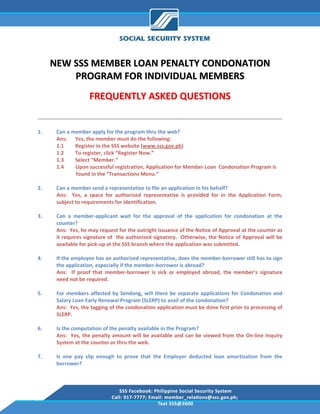

FAQs on the Penalty Condonation Program

- 1. NEW SSS MEMBER LOAN PENALTY CONDONATION PROGRAM FOR INDIVIDUAL MEMBERS FREQUENTLY ASKED QUESTIONS 1. Can a member apply for the program thru the web? Ans: Yes, the member must do the following: 1.1 Register in the SSS website (www.sss.gov.ph) 1.2 To register, click “Register Now.” 1.3 Select “Member.” 1.4 Upon successful registration, Application for Member Loan Condonation Program is found in the “Transactions Menu.” 2. Can a member send a representative to file an application in his behalf? Ans: Yes, a space for authorized representative is provided for in the Application Form, subject to requirements for identification. 3. Can a member‐applicant wait for the approval of the application for condonation at the counter? Ans: Yes, he may request for the outright issuance of the Notice of Approval at the counter as it requires signature of the authorized signatory. Otherwise, the Notice of Approval will be available for pick‐up at the SSS branch where the application was submitted. 4. If the employee has an authorized representative, does the member‐borrower still has to sign the application, especially if the member‐borrower is abroad? Ans: If proof that member‐borrower is sick or employed abroad, the member’s signature need not be required. 5. For members affected by Sendong, will there be separate applications for Condonation and Salary Loan Early Renewal Program (SLERP) to avail of the condonation? Ans: Yes, the tagging of the condonation application must be done first prior to processing of SLERP. 6. Is the computation of the penalty available in the Program? Ans: Yes, the penalty amount will be available and can be viewed from the On‐line Inquiry System at the counter or thru the web. 7. Is one pay slip enough to prove that the Employer deducted loan amortization from the borrower?

- 2. Ans: Yes, one month’s pay slip showing the deduction issued by the certifying employer within the amortization period satisfies the requirement under Situation 1a. 8. Will the Program under Situation 1a accept a pay slip/envelope showing deduction made even after the amortization period of the loan? Ans: Yes, for as long as it refers to the unpaid loan and issued by the certifying employer. 9. Will the Program allow an employee whose employer did not deduct the outstanding loan obligation from his separation/retirement benefits which is required under the SSS Salary Loan Program? Ans: No. The separated/retired employee was aware that his salary loan balance was not deducted from his benefits. He should have continued paying his loan on his own. 10. Can a member‐borrower whose Employer availed of the Employer Condonation but subsequently defaulted in the installment payment avail of the SSS Condonation Program for Individual Members? Ans: Yes, he is qualified if the account is delinquent for 3 or more months as of 01 April 2012. The balance of condonable penalty under the ER condonation program shall be reverted back to his account. 11. Will an employee who is included in the Employer’s Condonation Pprogram and is separated from the employer, be allowed to avail of the Individual Condonation Program? Ans: Yes, if he is delinquent as of 01 April 2012. 12. What if the employer is no longer existing today per counter verification but stated in the affidavit submitted by the borrower? Ans: If the certifying employer did not remit amount deducted and ceased operations upon checking, the employee may still qualify under Situation 1a for as long as the deductions were made within the amortization period of the loan. 13. If an employee is insisting that he did not avail of any SSS salary loan and yet he has a record of loan delinquency, can he just avail under Situation 1a so as to be able to meet the availment period and later ask for refund? Ans: Not under Situation 1a but under Situation 2, subject to eligibility requirements on contributions and loan amortization. 14. Since Situation 1a provides for 100% penalty condonation, most of the member‐borrowers would want to avail under this situation. Isn’t it proper for SSS to go after the delinquent employer instead and collect from the employer? Ans: The SSS under the law is mandated to run after the delinquent employers. However, since the availment period is only 6 months, the member borrower is advised to avail of the Program and any excess payment (assuming the employer will pay) shall be refunded to the employee upon request. 15. Will SSS still go after the employer if the loan has been paid by the member‐borrower under the Program?

- 3. Ans: Yes, the SSS will use the affidavit executed by the member for further verification and/or file appropriate case against the employer. 16. Can we allow partial payments within one (1) month for Situations 1a and 2 under the installment plan? Ans: Yes, but the payments must be made before the due date. Otherwise, penalties will accrue and any subsequent payment will be applied to penalty, interest and principal, in that order. 17. Is condonation automatic for beneficiaries who will apply for death claim within the availment period? Ans: No, the applicant shall fill up application form for condonation and this shall be attached to his death claim application. 18. If an employee has more than one loan account, that is, salary, calamity or emergency and only one loan account has 3 amortization payments, will the other loans qualify under the Program? Ans: No, only the loan account with 3 amortization payments shall qualify under the Program. 19. Why do we require that the 3 monthly amortization be posted to qualify a member‐applicant under Situation 2? Ans. The 3 monthly amortization should be posted to enable SSS to issue an updated statement of account of the member‐applicant which shall be the basis for the computation of condonable penalty and amount due. 20. During the 1st year of the loan, member‐borrower is still employed. However, on the 2nd year, borrower was separated from employment. What situation can the borrower qualify? Ans: If member‐borrower was deducted loan amortization in the 1st year but was not remitted by employer, he will qualify for Situation 1a; only one copy of pay‐slip is required. However, if no deductions were made from payroll, he may avail under Situation 2, subject to qualifying conditions. 21. If borrower will pay the required 3 monthly contributions for Jan., Feb. and March 2012 on April 20 (deadline for contribution payment), when can he file his application for condonation? Ans: On or after April 21 until July 2012 assuming no subsequent contributions are paid. However, the member should be encouraged to continue paying his contributions and avail of other SSS benefits in times of contingency. 22. In Situation 2, if the remaining balance in principal and interest is less than 1 month amortization, is the borrower still required to pay the 3 monthly amortization to avail of the Program? Ans: Not anymore. The borrower is qualified to avail of the Program as he has already paid about 23 monthly loan amortization.

- 4. 23. Can the borrower pay any amount in the Monthly Salary Credit (MSC) in order to qualify for condonation? Ans: If the premium paid is the 1st payment as a voluntary member, the member may choose any amount in the MSC. Otherwise, the change in MSC may be one or two salary brackets higher or lower than the previous MSC. 24. Where will the 3 monthly amortization be applied if member‐borrower pays prior to application for condonation? Ans: Any loan payments shall be applied to penalties, interest and to the principal of the loan, in that order. 25. What is the maximum term of installment? Ans: 3 years but the maturity date of the installment plan shall not exceed age 65. 26. Are post dated checks required for installment payments? Ans: No. Post dated checks are not required in the Condonation Program. 27. Why does a borrower have to wait for the two/three‐year period before he can renew a loan after availing himself of the Condonation Program? Ans: Since SSS is foregoing penalties, SSS is imposing sanctions to member‐borrowers who were remiss in the payment of loan obligation. 28. If mode of payment is on installment basis and the borrower defaults in the payment per schedule, what sanctions shall be imposed upon the member? Ans: Default in the payment of monthly installment by at least 2 months shall result in the following: • Termination of the approved installment plan; • Re‐imposition of balance of the condonable penalties; • Entire loan becomes due and demandable bearing the same interest rate of 3% per annum. Total loan obligation can be deducted from the member’s future benefits; • Permanent suspension of member’s loan privileges. 29. Will a member be allowed to pay in full after 12 months even if his installment term is 36 months? Will there be a rebate on interest and when is the renewal date? Ans: Yes. The member may fully pay anytime during the installment period based on the outstanding principal balance at the time of payment. There is no rebate of interest as interest computation is based on diminishing principal balance. Also, a member may renew his loan 3 years from date of full payment. 30. If a member has completed the required 120 monthly contributions for retirement, but lacks the required 3 monthly contributions for the last 6 months and has the required 3 monthly amortization prior to application, will he qualify under Situation 2 of the Program? Ans: No, unless he pays the required 3 monthly contributions for the last six months. But the member should be aware of the effect of updating his contributions since his pension will start accruing after the last posted contribution.

- 5. 31. If a member/beneficiary files a DDR claim, will he still file an application for the Condonation Program? Ans: Yes, the application for condonation shall be filed simultaneous with the filing of DDR claim. 32. If a member is due for retirement in February 2012, can he postpone filing of application for retirement in order to avail of the Program? Ans: Yes. The program covers members whose applications for retirement will be filed from 02 April 2012 to 30 September 2012, regardless of date of contingency. 33. If DDR application is refiled after the availment period due to compliance by the member of certain requirements, is he qualified to avail of the Program since his initial filing was made during the availment period? Ans: No, because the filing date in DDR database will be automatically replaced by the refiling date. The member should be advised to comply with the DDR requirements and re‐ submit the application within the availment peiod. 34. Will the Program allow a member to avail and deduct partial payments from his pensions? Ans: No, the total outstanding loan balance is deducted in full from the retirement benefit. 35. Can a member‐borrower file retirement even if the installment is still in effect? Ans: Yes, but remaining penalties will be deducted from the retirement claim. This is true to member‐borrowers whose installment plan will mature after age 60 but prior to age 65 and opts to retire. 36. Will a member who is about to retire or about to file a total disability claim qualify under Situation 1a since his employer deducted loan amortization from his pay/salary but did not remit to SSS? Ans: Yes. He shall file an application for condonation first, and pay the required amount due prior to filing of retirement so that the penalties to be waived is 100%. Otherwise, only 50% of the penalties is waived and the balance to be deducted from the benefits. 37. Can a member who availed of the Program under Situation 2 still avail of the 50% condonation under Situation 3 when he files his DDR claim? Ans. Not anymore as his loan is considered fully paid under Situation 2. 38. Will members who have no prior knowledge of the Program and learn about it beyond the availment period be allowed to request for reconsideration to avail of the Program? Ans: No, because the availment period of the program has already expired 39. Can the employees who will avail of the condonation authorize the employer to deduct the installment payments? Ans: Yes, however, the remittance should be separate from the regularly paying member‐ employees and SS Form ML‐1 (Monthly – Salary/Calamity/Educational/Emergency/Stock Investment Loan Payment Return) shall be used. Revised: March 21, 2012