Due Diligence. • Capital Adequacy, at the time, did not adequately account for Contingent Assets. • And ….

- 7. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com MAXIMIZE PROFIT subject to: RISK , REGULATORY, Compliance, Reporting, Etc. Constraints RISK . . . Default Liquidity Maturity Others . . . REGULATORY . . . Basel I Basel II Basel III Basel IV (In the making) TLAC Requirements Sanctions Rules USA_FATCA Requirements OECD_CRS (1st Reporting 2017) AML, Etc. . . . Uses of Funds Sources of Funds Reserves Loans Securities Other Investments Fixed Assets . . . All Types of Deposits Borrowings Other Sources Capital . . . Off-Balance Sheet With every Dollar in Profit a Bank Makes, it MUST satisfy all these Regulatory Constraints first! Legal Issues . . . From Originate‐To‐ hold To Originate‐To‐ Distribute (Decompose & Redistribute) CRS: Common Reporting Standards, essentially inspired by FATCA, is a framework between governments to exchange information obtained from local financial institutions to combat tax evasions. TLAC: The Proposed Minimum Total Loss Absorbing capacity requirements for Globally Systemically Important Banks (G‐Sibs). It aims to boost G‐Sibs’ capital and leverage ratios, ensuring these banks are equipped to continue critical functions without threatening financial market stability or requiring taxpayer support. Instead of to Off‐ Balance Sheet; now to Unregulated Shadow Banking with less concerns over loan monitoring & Follow up. Deteriorated quality of Capital with the Introduction of new instruments and Tier 3 The Banking Model…. got complicated These Changes matter much to Model Assumptions.

- 8. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com MAXIMIZE PROFIT subject to: RISK , REGULATORY, Compliance, Reporting, Etc. Constraints RISK . . . Default Liquidity Maturity Others . . . REGULATORY . . . Basel I Basel II Basel III Basel IV (In the making) TLAC Requirements Sanctions Rules USA_FATCA Requirements OECD_CRS (1st Reporting 2017) AML, Etc. . . . Uses of Funds Sources of Funds Reserves Loans Securities Other Investments Fixed Assets . . . Off-Balance Sheet Legal Issues . . . More Risky Assets are Unloaded to Off‐ Balance Sheet In its Latest Version, IFRS 9 speaks of NPAs (non‐Performing Assets) instead of only NPLs (Non‐Performing Loans). More Investment in Complex Financial Derivatives on all Sides of the Balance Sheet. More Capital Requirements by The Regulator; more Opportunities for capital Arbitrage…. The Banking Model…. got complicated These Changes matter much to Model Construction & Assumptions. Less Reliance on Deposit‐ Funding and More on Risky Borrowing (…roll‐over) All Types of Deposits Borrowings Other Sources Capital . . .

- 9. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com MAXIMIZE PROFIT subject to: RISK , REGULATORY, Compliance, Reporting, Etc. Constraints Uses of Funds Sources of Funds Reserves Loans Securities Other Investments Fixed Assets . . . Off-Balance Sheet The Banking Model…. got complicated All Types of Deposits Borrowings Other Sources Capital . . .

- 10. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com While Regulators were busy building the railroads on which they will require Bankers to Travel On. Banks and Bankers were gearing up for Dangerous Rock Climbing – Excessive Risk Taking: MBS, CDO, CDO2, etc. Asymmetric World Basel 1, 1½, 2, 2½, 3, 3½ or 4 !

- 11. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Era of Shadow Banking • Regulatory Compliance got Complicated yet Comprehensive with the Introduction of The Basel II Accord: Internal Models were Legitimized, and a Clear Curriculum was introduced to Graduate from one Model To The Next. • Regulators continued to look at the Regulated financial Institution the same way but things have changed: Assets – Liabilities = Net Worth (Cushion and so they thought) Not Much ChangeComplex Securitization Capital is gradually failing to serve as a Cushion with Loss‐ Absorbing Capacity Driven by Excessive Regulations, Financial Intermediation Migrated to the Opaque and Unregulated Banking Environment…. Internal Models Became more Sophisticated and relied on Unreasonable assumptions…. Regulators remained puzzled by the fast‐moving developments.

- 12. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Internal‐Model Maturity Qualifying Criteria CriteriaCriteria Standardized ApproachStandardized Approach Internal Ratings Based (IRB) ApproachInternal Ratings Based (IRB) Approach FoundationFoundation AdvancedAdvanced Ratings External Internal Internal Risk Weights Calibrated on the basis of External ratings by the Basel Committee Function provided by the Basel Committee Function provided by the Basel Committee Probability of Default (PD)- The likelihood that a borrower will default Over a given time period Implicitly provided by the Basel Committee; tied to risk Weights based on external Ratings Provided by bank based On own estimates Provided by banks based on Own estimates Exposure At Default (EAD) – the amount of The facility that is likely To be drawn if a default occurs Supervisory values set by the Basel Committee Supervisory values set by the Basel Committee Provided by the Bank based On own estimates Loss Given Default (LGD) – the proportion Of the exposure that will Be lost if a default occurs Implicitly provided by the Basel Committee; tied to risk Weights based on external Ratings Supervisory values set by the Basel Committee Provided by the Bank based On own estimates; extensive Process and internal control Requirements

- 13. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com CriteriaCriteria Standardized ApproachStandardized Approach Internal Ratings Based (IRB) ApproachInternal Ratings Based (IRB) Approach FoundationFoundation AdvancedAdvanced Maturity: the remaining Economic maturity of The exposure Implicit recognition Supervisory values set By the Basel Committee Or At National Discretion, Provided by Bank based On own estimates Provided by Bank based on Own estimates (with an Allowance to exclude certain Exposures) Data Requirements •Provision Dates •Default Events •Exposure Data •Customer Segmentation •Data Collateral Segmentation •External Ratings •Collateral Data •Rating Data •Default Events •Historical Data to Estimate PD (5 years) •Collateral Data Same as IRB Foundation, plus: •Historical loss data to estimate LGD (7 years) •Historical exposure data to Estimate EAD (7 years) Credit Risk Mitigation Techniques (CRMT) Defined by the Supervisory Regulator; including financial Collateral, guarantees, credit Derivatives, “netting” (on and Off balance sheet), and real Estate All collaterals from Standardized Approach; Receivables from goods And services; other Physical securities if Certain criteria are met All types of collaterals if Bank Can prove a CRMT by internal estimation Process requirement (Compliance With Mini requirements Will be subject to Supervisory review Under Pillar II) •Minimum requirements for Collateral management (administration/Evaluation) •Provisioning Process Same as standardized, Plus minimum Requirements to ensure Quality of internal ratings & PD estimation and Their use in the Risk Management process Same as IRB Foundation, plus Minimum requirements to Ensure quality of estimation Of all parameters The Internal‐Model Maturity Qualifying Criteria

- 14. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Bankers/Banks Versus Regulators • Banks: Migrated Financial Intermediation to the Unregulated Financial Sector in the pursuit of Profits • …and much more A Danger the Regulators Overlooked at the time There isn’t a Single BCBS Publication that does not point to the need to reduce Capital Arbitrage. • Regulatory Focus: Capital Arbitrage and How to Limit it. • …and much more

- 15. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Lenders Surplus Spending Units ‐SSUs • Individuals (Current Income is GREATER than Current Expenditures) • Firms (Earnings in excess of what the firm needs currently) • Government (Current Revenues are in excess of planned Expenditures) • Financial Intermediaries (Funding is currently GREATER than investment) Borrowers Deficit Spending Units ‐DSUs • Individuals (Current Income is LESS than Current Expenditures) • Firms (Earnings falls short of what the firm needs currently) • Government (Current Revenues fall short of planned Expenditures) • Financial Intermediaries (Funding is currently LESS than investment) Traditional Banks Dealers Securitization Money Market Mutual Funds Hedge Funds Finance Companies and Other Non‐Bank Lenders Money Money Money Money Securities Loans Money Money Loans Money Loans Money Securities Money Securities SecuritiesSecurities Money Securities Money Securities Shows the Flow of Funds from LENDERS to BORROWERS; not the reverse Model This ! Shadow Banking

- 16. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Regulations‐Induced Events What’s been Happening since: Regulations-Induced Events

- 17. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com • The Monetary Authority has not paid close attention to Unregulated Financial Intermediations (e.g., Shadow Banking) as major Economic Engines. • The Monetary Authority overlooked the Link between Money and Real Output: Steady growth in the various measures of money coupled with volatile changes in real output. • The Complexity and Cost (i.e., Burden) of Compliance are Rising exponentially. • The Basel Accord with a history of Incomplete Implementation: Basel 1, 1½, 2, 2½, 3, 3½ or 4 ! • Nowadays the US Congress is considering Regulatory Reliefs for certain size financial institutions (Senate Banking Committee Chairman Richard Shelby). Regulation‐Induced Events that Reshaped The Banking Model & Regulatory Focus. Regulations‐Induced Events

- 18. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com • The Structure of the Financial Landscape has turned Puzzling. • Regulations are increasingly becoming very Complex. • Regulators are increasingly becoming very Demanding. • Risk Management has taken a backseat to strict Adherence to ever increasing Regulatory Guidance. • The Regulatory System is becoming overwhelmingly Complex and Bureaucratic. • De‐Risking (which is in effect Re‐Risking) is on the rise! • The Banking Model has changed from Originate‐To‐Hold to Originate‐To‐Distribute. In addition, the major changes in the structure of Assets have not been well balanced (By Regulatory Guidance or else) with changes in Liabilities. • Basel’s Excessive Focus on Capital is significantly impacting the Core of the Banking Industry: Converting Demand & Savings Deposits into Productive Lending. Regulation‐Induced Events that Reshaped The Banking Model & Regulatory Focus. Regulations‐Induced Events

- 19. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com • Internal Models will no longer be used as indicators of an FI’s Risk Management Maturity. The Regulator will have the final say in the assignment of Risk Weights. • In April of 2011 a set of Supervisory Guidance was Jointly issued by the Office of the Controller of Currency (OCC) and the Federal Reserve on Model Risk Management and Validation. • Model Validation has been treated as a Compliance activity as opposed to a Risk Management Activity by many Financial Institutions. • Operational Risk, to date, remains at the bottom of the Priority List of CROs and, equally alarming, that of Supervisory Authorities. • The “Quant Jocks”: From Pricing Financial Derivatives in “Opaque Banking” to CROs in the Regulated Banking. • From “Velocity of Money” to the “Velocity of Collateral.”: Money Creation has taken the Unregulated Path. Next: Regulations Regulation‐Induced Events that Reshaped The Banking Model & Regulatory Focus. Regulations‐Induced Events

- 20. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com And On The Regulatory Front… It takes so long for the rules to change that by the time they are creeping into existence the markets have changed! Regulations

- 21. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Basel Accordwith a History of Incomplete Implementation Basel I Basel II Credit Risk Credit Risk Market Risk Operational Risk 1986 proposed 1999 proposed 1988 effective 2007 effective Basel III Credit Risk Market Risk Operational Risk Capital Quality Additional Buffers Liquidity: LCR, NSFR 2009 proposed Kick Off in 2011 Amendments Amendments Basel 2 ½ Basel 1 ½ Amendments Basel3½ Basel IV 2015 Anticipated Kick Off in 20?? • Capital Requirements • Liquidity Requirements • Disclosure Requirements • National Divergences • Risk Sensitivity • Use of Internal Models in Decision Making • Total Risks = Credit Plus Market Risks • Internal Models Emerged • Later on, Tier 3 Capital • Enhanced Pillar 2, 3 • Complex Securitization obtained higher Risk Weights. • Trading Books Regulations • How Often the Banking Model has Changed • How often Regulatory Guidelines have changed • How complex the banking environment has become • How technology has evolved • How Many Crisis Have We Had.

- 22. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Basel III 2009 proposed 2011 effective Capital Capital Buffers Conservation 2.5% & Countercyclical 2.5% Risk Management Liquidity (LCR ≥ 100%) (NSFR > 100%) Leverage ≥ 3% Reporting Less Reliance on External Rating Agencies • Increase in common equity requirements from 2% to 4.5% • In crease in Tier 1 Capital (Going Concern) from 4% to 6% • Tier 1 Capital can no longer include Hybrid Capital instruments with an incentive to redeem through features such as step‐up clauses. These will be phased out • Tier 3 Capital will be eliminated (Previously used for Market Risk) • Credit Valuation Adjustment (CVA) Capital Charge must be calculated to cover Mark‐to‐Market losses on counterparty risk to Over‐The‐Counter (OTC) Derivatives. • Stressed Parameters must be used to calculate counterparty Credit Risk • Effective Expected Positive Exposure (EPE) with stressed parameters to be used to address general wrong‐way risk (WWR) and counterparty credit risk • Banks must ensure complete trade capture and exposure aggregation across all forms of counterparty credit risk (not just OTC derivatives) at the counterparty‐specific level in a sufficient time frame to conduct regular stress testing. • A multiplier of 1.25 is applied to the correlation parameter of all exposures to financial institutions (meeting certain criteria) (Asset Value Correlation – AVC) • Additional Margining required for illiquid derivatives exposures. • 100% risk weight for Trade Finance. • Contractual maturity mismatch • Concentration of funding • Available unencumbered assets • Market‐related monitoring tools; asset prices and liquidity, Credit Default Swap (CDS) spreads and equity prices. • LCR by currency • Results of stress tests should be integrated into regular reporting to senior management Basel II += + ++ Regulations Basel III Changed the Rules of Engagement Dramatically! Milestone

- 23. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Regulations Model this …!

- 24. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Capital Requirements for Credit Risk Standardized Approach Foundation IRB Approach Advanced IRB Approach Market Risk (in line with 1993 & 1996) Standardized Approach Internal VaR Models Operational Risk BIA – Basic Indicator Approach SA - Standardized Approach AMA - Advanced Measurement Approach Regulatory Framework for Banks Internal Capital Adequacy Assessment Process (ICAAP) And Risk Control Self-Assessment (RCSA) Risk Management Supervisory Review & Evaluation Process (SREP) Evaluation of Internal Systems of Banks Assessment of Risk Profile Review of Compliance with all Regulations Supervisory Measures Disclosure Requirements of Banks Transparency for market participants concerning the Bank’s Risk Position (Scope of Application, Risk Management, Detailed Information on own funds, etc.) Enhanced Comparability of Banks Basel II Framework Pillar 1: Minimum Capital Requirements Pillar 2: Supervisory Review Process Pillar 3: Market Discipline 1999 proposed Basel II 1999 proposed 2007 effective Regulations

- 25. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Pillar 1: Minimum Capital Adequacy Ratios Calculation Of Exposure Calculation of PD/LGD Calculation of RWA Adjustments for Collateral Valuation Adjustments for Credit Mitigants Netting Balance Sheet Items Calculations Of Risk Weights Based on PD/LGD Supervisory Risk Weights and LGD Standardized Approach IRB (Foundation) IRB (Advance) Value at Risk Standardized Measurement Methods Interest Rate Risk Equity Position Risk Forex Risk Commodities Risk Treatment of Options Support for all Three Approaches Basic Indicator Approach: Capital is calculated as a percentage of Gross Income Standardized Approach: line of Business Based Exposure Indicators Advanced Measurement Approach: Capital Computations as per LDA Credit Risk Traded Market Risk Operational Risk External/Internal Rating Systems Pillar 2: Supervisory Oversight Pillar 3: Market Discipline Usage of Metadata which Enables transparency Capital for other Risks Rules-Based Engines Risk Assessment Reports Capital Adequacy Reporting Flexible Reporting Quantitative Reporting-IFRS 7 Qualitative Reporting-IFRS 7 Basel II 1999 proposed 2007 effective Regulations Supervisory Review & Evaluation Process (SREP) Evaluate FI’s Internal Systems Assess FI’s Risk Profile Review FI’s Compliance with all Regulations Does the Knowledge Exist to do All That?!

- 26. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Modeling

- 27. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com From Calculating the Credit Risk Capital Charge to Modeling Credit Risk, Regulations –Credit Risk

- 28. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com From Calculating the Operational Risk Capital Charge to Modeling Operational Risk, Regulations–Operational Risk

- 29. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Regulations–Operational Risk

- 30. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Regulations–Operational Risk

- 31. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Regulations–Market Risk Calculating the Market Risk Capital Charge

- 32. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Regulations–Market Risk Calculating the Market Risk Capital Charge

- 33. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Early Implementation: BASIC APPROACH Satisfactory Knowledge of Risk Management: STANDARDIZED APPROACHES Sufficiently Mature Risk Management: ADVANCED APPROACHES CAPITAL CHARGE BASEL II CAPITAL CHARGE (Pillar I: Minimum Capital Requirements, Pillar II, etc.) Risk Management Maturity Improved Risk Management Practices Lower Capital Charge The Incentive is in Capital Planning Regulations What Basel II Promoted What Basel III Downplayed

- 34. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Truth Be Told, Basel III tried to Specifically respond to the Crisis … Sub‐Prime Lending Excessive Risk Taking Housing Prices decline resulting in sub‐prime defaults Sub‐Prime Defaults, Securitized Assets & Derivatives Trading resulted in huge losses Excessive Leverage & Poor capital could not absorb losses fully, demanding fresh equity infusion Huge losses resulted in a crisis of confidence causing liquidity to evaporate Short‐term borrowing demanded fresh borrowing which failed in liquidity crisis Firms on the verge of insolvency; threatening system failure Governments step in to inject capital to prevent systemic failure Capital Conservation & Counter‐Cyclical Buffers Capital Conservation & Counter‐Cyclical Buffers a) Less reliance on external ratings agencies; b) Credit Valuation Adjustment capital charge; c) Stress Testing a) Higher quality & quantity of capital; b) Leverage Ratio Introduced; c) 100% weight for Trade Finance Enhanced Supervisory Review and Disclosure Two new Liquidity Ratios Correlation to financial institutions will carry more risk weights to prevent systemic risk and an overall collapse In stressed market situations, credit rating downgrades of financial institutions and securitized products further lowered valuations and increased losses. Securitization BUT not Enough! Regulations

- 35. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Basel 3½ or IV 2015 Anticipated Kick Off in 20__ Amendments Basel 3 ½ The Basel Accordwith a history of Incomplete Implementation Implications for Banks • Capital Requirements • Liquidity Requirements • Disclosure Requirements • National Divergences • Risk Sensitivity • Use of Internal Models in Decision Making Regulations Next: Banking Environment If Basel III tackled all issues of concerns, why are we getting ready to welcome Basel IV (or III ½) ? The Proposed New Capital Regime is a Seismic Shift

- 36. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Banking Environment The Complexityof Banking & Financial Intermediation • Induced By Excessive Regulations • Exploited By Bankers with the Help of Technology and Innovations

- 37. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Credit Intermediation Credit Intermediation has become more market‐based, and No Longer Institution‐Based Sources of Funds Uses of Funds Individuals (With Money to warehouse) Households/ Business Borrowings Non‐Intermediated Direct Funding (No Intermediaries) Households / Corporations (With Money to safe keep) Households/ Business Borrowings Banks “Originate and Hold Loans” Till Maturity. Traditional Banking (Institution‐Based Intermediation) Households / Corporations / Institutions / Securities Lenders / Pension Funds (With Money to Invest) MMMF Purchases CP ABCP Repos, Etc. ABS Intermediation ABS Issuance Loan Warehousing Loan Origination Household / Business Borrowings Shadow Banking (Multiple and Market‐Based, and Layered Intermediations) Note: MMF is Money Market Mutual Fund, CP is Commercial Papers, ABCP is Asset‐Backed CP, Repos is Repurchase Agreements, and ABS is Asset‐Backed Securities. rapid balance sheet growth, a market rise in leverage, and a proliferation of complex and difficult‐to‐value financial products. Banking Environment

- 38. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com ABS, MBS, CDO, CDO2 Camouflaged Risk About the Underlying Asset. • Housing prices became unrelated to their actual value. • People bought homes simply to sell them. • The easy availability of debt meant people charged too much for the asset. About the Banks. • CDOs allowed banks to avoid having to collect on them when they become due, since the loans are now owned by other investors. • Less discipline in adhering to strict lending standards, so that many loans were made to borrowers who weren’t credit worthy (ensuring disaster) About the CDOs. • CDOs became so complex that the buyers didn’t really know the value of what they were buying. • The Sophisticated Computer‐Based Models for CDOs Valuation is based on the assumption that housing prices would continue to go up. When prices went down, the computers couldn’t price the CDOs. • The Opaqueness and the complexity of CDOs created a market panic: Overnight the market for CDOs disappeared! Banking Environment

- 39. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Induced Risk & Complexity … but in the Shadow: Camouflaged By The Rating Agencies and Overlooked by The Regulators. • Despite the good intentions, ratings agencies and regulators were significant contributors to the imbalances that culminated in financial crisis. • The big three Rating Agencies’ (S & P, Moody’s, and Fitch) oligopoly prevailed – Without their ratings, companies could not sell debt instruments. An inherent conflict of interest arose; issuers paid the companies for ratings. Many investors depended on those evaluations when purchasing debt in lieu of a more thorough due‐diligence review. Investors ran into further difficulties because the evaluations frequently lagged material market development. • The Ratings Agencies were complicit in the growing complacency of investors leading up to the credit crisis. Large structured‐product deals involving complex securities were very profitable for ratings agencies. Issuers had the ability to choose among potential raters, leading to “ratings shopping.” The rating agencies shift from an Investor‐Pay to an Issuer‐Pay business model degraded the value of the evaluations provided because the agencies faced little risk from inaccurate ratings. Banking Environment Next: Compliance

- 40. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Compliance The Never Easing Pressure on Sanction

- 41. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Compliance By Fear … Higher Probability of De‐ Risking Non‐Compliance By Mistake… Due to lack of understanding … De‐Risking is a more likely outcome. Compliance Since De‐Risking has been on the rise, it must be that most of us have been complying ’By Fear’. We’re becoming increasingly good at COMPLIANCE BUT not in Assessing & Addressing the RISK of: • Compliance AND • that of Non‐Compliance Moving Risks to Opaque Banking has proven to be Very Risky (e.g., Last Financial Crisis) Compliance

- 42. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Assessment of The Magnitude of AML Risk International Wires Internet Banking High cash Users Suspicious Transactions Report Politically Exposed Persons Industry / Occupation Nationality Account Maturity Compliance Risk Bank Clients Bank Services Bank Products Geographies Private Banking International Correspondent Banking Offshore International Activity Account Data Transaction Data Economic Sanctions Non‐Non Cooperative Country Territories Country Watch List Examples of Risk Measures Compliance

- 43. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Assessment of Inherent AML Risk Inherent AML Risk Customer Base Product / Account Transactional Business Strategy Geography Portfolio of Product Offerings: • Sales Finance, Mortgages, Life Insurance, Anonymous Saving Accounts, …. • Maturity / Stability; Domicile / Residency; PEP Status • E‐Banking; Indirect Customers Portfolio of Transaction Types: • Domestic transfers, Cash deposits, International Checks, International transfers, … • Mergers & Acquisition activity • Business Strategy changes • Expected growth; product portfolio expansion; … • Staff Turnovers Examples of Risk Factors Country Risk Rating Models • Positive Factors (FATF, EU, BIS); Negative Factors (Sanctions, NCCT, Offshore, …) 1 2 3 4 5 1 2 3 4 5 Policies & Procedures Governance Training Risk Assessment Customer Risk Rating KYC, CIP, EDD PEPs Screening Surveillance Reporting Record Keeping Auditing Testing Control Areas Compliance Knowledge Gap

- 44. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Knowledge Gap Knowledge Gap • Who Knows what? • Is it enough? • The Regulatory Guideline Interpreter/Translator? • The Model Developer? • The Implementer? • The User? • How Wide is the Gap between Quantitative Finance and Technology Skills?

- 45. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Knowledge Gap The Players:Are They Adequately and Equally Knowledgeable: IT, Finance, Risk, Regulations, etc.? Basel Committee (BCBS) National RegulatorThe Regulated Banking Institution IT Model Developer Model Users Business Units Management What’s At Stake… Modeling Implementer Model Risk Management

- 46. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Model Risk Management The Financial Models & Model Risk Management (MRM)

- 47. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Unprecedented Volume of Global Regulations has (and is) Placing Considerable Demands on the Change Capacity of Banks Exacerbated by the Dangers of Failing to Effectively Interpret the Regulatory Agenda and Manage External Stakeholders’ Expectations. How Can You Control The Risks and Costs of Regulations. Model Risk Management

- 48. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com General Ledger Clients & Settlement P & L Risk Reporting Core Analytical Engine Model Risk Management Other Models Predictive Models Regulatory Models Asset‐Liability Management Models Risk Models Business Strategy Analysis Valuation Models Pricing Models Exposure Measurements B ACD These Risks could Exist Inside each Module and in the Interface between Two or More Modules Interface Between Two Modules

- 49. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Model Risks • Poor Data Quality • Incorrect Assumptions and Methodology • Bad Implementation • Bad Usage • Non‐Compatibility nor Comparability Between Existing and Newly Acquired Assets. • No Internal Data for Newly Developed/Introduced Products. Model Risk is most simply defined as the potential for adverse consequences from decisions based on incorrect or misused model outputs and reports. It holds great relevance in today’s markets because quantitative models are behind practically all decision‐making in the financial world – from trading and risk, to asset liability management, investment and regulations. Model Risk is not an area that can be ignored without consequences. Model Risk Management

- 50. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Damage for not doing the Job Right The Financial Institution The Amount Time / Reason $4‐5 Billions $1‐2 Billions $14 Trillions $5‐7 billions Long‐Term Capital Management (LTCM) National Australian Bank (NAB) Global Financial Crisis (GFC) JP Morgan 1997 / Model Assumptions 2001‐03/Rates Methodologies 2007/Correlation, Assumptions, Data 2012 / Model Control, Usage Model Risk Management

- 51. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com The Predictive Model that Caused the Recent Crisis Estimated Actual Ratings 3‐Year default Rate Dafault Rate AAA 0.001 0.10 AA+ 0.01 1.68 AA 0.04 8.16 AA‐ 0.05 12.03 A+ 0.06 20.96 A 0.09 29.21 A‐ 0.12 36.65 BBB+ 0.34 48.73 BBB 0.49 56.10 BBB‐ 0.88 66.67 Source : Donald MAcKenzie, University of Edinburgh CDOs Of Subprime‐Mortgage‐Backed Securities Issued in 2005‐07, % (Source: The Economist) This time of growth in CDOs is the era of “Quant Jocks”: Statistical experts whose job is to write computer programs that would model the value of the bundle of loans that made up a CDO. Model Risk Management

- 52. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Model Risk Framework & Processes • Independence of Various Functions, in particular, the model development, risk control and audit functions • Clear definitions of ownership with accountability aligned with incentives and authority • Effective Change Management Processes with checkpoints and defined criteria at each stage • Emphasis on documentation at each stage in the model lifecycle • Dissemination of Model Risk scores and user education along with model results • Recognition of Models as a “work‐in‐Progress” that need to be continually re‐examined and improved, rather than as a one‐ time effort • Recognition of the fact that quantitative finance and technology skills are separate, but require close collaboration. Model Risk Management

- 53. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com Model Development Model Implementation Model Use Formalized Control Framework FIRST LINE of Defense: Model Developers, Owners, and Users Independent Model Validation Testing Annual Model Review Process On‐Going Model Risk Monitoring Model Risk Identification and Measurement SECOND LINE of Defense: Model Risk Management Unit Model Risk Remediation and Mitigation GOVERNANCE and Oversight: Senior Management and Board of Directors Model Use Risk Escalation Periodic Model Risk Reporting Model Risk Appetite Model Risk Management FrameworkEmbedded in Policies, Procedures, and Roles & Responsibilities THIRD LINE of Defense: Internal Audit Audits the contents of and compliance with MRM Policies, Procedures, and Standards with the 1st and 2nd Lines of Defense Model Risk Management Framework Model Risk Management

- 54. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com INDEPENDENT Model Risk Management Staff Annual Review Process: Primary Components Annual Risk Assessment • Re‐Assess each Model’s inherent risk rating • Proactively Identify Areas of Elevated Model Risk • Assess Relevance and Sufficiency of Previous Validation Procedures • Re‐Measure the Materiality/ Significance of Outstanding (i.e., Un‐remediated) Model Risk Issues • Re‐Evaluate Necessity of Current Model Risk Mitigants Action Items • Affirm previous validation testing procedures and results, or • Perform targeted updates of previous validation testing procedures, and/or • Perform new targeted validation testing • Any identified model risk issues should be measured and subject to appropriate remediation and risk mitigation plans. Changes in Bank’s BusinessChanges in the Industry & Economy Changes in Regulations Changes in Model Use Performance Monitoring Information Advances in Industry Modeling Methodology Model Risk Management

- 55. Mohammad Fheili ⌂⌂⌂ fheilim@jtbbank.com In Closing … Thank You