Entry Norms, Book Building, and QIBs in Indian IPOs and FPOs

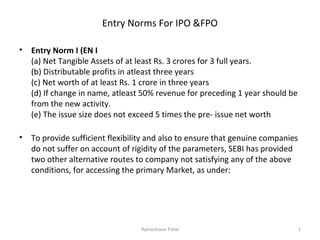

- 1. Entry Norms For IPO &FPO • Entry Norm I (EN I (a) Net Tangible Assets of at least Rs. 3 crores for 3 full years. (b) Distributable profits in atleast three years (c) Net worth of at least Rs. 1 crore in three years (d) If change in name, atleast 50% revenue for preceding 1 year should be from the new activity. (e) The issue size does not exceed 5 times the pre- issue net worth • To provide sufficient flexibility and also to ensure that genuine companies do not suffer on account of rigidity of the parameters, SEBI has provided two other alternative routes to company not satisfying any of the above conditions, for accessing the primary Market, as under: Rameshwar Patel 1

- 2. • Entry Norm II (EN II): (a) Issue shall be through book building route, with at least 50% to be mandatory allotted to the Qualified Institutional Buyers (QIBs). • (b) The minimum post-issue face value capital shall be Rs. 10 crore or there shall be a compulsory market-making for at least 2 years • OR Entry Norm III (EN III): (a) The "project" is appraised and participated to the extent of 15% by FIs/Scheduled Commercial Banks of which at least 10% comes from the appraiser(s). (b) The minimum post-issue face value capital shall be Rs. 10 crore or there shall be a compulsory market-making for at least 2 years. • In addition to satisfying the aforesaid eligibility norms, the company shall also satisfy the criteria of having at least 1000 prospective allotees in its issues Rameshwar Patel 2

- 3. Private Placement Market • It refers to the direct sale of newly issued securities to a small number of investors through merchant bankers. • These investors are selected clients; • Financial institutions • Corporate • Banks • High net worth individuals Benefits • Less time and cost of issue • Greater flexibility • Simplified procedure Rameshwar Patel 3

- 4. • • • • • • A preferential issue is an issue of shares or of convertible securities by listed companies to a select group of persons under Section 81 of the Companies Act, 1956 which is neither a rights issue nor a public issue. This is a faster way for a company to raise equity capital. The issuer company has to comply with the Companies Act and the requirements contained in Chapter pertaining to preferential allotment in SEBI (DIP) Advantages; To enhance promoters holding To issue shares by way of employees stock option plans For fresh issue to shareholder other than promoters and for take over of company by mgt. groups. Rameshwar Patel 4

- 5. Qualified institutional placement (QIP) • • • • • is a capital raising tool, primarily used in India, whereby a listed company can issue equity shares, fully and partly convertible debentures, or any securities other than warrants which are convertible to equity shares to a Qualified Institutional Buyer (QIB). Apart from preferential allotment, this is the only other speedy method of private placement whereby a listed company can issue shares or convertible securities to a select group of persons. QIP scores over other methods because the issuing firm does not have to undergo elaborate procedural requirements to raise this capital. Why was it introduced? The (SEBI) introduced the QIP process to prevent listed companies in India from developing an excessive dependence on foreign capital. Rameshwar Patel 5

- 6. Who can participate in the issue? • The specified securities can be issued only to QIBs, who shall not be promoters or related to promoters of the issuer. • The issue is managed by a Sebi-registered merchant banker. There is no pre-issue filing of the placement document with Sebi. • The placement document is placed on the websites of the stock exchanges and the issuer, with appropriate disclaimer to the effect that the placement is meant only for QIBs on private placement basis and is not an offer to the public. Rameshwar Patel 6

- 7. Book building Book building is actually a price discovery method. In this method, the company doesn't fix up a particular price for the shares, but instead gives a price range, e.g. Rs 80-100. When bidding for the shares, investors have to decide at which price they would like to bid for the shares, for e.g. Rs 80, Rs 90 or Rs 100. They can bid for the shares at any price within this range. Based on the demand and supply of the shares, the final price is fixed. The lowest price (Rs 80) is known as the floor price and the highest price (Rs 100) is known as cap price. The price at which the shares are allotted is known as cut off price. The entire process begins with the selection of the lead manager, an investment banker whose job is to bring the issue to the public. 7 Rameshwar Patel

- 8. The Process: • • • • • • • • • • The Issuer who is planning an offer nominates lead merchant banker(s) as 'book runners'. The Issuer specifies the number of securities to be issued and the price band for the bids. The Issuer also appoints syndicate members with whom orders are to be placed by the investors. The syndicate members input the orders into an 'electronic book'. This process is called 'bidding' and is similar to open auction. The book normally remains open for a period of 5 days. Bids have to be entered within the specified price band. Bids can be revised by the bidders before the book closes. On the close of the book building period, the book runners evaluate the bids on the basis of the demand at various price levels. The book runners and the Issuer decide the final price at which the securities shall be issued. Generally, the number of shares are fixed, the issue size gets frozen based on the final price per share. Allocation of securities is made to the successful bidders. The rest get refund orders. Rameshwar Patel 8

- 9. • • • • • • Types of investors There are three kinds of investors in a book-building issue. The retail individual investor (RII), the non-institutional investor (NII) and the Qualified Institutional Buyers (QIBs). RII is an investor who applies for stocks for a value of not more than Rs 100,000. Any bid exceeding this amount is considered in the NII category. NIIs are commonly referred to as high net-worth individuals. Each of these categories is allocated a certain percentage of the total issue. The total allotment to the RII category has to be at least 35% of the total issue. RIIs also have an option of applying at the cut-off price. This option is not available to other classes of investors. NIIs are to be given at least 15% of the total issue. And the QIBs are to be issued not more than 50% of the total issue. Allotment to RIIs and NIIs is made through a proportionate allotment system. The allotment to the QIBs is at the discretion of the BRLM. Rameshwar Patel 9

- 10. Book building vs fixed price • The main difference between the book building method and the fixed price method is that in the former, the issue price is not decided initially. • The investors have to bid for the shares within the price range given and based on the demand and supply of the shares, the issue price is fixed. On the other hand, in the fixed price method, the price is decided right at the start. Investors cannot choose the price, but must buy the shares at the price decided by the company. In the book building method, the demand is known every day during the offer period, but in fixed method, the demand is known only once the issue closes. Rameshwar Patel 10

- 11. • • • • • • • • • • • • • Qualified Institutional Buyers (QIBs) Qualified Institutional Buyers (QIBs) those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets. a ‘Qualified Institutional Buyer’ shall mean: a) Public financial institution as defined in section 4A of the Companies Act, 1956; b) Scheduled commercial banks; c) Mutual Funds; d) Foreign institutional investor registered with SEBI; e) Multilateral and bilateral development financial institutions; f) Venture Capital funds registered with SEBI. g) Foreign Venture Capital investors registered with SEBI. h) State Industrial Development Corporations. i) Insurance Companies registered with the Insurance Regulatory and Development Authority (IRDA). j) Provident Funds with minimum corpus of Rs.25 crores k) Pension Funds with minimum corpus of Rs. 25 crores "These entities are not required to be registered with SEBI as QIBs. Any entities falling under the categories specified above are considered as QIBs for the purpose of participating in primary issuance process." Rameshwar Patel 11

- 12. • A "Merchant Banker" could be defined as "An organisation that acts as an intermediary between the issuers and the ultimate purchasers of securities in the primary security market" • Merchant Banker has been defined under the Securities & Exchange Board of India (Merchant Bankers) Rules, 1992 as "any person who is engaged in the business of issue management either by making arrangements regarding selling, buying or subscribing to securities as manager, consultant, advisor or rendering corporate advisory service in relation to such issue management". Rameshwar Patel 12

- 13. Reverse Book Building • It is a price discovery mechanism for the companies who want to delist their shares or buy back shares from the shareholders. • Green Shoe Option; It is also referred to as an over allotment option. It is a mechanism to provide post listing price stability to an initial public offering. Rameshwar Patel 13