The Unbanked

•

1 like•226 views

Tanmia Capital has launched its Economic Papers series to address key topics in simple and informative manner The series will be issued in alternate Arabic and English regularly. Today's topic highlights financial inclusion and provides recent data from selected countries. (in English)

Report

Share

Report

Share

Recommended

Recommended

This presentation discusses the causes of Andhra Pradesh crisis, how it all started and the possible after-effects. It also examines how the Indian MFIs and the government should respond post this crisis. The presentation concludes with reactions from the clients.The Andhra Crisis:The Beginning Of An End Or End Of A Beginning?

The Andhra Crisis:The Beginning Of An End Or End Of A Beginning?MicroSave - Financial Inclusion Consulting

More Related Content

What's hot

This presentation discusses the causes of Andhra Pradesh crisis, how it all started and the possible after-effects. It also examines how the Indian MFIs and the government should respond post this crisis. The presentation concludes with reactions from the clients.The Andhra Crisis:The Beginning Of An End Or End Of A Beginning?

The Andhra Crisis:The Beginning Of An End Or End Of A Beginning?MicroSave - Financial Inclusion Consulting

What's hot (20)

Efl Juhudi webinar presentation: Using phsycometrics for smallholder credit s...

Efl Juhudi webinar presentation: Using phsycometrics for smallholder credit s...

The Andhra Crisis:The Beginning Of An End Or End Of A Beginning?

The Andhra Crisis:The Beginning Of An End Or End Of A Beginning?

Andhra Pradesh MFI Crisis and its Impact on Clients

Andhra Pradesh MFI Crisis and its Impact on Clients

MAJOR PAYMENT HICUPS FACED BY SMES, THE GROWTH DRIVERS OF INDIAN ECONOMY

MAJOR PAYMENT HICUPS FACED BY SMES, THE GROWTH DRIVERS OF INDIAN ECONOMY

Similar to The Unbanked

Similar to The Unbanked (20)

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

Wbg ffidr-editorial-financial-inclusion-banking-on-low incomehouseholds

The Singapore FinTech Consortium - Introduction to Financial Inclusion in Sou...

The Singapore FinTech Consortium - Introduction to Financial Inclusion in Sou...

Mobile and Electronic Payments Conference 2012 Myanmar

Mobile and Electronic Payments Conference 2012 Myanmar

Bridging the Small Business Credit Gap Through Innovative Lending by Accion V...

Bridging the Small Business Credit Gap Through Innovative Lending by Accion V...

Micro-finance In India, Opportunity and Challenges

Micro-finance In India, Opportunity and Challenges

Recently uploaded

Recently uploaded (20)

International economics – 2 classical theories of IT

International economics – 2 classical theories of IT

Fintech Belgium General Assembly and Anniversary Event 2024

Fintech Belgium General Assembly and Anniversary Event 2024

Top^Clinic Soweto ^%[+27838792658_termination in florida_Safe*Abortion Pills ...

Top^Clinic Soweto ^%[+27838792658_termination in florida_Safe*Abortion Pills ...

Managing personal finances wisely for financial stability and

Managing personal finances wisely for financial stability and

Falcon Invoice Discounting: Boost Your Cash Flow Effortlessly

Falcon Invoice Discounting: Boost Your Cash Flow Effortlessly

The Unbanked

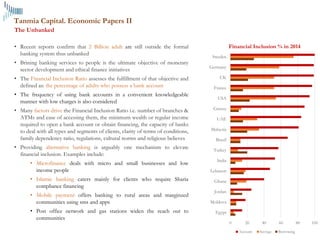

- 1. The Unbanked Tanmia Capital. Economic Papers II 0 20 40 60 80 100 Egypt Moldova Jordan Ghana Lebanon India Turkey Brazil Malaysia UAE Greece USA France UK Germany Sweden Financial Inclusion % in 2014 Account Savings Borrowing • Recent reports confirm that 2 Billion adult are still outside the formal banking system thus unbanked • Brining banking services to people is the ultimate objective of monetary sector development and ethical finance initiatives • The Financial Inclusion Ratio assesses the fulfillment of that objective and defined as: the percentage of adults who possess a bank account • The frequency of using bank accounts in a convenient knowledgeable manner with low charges is also considered • Many factors drive the Financial Inclusion Ratio i.e. number of branches & ATMs and ease of accessing them, the minimum wealth or regular income required to open a bank account or obtain financing, the capacity of banks to deal with all types and segments of clients, clarity of terms of conditions, family dependency ratio, regulations, cultural norms and religious believes • Providing alternative banking is arguably one mechanism to elevate financial inclusion. Examples include: • Microfinance deals with micro and small businesses and low income people • Islamic banking caters mainly for clients who require Sharia compliance financing • Mobile payment offers banking to rural areas and marginzed communities using sms and apps • Post office network and gas stations widen the reach out to communities

- 2. The Unbanked Tanmia Capital. Economic Papers II 0 20 40 60 80 100 Egypt Moldova Jordan Angola Ghana Lebanon India Kazakhstan Turkey Brazil Malaysia UAE Greece USA France UK Germany Sweden Financial Inclusion % in 2014• Recent reports confirm that 2 Billion adult are still outside the formal banking system thus unbanked • Brining banking services to people is the ultimate objective of monetary sector development and ethical finance initiatives • The Financial Inclusion Ratio assesses the fulfillment of that objective and defined as: the percentage of adults who possess a bank account • The frequency of using bank accounts in a convenient knowledgeable manner with low charges is also considered • Many factors drive the Financial Inclusion Ratio i.e. number of branches & ATMs and ease of accessing them, the minimum wealth or regular income required to open bank account or obtain financing, the capacity of banks to deal with all types and segments of clients, clarity of terms of conditions, family dependency ratio, regulations, cultural norms and religious believes • Providing alternative banking is arguably one mechanism to elevate financial inclusion. Examples include: • Microfinance deals with micro and small businesses and low income people • Islamic banking caters mainly for clients who require Sharia compliance financing • Mobile payment offers banking to rural areas and marginzed communities using sms and apps • Post office network and gas stations widen the reach out to communities