Marketing to the Post-Recession Consumers

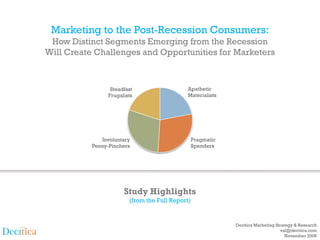

- 1. Marketing to the Post-Recession Consumers: How Distinct Segments Emerging from the Recession Will Create Challenges and Opportunities for Marketers Steadfast Apathetic Frugalists Materialists Involuntary Pragmatic Penny-Pinchers Spenders Study Highlights (from the Full Report) Decitica Marketing Strategy & Research val@decitica.com November 2009

- 2. What is this Study About? This research fills a major gap in marketers’ understanding of how the recession is shaping consumer behavior. We believe that marketing in the post-recession world needs a new lens to reflect the many differences in the way consumers have internalized the recession experience. Specifically, this research by Decitica concludes: 1. The effects of the Great Recession on consumer behavior are so profound that many of the assumptions underpinning consumer segmentation are no longer valid; and 2. Marketing strategies that do not fully recognize the diversity of consumers’ recession experiences won’t have the desired potency in the post-recession world. It is undeniable that this recession has shaken the bedrock of American consumerism. Many have accepted this radical change as the “new normal,” and not just a cyclical phenomenon. With consumer sentiment oscillating from mildly encouraging to disappointing, the trillion dollar question remains: When will the American consumer loosen the reins on restraint and ratchet up spending to meaningful levels? Experts posit that the household deleveraging process is far from complete. Adjustment of household balance sheets, which had begun in earnest in the thick of the recession, continues apace with nary a sign of ending anytime soon. With this backdrop, the debate continues whether the American consumers are so indelibly scarred by the recession that they have forever abandoned the profligate spending habits of the past in favor a more restrained approach. This study goes beyond superficial measures of consumer sentiment. Using data from a proprietary survey, this research not only concludes that the recession has caused a profound, deep-rooted change in consumers’ spending habits but also that there are four distinct consumer segments emerging from the recession. We provide highlights of our findings in the following pages. 2

- 3. Table of Contents Survey Methodology and Respondent Profile………..…………….……….... 4 Four Segments Emerging from the Recession……………….……………….. 5 1. Steadfast Frugalists……………………………….….…….……….…. 6 2. Involuntary Penny-Pinchers……………….……..…….….……….… 7 3. Pragmatic Spenders……………………………..……….……..…….. 8 4, Apathetic Materialists……..……………….…..…….…………….…. 9 Differences Across Segments, and Income, Gender and Age Groups Trading Down and Seeking Deals………….…………………………… 10 Pre-Purchase Deliberations…………………………….……………….. 12 Self-Efficacy in Practicing Restraint……………………………………. 14 Appreciating Thrift……………………………………………….………. 16 Permanent Change in Buying Behavior……………………………….. 18 Price Dominance and Diminished Brand Equity…………………….. 20 Decline in Hedonic Shopping……………….………………………….. 22 Decline in Impulse Buying…………………….………………………… 24 Psychological Effects from the Recession…………………………….. 26 What is in the Full Report?……………………………………………………….. 28 About Decitica………………………………………………………………...…… 29 3

- 4. Survey Methodology and Respondent Profile ◊ The data for the study were Gender Total Sample 1,055 collected through an online Age survey conducted August 5-12, 2009. OTX, a leading provider 16% of online-based research, 29% executed the survey on Decitica’s behalf. 48% ◊ The total sample of 1,055 survey 52% 21% respondents consisted of various demographic groups spanning gender, age (21-70), 18% income and region. 16% ◊ There were slightly more Women Men 21-29 30-39 40-49 50-59 60-70 women (52%) than men in the sample. ◊ Three in ten were people in Household Income Region their 20’s. 5% 8% ◊ 36% were from households with 20% 11% Below $25,000 22% income $100,000 or more. 18% $25,000-$49,999 ◊ Data were weighted on $50,000-$74,999 household income (HHI) using $75,000-$99,999 indicators from the Federal 20% $100,000-$149,999 Reserve’s Survey of Consumer $150,000-$199,999 23% Finances (2007). 24% $200,000 or more 35% 13% Northeast Midwest South West 4

- 5. Four Distinct Consumer Segments Emerging from the Recession ◊ Our consumer segmentation approach is based on the premise that the best way to predict future behavior is to analyze: (a) Howintensely a particular activity is already being practiced (greater the frequency, greater the probability of repeating that action in the future), (b) How much satisfaction is derived from this activity (greater the satisfaction, greater the likelihood of sticking to that behavior), and (c) How confident someone is in practicing desired behaviors (higher the confidence level, higher the odds of being successful in accomplishing the goal) . ◊ This study gathered extensive data on the frequency and satisfaction with twenty nine different purchase and consumption activities and the self-efficacy (i.e., consumers’ beliefs about their abilities to achieve certain outcomes) associated with various spending and saving strategies. ◊ Subjecting these data into Cluster Analysis, we identified four distinct segments emerging from the recession. They are: 1. Steadfast Frugalists, 2. Involuntary Penny-Pinchers, 3. Pragmatic Spenders, and 4. Apathetic Materialists Segment Size 20% 22% Apathetic Materialists Pragmatic Spenders Involuntary Penny-Pinchers 29% Steadfast Frugalists 29% ◊ The following pages describe these segments in some detail and provide highlights of data available in the full report. 5

- 6. 1. Steadfast Frugalists Main Characteristics: Gender Percent Below and Above $75,000 ◊ Size 20% in the population. HHI 30% ◊ 6 in 10 are women. 25% 22% ◊ Composed of people from all age groups; however, fewer 20% 18% 41% from Gen X and Gen Y. 15% ◊ Steadfast Frugalists are the 59% most disciplined in their 10% behaviors and seriously Below $75,000 $75,000 or More committed to self-restraint. HHI HHI ◊ It is likely that many of these Women Men individuals deemed themselves tightwads even before the recession. Percent in Each Age Group Percent in Each Geographic o 29% of individuals in this Region group considered themselves 30% 27% tightwads in this survey. 25% 25% 24% ◊ Marketers will find this group to 21% 21% 21% be the most challenging. 20% 20% 16% 18% 18% 15% 12% 10% 15% 21-29 30-39 40-49 50-59 60-70 Northeast Midwest South West Age Region 6

- 7. 2. Involuntary Penny-Pinchers Main Characteristics: Gender Percent Below and Above $75,000 HHI ◊ Size 29% in the population. 40% 36% ◊ 6 in 10 are women. 35% ◊ Over-represented by people in 30% their 30s and 40s. 39% 25% 22% ◊ Involuntary Penny-Pinchers are 20% the most severely affected – 15% 61% financially and emotionally -- by 10% the recession. Below $75,000 $75,000 or More HHI HHI ◊ Their new-found frugality for the most part has been forced Women Men upon them. Half have not saved any money for emergencies. ◊ Spending for a sizeable Percent in Each Age Group Percent in Each Geographic 38% Region proportion (38%) in this group 40% 37% 35% 34% exceeded their income last year, indicating that they were 29% 30% 30% not that disciplined to begin 26% 30% with. 26% 20% 18% 24% ◊ Marketers will find this group to 25% be quite challenging to influence mainly due to their 10% 20% lower/diminished capacity to 21-29 30-39 40-49 50-59 60-70 Northeast Midwest South West spend. Age Region 7

- 8. 3. Pragmatic Spenders Main Characteristics: Gender Percent in the Below and Above ◊ Size 29% in the population. $75,000 HHI ◊ 6 in 10 are men. 50% 40% 37% ◊ Over-represented by people in their 60s, and from the 42% 30% Northeast and West. 22% 20% ◊ Over a third of the people with 58% greater than $75,000 HHI are in 10% this group. Below $75,000 or $75,000 HHI More HHI ◊ Pragmatic Spenders have the greatest capacity – both Women Men financial and psychological – to willfully resurrect their past spending patterns. Percent in Each Age Group Percent in Each Geographic Region ◊ Their approach to spending is 60% tempered with caution; they 51% 35% 33% 50% 32% have cut back and are engaging 30% 28% in thrift like others but seem 40% 35% 26% less troubled by the recession. 29% 25% 30% ◊ Pragmatic Spenders will be the 20% 21% 20% 20% most attractive to marketers given their above-average 10% 15% financial wherewithal. 21-29 30-39 40-49 50-59 60-70 Northeast Midwest South West Age Region 8

- 9. 4. Apathetic Materialists Main Characteristics: Gender Percent Below and Above $75,000 ◊ Size 22% in the population. HHI 30% ◊ Slightly more men than women. 24% 25% ◊ Over-represented by people in 21% their 20s (Gen Y). 20% 45% ◊ Apathetic Materialists are less 55% 15% perturbed by the recession. They are the least changed in 10% terms of their spending habits Below $75,000 $75,000 or More and future intentions. HHI HHI ◊ It is likely that their relative Women Men indifference springs from their life stage – more younger, single people with limited Percent in Each Age Group Percent in Each Geographic Region disposable income at the 39% moment. 25% 24% 35% 23% 23% ◊ Apathetic Materialists will be an attractive target for youth- 25% 23% 21% oriented marketers. 20% 14% 15% 11% 10% 5% 15% 21-29 30-39 40-49 50-59 60-70 Northeast Midwest South West Age Region 9

- 10. Trading Down and Seeking Deals ◊ Steadfast Frugalists not only Buying on Sale or Using Coupons and Discounts engage in coupon-clipping and deal-seeking behaviors with 87% Steadfast Frugalists greater frequency but also do 71% so with considerable enthusiasm. 37% Involuntary Penny-Pinchers 55% o 9 in 10 find buying on sale or using coupons and discounts to 34% Pragmatic Spenders be satisfying. 20% % Who Find this Behavior Satisfying ◊ Involuntary Penny-Pinchers, 11% % Who Always Practice this Behavior forced to adopt frugality, shop Apathetic Materialists 12% for discounts and buy store labels quite extensively, but not 0% 20% 40% 60% 80% many of them get pleasure from these activities. Buying Store or Generic Brands o Less than 1 in 5 find buying store or generic labels to be satisfying. 59% Steadfast Frugalists 53% ◊ Pragmatic Spenders and Apathetic Materialists, perhaps 17% Involuntary Penny-Pinchers 56% motivated by different factors, get the least satisfaction from 15% Pragmatic Spenders trading down and clipping 8% coupons. 6% Apathetic Materialists 7% 0% 20% 40% 60% 10

- 11. Trading Down and Seeking Deals Income, Gender and Age Differences ◊ As the charts on the right Buying on Sale or Using Coupons and Discounts clearly indicate, gender is a 60% % Who Find this Behavior Satisfying % Who Always Practice this Behavior 54% significant determinant of 53% satisfaction associated with 55% 50% deal-seeking behaviors. 42% 43% 42% 40% o More than half of 40+ women 40% 44% find buying on sale or using 38% 40% 30% coupons/discounts to be satisfying. 30% 24% 34% o Younger males (below 30) 26% 24% 26% irrespective of income and 20% older males with HHI >$75,000 <75K, <75K, <$75K, <$75K, >75K, >75K, >$75K, >$75K, are the least prone to buy on Males, 21- Males, 40+ Females, Females, Males, 21- Males, 40+ Females, Females, sales promotions. 39 21-39 40+ 39 21-39 40+ ◊ Trading down to store or generic labels, while practiced Buying Store or Generic Brands 50% with greater frequency in the 41% below $75,000 households, is a 37% 38% less satisfying experience 40% generally across all eight 27% groups. 30% 30% 22% 22% o Women in the below $75,000 28% 19% 20% 16% HHI bracket find greater 22% 22% satisfaction from buying store 18% 15% 10% 16% 11% or generic brands. <75K, <75K, <$75K, <$75K, >75K, >75K, >$75K, >$75K, Males, 21- Males, 40+ Females, Females, Males, 21- Males, 40+ Females, Females, 39 21-39 40+ 39 21-39 40+ Below $75,000 $75,000 or Above Household Income Household Income 11

- 12. Pre-Purchase Deliberations ◊ Steadfast Frugalists are meticulous in their pre- Comparing Prices Before Purchase purchase activities, seeking and processing more product and 85% price information, and arriving Steadfast Frugalists 78% at purchase decisions after careful deliberations. Involuntary Penny-Pinchers 32% 60% o Three-quarter of SFs always compare prices and half are Pragmatic Spenders 26% % Who Find this Behavior Satisfying taking a longer time to 23% % Who Always Practice this Behavior evaluate and decide Apathetic Materialists 6% purchases. 7% o Given these proclivities, this group will be the most averse 0% 20% 40% 60% 80% to impulse buying. Taking a Longer Time to Evaluate and Decide Purchase ◊ Involuntary Penny-Pinchers, while being more rational in their purchase processes, do Steadfast Frugalists 64% not derive much satisfaction 52% from them. 15% ◊ Pragmatic Spenders and Involuntary Penny-Pinchers 47% Apathetic Materialists do not exert too much effort in pre- 12% % Who Find this Behavior Satisfying Pragmatic Spenders purchase deliberations, thus 5% % Who Always Practice this Behavior providing greater opportunities 4% to marketers. Apathetic Materialists 9% 0% 20% 40% 60% 80% 12

- 13. Pre-Purchase Deliberations Income, Gender and Age Differences ◊ There is a negative correlation Comparing Prices Before Purchase between income and pre- purchase deliberations. % Who Find this Behavior Satisfying % Who Always Practice this Behavior 50% 49% ◊ Households with less than 48% 47% 45% 46% $75,000 (except men below 30) are comparing prices and 40% 41% taking a longer time to evaluate 38% 37% 38% 38% 35% 36% with greater frequency than 32% households with HHI more than 30% 29% 29% 29% $75,000. 25% 24% ◊ Nearly half the 40+ women with 22% HHI <$75,000 say they find the 20% experience of comparing <75K, <75K, <$75K, <$75K, >75K, >75K, >$75K, >$75K, prices to be rewarding. Males, 21- Males, 40+ Females, Females, Males, 21- Males, 40+ Females, Females, 39 21-39 40+ 39 21-39 40+ ◊ Women with HHI less than $75,000 are more deliberative Taking a Long Time to Evaluate and Decide Purchases 40% in their purchase process. 36% 35% 33% 30% 27% 27% 27% 26% 25% 24% 25% 22% 22% 20% 20% 19% 18% 15% 14% 12%11% 10% <75K, <75K, <$75K, <$75K, >75K, >75K, >$75K, >$75K, Males, 21- Males, 40+ Females, Females, Males, 21- Males, 40+ Females, Females, 39 21-39 40+ 39 21-39 40+ Below $75,000 $75,000 or Above Household Income Household Income 13

- 14. Self-Efficacy (Confidence in Practicing Restraint) ◊ What makes this research Percent Who are Highly Confident Percent Who are Highly Confident particularly unique is the in in Resisting the Temptation to Spend examination of consumers’ self- Controlling Spending Now and Worry Later efficacy in practicing spending 100% 87% 100% 87% restraint. (There is ample established research to show that 80% 69% 80% 73% individuals high in self-efficacy are more successful in 60% 60% 46% 42% implementing desired 40% 40% behaviors.) 20% 20% ◊ Self-efficacy is the belief in 4% 5% one’s abilities to successfully 0% 0% achieve certain outcomes. Percent Who are Highly Confident Percent Who are Highly Confident ◊ It is evident from the charts on in in Sticking to Budget this page that Steadfast Saving Money Frugalists and Pragmatic 100% Spenders are the most 80% 70% 82% 80% confident in controlling 60% 52% 59% spending, resisting the 60% temptation to spend now and 40% 34% worry later, save money and stick 40% to a budget. 18% 20% 20% ◊ Apathetic Materialists have the 5% 4% least confidence in successfully 0% 0% restraining themselves. Apathetic Materialists Involuntary Penny-Pinchers Pragmatic Spenders Steadfast Frugalists 14

- 15. Self-Efficacy (Confidence in Practicing Restraint) Income, Gender and Age Differences ◊ Age is positively correlated Percent Who are Highly Confident in Controlling Spending with self-efficacy in controlling 70% spending. 65% 60% 61% ◊ Both men and women 40 years 60% 57% 58% or older, irrespective of income, 55% are significantly more confident 50% 47% about restraining spending. 43% 45% 42% ◊ 40+ women with greater 40% 37% disposable income are the most 35% confident about resisting the 30% temptation to spend now and >$75K, <$75K, <75K, >75K, <75K, <$75K, >75K, >$75K, worry later, indicating they are Females, Females, Males, 21- Males, 21- Males, 40+ Females, Males, 40+ Females, more long-term focused. 21-39 21-39 39 39 40+ 40+ o This finding is not good news for marketers whose traditional Percent Who are Highly Confident in Resisting the Temptation to Spend audience are mainly boomer 80% Now and Worry Later women. 72% 70% 66% 67% 63% 60% 50% 41% 41% 43% 40% 37% 30% <75K, <$75K, >75K, >$75K, <$75K, >75K, <75K, >$75K, Males, 21- Females, Males, 21- Females, Females, Males, 40+ Males, 40+ Females, 39 21-39 39 21-39 40+ 40+ Below 40 Years 40 Years or Older 15

- 16. Appreciating Thrift ◊ As is common knowledge now, “This recession has made me appreciate the simple things in the Great Recession has 80% life.” 77% induced new attitudes towards thrift. 60% ◊ What is most interesting is the 60% variation in the internalization 45% of the recession experience 40% across the four segments we 31% have identified. 20% ◊ The intensity of the new Apathetic Pragmatic Involuntary Steadfast realization increases linearly Materialists Spenders Penny-Pinchers Frugalists from Apathetic Materialists to Steadfast Frugalists, with Pragmatic Spenders and Involuntary Penny-Pinchers in “I have begun to appreciate the benefits of thrifty living as a between. result of my experience during this recession.” ◊ Steadfast Frugalists are the most appreciative of what the 68% 70% recession has taught them: simplicity and thrifty living. 48% 50% 37% 30% 20% 10% Apathetic Pragmatic Involuntary Steadfast Materialists Spenders Penny-Pinchers Frugalists Percent who agree or strongly agree 16

- 17. Appreciating Thrift Income and Gender Differences ◊ The recession experience has “This recession has made me appreciate the simple things in led to greater appreciation of life.” thrifty living among women with HHI less than $75,000. 60% 58% ◊ More than half in this group say 55% 52% they appreciate the simple things in life and the benefits of 50% 49% 49% thrifty living. 45% 40% Males with HHI Females with HHI Males with HHI Females with HHI <$75,000 <$75,000 >$75,000 >$75,000 “I have begun to appreciate the benefits of thrifty living as a result of my experience during this recession.” 60% 55% 51% 50% 45% 42% 41% 40% 35% 35% 30% Males with HHI Females with HHI Males with HHI Females with HHI <$75,000 <$75,000 >$75,000 >$75,000 17

- 18. Permanent Change in Buying Behavior? ◊ When asked whether the “This recession has changed what and how I buy forever.” recession has permanently altered buying behavior, the strongest feelings were 70% expressed by Steadfast 52% 55% Frugalists and Involuntary 50% Penny-Pinchers. 28% o More than half in these two 30% 21% groups agreed or strongly agreed with this statement. 10% ◊ In terms of actions taken to Apathetic Pragmatic Spenders Involuntary Penny- Steadfast Frugalists control spending habits, two- Materialists Pinchers third of Pragmatic Spenders said they are already doing something about it. This is “I am not just thinking about controlling my spending habits, I compellingly evident from a am already doing something about it.” variety of data. 88% 79% 80% 67% 60% 40% 34% 20% Apathetic Pragmatic Spenders Involuntary Penny- Steadfast Frugalists Materialists Pinchers 18

- 19. Permanent Change in Buying Behavior? Income and Gender Differences ◊ Once again, income is “This recession has changed what and how I buy forever.” positively correlated with the degree of (stated) change in buying habits. 50% o 4 in 10 of both men and women 41% 42% with less than $75,000 HHI feel 40% the recession has changed 34% what and how they buy 31% forever. 30% ◊ In terms of putting the new attitudes into action, more 20% women (70%), irrespective of Males with HHI Females with HHI Males with HHI Females with HHI income level, profess to be <$75,000 <$75,000 >$75,000 >$75,000 doing something about controlling spending habits. “I am not just thinking about controlling my spending habits, I am already doing something about it.” 80% 70% 70% 70% 66% 61% 60% 50% Males with HHI Females with HHI Males with HHI Females with HHI <$75,000 <$75,000 >$75,000 >$75,000 19

- 20. Price Dominance and Diminished Brand Equity ◊ As marketers know too well, “I am the kind who first looks at price before I consider other price has become the dominant features.” consideration in the purchase of all kinds of products. 70% 66% ◊ What is of considerable 60% 52% significance is the fact that half 50% of Pragmatic Spenders are 40% looking at price before other 27% features and one-third say that 30% brand name products are not 20% 14% worth the extra price, heralding 10% what will likely be a long uphill 0% struggle by marketers to shift Apathetic Pragmatic Spenders Involuntary Penny- Steadfast Frugalists the focus away from price. Materialists Pinchers ◊ These new beliefs will continue to diminish the effects of brand “I have come to realize that brand name products are not worth communications by marketers. the extra price.” ◊ As is clear from the charts, 60% Involuntary Penny-Pinchers 49% 50% followed by Apathetic Materialists are the least price 40% 32% sensitive, but this may be little 30% consolation to consumer 20% 16% marketing firms. 10% 4% 0% Apathetic Pragmatic Spenders Involuntary Penny- Steadfast Frugalists Materialists Pinchers 20

- 21. Price Dominance and Diminished Brand Equity Income and Gender Differences ◊ Women below $75,000 HHI are “I am the kind who first looks at price before I consider other the most price sensitive, with features.” half of them saying that they look at price before other 60% 53% features. 50% ◊ Men above $75,000 HHI do not 37% pay as much attention to price 40% 33% and are more brand-conscious 30% than other groups. 21% 20% 10% Males with HHI Females with HHI Males with HHI Females with HHI <$75,000 <$75,000 >$75,000 >$75,000 “I have come to realize that brand name products are not worth the extra price.” 40% 30% 30% 24% 22% 20% 14% 10% Males with HHI Females with HHI Males with HHI Females with HHI <$75,000 <$75,000 >$75,000 >$75,000 21

- 22. Decline in Hedonic Shopping ◊ This research also examined changes in materialism, Getting a Lot of Pleasure from Buying Things compulsive buying and impulse 80% buying. * ◊ Overall, all four segments confess to getting less pleasure 70% 70% 69% from buying things now compared to the time before the recession. Also, what is 60% more telling is that fewer 58% anticipate this to be true one 55% year from now. 50% ◊ Apathetic Materialists continue to derive the most gratification 45% 45% from buying, but even this 43% 40% 39% group of consumers has shown 38% a declining interest in 35% materialistic consumption. 30% ◊ The steepest decline in hedonic shopping has been for 25% 25% Involuntary Penny-Pinchers. 20% True Before 2008 Has Been True Since Expect to be True One *The full report has more data based 2008 Year from Now on multiple measures of materialism, compulsive consumption and impulse Apathetic Materialists Involuntary Penny-Pinchers buying. Pragmatic Spenders Steadfast Frugalists 22

- 23. Decline in Hedonic Shopping Income and Gender Differences ◊ Pleasure from buying has Getting A Lot of Pleasure from Buying Things dropped significantly for all 70% four income-gender groups. ◊ The greatest decline has been for women with HHI below $75,000. 61% 60% 59% 57% 50% 49% 49% 49% 48% 46% 44% 40% 39% 34% 32% 30% True Before 2008 Has Been True Since Expect to be True One 2008 Year from Now Males with HHI <$75,000 Males with HHI >$75,000 Females with HHI <$75,000 Females with HHI >$75,000 23

- 24. Decline in Impulse Buying ◊ The drop in impulse buying is Buying on Impulse quite stark for all segments, particularly for Involuntary 70% Penny-Pinchers. 64% ◊ Apathetic Materialists continue 60% to be the most impulsive in their 61% purchases, with 40% saying they expect to buy on impulse 50% even one year from now. 49% 46% 46% ◊ Steadfast Frugalists, while not 40% that spontaneous to begin with, 40% have become even less so. 30% 30% 25% 25% 25% 20% 24% 18% 10% True Before 2008 Has Been True Since Expect to be True One 2008 Year from Now Apathetic Materialists Involuntary Penny-Pinchers Pragmatic Spenders Steadfast Frugalists 24

- 25. Decline in Impulse Buying Income and Gender Differences ◊ It is striking that the pattern of 70% Buying on Impulse change in impulse buying is uniform across all income-age groups. 59% 60% 56% 56% 50% 51% 40% 35% 33% 32% 30% 30% 32% 27% 28% 20% 21% 10% True Before 2008 Has Been True Since Expect to be True One 2008 Year from Now Males with HHI <$75,000 Males with HHI >$75,000 Females with HHI <$75,000 Females with HHI >$75,000 25

- 26. Psychological Effects from the Recession ◊ A fact that is clearly evident is 100% 100% Depressed Scared the psychological toll the recession has taken on many 77% 80% 80% Americans. However, what is 66% often overlooked are the 61% 58% 60% 57% 60% 55% 55% 60% 56% differences in the effects among 48% 46% various segments/groups. 40% 43% 38% 37% ◊ Among the four segments in our 40% 40% study, the Involuntary Penny- 25% Pinchers are enduring the 20% 20% greatest psychological distress. Frequently Felt Feel Depressed About Frequently Felt Feel Scared About the Depressed in the Last the Future Scared in the Last Future o 77% are “scared” and 87% are One Year One Year “worried” about their future. o This is not that much of a Stressed Worried surprise given the financial 100% 100% 87% burdens imposed on them due 81% 81% 81%80% to the recession. 54% of 80% 74% 80% 70% 70% 72% Involuntary Penny-Pinchers 69% 68%66% 64% experienced a loss of 10% or 59% 61% more in their income in the last 60% 53% 60% one year. ◊ On a relative basis, the 40% 40% Apathetic Materialists seem to have been the least affected 20% 20% emotionally. Frequently Felt Feel Stressed About Frequently Felt Feel Worried About The full report has data on 19 emotions – Stressed in the Last the Future Worried in the Last the Future One Year One Year both positive and negative. Apathetic Materialists Involuntary Penny-Pinchers Pragmatic Spenders Steadfast Frugalists 26

- 27. Psychological Effects from the Recession Income and Gender Differences ◊ By now it should be apparent Depressed Scared that the demographic group that has been the most severely affected and the most 80% 80% 68% fundamentally altered is women 64% with HHI less than $75,000. 59% 59% 60% 60% 52% 54% 50% 50% 50% o The charts to the right provide 45% further evidence as to why this 40%39% 39% 40% is so. 40% 33% 40% 30% ◊ There is a strong correlation between the level of 20% 20% psychological distress and the Frequently Felt Feel Depressed About Frequently Felt Feel Scared About the new attitudes and behaviors Depressed in the Last the Future Scared in the Last One Future One Year Year adopted by consumers to cope with the effects of the recession. Worried Stressed 79% 79% 81% 80% 73% 80% 72% 75% 70% 71% 67% 67%65% 68% 64% 65% 62% 58% 60% 60% 40% 40% 20% 20% Frequently Felt Feel Stressed About Frequently Felt Feel Worried About Stressed in the Last the Future Worried in the Last the Future One Year One Year Males with HHI <$75,000 Males with HHI >$75,000 Females with HHI <$75,000 Females with HHI >$75,000 27

- 28. What is in the Full Report? ◊ The full report, available for a fee, contains many more details, including data and analysis of the following topics. For more information, please contact val@decitica.com. 1. 18 attitudes dealing with the effects of the recession 2. Frequency of 29 behaviors practiced to cope with the recession 3. Satisfaction associated with 29 behaviors practiced to cope with the recession 4. Self-efficacy (i.e., self-confidence) associated with 15 spending and consumption restraint behaviors 5. Recession’s effects on consumers’ emotional state (i.e., 19 different emotions) 6. 15 measures of materialism, compulsive and impulsive buying 7. 10 measures of consumers’ thinking styles 8. 5 measures of maximizing-satisficing approach in buyer behavior 9. Changing role of price in purchase decisions, value-orientation, brand effects, pre-purchase activities, etc. 10. Expectations of future income 11. Detailed data on saving behaviors 12. Unique data on household budgeting practices 13. Triggers for increasing spending ◊ Analyses of the above data are available for each of the segments identified in this study and also for a variety of demographic groups based on gender, income level and age group. ◊ Custom statistical analysis and interpretation also provided for an additional fee. 28

- 29. Decitica Decitica is a marketing strategy and research firm. We specialize in discovering new insights into evolving market structures and customer behaviors. Our toolkit relies on traditional market research techniques and new approaches based on digital technologies and social media. Decitica was founded with a simple goal in mind: to help marketing executives with truly excellent and compelling perspectives and advice on how best to market, engage and collaborate with customers. Dr. Val Srinivas is the Principal of Decitica with over 15 years of experience. Before establishing Decitica, he was Head of Marketing Strategy in the institutional advisory group at Morgan Stanley Investment Management. Prior to this, he led the global Market Research and Competitive Intelligence function at Standard & Poor’s for nine years. Val has conducted hundreds of studies covering brand equity, new product design, customer loyalty and satisfaction, segmentation, pricing, demand analysis and competitive analysis. He also served as an Adjunct Professor of Marketing at Rutgers Business School, where he received a Ph.D. in Marketing. Val's doctoral thesis was on marketing financial advice and investors' advice-seeking behavior. Val can be reached at val@decitica.com. 29