Aml training

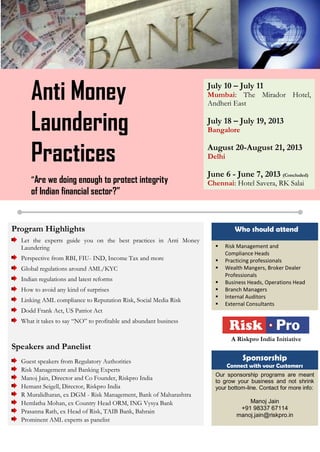

- 1. Anti Money Laundering Practices “Are we doing enough to protect integrity of Indian financial sector?” July 10 – July 11 Mumbai: The Mirador Hotel, Andheri East July 18 – July 19, 2013 Bangalore August 20-August 21, 2013 Delhi June 6 - June 7, 2013 (Concluded) Chennai: Hotel Savera, RK Salai Risk Management and Compliance Heads Practicing professionals Wealth Mangers, Broker Dealer Professionals Business Heads, Operations Head Branch Managers Internal Auditors External Consultants Program Highlights Let the experts guide you on the best practices in Anti Money Laundering Perspective from RBI, FIU- IND, Income Tax and more Global regulations around AML/KYC Indian regulations and latest reforms How to avoid any kind of surprises Linking AML compliance to Reputation Risk, Social Media Risk Dodd Frank Act, US Patriot Act What it takes to say “NO” to profitable and abundant business Speakers and Panelist Guest speakers from Regulatory Authorities Risk Management and Banking Experts Manoj Jain, Director and Co Founder, Riskpro India Hemant Seigell, Director, Riskpro India R Muralidharan, ex DGM - Risk Management, Bank of Maharashtra Hemlatha Mohan, ex Country Head ORM, ING Vysya Bank Prasanna Rath, ex Head of Risk, TAIB Bank, Bahrain Prominent AML experts as panelist Who should attend Our sponsorship programs are meant to grow your business and not shrink your bottom-line. Contact for more info: Manoj Jain +91 98337 67114 manoj.jain@riskpro.in Sponsorship Connect with your Customers For more information, visit www.riskpro.in/AMLtraining A Riskpro India Initiative

- 2. Background on Anti Money Laundering Banks face growing costs to comply with AML requirements. With a zero tolerance level in Money Laundering and associated large regulatory penalties for non compliance, Banks and other Financial Institutes are spending immense time and efforts to achieve compliance. Needless to say, it is still not enough. The Black Swan can enter into any Financial Institute’s Branch on any given day and sting the Bank by surprise. The Challenge The solution to the above challenge is the implementation of a formal and a structured AML Mitigation and oversight system and processes that effectively identify, assess, and manage such risk within acceptable levels. Overview and Summary The course provides participants the understanding of Anti Money Laundering, KYC and Combating Terrorism Financing. The conference provides participants with practical tools and methods required for implementation of the framework. This is an instructor led course designed to provide a practical understanding of the new global framework for risk management. In this two days intensive course, participants gain a complete understanding for implementing AML/KYC processes in their organization. Practical exercises and case studies help to better understand concepts and evaluation of multiple methods and techniques. Program Details and Agenda This conference focuses on current money laundering trends, recent case studies and lessons learned. It is an opportunity for legal, compliance, risk and Banking professionals to interact with industry experts, regulators and peers to address the key issue. “Are we doing enough to protect the integrity of the Indian financial system” See detailed Agenda on the next page. Training Methodology and Course Content This is an interactive conference that combines formal theoretical presentations, case studies and expert views. Delegate Course Material includes full set of presentation slides Delivery by Risk Management Experts with practical experiences Additional Handouts based on exercised and recent news coverage Completion certificate Training Objectives The goal of this course is to provide you an overview of the Anti Money Laundering developments, recent trends, challenges and other implications. The conference also addresses best practices and how to design effective AML frameworks. The training program is designed to ensure that participants can implement it in their organisation with minimal external consulting support. The following are the training objectives for the program: Building a business case for Board and senior management approval How to setup and implement the principles and framework within your organisation Comprehensive review and understanding of the Risk Management process and systems specifically addressing AML/ KYC and CTF Understand various risk identification and risk assessment techniques relating to AML

- 3. 8:30 Registration 9:30 Welcome Address Guest speaker 10:00 Global emerging challenges in Money laundering efforts Global perspective to AML Latest developments in AML/KYC 10:45 What’s New and Recent Regulatory Developments in AML and FATF (Indian and International perspective) Regional perspectives from the USA, UK and Asia on enforcement and the impact of money laundering. Prevention of Money Laundering Act (PMLA)- Overview and Key Provisions Recent developments in Indian regulations, PMLA updates RBI Guidelines for KYC and AML SEBI Guidelines for KYC and AML 11:30 Break and Refreshments 11:45 Introduction to Money Laundering Define money laundering and terrorist financing Identify the principal sources of laundered money Identify the reasons why criminals launder money Recognize the consequences of money laundering Post 9/11 International Convergence on prevention of money laundering 12:30 Know Your Customer Basics Define the KYC policy Identify the principal elements of the KYC policy Identify the risks of not implementing the KYC policy 13:30 Lunch and Networking Break 14:30 Customer Profiling / Risk Profiling Objectives of customer identification in a KYC policy the challenges for business in establishing beneficial ownership Understand the typical higher risk and lower risk customer profiles Recognize higher risk and lower risk customer profiles Politically Exposed Person (PEP) Risk Nature and impact of blacklists Examples of high risk customers and AML vulnerabilities 15:30 Networking and Short Tea Break 15:45 US Patriot Act, Dodd Frank and other international regulations addressing AML Key aspects of US Patriot Act Recent international Money laundering cases UK Bribery Act 16:45 Compliance Culture and strengthening Compliance Risk Management Robustness of compliance risk management Round the year AML trainings and awareness Staff accountability and disciplinary action 17:30 Open Forum / Q& A 18:00 End of Day One 9:15 Welcome Address Guest speaker 10:00 Recognising and Reporting Suspicious Activities Recognize suspicious activities Red Flags for Money Laundering Activity Reporting requirements as per PMLA Increasing data quality and improving AML Analytics 11:30 Break and Refreshments 11:45 Designing an effective AML Framework – Banking Perspective 10 strategies to mitigate International Money Laundering Risks How to build and maintain effective AML and Sanctions controls Addressing AML in Institutes with multi country setup How Can Auditing AML activities strengthen AML Compliance? Integrating FCPA and Anti Bribery frameworks in AML strategies 13:30 Lunch and Networking Break 14:30 Use of AML Technology to detect money laundering Software demonstration of latest technologies Role and functions of such technologies in compliance and operational risk management Best Practices to Improve AML Audit Processes 15:30 Networking and Short Tea Break 15:45 Designing an effective AML Framework – NBFC and Insurance Perspective Third party product. Sale of products and addressing black money Strengthening regulation for Non Banking Institutes. 17:00 Whistle Blowing, Corporate Governance and Money Laundering How to Integrate AML efforts whistle blowing framework Strengthening corporate governance framework to address Money Laundering and KYC violations 17:30 Open Forum / Q& A 18:00 End of Program Day 1:- Emerging Challenges, implications and Introductions Day 2:- Strategies to Combat AML and Terrorism

- 4. Pricing, Dates and Location Chennai Date TBD Pricing Rs 8,500 plus taxes Location Hotel Savera, 146, Dr. Radhakrishnan Rd, Chennai Ph : 044 - 2811 4700 Bangalore Date July 18-19, 2013 Pricing Rs 9,500 plus taxes Location TBD Central District Hotel Bangalore Mumbai Date July 10-11, 2013 Pricing Rs 9,500 plus taxes Location The Mirador Hotel, Opp Solitaire Park, Andheri East, Mumbai Delhi Date Aug 20-21, 2013 Pricing Rs 8,500 plus taxes Location TBD Central District Hotel Delhi Contact V. Murali v.murali@riskpro.in (+91-98845 57947) R. Murali murali@riskpro.in (+91 – 95660 77326) Contact Casper Abraham casper.abraham@riskpro.in (+ 91- 9094070458) Medha Kulkarni medha.kulkarni@riskpro.in (+91 – 99455 51326) Contact Manoj Jain manoj.jain@riskpro.in (+91-98337 67114) Shriram Gokte shriram.gokte@riskpro.in (+91-98209 94063) Contact Rahul Bhan Rahul.bhan@riskpro.in (+ 91- 99680 05042) Hemant Seigell hemant.seigell@riskpro.in (+91 – 99536 97905) All above prices are per participant. Service Tax extra as applicable Discounts: For four or more nominations from same organisation, discount of 10% of the program fee Nominations not refundable. Change of nomination permitted. Unused amount permitted to be carried forward. Prior registration and payment required More information Kindly Send nomination along with the payment / contact details (Participant Name, Contact Number, Designation, email id) any of the above contact points. PAYMENT DETAILS Payments to be in the name of “Riskpro India Ventures Private Limited” NEFT Details: Beneficiary Name: Riskpro India Ventures Private Limited Bank Name: HDFC Bank, MIDC – Andheri - Mumbai, India Bank Account 14252560001055 (Current Account) IFSC Code HDFC0001425 / MICR Code 400240126 PAN Number AAFCR5508L / SERVICE TAX NO AAFCR5508LSD001 About Riskpro Riskpro India is a specialized Risk Management solutions and Risk consulting company. It is managed by experienced professionals with experiences spanning various industries. We are one of the fastest growing risk consulting firms in India. For more details on Riskpro India, Please visit www.riskpro.in Some of Riskpro’s Training Clients