Contenu connexe

Similaire à Novo Grass Roots Research Report (20)

Novo Grass Roots Research Report

- 1. !

www.grassrootsrd.com Telephone: (415) 454-6985

!

June 30, 2009

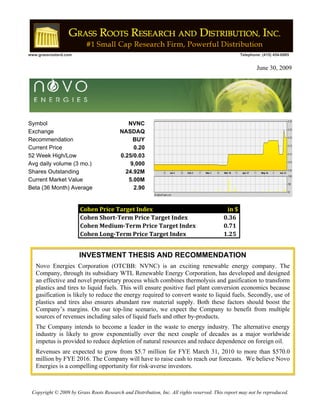

Symbol NVNC

Exchange NASDAQ

Recommendation BUY

Current Price 0.20

52 Week High/Low 0.25/0.03

Avg daily volume (3 mo.) 9,000

Shares Outstanding 24.92M

Current Market Value 5.00M

Beta (36 Month) Average 2.90

Cohen!Price!Target!Index in!$

Cohen!Short"Term!Price!Target!Index !! !0.36

Cohen!Medium"Term!Price!Target!Index !! !0.71

Cohen!Long"Term!Price!Target!Index !! !1.25

INVESTMENT THESIS AND RECOMMENDATION

Novo Energies Corporation (OTCBB: NVNC) is an exciting renewable energy company. The

Company, through its subsidiary WTL Renewable Energy Corporation, has developed and designed

an effective and novel proprietary process which combines thermolysis and gasification to transform

plastics and tires to liquid fuels. This will ensure positive fuel plant conversion economics because

gasification is likely to reduce the energy required to convert waste to liquid fuels. Secondly, use of

plastics and tires also ensures abundant raw material supply. Both these factors should boost the

Company’s margins. On our top-line scenario, we expect the Company to benefit from multiple

sources of revenues including sales of liquid fuels and other by-products.

The Company intends to become a leader in the waste to energy industry. The alternative energy

industry is likely to grow exponentially over the next couple of decades as a major worldwide

impetus is provided to reduce depletion of natural resources and reduce dependence on foreign oil.

Revenues are expected to grow from $5.7 million for FYE March 31, 2010 to more than $570.0

million by FYE 2016. The Company will have to raise cash to reach our forecasts. We believe Novo

Energies is a compelling opportunity for risk-averse investors.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

- 2. Grass Roots Research and Distribution, Inc.

!

EXECUTIVE SUMMARY

! Novo Energies Corporation (OTCBB: NVNC) is focused on converting plastics and tire waste to

liquid fuels such as diesel, gasoline and fuel additives, thus expanding its presence in the alternative

energy industry.

! The Company plans to build small local industrial plants designed to transform residual plastics and

tires to valuable liquid Low Carbon Fuels such as diesel, gasoline and fuel additives.

! The Company’s subsidiary, WTL Renewable Energy Corporation, has developed and designed an

effective and novel proprietary process which combines thermolysis and gasification to transform

plastics and synthetic tires to liquid fuels such as diesel, gasoline and fuel additives.

! The U.S. government is encouraging more economical renewable energy sources due to its growing

concern over the impact of conventional fuels on the environment. These concerns, coupled with

factors such as depleting oil reserves, combine to drive demand for renewable energy sources.

! Spurred by growing political concerns in Middle East, increase in demand for oil from developing

nations and rising oil prices, have led to alternative fuels quickly becoming vital to domestic energy

supplies.

! As a result, the projected growth for this new and exciting business opportunity of conversion of

waste-to-liquid fuel is estimated at 10% to 50% per year. Novo Energies plans to capitalize on this

impending growth in demand for alternative fuels.

! The Company is in a better position to benefit from the projected growth in demand for alternative

energy sources, as it plans to use the abundant supplies of plastic and tire as its raw material sources.

Financial Forecasts and Valuation

! We project revenues of $5.7 million for FYE 2010 and more than $570 million by 2016. These

projections are based on the Company’s plant construction schedule, sustained level of capital

expenditure and pipeline of opportunities. The Company will have to raise cash to meet our

forecasts.

! Our short-term price target of $0.36 is derived using the multiple based valuation approach which

uses the Price-to-Earnings and Price-to-Book Value ratios. This represents an upside potential of 80%

over the current market price of $0.20.

! We have our targeted multiple approach of valuation to derive our intermediate term price target.

Based targeted Price-to-Earnings and Price-to-Sales ratios and Base Case financial forecasts, the

Novo common stock is valued at $0.71.

! We have valued the stock using our Discounted Cash Flow (DCF) method to arrive at long-term price

target of $1.25, reflecting forward P/E multiples of 29.5x and 16.3x our estimated FYE 2010 EPS and

FYE 2011 EPS, respectively.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 2 of 19

- 3. Grass Roots Research and Distribution, Inc.

!

ABOUT THE COMPANY

Novo Energies Corporation (OTCBB: NVNC) is focused on expanding its presence in the renewable

energy sector by developing and implementing solutions and technology. The Company’s mission is to

develop such solutions while maintaining its commitment to conserve energy, natural resources and help

reduce pollutants and unwanted biological agents. The Company’s subsidiary, WTL Renewable Energy

Corporation, has developed and designed an effective and novel proprietary process which combines

thermolysis and gasification to transform plastics and synthetic tires to liquid fuels such as diesel,

gasoline and fuel additives. The Company plans to build small local industrial plants designed to

transform residual plastics and tires to valuable liquid Low Carbon Fuels such as diesel, gasoline and

fuel additives.

UNDERSTANDING WASTE-TO-LIQUID SOLUTION

Waste-to-Liquid (WTL) or energy-from-waste (WtE) is the process of creating energy in the form of

electricity or heat from waste sources. It is a form of energy recovery that produces electricity using

various processes such as:

! Gasification (produces combustible gas, hydrogen, synthetic fuels)

! Thermal Depolymerization (produces synthetic crude oil, which can be further refined)

! Pyrolysis (produces combustible tar/bio-oil and chars)

! Plasma arc gasification (PGP) or plasma gasification process (produces rich syngas including

hydrogen and carbon monoxide usable for fuel cells or generating electricity to drive the plasma

arch, usable vitrified silicate and metal ingots, salt and sulphur)

ADVANTAGE OF WASTE-TO-LIQUID SOLUTION

These non-polluting waste-to-Low Carbon Fuels facilities will be able to provide energy to nations

seeking independence from petroleum-based fuels, while also helping solve those nation’s

environmental problems. The exhibit below highlights the advantage of waste-to-liquid opportunity

when compared to other conventional source of energy:

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 3 of 19

- 4. Grass Roots Research and Distribution, Inc.

!

Figure 1: Overview of Competitive Advantages of WTL Solution

Source: Company Presentation

! Renewable Source of Energy – produced from plastic and tire waste

! Superior Economics – when compared to other renewable energy sources, waste-to-liquid is a

cost effective source of energy

! Abundance Raw Material Supply – unlike other raw materials used for renewable energy, this

solution uses plastic and tire wastes which are readily available

! Landfill Development – dramatically extending the useful life by radically reducing the volume

of recyclable waste being dumped and ultimately reducing the size of the existing landfill

! Reducing Foreign Oil Dependency – providing self-sufficient fuel sources of synthetic fuels in-

country

! Local Economics – creating local jobs, development of economically disadvantaged, generating

tax revenue to the community and energy savings for consumers.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 4 of 19

- 5. Grass Roots Research and Distribution, Inc.

!

COMPANY BUSINESS MODEL

Novo Energies plans to use plastic and tire as raw material to convert the same to liquid fuels provides

two-fold advantages as shown below:

Figure 2: Waste-to-Liquid Opportunity - Advantages

Source: Company Presentation

The Company’s business model is based primarily on revenues from the sale of fuel and other by-

products such as steel plates and carbon black.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 5 of 19

- 6. Grass Roots Research and Distribution, Inc.

!

Figure 3: Proposed Business Approach

Source: Company Presentation

The key to Novo’s business model is the use of right technology and process. The Company proposes to

combine the gasification and thermolysis processes in a novel manner as it will be able to achieve the

desired level of fuel production with initial levels of energy required for the process being generated

from gasification.

Figure 4: Plastic Waste-to-Liquid Fuel Process

Source: Company Presentation

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 6 of 19

- 7. Grass Roots Research and Distribution, Inc.

!

Figure 5: Tire Waste-to-Liquid Process

Source: Company Presentation

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 7 of 19

- 8. Grass Roots Research and Distribution, Inc.

!

COMPANY GROWTH DRIVERS

Figure 6: Novo’s Growth and Value Drivers

Unique! Huge! Experienced!

Innovative!

Business! Industry! Management!

Technology!

Model Opportunity! Team!

•Conversion!of!plastic! •Company!plans!to! •World!energy! •Proactive!and!

and!tire!waste!to! use!a!combination!of! demand!expected!to! forward!looking!

liquid!fuels Gasification!and! grow!by!44%!over!the! management!team!

•Reduces!waste!and! Thermolysis. period!between!2006" with!significant!

converts!the!same!to! •Increases!the!net!fuel! 2030 experience!in!this!

energy production!in!the! •Renewed!focus!on! field.

•Abundant!raw! entire!process alternative!energy! •Company!well!placed!

material!availability sources!to!reduce! for!strong!and!rapid!

•Multiple!sources!of! foreign!dependence growth.

revenues

Source: Cohen Research

FINANCIAL FORECASTS

Figure 7: Revenue Forecasts – Base Case

all!figures!in!$!million 2010E 2011E 2012E 2013E 2014E 2015E 2016E

Plastic!Segment

!"#$%&'()*+,&"-&.%$/#0 &&&&&&&&&&&&&&&&

123 &&&&&&&&&&&&&&&&

423 &&&&&&&&&&&&&1323 &&&&&&&&&&&&&5423 &&&&&&&&&&&&&4323 &&&&&&&&&&&&&6423 &&&&&&&&&&&13323

7+8+/(+0&9+,&9%$/# &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&&&&

525

%!growth 323: 323: 323: 323: 323: 323:

TOTAL!REVENUES &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&1123 &&&&&&&&&&&&&5523 &&&&&&&&&&&&&4423 &&&&&&&&&&&11323 &&&&&&&&&&&1;423 &&&&&&&&&&&55323

Tire!Segment

!"#$%&'()*+,&"-&.%$/#0 &&&&&&&&&&&&&&&&

123 &&&&&&&&&&&&&&&&

423 &&&&&&&&&&&&&1323 &&&&&&&&&&&&&5423 &&&&&&&&&&&&&4323 &&&&&&&&&&&&&6423 &&&&&&&&&&&13323

7+8+/(+0&9+,&9%$/# &&&&&&&&&&&&&&&&

<24 &&&&&&&&&&&&&&&&

<24 &&&&&&&&&&&&&&&&

<24 &&&&&&&&&&&&&&&&

<24 &&&&&&&&&&&&&&&&

<24 &&&&&&&&&&&&&&&&

<24 &&&&&&&&&&&&&&&&

<24

%!growth 323: 323: 323: 323: 323: 323:

TOTAL!REVENUES &&&&&&&&&&&&&&&&

<24 &&&&&&&&&&&&&1624 &&&&&&&&&&&&&<423 &&&&&&&&&&&&&=624 &&&&&&&&&&&16423 &&&&&&&&&&&5;524 &&&&&&&&&&&<4323

TOTAL!REVENUES &&&&&&&&&&&&&&&&

426 &&&&&&&&&&&&&5=24 &&&&&&&&&&&&&4623 &&&&&&&&&&&1>524 &&&&&&&&&&&5=423 &&&&&&&&&&&>5624 &&&&&&&&&&&46323

Figure 8: Sales, Earnings and Margin Forecasts – Base Case

all!figures!in!$!million 2010E 2011E 2012E 2013E 2014E 2015E 2016E

7+8+/(+0 &&&&&&&&&&&&&&&&

426 &&&&&&&&&&&&&5=24 &&&&&&&&&&&&&4623 &&&&&&&&&&&1>524 &&&&&&&&&&&5=423 &&&&&&&&&&&>5624 &&&&&&&&&&&46323

%!growth 0.0% 400.0% 100.0% 150.0% 100.0% 50.0% 33.3%

?,"00&.,"-@# &&&&&&&&&&&&&&&&

>2< &&&&&&&&&&&&&512> &&&&&&&&&&&&&>52= &&&&&&&&&&&13;2A &&&&&&&&&&&51<2= &&&&&&&&&&&<532; &&&&&&&&&&&>5624

Gross!Profit!Margin 75.0% 75.0% 75.0% 75.0% 75.0% 75.0% 75.0%

BCD!EF &&&&&&&&&&&&&&&&

52< &&&&&&&&&&&&&1126 &&&&&&&&&&&&&5<24 &&&&&&&&&&&&&4=2; &&&&&&&&&&&1162< &&&&&&&&&&&1642A &&&&&&&&&&&5<>24

EBITDA!Margin 41.1% 41.1% 41.1% 41.1% 41.1% 41.1% 41.1%

'+#&.,"-@# &&&&&&&&&&&&&&&&

123 &&&&&&&&&&&&&&&&

;26 &&&&&&&&&&&&&1126 &&&&&&&&&&&&&542; &&&&&&&&&&&&&>A26 &&&&&&&&&&&&&6324 &&&&&&&&&&&&&A52=

Net!Profit!Margin 17.4% 23.4% 20.6% 18.0% 17.4% 16.5% 16.3%

B$,/@/G0&.+,&HI$,+&J&C$0@K&L&E@%(#+M &&&&&&&&&&&32355 &&&&&&&&&&&321>A &&&&&&&&&&&325;5 &&&&&&&&&&&3246< &&&&&&&&&&&12111 &&&&&&&&&&&1246= &&&&&&&&&&&52364

N,++&O$0I&N%"P&#"&N@,) &&&&&&&&&&&&&&Q62;R &&&&&&&&&&&&&&Q<2;R &&&&&&&&&&&&

Q1;25R &&&&&&&&&&&&

Q<32=R &&&&&&&&&&&&

Q<>2>R &&&&&&&&&&&&&1>24 &&&&&&&&&&&&&;<2>

Strong focus on commercialization of superior technology platform and potential build-up of new

facilities will result in projected revenues of $5.7 million for FYE 2010 and $28.5 million in FYE 2011.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 8 of 19

- 9. Grass Roots Research and Distribution, Inc.

!

With financing, we project revenues to grow thereafter from $57.0 million in FYE 2012 to $570.0

million by FYE 2016. The key driver for this growth is the continued demand for alternative energy

solutions. Due to its multiple sources of revenues and constant nature of business operations we expect

Novo’s gross margins to remain constant throughout our forecast period (Management Guidance).

However, as the Company constructs larger projects, we expect operating expenses to increase at a

decreasing rate, resulting in higher operating and net profit margins.

The robust industry demand coupled with continuous focus on cost effective and efficient energy

solutions will drive Novo’s operations in North America. Growth prospects are impressive and depend

on the successful fund raising by the Company.

VALUATION

SHORT TERM PRICE TARGET $0.36

We have valued the stock using Multiple Based Valuation Methodology to derive our short-term target

price. This method uses the industry average 2009E Price-to-Equity and Price-to-Book Value multiple.

Our formula is shown below.

Figure 9: Short-Term Multiple-based Valuation

Description Market!Cap!($Mn) Price!to!Earnings Price!To!Bk.!Val

S$0#+&T$/$G+)+/#U&D/K2 1<2A3C &&&&&&&&&&&&&&&&&&&&&&&&1<2A &&&&&&&&&&&&&&&&&&&&&&&&&&&

52>

7+9(*%@K&H+,8@K+0&D/K2 A23;C &&&&&&&&&&&&&&&&&&&&&&&&4<2> &&&&&&&&&&&&&&&&&&&&&&&&&&&

125

H#+,@KVK%+&D/K2 >2<3C &&&&&&&&&&&&&&&&&&&&&&&&5=25 &&&&&&&&&&&&&&&&&&&&&&&&&&&

;2<

S$0#+&O"//+K#@"/0&D/K2 12A4C &&&&&&&&&&&&&&&&&&&&&&&&162< &&&&&&&&&&&&&&&&&&&&&&&&&&&

124

O%+$/&W$,*",0&D/K2 1256C &&&&&&&&&&&&&&&&&&&&&&&&5>23 &&&&&&&&&&&&&&&&&&&&&&&&&&&

52A

Average!Ratios!(used!for!valuation) !!!!!!!!!!!!!!!!!!!!!!!27.4 !!!!!!!!!!!!!!!!!!!!!!!!!!2.9

'"8"&B/+,G@+0

B.H&Q5313B&J&5315BR &&&&&&&&&&&&&&&&&&&&&&&&&&&321

C""X&Y$%(+&Q5313B&J&5315BR &&&&&&&&&&&&&&&&&&&&&&&&1323

Market!Cap!based!on!"! !!!!!!!!!!!!!!!!!!!!!!!!!!4.0 !!!!!!!!!!!!!!!!!!!!!!!28.5

HI$,+0&Z(#0#$/M@/G &&&&&&&&&&&&&&&&&&&&&&&&>>26 &&&&&&&&&&&&&&&&&&&&&&&&>>26

Price!Target!based!on!" !!!!!!!!!!!!!!!!!!!!!!!0.09 !!!!!!!!!!!!!!!!!!!!!!!0.64

Short!Term!Target!Price !!!!!!!!!!!!!!!!!!!!!!!0.36

INTERMEDIATE TERM PRICE TARGET $0.71

Our Intermediate term price valuation methodology is based on Multiple Based Valuation Methodology.

Note: for companies such as Novo which are still in early inception stages, we use the expected multiple

method to derive our intermediate term price target.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 9 of 19

- 10. Grass Roots Research and Distribution, Inc.

!

Figure 10: Intermediate Term Multiple-based Valuation Methodology

Description Price!to!Earnings Price!To!Bk.!Val

B[9+K#+M&D/M(0#,V&F8+,$G+&J&531< &&&&&&&&&&&&&&&&&&&&&&1=254 &&&&&&&&&&&&&&&&&&&&&&&&12A1

'"8"&B/+,G@+0&J&531< &&&&&&&&&&&&&&&&&&&&&&&&3246 &&&&&&&&&&&&&&&&&&&&&&>42;1

Market!Cap.!2013 !!!!!!!!!!!!!!!!!!!!!

10.45 !!!!!!!!!!!!!!!!!!!!!

86.93

HI$,+0&Z(#0#$/M@/G &&&&&&&&&&&&&&&&&&&&&&>>263 &&&&&&&&&&&&&&&&&&&&&&>>263

Price!Target !!!!!!!!!!!!!!!!!!!!!!!0.23 !!!!!!!!!!!!!!!!!!!!!!!1.94

Average!Price!in!2013 !!!!!!!!!!!!!!!!!!!!!!!1.09

E@0K"(/#&N$K#", &&&&&&&&&&&&&&&&&&&&&&&&32<4

Intermediate!Term!Target!Price !!!!!!!!!!!!!!!!!!!!!!!0.71

LONG TERM PRICE TARGET $1.07-$1.47

We have used our Discounted Cash Flow (DCF) method of valuation to create our Long-term per Share

Price Target. Using an assumed cost of equity of 20%, our Base Case target price is a conservative

$1.25 per share. Note our three assumed cases: Base, Optimistic, and Pessimistic.

Figure 11: Discounted Cash Flow Method of Valuation – Base Case

all!figures!in!$!million 2010E 2011E 2012E 2013E 2014E 2015E 2016E

'+#&D/K")+ &&&&&&&&&&&&&&&&

123 &&&&&&&&&&&&&&&&

;26 &&&&&&&&&&&&&1126 &&&&&&&&&&&&&542; &&&&&&&&&&&&&>A26 &&&&&&&&&&&&&6324 &&&&&&&&&&&&&A52=

E+9,+K@$#@"/ &&&&&&&&&&&&&&&&

125 &&&&&&&&&&&&&&&&

<2> &&&&&&&&&&&&&&&&

=2< &&&&&&&&&&&&&1=2A &&&&&&&&&&&&&<A2A &&&&&&&&&&&&&;;21 &&&&&&&&&&&&&A52<

D/#+,+0#&."0#&!$[ &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&&

32> &&&&&&&&&&&&&&&&

125 &&&&&&&&&&&&&&&&

525 &&&&&&&&&&&&&&&&

>24 &&&&&&&&&&&&&&&&

;2< &&&&&&&&&&&&&&&&

;2=

NOPLAT !!!!!!!!!!!!!!!2.2 !!!!!!!!!!!!10.5 !!!!!!!!!!!!21.2 !!!!!!!!!!!!46.7 !!!!!!!!!!!!94.0 !!!!!!!!!!

142.9 !!!!!!!!!!

191.8

OI$/G+&@/&S",X@/G&O$9@#$% &&&&&&&&&&&&&&Q<26R &&&&&&&&&&&&&&&&

626 &&&&&&&&&&&&Q132>R &&&&&&&&&&&&&&&&

124 &&&&&&&&&&&&&&&&

524 &&&&&&&&&&&&&&&&

524 &&&&&&&&&&&&&&&&

524

O$9@#$%&B[9+/M@#(,+ &&&&&&&&&&&&&&Q;25R &&&&&&&&&&&&

Q512=R &&&&&&&&&&&&Q5623R &&&&&&&&&&&&Q6A23R &&&&&&&&&Q1<123R &&&&&&&&&Q1<123R &&&&&&&&&Q1<123R

Free!Cash!Flow!to!Firm!(FCF) !!!!!!!!!!!!!(7.6) !!!!!!!!!!!!!(3.6) !!!!!!!!!!!

(16.2) !!!!!!!!!!!

(30.8) !!!!!!!!!!!

(34.4) !!!!!!!!!!!!14.5 !!!!!!!!!!!!63.4

Present!Value!of!FCF !!!!!!!!!!!!!(6.4) !!!!!!!!!!!!!(2.9) !!!!!!!!!!!

(11.3) !!!!!!!!!!!

(19.3) !!!!!!!!!!!

(18.9) !!!!!!!!!!!!!!!6.6 !!!!!!!!!!!!23.1

SFOO 5323: 112A: 1526: 152>: 152=: 1>21: 1424:

O"0#&"-&B(@#V 53:

!+,)@/$%&?,"P#I&7$#+ 4:

!+,)@/$%&Y$%(+ &&&&&&&&&&&5<12;

Present!Value!of!Terminal!Value !!!!!!!!!!!!84.5

Total!Enterprise!Value! !!!!!!!!!!!!55.5

]+00^&'+#&E+*# &&&&&&&&&&&&&325>

Total!Project!Equity!Value !!!!!!!!!!!!55.7

!"#$%&HI$,+0&Z(#0#$/M@/G &&&&&&&&&&&&&>>26

Per!Share!Price!Target $!!!!!!!!!!1.25

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 10 of 19

- 11. Grass Roots Research and Distribution, Inc.

!

Figure 12: Range of Long-term Target Price based on range of Discount Rate

Long!Term!Price!Target!Range!" Range!of!Cost!of!Equity

3.00!

2.50!

2.00!

in!US$

1.50!

1.00!

0.50!

"

22.0% 21.0% 20.0% 19.0% 18.0%

Optimistic!Case 1.18! 1.42! 1.72! 2.07! 2.49!

Base!Case 0.78! 1.00! 1.25! 1.54! 1.90!

Pessimistic!Case 0.43! 0.61! 0.82! 1.08! 1.38!

Figure 13: Range of Long-term Target Price based on range of Terminal Growth Rate

Long!Term!Price!Target!Range!" Range!of!Terminal!

Growth!Rate

2.40!

2.20!

2.00!

1.80!

1.60!

in!US$

1.40!

1.20!

1.00!

0.80!

0.60!

0.40!

3.0% 4.0% 5.0% 6.0% 7.0%

Optimistic!Case 1.40! 1.55! 1.72! 1.92! 2.17!

Base!Case 0.91! 1.07! 1.25! 1.47! 1.74!

Pessimistic!Case 0.49! 0.64! 0.82! 1.05! 1.33!

We believe all our price targets are conservative because our forecast for Novo’s revenues in 2009 and

2010 is based on minimal investment in capital generating assets i.e. plants. Any additional capital

expenditure will add to the top-line and bottom line, thus resulting in potentially higher share prices. As

a practical matter, if Novo receives between $8-$10 million of funding, the stock could trade at

significantly higher prices in the immediate term.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 11 of 19

- 12. Grass Roots Research and Distribution, Inc.

!

COHEN GROWTH DRIVER ANALYSIS

Figure 14: Cohen Growth Driver Analysis – Base Case

all!figures!in!$!million 2010E 2011E 2012E 2013E 2014E 2015E 2016E

7+8+/(+0 &&&&&&&&&&&&&&&&

426 &&&&&&&&&&&&&5=24 &&&&&&&&&&&&&4623 &&&&&&&&&&&1>524 &&&&&&&&&&&5=423 &&&&&&&&&&&>5624 &&&&&&&&&&&46323

?,"00&T$,G@/ 6423: 6423: 6423: 6423: 6423: 6423: 6423:

Z9+,$#@/G&T$,G@/ >121: >121: >121: >121: >121: >121: >121:

'+#&T$,G@/&J&D/K")+&F8$@%2&!"&HI,+I"%M+,0 162>: 5<2>: 532;: 1=23: 162>: 1;24: 1;2<:

B.H&J&E@%(#+M &&&&&&&&&&&&&3235 &&&&&&&&&&&&&3214 &&&&&&&&&&&&&325; &&&&&&&&&&&&&3246 &&&&&&&&&&&&&1211 &&&&&&&&&&&&&124= &&&&&&&&&&&&&523=

BCD!EF &&&&&&&&&&&&&&&&

52< &&&&&&&&&&&&&1126 &&&&&&&&&&&&&5<24 &&&&&&&&&&&&&4=2; &&&&&&&&&&&1162< &&&&&&&&&&&1642A &&&&&&&&&&&5<>24

N,++&O$0I&N%"P &&&&&&&&&&&&&&Q;2>R &&&&&&&&&&&&&&Q52AR &&&&&&&&&&&&

Q112<R &&&&&&&&&&&&

Q1A2<R &&&&&&&&&&&&

Q1=2AR &&&&&&&&&&&&&&&&

;2; &&&&&&&&&&&&&5<21

O$0I &&&&&&&&&&&&&&&&

325 &&&&&&&&&&&&&&&&

A2< &&&&&&&&&&&&&&&&

<25 &&&&&&&&&&&&&&&&

62= &&&&&&&&&&&&&1A26 &&&&&&&&&&&&&>;25 &&&&&&&&&&&&&A62A

S",X@/G&O$9@#$% &&&&&&&&&&&&&&Q<26R &&&&&&&&&&&&

Q112>R &&&&&&&&&&&&&&Q123R &&&&&&&&&&&&&&Q524R &&&&&&&&&&&&&&Q421R &&&&&&&&&&&&&&Q62;R &&&&&&&&&&&&

Q1321R

]"/G&!+,)&E+*# &&&&&&&&&&&&&&&J &&&&&&&&&&&&&1<24 &&&&&&&&&&&&&542< &&&&&&&&&&&&&;>2; &&&&&&&&&&&11=2< &&&&&&&&&&&1<A24 &&&&&&&&&&&1<624

!"#$%&E+*# &&&&&&&&&&&&&&&J &&&&&&&&&&&&&1<24 &&&&&&&&&&&&&542< &&&&&&&&&&&&&;>2; &&&&&&&&&&&11=2< &&&&&&&&&&&1<A24 &&&&&&&&&&&1<624

!"#$%&F00+#0 &&&&&&&&&&&&&&&&

;21 &&&&&&&&&&&&&<625 &&&&&&&&&&&&&4>24 &&&&&&&&&&&1<<23 &&&&&&&&&&&54A23 &&&&&&&&&&&<6<24 &&&&&&&&&&&>=621

EHZ &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24

D/8+/#",V&!(,/0 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24 &&&&&&&&&&&&&<;24

N@[+M&F00+#&!(,/0 &&&&&&&&&

<A6235 &&&&&&&&&

<4=2;3 &&&&&&&&&

<4521A &&&&&&&&&

<><25< &&&&&&&&&

<<A2<A &&&&&&&&&

<<=211 &&&&&&&&&

<<62>;

O$0I&OVK%+ &&&&&&&&&&&&&&&&

325 &&&&&&&&&&&&&&&&

325 &&&&&&&&&&&&&&&&

12< &&&&&&&&&&&&&&&&

12< &&&&&&&&&&&&&&&&

12< &&&&&&&&&&&&&&&&

12< &&&&&&&&&&&&&&&&

12<

Annual!Change,!Turns! 2010E 2011E 2012E 2013E 2014E 2015E 2016E

7+8+/(+0 >3323: 13323: 14323: 13323: 4323: <<2<:

?,"00&T$,G@/ 323: 323: 323: 323: 323: 323:

Z9+,$#@/G&T$,G@/ 323: 323: 323: 323: 323: 323:

'+#&T$,G@/ <<2A: J1523: J152;: J<23: J42<: J12>:

B.H&J&E@%(#+M 4;A24: 6;21: 11=2>: A>23: >523: <124:

BCD!EF >3323: 13323: 14323: 13323: 4323: <<2<:

N,++&O$0I&N%"P J4>2A: 5A>21: 6324: J52<: J1<>2=: 54523:

O$0I <=1<2;: J;426: 1>>23: 14<21: 1<423: 11523:

S",X@/G&O$9@#$% 53A2;: JA121: 14323: 13323: 4323: <<2<:

]"/G&!+,)&E+*# 323: =62=: 14423: =<23: 162A: J12>:

!"#$%&E+*# 323: =62=: 14423: =<23: 162A: J12>:

!"#$%&F00+#0 43=2<: >;2<: 1>>25: A>2=: >>25: <32>:

EHZ 323: 323: 323: 323: 323: 323:

D/8+/#",V&!(,/0 323: 323: 323: 323: 323: 323:

N@[+M&F00+#&!(,/0 JA26: J12=: J524: J121: J32>: J325:

O$0I&OVK%+ <42<: 43A2A: 323: 323: 323: 323:

The Cohen Growth Drivers Model is an intelligent road map used by many securities analysts to analyze

the forecasted growth of a given company. We expect significant top-line growth driven by the

Company’s expected plant commercialization. We believe our estimates are conservative as they are

based on the current capital spending capacity of the Company and do not include any additional capital

expenditure the Company may have in due course. Also, gross and operating margin projections are kept

constant.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 12 of 19

- 13. Grass Roots Research and Distribution, Inc.

!

CONCLUSION

Novo Energies is an exciting alternative energy company. The Company’s core business of converting

waste materials such as plastic and tire to liquid fuels utilizing a suite of proprietary technologies targets

significant corporate growth. The Company has a robust business model built on multiple sources of

revenues and positive energy conversion economics. Along with a majority revenues from oil and liquid

fuel sales, the top-line should benefit from income from sale of by-products. Further, the Company plans

to use a combination of gasification and thermolysis technologies, resulting in better conversion

economics. This in our view is a unique business model as it allows the Company to become a low cost

producer of alternative energies.

The alternative energy industry is expected to expand to over $40 billion in the next couple of years. We

expect significant growth potential for the Company’s products, especially after the Company acquires

an equity partner to support its expansion plans. Revenues are expected to grow from $5.7 million for

Fiscal Year End (FYE) December 31, 2009 to more than $570.0 million by FYE 2015. The Company

will have to acquire considerable funding to meet our projections.

We believe the Company’s strong management team, robust revenue streams and growth potential in its

marketplace makes the stock a potential valuable investment proposition. The Company will have to

raise funds to meet our projections. Novo Energies provides an exciting long term investment

opportunity.

RS/Grass Roots Distribution Research

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 13 of 19

- 14. Grass Roots Research and Distribution, Inc.

!

LATEST PRESS RELEASE

Atlantic Wine Agencies, Inc. (to Be Known as Novo Energies Corporation) Appoints New President

and Chief Operations Officer

NEW YORK, NY -- (Marketwire) -- 05/08/09 -- Atlantic Wine Agencies, Inc. (OTCBB: AWIN), a

publicly traded Company listed on the Over the Counter Market (OTCBB) under the symbol "AWIN,"

announced today that: (i) it has begun taking the necessary steps to change its name to Novo Energies

Corporation and (ii) Mr. Andre L'Heureux has been appointed as our new President and Chief

Operations Officer effective today.

Mr. L'Heureux has over 25 years of experience in the chemical and biotechnological sector. He will be

responsible for the planning, implementation and production of Novo Energies' first operating plastics

and synthetic tire depolymerization plants in Quebec, Canada, the first such plant in Quebec. Novo

Energies has developed a proprietary waste to liquid renewable energy solution.

Previously, Mr. L'Heureux was the President of Chemco Inc., a private chemical company for industrial

water treatment products. Mr. L'Heureux has been a researcher in the development of polymer and

biopolymer products. In 1984, he finished his studies as mechanical technologist from Limoilou

College. Mr. L'Heureux continued his studies in the field of business administration at the University of

Quebec.

Novo Energies Corporation Chairman and Chief Executive Officer Antonio Treminio stated: "It is a

pleasure to have Mr. Andre L'Heureux join our management team. Andre's extensive experience in the

field, vision and 'can do' attitude will help us build a world-class business providing an alternative and

effective solution to the global energy crises."

Mr. Andre L'Heureux commented: "It is with great pleasure that I accept these responsibilities and look

forward to working with the current management team to meet our objectives in the most efficient and

effective way possible. We are currently facing a global crises where our natural resources are been

constantly depleted and unless we act today and start implementing new renewable solutions, our future

generations and ourselves may face irreversible consequences affecting our natural environment."

More information will be provided as the Company progresses with its developments.

About Atlantic Wine Agencies, Inc. (to be known as Novo Energies Corporation) is a public company

trading on the Over the Counter Bulletin Board Market ("OTCBB") headquartered in New York. The

Company's new mission is to continue expanding within the renewable energy sector by developing and

implementing renewable energy solutions while maintaining its commitment to conserve energy, natural

resources and help reduce pollutants and unwanted biological agents.

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 14 of 19

- 15. Grass Roots Research and Distribution, Inc.

!

FINANCIAL EXHIBITS

Income Statement – Base Case

all!figures!in!$!million 2010E 2011E 2012E 2013E 2014E 2015E 2016E

Revenues !!!!!!!!!!!!!!!5.7 !!!!!!!!!!!!28.5 !!!!!!!!!!!!57.0 !!!!!!!!!!

142.5 !!!!!!!!!!

285.0 !!!!!!!!!!

427.5 !!!!!!!!!!

570.0

O"0#&"-&?""M0&H"%M &&&&&&&&&&&&&&&&12> &&&&&&&&&&&&&&&&

621 &&&&&&&&&&&&&1>2< &&&&&&&&&&&&&<42; &&&&&&&&&&&&&612< &&&&&&&&&&&13;2A &&&&&&&&&&&1>524

Gross!Profit !!!!!!!!!!!!!!!4.3 !!!!!!!!!!!!21.4 !!!!!!!!!!!!42.8 !!!!!!!!!!

106.9 !!!!!!!!!!

213.8 !!!!!!!!!!

320.6 !!!!!!!!!!

427.5

H+%%@/G&$/M&FM)@/&B[9+/0+0 &&&&&&&&&&&&&&&&12A &&&&&&&&&&&&&&&&

A26 &&&&&&&&&&&&&1A2< &&&&&&&&&&&&&>=2< &&&&&&&&&&&&&A;24 &&&&&&&&&&&1>>2= &&&&&&&&&&&1A<23

Operating!Profit/!EBITDA !!!!!!!!!!!!!!!2.3 !!!!!!!!!!!!11.7 !!!!!!!!!!!!23.5 !!!!!!!!!!!!58.6 !!!!!!!!!!

117.3 !!!!!!!!!!

175.9 !!!!!!!!!!

234.5

E+9,+K@$#@"/&$/M&F)",#@_$#@"/ &&&&&&&&&&&&&&&&125 &&&&&&&&&&&&&&&&

<2> &&&&&&&&&&&&&&&&

=2< &&&&&&&&&&&&&1=2A &&&&&&&&&&&&&<A2A &&&&&&&&&&&&&;;21 &&&&&&&&&&&&&A52<

EBIT !!!!!!!!!!!!!!!1.1 !!!!!!!!!!!!!!!8.3 !!!!!!!!!!!!15.2 !!!!!!!!!!!!39.7 !!!!!!!!!!!!77.4 !!!!!!!!!!

109.8 !!!!!!!!!!

142.2

D/#+,+0#&B[9+/0+U&'+# &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&&

324 &&&&&&&&&&&&&&&&

12> &&&&&&&&&&&&&&&&

<21 &&&&&&&&&&&&&&&&

;2> A23

&&&&&&&&&&&&&&&& &&&&&&&&&&&&&&&&

A26

Z#I+,&D/K")+&QB[9+/0+0R &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&J &&&&&&&&&&&&&&&J

EBT !!!!!!!!!!!!!!!1.1 !!!!!!!!!!!!!!!7.8 !!!!!!!!!!!!13.8 !!!!!!!!!!!!36.6 !!!!!!!!!!!!70.9 !!!!!!!!!!

100.8 !!!!!!!!!!

132.5

.,"8@0@"/&-",&!$[$#@"/ &&&&&&&&&&&&&&&&321 &&&&&&&&&&&&&&&&

125 &&&&&&&&&&&&&&&&

521 &&&&&&&&&&&&&1123 &&&&&&&&&&&&&512< &&&&&&&&&&&&&<325 &&&&&&&&&&&&&<A2=

Net!Profit !!!!!!!!!!!!!!!1.0 !!!!!!!!!!!!!!!6.7 !!!!!!!!!!!!11.7 !!!!!!!!!!!!25.6 !!!!!!!!!!!!49.7 !!!!!!!!!!!!70.5 !!!!!!!!!!!!92.8

HI$,+0&Z(#0#$/M@/G&J&C$0@K &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26

HI$,+0&Z(#0#$/M@/G&J&E@%(#+M &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26 &&&&&&&&&&&&&>>26

B.H&J&C$0@K &&&&&&&&&&&32355 &&&&&&&&&&&321>A &&&&&&&&&&&325;5 &&&&&&&&&&&3246< &&&&&&&&&&&12111 &&&&&&&&&&&1246= &&&&&&&&&&&52364

B.H&J&E@%(#+M &&&&&&&&&&&32355 &&&&&&&&&&&321>A &&&&&&&&&&&325;5 &&&&&&&&&&&3246< &&&&&&&&&&&12111 &&&&&&&&&&&1246= &&&&&&&&&&&52364

Copyright © 2009 by Grass Roots Research and Distribution, Inc. All rights reserved. This report may not be reproduced.

Page 15 of 19