Auto Parts Store Cap Rates Compress

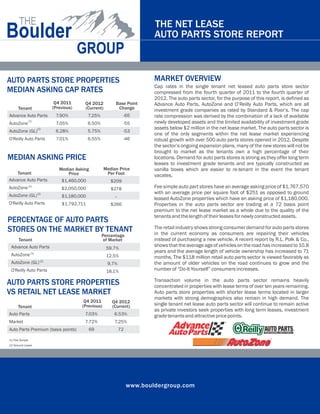

- 1. THE NET LEASE AUTO PARTS STORE REPORT AUTO PARTS STORE PROPERTIES MARKET OVERVIEW Cap rates in the single tenant net leased auto parts store sector MEDIAN ASKING CAP RATES compressed from the fourth quarter of 2011 to the fourth quarter of 2012. The auto parts sector, for the purpose of this report, is defined as Q4 2011 Q4 2012 Base Point Advance Auto Parts, AutoZone and O’Reilly Auto Parts, which are all Tenant (Previous) (Current) Change investment grade companies as rated by Standard & Poor’s. The cap Advance Auto Parts 7.90% 7.25% -65 rate compression was derived by the combination of a lack of available AutoZone (1) 7.05% 6.50% -55 newly developed assets and the limited availability of investment grade (2) assets below $2 million in the net lease market. The auto parts sector is AutoZone (GL) 6.28% 5.75% -53 one of the only segments within the net lease market experiencing O'Reilly Auto Parts 7.01% 6.55% -46 robust growth with over 500 auto parts stores opened in 2012. Despite the sector’s ongoing expansion plans, many of the new stores will not be brought to market as the tenants own a high percentage of their MEDIAN ASKING PRICE locations. Demand for auto parts stores is strong as they offer long term leases to investment grade tenants and are typically constructed as Median Asking Median Price vanilla boxes which are easier to re-tenant in the event the tenant Tenant Price Per Foot vacates. Advance Auto Parts $1,460,000 $209 AutoZone (1) $2,050,000 $278 Fee simple auto part stores have an average asking price of $1,767,570 (2) with an average price per square foot of $251 as opposed to ground AutoZone (GL) $1,180,000 – leased AutoZone properties which have an asking price of $1,180,000. O'Reilly Auto Parts $1,792,711 $266 Properties in the auto parts sector are trading at a 72 basis point premium to the net lease market as a whole due to the quality of the tenants and the length of their leases for newly constructed assets. PERCENTAGE OF AUTO PARTS STORES ON THE MARKET BY TENANT The retail industry shows strong consumer demand for auto parts stores Percentage in the current economy as consumers are repairing their vehicles Tenant of Market instead of purchasing a new vehicle. A recent report by R.L. Polk & Co., Advance Auto Parts shows that the average age of vehicles on the road has increased to 10.8 59.7% years and the average length of vehicle ownership has increased to 71 AutoZone (1) 12.5% months. The $118 million retail auto parts sector is viewed favorably as AutoZone (GL) (2) 9.7% the amount of older vehicles on the road continues to grow and the O'Reilly Auto Parts 18.1% number of “Do-It-Yourself” consumers increases. Transaction volume in the auto parts sector remains heavily AUTO PARTS STORE PROPERTIES concentrated in properties with lease terms of over ten years remaining. VS RETAIL NET LEASE MARKET Auto parts store properties with shorter lease terms located in larger markets with strong demographics also remain in high demand. The Q4 2011 Q4 2012 Tenant (Previous) (Current) single tenant net lease auto parts sector will continue to remain active as private investors seek properties with long term leases, investment Auto Parts 7.03% 6.53% grade tenants and attractive price points. Market 7.72% 7.25% Auto Parts Premium (basis points) 69 72 (1) Fee Simple (2) Ground Lease www.bouldergroup.com

- 2. THE NET LEASE AUTO PARTS STORE REPORT MEDIAN ASKING CAP RATE BY LEASE TERM REMAINING (2) Years Remaining Advance Auto Parts AutoZone (1) AutoZone (GL) O'Reilly Auto Parts 18-20 N/A 6.50% 5.50% 6.25% 15-17 6.85% 6.75% 5.75% 6.50% 10-14 7.00% 6.78% 5.87% 6.73% 6-9 7.53% 6.80% 5.90% 6.80% Under 5 8.73% 6.80% 6.50% 6.90% (1) Fee Simple (2) Ground Lease SELECTED SINGLE TENANT AUTO PARTS STORE SALES COMPARABLES Price Lease Term Sale Date Tenant City State Price Per SF Cap Rate Remaining Jul-12 AutoZone Slidell LA $2,077,000 $282 6.50% 14 Jul-12 AutoZone Phillipsburg PA $1,620,500 $220 6.85% 17 Jan-12 Advance Auto Parts Machesney Park IL $1,520,000 $248 7.25% 15 Jun-12 Advance Auto Parts Clayton GA $1,425,000 $204 7.60% 7 Jun-12 O'Reilly Auto Parts Battle Creek MI $1,253,000 $174 7.25% 17 Feb-12 O'Reilly Auto Parts Roanoke VA $1,200,000 $200 7.00% 14 Jun-12 O'Reilly Auto Parts Muskegon MI $1,100,000 $183 7.09% 15 Oct-12 Advance Auto Parts Nelsonville OH $705,000 $128 7.20% 12 The above sales comparables are fee simple transactions. www.bouldergroup.com

- 3. THE NET LEASE AUTO PARTS STORE REPORT AUTO PARTS STORE MEDIAN ASKING CAP RATES & PERCENT OF MARKET BY REGION Median Asking Cap: 6.64% Percent of Market: 8% Median Asking Cap: 7.00% Percent of Market: 43% Median Asking Cap: 7.00% Percent of Market: 5% WEST A ST HE RT MOUNTAIN MIDWEST NO SOUTH Median Asking Cap: 6.60% Percent of Market: 11% Median Asking Cap: 7.00% Percent of Market: 33% www.bouldergroup.com

- 4. THE NET LEASE AUTO PARTS STORE REPORT COMPANY COMPARISON Advance Auto Parts AutoZone O'Reilly Auto Parts Credit Rating BBB- (Stable) BBB (Stable) BBB (Stable) Market Cap $5 billion $13 billion $10 billion Revenue $6 billion $8 billion $6 billion 2012 Stores Built 130 193 180 Number of Stores 3,727 5,029 3,896 Typical Lease Term 10 or 15 year primary term 20 year primary term 20 year primary term with fifteen years of options with twenty years of options with fifteen years of options Typical Rent Increases Not in primary term; 7.50% Not in primary term; 10% increase in 10% in lease year 11 and each option increases in option periods option periods period FOR MORE INFORMATION AUTHOR John Feeney | Research Director john@bouldergroup.com CONTRIBUTORS Randy Blankstein | President Jimmy Goodman | Partner Chad Gans | Research Analyst rblank@bouldergroup.com jimmy@bouldergroup.com chad@bouldergroup.com © 2013. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. www.bouldergroup.com