Fully solved assignments for banking operations subject

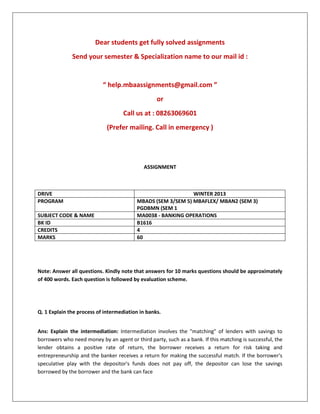

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ) ASSIGNMENT DRIVE WINTER 2013 PROGRAM MBADS (SEM 3/SEM 5) MBAFLEX/ MBAN2 (SEM 3) PGDBMN (SEM 1 SUBJECT CODE & NAME MA0038 - BANKING OPERATIONS BK ID B1616 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q. 1 Explain the process of intermediation in banks. Ans: Explain the intermediation: Intermediation involves the "matching" of lenders with savings to borrowers who need money by an agent or third party, such as a bank. If this matching is successful, the lender obtains a positive rate of return, the borrower receives a return for risk taking and entrepreneurship and the banker receives a return for making the successful match. If the borrower's speculative play with the depositor's funds does not pay off, the depositor can lose the savings borrowed by the borrower and the bank can face

- 2. Q. 2 Analyse the rate of interest paid on savings bank deposit and current account deposit of one public sector bank and one private sector bank. Discuss the factors that has an impact on pricing of deposit related services. Ans: Analysis of interest rates: The Congressional Budget Office has been busy on its blog lately, posting both snapshots of federal programs and also publishing responses to questions they have received from Members of Congress at hearings. Their latest post from director Doug Elmendorf is the latter variety, showing the sensitivity of budget projections to changes in interest rates. Of course, interest rates are a big factor in a government's interest burden. As an example, the low interest rates the federal government currently faces allow them to pay the same Q.3 Discuss Asset Liability Management strategy and explain the ALM perspectives. Ans: Asset Liability Management strategy: Initially pioneered by Anglo-Saxon financial institutions during the 1970s as interest rates became increasingly volatile, asset and liability management (often abbreviated ALM) is the practice of managing risks that arise due to mismatches between the assets and liabilities. The process is at the crossroads between risk management and strategic planning as is not just offering solution to mitigate or hedge the risks arising from the interaction of assets and liabilities but is conducting the bank from a long-term perspective ( Q.4 Analyse how factoring is different from forfaiting and bill discounting. Ans: Explain Factoring forfeiting and bill discounting Factoring is a financial transaction in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount.A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter.

- 3. Q.5 Trace the history of RBS bank (merger story). Where is its head office located? List out the locations of RBS bank branches in India. Ans: History: The Royal Bank of Scotland Group is one of the world's leading financial services providers, and one of the oldest banks in the UK. Following the takeover of National Westminster Bank in 2000, the Group's global business has continued to grow. In addition to a strong UK presence, we have offices in Europe, the USA and Asia. By the end of 2002, we were the second largest bank in Europe and the fifth largest in the world by market capitalisation. In the UK, the RBS branch network Q. 6 Differentiate between NEFT and RTGS as well as SWIFT Ans: NEFT National Electronic Funds Transfer (NEFT) NEFT is electronic funds transfer system, which facilitates transfer of funds to other bank accounts in over 63000 bank branches across the country. This is a simple, secure, safe, fastest and cost effective way to transfer funds especially for Retail remittances. FEATURES & BENEFITS Customers can remit any amount using NEFT Customer intending to remit money through NEFT has to furnish the following particulars: Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or

- 4. Call us at : 08263069601 (Prefer mailing. Call in emergency )