India Equity Analytics | Buy Stock of Sobha Developers Ltd and Suprajit Engineering Ltd

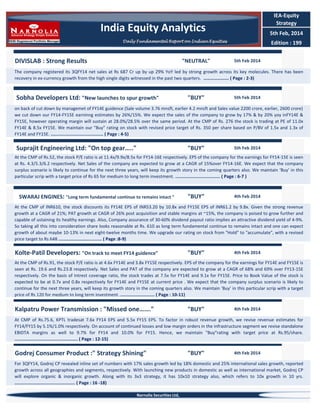

- 1. IEA-Equity Strategy India Equity Analytics 5th Feb, 2014 Daily Fundamental Report on Indian Equities DIVISLAB : Strong Results "NEUTRAL" Edition : 199 5th Feb 2014 The company registered its 3QFY14 net sales at Rs 687 Cr up by up 29% YoY led by strong growth across its key molecules. There has been recovery in ex-currency growth from the high single digits witnessed in the past two quarters. …………………. ( Page : 2-3) Sobha Developers Ltd: "New launches to spur growth" "BUY" 5th Feb 2014 on back of cut down by managemet of FY14E guidence (Sale volume 3.76 mnsft, earlier 4.2 mnsft and Sales value 2200 crore, earlier, 2600 crore) we cut down our FY14-FY15E earninng estimates by 26%/15%. We expect the sales of the company to grow by 17% & by 20% yoy inFY14E & FY15E, however operating margin will sustain at 28.0%/28.5% over the same period. At the CMP of Rs. 276 the stock is trading at PE of 11.0x FY14E & 8.5x FY15E. We maintain our "Buy" rating on stock with revised price target of Rs. 350 per share based on P/BV of 1.5x and 1.3x of FY14E and FY15E. ........................................ ( Page : 4-5) Suprajit Engineering Ltd: "On top gear….." "BUY" 5th Feb 2014 At the CMP of Rs.52, the stock P/E ratio is at 11.4x/9.9x/8.5x for FY14-16E respectively. EPS of the company for the earnings for FY14-15E is seen at Rs. 4.3/5.3/6.2 respectively. Net Sales of the company are expected to grow at a CAGR of 15%over FY14-16E. We expect that the company surplus scenario is likely to continue for the next three years, will keep its growth story in the coming quarters also. We maintain ‘Buy’ in this particular scrip with a target price of Rs 65 for medium to long term investment. .................................. ( Page : 6-7 ) SWARAJ ENGINES: "Long term fundamental continue to remains intact " "BUY" 4th Feb 2014 At the CMP of INR610, the stock discounts its FY14E EPS of INR53.20 by 10.8x and FY15E EPS of INR61.2 by 9.8x. Given the strong revenue growth at a CAGR of 21%; PAT growth at CAGR of 26% post acquisition and stable margins at ~15%, the company is poised to grow further and capable of ustaining its healthy earnings. Also, Company assurance of 30-60% dividend payout ratio implies an attractive dividend yield of 4-9%. So taking all this into consideration share looks reasonable at Rs. 610 as long term fundamental continue to remains intact and one can expect growth of about maybe 10-13% in next eight-twelve months time. We upgrade our rating on stock from "Hold" to "accumulate", with a revised price target to Rs 648 ................................. ( Page :8-9) Kolte-Patil Developers: "On track to meet FY14 guidence" "BUY" 4th Feb 2014 At the CMP of Rs.91, the stock P/E ratio is at 4.6x FY14E and 3.8x FY15E respectively. EPS of the company for the earnings for FY14E and FY15E is seen at Rs. 19.6 and Rs.23.8 respectively. Net Sales and PAT of the company are expected to grow at a CAGR of 68% and 69% over FY13-15E respectively. On the basis of Intrest coverage ratio, the stock trades at 7.5x for FY14E and 9.1x for FY15E. Price to Book Value of the stock is expected to be at 0.7x and 0.8x respectively for FY14E and FY15E at current price . We expect that the company surplus scenario is likely to continue for the next three years, will keep its growth story in the coming quarters also. We maintain ‘Buy’ in this particular scrip with a target price of Rs 120 for medium to long term investment. .......................... ( Page : 10-11) Kalpatru Power Transmission : "Missed one……." "BUY" 4th Feb 2014 At CMP of Rs.75.6, KPTL tradesat 7.6x FY14 EPS and 5.5x FY15 EPS. To factor in robust revenue growth, we revise revenue estimates for FY14/FY15 by 5.1%/1.0% respectively. On account of continued losses and low margin orders in the infrastructure segment we revise standalone EBIDTA margins as well to 9.7% for FY14 and 10.0% for FY15. Hence, we maintain "Buy"rating with target price at Rs.95/share. ................................................ ( Page : 12-15) Godrej Consumer Product :" Strategy Shining" "BUY" 4th Feb 2014 For 3QFY14, Godrej CP revealed inline set of numbers with 17% sales growth led by 18% domestic and 25% international sales growth, reported growth across all geographies and segments, respectively. With launching new products in domestic as well as international market, Godrej CP will explore organic & inorganic growth. Along with its 3x3 strategy, it has 10x10 strategy also, which refers to 10x growth in 10 yrs. .............................................. ( Page : 16 -18) Narnolia Securities Ltd,

- 2. DIVISLAB "NEUTRAL" 05th Feb' 14 Strong Results NEUTRAL 1337 1420 1350 6% 5% Result Update CMP Target Price Previous Target Price Upside Change from Previous Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs, Cr) Average Daily Volume Nifty 532488 DIVISLAB 1390/905 17842 5.43 6000 Stock Performance-% 1M Absolute Rel. to Nifty 7.6 11 1yr 26.2 26.17 YTD 15.5 3.5 Share Holding Pattern-% Promoters FII DII Others Current 2QFY14 1QFY1 4 52.1 52.1 52.2 16.3 15.8 14.8 13.2 12.5 12.5 18.5 19.5 20.5 One Year Price vs Nifty The company registered its 3QFY14 net sales at Rs 687 Cr up by up 29% YoY led by strong growth across its key molecules. There has been recovery in ex-currency growth from the high single digits witnessed in the past two quarters. The operating EBITDA for the quarter under review came at Rs 288 Cr and OPM at 41.7%.The operating margins improve by almost 760bps on the back of improvement in company’s operating metrics, currency benefits and lower power cost . The RM cost to sales for the quarter came at 36% while it was 49 % for the same time last fiscal. The employ cost as percentage of sales also showed improvement of 100 bps on yearly basis. The company has cut down its other expenses for the quarter to Rs 88 and it stands at 13 % of the net sales from 8% a year ago. The profits after tax came at Rs 218 Cr and NPM at 31.7 %.The other income for the quarter came at Rs 8 Cr verses 22 Cr for the same time last fiscal. The tax rate for the quarter was lower on yearly basis at 20 %.Forex Loss for the current quarter amounted to Rs 5 Cr while there was a forex gain of Rs 16 Cr during the corresponding quarter last year. Key takeaways from management interaction > Sales from DSN SEZ (all 5 units) are at of Rs 3.3 Bn for 9MFY14 (versus Rs 2.2 Bn in FY2013). The company has total investments of Rs 6.0 Bn in the DSN SEZ and expects the asset turnover to be 1.8-2.0 times. > Carotenoid sales for 9MFY14 are at Rs 910 Mn and expected to reach Rs1.5 Bn for FY2015. >The company expects the inspection (by regulatory/customers) for the 3 additional units at DSN SEZ in 4QFY14. Sales from these units are expected to ramp up in 2QFY15. > There has been reduction in power and fuel cost since August 2013 with 160 bps decline on a sequential basis. >CWIP is at Rs1.8 Bn at the end of 9MFY14. There has been a sharp increase in receivables at Rs 7.1 Bn – 108 days versus 86 days in FY2013. Inventory days have improved to 140 days in 9MFY14 versus 161 days in 1HFY14. View & Valuation The stock at CPM of Rs 1337 is trading at 22.05 x of one year forward FY14E EPS of Rs 61.The stock has achieved our recommended Target price of Rs 1350 and therefore we change our view to Neutral from BUY. The strong 3QFY14 results ,improvement in operating metrics, Currency movement are few factor which still provide some upsides. We have slightly revised our target price upwards to Rs 1420 based on our analysis. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 689 287 218 41.7% 31.6% 2QFY14 567 249 205 43.9% 36.2% (QoQ)-% 21.5 15.3 6.3 (230bps) (450bps) 3QFY13 534 182 143 34.1% 26.8% Rs, Crore (YoY)-% 29.0 57.7 52.4 760bps 490bps (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 2

- 3. DIVISLAB Sales and PAT Trend (Rs) Net sales at Rs 687 Cr up by up 29% YoY led by strong growth across its key molecules. (Source: Company/Eastwind) OPM % Operating margins improve by almost 800bps on the back of improvement in company’s operating metrics, currency benefits and lower power cost . (Source: Company/Eastwind) NPM % The tax rate for the quarter was lower on yearly basis at 20 %.Forex Loss for the current quarter amounted to Rs 5 Cr (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 3

- 4. Sobha Developers Ltd. "Buy" 5th Feb' 14 "New launches to spur growth….." Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 276 350 460 27% -24% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 532784 SOBHA 282/472 3052 105448 6002 Stock Performance-% 1M -17 (14) Absolute Rel. to Nifty 1yr -36 -35 YTD -21 (27) Share Holding Pattern-% Promoters FII DII Others 3QFY14 60.6 32.7 2.9 3.9 1 yr Forward P/B 2QFY14 1QFY14 60.6 60.6 33.2 33.5 2.6 2.8 3.7 3.1 Despite of week volume numbers in NCR & Chennai Sobha reported its Q3FY14 numbers with a topline that was inline street expectations at Rs. 544.3 crore. EBITDA for the quarter stood at Rs. 149.0 crore, growing 8.4% yoy. The EBITDA margin were down 460 bps, yoy and stands at 27.4% during the quarter mainly on account of higher proportion of contractual projects segment (this segment fetches about 20 per cent margins compared with property development business’ 35 per cent and increase in input costs. However managemnet assures that goinf forward margins should be around 28 percent and at profit before tax (PBT) and profit after tax (PAT) level we are at 10 percent to 11 percent level. We maintain our "Buy" rating on stock, however on back of cut down by managemet of FY14E guidence (Sale volume 3.76 mnsft, earlier 4.2 mnsft and Sales value 2200 crore, earlier, 2600 crore) we cut down our FY14-FY15E earninng estimates by 26%/15% and also reduce our price target to Rs. 350 Lowered FY14E sales volume & revenue Guidence Sobha had at the begning of the fiscal set guidence of new sales area of 4.20 mnsft at Rs. 2600 crore for the current fiscal. At the close of 3 quarters of FY14, the company has registered a new sales area of 2.66 mnsft valued at 1737 crore. However, post 3QFY14 result, management had lowered his sales volume and booking guidence to 3.76 mnsft and Rs. 2200 crore largely attributed to delay in approvels Growth story remain intact; The firm had launched two new projects: 0.66 mnsft of developable area and 0.46 mnsft of saleable area in 3QFY14 and six new projects: 3.38 mnsft of developable area and 2.01 mnsft of saleable area in 9MFY14. In CY14, the firm has plans to launch 11 mnsft, and out of which 3 mnsft in 4QFY14 especially in the Rs7.5-15mn price bracket that continues to see stable demand as a result we able to belive that company will able to achive is revised sales volume guidence for FY14E. Valuations; on back of cut down by managemet of FY14E guidence (Sale volume 3.76 mnsft, earlier 4.2 mnsft and Sales value 2200 crore, earlier, 2600 crore) we cut down our FY14-FY15E earninng estimates by 26%/15%. We expect the sales of the company to grow by 17% & by 20% yoy inFY14E & FY15E, however operating margin will sustain at 28.0%/28.5% over the same period. At the CMP of Rs. 276 the stock is trading at PE of 11.0x FY14E & 8.5x FY15E. We maintain our "Buy" rating on stock with revised price target of Rs. 350 per share based on P/BV of 1.5x and 1.3x of FY14E and FY15E. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 544.3 149.0 58.3 27.4% 10.7% 2QFY14 540.8 143.3 56.6 26.5% 10.8% Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% 0.6 4.0 3.0 90 bps (10) bps Rs, Crore 3QFY13 (YoY)-% 429.8 26.6 137.4 8.4 52.6 10.8 32.0% (460) bps 12.2% (150) bps (Source: Company/Eastwind) 4

- 5. SOBHA DEVELOPERS Ltd. Key financials : PARTICULAR 2010A 2011A 2012A 2013A 2014E 2015E 1130 4 1134 264 231 32 69 166 27 NA 139 25 2.4 13.6 1394 5 1400 360 332 28 86 251 67 NA 185 29 3.0 18.8 1408 6 1414 467 428 39 117 318 108 NA 210 49 5.0 21.4 1865 6 1870 548 489 59 171 324 107 NA 217 69 7.0 22.1 2180 6 2186 610 542 68 175 373 126 NA 247 69 7.0 25.2 2616 6 2622 746 674 72 200 479 162 NA 317 69 7.0 32.3 23.3% 12.2% 5.0% 0.9% 8.1% 6.5% 25.8% 13.2% 6.9% 1.1% 10.0% 8.7% 33.1% 14.9% 6.5% 1.5% 10.5% 10.1% 29.4% 11.6% 6.3% 2.0% 10.2% 11.1% 28.0% 11.3% 9.1% 2.5% 10.7% 11.1% 28.5% 12.1% 11.7% 2.5% 12.4% 11.8% Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Extra Oridiniary Items Reported PAT Dividend (INR) DPS EPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Ammount in crores (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 5

- 6. Suprajit Engineering Ltd. "Buy" 5th Feb' 14 "On top gear….." Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 52 65 NA 25% NA Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume (Nos.) Nifty 532509 SUPRAJIT 32/62 624 10772 6002 Stock Performance-% 1M -3 1 Absolute Rel. to Nifty 1yr 56 57 YTD 57 51 Share Holding Pattern-% Promoters FII DII Others 3QFY14 51.8 1.9 1.6 44.7 1 yr Forward P/B 2QFY14 1QFY14 51.8 51.8 1.4 0.9 1.7 1.4 45.1 45.9 Despite adverse market conditions, for the quarter ended December 2013, Suprajit Engineering registered a good 30% rise in consolidated sales (including other operating income) to Rs 159.53 crore. OPM jumped 260 basis points to 18.8% which lifted OP growth to 50% to Rs 30.02 crore. Other income stood at negative Rs 68 lakh (against Rs 29 lakh) and interest cost jumped 27% to Rs 3.43 crore. After providing for depreciation (up 14% to Rs 2.26 crore), PBT jumped 51% to Rs 23.65 crore. Whereas tax grew 62% to Rs 7.50 crore after which PAT grew 47% to Rs 16.1 crore. Aftermarket and non-automotive exports business clocked robust growths of 35% and 45% respectively. Suprajit Engineering (SEL) continues to deliver robust margins (at 16-17%) despite weakness in the automotive space. With healthy return ratios (RoE ~30%, RoCE ~25%) and strong balance sheet. We expect a revenue growth for FY14-16E by 15% on back of strong capacity expansion plan abd growth potential in the business. We modelled our valuation parameteres, which make us believe that share is trading at lower then fair value at current market price. We have "Buy" rating on stock with a Target price of Rs. 65. Capex will see the company having the world's largest cable capacities The Board of Directors critically assessed the business prospects for the next two years and have approved the following capex plans considering the business growth in the next two years. • A new cable plant, measuring 80,000 sf.ft at Narsapura Industrial area, Karnataka, on the land already in possession. • A new cable plant measuring 50,000 sq.ft to meet the customer requirements in Chennai at the recently allotted land at Vallam-Vadagal Industrial Park, Tamilnadu. • Significant capacity expansion at the existing Pathredi plant, Rajasthan, with an additional plant measuring 110,000 sq.ft. • Complete renovation and refurbishing of an existing plant in Bommasandra, Bangalore to relocate the aftermarket manufacturing facility to meet increased demand. • Several balancing equipment and buildings in other existing units to fine-tune the capacities to meet additional customer requirements. • Additional equipments to add capacity at its 100% owned subsidiary, Suprajit Automotive. • The capex for the above plans would be approximately Rs. 60 crore. With these capex plans spread over the next 18-24 months, the company's standalone cable capacity will exceed 200 mn cables / year and on a consolidated basis will exceed 225 mn cables year. This would be one of the world's largest cable capacities. Valuations At the CMP of Rs.52, the stock P/E ratio is at 11.4x/9.9x/8.5x for FY14-16E respectively. EPS of the company for the earnings for FY14-15E is seen at Rs. 4.3/5.3/6.2 respectively. Net Sales of the company are expected to grow at a CAGR of 15%over FY14-16E. We expect that the company surplus scenario is likely to continue for the next three years, will keep its growth story in the coming quarters also. We maintain ‘Buy’ in this particular scrip with a target price of Rs 65 for medium to long term investment. Financials Rs, Crore 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% Revenue 159.5 123.1 29.6 123.1 29.5 EBITDA 30.0 21.0 43.0 20.0 49.9 PAT 16.2 13.9 16.2 10.8 49.1 EBITDA Margin 18.8% 17.1% 170 bps 16.3% 250 bps PAT Margin 10.2% 11.1% (90) bps 8.8% 140 bps (Consolidated) (Source: Company/Eastwind) 6 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report.

- 7. SOBHA DEVELOPERS Ltd. Key financials : PARTICULAR 2010A 2011A 2012A 2013A 2014E 2015E 2016E 248 0 249 47 40 7 6 34 11 0 24 6 0.5 2.0 347 5 351 57 50 7 7 47 13 0 34 6 0.5 2.8 424 3 427 69 61 7 9 55 15 0 40 9 0.8 3.3 463 3 465 77 69 8 10 67 20 5 47 10 0.9 3.9 540 7 547 92 84 8 13 78 23 0 55 15 1.2 4.6 637 7 644 107 97 10 15 89 26 0 63 17 1.4 5.3 752 7 759 127 115 12 17 105 31 0 74 19 1.6 6.2 19.0% 9.4% 12.2% 3.1% 33.5% 22.5% 16.5% 9.6% 15.1% 2.8% 34.8% 25.3% 16.2% 9.3% 16.8% 3.8% 30.8% 23.2% 16.7% 10.1% 11.8% 2.6% 28.3% 20.6% 17.0% 10.0% 8.8% 2.4% 26.5% 19.6% 16.9% 9.8% 10.1% 2.7% 25.0% 18.9% 16.9% 9.7% 11.8% 3.0% 24.1% 18.7% 70 62 132 12 16 97 66 163 12 19 129 82 212 12 20 167 111 278 12 33 207 252 307 140 160 180 347 412 487 12 12 12 52 (Source:52 52 Company/Eastwind) 5.9 2.7 6.5 8.2 8.1 2.3 6.8 6.6 10.8 1.8 6.6 6.0 13.9 2.4 6.8 8.5 17.2 3.0 6.4 11.4 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Extra Oridiniary Items Reported PAT Dividend (INR) DPS EPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share (Adj) CMP Ammount in crores Valuation Book Value P/B Int/Coverage P/E 21.0 2.5 6.5 9.9 25.6 2.0 6.7 8.5 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 7

- 8. SWARAJ ENGINES Ltd. V- "Accumulate" 4th Feb' 14 " Long term fundamental continue to remains intact…. " Result update Accumulate CMP Target Price Previous Target Price Upside Change from Previous 598 648 600 8% 7% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 500407 SWARAJENG 382/535 742 601 6,002 Stock Performance-% Absolute Rel. to Nifty 1M (6.6) (2.3) 1yr 24.3 24.7 YTD 51.4 45.3 2QFY14 50.6 1.9 10.4 37.1 1QFY14 50.6 1.5 10.6 37.3 Share Holding Pattern-% Promoters FII DII Others 3QFY14 50.6 1.9 10.6 36.9 1 yr Forward P/B Swaraj Engines posted a moderate revenue growth of 20.8% to Rs. 150.2 crore during Q3FY14 over corresponding period of previous year due to 21.2% growth yoy reported in diesel engines sales volume. Company sold 18,530 diesel engines during the quarter as compared to 15,288 engines sold during corresponding period of previous year. EBITDA of the company marginally outpaced by the revenue due to unexpected rise in non operating expenses and stands at Rs. 21.8 crore up by 18.6% yoy. Though company managed to control material cost, which constitutes ~90% of the total expenses; however, employee cost and administration expenses reported the growth of 22.1% and 23.9% respectively during the quarter. As a result, EBITDA and PBT margin reported a marginal deterioration of 24bps and 5bps during Q3FY14 yoy respectively. PAT reflected in-line numbers and reported the yoy growth of 21.4% to Rs. 16.7 crore before extra ordiniary item of Rs. 1.15 crore; while PAT margin improved by 5bps. Leading supplier to Mahindra & Mahindra Ltd : Leading supplier to Mahindra & Mahindra Ltd – A key source to growth: SEL enjoys the access to the India’s largest tractor manufacturer “M&M” (41% market share in Domestic tractor industry), which has a holding of 33% in SEL. Swaraj Engines Ltd manufactures tractor engines solely for the “Swaraj Division” of M&M. It caters to ~80% demand of Swaraj division of M&M and rest 20% of demand is met through Kirloskar Oil Engines, which has a holding of 17% in SEL. The demand from M&M is estimated to grow further and reach ~85‐90%. Outlook : We have modeled a 25% of revenue growth for FY15 yoy respectively, due to SWE’s ability to maintain growth in product volume and recent enhancement in annual production capacity from 75,000 units to 105,000 units. Company currently operates at TTM EBITDA and net margin of 14.8% and 11.3% respectively, which provides sufficient cushion against operating cost. With liquidity being moderate and cash flow positive, company has enough cash to finance its expansion plan of Rs. 38 crore through internal accruals. Valuations : At the CMP of INR610, the stock discounts its FY14E EPS of INR53.20 by 10.8x and FY15E EPS of INR61.2 by 9.8x. Given the strong revenue growth at a CAGR of 21%; PAT growth at CAGR of 26% post acquisition and stable margins at ~15%, the company is poised to grow further and capable of ustaining its healthy earnings. Furthermore, despite the capex of INR58crore, the company has strong cash flows and the company is debt free. Also, Company assurance of 30-60% dividend payout ratio implies an attractive dividend yield of 4-9%. So taking all this into consideration share looks reasonable at Rs. 610 as long term fundamental continue to remains intact and one can expect growth of about maybe 10-13% in next eight-twelve months time. We upgrade our rating on stock from "Hold" to "accumulate", with a revised price target to Rs 648. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14A 150.2 21.8 15.6 14.5% 10.8% 2QFY14A 151.6 22.7 17.2 14.9% 11.0% (Standalone) (Var)-% -0.9% -3.8% -9.5% (40) bps (20) bps 3QFY13A 124.6 18.4 13.8 14.8% 10.7% Rs, Crore (YoY)-% 21.7% 23.3% 24.9% (30) bps 10 bps (Source: Company/Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 8

- 9. 9 SWARAJ ENGINES Ltd. Key financials : PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 208 5 213 32 27 5 0 32 11 21 7 17.2 5.9 282 10 292 50 45 5 0 55 17 37 12 30.1 9.3 361 8 369 61 56 4 0 64 20 44 14 35.4 11.6 449 12 461 69 65 4 0 77 24 53 19 42.5 15.1 479 15 494 71 64 7 0 79 24 55 48 44.6 38.4 602 18 620 87 78 9 0 96 30 66 24 53.5 19.3 750 20 770 109 98 11 0 118 37 81 30 65.4 24.2 15.3% 15.1% 10.0% 8.0% 2.7% 21.9% 21.9% 17.6% 18.7% 12.8% 31.6% 9.8% 30.4% 30.4% 16.8% 17.4% 11.9% 12.2% 4.0% 28.8% 28.8% 15.5% 16.8% 11.5% 9.9% 3.5% 28.4% 28.4% 14.9% 16.1% 11.2% 11.3% 9.7% 28.6% 28.6% 14.5% 16.0% 11.0% 9.0% 3.2% 28.1% 28.1% 14.5% 15.7% 10.8% 10.9% 4.0% 28.3% 28.3% 97 1 214 123 1 95 152 1 290 186 1 429 194 1 395 236 1 598 287 1 598 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Reported PAT Dividend EPS DPS Yeild % EBITDA % PBT % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth No of Share CMP (Ammount in crore) Valuation Book Value P/B P/E Net Sales/Equity (Source: Company/Eastwind) 78.3 2.7 3.5 2.1 (Source: Company/Eastwind Research) 98.8 1.0 5.3 2.3 122.6 2.4 5.6 2.4 150.0 2.9 5.1 2.4 156.0 2.5 6.8 2.5 190.2 3.1 11.2 2.5 231.5 2.6 9.1 2.6 (Figures In crore) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 9

- 10. Kolte-Patil Developers Ltd. V- "Buy" 4th Feb' 14 "On track to meet FY14 guidence.........." Result update Buy CMP Target Price Previous Target Price Upside Change from Previous 74 100 120 35% 0% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Crores) Average Daily Volume Nifty 532924 KOLTEPATIL 49/115 558 239,587 6,002 Stock Performance-% Absolute Rel. to Nifty 1M (18.8) (14.5) 1yr (36.6) (36.3) YTD (16.3) (22.4) 2QFY14 74.5 1.4 0.8 23.5 1QFY14 74.5 1.5 0.5 23.5 Share Holding Pattern-% Promoters FII DII Others 3QFY14 74.5 1.4 0.4 23.8 1 yr Forward P/B The company posted de-growth in its revenue and net profit during the third quarter compared to same period last year. KPD's net revenue for Q3FY14 dipped to Rs 188 crore against Rs 225 crore in Q3FY13. The company's net profit also decreased to Rs 20.40 crore in Q3FY14 against Rs 30.52 crore in Q3FY13. However, the company's net revenues for first nine months for FY14 grew by 15 per cent to Rs 593 crore against Rs 518 crore in 9MFY13. Interestingly the company's EBITDA soared up by 45 per cent to Rs 181 crore in 9MFY14 on yearly basis. This has improved its EBITDA margins by 630 basis points on yearly basis. The PAT stood at Rs 79 crore in 9MFY14 against the PAT during same period in last financial year. Based on revised volume guidence by management in range of 1.8-2.0mnsft, we cut our FY14/FY15 earnings by 5%/8% while maintaining BUY with a revised TP of Rs 100 (Rs 120 earlier) New sales booking recorded in Q3FY14 is 0.44 msf of which about 93% is residential and 7% commercial projects. The sales value was worth Rs 253 crore. The Average price realization (APR) for the quarter stood at Rs 5730/sft with average price for residential project stood at Rs 5421/sft and that for commercial project at Rs 9932/sft. The ongoing projects as end of Dec 2013 have a saleable area is 14.1 msf (KPDL's share is 9.3 msf) and of which the company already sold about 7.8 msf with a sale value of Rs 3157.7 crore. Cumulative collection as end of Dec 2013 in case of ongoing projects is about Rs 2442.7 crore and the collection in Q3FY14 stood at Rs 230 crore. In January 2014 launched 0.2 msf (of total saleable area of 0.9 msf) of Jazz Phase I at Aundh. Jan 2, 2014 the company obtained final approval and started pre launch activity and made 34 units as far as 0.6 msf Mirabilis, Horamavu, Bengaluru project. Gross debt excluding compulsory convertible debentures (CCD) is Rs 205 crore and the net debt is Rs 127 crore. In Q3FY14 recorded its first sale in Mumbai of 2,200 sft. at an APR of Rs 34375/sft. Management Guidence Management is hopeful of achiveing a topline target of Rs. 800-900 crore for FY14E and new area sales booking of 1.8 - 2 msf for FY2014 with average price realization of Rs 5300/sft. Valuations At the CMP of Rs.91, the stock P/E ratio is at 4.6x FY14E and 3.8x FY15E respectively. EPS of the company for the earnings for FY14E and FY15E is seen at Rs. 19.6 and Rs.23.8 respectively. Net Sales and PAT of the company are expected to grow at a CAGR of 68% and 69% over FY13-15E respectively. On the basis of Intrest coverage ratio, the stock trades at 7.5x for FY14E and 9.1x for FY15E. Price to Book Value of the stock is expected to be at 0.7x and 0.8x respectively for FY14E and FY15E at current price . We expect that the company surplus scenario is likely to continue for the next three years, will keep its growth story in the coming quarters also. We maintain ‘Buy’ in this particular scrip with a target price of Rs 120 for medium to long term investment. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 188.1 57.3 20.4 30.4% 15.8% 2QFY14 188.6 60.3 32.2 32.0% 18.3% (Var)-% -0.3% -5.0% -36.7% (160) bps (250) bps 3QFY13 225.4 62.9 30.6 27.9% 16.6% Rs, Crore (YoY)-% -16.5% -9.0% -33.2% 252 bps (80) bps (Source: Company/ Eastwind Research) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 10

- 11. Kolte-Patil Developers Ltd. Key financials : PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 186 50 236 85 84 1 8 126 40 9 8 11.5 1.0 148 5 153 58 57 2 8 54 16 36 8 5.0 1.0 204 5 209 91 89 2 7 87 30 61 12 7.5 1.6 249 10 260 68 66 2 24 50 14 82 12 4.7 1.6 743 7 750 201 196 5 42 160 55 108 30 16.4 4.0 825 7 832 248 240 8 46 201 69 132 30 17.4 4.0 908 18 925 272 265 8 46 237 81 155 30 20.5 4.0 45.8% 36.7% 58.0% 5.1% 13.2% 10.6% 39.5% 24.7% 9.3% 1.9% 5.6% 4.6% 44.4% 27.3% 16.4% 3.5% 8.2% 6.5% 27.2% 13.8% 12.1% 4.1% 5.0% 3.8% 26.4% 16.2% 18.4% 4.5% 17.3% 13.9% 30.0% 15.9% 23.7% 5.4% 16.1% 12.3% 30.0% 16.8% 27.9% 5.4% 16.4% 13.0% 657 159 816 8 20 675 150 824 8 54 700 175 874 8 46 721 226 947 8 39 717 819 944 173 250 250 891 1069 1194 8 8 8 89 74 74 (Source: Company/Eastwind) 87.2 0.2 11.2 1.7 89.4 0.6 6.8 10.8 92.3 0.5 13.1 6.1 95.2 0.4 2.7 8.3 94.6 0.9 5.1 5.4 Performance Revenue Other Income Total Income EBITDA EBIT DEPRICIATION INTREST COST PBT TAX Reported PAT Dividend EPS DPS Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Capital Employed No of Share CMP (Ammount in crore) Valuation Book Value P/B Int/Coverage P/E (Source: Eastwind Research) 108.1 0.7 5.2 4.2 124.6 0.6 5.8 3.6 (Figures in crore) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 11

- 12. Kalpatru Power Transmission "Buy" 4th Feb' 14 "Missed one……." Result Buy CMP Target Price Previous Target Price Upside Change from Previous 73 95 120 30% -21% Market Data BSE Code NSE Symbol 52wk Range H/L Capital Mkt (Rs Crores) Average Daily Volume (Nos.) Nifty 522287 KALPATPOWR 64/105 1201 48500 6002 Stock Performance-% 1M -18 (13) Absolute Rel. to Nifty 1yr -25 (24) YTD -11 (17) Share Holding Pattern-% Promoters FII DII Others 3QFY14 2QFY14 1QFY14 59 59 58 9.7 9.9 10.9 23.2 23.4 23.2 7.6 7.3 7.8 1 yr Forward P/B Kalpataru Power Transmission reported a 18% growth in standalone net sales to Rs 1051.34 crore. The growth was driven by Transmission business, which constitute about 96% of total sales and was up by 25% YoY to Rs 1007.22 crore. Infrastructure segment comprising of Railways and Pipeline execution reported a 61% fall in net sales to Rs 28.05 crore largely due to lower execution and excessive rainfall in Eastern region of the country. Other segment comprising of Biogas reported a 6% growth in net sales to Rs 16.07 crore. OPM was down by 110 bps to 8.9%. While there was a better execution of Transmission sector business including higher execution of export orders having better margins, continued losses in Infrastructure segment resulted in fall in OPM. The PBIT of Transmission business stood at Rs 89.51 crore with PBIT margin of about 9%, where as Infrastructure business reported loss of about Rs 15.23 crore as compared to profit of Rs 5 lakh for Dec'12 quarter. The Other segment PBIT was down by 11% to Rs 1.80 crore. Thus overall OP was up by 6% to Rs 94.04 crore. JMC Projects EBITDA margins improve to 5.1%, PAT up 75.6% yoy to Rs.31.4mn: Standalone PAT grew by 75.1% yoy to Rs.58.3mn upon 8.8% yoy growth in income from operations to Rs.6651mn, better than our PAT and revenue estimates of Rs.32.1 and Rs.6426mn. Robust execution of better margin factories and buildings orders and cost optimization measures,led 40 bps yoy increase in EBITDA margins to5.1%, Standalone Performance for nine months ended Dec 2013 Kalpataru Power Transmission reported a 26% growth in standalone net sales to Rs 2903.14 crore for the nine months ended Dec'13 period. The growth was driven by Transmission business, which constitute about 94% of total sales and was up by 33% YoY to Rs 2720.41 crore. Infrastructure segment comprising of Railways and Pipeline execution reported a 36% fall in net sales to Rs 138.48 crore largely due to lower execution and excessive rainfall in Eastern region of the country. Other segment comprising of Biogas reported a 13% growth in net sales to Rs 44.25 crore. OPM was down by 30 bps to 9.5%. While there was a better execution of Transmission sector business including higher execution of export orders having better margins, continued losses in Infrastructure segment resulted in fall in OPM The PBIT of Transmission business stood at Rs 259.25 crore with PBIT margin of about 9.5%, improvement of 60 bps YoY, where as Infrastructure business reported loss of about Rs 36.48 crore as compared to profit of Rs 5.45 crore for nine months ended Dec'12 period. The Other segment PBIT was stood at Rs 3.49 crore as compared to Rs 0.47 crore for nine months ended Dec'12 period. Thus overall OP was up by 23% to Rs 277.15 crore. Other income was up by 10% to Rs 37.80 crore. Interest was up by about 24% to Rs 114.26 crore and depreciation was up by 35% to Rs 51.33 crore, after which the PBT was up by 16% to Rs 149.36 crore. After providing total tax of Rs 50 crore, up by 25% YoY, standalone PAT for nine Financials Rs, Crore 3QFY14 2QFY14 (QoQ)-% 3QFY13 (YoY)-% Revenue 1051.3 962.2 9.3 889.7 18.2 EBITDA 94.0 91.1 3.2 88.6 6.2 PAT 33.7 31.0 8.7 35.1 -4.1 EBITDA Margin 8.9% 9.5% (60) bps 10.0% 110 bps PAT Margin 3.2% 3.2% 0 bps 3.9% (70) bps (Standalone) (Source: Company/Eastwind) 12 Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report.

- 13. Kalpatru Power Transmission. Concall Highlights: • PGCIL has changed its model on bidding as PGCIL itself needs to be now competitive for winning future bids. Competition continues to remain as it is, although everybody has become cautious. Management expects good orders from PGCIL in Mar'14 quarter, which is the normal trend. • Infrastructure segment comprising of railways and pipelines continue to report losses due to lower execution, delays for some projects due to ROW issues and high and extended rainfall in Eastern region of India, where the company has maximum orders. • Infrastructure business has an order book of around Rs 420 crore of which 80% are legacy orders. Management expects legacy orders to end by 2 more quarters after which better margins and better results within the sector will come in. Railways are not making any money and it's been very disappointing with not much to bid in and legacy orders hurting the margins. • About 50% of order book is from Government contracts in JMC Projects and rests are private. Q4 will see some more margin improvement due to better execution. Margin improvement of about 50-75 bps will continue in FY'15 for JMC Projects. • Overall, the management expects to end the year with a 20% net sales growth for FY'14 for KPTL and about 15% for FY'15. Margins will hover around 10-10.5% for transmission business segment. • Company has standalone debt of abut Rs 650 crore which it expects to bring down by about Rs 100 crore by end of FY'14. Average interest costs is about 10.5%. Consolidated debt is about Rs 2600 crore. Healthy order book: Consolidated order book as end of Dec 2013 was above Rs 12500 crore and of which KPTL's was Rs 7000 crore and that of JMC Project's was Rs 5500 crore. JMC received new order worth Rs 880 crore in Q3 FY'14. About 54% of order book of Transmission business was from international markets. About 50% of order book is from Government contracts in JMC Projects and rests are private. Outlook: At CMP of Rs.75.6, KPTL tradesat 7.6x FY14 EPS and 5.5x FY15 EPS. To factor in robust revenue growth, we revise revenue estimates for FY14/FY15 by 5.1%/1.0% respectively. On account of continued losses and low margin orders in the infrastructure segment we revise standalone EBIDTA margins as well to 9.7% for FY14 and 10.0% for FY15. Hence, we maintain "Buy"rating with target price at Rs.95/share. Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 13

- 14. Kalpatru Power Transmission. Story in graphs : T&D Revenue (INR) & T&D EBIT (%) (Q-o-Q) : Standalone, INR in crores (Source: Company/Eastwind) Revenue (Q-o-Q) : Standalone, INR in crores (Source: Company/Eastwind) Margin % (Q-o-Q) : INR in crores (Source: Company/Eastwind) Cost % of revenue : (Source: Company/Eastwind) Cost as a % of sales (Q-o-Q) : (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 14

- 15. Kalpatru Power Transmission. Key financials : PARTICULAR 2009A 2010A 2011A 2012A 2013A 2014E 2015E 3246 4032 4363 5308 6085 7210 8166 Performance Revenue Other Income 35 25 31 33 36 30 30 Total Income 3281 4057 4394 5341 6121 7240 8196 EBITDA 329 448 464 500 475 584 692 EBIT 272 373 376 402 352 445 525 DEPRICIATION 58 75 88 99 122 139 167 INTREST COST 137 126 117 158 194 263 263 PBT 170 272 291 277 194 212 293 TAX 42 69 79 73 60 65 90 Reported PAT Dividend EPS DPS 128 23 9.7 1.7 203 23 15.3 1.7 211 27 13.8 1.7 204 27 13.3 1.7 135 27 8.8 1.7 147 27 9.6 1.7 203 27 13.2 1.7 10.1% 3.9% 14.6% 2.6% 14.7% 7.1% 11.1% 5.0% 7.3% 0.8% 19.7% 10.5% 10.6% 4.8% 11.4% 1.4% 12.9% 8.5% 9.4% 3.8% 12.3% 1.6% 11.0% 6.5% 7.8% 2.2% 10.6% 2.1% 6.9% 3.7% 8.1% 2.0% 13.1% 2.4% 7.1% 3.2% 8.5% 2.5% 18.0% 2.4% 9.0% 4.3% 870 945 1815 13 66 1027 901 1929 13 210 1645 831 2476 15 121 1851 1281 3133 15 108 1947 2068 2244 1669 2500 2500 (Source: Company/Eastwind) 3616 4568 4744 15 15 15 Company/Eastwind) 83 (Source: 73 73 65.6 1.0 2.0 6.8 77.5 2.7 3.0 13.7 107.2 1.1 3.2 8.8 120.7 0.9 2.5 8.1 126.9 0.7 1.8 9.4 Yeild % EBITDA % NPM % Earning Yeild % Dividend Yeild % ROE % ROCE% Position Net Worth Total Debt Ammount in crores Capital Employed No of Share INR in crores CMP Valuation Book Value P/B Int/Coverage P/E (Source: Eastwind Research) 134.8 0.5 1.7 7.6 146.2 0.5 2.0 5.5 (Figures in crore) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 15

- 16. Godrej Consumer Product "BUY" 4th Feb' 14 " Strategy Shining" Result update CMP Target Price Previous Target Price Upside Change from Previous BUY 722 960 725 33% 32% Market Data BSE Code NSE Symbol 52wk Range H/L Mkt Capital (Rs Cr) Average Daily Volume Nifty 532424 GODREJCP 977/672 24573 120012 6002 Stock Performance 1M Absolute -13.8 Rel. to Nifty -10.3 1yr 1.5 1.4 YTD 5.4 0.6 Share Holding Pattern-% Current 2QFY14 1QFY14 Promoters 63.3 63.3 63.3 FII 28.9 28.7 28.3 DII 1.4 1.2 1.2 Others 6.5 6.8 7.2 1 yr Forward P/B Almost inline set of numbers; For 3QFY14, Godrej CP revealed inline set of numbers with 17% sales growth led by 18% domestic and 25% international sales growth, reported growth across all geographies and segments, respectively. PAT grew by 14% on YoY basis. Its strong focus on driving growth in the domestic and international market by expansion of products and distribution reach, we expect strong earning in near future. With launching new products in domestic as well as international mkt, Godrej CP will explore organic & inorganic growth. Along with its 3x3 strategy, it has 10x10 strategy also, which refers to 10x growth in 10 yrs. Margin decline: The Company has been able to maintain its margin more than 15% mark. EBITDA margin declined 110bps (YoY) to 15.7%, due to rise in A&P cost by 80 bps to 11.5%. However, there was decline in RM cost by 500 bps to 38.8% of adjusted net sales. On Category wise: During the Quarter, Household insecticides grew by +8%, adversely impacted by abnormal seasonal slowdown. Both the key brands Hit and Good knight continue to gain share and strengthen market leadership positions across all formats. Soap sales growth was +6%, volume growth at +4%, ahead of the category growth, but down in value and volume term. Strong momentum in hair colours was maintained, delivering sales growth at +37%. Liquid detergents grew 36%. Geography wise performance: For 3QFY14, Business from India grew by 18% and contributed 53% of total revenue, Indonesia grew by +18% and contributed 17% of total revenue, Africa grew by 29% and contributed 15% of total revenue, Latin America grew by 15% and contributed 8% of total revenue and Europe’s business continued strong sales performance on both organic and Soft & Gentle (S&G) product portfolio. Business reported growth of 124%. Products strategy: The company continues to gain and enjoy market leader ship position across all three formats. The company is driving increase in penetration with launch of "Goodknight Advanced colour play". Recent developments: The Company has entered into an agreement on Oct 7, 2013, to acquire a 30% stake in Bhabani Blunt Hair Dressing Pvt Ltd, a premier hair salon company with one of the strongest consumer franchises in this space. View and Valuations: Its strong 20%+ growth in the domestic household insecticides business is the key growth driver. We expect strong momentum to continue in its international business led by Megasari and consolidation of Darling business. Despite some concerns related to higher leverage, lost domestic focus, macro uncertainties in Africa and LatAM, and currency risk, we remain confident of achieving the 20%+ sales growth with strong PAT growth for FY14E & beyond. At a CMP of Rs722, stock trades at 5.1x FY15E P/BV. We retain BUY with a price target of Rs 960. Financials Revenue EBITDA PAT EBITDA Margin PAT Margin 3QFY14 1982.3 311.1 196 15.7% 9.9% 2QFY14 1961.7 299.8 195 15.3% 9.9% Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. (QoQ)-% 1.1% 3.8% 0.5% 210bps 220bps 3QFY13 1695.6 284.9 172.2 16.8% 10.2% Rs, Cr (YoY)-% 16.9% 9.2% 13.8% (30bps) (10bps) 16

- 17. Godrej Consumer Product Sales and its Growth(%) India branded business grows 17%, ahead of the market growth across core categories. (Source: Company/Eastwind) Margin-% It expects expansion in gross margin, which will help it to fund new product launches. (Source: Company/Eastwind) Region-wise EBITDA Margin Regions India Indonesia Africa Latin America Europe 2QFY12 18.9% 19.4% 26.0% 7.4% 11% 3QFY12 20.4% 20.6% 31% 9% 5% 4QFY12 20.2% 20.7% 19.3% 16.3% 10.5% 1QFY13 15.1% 18% 19% 3% 13% 2QFY13 17.6% 19% 16% 4% 9% 3QFY13 18% 20% 20% 8% 5% 4QFY13 1QFY14 2QFY14 3QFY142 16.7% 15.8% 18.9% 18.5% 19% 15% 17% 16.0% 7% 13% 14% 18.0% 9% 3% 7% 9.0% 13% 9% 10% 6.0% (Source: Company/Eastwind) Domestic and Export sales-(% of Sales) (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 17

- 18. Godrej Consumer Product Key facts from Conference call (attended on 3rd Feb 2014); (1) The management stated that the company is continue to be aggressive in launching new innovations that have been well accepted by consumers. They are backing new launches with strong investments. (2) More focusing on Innovative pipeline and Brand equity to maintain its market share across brands,They will launch a new product next week, but they did not tell the segment name. (3) Q4 will be better quarter for household segments. (4)The company will continue investing judiciously for the longer term to improve position, create competitive advantage and emerge stronger than before. (5) They are not seeing any major impact on Argentina or Africa revenue, because of economic uncertainties, Financials and Valuation Rs in Cr, Sales Other Operating Income Total income from operations RM Cost Purchases of stock-in-trade WIP Employee Cost Ad Spend Other expenses Total expenses EBITDA Depreciation and Amortisation Other Income Exceptional Item EBIT Interest PBT Tax Exp PAT Growth-% (YoY) Sales EBITDA PAT Expenses on Sales-% RM Cost Ad Spend Employee Cost Other expenses Tax rate Margin-% EBITDA EBIT PAT Valuation: CMP No of Share NW EPS BVPS RoE-% Div- Payout-% P/BV P/E FY10 2041.2 2.5 2043.7 619.59 367.16 -40.45 151.81 132.8 402.98 1633.89 409.81 23.6 44.81 0 386.21 11.1 419.92 80.33 339.59 FY11 3693.6 28.11 3721.71 1458.28 294.12 -45.22 284.51 352.85 695.96 3040.5 681.21 49.92 24.13 41.14 631.29 43.64 652.92 138.21 514.71 FY12 4866.16 45.93 4912.09 2174.67 356.11 -212.26 391.91 449.86 850.47 4010.76 901.33 64.44 6.07 200.17 836.89 65.84 977.29 226.05 751.24 FY13 6390.79 16.58 6407.37 2640.31 451.03 -118.06 590.68 660.35 1196.46 5420.77 986.6 77 67.78 96.12 909.6 77.45 996.05 179.18 816.87 FY14E 7701.26 15.40 7716.66 3028.79 559.46 -23.15 733.08 887.42 1311.8 6497.4 1219.2 92.7 57.9 38.6 1126.5 87.7 1135.3 204.35 930.9 FY15E 9053.82 18.11 9071.93 3719.49 657.71 -90.72 907.19 997.91 1587.6 7779.2 1292.7 100.4 90.7 45.4 1192.3 78.7 1249.7 249.94 999.8 46.3% 95.2% 97.0% 81.0% 66.2% 51.6% 31.7% 32.3% 46.0% 31.3% 9.5% 8.7% 20.5% 23.6% 14.0% 17.6% 6.0% 7.4% 30.3% 6.5% 7.4% 19.7% 19.1% 39.2% 9.5% 7.6% 18.7% 21.2% 44.3% 9.2% 8.0% 17.3% 23.1% 41.2% 10.3% 9.2% 18.7% 18.0% 39.3% 11.5% 9.5% 17.0% 18.0% 41.0% 11.0% 10.0% 17.5% 20.0% 20.1% 18.9% 16.6% 18.3% 17.0% 13.8% 18.3% 17.0% 15.3% 15.4% 14.2% 12.7% 15.8% 14.6% 12.1% 14.3% 13.1% 11.0% 261 30.8 954.7 11.0 31.0 35.6% 30.6% 8.4 23.7 365 32.4 1725.2 15.9 53.2 29.8% 38.3% 6.9 23.0 559 34 2815.2 22.1 82.8 26.7% 22.6% 6.8 25.3 836 34.03 3313.0 24.0 97.4 24.7% 23.0% 8.6 34.8 722.0 34.03 4044.9 27.4 118.9 23.0% 21.4% 6.1 26.4 722.0 34.03 4845.6 29.4 142.4 20.6% 19.9% 5.1 24.6 (Source: Company/Eastwind) Narnolia Securities Ltd, Please refer to the Disclaimers at the end of this Report. 18

- 19. N arnolia Securities Ltd 402, 4th floor 7/ 1, Lord s Sinha Road Kolkata 700071, Ph 033-32011233 Toll Free no : 1-800-345-4000 em ail: research@narnolia.com , w ebsite : w w w .narnolia.com Risk Disclosure & Disclaimer: This report/message is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Narnolia Securities Ltd. (Hereinafter referred as NSL) is not soliciting any action based upon it. This report/message is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any from. The report/message is based upon publicly available information, findings of our research wing “East wind” & information that we consider reliable, but we do not represent that it is accurate or complete and we do not provide any express or implied warranty of any kind, and also these are subject to change without notice. The recipients of this report should rely on their own investigations, should use their own judgment for taking any investment decisions keeping in mind that past performance is not necessarily a guide to future performance & that the the value of any investment or income are subject to market and other risks. Further it will be safe to assume that NSL and /or its Group or associate Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise, individually or otherwise in the recommended/mentioned securities/mutual funds/ model funds and other investment products which may be added or disposed including & other mentioned in this report/message.