Contenu connexe

Similaire à C2 C Eng One Pager Banking

Similaire à C2 C Eng One Pager Banking (20)

C2 C Eng One Pager Banking

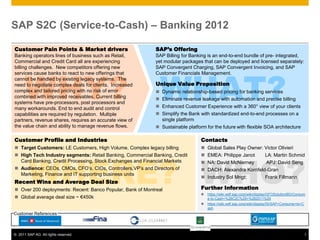

- 1. SAP S2C (Service-to-Cash) – Banking 2012

Customer Pain Points & Market drivers SAP’s Offering

Banking operators lines of business such as Retail, SAP Billing for Banking is an end-to-end bundle of pre- integrated,

Commercial and Credit Card all are experiencing yet modular packages that can be deployed and licensed separately:

WHY? WHAT?

billing challenges. New competitors offering new SAP Convergent Charging, SAP Convergent Invoicing, and SAP

services cause banks to react to new offerings that Customer Financials Management.

cannot be handled by existing legacy systems. The

need to negotiate complex deals for clients. Increased Unique Value Proposition

complex and tailored pricing with no risk of error Dynamic relationship-based pricing for banking services

combined with improved receivables. Current billing Eliminate revenue leakage with automation and precise billing

systems have pre-processors, post processors and

many workarounds. End to end audit and control Enhanced Customer Experience with a 360° view of your clients

capabilities are required by regulation. Multiple Simplify the Bank with standardized end-to-end processes on a

partners, revenue shares, requires an accurate view of single platform

the value chain and ability to manage revenue flows. Sustainable platform for the future with flexible SOA architecture

Customer Profile and Industries Contacts

Target Customers: LE Customers, High Volume, Complex legacy billing Global Sales Play Owner: Victor Olivieri

WHERE? WHO?

High Tech Industry segments: Retail Banking, Commercial Banking, Credit EMEA: Philippe Janot LA: Martin Schmid

Card Banking, Credit Processing, Stock Exchanges and Financial Markets NA: David McNierney APJ: David Seng

Audience: CEOs, CMOs, CFO’s, CIOs, Controllers,VP’s and Directors of DACH: Alexandra Kornfeld-Gran

Marketing, Finance and IT supporting business units

Industry Sol Mngt: Frank Fillmann

Recent Wins and Average Deal Size

Over 200 deployments: Recent: Banco Popular, Bank of Montreal Further Information

https://wiki.wdf.sap.corp/wiki/display/GFOSolutionBD/Consum

Global average deal size ~ €450k e-to-Cash+%28C2C%29+%282011%29

https://wiki.wdf.sap.corp/wiki/display/IS/SAP+Consume+to+C

ash

Customer References

© 2011 SAP AG. All rights reserved. 1