Bba603 role of international financial institutions

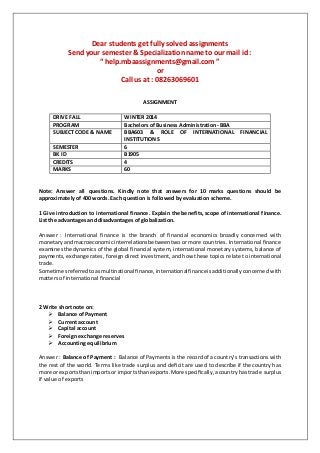

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 ASSIGNMENT DRIVE FALL WINTER 2014 PROGRAM Bachelors of Business Administration- BBA SUBJECT CODE & NAME BBA603 & ROLE OF INTERNATIONAL FINANCIAL INSTITUTIONS SEMESTER 6 BK ID B1905 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. 1 Give introduction to international finance. Explain the benefits, scope of international finance. List the advantages and disadvantages of globalization. Answer : International finance is the branch of financial economics broadly concerned with monetaryandmacroeconomicinterrelationsbetweentwo or more countries. International finance examinesthe dynamics of the global financial system, international monetary systems, balance of payments,exchange rates, foreign direct investment, and how these topics relate to international trade. Sometimesreferredtoasmultinational finance,internationalfinanceisadditionally concerned with matters of international financial 2 Write short note on: Balance of Payment Current account Capital account Foreign exchange reserves Accounting equilibrium Answer : Balance of Payment : Balance of Payments is the record of a country’s transactions with the rest of the world. Terms like trade surplus and deficit are used to describe if the country has more or exportsthanimportsor importsthanexports.More specifically,acountry has trade surplus if value of exports

- 2. Current account : The current account consists of the balance of trade, net factor income and net cash transfers. The current account balance is one of two major measures of a country's foreign trade Capital account : A national account that shows the net change in asset ownership for a nation.The capital account isthe net result of public and private international investments flowinginandout of a country. A capital account deficit shows that more money is flowing out of Foreign exchange reserves : Deposits of a foreign currency held by a central bank. Holding the currenciesof othercountriesasassetsallow governmentstokeeptheircurrenciesstable and reduce the effect of Accounting equilibrium:the state of balance inthe economy where supply equals demand or a country’s balance of payments is neither in deficit nor in excess. The state in which Q.3 Explain cash-in-advance and write the process of issuing letter of credit and different types of letter of credit. Answer : Cash in Advance The cash-in-advance constraint (sometimes known as the Clower constraint after American economistRobertClower)[1] is an idea used in economic theory to capture monetary phenomena. In the mostbasic economicmodels(suchasthe Walrasmodel orthe Arrow–Debreu model) there is no role for money, as these models are not sufficiently detailed to consider how people pay for goods, other than to say Q. 4 Write down the differences between GATT and WTO. Explain the problems and achievements of GATT & WTO. Answer: Difference between WTO and GATT:- The World Trade Organization is not a simple extension of GATT; on the contrary, it completely replacesitspredecessorandhasa verydifferentcharacter.Among the principal differences are the following: The GATT wasa setof rules,amultilateral agreement,withnoinstitutional foundation, only a small associated secretariat which had its origins in the attempt to establish an International Trade Organization in the 1940s. The WTO is 5 Explain the main functions of banks. Write down the lending activities and lending policies of bank.

- 3. Answer: Functions of banks A. Primary Functions of Banks ↓ The primaryfunctionsof a bank are also knownasbankingfunctions.Theyare the main functions of a bank. These primary functions of banks are explained below. 1. Accepting Deposits Q.6 Write the objectives of global financial regulation. Explain the key features of Basel III and its impact. Answer: Aims of regulation The objectives of financial regulators are usually: Market confidence – to maintain confidence in the financial system Financial stability – contributing to the protection and enhancement of stability of the financial system Consumer protection – securing the appropriate degree of protection for consumers. Reduction of financial crime – reducing the extent to which it is possible for a regulated business to be used for a purpose con Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601