2010 Houston Economic Forecast - GHP

- 1. 2010 EMPLOYMENT FORECAST

A publication of the Greater Houston Partnership December 14, 2009

The short version of the Greater Houston Partner- region—not even Houston—has been immune to its

ship’s ’10 employment forecast is that metropolitan effects. Houston, however, was sheltered for an-

Houston, which probably lost nearly 93,000 jobs other year or so by the sharp run-up in energy

this year (December to December), will end ’10 prices, which by July ’08 had seen the price of West

with a net gain of 1,900. The good news in this Texas Intermediate (WTI) crude oil nearly triple,

forecast is that Houston comes to next December from less than $53 per barrel in early ’07 to more

moving in the right direction. Job losses cease than $147, while Henry Hub natural gas more than

around mid-year, and Q3/10 brings the first blush of doubled, from less than $6 per 1,000 cu.ft. in

job growth in Houston’s nascent recovery. summer ’07 to more than $13. The stimulative ef-

fects of high and rising energy prices shielded

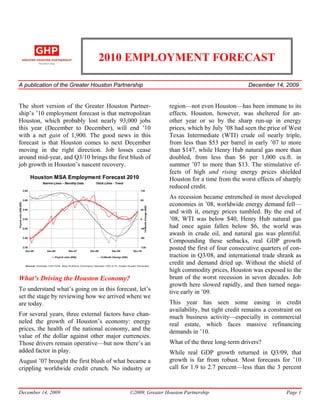

Houston MSA Employment Forecast 2010 Houston for a time from the worst effects of sharply

reduced credit.

As recession became entrenched in most developed

economies in ’08, worldwide energy demand fell—

and with it, energy prices tumbled. By the end of

’08, WTI was below $40, Henry Hub natural gas

had once again fallen below $6, the world was

awash in crude oil, and natural gas was plentiful.

Compounding these setbacks, real GDP growth

posted the first of four consecutive quarters of con-

traction in Q3/08, and international trade shrank as

Sourc es : Es ti ma tes 1 2 /0 5 -10 /09 , Texa s W ork fo rce Co mm iss io n; fore ca sts 11 /0 9 -12 /10 , Gre ate r Ho us to n Pa rtne rshi p

credit and demand dried up. Without the shield of

high commodity prices, Houston was exposed to the

What’s Driving the Houston Economy? brunt of the worst recession in seven decades. Job

growth here slowed rapidly, and then turned nega-

To understand what’s going on in this forecast, let’s tive early in ’09.

set the stage by reviewing how we arrived where we

are today. This year has seen some easing in credit

availability, but tight credit remains a constraint on

For several years, three external factors have chan- much business activity—especially in commercial

neled the growth of Houston’s economy: energy real estate, which faces massive refinancing

prices, the health of the national economy, and the demands in ’10.

value of the dollar against other major currencies.

Those drivers remain operative—but now there’s an What of the three long-term drivers?

added factor in play. While real GDP growth returned in Q3/09, that

August ’07 brought the first blush of what became a growth is far from robust. Most forecasts for ’10

crippling worldwide credit crunch. No industry or call for 1.9 to 2.7 percent—less than the 3 percent

December 14, 2009 ©2009, Greater Houston Partnership Page 1

- 2. HOUSTON—2010 EMPLOYMENT FORECAST

growth that’s needed to provide a stimulus to the naled expanded production on tap for Q1/10. The

Houston region. tax credit for first-time homebuyers provided a

• boost to housing. Exports and imports notched solid

The dollar weakened substantially over the course gains in Q3/09. Improvement in indicators such as

of ’09, but—in contrast to what happens in an ex- these underlies the widespread expectation that the

panding economy—did little to help exports be- U.S. is likely to see growth in payroll employment

cause demand was tepid. A weak dollar should in either Q1 or Q2. Houston, the Partnership be-

bolster Houston exports when recovery abroad lieves, is likely to follow suit in Q3.

quickens the pace of international trade.

Looking Back at 2009

Energy prices were a mixed bag in ’09. Throughout

What happened in Houston in ’09 is largely con-

the latter half of the year, oil traded at prices higher

than supply/demand fundamentals justified, appar- tained in three stories—upstream energy, construc-

ently reflecting the anticipation of improved de- tion, and international trade.

mand as economies return to health worldwide.

Upstream energy: The supersector name is “mining

Natural gas prices, on the other hand, languished

(dropping below $2 on occasion) as gas in storage and logging,” but nearly all of it in Houston is oil

rose to record levels and threatened to reach capa- and gas. It’s of particular importance to the region’s

city. economy because average annual pay is well above

$100,000—the only industry to break

Employment, of course, is a lagging

the six-figure barrier—so its employ-

economic indicator. When economic What happened in ment level has a disproportionately

conditions start to improve and Houston in ’09 is

demand for goods and services large impact on industries that de-

begins to revive, employers respond

largely contained in pend heavily on discretionary con-

by increasing hours worked, drawing three stories—up sumer spending.

down excess labor capacity without stream energy, con

Data are available for two compo-

adding jobs. When demand grows to struction, and inter

nents of this supersector in Houston.

the point where extracting more national trade.

production from current employees is Oil and gas extraction, which in-

no longer feasible, the next step often cludes many of the major exploration

is to add temporary workers. Only when demand is and production firms engaged in multi-year pro-

seen as stable, and downside risks as limited, are grams abroad, has continued to add jobs, and should

employers likely to make new hires. end ’09 with an over-the-year gain of 2,100 or so.

In Houston’s case, a return to sustained job growth (The latest data at this writing are for October.)

depends heavily not only on renewed demand for Support activities for mining, which in Houston is

energy and for chemicals and plastics products dominated by oilfield service companies, is more

(many of which are used in construction and manu- susceptible to short-term shifts in demand, and shed

facturing), but also on revived international trade. about 5,100 jobs this year. Together, if these

This means that economic recovery elsewhere is a expectations are met, these two industries will have

prerequisite for substantial job growth in Houston. contracted 3.3 percent in ’09.

Late ’09 saw scattered positive economic signs for

the national economy. Consumer spending has im- We expect construction to have lost 23,300 jobs—

proved modestly across much of the nation. Given one in nine—this year, accounting for a quarter of

increased spending, lean inventories suggest that the region’s net job loss. Steep cuts in construction

production must rise to meet demand—and a short- activity have affected other industries, and are al-

term leading indicator of industrial production sig- most certainly involved in the loss of some 6,400

December 14, 2009 ©2009, Greater Houston Partnership Page 2

- 3. HOUSTON—2010 EMPLOYMENT FORECAST

jobs in fabricated metal products manufacturing and to be little changed in ’10, averaging about $79 for

6,600 in architectural and engineering services. the year and edging above $81 in Q4. On the other

hand, EIA sees total domestic natural gas

International trade: Houston has long occupied a consumption declining 0.4 percent as some power

prominent position in international business. It’s generation shifts away from natural gas to new

ironic that international trade now appears to have coal-fired generation, more than offsetting rising

made Houston more vulnerable than the other large residential, commercial and industrial gas usage. In

Texas metros to the steep worldwide drop in trade EIA’s forecast, natural gas prices are pushed higher

induced by limited credit availability. From Decem- by declining production, but remain below $5

ber ’08 to December ’09, wholesale trade employ- through Q3, rising to $5.20 in Q4. These

ment in Houston fell about 11.7 percent, costing inauspicious scenarios for growth in exploration

16,400 jobs. The related category of transportation and production activity suggest continuation of this

that includes warehousing, water transport and rail year’s corporate and field layoffs into ’10. Even

transport is likely to have shed another 10,000 jobs, though most of the majors are involved in multi-

down 17.9 percent. year projects that are not strongly influenced by

short-term price movements, recently announced

Those three stories involve industries that represent

job cuts and budget reductions at some leading

more than two-thirds of the job loss we project

firms indicate that E&P employment in Houston

Houston to have sustained this year—and that tally

will decline by nearly 2 percent in ’10. Oilfield ser-

doesn’t include the effects of upstream energy re-

vices firms, which are likely to have eliminated

ductions on such industries as retail trade, food ser-

about 5,100 jobs this year, could easily drop another

vices, entertainment and recreation, and personal

1,400 in ’10. Overall, we expect mining and logging

services. Accordingly, what happens to them is like-

employment to decline by 2,300 jobs, or 2.6

ly to dominate Houston’s employment picture next

percent. This loss, of course, will have ripple effects

year.

on industries that depend heavily on consumers’

What’s in Store for 2010 discretionary spending.

On balance, the Houston metro area should eke out Construction: Aside from potential federal stimulus

a net job gain—1,900 jobs—next year. That’s the spending and tax incentives, there’s little to spark

end product of gains and losses for individual in- construction in Houston next year. Except in special

dustries that respond in different ways to economic cases, strict lending standards pose a daunting chal-

developments. As we turn to a detailed look at next lenge to financing most projects of any type.

year (see table, p. 6), we emphasize that the precise

numbers in a forecast aren’t as important as under- • Single-family residential construction—perhaps

standing the reasons underlying the forecast. Being buoyed by federal tax credits, but still con-

aware of what drives a forecast allows one to adjust strained by strict lending standards—is unlikely

expectations when unanticipated changes occur. next year to see much more than a repetition of

this year’s 15,000 or so starts.

Upstream energy: On the assumption that U.S. real • At a time when apartments are plentiful, when a

GDP grows 1.9 percent (most other forecasts are a difficult job market is compelling some young

bit higher) and world real oil-consumption- adults to return to their parental homes, and

weighted GDP grows 2.6 percent next year, the when financing for new complexes is exceed-

U.S. Energy Information Administration (EIA) ingly tight, multi-family construction should re-

expects the price of West Texas Intermediate crude main at a low level.

December 14, 2009 ©2009, Greater Houston Partnership Page 3

- 4. HOUSTON—2010 EMPLOYMENT FORECAST

• Declining employment has all but eliminated Port of Houston to mask what happens with other

demand for new general purpose office space. commodities. Excluding mineral fuels, the 12-

• Groundbreaking on new industrial projects, month total volume of Port of Houston imports and

CBRE reports, has fallen “to a near standstill exports peaked in August ’08 and then fell 19.0 per-

amidst concerns of overbuilding as well as a cent over the next 12 months before posting a slight

lack of money to support proposed projects.” improvement to a decline of 18.4 percent this Sep-

• This year’s store closings and decline in con- tember (the latest data available at this writing).

sumer spending have dampened retail prospects, Had demand abroad not contracted, the weakening

and the credit crunch makes prospects for retail of the dollar in ’09 would have made Houston ex-

construction next year dim. CBRE opines: ports more attractive. With economic growth now

“New construction should continue to decline accelerating in some Asian economies (e.g., India

rapidly due to the inability of developers to find and China) and returning in some developed econo-

affordable financing and meet higher pre- mies (e.g., Germany and France), trade volumes

leasing requirements set by lenders.” should improve—and Houston certainly hasn’t lost

• Even public works construction is suffering. De- its capacity to handle international trade. Q3/09

spite the prospects for rising enrollments, some brought solid gains in imports and exports at the na-

local school districts have deferred issuing tional level, brightening the prospects for further

bonds for new school construction because de- growth in ’10. These prospects underpin the Part-

clining property values threaten tax revenues. nership’s expectation that wholesale trade in Hous-

Projects for which funding is either already as- ton next year will regain 5,200 of the 16,400 jobs it

sured or not burdened by credit constraints— lost this year, and that the unpublished conglom-

METRO’s light rail, for instance—should go erate of industries that includes warehousing, wa-

forward. terborne transportation, and rail transportation will

While ’09 probably saw the brunt of the hits to con- add back 2,900 of the 10,000 jobs it lost this year.

struction employment in the Houston region, a fur- What of other industries with large numbers of jobs

ther modest decline in ’10 seems unavoidable. The in Houston?

Partnership expects this loss to run to 5,500 jobs, or

Houston MSA Job Change by Industry 2008-2010

3.1 percent, despite a slight uptick in heavy and 10

civil engineering construction. 5

0

-5

International trade: Unfortunately, the industry -10

definitions used by the Bureau of Labor Statistics to -15

Net Change (000)

-20

tally employment data don’t permit us to isolate in- -25

Arts, Entertain & Rec

Wholesale Trade

Retail Trade

Transp, Whsng & Util

Prof& Business Svcs

Educational Svcs

Lodging & Food Svcs

Mining & Logging

Construction

Information

Finance & Insurance

Health & Soc Assist

Other Services

Manufacturing

Real Est & Rent/Lease

Government

ternational trade. We gain some insight to what’s

going on by looking at wholesale trade and the resi-

dual category in transportation and warehousing

that includes warehousing, waterborne 2008 2009 2010

transportation and rail transportation as primary

components. Manufacturing declines for a second consecutive

As developed economies worldwide fell into reces- year in this forecast—but by only 2.1 percent, ver-

sion, demand for goods declined, and international sus 7.5 percent this year. About three-fourths of the

trade shipments declined precipitously. Oil consti- 4,800 manufacturing jobs expected to be lost in ’10

tutes a sufficiently large portion of imports to the are in fabricated metal products manufacturing,

December 14, 2009 ©2009, Greater Houston Partnership Page 4

- 5. HOUSTON—2010 EMPLOYMENT FORECAST

which is adversely affected by dwindling construc- Accommodation and food services ekes out a net

tion activity. gain of 0.5 percent in ’10. The year is a difficult one

for the lodging industry, but an improving regional

Retail trade, which will have lost a bit more than

economy moving toward ’11 should bolster restau-

10,000 jobs this year, nearly breaks even in ’10,

rants and other food services.

shedding just 400 jobs—less than it lost in ’08. This

forecast anticipates rising consumer confidence as Government should add 4,100 jobs—a 1.1 percent

job losses abate in the first half of ’10 and gains ap- increase—as 4,800 jobs added in public education

pear in the second half. An expanding consumer more than offset a modest decline in other govern-

market adds support for retail trade employment: mental functions. The gains in public education are

population growth in this decade has consistently predicated not only on population growth, but also

exceeded 100,000 persons per year in the 10-county on the rise in demand for additional education and/

metropolitan area. or vocational training that typically occurs in a re-

cession, when laid-off workers and entrants to the

Professional, scientific and technical services,

work force who can’t find employment seek to up-

which saw employment decline about 3.3 percent

grade their skills. The forecast for government also

this year, ends next year almost even as a continued

recognizes that many political jurisdictions are see-

decline into summer is reversed. This sector is bu-

ing reduced revenues from property and sales taxes.

oyed by a second year of 4.0 percent growth in

computer systems design and a 2.1 percent gain in One of many uncertainties that could alter this fore-

legal services. Architectural and engineering cast is the extent of additional federal actions to

services, however, are expected to decline 1.9 blunt the inroads made by this recession. The antici-

percent after a 9.8 percent drop this year, hurt by pated expansion in public education in this forecast

both the continued decline in construction activity assumes that funding will be available—something

and the less-than-robust outlook for upstream ener- that may depend on federal assistance. Elsewhere,

gy. however, this forecast does not assume any addi-

tional federal intervention. A wide range of policy

Administrative and support services is expected to

actions that have been discussed in recent weeks

reverse this year’s loss of 5,200 jobs with a net gain

could provide greater gains or smaller losses than

of 5,400. A solid advance in employment

this forecast anticipates across a wide range of in-

services—a harbinger of growth in permanent

dustries.

jobs—more than offsets mild declines in other

fields, including services to buildings. Hiring The outlook for ’10 isn’t nearly so dire as was the

temporary workers is frequently management’s first forecast for ’09. We see job losses here continuing

response when demands from an improving well into ’10, but at moderating rates. By the time

economy outstrip the production capacity of current we reach the final quarter of next year, employ-

staff. ment—a lagging indicator—should be on the up-

swing. Houston’s economy is fundamentally sound,

Health care and social assistance isn’t immune to and it’s well-positioned to return to vigorous

recessionary pressures, but its dominant health care growth as recession turns to growth across the

component also is driven by the growth and aging globe.

of the population it serves. This forecast sees job

growth slowing from 2.0 percent this year to 1.6

percent next year. Revenue flows constrain growth

in health care, and demand for social services eases

in the latter part of the year.

December 14, 2009 ©2009, Greater Houston Partnership Page 5

- 6. 2010 NONFARM PAYROLL EMPLOYMENT FORECAST

HOUSTON-SUGAR LAND-BAYTOWN MSA

Employment (000) Change During Year (000) Pct Change During Year

12/08 12/09 12/10 '08 '09 '10 '08 '09 '10

Total Nonfarm Payroll Jobs 2628.1 2535.2 2537.1 22.5 -92.9 1.9 0.9 -3.5 0.1

Total Private 2260.6 2161.4 2159.2 19.0 -99.2 -2.1 0.8 -4.4 -0.1

Goods Producing 541.7 496.7 484.0 14.5 -45.0 -12.7 2.8 -8.3 -2.6

Services Providing 2086.4 2038.6 2053.1 8.0 -47.8 14.6 0.4 -2.3 0.7

Natural Resources & Mining 93.7 90.3 88.0 7.6 -3.4 -2.3 8.8 -3.6 -2.6

Construction 203.9 180.6 175.1 1.1 -23.3 -5.5 0.5 -11.4 -3.1

Manufacturing 244.1 225.7 220.9 5.8 -18.4 -4.8 2.4 -7.5 -2.1

Wholesale Trade 140.5 124.1 129.3 3.4 -16.4 5.2 2.5 -11.7 4.2

Retail Trade 277.4 267.2 266.8 -0.7 -10.2 -0.4 -0.3 -3.7 -0.1

Utilities 16.1 15.9 15.8 0.5 -0.2 -0.1 3.2 -1.2 -0.5

Transportation & Warehousing 111.1 100.3 103.5 -2.4 -10.8 3.2 -2.1 -9.7 3.2

Information 36.1 34.3 32.9 -0.7 -1.8 -1.4 -1.9 -5.1 -4.0

Finance & Insurance 90.8 88.4 86.7 -1.4 -2.4 -1.7 -1.5 -2.6 -1.9

Real Estate & Rental and Leasing 53.1 52.2 51.9 0 -0.9 -0.3 0.0 -1.7 -0.6

Professional & Business Services 384.7 367.5 367.4 2.9 -17.2 -0.1 0.8 -4.5 0.0

Educational Services 41.3 42.1 43.0 0.4 0.8 1.0 1.0 1.9 2.3

Health Care & Social Assistance 248.6 253.7 257.7 5.3 5.1 4.0 2.2 2.0 1.6

Arts, Entertainment & Recreation 24.9 26.1 27.9 -0.2 1.2 1.8 -0.8 4.8 7.0

Accommodation & Food Services 204.1 205.5 206.6 -1.2 1.4 1.1 -0.6 0.7 0.5

Other Services 90.2 87.5 85.7 -1.4 -2.7 -1.8 -1.5 -3.0 -2.1

Government 367.5 373.8 377.9 3.5 6.3 4.1 1.0 1.7 1.1

Sources: Estimates 12/07-10/09, Texas Workforce Commission; forecasts 11/09-12/10, Greater Houston Partnership

____________________________________

The Greater Houston Partnership is the primary advocate of Houston’s business community

and is dedicated to building regional economic prosperity.

Visit the Greater Houston Partnership on the World Wide Web at www.houston.org.

Contact us by phone at 713-844-3600.

December 14, 2009 ©2009, Greater Houston Partnership Page 6