permenkeu 40 pmk.03.2010 E

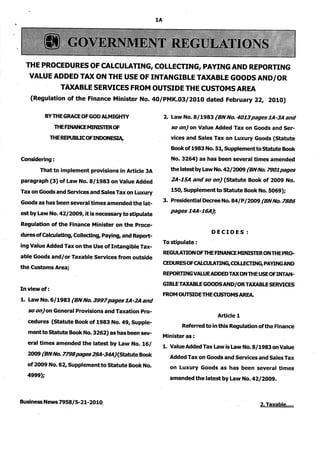

- 1. 1A THE PROCEDURES OF CALCULATING, COLLECTING, PAYING AND REPORTING VALUE ADDED TAX ON THE USE OF INTANGIBLE TAXABLE GOODS AND/OR TAXABLE SERVICES FROM OUTSIDE THE CUSTOMS AREA (Regulation of the Finance Minister No. 40/PMK.03/2010 dated February 22, 2010) BY THE GRACE OF GOD AUMIGHTY THE FINANCE MINISTER OF THE REPUBUC OF INDONESIA, Considering: That to implement provisions in Article 3A paragraph (3) of Law No. 8/1983 on Value Added Tax on Goods and Services and Sales Tax on Luxury Goods as has been several times amended the latest by Law No. 42/2009, it is necessary to stipulate Regulation. of the Finance Minister on the Procedures of Calculating, Collecting, Paying, and Reporting Value Added Tax on the Use of Intangible Taxable Goods and/or Taxable Services from outside the Customs Area; Inviewof: . 1. Law No. 6/1983 (BN No. 3997 pages 1A-2A and so on) on General Provisions and Taxation Procedures (Statute Book of 1983 No. 49,Supplementto Statute Book No. 3262) as has been several times amended the latest by Law No. 16/ 2009 (BN No. 7798 pages 29A-34A} (Statute Book of 2009 No. 62, Supplement to Statute Book No. 4999); Business News 7958/5-21-2010, 2. Law No. 8/1983 (BN No. 4013 pages lA-3A and so on) on Value Added Tax on Goods and Services and Sales Tax on Luxury Goods (Statute Book of 1983 No. 51, Supplementto Statute Book No. 3264) as has been several times amended the latest by Law No. 42/2009 (BN No. 7901 pages 2A-1SA and so on) (Statute Book of 2009 No. 150, Supplementto Statute Book No. 5069); 3. Presidential Decree No. 84/P /2009 (BN No. 7886 pages 14A-16A), DECIDES: To stipulate: REGULA lION OF THE FINANCE MINISTER ON THE PR(),. CEDURESOFCALCULAlING,COLLECllNG,PAYINGAND REPORlING VALUE ADDED TAX ON THE USE OFINTANGIBLETAXABLE GOODS AND/OR TAXABLE SERVICES FROM OUTSIDE THE CUSTOMS AREA. Article 1 Referred to in this Regulation ofthe Finance Minister as : 1. Value Added Tax "law is Law No. 8/1983 on Value Added Tax on Goods and Services and Sales Tax on Luxury Goods as has been several times amended the latest by Law No. 42/2009. 2. Taxable .....

- 2. 2. Taxable services are services subjected to tax under the Value Added Tax Law. 3. Taxable goods are goods subjected to tax under the Value Added Tax Law. 4. Tax payment form is evidence of tax payment made using a form or other means to the state treasury through payment places appointed by the Finance Minister. 2A 5. Taxable company is a company delivering taxable goods and/or rendering taxable services· subjected to tax based on the Value Added Tax Law. 6. Customs area is the territory of the Republic of Indonesia covering land, sea and air as well as certain places in the Exclusive Economic Zone and continental shelf in which the customs law is put into force. Article 2 Value added tax shall be imposed on the use of intangible taxable goods and/ or taxable services from outside the customs area within the customs area. Article 3 (1) Value added tax owed to the use of intangible taxable goods and/or taxable services from outside the customs area shall be calculated as follows: a. 100/0 (ten percent) multiplied by the sum paid or ought to be paid to the party delivering intangible taxable goods and/ or taxable services, if the sum paid or ought to be paid does not include value added tax; or Business News 7958/5-21-2010 b. 10/110 (ten per one hundred and ten) mul- . tiplied by the sum paid or ought to be paid to • the party delivering intangible taxable goods and/or taxable services, if the sum paid or ought to be paid includes value added tax. (2) If contract or written agreement for the sum paid or ought to be paid as referred to in paragraph (1) is not found or is found but it does not firmly state that the sum in the contract or written agreement includes value added tax, value added tax due shall be calculated as much as 10% (ten percent) multiplied by the sum paid or ought to be paid to the party delivering intangible taxable goods and/ or taxable services from outside the customs area. Article 4 The value added tax as referred to in Article 2 shall become due at the time when the use of intangible taxable goods and/ or taxable services from outside the customs area begins. Article 5 (1) The time when the use of intangible taxable goods and / or taxable services from outside the customs area begins as referred to in Article 4 is the time believed to have occurred earlier than the following events: a. the time when the intangible taxable goods and/or taxable services are really used by the party using them; b. the time when the acquisition price of the intangible taxable goods and/or taxable services is declared as debt by the party u~ing them; c. the .....

- 3. c. the time when the selling price of the intangible goods and/or the replacement of taxable services is collected by the party delivering them; or d. the time when the acquisition price of the intangible taxable goods and/or taxable services is paid partly or wholly by the party using them. (2) If the time when the use of intangible taxable goods and/or taxable services from outside the customs area begins as referred to in paragraph (1) is unknown, the time when the use of intangible taxable goods and/or taxable services from outside the customs area begins is the date of signing the contract or agreement or other moment set by the Director General of Taxation. Artide6 (1) The value added tax due as referred to in Article 3 shall be collected and paid entirely to the state treasury through a post office or perception bank using a tax payment foa:m by individuals or bodies using intangible taxable goods andl or taxable services from outside the customs area, no later than the 15th of the following month after the time when the tax becomes due as referred to in Article 4. (2) The tax payment form as referred to in paragraph (1) shall use the format of tax payment form provided for in the law and regulation on general provisions and taxation procedures, by observing the following matters: Business News 7958/5-21-2010 3A a. the column "Name of Taxpayer" and "Address of Taxpayer" are filled with the name and address of the individual or body residing or domiciled outside the customs area delivering intangible taxable goods and/or taxable services to the customs area. b. the column "Taxpayer Code Number" is filled with 0 (nil), except the code of the Tax Service Office which is filled with the code of the Tax Service Office of the party using intangible taxable goods and/or taxable services. c. the box "taxpayer" is filled with the name and taxpayer code number of the party using intangible taxable goods and/or taxable services. Article 7 (1) For taxable companies, valued added tax paid as referred to in Article 6 shall be reported in periodic value added tax returns in the month when the tax becomes due. (2) The periodic value added tax returns as referred to in paragraph (1) shall be treated as a report on the collection of value added tax on the use of intangible taxable goods andl or taxable services from outside the customs area. (3) Individuals or bodies other than taxable cQmpanies shall report value added tax paid as referred to in Article 6 using the third sheet of tax payment form to the Tax Service Office whose jurisdiction covers the residences ofthe individuals or domiciles of the bodies no later than the end of the following month after the tax becomes due. Article 8 .....

- 4. Article 8 Individuals or bodies paying value added tax after the period of time as referred to in Article 6 shall be liable to administrative sanctions in the form of interest in accordance with the law and regulation on general provisions and taxation procedures. Article 9 When this Regulation ofthe Finance Minister begins to take effect, Decree of the Finance Minister No. 568/KMK.03/2000 on the Procedures of Calculating, Collecting, Paying, and Reporting Value Added Tax on the Use of Intangible Taxable Goods andlor Taxable Services from outside the Customs Area shall be declared null and void. Artide10 This Regulation of the Finance Minister $hall come into force as from April 1, 2010. 4A For public cognizance, this Regulation of the Finance Minister shall be promulgated by placing it in the State Gazette of the Republic of Indonesia. stipulated in Jakarta on February 22,2010 lHEflNANCEMINISrER, sgd. SRI MULYANIINDRAWATI Promulgated in Jakarta on February 22, 2010 THE MINISfER OF LAW AND HUMAN RIGHTS, sgd. PATRIAUSAKBAR THE SfATEGAZE'TliOFllIE REPUSLlCOFINDONESIA OF 2010 NO. 96 -==={ S )===-