Draft lite davis langdon national construction conference oct 2012

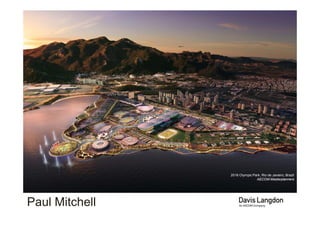

- 1. Construction Review and Outlook Davis Langdon, An AECOM Company 2016 Olympic Park, Rio de Janeiro, Brazil AECOM Masterplanners Paul Mitchell

- 2. AGENDA • Review • Construction Output • Stimuli • Public Capital Programme • European Investment Bank • REIT’s • Industry Issues NUIG Enginerering Building Cost and Project Management

- 3. 2012 Review • Industry still falling but at much slower rate – down 9% to 7.75bn (-27% in ‘11) • Still well short of €15bn target €40.0 bn €35.0 bn • Tender prices erratic; slightly increasing +3% on avg; €30.0 bn €25.0 bn • Prices now at early 2000 prices €20.0 bn • Materials; €15.0 bn oil & gas products more expensive + 2% €10.0 bn •€5.0 bn Public spending -18% (reduced from €4.7bn to forecast €3.4bn) €0.0 bn • Housing Output down to c.6/7,000 units • NAMA announces €2bn construction budget over 4 years (May ‘12) • Government announces €2.25bn stimulus package (July ‘12)

- 5. Construction Output €45,000m €40,000m €35,000m €30,000m CONSTRUCTION OUTPUT €25,000m 15% PER ANNUM €20,000m OPTIMUM GROWTH 12% OF GNP €15,000m 10% PER ANNUM GROWTH €10,000m €5,000m €0m 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 6. What does 10% p.a. growth look like? 45,000 X 30 extra Primary Schools 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 ‐ 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 7. X 30 extra Primary Schools

- 8. What does 10% p.a. growth look like? 45,000 X 30 extra Primary Schools 40,000 35,000 X 15 extra Secondary Schools 30,000 25,000 20,000 15,000 10,000 5,000 ‐ 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 9. X 15 extra Secondary Schools

- 10. What does 10% p.a. growth look like? 45,000 X 30 extra Primary Schools 40,000 35,000 X 15 extra Secondary Schools 30,000 X 10 extra 3rd level Buildings 25,000 20,000 15,000 10,000 5,000 ‐ 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 11. X 10 extra 3rd level Buildings

- 12. What does 10% p.a. growth look like? 45,000 X 30 extra Primary Schools 40,000 35,000 X 15 extra Secondary Schools 30,000 X 10 extra 3rd level Buildings 25,000 20,000 X 2 new mental health facilities 15,000 X 4 Hospital Ward Blocks 10,000 5,000 X 30 housing estate workouts ‐ 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 13. X 30 housing estate workouts

- 14. What does 10% p.a. growth look like? 45,000 X 30 extra Primary Schools X 1 new Children’s Hospital 40,000 35,000 X 15 extra Secondary Schools X 1 large FDI New Office Block 30,000 X 10 extra 3rd level Buildings 25,000 X 1 No. Central Bank move 20,000 X 2 new mental health facilities 15,000 X 4 Hospital Ward Blocks X 1 No. Intel major investment 10,000 5,000 X 30 housing estate workouts X 20 FDI Fit Outs ‐ 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 15. Is it achievable? What about 15%...? €45,000m • Probable? €40,000m • Year on year? €35,000m • Against a falling PCP? €30,000m CONSTRUCTION • Nama - €500m p.a. X 4 yrs. OUTPUT €25,000m • Stimulus – €2.24bn €20,000m • Can we respond? €15,000m 15% PER OPTIMUM ANNUM 10% PER 12% OF GNP GROWTH ANNUM GROWTH €10,000m €5,000m €0m 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 16. Employment Titanic Quarter AECOM Engineering Services

- 17. What does this do for employment? €45,000m €40,000m €35,000m • 20,000 new employees by 2015? €30,000m CONSTRUCTION OUTPUT • Project type – labour intensive v. non €25,000m 170k 145k 125k €20,000m 100k 85k 70k 55k €15,000m OPTIMUM 40k 25-30k 12% OF GNP 15-20k 10k €10,000m 10% PER €5,000m ANNUM GROWTH €0m 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 18. Stimulus? Telecity Data Centre Cost Management Services

- 19. NAMA €2bn investment €45,000m • €2bn targeted at major centres to address supply shortages €40,000m Dublin, Cork, Limerick, Galway & Dublin Commuter counties €35,000m • Commercial & Residential sectors €30,000m CONSTRUCTION • It can be recycled (fund to develop – sell – use proceeds to fund again) OUTPUT €25,000m • 100% of the finance will go to construction • Only invest if there is a return better than selling / waiting €20,000m • €587m already funded €15,000m OPTIMUM 12% OF GNP €10,000m €2bn over 4 €5,000m years from 2013 €0m 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 20. NAMA €2bn investment €45,000m • €587m funded before announcement: €40,000m • €50m for Dun Laoghaire housing scheme €35,000m • €25m for South Dublin housing schemes • €30m to housing schemes throughout Ireland €30,000m • €13m for Charlestown SC CONSTRUCTION OUTPUT • €47m on shopping centres in Laois, North Dublin and Waterford €25,000m • €7m on Dublin Cinema • €3m hotel refurb in Cork €20,000m • €3m hospital in Dublin €15,000m OPTIMUM 12% OF GNP €10,000m €2bn over 4 €5,000m years from 2013 €0m 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

- 21. Government Stimulus • €2 ¼ bn stimulus package announced in July 12 €1.4bn non-Exchequer funding for PPP projects €0.35bn in State funding of PPP’s €0.50bn for Public Infrastructure • 13,000 jobs non‐Exchequer funding for PPP projects, €1.40bn, 62% Public State funding of Infrastructure , PPP’s, €0.35bn, €0.50bn, 22% 16% 49 The Leadenhall Building, London Cost Management Services

- 22. Government Stimulus • Proposed projects Education Health 1. 2 Nr. new PPP schools bundles 1. 2 Nr. new Primary Care Bundles (~ 10 Nr. (~ 12 Nr. post-primary schools) centres) 2. Stage One of Grangegorman Transport Justice 1. N17/N18 Gort to Tuam 1. Courthouses (extent TBA) 2. M11 Gorey to Enniscorthy 2. Garda Divisional Headquarters 3. N25 New Ross Bypass 3. State pathology Laboratory 4. Galway City Bypass (target) Grangegorman Campus Cost and Project Management Services

- 23. Public Capital Programme (PCP) UCD Student Learning Leisure and Sports Facility Project and Cost Management Services

- 24. Public Capital Programme (PCP) • 5 year €17bn PCP announced in Nov ‘11 • €3.9bn in 2012 • 14% reduction for 2013 • ‘Forecast’ at consistent output from 2013-2016 €4,500m Other €4,000m €3,500m Health 2012 Other €3,000m 13% Education & Skills Transport, €2,500m Tourism & Health Sport 10% €2,000m Jobs, Enterprise & 31% Innovation €1,500m Education & Skills Environment, €1,000m 11% Community & Environmen Jobs, Local Govt t, €500m Enterprise & Community Transport, Innovation Tourism & Sport & Local Govt €0m 13% 22% 2012 2013 2014 2051 2016 UCD Student Learning Leisure and Sports Facility Project and Cost Management Services

- 25. Public Capital Programme (PCP) • So howSpentthe Plan going....3 •months left? in 9 months is To Spend €1.7bn spent €1,400m €1,200m • €2.2bn to spend in 3 months.. €793m €1,000m 43% €800m 57% €596m €600m €309m €400m €150m €59m €158m €438m €59m €42m €200m €280m €265m €21m €232m €21m €205m €109m €59m €45m €35m €23m €0m Spent To Spend UCD Student Learning Leisure and Sports Facility Project and Cost Management Services

- 26. European Investment Bank (EIB) Rion-Antirion Bridge, Greece AECOM Engineering Services

- 27. European Investment Bank (EIB) • EIB was set up in 1958 by the Treaty of Rome • Shareholders: 27 EU Member States (Ireland owns 0.567%) • Non-profit-maximising • EIB’s Lending in Ireland: €12bn in nearly 300 projects The Shard, London Cost Management Services

- 28. European Investment Bank (EIB) Pre-accession Countries include: Candidate Countries: Croatia, Iceland, the Former Yugoslav Republic of Macedonia, Montenegro and Turkey. Potential Candidate Countries: Albania, Bosnia and Herzegovina, Kosovo, Serbia.

- 29. European Investment Bank (EIB)

- 30. European Investment Bank (EIB) • EIB funding in Ireland €2.7bn in the last 5 years €1.1bn in Energy €765m in Transport €435m to SME through Banks Urban Infrastructure, €309m to Health & Education €15m SME Credit €15m to Industry Transport, Lines, €435m €765m €15m to Urban Infrastructure Health, Education, Energy, €309m €1,107m Industry, €15m

- 31. European Investment Bank (EIB) €2.7bn in the last 5 years €1.1bn in Energy ESB Network And E-Cars Infrastructure Bord Gais Whitegate CCGT Eirgrid East-West Interconnector Ten-E ESB Renewable Programme ESB Aghada Gas Fired Power Station €765m in Transport Dublin Airport Terminal 2 (Ten) Dublin Airport Development - Ten M50 Motorway M7 - M8 Portlaoise N6 Galway To East Ballinasloe PPP

- 32. European Investment Bank (EIB) €2.7bn in the last 5 years €435m to SME through Banks Allied Irish Banks Loan for SME II Allied Irish Bank Loan for SME I Bank Of Ireland Loan for SME I Ulster Bank Loan for SME I (120,000 SME’s reached in 2011 Source: EIB) €309m to Health & Education Irish School Programme (550 classrooms) University College Dublin (Science and Law Buildings) Irish Schools Investment Programme (27 schools PPP) Trinity College Dublin (Biomedical Research Building)

- 33. European Investment Bank (EIB) 2012 and beyond EIB committed to enhanced support for Ireland Key areas: Strategic infrastructure through PPP Financing Access to Finance for SMEs and mid-caps …and in the longer-term Exchequer-funded investments support to the Corporate sector €1,200m Further ways for financing the SMEs and Mid-Caps €1,000m Under Appraisal €400m €800m Signed / Approved €600m €1,020m Financed €400m €500m €450m €475m €200m €345m €256m €100m €0m 2007 2008 2009 2010 2011 2012

- 34. European Investment Bank (EIB) 2012 and beyond €100m financed Irish Schools programme €500m approved €155m for Bord Gais Onshore Wind €75m for N11-N7 Motorway PPP N17-N18 Gort to Tuam PPP €400m under appraisal €200m for AIB Loan for SME’s & Mid Caps €200m for Irish Water programme

- 35. European Investment Bank (EIB) EIB’s project due diligence and credit process

- 36. European Investment Bank (EIB) What can be financed by the EIB? Projects in line with EIB priorities (broadly Transport, Energy and Knowledge Economy) Eligible costs Counterparts with an acceptable credit profile EIB can finance up to 50% of the total project cost University College Dublin: Campus development incl. Science Centre, School of Law and student accommodation

- 37. Real Estate Investment Trusts (REIT’s) The Shard, London Cost Management Services

- 38. Real Estate Investment Trusts (REIT’s) • What is a REIT? • A real estate investment trust, or REIT, is a company that owns, and in most cases, operates income- producing real estate. • Most of its assets and income tied to real estate (investment rather than development). • It must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends. • Owing to 90% annual dividend it avoids corporation tax which is one of it’s benefits. The Tate Modern extension Cost Management Services

- 39. Real Estate Investment Trusts (REIT’s) • What is a REIT? • There are 25 REIT’s operating in the UK with a total market cap in excess of £26bn. • UK REIT scheme was launched in January 2007 • There are 166 REIT’s operating in the US on the stock exchange with a total market cap in excess of $579bn. There are 1100 in the overall US market. • Transparent operating structure • Investments are under constant scrutiny in market and tend to be very liquid; traded much like equities. One World Trade Center, New York AECOM Construction Management

- 40. Real Estate Investment Trusts (REIT’s) What is the benefit of REIT’s to the construction industry? • Attract funds to Ireland’s property market • Introduce liquidity to investment market • It offers a chance for the smaller investor to invest in diversified large scale commercial property. • Release Nama / Developer funds from illiquid assets which in turn would create funding for development needs REIT NAMA €€€ €€€

- 41. Real Estate Investment Trusts (REIT’s) How probable is a REIT in Ireland? • Fine Gael Manifesto 2011 • Legislation is currently passing through government • Nama would welcome the introduction – big benefits in unwinding assets • Domestic investors might be very eager to get in on liquid commercial investment • International Investors would be very interested (e.g. €1bn chasing recent Office Building sale) • Hopefully Budget 2013 will lead the way... One Warrington Place Pre-acquisition Due Diligence

- 42. Industry Issues National Children’s Hospital (Mater site) Cost Management Services Cleveland Clinic, Abu Dhabi, U.A.E Cost Management Services

- 43. Industry Issues • Abnormally Low Tenders • Public Sector capacity to deliver PCP • Graduate & Apprentice pipeline • PPP model & cancellations • Circular 10/10 • Public Procurement Procedures • Performance and Infrastructure Bonds • Disputes • Building Regulations & Compliance New Engineering Building NUIG Cost and Project Management

- 44. Thank You Paul Mitchell, Director Head of Office ‐ Ireland Olympic Stadium, London Cost & Project Management Services Davis Langdon, An AECOM Company paul.mitchell@davislangdon.com