Presentation on related party transactions

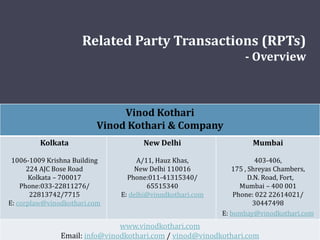

- 1. Vinod Kothari Vinod Kothari & Company Kolkata 1006-1009 Krishna Building 224 AJC Bose Road Kolkata – 700017 Phone:033-22811276/ 22813742/7715 E: corplaw@vinodkothari.com New Delhi A/11, Hauz Khas, New Delhi 110016 Phone:011-41315340/ 65515340 E: delhi@vinodkothari.com Mumbai 403-406, 175 , Shreyas Chambers, D.N. Road, Fort, Mumbai – 400 001 Phone: 022 22614021/ 30447498 E: bombay@vinodkothari.com www.vinodkothari.com Email: info@vinodkothari.com / vinod@vinodkothari.com Related Party Transactions (RPTs) - Overview

- 2. Copyright • The presentation is a property of Vinod Kothari & Co. • No part of it can be copied, reproduced or distributed in any manner, without explicit prior permission. • In case of linking, please do give credit and full link 2

- 3. About Us • Vinod Kothari & Co., ▫ Based in Kolkata, Mumbai, Delhi • We are a team of consultants, advisors & qualified professionals having over 25 years of practice. 3 Our Organization’s Credo: Focus on capabilities; opportunities follow

- 4. RPTs under Companies Act, 2013

- 5. Section 188, Rules 6A & 15 of MBP Rules, 2014

- 6. Who all are related parties?-1/2 Director or KMP or relative thereof Director (excl. IDs) or KMPs of the holding company or his relative Firm, in which a director, manager or his relative is a partner Private company in which a director or manager or his relative is a member or director Related Party 6

- 7. Who all are related parties?-2/2 Public company in which a director or manager is a director and holds along with his relatives, more than 2% of its paid-up share capital any body corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager any person on whose advice, directions or instructions a director or manager is accustomed to act any company which is— (A) a holding, subsidiary or an associate company of such company; or (B) a subsidiary of a holding company to which it is also a subsidiary Note- shall not apply to private companies Related Party 7

- 8. Who all are excluded? Director or KMP of associate and JV companies Investing company or venturer of the company Being proposed under Bill, 2017 Public companies where directors hold less than 2% share capital Any person appointed in senior management in the company or its holding, or subsidiary or associate company 8

- 9. Related Parties and Related Party Transactions • Definition is specific ▫ Includes family members of HUF • Related party transactions under the law are subject to serious restraint • Most transactions that a company may have with “related parties” require approval of Board ▫ Directors are required to observe compliance u/s 184(2) with regard to disclosure of interest and non- participation in a particular discussion. ▫ Private company directors may participate subject to disclosure • In the general meeting the member who is a related party shall not vote if he is related party to the context of a particular transaction • All transactions with related parties though not covered by section 188, shall require approval of Audit Committee in terms of sec 177. 9

- 10. 10 Section 2(76) defines “related party” • By way of Companies 1st (Removal of Difficulties) Order, 2014, the lacuna in drafting of section 2(76)(v) has been rectified to now read as: • public company in which a director or manager is a director AND holds along with his relatives, more than 2% of its paid-up share capital • The apprehension about companies having common IDs being classified as a related party has been mitigated • 2nd RoD Order • a private company to be treated as related party if the director/ manger or HIS RELATIVE is director or member Rule 2 of Companies (Meetings of Board and its Powers) Rules, 2014 also defines “related party” • It reads as: • Director or KMP of holding company or his relatives shall be related party Related Parties

- 11. Transactions covered under Sec 188 11 Sale, purchase or supply of any goods or materials; Note- “goods” means every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale . (Sec 2(7) of the Sale of Goods Act*, 1930) Selling or otherwise disposing of, or buying, property of any kind; Leasing of property of any kind Availing or rendering of any services Appointment of any agent for purchase or sale of goods, materials, services or property Underwriting the subscription of any securities or derivatives thereof, of the company Such related party's appointment to any office or place of profit in the company, its subsidiary company or associate company

- 12. Materiality of RPTs- Rule 15 of MBP Rules • Without prior approval of company by a Resolution, a company cannot transact with related parties where the transaction or transactions to be entered into are for– • sale, purchase or supply of any goods or materials directly or through appointment of agents > 10% of the annual turnover or Rs. 100 crore; lower one • selling or otherwise disposing of, or buying, property of any kind directly or through appointment of agents > 10% of net worth or rs. 100 crore; lower one leasing of property of any kind > 10% of the net worth or 10% of the turnover or Rs. 100 crore; lower one availing or rendering of any services directly or through appointment of agents > 10% of the net worth or Rs. 50 crore; lower one appointment to any place of profit in the company, its subsidiary or associate company at a monthly remuneration > Rs. 2.5 lakhs; remuneration for underwriting the subscription of any securities or derivatives thereof of the company > 1% of the net worth 12 Type of transaction Maximum limit sale, purchase or supply of any goods or materials directly or through appointment of agents 10% of the annual turnover or Rs. 100 crore; lower one selling or otherwise disposing of, or buying, property of any kind directly or through appointment of agents 10% of net worth or rs. 100 crore; lower one leasing of property of any kind 10% of the net worth or 10% of the turnover or Rs. 100 crore; lower one availing or rendering of any services directly or through appointment of agents 10% of the net worth or Rs. 50 crore; lower one appointment to any place of profit in the company, its subsidiary or associate company at a monthly remuneration Rs. 2.5 lakhs remuneration for underwriting the subscription of any securities or derivatives thereof of the company 1% of the net worth

- 13. Other pointers The turnover or net worth shall be on the basis of the Audited Financial Statement of the preceding financial year Any transaction entered into ordinary course of business or transactions on ‘arm’s length basis’ shall not require any approval of Board or of members of the company. However the same shall still require the approval of Audit Committee However, one has to consider the provisions under sec 166 also ‘arm’s length’ transaction would mean a transaction between two related parties that is conducted without any conflict of interest 13

- 14. Determination of transaction to be at arm’s length • Illustrative tests- ▫ prices/ discounts/ premiums and on such terms which are offered to unrelated parties of similar category/ profile ▫ commercially negotiated transaction ▫ pricing is arrived at as per the rule/guidelines that may be issued by or acceptable for the purpose of Ministry of Corporate Affairs, Government of India/ Income Tax Act, 1961, Securities and Exchange Board of India as applicable to any of the contract/ arrangements contemplated under the Companies Act, 2013, Rules framed thereunder or Listing Regulations ▫ terms of contract/arrangement other than pricing are generally on a basis similar to those as may be applicable for similar category of goods and services or similar category/ profile of counterparties ▫ may also apply the most appropriate method from any of the following methods as prescribed under Section 92C(1) of the Income Tax Act, 1961 read with Rule10B of the Income Tax Rules, 1962 ▫ May seek professional opinion 14

- 15. Pricing methods- Sec. 92C(1) of IT Act Comparable Uncontrolled Price Method(CUP): Cost Plus Method Resale Price Method(RPM) Transactional Profit Method Profit Split Method Transactional Net Margin Method 15

- 16. RPTs under AS 18

- 17. Related party & related party relationships-1/3 • Considered related if at any time during the reporting period one party has ▫ the ability to control the other party or ▫ exercise significant influence over the other party in making financial and/or operating decisions • enterprises that ▫ directly, or indirectly through one or more intermediaries, ▫ control, or are controlled by, or are under common control ▫ with, the reporting enterprise ▫ including holding companies, subsidiaries and fellow subsidiaries 17

- 18. Related party & related party relationships-2/3 • associates and JVs • investing party or venturer • individuals owning, ▫ directly or indirectly, ▫ an interest in the voting power ▫ that gives them control or significant influence over the enterprise, and ▫ relatives of any such individual • KMP and relatives; and • enterprises over which any related person as mentioned above is able to exercise significant influence- ▫ includes enterprises owned by directors or major shareholders and ▫ enterprises that have a member of key management in common with the reporting enterprise 18

- 19. Related party & related party relationships-3/3 • Not related parties- ▫ Companies having merely common directors ▫ unless the director is able to affect the policies of both companies in their mutual dealings • a single customer, supplier, franchiser, distributor, or general agent with whom transaction of a significant volume of business merely by virtue of the resulting economic dependence • Parties in the course of their normal dealings with an enterprise by virtue only of those dealings ▫ providers of finance; ▫ trade unions; ▫ public utilities; ▫ government departments and ▫ government agencies including government sponsored bodies 19

- 20. Related Party- Act, 2013 & AS 18 -1/2 Particulars Whether related party under Act, 2013 Whether related party under AS-18 Director or relative Yes If only common then no. If the director can affect policies, then yes. KMP or relative Yes. KMP defined to include persons with authority and responsibility for planning, controlling activities Yes. KMP defined to mean MD/CEO/manager, WTD, CS, CFO. Director , KMP and his relatives of holding company Yes No Firm in which director, manager or his relative is a partner Yes No Private company in which director or manager or his relative is a member or director Yes No Public company with common director and holds along with relatives 2% of paid up capital Yes No 20

- 21. Related Party- Act, 2013 & AS 18 -2/2 Particulars Whether related party under Act, 2013 Whether related party under AS-18 BoD accustomed to act in accordance with directions of director or manager Yes Yes Holding company, subsidiary or associate Yes Yes Fellow subsidiary Yes Yes Joint venture Yes Yes Fellow associate No Yes, if an individual controls or exercises significant influence over both the enterprises A person on whose advice a director or manager accustomed to act Yes Yes. In case of individual , there must be an interest in the voting power that gives them control or significant influence. Relatives of such individuals shall also be related party. 21

- 22. Comparison between AS- 18 & IND-AS 24

- 23. Related Party- AS 18 & IND AS 24 Particulars AS- 18 IND AS 24 Relative/ Close member of a person’s family • Spouse • spouse or domestic partner; • children and dependants of person’s spouse or domestic partner are an addition to the list. KMP • who have the authority and responsibility for planning, directing and controlling the activities of the reporting enterprise. • having authority and responsibility for planning, directing and controlling the activities of the entity, directly or indirectly, including any director (whether executive or otherwise) Person as a related party • individuals owning, directly or indirectly, an interest in the voting power of the reporting enterprise that gives them control or significant influence over the enterprise, and relatives of any such individual; • A person or a close member of that person’s family is related to a reporting entity if that person: • has control or joint control of the reporting entity; • has significant influence over the reporting entity; or 23

- 24. Related Party- AS 18 & IND AS 24 Particulars AS- 18 IND AS 24 KMP as related party • key management personnel and relatives of such personnel shall be related party • Same as AS-18 ,KMP of parent entity and close member of that person’s family included under IND-AS 24 • KMP includes directors( executive or otherwise) Entities as related party • holding companies, subsidiaries and fellow subsidiaries • Group companies are an addition Both entities are Joint Ventures of the same third party • No such provision • Yes. Eg. If A ltd has JV1 (formed by A & B) and JV2 (formed by A & C) then JV 1 and JV2 are related parties One entity is a joint venture of a third entity and the other entity is an associate of the third entity. • No such provision • Yes. Eg. If A ltd has JV1 (formed by A & B) and A ltd holds 25% in Z Ltd then JV1 and Z Ltd are related parties 24

- 25. Related Party- AS 18 & IND AS 24 Particulars AS- 18 IND AS 24 The entity, or any member of a group of which it is a part, provides key management personnel services to the reporting entity or to the parent of the reporting entity. • No such provision • IND AS 24 has included such entity in the definition of related party Two companies because they have a director in common • No, it shall not be considered as RP • The exclusion has been expanded to include directors and KMP Two joint venturers simply because they share joint control of a joint venture. • No such exclusion • While co-venturers are not expressly covered under the definition, it has been expressly excluded. 25

- 26. Definition of “control” & “Joint Control” IND-AS 110 provides for control as under: ▫ An investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. IND-AS 111 provides for Joint control as under: ▫ Joint control is the contractually agreed sharing of control of an arrangement, which exists only when decisions about the relevant activities require the unanimous consent of the parties sharing control. 26

- 27. Definition of “Significant Influence” • IND-AS 28 defines significant influence as under: ▫ power to participate in the financial and operating policy decisions of the investee ▫ but is not control or joint control of those policies. 27

- 28. Related Party- Act, 2013 & IND-AS 24 (1/3) Particulars Whether related party under Act, 2013 Whether related party under IND-AS 24 Director or relative Yes Yes if the director or relative has control or joint control over the reporting entity or has significant influence over the reporting entity. KMP or relative Yes. KMP defined to include persons with authority and responsibility for planning, controlling activities Yes. KMP defined to include persons with authority and responsibility for planning, controlling activities, directly or indirectly, including any director of the entity Director , KMP and his relatives of holding company Yes No Firm in which director, manager or his relative is a partner Yes No Private company in which director or manager or his relative is a member or director Yes No Public company with common director and holds along with relatives 2% of paid up capital Yes No 28

- 29. Related Party- Act, 2013 & IND-AS 24- (2/3) Particulars Whether related party under Act, 2013 Whether related party under IND-AS 24 BoD accustomed to act in accordance with directions of director or manager Yes Yes Holding company, subsidiary or associate Yes Yes Fellow subsidiary Yes Yes Joint venture Yes Yes Fellow associate No Yes, if an individual controls or exercises significant influence over both the enterprises A person on whose advice a director or manager accustomed to act Yes Yes. In case of individual , there must be an interest in the voting power that gives them control or significant influence. Relatives of such individuals shall also be related party. 29

- 30. Related Party- Act, 2013 & IND-AS 24(3/3) Particulars Whether related party under Act, 2013 Whether related party under IND-AS 24 Two joint venturers No Co-venturers have been excluded from the definition of RPTs. Two entities having a common KMP or a member of KMP of one entity has significant influence over another entity No No 30

- 32. Section 40A(2) Any excess or unreasonable payment made to a related person shall be disallowed To be compared to the fair market value of the goods, services or facilities for which payment is made; Legitimate business needs of the business; Benefit derived by or accruing as a result of expenditure 32

- 33. Sequence of Approvals for RPTs

- 34. Sequence of approvals required u/s 188 • Contract in Ordinary Course of business and on arm’s length basis ▫ Only Audit Committee approval Need not be prior approval However, prior omnibus approval may be granted • Contracts not in the ordinary course of business ▫ may be approved by Audit Committee and ▫ will be recommended to Board for approval. • Contracts in Ordinary Course of business not on Arm’s Length basis ▫ Audit Committee cannot approve ▫ Considering provisions under Sec 166 (duties of directors), Board to take necessary action subject to the approval of the shareholders • If approval of Board or prior approval of S/H not obtained ▫ Needs to be ratified within 3 months from date. 34

- 35. Rule 6A of MBP Rules - Omnibus Approval

- 36. Criteria for omnibus approval • Audit Committee to set criteria for granting omnibus approval ▫ Such criteria are subject to approval of the Board • The criteria to include- ▫ maximum value of the transactions, in aggregate and per transaction, which can be allowed under the omnibus route in a year; ▫ extent and manner of disclosures to be made at the time of seeking such approval; ▫ review, at such intervals, as decided by the committee of RPTs entered into by the company pursuant to each of the omnibus approval made; ▫ transactions which cannot be subject to the omnibus approval 36

- 37. Consideration of Audit Committee • Committee to consider the following- ▫ repetitiveness of the transactions (in past or in future); ▫ justification for the need of omnibus approval ▫ need of the omnibus approval ▫ in the best interest of the company 37

- 38. Foreseen & unforeseen transactions • For foreseen transactions the approval shall contain the following- ▫ name of the related parties; ▫ nature and duration of the transaction; ▫ maximum amount of transaction that can be entered into; ▫ the indicative base price or current contracted price and the formula for variation in the price, if any; and ▫ any other information relevant or important for the Audit Committee to take a decision on the proposed transaction • For unforeseen transaction- ▫ Value shall not exceed 1 crore per transaction 38

- 39. Other pointers Validity of omnibus approval is one financial year. shall require fresh approval after the expiry of such financial year. No omnibus approval for transactions in respect of selling or disposing of the undertaking of the company. ▫ Further, transactions which are not at arm’s length cannot be approved by the Audit Committee Additional conditions may be set out by Audit Committee as may deem fit. 39

- 40. Section 188 – other provisions -1/6 40 Will related party transactions entered into in the ‘ordinary course of business’ require to be passed by such resolutions of shareholders? • The third proviso to Section 188 (1) of the Act, 2013 provides that the company will not require the approval of the Board and / or shareholders provided the transactions are entered into by the company with the related party: • in the ordinary course of business; and • such transactions are on an arms’ length basis • Accordingly, any transaction which takes place in the ordinary course of business, but is not on an arms’ length basis will be covered under the provisions of Section 188 (1) of the Act, 2013. • However, one has to still observe Section 166 Has any criteria been prescribed for determining which RPTs has been entered into on an arms’ length basis? • No. The Act, 2013 does not prescribe any criteria for determining whether the RPT was entered into on an arms’ length basis. It would, therefore, be a subjective decision to be decided upon by the Board of Directors of every company.

- 41. Section 188 – other provisions – 2/6 41 Has any exemption been given to transactions between holding and subsidiary companies, considering that most of the transactions between them can never be on arms’ length basis? • Exemption of obtaining shareholders resolution is only granted to transactions entered into between a holding company and wholly owned subsidiary companies • Hence, approval of Board and Audit Committee shall still be required. • The very concept of a holding subsidiary relationship is that the subsidiaries mainly thrive on the transactions with their holding companies. • However, no exemption has been given to holding subsidiary transactions which are not on an arms’ length transactions.

- 42. Section 188 – other provisions -3/6 42 >The 3rd proviso says so. However, one has to take care of the provisions of Sec166 also. >Further, all RPTs entered into by a company alongwith any modifications to the same will require approval of the Audit Committee of the company, if any. >Therefore, it seems that while all arms’ length transactions in ordinary course of business with related parties are not required to be approved by the Board or shareholders, they would still require approval of the Audit Committee, if any and considering the provisions of Sec 166, of the Board also. Does it mean that RPTs which are in the ordinary course of business and on an arms’ length basis will not be required to be passed by the Board?

- 43. Section 188 – other provisions -4/6 43 Are directors liable for any loss suffered by the company with respect to RPTs? Any RPTs entered into by a company without prior approval of the Board or shareholders, needs to be ratified within 3 months of entering into such RTPs. Otherwise- The RPT shall become voidable at the instance of the Board; and If the same is with any director, or is authorised by any other director, the director(s) concerned shall be required to indemnify the company against any loss incurred by it. The company has power to initiate any proceeding against director or employee who has entered into such contract or arrangement. In terms of section 164, he shall be disqualified for appointment as a director of any other company for 5 years.

- 44. Section 188 – other provisions -5/6 • All companies are not required to form an Audit Committee. Therefore companies not having Audit Committees are not required to get its RPTs approved by the Audit Committee. • However, where a company has an Audit Committee, approval of the RPT by the Audit Committee is necessary since the Committee is required to act in accordance with its terms of reference. • Once approved by the Audit Committee, the same may be recommended to the Board for its approval. 44 Is it mandatory for a company to get its RPTs approved by an Audit Committee?

- 45. Section 188 – other provisions -6/6 45 Does lending/guarantee to/from subsidiary come under related party contract? Does the issue or subscription of securities covered? •A subsidiary is certainly a related party as per section 2(76). •However section 188 does not cover either loans or guarantees or issue or subscription of securities. •But section 177(4)(iv) will certainly cover such contracts which requires Audit Committee approval.

- 46. Procedure to be followed for entering into RPTs -1/2 Seria l No Particulars Remarks Mandatory Provisions 1 The RPT will first need to be approved by the Audit Committee , if any. In case the company does not have any Audit Committee, this provision will not apply. As per the Rules, only: (i) listed companies, (ii) Every public company having : •paid up capital of 10 crore or more; or •turnover of Rs. 100 crore or more •in aggregate outstanding loans and borrowings, debentures or deposits exceeding Rs. 50 crore or more. are mandatorily required to form an Audit Committee. 2 Once approved by the Audit Committee, if any, the Board of Directors of the Company will need to pass the resolution at a meeting of the Board Such resolutions cannot be passed by a resolution by circulation. 46

- 47. Procedure to be followed for entering into RPTs -2/2 For companies with paid up capital of Rs. 1 crore or more 3 The RPT will additionally need to be passed by the shareholders of the company Members who are also related party to the particular contract cannot vote on such resolutions. This is not required for transactions between holding company and wholly owned subsidiary companies RPTs entered in ordinary course of business and on an arms’ length basis 4 None of the provisions u/s 188 will apply to such transactions. However, approval by Audit Committee, if any would still be applicable. 47

- 48. Contravention of Sec 188 • Punishment for violation of provisions of the section ▫ Listed Company Imprisonment extending to 1 year or Fine Rs. 25,000 – Rs. 5 lakhs or with both ▫ Any other company Fine Rs. 25,000 – Rs. 5 lakhs ▫ Penalty on any director or employee who enters into or authorizes the contract in contravention of provisions of the section ▫ Punishment levied even if no loss has been incurred by Company from such RPT. 48

- 49. RPTs under Listing Regulations

- 50. Regulation 23

- 51. Related party & related party transaction • Regulation 2(1)(zb)- related party means a related party as defined under ▫ section 2(76) of CA, 13, or ▫ under the applicable accounting standards • Regulation 2(1)(zc)- • “related party transaction” means ▫ a transfer of resources, ▫ services or ▫ obligations ▫ between a listed entity and a related party, ▫ regardless of whether a price is charged and • In terms schedule II of LODR Audit Committee to madatorily review a statement of significant RPTs as defined by Audit Committee ▫ For this purpose, possible meaning of significant transaction may be transaction of above 1 crore. 51

- 52. Requirements under regulation 23 in brief Formulation of policy on “materiality” and on dealing with RPT Material RPT Previous +proposed transaction during FY exceeds 10% of annual consolidated turnover All RPT shall require prior approval of the audit committee Audit committee may grant omnibus approval Quarterly review of RPTs pursuant to omnibus approval Resolution valid for 1 year Material RPT shall require approval of shareholders Earlier it was Special Resolution Now ordinary resolution All related party to abstain from voting Existing transactions may be continued only after approval of shareholders at the general meeting held after these regulations Exceptions ▫ transactions entered into between two government companies; ▫ transactions entered into between a holding company and its wholly owned subsidiary whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval. 52

- 53. Corporate Governance Provisions • Company to frame a policy on materiality of Related Party Transactions and on dealing with Related Party Transactions • Who would approve the policy ▫ Logically, audit committee, followed by the board • Policy on dealing with material transaction to be put on the website of the company and a web link thereto should be mentioned in the Annual report • Contract or arrangement with related parties to be disclosed in the Board Report with the justification for entering into such contract or arrangement • Listed entity to make disclosure in compliance with AS 18 on “related party disclosures” in its annual report • Details of material transactions with related parties to be disclosed in quarterly compliance report on corporate governance 53

- 54. Recommended contents of RPT Policy • Terms of the Policy ▫ Requirement of approval of Audit Committee, Board, shareholders ▫ Arm’s length transactions ▫ Transactions u/s 188 and LODR • Governance Structure ▫ Identification of related parties and related party transactions Who and how to identify ▫ How to ascertain a transaction to be at arm’s length methods thereon ▫ How to ascertain a transaction to be in ordinary course of business ▫ Procedure for approval and review of RPTs • Omnibus Approval by Audit Committee ▫ Criteria for such approval ▫ Other conditions • Dissemination of information ▫ Where, to whom and how to report 54

- 56. Conditions for omnibus approval • Audit committee ▫ to lay down the criteria for granting the omnibus approval in line with the policy on related party transactions ▫ such approval shall be applicable in respect of transactions which are repetitive in nature ▫ to satisfy itself the need for such omnibus approval and that such approval is in the interest of the listed entity 56

- 57. Foreseen & unforeseen transactions • For foreseen transaction the approval to specify- ▫ the name(s) of the related party, ▫ nature of transaction, ▫ period of transaction, ▫ maximum amount of transactions that shall be entered into, ▫ the indicative base price / current contracted price and the formula for variation in the price if any; and ▫ such other conditions as the audit committee may deem fit • For Unforeseen transaction- ▫ Value shall not exceed 1 crore per transaction 57

- 58. Other pointers • Review on quarterly basis • Validity for one year ▫ Year is not defined • Exemption to transactions between ▫ govt. companies ▫ holding and wholly owned subsidiaries 58

- 59. Comparison CA,13 & Listing Regulations

- 60. 60 RPTs under Act, 2013 & SEBI LODR summarised-1/3 Basis Companies Act, 2013 SEBI LODR Scope of Related Party As defined under Section 2 (76) As defined under Section 2 (76) and AS-18/ IND AS 24 Scope of Transaction Transactions covered under Section 188 (1) Transfer of resources, services or obligations between a company and a related party, regardless of whether a price is charged Hierarchy of approvals Approval of Audit Committee, Prior approval of Board and Shareholders Prior approval of Audit Committee and Shareholder’s approval Carve-out for ordinary course and arm’s length transactions Excluded from the purview of Section 188 (1) No such carve-outs Materiality As provided under Rule 15 10% of annual consolidated turnover

- 61. 61 Basis Companies Act, 2013 SEBI LODR Exclusions while computing materiality Transactions in ordinary course and on arm’s length basis No such exclusion Need for prior approval by shareholders Prior approval required for material transactions No such requirement. Voting by related parties Related party who are parties to the transaction to abstain from voting All related parties to abstain from voting Applicability to existing transactions Applicable only to transactions entered into on or after April 1, 2014 All existing material related party contracts or arrangements entered into prior to 2nd September and which may continue beyond such date. Policy on Material RPTs No such requirement Regulation 23 Exemption to government From the shareholders resolution From the approval of Audit committee as well as shareholders RPTs under Act, 2013 & SEBI LODR summarised-2/3

- 62. 62 Basis Companies Act, 2013 SEBI LODR Review of transactions under omnibus approval Audit committee may decide Quarterly Transactions which cannot be entered into under omnibus approval Audit committee to decide No such requirement. Selling and disposing of undertaking Cannot grant omnibus approval No such restriction Criteria for omnibus approval Prescribed in Rule 6A of MBP Rules Not prescribed Validity of omnibus approval One financial year One year Authority to set criteria for granting omnibus approval Audit Committee subject to approval of Board Audit Committee RPTs under Act, 2013 & SEBI LODR summarised-3/3

- 63. Consolidated requirements under CA,13 & Listing Regulations

- 64. 64 Scope of Audit Committee approval Mandatory prior approval (Listing Regulations) Specific approval Omnibus approval Recurring foreseen transactions No limit on value Unforeseen transactions Transactions of value not exceeding 1 crore Each transaction a separate contract, then each transaction value Several transactions in a single contract, the contract value Omnibus approval (Act) Same as omnibus approval under Listing Regulations except selling and disposing of undertaking Post facto Ratifying the RPTs already undertaken

- 65. 65 Scope of Board approval Transactions covered under Sec 188 Transaction is in ordinary course of business and at arm's length No approval required Transaction is NOT in ordinary course of business and at arm's length Transactions not covered under sec 188 No approval required

- 66. 66 Scope of shareholder's approval Material RPT as defined under Listing Regulations Entered into with wholly owned subsidiary No approval required Entered into with any other Related Party Approval of shareholders required by way of an Ordinary Resolution All related parties to abstain from voting Value exceeds the limits under Rule 15 of MBP Rules, 2014 and the transaction is not in ordinary course of business and not at arm's length Prior approval of shareholders is required by way of an Ordinary Resolution Related parties that are parties to the contract shall abstain from voting Entered into with wholly owned subsidiary No approval required

- 67. RPTs & AC approval Transaction Listed Company Unlisted/ Debt Listed Reimbursement of expenses Not an RPT. Not required Allotment of company flat to director along with maintenance Not required if rent free accommodation is part of remuneration structure Subscription to equity of WOS No. Not an RPT u/s 188. AC approval reqd as no exemption exists u/s 177 (4) . Subscription to equity/ security of subsidiary or associate Yes. Not an RPT u/s 188. AC approval reqd u/s 177 (4) Appointment of Director/ KMP Not an RPT unless the appointee is a related party prior to appointment. Granting of ESOP to Directors/ KMP Is an RPT, approval not required if granting of ESOPs are part of Rem structure. Not an RPT u/s 188 Guarantee for Loan taken by subsidiary Yes Not an RPT u/s 188. AC approval reqd u/s 177 (4) 67

- 68. Transaction Listed Company Unlisted/ Debt Listed Increase in remuneration of Managing Director Is an RPT. Can be excluded under RPT policy as approval of Board and S/H is reqd u/s 196. Not an RPT u/s 188. AC approval reqd u/s 177 (4), Can be excluded under RPT policy as approval of Board and S/H is reqd u/s 196. Payment of Dividend to all S/H including Related Party Not an RPT as the dividend is distributed to all S/H. Not an RPT u/s 188. Increase in remuneration of KMP Is an RPT. AC may delegate power to determine increments to MD. Not an RPT u/s 188. AC approval reqd u/s 177 (4), AC may delegate power to determine increments to MD Re-appointment of MD/ WTD before expiry of the term Is an RPT. Can be excluded under RPT policy as approval of Board and S/H is reqd u/s 196. Will not be an RPT u/s 188 (1) (f) if the MD/ WTD will receive remuneration entitled to as director. Increase in sitting fees Is an RPT. AC approval can be excluded under RPT policy as approval of NRC and Board will be required. Will not be an RPT u/s 188 (1) (f) as directors will receive fees entitled to as director. AC approval can be excluded as approval of NRC and Board will be required. 68

- 69. Provisions under Secretarial Standards & Guidance notes thereon

- 70. SS-1 • Director shall not be ▫ reckoned for quorum in respect of an item in which he is interested and ▫ present during discussions and voting on such item. ▫ Section 184(2) and Rule 15 of MBP Rules also talks about the same • In case of all the directors are interested ▫ To be decided at general meeting ▫ In general meeting voting entitlement shall be decided in terms of Section 188, Rule 15 of MBP Rules and SS-2 70

- 71. SS-2 • Related party not entitled to vote in a resolution in which he is a related party. • However, shall be counted for the purpose of quorum. • In case of public companies chairman is- ▫ not entitled to propose a resolution in which he is interested ▫ not entitled to conduct proceeding of the meeting ▫ required to entrust the conduct of the proceeding of the meeting to un-interested director or to other member ▫ to resume only after the matter is transacted This restriction is applicable only if the interest w.r.t only a particular transaction. 71

- 72. Reporting Requirements of RPTs

- 73. Authority of reporting • By Statutory Auditor • By Secretarial Auditor • By Cost Auditor • By the Board 73

- 74. By Statutory Auditor Financial Reporting framework requires adequate disclosure of RPTs to enable users of financial statements to understand their nature and actual or potential effects in the financial statements. SA 550 deals with reporting on related party transaction when performing audit of financial statements; Auditor shall inspect the following for indications of the existence of RPTs ▫ Bank, legal and third party confirmations obtained as part of the auditor’s procedures; ▫ Minutes of meeting of shareholders and of those charged with governance ▫ Such other records or documents as the auditor considers necessary in the circumstances of the entity 74

- 75. By Secretarial Auditor • The Secretarial Auditor of the Company to provide observations in MR-3 ▫ Regarding non- compliances for entering into RPTs. • Auditor to ensure compliances and seek for necessary clarification. • The Auditor must also keep a check that such relevant RPTs have been made on arm’s length price 75

- 76. By Cost Auditor (1/2) • Cost Audit Rules, 2011 requires disclosures and subsequent reporting in the cost audit report for related party transactions; • Details of related party transaction are required to be provided in respect of each related party and each product/service for the year as a whole and not transaction-wise in Para D-5 of the Cost Audit Report 76

- 77. By Cost Auditor (2/2) Auditor to determine normal price for RPTs The basis used to determine normal price includes: Comparable uncontrolled price method Resale price method Cost plus method Profit Split method Transactional Net Margin method 77

- 78. Records under Cost Audit Rules • Cost Audit Rules cover the following transactions for which the company needs to maintain records– ▫ purchase and sale of raw materials, finished goods, rendering of services, process materials and rejected goods including scraps and other related materials; ▫ utilisation of plant facilities and technical know-how; ▫ supply of utilities and any other services; ▫ administrative, technical, managerial or any other consultancy services; ▫ purchase and sale of capital goods including plant and machinery; and ▫ any other payment related to the production of goods or rendering of services under reference 78

- 79. By the company • Board’s Report [ sec. 134] ▫ In AOC- 4 ▫ Material transactions ▫ RPTs not at arm’s length ▫ Only sec. 188 transactions • Annual report ▫ Material significant RPTs having potential with the interests of the company 79

- 80. Restriction on participation & voting

- 81. Restriction for Board members 81 Type of Company Relevant provisions Public Company • Restriction on participation & voting in the resolution. [sec. 184(2), 166) Private Company • No restrictions on voting provided the concerned related party makes adequate disclosures. [sec. 184(2) Listed Company • RPTs not required Board approval • However, Board’s has its own responsibility of monitor and manage potential conflicts of interest.[reg. 4]

- 82. Restriction for shareholders Type of Company Relevant provisions Public Company • Restriction on shareholder in the context of the particular transaction only. [MCA Circular dtd. July 17, 2014] Private Company • No restrictions on voting provided the concerned related party makes adequate disclosures. [MCA notification dtd. June 5, 2015] Listed Company • Restriction on voting for all related parties. [reg. 23] 82

- 84. Changes in brief W.r.t restriction on voting by interested shareholders- ▫ Restriction shall not apply where 90% or more of members, in number, are relatives of promoters or related parties. Sec. 177 RPT not covered u/s 188 to be recommended to Board if AC does not approve the same; Ratification of RPTs not exceeding 1 cr. within 3 months Exemption to a transaction not covered in sec. 188 between Hold and subsidiary co. This can be interpreted that though sec. 188 exempts such transactions however, 177 shall still apply. 84