JLL Detroit Office Insight & Statistics – Q2 2016

•

1 like•84 views

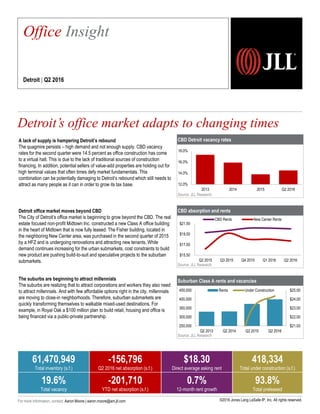

The quagmire persists – high demand and not enough supply. CBD vacancy rates for the second quarter were 14.5 percent as office construction has come to a virtual halt.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

JLL Pittsburgh Office Insight & Statistics - Q3 2019

JLL Pittsburgh Office Insight & Statistics - Q3 2019

JLL Cincinnati Office Insight & Statistics - Q2 2016

JLL Cincinnati Office Insight & Statistics - Q2 2016

JLL Pittsburgh Office Insight & Statistics - Q2 2020

JLL Pittsburgh Office Insight & Statistics - Q2 2020

JLL Pittsburgh Office Insight & Statistics - Q2 2018

JLL Pittsburgh Office Insight & Statistics - Q2 2018

JLL Downtown Chicago Office Market Update - Q3 2016

JLL Downtown Chicago Office Market Update - Q3 2016

JLL Pittsburgh Office Insight & Statistics - Q2 2019

JLL Pittsburgh Office Insight & Statistics - Q2 2019

JLL Pittsburgh Office Insight & Statistics - Q4 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2018

Viewers also liked

Viewers also liked (7)

Similar to JLL Detroit Office Insight & Statistics – Q2 2016

Similar to JLL Detroit Office Insight & Statistics – Q2 2016 (17)

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2019

JLL Pittsburgh Office Insight & Statistics - Q4 2019

JLL Pittsburgh Office Insight & Statistics - Q4 2017

JLL Pittsburgh Office Insight & Statistics - Q4 2017

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q2 2021

JLL Pittsburgh Office Insight & Statistics - Q2 2021

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

More from Aaron Moore

More from Aaron Moore (9)

JLL Detroit Industrial Insight & Statistics - Q2 2016

JLL Detroit Industrial Insight & Statistics - Q2 2016

Recently uploaded

Recently uploaded (20)

M3M The Line Brochure - Premium Investment Opportunity for Commercial Ventures

M3M The Line Brochure - Premium Investment Opportunity for Commercial Ventures

Call Girls In Seelampur Delhi ↬8447779280}Seelampur Escorts Service In Delhi...

Call Girls In Seelampur Delhi ↬8447779280}Seelampur Escorts Service In Delhi...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

Enjoy Night ≽ 8448380779 ≼ Call Girls In Iffco Chowk (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Iffco Chowk (Gurgaon)

Best Deal Virtual Space in Satya The Hive Tata Zudio 750 Sqft 1.89 Cr All inc...

Best Deal Virtual Space in Satya The Hive Tata Zudio 750 Sqft 1.89 Cr All inc...

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

Shapoorji Pallonji Joyville Vista Pune | Spend Your Family Time Together

Shapoorji Pallonji Joyville Vista Pune | Spend Your Family Time Together

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Call Girls In Vasant Vihar Delhi 💯Call Us 🔝8264348440🔝

Call Girls In Vasant Vihar Delhi 💯Call Us 🔝8264348440🔝

JLL Detroit Office Insight & Statistics – Q2 2016

- 1. CBD Detroit vacancy rates Source: JLL Research CBD absorption and rents Source: JLL Research Suburban Class A rents and vacancies Source: JLL Research Detroit’s office market adapts to changing times 2,257 Office Insight Detroit | Q2 2016 61,470,949 Total inventory (s.f.) -156,796 Q2 2016 net absorption (s.f.) $18.30 Direct average asking rent 418,334 Total under construction (s.f.) 19.6% Total vacancy -201,710 YTD net absorption (s.f.) 0.7% 12-month rent growth 93.8% Total preleased A lack of supply is hampering Detroit’s rebound The quagmire persists – high demand and not enough supply. CBD vacancy rates for the second quarter were 14.5 percent as office construction has come to a virtual halt. This is due to the lack of traditional sources of construction financing. In addition, potential sellers of value-add properties are holding out for high terminal values that often times defy market fundamentals. This combination can be potentially damaging to Detroit’s rebound which still needs to attract as many people as it can in order to grow its tax base. Detroit office market moves beyond CBD The City of Detroit’s office market is beginning to grow beyond the CBD. The real estate focused non-profit Midtown Inc. constructed a new Class A office building in the heart of Midtown that is now fully leased. The Fisher building, located in the neighboring New Center area, was purchased in the second quarter of 2015 by a HFZ and is undergoing renovations and attracting new tenants. While demand continues increasing for the urban submarkets, cost constraints to build new product are pushing build-to-suit and speculative projects to the suburban submarkets. The suburbs are beginning to attract millennials The suburbs are realizing that to attract corporations and workers they also need to attract millennials. And with few affordable options right in the city, millennials are moving to close-in neighborhoods. Therefore, suburban submarkets are quickly transforming themselves to walkable mixed-used destinations. For example, in Royal Oak a $100 million plan to build retail, housing and office is being financed via a public-private partnership. 12.0% 14.0% 16.0% 18.0% Q2 2016201520142013 $15.50 $17.50 $19.50 $21.50 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 CBD Rents New Center Rents $21.00 $22.00 $23.00 $24.00 $25.00 250,000 300,000 350,000 400,000 450,000 Q2 2013 Q2 2014 Q2 2015 Q2 2016 Rents Under Construction For more information, contact: Aaron Moore | aaron.moore@am.jll.com ©2016 Jones Lang LaSalle IP, Inc. All rights reserved.

- 2. Current conditions – submarket Historical leasing activity (s.f.) Source: JLL Research Source: JLL Research Total net absorption (s.f.) Source: JLL Research Total vacancy rate (%) Source: JLL Research Direct average asking rent ($ p.s.f.) Source: JLL Research -1,304,860 -476,545 -1,953,820 -1,767,490 1,277,568 1,510,536 176,382 1,288,053 872,323 -201,710 -2,500,000 -1,000,000 500,000 2,000,000 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD 2016 $20.75 $19.73 $19.31 $19.10 $18.56 $18.15 $17.76 $17.99 $18.41 $18.32 $17.00 $18.50 $20.00 $21.50 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q2 2016 25.9% 26.7% 30.0% 32.9% 30.8% 28.3% 28.0% 25.3% 19.0% 19.6% 15.0% 25.0% 35.0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q2 2016 Northern I-275, Washtenaw Landlordleverage Tenantleverage Peaking market Falling market Bottoming market Rising market CBD Downriver, Dearborn 5,000,000 5,300,000 5,100,000 3,300,000 989,081 0 2,000,000 4,000,000 6,000,000 2012 2013 2014 2015 YTD 2016 Southfield, Troy, Macomb, Farmington Hills ©2016 Jones Lang LaSalle IP, Inc. All rights reserved.For more information, contact: Aaron Moore | aaron.moore@am.jll.com Royal Oak Southern I-275 North Oakland Birmingham New Center

- 3. Office statistics Detroit | Q2 2016 Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD completions (s.f.) Under construction (s.f.) CBD Totals 12,843,492 -90,382 -10,198 -0.1% 14.4% 14.5% $20.61 0 0 New Center Totals 1,117,100 4,348 4,348 0.4% 20.9% 21.2% $18.20 0 0 Urban Totals 13,960,592 -86,034 -5,850 0.0% 14.9% 15.0% $20.34 0 0 Birmingham/Bloomfield Totals 2,858,942 17,486 24,065 0.8% 7.6% 8.0% $23.43 0 34,354 Dearborn Totals 2,547,516 -5,533 -1,713 -0.1% 43.5% 43.5% $15.16 0 0 Downriver Totals 404,475 547 412 0.1% 41.9% 41.9% $12.65 0 0 Farmington/Farmington Hills Totals 4,178,825 -24,686 -32,807 -0.8% 25.9% 26.0% $18.13 0 0 Macomb Totals 945,140 -3,167 -18,337 -1.9% 11.4% 11.4% $17.21 0 0 Northern I-275 Corridor Totals 3,621,671 -402 -70,431 -1.9% 12.7% 13.2% $19.65 0 383,980 North Oakland Totals 2,375,789 -18,269 -38,522 -1.6% 18.3% 8.7% $17.78 0 0 Royal Oak/Southeast Oakland Totals 638,607 -7,400 -6,567 -1.0% 11.1% 11.1% $15.80 0 0 Southern I-275 Corridor Totals 1,129,017 0 161,168 14.3% 0.0% 0.0% $0.00 0 0 Southfield Totals 12,810,271 -9,902 153,819 1.2% 25.7% 25.9% $17.38 0 0 Troy Totals 10,470,696 -14,296 -17,667 -0.2% 24.4% 24.6% $18.12 0 0 Washtenaw Totals 5,529,408 -5,140 -349,280 -6.3% 9.4% 11.2% $23.85 0 0 Suburbs Totals 47,510,357 -70,762 -195,860 -0.4% 21.1% 21.0% $17.90 0 418,334 Detroit Totals 61,470,949 -156,796 -201,710 -0.3% 19.7% 19.6% $18.32 0 418,334 CBD A 6,194,714 -88,183 -43,001 -0.7% 14.2% 14.4% $22.20 0 0 Urban A 6,194,714 -88,183 -43,001 -0.7% 14.2% 14.4% $22.20 0 0 Birmingham/Bloomfield A 1,413,082 3,041 7,435 0.5% 6.6% 6.6% $27.68 0 34,354 Dearborn A 446,890 0 0 0.0% 11.3% 11.3% $25.00 0 0 Farmington/Farmington Hills A 618,109 0 -18,728 -3.0% 14.1% 14.1% $22.50 0 0 Macomb A 295,494 -3,167 -411 -0.1% 2.3% 2.3% $19.29 0 0 Northern I-275 Corridor A 1,059,039 -7,300 -4,959 -0.5% 4.2% 4.2% $22.80 0 383,980 North Oakland A 433,137 13 -18,577 -4.3% 47.5% 47.5% $20.02 0 0 Southern I-275 Corridor A 950,857 0 161,168 16.9% 0.0% 0.0% NA 0 0 Southfield A 2,789,819 -3,383 154,554 5.5% 16.4% 16.7% $22.89 0 0 Troy A 1,924,131 -1,670 70,189 3.6% 16.5% 17.3% $25.46 0 0 Washtenaw A 3,220,406 -2,071 -247,653 -7.7% 9.7% 12.8% $25.80 0 0 Suburbs A 13,150,964 -14,537 103,018 0.8% 12.0% 12.9% $23.92 0 418,334 Detroit A 19,345,678 -102,720 60,017 0.3% 12.7% 13.4% $23.31 0 418,334 CBD B 6,648,778 -2,199 32,803 0.5% 14.5% 14.6% $19.16 0 0 New Center B 1,117,100 4,348 4,348 0.4% 20.9% 21.2% $18.20 0 0 Urban B 7,765,878 2,149 37,151 0.5% 15.5% 15.5% $18.97 0 0 Birmingham/Bloomfield B 1,445,860 14,445 16,630 1.2% 8.7% 9.3% $20.26 0 0 Dearborn B 2,100,626 -5,533 -1,713 -0.1% 50.3% 50.3% $14.69 0 0 Downriver B 404,475 547 412 0.1% 41.9% 41.9% $12.65 0 0 Farmington/Farmington Hills B 3,560,716 -24,686 -14,079 -0.4% 28.0% 28.1% $17.75 0 0 Macomb B 649,646 0 -17,926 -2.8% 15.5% 15.5% $17.07 0 0 Northern I-275 Corridor B 2,562,632 6,898 -65,472 -2.6% 16.2% 16.9% $19.31 0 0 North Oakland B 1,942,652 -18,282 -19,945 -1.0% 11.8% 11.8% $15.77 0 0 Royal Oak/Southeast Oakland B 638,607 -7,400 -6,567 -1.0% 11.1% 11.1% $15.80 0 0 Southern I-275 Corridor B 178,160 0 0 0.0% 0.0% 0.0% $0.00 0 0 Southfield B 10,020,452 -6,519 -735 0.0% 28.3% 28.5% $16.49 0 0 Troy B 8,546,565 -12,626 -87,856 -1.0% 26.2% 26.3% $17.08 0 0 Washtenaw B 2,309,002 -3,069 -101,627 -4.4% 9.0% 9.0% $20.90 0 0 Suburbs B 34,359,393 -56,225 -298,878 -0.9% 24.6% 24.7% $16.78 0 0 Detroit B 42,125,271 -54,076 -261,727 -0.6% 22.9% 23.0% $17.05 0 0 ©2016 Jones Lang LaSalle IP, Inc. All rights reserved.For more information, contact: Aaron Moore | aaron.moore@am.jll.com