C Miller Project 2 Wk7

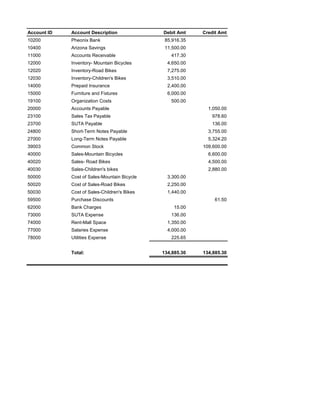

- 1. Account ID Account Description Debit Amt Credit Amt 10200 Pheonix Bank 85,916.35 10400 Arizona Savings 11,500.00 11000 Accounts Receivable 417.30 12000 Inventory- Mountain Bicycles 4,650.00 12020 Inventory-Road Bikes 7,275.00 12030 Inventory-Children's Bikes 3,510.00 14000 Prepaid Insurance 2,400.00 15000 Furniture and Fixtures 6,000.00 19100 Organization Costs 500.00 20000 Accounts Payable 1,050.00 23100 Sales Tax Payable 978.60 23700 SUTA Payable 136.00 24800 Short-Term Notes Payable 3,755.00 27000 Long-Term Notes Payable 5,324.20 39003 Common Stock 109,600.00 40000 Sales-Mountain Bicycles 6,600.00 40020 Sales- Road Bikes 4,500.00 40030 Sales-Children's bikes 2,880.00 50000 Cost of Sales-Mountain Bicycle 3,300.00 50020 Cost of Sales-Road Bikes 2,250.00 50030 Cost of Sales-Children's Bikes 1,440.00 59500 Purchase Discounts 61.50 62000 Bank Charges 15.00 73000 SUTA Expense 136.00 74000 Rent-Mall Space 1,350.00 77000 Salaries Expense 4,000.00 78000 Utilities Expense 225.65 Total: 134,885.30 134,885.30

- 2. Beginning GL Balance 80,400.00 Add: Cash Receipts 14,541.30 Less: Cash Disbursements (9,009.95) Add (Less) Other (15.00) Ending GL Balance 85,916.35 Ending Bank Balance 87,226.44 Add back deposits in transit Total deposits in transit (Less) outstanding checks Jan 29, 2008 5013 (245.00) Jan 29, 2008 5014 (175.80) Jan 29, 2008 5015 (225.65) Total outstanding checks (646.45) Add (Less) Other Total other Unreconciled difference (663.64) Ending GL Balance 85,916.35

- 3. Item ID Item Class Item Description Stocking U/M Cost Method Qty on Hand cbikes Stock item children's bikes each LIFO 78.00 mbicycles Stock item Mountain bicycles each LIFO 31.00 rbikes Stock item road bikes each LIFO 97.00

- 4. Item Value Avg Cost % of Inv Value 3,510.00 22.74 4,650.00 30.13 7,275.00 47.13 15,435.00 100.00

- 5. ASSETS Current Assets Pheonix Bank $ 85,916.35 Arizona Savings 11,500.00 Accounts Receivable 417.30 Inventory- Mountain Bicycles 4,650.00 Inventory-Road Bikes 7,275.00 Inventory-Children's Bikes 3,510.00 Prepaid Insurance 2,400.00 Total Current Assets 115,668.65 Property and Equipment Furniture and Fixtures 6,000.00 Total Property and Equipment 6,000.00 Other Assets Organization Costs 500.00 Total Other Assets 500.00 Total Assets $ 122,168.65 LIABILITIES AND CAPITAL Current Liabilities Accounts Payable $ 1,050.00 Sales Tax Payable 978.60 SUTA Payable 136.00 Short-Term Notes Payable 3,755.00 Total Current Liabilities 5,919.60 Long-Term Liabilities Long-Term Notes Payable 5,324.20 Total Long-Term Liabilities 5,324.20 Total Liabilities 11,243.80 Capital

- 6. Common Stock 109,600.00 Net Income 1,324.85 Total Capital 110,924.85 Total Liabilities & Capital $ 122,168.65

- 7. Current Month Year to Date Revenues Sales-Mountain Bicycles $ 6,600.00 47.21 $ 6,600.00 47.21 Sales- Road Bikes 4,500.00 32.19 4,500.00 32.19 Sales-Children's bikes 2,880.00 20.60 2,880.00 20.60 Sales-Services 0.00 0.00 0.00 0.00 Sales-Clearance 0.00 0.00 0.00 0.00 Interest Income 0.00 0.00 0.00 0.00 Other Income 0.00 0.00 0.00 0.00 Finance Charge Income 0.00 0.00 0.00 0.00 Shipping Charges Reimbursed 0.00 0.00 0.00 0.00 Sales Returns and Allowances 0.00 0.00 0.00 0.00 Sales Discounts 0.00 0.00 0.00 0.00 Total Revenues 13,980.00 100.00 13,980.00 100.00 Cost of Sales Cost of Sales-Mountain Bicycle 3,300.00 23.61 3,300.00 23.61 Cost of Sales-Road Bikes 2,250.00 16.09 2,250.00 16.09 Cost of Sales-Children's Bikes 1,440.00 10.30 1,440.00 10.30 Cost of Sales-Service 0.00 0.00 0.00 0.00 Cost of Sales-Salaries and Wag 0.00 0.00 0.00 0.00 Cost of Sales-Freight 0.00 0.00 0.00 0.00 Cost of Sales-Other 0.00 0.00 0.00 0.00 Inventory Adjustments 0.00 0.00 0.00 0.00 Purchase Returns and Allowance 0.00 0.00 0.00 0.00 Purchase Discounts (61.50) (0.44) (61.50) (0.44) Total Cost of Sales 6,928.50 49.56 6,928.50 49.56 Gross Profit 7,051.50 50.44 7,051.50 50.44 Expenses Default Purchase Expense 0.00 0.00 0.00 0.00 Advertising Expense 0.00 0.00 0.00 0.00 Auto Expenses 0.00 0.00 0.00 0.00 Bad Debt Expense 0.00 0.00 0.00 0.00 Bank Charges 15.00 0.11 15.00 0.11 Cash Over and Short 0.00 0.00 0.00 0.00 Depreciation Expense 0.00 0.00 0.00 0.00 Dues and Subscriptions Exp 0.00 0.00 0.00 0.00 Freight Expense 0.00 0.00 0.00 0.00 Income Tax Expense 0.00 0.00 0.00 0.00 Insurance Expense 0.00 0.00 0.00 0.00 Interest Expense 0.00 0.00 0.00 0.00 Legal and Professional Expense 0.00 0.00 0.00 0.00

- 8. Licenses Expense 0.00 0.00 0.00 0.00 Loss on NSF Checks 0.00 0.00 0.00 0.00 Maintenance Expense 0.00 0.00 0.00 0.00 Meals and Entertainment Exp 0.00 0.00 0.00 0.00 Office Expense 0.00 0.00 0.00 0.00 Payroll Tax Expense 0.00 0.00 0.00 0.00 FUTA Expense 0.00 0.00 0.00 0.00 SUTA Expense 136.00 0.97 136.00 0.97 FICA Expense 0.00 0.00 0.00 0.00 Medicare expense 0.00 0.00 0.00 0.00 Postage Expense 0.00 0.00 0.00 0.00 Rent-Mall Space 1,350.00 9.66 1,350.00 9.66 Repairs Expense 0.00 0.00 0.00 0.00 Supplies Expense 0.00 0.00 0.00 0.00 Telephone Expense 0.00 0.00 0.00 0.00 Travel Expense 0.00 0.00 0.00 0.00 Salaries Expense 4,000.00 28.61 4,000.00 28.61 Wages Expense 0.00 0.00 0.00 0.00 Utilities Expense 225.65 1.61 225.65 1.61 Purchase Disc-Expense Items 0.00 0.00 0.00 0.00 Gain/Loss on Sale of Assets 0.00 0.00 0.00 0.00 Total Expenses 5,726.65 40.96 5,726.65 40.96 Net Income $ 1,324.85 9.48 $ 1,324.85 9.48

- 9. Current Month Year to Date Cash Flows from operating activities Net Income $ 1,324.85 $ 1,324.85 1,324.85 1,324.85 Adjustments to reconcile net income to net cash provided by operating activities Accum. Depreciation - Furnitur 0.00 0.00 Accum. Depreciation - Equipmen 0.00 0.00 Accum. Depreciation - Automobi 0.00 0.00 Accum. Depreciation - Other 0.00 0.00 Accounts Receivable (417.30) (417.30) Accounts Receivable Service 0.00 0.00 Other Receivables 0.00 0.00 Inventory- Mountain Bicycles 1,350.00 1,350.00 Inventory-Road Bikes 975.00 975.00 Inventory-Children's Bikes 540.00 540.00 Cleaning Supplies Inventory 0.00 0.00 Office Supplies Inventory 0.00 0.00 Prepaid Insurance 0.00 0.00 Employee Advances 0.00 0.00 Other Current Assets 0.00 0.00 Accounts Payable 1,050.00 1,050.00 Sales Tax Payable 978.60 978.60 Wages Payable 0.00 0.00 Medicare Employee Taxes Payabl 0.00 0.00 Federal Payroll Taxes Payable 0.00 0.00 FUTA Tax Payable 0.00 0.00 State Payroll Taxes Payable 0.00 0.00 SUTA Payable 136.00 136.00 Medicare Employer Taxes Payabl 0.00 0.00 Income Taxes Payable 0.00 0.00 FICA Employee Taxes Payable 0.00 0.00 FICA Employer Taxes Payable 0.00 0.00 Customer Deposits 0.00 0.00 Contracts Payable 0.00 0.00 Short-Term Notes Payable (245.00) (245.00) Suspense-Clearing Account 0.00 0.00 Total Adjustments 4,367.30 4,367.30 Net Cash provided by Operations 5,692.15 5,692.15 Cash Flows from investing activities Used For

- 10. Furniture and Fixtures 0.00 0.00 Equipment 0.00 0.00 Automobiles 0.00 0.00 Other Depreciable Property 0.00 0.00 Organization Costs 0.00 0.00 Accum. Amortiz. - Org. Costs 0.00 0.00 Net cash used in investing 0.00 0.00 Cash Flows from financing activities Proceeds From Long-Term Notes Payable 0.00 0.00 Other Long-Term Liabilities 0.00 0.00 Common Stock 0.00 0.00 Paid-in Capital 0.00 0.00 Dividends Paid 0.00 0.00 Used For Long-Term Notes Payable (175.80) (175.80) Other Long-Term Liabilities 0.00 0.00 Common Stock 0.00 0.00 Paid-in Capital 0.00 0.00 Dividends Paid 0.00 0.00 Net cash used in financing (175.80) (175.80) Net increase <decrease> in cash $ 5,516.35 $ 5,516.35 Summary Cash Balance at End of Period $ 97,416.35 $ 97,416.35 Cash Balance at Beg of Period (91,900.00) (91,900.00) Net Increase <Decrease> in Cash $ 5,516.35 $ 5,516.35

- 11. Customer ID Customer Date Trans No Type Debit Amt Credit Amt Balance DB001 David Barson 1/14/08 101 SJ 321.00 321.00 RL002 Rick Lender No Activity 0.00 SW003 Susan winter 1/22/08 102 SJ 96.30 96.30 Report Total 417.30 417.30

- 12. Vendor ID Vendor Date Trans No Type Paid Debit Amt ABC111 ABC Mountain Bicycles 1/7/08 74A PJ * ABC111 ABC Mountain Bicycles 1/21/08 5007 CDJ 30.00 ABC111 ABC Mountain Bicycles 1/21/08 5007 CDJ 1,500.00 ABC111 ABC Mountain Bicycles 1/24/08 88A PJ ERB112 Elton's Road Bikes 1/7/08 ER555 PJ * ERB112 Elton's Road Bikes 1/21/08 5008 CDJ 18.00 ERB112 Elton's Road Bikes 1/21/08 5008 CDJ 900.00 ERB112 Elton's Road Bikes 1/24/08 ER702 PJ TW113 Tiny Tots Wheels 1/7/08 801 PJ * TW113 Tiny Tots Wheels 1/21/08 5009 CDJ 13.50 TW113 Tiny Tots Wheels 1/21/08 5009 CDJ 675.00 TW113 Tiny Tots Wheels 1/24/08 962 PJ Report Total 3,136.50

- 13. Credit Amt Balance 1,500.00 1,500.00 30.00 1,500.00 0.00 450.00 450.00 900.00 900.00 18.00 900.00 0.00 375.00 375.00 675.00 675.00 13.50 675.00 0.00 225.00 225.00 4,186.50 1,050.00

- 14. GL Trial balance $134,885.30 Total Assets $122,168.65 Pheonix bank Acct. $85,916.35 Total Revenues $13,980.00 Net Income $1,324.85 Mountain Bikes - Inv. $4,650.00 Road bikes- Inv $7,275.00 Children's Bikes - Inv. $3,510.00 Short - term Notes payable $3,755.00 Common Stock $109,600.00 Total Expense $5,726.65 Accounts payable incurred ? Yes