Strength Of Ubs New

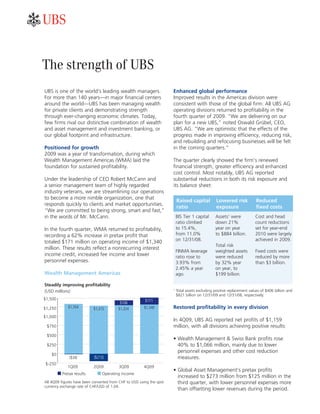

- 1. ab The strength of UBS UBS is one of the world’s leading wealth managers. Enhanced global performance For more than 140 years—in major financial centers Improved results in the Americas division were around the world—UBS has been managing wealth consistent with those of the global firm: All UBS AG for private clients and demonstrating strength operating divisions returned to profitability in the through ever-changing economic climates. Today, fourth quarter of 2009. “We are delivering on our few firms rival our distinctive combination of wealth plan for a new UBS,” noted Oswald Grübel, CEO, and asset management and investment banking, or UBS AG. “We are optimistic that the effects of the our global footprint and infrastructure. progress made in improving efficiency, reducing risk, and rebuilding and refocusing businesses will be felt Positioned for growth in the coming quarters.” 2009 was a year of transformation, during which Wealth Management Americas (WMA) laid the The quarter clearly showed the firm’s renewed foundation for sustained profitability. financial strength, greater efficiency and enhanced cost control. Most notably, UBS AG reported Under the leadership of CEO Robert McCann and substantial reductions in both its risk exposure and a senior management team of highly regarded its balance sheet: industry veterans, we are streamlining our operations to become a more nimble organization, one that Raised capital Lowered risk Reduced responds quickly to clients and market opportunities. ratio exposure fixed costs “We are committed to being strong, smart and fast,” in the words of Mr. McCann. BIS Tier 1 capital Assets1 were Cost and head ratio climbed down 21% count reductions In the fourth quarter, WMA returned to profitability, to 15.4%, year on year set for year-end recording a 62% increase in pretax profit that from 11.0% to $884 billion. 2010 were largely on 12/31/08. achieved in 2009. totaled $171 million on operating income of $1,340 Total risk million. These results reflect a nonrecurring interest FINMA leverage weighted assets Fixed costs were income credit, increased fee income and lower ratio rose to were reduced reduced by more personnel expenses. 3.93% from by 32% year than $3 billion. 2.45% a year on year, to Wealth Management Americas ago. $199 billion. Steadily improving profitability (USD millions) 1 Total assets excluding positive replacement values of $406 billion and $821 billion on 12/31/09 and 12/31/08, respectively. $1,500 $171 $106 $1,250 $1,354 $1,315 $1,324 $1,340 Restored profitability in every division $1,000 In 4Q09, UBS AG reported net profits of $1,159 $750 million, with all divisions achieving positive results: $500 • Wealth Management & Swiss Bank profits rose $250 40% to $1,066 million, mainly due to lower personnel expenses and other cost reduction $0 ($34) ($213) measures. $-250 1Q09 2Q09 3Q09 4Q09 • Global Asset Management’s pretax profits Pretax results Operating income increased to $273 million from $125 million in the All 4Q09 figures have been converted from CHF to USD using the spot third quarter, with lower personnel expenses more currency exchange rate of CHF/USD of 1.04. than offsetting lower revenues during the period.

- 2. • Investment Bank quarterly pretax profit totaled Our current long-term credit ratings are among the $285 million, compared with a pretax loss of highest in the industry: $1,317 million in the third quarter, which ended September 30. Credit ratings (as of February 9, 2010) One of the world’s strongest and Moody’s best-capitalized banks long-term S&P long-term rating/outlook rating/outlook As a result of the continued reduction of risk- weighted assets, our BIS Tier 1 capital ratio totaled UBS Aa3 A+/S 15.4% at the end of 2009, up from 11% a Credit Suisse Aa2/N A/S year earlier. JPMorgan Aa1 AA- Wells Fargo A1/S AA-/N Tier 1 capital ratio, 4Q 2009 Goldman Sachs A1/N A/N 20 Bank of America A2/N A/N Morgan Stanley A2/N A/N 16.3% 15 15.4% 15.4% 15.0% 12.6% 11.7% 10 11.1% 10.4% 5 0 CS UBS DB MS/SB GS Citi JPM BoA/ML European firms U.S. firms UBS Financial Services Inc. www.ubs.com/financialservicesinc UBS Financial Services Inc. and UBS International Inc. are subsidiaries of UBS AG. ©2010 UBS Financial Services Inc. All rights reserved. Member SIPC. As of February 9, 2010