How The Philippines Is Presented To Foreign Mining Investors

- 1. Philippines A supplement to Mining Journal

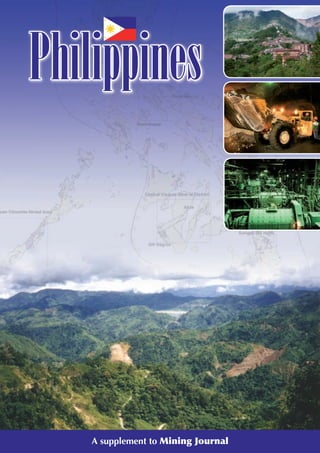

- 2. INTRODUCTION A message from the MDC/DENR A CCOMPLISHMENTS are government shares in mining taxes, fees and CONTENTS visions transformed into royalties. We also hope to expand the Message from the MDC 2 action. The accomplishment allocation for community development and Introduction 2-3 report of the Minerals provide funds for the conduct of information, Why invest in the Philippines? Development Council (MDC) education and communication campaigns for Mineral potential proves that the government and the private responsible mining. Moreover, the MDC will Climate sector remain committed to the vision of continue to work for the implementation of Government revitalising the minerals industry as one of the means the Extractive Industries Transparency Initiative to Country overview 4-9 to conquer poverty. ensure greater transparency in revenue collection and Mineral industry We have come a long way since President Gloria management. We will likewise continue to rationalise Government policies affecing industry Macapagal Arroyo announced a policy shift from the implementation of small-scale mining laws, rules Gold, copper and nickel “tolerance to active promotions” of the industry in and regulations and strengthen the implementation of Recent developments 10-12 Year 2004. With the MDC as overall co-ordinator of the streamlined permitting procedures. MDC history 12 the ‘revitalization programme’, we have promoted We expect the mining sector to continue facing MDC directory 14 priority mining and exploration projects here and more challenges in the wake of the global financial Cover image: Prospective ground for epithermal gold on abroad, harmonised the implementation of some laws crisis. However, we are confident the MDC will be Mindanao Island. Inset: Three photos of Philex Mining: the and policies affecting the sector, and engaged all able to assist the industry seek innovative ways to mine community; co-workers at the underground mine stakeholders in continuous and meaningful dialogues. overcome this hurdle. The MDC will not waiver in its works; and the ball mill – mill department Photos: Philex We have chosen to act on the issues and concerns mission of developing our mineral resources for the outlined in the Minerals Action Plan that will benefit of the country and the Filipino people. The promote an investment climate that is more tasks seem daunting but we have already begun some Published in September 2009 by: conducive for business, while balancing out the good actions, and we will not rest till we bring it to Aspermont UK Albert House, 1 Singer Street interests of host communities, local governments and full completion. London EC2A 4BQ other stakeholders, and without sacrificing the quality United Kingdom of our environment. Tel: +44 (0)20 7216 6060 Fax: +44 (0)20 7216 6050 In the coming years, the MDC will remain focused E-mail: editorial@mining-journal.com on several action points including the development of Website: www.mining-journal.com an industrialisation programme through the Hon. Jose L. Atienza, Jr Supplement editor: Chris Hinde development of services and supplier industries and Chairman, Minerals Development Design and production: Tim Peters, of downstream processing for metal and manufac- Council, Office of the President, tured products. We will continue to support the and Secretary, Department of Printed by Stephens & George, Merthyr Tydfil, UK passage of the bill on the direct remittance of local Environment and Natural Resources © Aspermont UK 2009 Asian gateway operations started in late 2008 and early 2009, defying scepticism that has hounded commodity markets. The Philippines earned its high rating by posting economic growth averaging 4.4% annually from 2001 to 2006, the country’s best six-year average in the The Philippines is a natural gateway to the other Asia-Pacific past 18 years. GDP growth in 2007 was a remarkable economies, and has flourishing trade links with the region 7.1%, while there was a growth of 3.8% in 2008 T despite the international difficulties. Interest rates HE country enjoys democracy, with a have remained stable, and inflation has further eased free market economy, and remains in view of fiscal and monetary reforms. Country information among Asia-Pacific region’s top The Philippine government has deregulated the investment destinations owing to its telecommunications, shipping, oil and energy, banking Location: liberalised investment policies and and insurance industries, and has a continuing The Philippines lie in the western Pacific Ocean, conducive investment environment. economic and financial reform programme. Straddling just north of the equator, southeast of the Asian Investor interest in the domestic mining industry the well-defined belt of volcanoes around the Pacific mainland, with Taiwan north and Indonesia to the did not wane last year despite the global financial crisis. (the so-called Ring of Fire), the Philippines has the south. The strong demand for minerals and metals by China, greatest number of proven deposits of metallic and India, Korea, Japan and other developing countries in non-metallic minerals among Southeast Asian Capital: Manila. the region has sustained exploration and mining countries. activities in the Philippines. While there has been a Geography: reduction in the exports of nickel ore shipments, WHY INVEST IN THE PHILIPPINES? The Philippines is the world’s second-largest demand for the country’s other resources in gold, Existing mining laws are attractive to investors. They archipelago after Indonesia. It consists of 7,107 copper, iron ore, chromite and coal remained good. allow co-production, joint venture, mineral production islands, with a total land area of 299,764km2 . The With prices of these commodities considered sharing, and financial or technical assistance interior is mountainous, skirted by lowlands and above break-even levels, a number of mining agreements for large-scale mining projects. The alluvial plains. The highest point is Mt Apo on current policy of revitalising mining has spurred Mindanao Island at 2,954m above sea level. renewed interest in the industry. The presence of According to the Philippine Institute of major mining companies such as Anglo American, Volcanology and Seismology, there are more than AngloGold Ashanti, BHP Billiton, CVRD, Phelps Dodge, 400 volcanoes throughout the archipelago, of Sumitomo Mining and Xstrata, attest to the allure of which 22 are active, 27 are potentially active, and Philippine mining. more than 350 are inactive. There are three major The country’s private and government sectors are island groups: Luzon,Visayas and Mindanao. taking stock of the current metals market and the surging minerals demand of industrialising countries, 2 Mining Journal special publication – Philippines September 2009

- 3. INTRODUCTION notably from China and India, and the recovery of the Japanese economy. With the rest of the world’s significant economies likewise on an upswing, the Mining industry, benefits to the economy prospects are bright for Philippine minerals. In a special report London-based Mining Journal Gross domestic product and export growth wrote recently that “over the past decade, and despite (share of mining in gdp and total exports) stiff competition from other countries for the Year GDP GVA/Mining % Total Exports Minerals Share % exploration dollar, the Philippines has progressed (PP million) (US$ m) Share (US$m) (US$m) significantly, and exploration activity has resulted in 1990 721 29.6 11,091 1.5 8,126 723 8.8 the discovery of a new generation of potentially 1995 803 31.2 10,681 1.3 17,447 893 5.1 world-class deposits, such as Tampakan (copper), Far 2000 973 22.0 10,533 1.1 38,078 650 1.2 Southeast (copper-gold), Boyongan (copper) and many 2005 1,211 22.0 20,032 1.7 40,263 1,084 2.7 others. They can be differentiated from previous 2006 1,277 24.9 18,812 1.5 47,410 2,756 5.8 discoveries that were of low grade and shallow- 2007 1,369 29.7 23,678 1.7 50,276 3,299 6.6 seated”. 2008 1,432 33.2 23,817 1.7 48,202* 2,482* 5.2* Source:NSCB and Bangko Sentral ng Pilipinas (BSP); * Preliminary MINERAL POTENTIAL The Philippines covers some 30Mha but only less than Excise tax and royalties derived from mining 2% are presently covered by mining permits, and Year Excise Tax Royalties Total some 30% of the remaining area is regarded by the (US$m) (PP m) (US$m) (PP m) (US$m) (PP m) Mines and Geosciences Bureau to be geologically 1990 30.0 730.0 0.67 16.2 30.7 746.3 prospective for metallic minerals. As a result, there is 1995 6.8 174.5 0.64 16.5 7.4 191.0 an estimated 9Mha that has potential for metallic 2000 5.6 243.3 781.5 34.5 6.3 277.9 minerals. 2005 4.6 251.3 2.6 145.1 7.2 396.5 A large pool of Filipino professional geologists and 2006 9.5 489.6 2.2 112.7 11.7 602.3 mining engineers have extensive experience in mineral 2007 23.8 1.1 12.6 579.9 36.4 1,679.9 exploration and mining operations. A continuing 2008 14.8 660.3 9.3 414.8 24.2 1,075.1 scholarship and training programme is being Source:BIR and MGB/DENR implemented to address an increasing demand for skilled workers. Moreover, English is spoken and understood throughout the archipelago. Geologically prospective areas The Philippines offers foreign investors a high 11% for metallic minerals standard of living at low cost. First-rate housing, 30% hotels, schools and recreation facilities are found in Land area covered by approved Metro Manila and in major cities all over the country. mining tenements Repatriation of the earnings and capital of foreign investors is guaranteed. Investors from various lands 57% 2% Other land areas in the Philippines will find the Filipino people a happy mix of Asian and Western cultures. Among Asian countries, the Philippines is perceived to be the most westernised. Protected areas But the tapestry of Philippine culture also threads other than Spanish and American-Malay, Chinese, Arabian, Indian and Japanese. These are the major Percentage of highly prospective areas in the Philippines cultures that streamed into Philippine history, along with influences from the English, the French, the climate can be divided into two major seasons: first, GOVERNMENT Germans and the Dutch. Still, 110 ethno-linguistic the rainy season from June to November, during the The Philippines is an independent democratic and groups scattered throughout the archipelago retain southwest monsoon; and, second, the dry season from republican state. Its government consists of three their distinctive identities and dialects. December to May. The dry season may be further co-equal branches: the executive, the legislature and divided into the cool dry season (December to the judiciary. Executive power is vested in the CLIMATE February) coinciding with the northeast monsoon, President; legislative power in the bicameral Congress; The Philippines has a tropical-marine climate, and the hot dry season (March to May). and judicial power in the Supreme Court and other characterised by relatively high temperature, high Straddling the typhoon belt, the Philippines courts established by law. humidity and abundant rainfall, similar in many experiences 15-20 typhoons yearly, usually from July The President is elected by direct vote of the respects to the climate of Central America. The mean to October. The typhoons move generally northwest- people for a single term of six years. In the Congress, annual temperature is 26.6°C, except in Baguio City. erly from the Marianas and Caroline Islands in the the Members of the House of Representatives hold The coolest month is January with a mean tempera- Pacific, sparing Mindanao Island. three-year terms, while those of the Senate serve for ture of 25.5°C; the warmest is May, with a mean six years. Local government officials have temperature of 28.3°C. Baguio City, at an elevation three-year terms. of 1,500m, has a mean annual temperature of The most recent elections for the Congress and 18.3°C, earning its popularity as the country’s local government officials were held in May 2007. summer capital. The magistrates of the Supreme Court and of the The country’s average monthly relative humidity lower courts are appointed by the President from varies between 71% in March and 85% in the nominees of the Judicial and Bar Council, September. Mean annual rainfall ranges from 965 to without need for congressional confirmation. 4,064mm annually. Baguio City, eastern Samar and Provinces are headed by governors, and cities eastern Surigao receive the greatest amount of and municipalities by mayors. rainfall, while the southern portion of Cotabato The barangay is the basic political unit and is receives the least. At General Santos City in South administered by a set of elective officials headed by Cotabato, the average annual rainfall is only 978mm. the chairman, locally known as the punong Based on temperature and rainfall, the country’s barangay. September 2009 Mining Journal special publication – Philippines 3

- 4. COUNTRY OVERVIEW Economy stays buoyant despite downturn Drill technicians load core into trays for geological assessment By Artemio F. Disini, at the Tampakan copper-gold mine project in the southern Chairman Philippines, in mid-2008 D Photo: Indophil Resources via Bloomberg News ESPITE the reeling effects of the global financial crisis, the Philippine economy that, taken overall, the Philippines would be better posted a 3.8% growth in GDP for insulated from the collapse of external demand 2008, albeit lower than the previous compared with other Asian economies. year’s 7.1% record. The Philippine government remains optimistic that Latest data for the Philippine economy shows that the economy will be better placed to weather the country is holding its head above water, with real recession in 2009, with GDP growth at 0.8-1.8%. GDP growth remaining positive (0.4% in the quarter Exports are expected to fall but the remittances of to end-March). Despite its small growth, the overseas workers will be about the same, or better, upheld the constitutionality of the Financial or Philippines is one of only four countries in Asia able to than for last year at US$17.0 billion. Technical Assistance Agreement (FTAA) and the post positive GDP growth in the first quarter of this Mining Act of 1995. The law allows 100% foreign year. The others are Indonesia,Vietnam and China. MINERAL INDUSTRY ownership in Philippine mining companies. With exports accounting for only one-third of The country has seen an upsurge in foreign mining Over 30 foreign companies have investments in the GDP, Standard Chartered Bank recently predicted investment since 2005, when the Supreme Court Philippine mining sector. These include the world’s largest mining company, BHP Billiton, Brazil’s Vale and Anglo American. Some 24 flagship projects are Government policies affecting the mining industry projected to be operational before 2016, and the Mines and Geosciences Bureau reported at least 50 BoI approval In 2005, the government officially changed its exploration projects that have ‘good’ potential for The Board of Investments (BoI) has approved the stance of mere tolerance to active promotion of the development. government’s 2009 Investment Priorities Plan (IPP). mining industry. The frequent changes of Secretaries, Mining in 2008 contributed 1.5% of GDP. The This incorporates mining initiatives, and adds to the however, have hampered the implementation of national target is to attain the 6.6% of GDP by 2011 plans to provide incentives to firms that would effective long-term policies of the DENR. (which would fix the Philippines firmly as a ‘mining generate or save jobs in spite of the global country’. While it is still attainable, the target is likely economic slowdown. Cancellation of dormant mining claims to be delayed by at least three years due to the The Department of Environment and Natural reduction in mining investments, and to delays in More efficient excise tax remittances Resources has given instructions to the Mines and implementation of the larger projects. An important, and much-awaited, government Geosciences Bureau (MGB) to review mining The government has scaled down its mining approval is the direct payment of the share of excise applications/permits that have not been active for investment target for this year to about taxes to the local government units. After many years five to ten years. US$800 million, down from the original US$1 billion of lobbying by the Chamber of Mines (CoM), the This situation, according to the DENR, has a but still above last year’s US$650 million inflow. different government agencies (represented in the negative effect on investors, hence the necessity of Mineral Development Council; MDC), primarily the the review. Dormant mining claims and tenements INFLUX OF FILIPINO INVESTORS Departments of Environment and Natural Resources will be cancelled and restored to government During the past two years, numerous large Filipino (DENR), Budget and Management (DBM) and Interior ownership. To implement this policy, a three-stage corporations (or Filipino-based subsidiaries) have and Local Government (DILG), were able to finalise notification process will be adopted. been drawn to the domestic mining sector. These the rules (which will be implemented in 2010). The organisations include First Pacific Co, San Miguel, excise tax of metal revenues for 2009 will be paid to Cancellation of mining applications Macroasia and APC. They were attracted to mining the different local government units (LGU) in March The CoM has expressed its “grave concern” over a due to the government’s support in developing the 2010. This new schedule of three months contrasts DENR memoranda (dated March and May 2009) to mining sector and the great potential of the various with the present two to three years. the regional directors of the MGB directing local metal deposits. it to deny all mining applications that have First Pacific invested in Philex Mining Corp and Accelerating permit approvals been rejected by indigenous peoples (IP). In acquired an initial 22% equity. It is currently carrying To facilitate investments in the mining a letter to the Secretary, the Chamber out a due-diligence study on Lepanto’s Far Southeast industry, the old issue of the lengthy expressed concern about procedural copper-gold project. San Miguel is in talks with various approval of permits had to be resolved. In ambiguities created by the memoranda that mining groups and is open to an array of opportuni- July 2009, the DENR put in place a process may undermine its efforts at promoting ties. Macroasia is developing its nickel deposit in of streamlining the permitting process to make it investments and competitiveness in the industry. Palawan for direct shipping ore and is considering the faster and more transparent. The CoM requested that there should be clear construction of a processing plant. APC has coal According to DENR Secretary Joselito Atienza, guidelines on the procedures in obtaining Certifica- projects in Isabela and Masbate, and nickel and gold the permits for mining will be carried out in a tion Precondition (CP) or Free and Prior Informed prospects in Mindanao. period of seven weeks from the current minimum Consent (FPIC). It should also address the issue of These companies can readily finance the of 17 weeks. The environment compliance certificate when the non-grant of a CP or FPIC becomes final development of medium-sized projects. They are (ECC) will be decided within three weeks from (ie no longer negotiable with IP). It should also likewise familiar in dealing with groups opposing filing, compared with the current one year. While include the possibility of compromise or of an appeal mining such as the Catholic Church, environmentalists these efforts are being promoted during the latter by the EP or mineral agreement applicant. The and New People’s Army (NPA). Being local companies part of the Secretary’s tenure, it is still a welcome Secretary agreed to the drafting of procedures to they are more knowledgeable about local cultural move for the industry. address such concerns. sensitivities, and are more acceptable to the local communities. 4 Mining Journal special publication – Philippines September 2009

- 6. COUNTRY OVERVIEW GOLD SECTOR probable reserve was estimated from an indicated Runruno lies 320km north of Manila in the mineral The production of gold fell by 8% from 38.8t in 2007 resource of 1.25Mt at 15.0g/t gold, containing rich province of Nueva Viscaya. The results of its to 35.6t in 2008. The decline was due to a decrease in 603,000oz. This was the result of over 40,000m of recently-completed scoping/pre-feasibility study the gold produced by large-scale mining companies, drilling and over 6,000m of underground development indicate its economic viability. It will have an annual whose output represented about a fifth of the completed in 2008. The Co-O gold veins are narrow production of 183,000oz gold and 1.7Mlb molybde- country’s total production. but have the highest grade among the country’s num. The capital cost is about US$208 million and the Bangko Sentral Ng Pilipinas (Philippine Central operating gold mines. operation will have an average cash operating cost of Bank) reported that it had purchased 28.2t (about For its Runruno gold project, London-based Metal US$285/oz after credits for molybdenum. 80% of the country’s total production) from small- Exploration reported that it has defined a JORC- The bankable feasibility study (BFS) on the Runruno scale miners. compliant inferred and indicated mineral resource of project was launched last February,and is expected to The country’s gold production is projected to 2.0Moz gold and 34.4Mlb molybdenum, contained take a year to complete. The BFS is expected to cost increase to 70t/y when the large copper-gold projects within 31.17Mt of ore at average grades of 2.00g/t US$15 million. DENR has endorsed the company’s become operational in about four years. gold and 0.05% molybdenum. FTAA application in respect of Runruno. Two Australian companies, CGA Mining and Medusa Mining Ltd, are new performers in the gold Gold mineralisation is COPPER sector. Victoria Mine mostly found in the The country produced about as much copper last CGA Mining (formerly called Central Asia Gold (10 MMt, 6.94 g/t Au) Acupan Mine central Cordilleras, year as it did in 2007, at 22,565t. The Rapu Rapu Ltd) started commissioning its gold project during (10.61 MMt, 2.46 g/t Au) and most of the polymetallic and Atlas Toledo copper mines became the first quarter of 2009. The project is the former areas in Mindanao operational during the year. TVI completed its Masbate gold mine that was operated for 14 years commissioning and began production during the by Atlas Consolidated Mining Co until it shut in first quarter of 2009. 1994. Due to the problems brought about by the The project has indicated resources containing economic crisis, the planned development of a mine 3.3Moz and inferred resources of 1.77Moz, including Panaon by Oceana Gold has been deferred, and the project prospect a probable mining reserve of 1.98Moz of gold (at a has been placed under care and maintenance. Siana Mine cut-off of 0.7g/t). The projected annual production (7.7 MMt, 3.3 g/t Au) Switzerland-based Xstrata has announced the Diwalwal Project of 200,000oz is scheduled to be reached next year. Sibutad (10.2 MMt, 8.10 g/t Au) preliminary results of a two-year extended Mine Medusa Mining advised that it has completed a NDMC Prospects pre-feasibility study for its Tampakan copper and JORC-compliant ore reserve estimation for the Masara Mine (0.5 MMt, 9 g/t Au) gold mine in Mindanao. The study was completed in Co-O mine in eastern Mindanao. It has an indicated Boringot Prospect April 2009 for Sagittarius Mines Inc (SMI), and and inferred resource totalling 1.38Moz. The confirmed a 2,200Mt mineral resource base initially Bringing innovative, low-cost nickel heap leaching technology to the Philippines The Acoje joint venture between Rusina and European Nickel in Zambales is trialing innovative heap leaching technology for nickel laterites. Developed by European Nickel as a low-cost and environmentally-friendly alternative to high-pressure acid leaching, the heap leach trial site will commence irrigation of the leach pads in third quarter 2009. The plant will produce a mixed hydroxide nickel product. A bankable feasibility study, examining a full-scale commercial plant producing around 25,000 tpa nickel, is expected to be completed in 2010. The project capital cost is currently estimated to be in the range of US$500 million, with an operating cost forecast of around US$3.10/lb of nickel. www.enickel.co.uk www.rusina.com.au 6 Mining Journal special publication – Philippines September 2009

- 7. COUNTRY OVERVIEW containing about 1,400Mt of mill feed. It has a proposed stage-one open-pit mining and milling rate Ultramafic rocks Bully Bueno SAN MARIANO Prospect of 44Mt/y, leading to a stage-two rate of 66Mt/y after VMS Prospect and ophiolitic Batong Buhay Mine Lepanto Enargite Mine (69 MMt, 0.59% Cu, 0.31 g/t ____________ three years. belts Au) Sto. Tomas II Mine Far Southeast deposit Tampakan will have a life-of-mine average BARLO VMS (449 MMt, 0.375% Cu, 0.7 g/t (650 MMt, 0.65% Cu, 1.3 g/t production of 325,000t/y of copper for 20 years, with Deposit Au) Au) Dizon Mine output expected to peak at more than 400,000t/y of (187 MMt, 0.36% Cu, 0.93 g/t Copper mineralisation is Au) copper and 310,000oz/y of gold. likewise indicated mostly The mill recovery rates will be 83-90% for copper SULAT VMS in the Cordilleras, and Prospect and 60-80% for gold, with a copper concentrate grade most of the areas in of 37-40% copper. The mine also has an operating cost Mindanao base of less than US$0.60/lb of copper after gold Boyungan deposit (300 MMt, 0.6% Cu, 1.0 g/t credits. It has an initial stage-one capital expenditure Au) of about US$5.2 billion. The schedule for start-up of Amacan Mine commissioning and production is early 2016. (116 MMt, 0.37% Cu, Following the completion of the extended pre- 0.36 g/t Au) feasibility study, a US$74 million feasibility study was Kingking deposit (400 MMt, 0.35% Cu, approved by the shareholders, which will entail a Tampakan deposit 0.6 g/t Au) (>1000 MMt, 0.7% Cu, 0.3 g/t Au) detailed engineering study. This study will determine whether the project will advance to development stage. SMI engaged the services of Bechtel, a global disagreed earlier with the results of Anglo American’s the project. Philex is now carrying out more extensive leader in engineering and construction, as the lead pre-feasibility study on the project. exploration work in the sulphide zones of the Bayugo engineer for the Tampakan feasibility study. This study concluded that “a mining operation deposit, located north of the Boyongan orebody. The The study will be submitted to the government by based on the currently-defined resources, proposed sulphide zones are easier to mine by block caving and the second quarter of 2010. The decision to develop a mining and processing methods, assumed long-term a mooted single-stage flotation gives better metal major mine at Tampakan will depend on the outcomes copper and gold prices and estimated capital and recoveries. Philex plans to undertake a bankable of the feasibility study, which will examine the project’s operating costs, could not provide an acceptable rate feasibility study by 2010. The Boyongan project is economic, social and environmental viability. on return on the project investment”. The projected expected to be operational before 2014, when the Philex Mining Co has bought the 50% stake of capital cost was US$750 million. reserves of Philex’s Padcal mine would have been Anglo American in the Boyongan copper-gold project Philex disputed the assumptions, and conclusions, mined out. in Surigao del Norte for US$55 million. Philex made by Anglo American, and negotiated to acquire Hong Kong conglomerate First Pacific Co (FPCL) Consistently delivering value Since establishment in 1992, Lycopodium has focussed on the delivey of high-quality, cost- r effective enginee ring and project management f services across a broad range of mineral commodities regardless of project scale or location. T To service the Philippines area, we offer: f • Manila-based engineering and drafting teams • Extensive feasibility study and project development experience • Recent project development with Masbate and Rapu Rapu • Current study involvement with Runruno Contact: Brad Hannam or Steve Zaninovich T: +61 8 6210 5222 E: minerals@lycopodium.com.au W: www.lycopodium.com.au September 2009 Mining Journal special publication – Philippines 7

- 8. COUNTRY OVERVIEW 8 Mining Journal special publication – Philippines September 2009

- 9. COUNTRY OVERVIEW acquired a 20.06% stake in Philex Mining for Surigao del Norte. The project cost has been reduced Nickel and US$135 million in November 2008. It has since to US$1.1 billion from the original US$2.0 billion. ISABELA nickel laterites PROSPECT increased its stake to 22.0%. Sumitomo, Mitsui and Sojitz are the Japanese partners are scattered in The Far Southeast project of Lepanto Consolidated of the Zamora Group that will construct the new GLOBAL PROSPECT Luzon, Visayas and (23 MMt, 1.75% Ni) Mining Co is a large, deep-seated copper-gold HPAL plant. Mindanao porphyry deposit, located below the enargite mine. In European Nickel plc has reported that test work at November 2007, Lepanto Consolidated signed a its Acoje joint venture with Rusina Mining NL in COTO PROSPECT (24 MMt, 1.68% Ni) MT. KADIG joint-venture agreement with China’s Zijin Mining Zambales continues to have high recoveries and DEPOSIT Group for development of the project. The latest leaches rapidly in the column tests compared with information, however, stated that Zijin Mining has many other deposits. The nickel recoveries are in the pulled out from the project. 75-80% range. The company announced that ROMBLON GUIAN In May 2009, FPCL signed a Memorandum of construction of the heap-leach trial site is progressing PROSPECT DEPOSIT Agreement with Lepanto to undertake due diligence well, while construction of the heap-leach pad and on the Far Southeast project, with an exclusivity ancillary facilities has been completed. The heap will DINAGAT clause of three months. The due-diligence study is be stacked to a height of about 3m and irrigation was DEPOSIT continuing, with the objective of FPCL acquiring a due to start in October 2009. The project capital cost HINATUAN & majority interest in the project. is about US$450 million, with an operating cost of TMM Ni Project TAGANITO MINES Concurrent to this study by FPCL is its due about US$4/lb. A bankable feasibility study will be diligence on Manila Mining Corp with a similar aim to completed by mid-2010. PALAWAN HPP PROJECT acquire majority interest of its mining projects. Manila’s Intex’s plans aim at completing a definitive feasibility (11.5 MMt, 2.3% Ni) PUJADA Kalayaan project lies at the northern extension of the study and environmental permitting by year-end, and DEPOSIT Bayugo orebody, which is being explored in the Philex to start on engineering details in 2010, and a stage-one (>500 MMt, 1% Ni) claims. Drilling undertaken by Anglo American at HPAL processing plant in 2013. The mine is in Mindoro. TAWI-TAWI Kalayaan in 2008 confirmed these extensions. Pre-feasibility study estimates by Aker Solutions in PROSPECT June 2008 suggest operating costs of US$2.7/lb Ni for NICKEL stage one and about US$2.0/lb Ni when stage two is withdraw legal cases against each other over the High international inventories of nickel, along with included. The capital costs are US$2.2 billion and Pujada nickel project in Mindanao, according to the sharply reduced demand, resulted in a sharp fall in the US$0.9 billion for stages one and two, respectively. The DENR. The latter’s Secretary said BHP Billiton is not nickel price last year. Direct shipping ore (DSO) annual capacity was estimated to increase by 25% to withdrawing its investments in the country as it exports from the Philippines to China fell 23% to 50,000t nickel metal, without a significant rise in capital agreed with Amcor to start from a clean slate. 5.67Mt in 2008. However, the market opened up expenditure. BHP Billiton and its Filipino partner Eramen Nickel has recently completed its mineral gradually in early 2009 when China started purchasing Asiaticus Management Corp (Amcor) have decided toresource calculation and has an indicated resource of low-grade nickel ore (1% Ni) with high iron 108Mt with a grade of 1.21% Ni. The project, in content (over 45% Fe). However, the price of Zambales, lies adjacent to the Acoje mine. this DSO was only about US$10/t, and only a Annual mineral production Eramen is currently studying the several options few local mining companies (in Mindanao, which to operate the project with a processing plant. has a short hauling distance to the loading 2006 2007 2008 AIM-listed Toledo recently reported results ports) are able to operate at this price level. Gold (kg) 36,100 38,800 35,600 for the year to March 2009. It reported record Coral Bay Nickel successfully completed its Silver (kg) 23,500 27,800 12,700 production at its Berong nickel mine through expansion in the first quarter of 2009 with the Copper 17,200 22,900 21,200 October 2008. Shipments for the same period, doubling of its present capacity of 10,000t/y in Nickel ore (Mt) 3.58 6.20 7.38 to customers in Australia and China, were also the high-pressure acid leach (HPAL) plant to Nickel mixed sulphides (Mt) 8,200 10,100 10,600 higher than the comparable 2007 period. 20,000t. The capital cost of the expansion was Chromite ore (metallurgical grade) 25,000 16,600 13,500 Subject to securing sufficient profitable sales about US$295 million and the work was Chromite ore (Chemical) 16,800 11,700 1,700 contracts, the Berong mine can restart achieved within budget. The nickel and cobalt Chromite ore (refractory grade) 4,700 3,400 – production at short notice. Longer term, Toledo metal recoveries have likewise been achieved at Coal (Mt) 2.597 3.830 3.950 aims to be major value-added nickel producer over 90%. Oil (bbl) 181,000 184,000 964,800 and is progressing its talks with European Nickel Asia will be announcing before the Condensate (’000 bbl) 5,123 5,753 5,606 Nickel and Jiangxi Rare Earth and Rare Metals end of 2009 its decision to proceed with the Gas (billion ft3) 108,600 130,200 137,000 Tungsten Group about a possible heap-leach construction of a 30,000t/y HPAL plant in and processing operation at Berong. September 2009 Mining Journal special publication – Philippines 9

- 10. RECENT DEVELOPMENTS Untapped sector holds much promise T HE opportunities for development in the Philippines are vast, and the 28 Mining Development Projects prospective entry of San Miguel Corp, as well as that of First Pacific, indicates that the relatively untapped sector Tampakan Copper Project Amacan Copper Project holds a lot of promise. With a reported 7,100Mt of Far Southeast Copper Project Rapu-Rapu Polymetallic Boyongan Copper Project Didipio Cu-Au Project metallic minerals and 51,000Mt of non-metallic Carmen Copper Project Kingking Cu-Au Project minerals waiting to be unearthed, downstream Batong Buhay Copper Project Padcal Expansion Project processing and manufacturing remains an area of San Antonio Copper Project immense potential. There has been record growth since 2005, with good performance in investments, production, tax Itogon Gold Project Diwalwal Gold Project revenues and exports. There has been an increase in Masbate Gold Project Siana Gold Project Teresa Gold Project Canatuan Au-Cu Project mining company listings in the local bourse from less Masara Gold Project -Apex than four in 2004 to the current 15. The Philippine mining industry’s growth in 2008 was subdued, largely owing to the decline in metal prices (especially nickel). Mindoro Nickel Project ACT Nickel Project CTP Nickel Project Pujada Nickel Project The operations of Atlas Consolidated Mining and Palawan HPAL Project Berong Nickel Project Development Corp (which has increased its Nonoc Nickel Project Acoje PGE Nickel Proj. production capacity recently), as well as the Masbate Surigao-Sumitomo HPAL Manticao Ferro Nickel operation, somewhat cushioned the decline in nickel Iligan Ferro-Nickel production. The value of total Philippine production was Akle Cement Project estimated at PP92.3 billion, reflecting the decrease in metal prices and a contraction of about 8.9% over the FAVOURABLE SHIFT recorded total of PP101.0 billion in 2007. Total mineral exports in 2008, on the other hand, were estimated at There has been a structural shift in recent years that has favoured a rapid growth in those developing “The Philippine mining The US$2.5 billion, accounting for 5.2% of the country’s countries that have a large population (such as China industry is expected to total exports of US$48.2 billion. Excise tax revenue from the mining sector reached and India, whose growth in 2008 can still be considered high). This trend is expected to continue be over the hump within PP1.1 billion in 2007, an increase of 125% from the as their population strives for material possessions. the year as financial 2006 figure of PP489.6 million. The figures for 2008 was only PP660 owing to the low commodity prices. Growth in these economies and the rest of Asia will be resource-intensive due to industrialisation and stimulus and economic Investment inflow from US$840 million in 2006 urbanisation. rescue packages take went up to US$1.4 billion in 2007 but settled back to under US$1 billion last year. However, MGB/DENR Moreover, there have been positive indications recently that financial institutions and banks are more effect. Philippine predicts that mining will be a US$13 billion industry liquid, and the industry only needs to be innovative in economic fundamentals by 2013. Some projects that were initially targeted to start accessing them through private equity, sovereign funds, retail investors, listing by way of introduction, remain strong” in 2008 were reassessed, rescheduled and are now dual listing and payment in kind. being repackaged to pare down capital expenditure. With the current operating investment environ- reduce risk and gain investor trust and confidence. These include Sumitomo’s Taganito nickel plant, Global ment, the Philippine government is expected to play a These include the implementation of the Philippine Steel’s expansion and Rusina’s US$498 million HPAL role in mitigating sovereign and political risk through Mineral Reporting Code (patterned after Australia’s project in Zambales. cover and participation through sovereign guarantee JORC), more liberalised market-listing rules, and Demand for mineral commodities is still strong and to move the mining industry forward. This can be implementation and monitoring of corporate social since the US is now significantly less important in implemented through PhilExim, which provides responsibility (CSR). Local government units will now world commodity demand than it was five years ago, guarantees on local and foreign loans to exporters to be given their share of the excise tax directly after the the repercussions of its downturn will not be felt finance developmental projects and industries end of the first quarter of every year. Other heavily in the mining sector, which has already encouraged by government policy. corporate governance mechanisms are expected to diversified its markets. Non-financial issues also need to be considered to gain leverage on mining projects. As partners in mineral resource development, the A drill rig in the government accepts that it needs to play a role in risk North Block of participation, and to provide sovereign credit Rusina’s Ajoce guarantees. These measures will enhance the chromite project. investment environment and ensure the industry’s Rusina is paring growth. The government should also engage sectors down its HPAL that still have reservations about the revitalisation of project in Zambales the mining industry. OUTLOOK Being immersed in volatile market conditions typical of internationally traded commodities, the Philippine mining industry is expected to be over the hump within the year as financial stimulus and economic rescue packages take effect. Philippine economic fundamentals remain strong and this would definitely 10 Mining Journal special publication – Philippines September 2009

- 11. Partners Avelino J. Cruz, Jr. F. Arthur L. Villaraza Simeon V. Marcelo Raoul R. Angangco Sylvette Y. Tankiang Elma Christine R. Leogardo Bienvenido I. Somera, Jr. Alejandro Alfonso E. Navarro Joe Nathan P. Tenefrancia Augusto A. San Pedro, Jr. Manuel L. Manaligod, Jr. Susan D. Villanueva Patricia A. O. Bunye Rodel A. Cruz Aida Araceli G. Roxas‐Rivera Thea T. Daep John Jerico L. Balisnomo Miguel U. Silos Elmar B. Galacio Rosa Michele C. Bagtas Divina Gracia E. Pedron Franchette M. Acosta Senior Associates Ma. Joycelyn L. Guirnalda Victor E. M. Pangilinan Pancho G. Umali Aldrich Fitz U. Dy Associates Rene Raphael A. Guina Katrina V. Doble Kristoffer James E. Purisima Rogelio D. Torres, Jr. Leslie Monica G. Raymundo Charisse Jen S. Choa Mark Hadrian P. Gamo Joseph Anthony P. Lopez Jean Jacquelyn A. De Castro Tara Ann I. Vea Rowanie A. Nakan Khristine C. Dy Jaclyn B. Gonzales Ruth Nichole R. Ureta Raymond G. Pasiliao Wenceslao B. Fernandez Leonardo A. Singson Heather Ezra C. Annang Ma. Sophia E. Cruz‐Abrenica Charmian Wyanet S. Zaragoza Candy T. Avance Jonathan T. Pampolina Charles Edward M. Cheng Reezann Keith E. Ramos Fritzzie Lyn F. Español Ramon Manolo A. Alcasabas Juanito L. Sañosa, Jr. Davidson Rich L. Sih Ma. Francesca Q. Baltazar Jacques S. Lynn Julius Gregory B. Delgado Oliver P. Baclay, Jr. Kristin Charisse C. Siao Regidor A. Ponferrada Stella Angela G. Pastores Maria Karen S. Olidan Maria Cecilia G. Natividad Abigail V. Go Michael Angelo O. Lopez Esther Rose N. Rances Christianne Grace F. Salonga Robert Leo C. Ty Mark Francis P. Abaya 118 Perea Street, Legaspi Village, 1229 Makati City, Philippines I P.O. BOX 3559 Makati Central Tel.: (632) 818‐9838; 818‐9880; 818‐9550 I Fax: (632) 816‐7057; 817‐1324; 894‐4729 info@cvclaw.com I www.cvclaw.com

- 12. RECENT DEVELOPMENTS help keep the economy and the industry afloat. Judging from the interest shown by mining companies in accessing funds to finance pipeline and mature projects and those in the final feasibility stages, chances are strong that the various projects in the pipeline will push through after project reassessments. A surge in investments and production may be expected towards the end of Ampucao Proj.(Benguet) Sogod Proj. (S. Leyte) Colet Proj.(Negros Occ.) 2010. Paco Proj.(Surigao Norte) Tagpura Proj. (Compostela) Claveria Proj.(Cagayan) With projects being rescheduled and the likely Tabuk Proj. (Kalinga) Hixbar Proj. (Rapu-Rapu Is) Papaya Proj.(N. Vizcaya) Gambang Proj.(Benguet) Manat Proj. (Compostela) Conner Proj. (Apayao) continuation of supply side difficulties, most commodity prices are expected to remain well above their long run levels over the short and Kingking Proj. (Davao Or.) Pantuyan Proj. (Leyte) Panag Proj. (Compostela) Batoto Proj.(Compostela) medium term. Del Gallego Proj. (Quezon) Mabuhay Proj. (Surigao Norte) Negros Proj. (Negros Or.) Kematu Proj. (South Cotabato) Rescheduled projects are therefore expected to Alicia Proj. (Zamboanga Sur) Archangel Proj. (Batangas) be implemented within 2010 to take advantage of Kalaya-an Proj. (Surigao N.) Hinonangan Proj. (S. Leyte) Pana-on Proj. (Leyte) Labo Proj. (Camarines Norte) price improvements. The availability of funding is Tongonan Proj. (Leyte) Nalesbitan Proj.(Camarines Norte) crucial in ensuring the continuation of bullish Surigao Proj. (Surigao N.) Cordon Proj. (Isabela) Pao Proj. (Nueva Vizcaya) Pantingan Proj. (Bataan) sentiments and perspective in the industry. Road 5 M Proj. (Davao Or.) Agata Proj. (Agusan del Norte) On the part of government, it has made Camp 3 Proj. (Benguet) TMC Proj. (Antique-Iloilo) commitment to do its best in resolving administrative issues, and is determined to provide the necessary Acoje Proj. (Zambales) support to revitalise the industry, particularly in Sta. Cruz Proj. (Zambales) Berong Proj. (Palawan) Mindanao, where mineral resources abound. The government is also bent on transparency, and Samar Bauxite Project, (Samar) is working to enlist in the Extractive Industry Transparency Initiative (EITI), and also in streamlin- Pamplona, Negros Oriental ing operations to prevent corruption. Much remains to be seen but a lot of indicators point to a more stabilised metals market within the next few years. MDC enters its fifth year Minerals Development Council T HE Minerals Development Council pro-life advocate benefited the Council by attracting Office of the Executive Director: (MDC) was created by President new dialogue partners in the government’s advocacy 2/F DENR Building,Visayas Ave., Diliman, Gloria Macapagal-Arroyo on October for responsible mining. Quezon City, Philippines 1101 11, 2005 when Executive Order No. The MDC’s active engagement with local Tel: (+632) 9262628 469 was issued to advance the government partners culminated in the inclusion of Fax: (+632) 9264708 government policy of responsible and sustainable the LGU Leagues (eg League of Provinces, League of development of the country’s mineral resources. Municipalities, League of Cities and the Liga ng mga MDC Secretariat: As envisaged, it is empowered to enlist the Barangay) as regular Council Members. 2/F Petrolab Building, Mines and Geosciences assistance of any agency or instrumentality of the Also, through its various activities, the MDC stood Bureau, North Avenue, Diliman Quezon City government, including government-owned or firm in balancing the interests of various stakeholder Telefax: (632) 9209123 -controlled corporations, to harmonise requirements groups with the rule of law and the pursuit of national E-mail: mdc_pilipinas@yahoo.com.ph and procedures that would facilitate the inflows of development goals. The Council addressed legitimate investments into the mining industry. issues against some mining projects while carefully Since its inception, the MDC has evolved from laying down the law when conflicts arise due to the Presidential Adviser for Multilateral Development being an interagency council that seeks to resolve the different interpretation or implementation of the represented by Her Excellency, Ambassador Delia D problems of the industry through policy reforms and same law(s). The Council also tried to listen to Albert, Department of the Interior and Local investment promotions, into a more active and dissenting voices opposed to mining by stressing that Government (DILG), Department of Finance (DOF), consultative body that addresses the policy and the government’s programme is not for “mining at all National Economic and Development Authority operational problems of the industry at the national cost” but only for responsible mining and that the (NEDA), Department of Trade and Industry (DTI), and, recently, at the regional levels through the economic, environmental, and social safeguards are in Department of Agrarian Reform (DAR), Department creation of the Regional Minerals Development place to prevent or minimise the impacts of the of Agriculture (DA), Department of National Defense Councils (RMDCs). exploration, development, and utilisation of the (DND), Department of Labor and Employment The appointment of Secretary Jose L. Atienza, Jr. to country’s mineral wealth. (DOLE), Presidential Management Staff (PMS), the DENR came at a crucial time in the development The MDC was equally challenged in Year 2008 by National Commission on Indigenous Peoples (NCIP), of the Philippine mining industry. Before the creation the escalation of armed attacks against some National Anti-Poverty Commission (NAPC), Philippine of the MDC, the major bottleneck that hampered the exploration and mining projects. The Council took an Information Agency (PIA), Chamber of Mines of the resurgence of the industry was the conflicting and active stand by emphasising that the State owns Philippines (COMP), League of Municipalities of the tedious requirements among the concerned mineral resources and that the mining companies are Philippines (LMP), League of Provinces of the government agencies in the grant of mining merely government contractors. It is also obligated to Philippines (LPP), League of Cities of the Philippines tenements. In recent years, however, the challenge for protect and defend the national interest. (LCP), and the Liga ng mga Barangay sa Pilipinas (LnB). the mining industry is securing the social licence to The MDC accomplishments were a collaboration The accomplishments which were translated in operate from local government units (LGUs), host of efforts of all the members of the council that concrete terms are testament to the collective vision communities, civil society groups and the religious includes individual members: the Department of and action of the Council Members who believe that sector. Mr Atienza’s experience as a former local chief Environment and Natural Resources, particularly the responsible mining can effectively contribute to the executive, political and human-rights activist, and Mines and Geosciences Bureau (MGB), the sustainable development of the country. 12 Mining Journal special publication – Philippines September 2009

- 13. September 2009 Mining Journal special publication – Philippines

- 14. CONTACTS MDC directory Department of Environment and National Economic and Department of National Defense League of Municipalities of the Natural Resources (DENR) Development Authority (NEDA) (DND) Philippines (LMP) DENR Building,Visayas Avenue, NEDA Building, 12 Saint Jose Maria DND Building, Camp Aguinaldo 2nd Floor LMP Bldg., 265 Ermin Garcia St, Diliman, Quezon City NCR 1100 Escriva Drive, EDSA, Quezon City NCR 1110 Cubao, Quezon City Tel: +63 (2) 928 0691 or 925 2329 Ortigas Center, Pasig City NCR 1605 Tel. Nos. + 63 (2) 911-6268, Tel: +63 (2) 913 5737, 913 5738 Fax: +63 (2) 929 6628, 920 4301 Telefax: + 63 (2) 631 3734, 631 3739 911-6460, 911-4438 Fax: +63 (2) 440 7280 / 4407306 www.denr.gov.ph www.neda.gov.ph Fax + 63 (2) 911-4360 www.lmp.org.ph www.dnd.gov.ph Presidential Adviser for Department of Trade and League of Provinces of the Multilateral Development Industry (DTI) Presidential Management Philippines (LPP) (PAMD) Industry & Investments Building Staff (PMS) 1510 West Tower, PSE Bldg. Embassy of the Republic of the Philippines 385 Senator Gil J. Puyat Ave., PMS Building, Arlegui St., San Miguel, Exchange Road, Ortigas Centre, Pasig City Uhlandstr. 97, D-10715 Berlin, Germany Makati City NCR 1200 Malacañang Compound, Manila Tel: +63 (2) 687 5399, 631 0170, 631 0197 Tel: (030) 864 9500 Fax: (030) 873-2251 Tel: +63 (2) 890-9332, 897-6682 Tel Nos. + 63 (2) 734-2206, 734-3971-75 Fax + 63 (2) 687-4048 Fax: + 63 (2) 895-3512 Fax: + 63 (2) 734-2201 www.lpp.gov.ph Department of the Interior and www.dti.gov.ph www.pms.gov.ph Local Government (DILG) League of Cities of the A. Francisco Gold Condominium II, Department of Agrarian National Commission on Philippines (LCP) EDSA cor. Mapagmahal Street Reform (DAR) Indigenous Peoples (NCIP) LCP Bldg. 1278 Estrada Corner Lemery Brgy. Piñahan, Diliman, Quezon City DAR Building, Elliptical Road 2/F N. dela Merced Bldg. (DELTA) Streets, Malate, Manila 1004 Tel: +63 (2) 925-2333 Diliman, Quezon City NCR 1100 cor. West Ave., Quezon City Tel: +63 (2) 521 6384, 521 6461 Fax +63 (2) 925-3843 Tel Nos.+63 (2) 929-4101, Tel: +63 (2) 373 9787 Fax: +63 (2) 521 7298 / 521 8239 www.dilg.gov.ph 928-7031 loc. 406 Fax +63 (2) 373 9765 www.lcp.org.ph Fax: + 63 (2) 922-8975 www.ncip.gov.ph Department of Finance (DOF) www.dar.gov.ph Liga ng mga Barangay (LnB) DOF Building, BSP Complex, National Anti-Poverty 2nd Floor, Old Sanguniang Bldg. Roxas Boulevard,cor. P. Ocampo Street, Department of Agriculture (DA) Commission (NAPC) Caloocan City Hall Complex Pasay City NCR 1004 DA Building, Elliptical Road, 3/F, Agricultural Training Institute Building A. Mabini St. Caloocan City Tel: + 63 (2) 523 5727, 525 1321, Diliman, Quezon City NCR 1104 Elliptical Road, Diliman, Quezon City Tel: +63 (2) 2881653 524 1633 Tel: +63 (2) 920-2223 Tel: + 63 (2) 426 5028 Fax +63 (2) 324-5299 Fax: +63 (2) 523 5143 Fax + 63 (2) 929-8183 Fax + 63 (2) 426 5249 www.barangay.gov.ph www.dof.gov.ph www.da.gov.ph www.napc.gov.ph Minerals Development Council Philippine Information Agency (MDC) Secretariat (PIA) 2nd Flr. Petrolab Building Toledo Mining Corporation Philippine Information Agency Building Mines and Geosciences Bureau Visayas Avenue, Diliman, Quezon City North Avenue, Diliman, Quezon City (AIM:TMC) is an emerging Tel: +63 (2) 921 7941, 920 4386, 920 1224 Telefax: +63 (2) 920 9123 nickel producer focused on Fax: +63 (2) 928 6917 E-mail: mdc_pilipinas@yahoo.com.ph the economic processing of www.pia.gov.ph DENR- Mines and Geosciences nickel laterites in the Department of Labor and Bureau (MGB) Philippines. Employment 2nd Flr. Fernandez Bldg., MGB Compound DOLE Building, Intramuros Manila NCR North Avenue, Diliman, Quezon City The company has strategic 1002 Tel: +63 (2) 928 8642, 920 9120 interests in four large, Tel: +63 (2) 527-3000 loc.712 Fax: +63 (2) 920 1635 Fax: +63 (2) 527-3462 www.mgb.gov.ph good-grade nickel deposits www.dole.gov.ph on Palawan Island, with a DTI-Board of Investments (BOI) Chamber of Mines of the Industry & Investment Building combined pre-JORC Philippines (CoMP) 385 Senator Gil Puyat Avenue resource base of more than Rm. 809, Ortigas Bldg., Makati City 300 million tonnes, or Ortigas Ave., Pasig City Tel: +63 (2) 890 9332, 895 3701, Tel: +63 (2) 635 4123 24 897 6682 loc. 308 3.1 million tonnes of Fax: +63 (2) 635 4160 Fax: +63 (2) 895-3980 contained nickel. www.chamberofmines.com.ph www.boi.gov.ph Toledo is also advancing its activities downstream in partnership with European Nickel and Jiangxi Rare Earth and Rare Metals Tungsten Group (JXTC). For more information London office: +44 (0)20 7514 1480 Manila office: +63 2 817 7104 info@toledomining.com www.toledomining.com 14 Mining Journal special publication – Philippines September 2009

- 15. International standard for construction and mining Leighton Asia offers its clients the highest standard of mining solutions. Operations were established in the Asian region in 1972 and in the Philippines in 1996. We are focused on continued success and growth in the region with local knowledge and international experience. Leighton Asia is part of the Leighton Group, the world’s leading contract miner, with over 60 years of global mining experience. We engage a team of committed engineering and management professionals coupled with a plant fleet we own, operate and maintain to offer our clients ‘real’ mining and construction solutions. Leighton Contractors (Philippines), Inc. 7/F L.V. Locsin Building, 6752 Ayala Avenue corner Makati Avenue, Makati City Philippines t: +632 841 0998 f: +632 811 0158 e: info@leighton.com.ph www.leightonasia.com