Gulf of Mexico decommissioning market 2013

- 1. Decomworld Market Analysis, Gulf of Mexico

Offshore Decommissioning Report 2013-14, Gulf of Mexico

Decommissioning market opportunities

The Outer Continental Shelf Gulf of Mexico (GOM) is the largest, most active and competitive decommissioning market

in the world. Since 1947, almost 7,000 structures have been installed in the federal waters of the GOM and over 4,000

structures have now been removed.

Thank you for your interest in the Offshore Decommissioning

Report 2013-14, Gulf of Mexico.

For more information please click here: www.decomworld.com/gomreport

Alternatively, contact our Marketing Manager:

Maria Vincent

œ : +44 (0) 0207 375 7528

* : mvincent@decomworld.com

© DecomWorld 2013 | DecomWorld is part of FC Business Intelligence Limited,

a registered company in England and Wales – Registered Number 03172417.

7-9 Fashion Street, London, E1 6PX, UK. DecomWorld are a business unit of

FC Business Intelligence providing focused news, events, reports, updates

and information for the global offshore decommissioning industry.

Notes

2012e Removal forecasts require prognostication of a large number of uncertain factors. There are numerous uncertainties in estimating

decommissioning expenditures and market size. Unlike activity statistics, which are well-defined and unambiguous, estimates of

decommissioning expenditures are subject to significant uncertainty from a variety of sources.

➤ To receive the latest

discounts on the Offshore

Decommissioning Report

2013-14, Gulf of Mexico

for you and/or your team,

click here

STR

U

C

T

U

R

E

ST

R

U

C

T

U

R

E

STR

U

C

T

U

R

E

STR

U

C

T

U

R

E

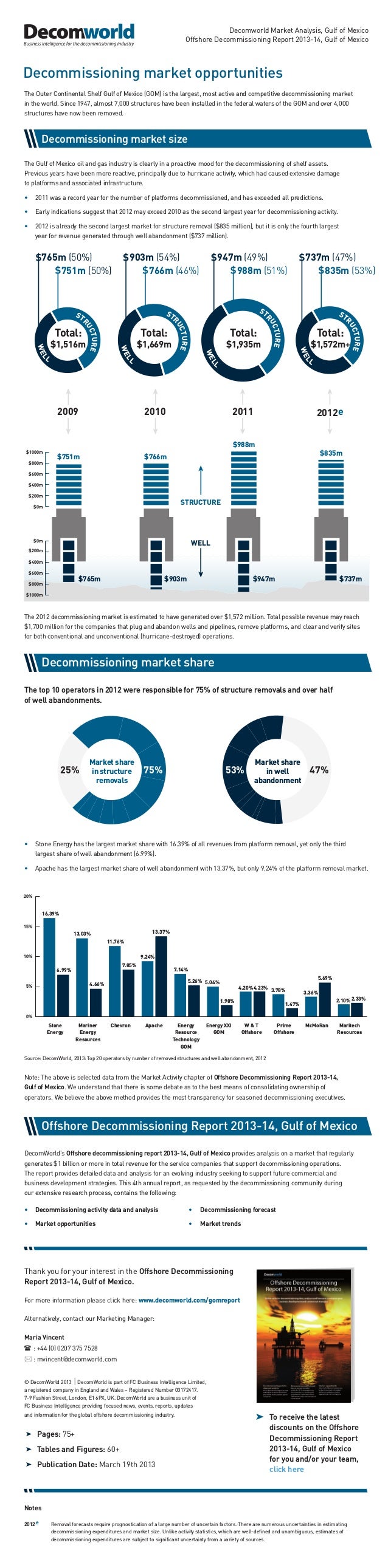

Decommissioning market size

DecomWorld’s Offshore decommissioning report 2013-14, Gulf of Mexico provides analysis on a market that regularly

generates $1 billion or more in total revenue for the service companies that support decommissioning operations.

The report provides detailed data and analysis for an evolving industry seeking to support future commercial and

business development strategies. This 4th annual report, as requested by the decommissioning community during

our extensive research process, contains the following:

• Decommissioning activity data and analysis • Decommissioning forecast

• Market opportunities • Market trends

Offshore Decommissioning Report 2013-14, Gulf of Mexico

The top 10 operators in 2012 were responsible for 75% of structure removals and over half

of well abandonments.

Source: DecomWorld, 2013: Top 20 operators by number of removed structures and well abandonment, 2012

Note: The above is selected data from the Market Activity chapter of Offshore Decommissioning Report 2013-14,

Gulf of Mexico. We understand that there is some debate as to the best means of consolidating ownership of

operators. We believe the above method provides the most transparency for seasoned decommissioning executives.

Decommissioning market share

$765m (50%)

$751m (50%)

$903m (54%)

$766m (46%)

$947m (49%)

$988m (51%)

$737m (47%)

$835m (53%)

Total:

$1,935m

The Gulf of Mexico oil and gas industry is clearly in a proactive mood for the decommissioning of shelf assets.

Previous years have been more reactive, principally due to hurricane activity, which had caused extensive damage

to platforms and associated infrastructure.

• 2011 was a record year for the number of platforms decommissioned, and has exceeded all predictions.

• Early indications suggest that 2012 may exceed 2010 as the second largest year for decommissioning activity.

• 2012 is already the second largest market for structure removal ($835 million), but it is only the fourth largest

year for revenue generated through well abandonment ($737 million).

• Stone Energy has the largest market share with 16.39% of all revenues from platform removal, yet only the third

largest share of well abandonment (6.99%).

• Apache has the largest market share of well abandonment with 13.37%, but only 9.24% of the platform removal market.

W

E

L

L

W

E

L

L

W

E

L

L

W

E

L

L

2011

2010 2012e

2009

Total:

$1,572m+

Total:

$1,516m

Total:

$1,669m

Stone

Energy

Mariner

Energy

Resources

Chevron Apache Energy

Resource

Technology

GOM

Energy XXI

GOM

W & T

Offshore

Prime

Offshore

McMoRan Maritech

Resources

13.03%

11.76%

9.24%

7.14%

4.20%

3.78%

3.36%

2.10%

5.04%

16.39%

6.99%

7.85%

13.37%

5.26%

1.98%

4.23%

1.47%

5.69%

2.33%

4.66%

$765m $903m $947m $737m

$0m

$200m

$400m

$600m

$800m

$1000m

$0m

$200m

$800m

$600m

$400m

$1000m

STRUCTURE

WELL

$988m

$835m

$751m $766m

The 2012 decommissioning market is estimated to have generated over $1,572 million. Total possible revenue may reach

$1,700 million for the companies that plug and abandon wells and pipelines, remove platforms, and clear and verify sites

for both conventional and unconventional (hurricane-destroyed) operations.

0%

5%

10%

15%

20%

Market share

in structure

removals

Market share

in well

abandonment

25% 75% 53% 47%

➤ Pages: 75+

➤ Tables and Figures: 60+

➤ Publication Date: March 19th 2013