Acct 504 final exam

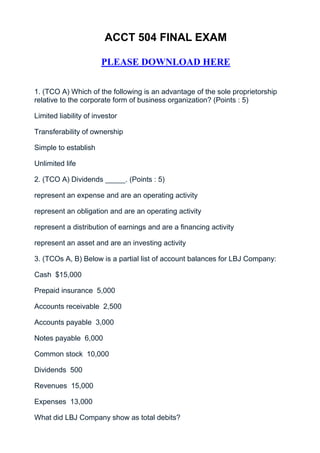

- 1. ACCT 504 FINAL EXAM PLEASE DOWNLOAD HERE 1. (TCO A) Which of the following is an advantage of the sole proprietorship relative to the corporate form of business organization? (Points : 5) Limited liability of investor Transferability of ownership Simple to establish Unlimited life 2. (TCO A) Dividends _____. (Points : 5) represent an expense and are an operating activity represent an obligation and are an operating activity represent a distribution of earnings and are a financing activity represent an asset and are an investing activity 3. (TCOs A, B) Below is a partial list of account balances for LBJ Company: Cash $15,000 Prepaid insurance 5,000 Accounts receivable 2,500 Accounts payable 3,000 Notes payable 6,000 Common stock 10,000 Dividends 500 Revenues 15,000 Expenses 13,000 What did LBJ Company show as total debits?

- 2. (Points : 5) $34,000 $36,000 $70,000 $31,000 4. (TCOs B, E) Why is the accrual basis of accounting preferred by GAAP? (Points : 5) The Accrual basis is easier to use. The Accrual basis is also preferred by the Internal Revenue Service. The Accrual basis complies with the revenue recognition and matching principles. The Accrual basis requires fewer accounting resources. 5. (TCO D) In a period of increasing prices, which inventory cost flow assumption will result in the highest amount of net income?(Points : 5) LIFO The average cost method FIFO Income tax expense for the period will be the same under all assumptions. 6. (TCOs A, E) Equipment was purchased for $75,000 on January 1, 2011. Freight charges of $3,200 were incurred and there was a cost of $6,000 for installation. It is estimated the equipment will have a $12,000 salvage value at the end of its 5-year useful life. Depreciation expense for 2011 using the straight-line method will be _____. (Points : 5) $13,800 $14,440 $12,600 $13,240

- 3. 7. (TCO D,G) Payne Corporation issues 100 twenty-year, 6%, $1,000 bonds dated July 1, 2010, at 94. The journal entry to record the issuance will show a _____. (Points : 5) debit to Cash of $100,000 credit to Bonds Payable of $94,000 credit to Premium on Bonds Payable of $4,000 debit to Discount on Bonds Payable of $6,000 8. (TCO C) Accounts receivable arising from sales to customers amounted to $80,000 and $100,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $1,000,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is _____. (Points : 5) $20,000 $1,020,000 $1,000,000 $980,000 9. (TCO F) If you are making comparisons within a company to detect changes in financial relationships and significant trends, you are performing what type of analysis? (Points : 5) Industry averages analysis Intercompany analysis Common-size analysis Intracompany analysis 10. (TCO F) The formula for performing horizontal analysis is _____. (Points : 5) (Current Year Amount minus Base Year Amount) divided by Current Year Amount Base Year Amount divided by Current Year Amount Current Year Amount minus Base Year Amount (Current Year Amount minus Base Year Amount) divided by Base Year Amount

- 4. 11. (TCO F) Horizontal analysis is a technique for evaluating a series of financial statement data over a period of time _____.(Points : 5) that has been arranged from the highest number to the lowest number that has been arranged from the lowest number to the highest number to determine which numbers are in error to determine the amount and/or percentage increase or decrease that has taken place 12. (TCO F) A common measure of liquidity is _____. (Points : 5) debt-to-total-assets ratio cash debt coverage free cash flow working capital 13. (TCO F) Short-term creditors would be most interested in which of the following ratios? (Points : 5) Average collection period Times interest earned Cash debt coverage Free cash flow 14. (TCO G) To calculate the market value of a bond, we need to _____. (Points : 5) multiply the bond price times the interest rate calculate the present value of the principal only calculate the present value of the interest only calculate the present value of both the principal and 1. (TCO A) Use the following partial financial statement information below to calculate the liquidity and profitability ratios. This information can be used to correctly solve each of the ratios below.

- 5. Average common shares outstanding 35,000 Current liabilities $25,000 Capital expenditures $20,000 Net income $50,000 Cash provided by operations $77,000 Net sales $100,000 Preferred stock dividends paid $30,000 Total liabilities $50,000 Current assets $20,000 Total assets $80,000 Instructions: Compute the following. a) Current ratio b) Working capital c) Earnings per share d) Debt-to-total-assets ratio e) Free cash flow To earn full credit, you must show the formula you are using, show your computations, and explain the meaning of each of your ratio results. (Points : 30) Metric Formula Used Figure Indication Current Ratio (Current Assets)/(Current Liabilities) 0.8x This means that the firm will have a hard time paying off its current liabilities if the need arises. Working Capital Current Assets-Current Liabilities -$5,000 This means that the firm cannot continue its operations without facing many obligations. Earnings per share (Net Income-Preferred Dividends)/(Number of Common Shares) $0.57 a share This means that investors are earning $0.57 per share owned. Debt to total assets ratio ((Total Debt))/(Total Assets) 0.625 This means the company’s capital structure relies so much on debt FCF Cash by operations-Capital Exp. $57,000 This tells us that the company has $57,000 cash to be used. 2. (TCO D) The Oxford Company has budgeted sales revenues as follows. Oct Nov Dec Credit sales $120,000 $96,000 $72,000

- 6. Cash sales 72,000 204,000 156,000 Total sales 192,000 300,000 228,000 Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit, with 60% paid in the month of purchase and 40% in the month following purchase. Budgeted inventory purchases are $260,000 in October, $180,000 in November, and $84,000 in December. Other budgeted cash receipts include (a) the sale of plant assets for $49,400 in November and (b) the sale of new common stock for $67,400 in December. Other budgeted cash disbursements include (a) operating expenses of $27,000 each month, (b) selling and administrative expenses of $50,000 each month, (c) dividends of $76,000 to be paid in November, and (d) purchase of equipment for $24,000 cash in December. The company has a cash balance of $40,000 at the beginning of December and wishes to maintain a minimum cash balance of $40,000 at the end of each month. An open line of credit is available at the bank and carries an annual interest rate of 12%. Assume that all borrowing is done on the first day of the month in which financing is needed and that all repayments are made on the last day of the month in which excess cash is available. Also assume that $14,000 of financing was obtained on November 1. Requirements: Use this information to prepare a schedule of expected cash payments for purchases of inventory for the months of November and December only. This question does not require creation of an entire cash budget so please only create the schedule that is asked for in the question because otherwise you will be wasting valuable time. (Points : 30) Nov Dec Beginning Cash Balance $32,000 $40,000 Cash Receipts: Cash sales $204,000 $156,000 Collection of Sales $105,600 $81,600 Sale of Plant $49,400 $0 Sale of Stocks $0 $67,400

- 7. Cash Disbursements: Payment of Purchases ($212,000) ($122,400) Operating Expenses ($27,000) ($27,000) S&A Expenses ($50,000) ($50,000) Dividends ($76,000) $0 Equipment Purchase $0 ($24,000) Interest Payments $0 ($1,680) Borrowing $14,000 $0 Ending Balance $40,000 $119,920 3. (TCOs B, E) The following items are taken from the financial statements of Lansing Company for 2010. Accounts payable $16,500 Accounts receivable 25,500 Accumulated depreciation 12,600 Bonds payable 35,000 Cash 55,000 Common stock 75,000 Cost of goods sold 53,000 Depreciation expense 6,300 Dividends 5,300 Equipment 35,000 Interest expense 4,300 Patents 6,500 Retained earnings, January 1 80,000 Salaries expense 42,000

- 8. Sales revenue 115,000 Supplies 3,500 Instructions: Prepare an income statement and a retained earnings statement for Lansing Company. (Points : 30) Lansing Company Income Statement Sales Revenue $115,000 Cost of Goods Sold ($53,000) Gross Margin $62,000 Salaries Expense ($42,000) Depreciation Expense ($6,300) Interest Expense ($4,300) Net Income $9,400 Lansing Company Statement of Retained Earnings Beginning Retained Earnings $80,000 Add: Net Income $9,400 Less: Dividends Paid ($5,300) Ending Retained Earnings $89,400 4. (TCO D) Your friend James has hired you to evaluate the following internal control procedures. a) Explain to your friend whether each of the numbered items below is an internal control strength or weakness. You must also state which principle relates to each of the internal controls. b) For the weaknesses, you also need to state a recommendation for improvement. Everyone has access to the petty cash fund.

- 9. Cash register codes are assigned to each cashier. The treasurer is the only one allowed to sign checks. Supervisors count cash receipts daily. The treasurer approves of the purchases and makes the payment because he is familiar with the purchases. (Points : 30) Control Principle Type Everyone has access to the petty cash fund Proper authorization Weakness Cash register codes are assigned to each cashier. Segregation of duties Strength The treasurer is the only one allowed to sign checks. Proper Authorization Strength Supervisors count cash receipts daily. Independent checks Strength The treasurer approves of the purchases and makes the payment because he is familiar with the purchases. Proper Authorization Weakness b.) For the weaknesses, it is wise to limit the access to the petty cash funds, and instead designate a number of authorized people to have access into it. If everyone has access to the petty cash fund, then there is a high risk of running into fraud or theft. Also, it is not an adequate reason to let the treasurer approve the purchases just because he is familiar with them. A thorough analysis should be taken into consideration, and the treasurer should be accompanied with another authorized employee with regards to making approvals of this kind. 5. (TCOs D, E) Please prepare the following journal entries. Indicate which account should be debited with the abbreviation DR in front of the account name and which account should be credited with the abbreviation CR in front of the account name along with the dollar amount of the debit and credit. a) Investors invested $150,000 in exchange for 10,000 shares of common stock. b) Company made payment on account for $10,000 c) Company received $15,000 for services not yet performed d) Company purchased $7,500 worth of equipment e) Company billed $5,000 for services performed (Points : 30)

- 10. Cash DR $150 ,000 Common Stock CR $150,000 Accounts Payable DR $10,000 Cash CR $10,000 Cash DR $15,000 Unearned Revenue CR $15,000 Equipment DR $7,500 Cash CR $7,500 Accounts Receivables DR $5,000 Service Revenue CR $5,000 6. (TCO C) Please indicate which section of the statement of cash flows should contain each of the following items and whether each item would result in an inflow or outflow of cash. The sections are Operating, Investing, and Financing. a) Depreciation of equipment b) Increase in accounts payable c) Sold a building at book value d) Paymentofdividends e) Increase in inventory (Points : 30) Event Section Result Depreciation of equipment Operating Inflow Increase in accounts payable Operating Inflow Sold a building at book value Investing Inflow Payment of dividends Financing Outflow Increase in inventory Operating Outflow