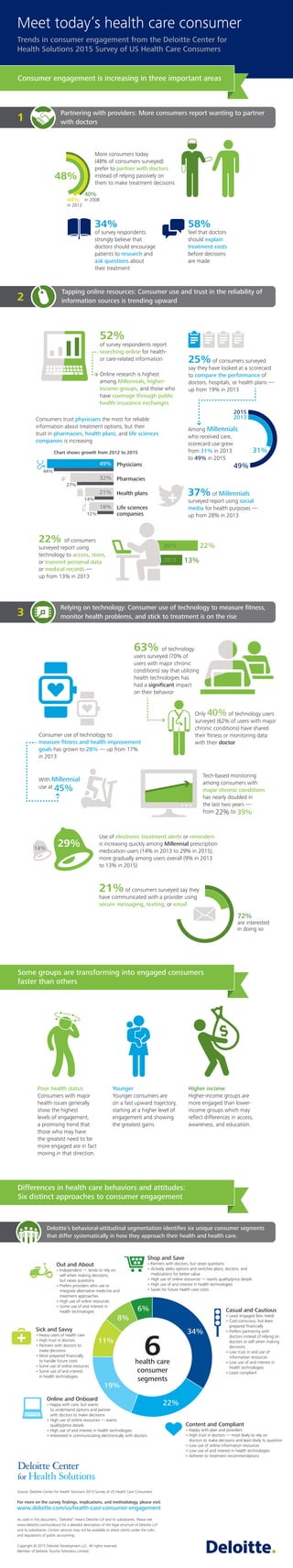

Meet today's health care consumer

- 1. As used in this document, “Deloitte” means Deloitte LLP and its subsidiaries. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations of public accounting. Copyright © 2015 Deloitte Development LLC. All rights reserved. Member of Deloitte Touche Tohmatsu Limited Source: Deloitte Center for Health Solutions 2015 Survey of US Health Care Consumers For more on the survey findings, implications, and methodology, please visit: www.deloitte.com/us/health-care-consumer-engagement Meet today’s health care consumer Trends in consumer engagement from the Deloitte Center for Health Solutions 2015 Survey of US Health Care Consumers Partnering with providers: More consumers report wanting to partner with doctors1 Tapping online resources: Consumer use and trust in the reliability of information sources is trending upward More consumers today (48% of consumers surveyed) prefer to partner with doctors instead of relying passively on them to make treatment decisions 63% of technology users surveyed (70% of users with major chronic conditions) say that utilizing health technologies has had a significant impact on their behavior Only 40% of technology users surveyed (62% of users with major chronic conditions) have shared their fitness or monitoring data with their doctor Consumer use of technology to measure fitness and health improvement goals has grown to 28% — up from 17% in 2013 Poor health status Consumers with major health issues generally show the highest levels of engagement, a promising trend that those who may have the greatest need to be more engaged are in fact moving in that direction. Younger Younger consumers are on a fast upward trajectory, starting at a higher level of engagement and showing the greatest gains. Higher income Higher-income groups are more engaged than lower- income groups which may reflect differences in access, awareness, and education. With Millennial use at 45% of survey respondents strongly believe that doctors should encourage patients to research and ask questions about their treatment 48% 40% in 200844% in 2012 34% feel that doctors should explain treatment costs before decisions are made 58% Relying on technology: Consumer use of technology to measure fitness, monitor health problems, and stick to treatment is on the rise 52% of survey respondents report searching online for health- or care-related information 25% of consumers surveyed say they have looked at a scorecard to compare the performance of doctors, hospitals, or health plans — up from 19% in 2013 Online research is highest among Millennials, higher- income groups, and those who have coverage through public health insurance exchanges 22% of consumers surveyed report using technology to access, store, or transmit personal data or medical records — up from 13% in 2013 Among Millennials who received care, scorecard use grew from 31% in 2013 to 49% in 2015 37% of Millennials surveyed report using social media for health purposes — up from 28% in 2013 31% 2015 2013 49% 2015 2013 22% 13% Deloitte’s behavioral-attitudinal segmentation identifies six unique consumer segments that differ systematically in how they approach their health and health care. Differences in health care behaviors and attitudes: Six distinct approaches to consumer engagement Casual and Cautious • Least engaged (less need) • Cost-conscious, but least prepared financially • Prefers partnering with doctors instead of relying on doctors or self when making decisions • Low trust in and use of information resources • Low use of and interest in health technologies • Least compliant Content and Compliant • Happy with plan and providers • High trust in doctors — most likely to rely on doctors to make decisions and least likely to question • Low use of online information resources • Low use of and interest in health technologies • Adheres to treatment recommendations Online and Onboard • Happy with care, but wants to understand options and partner with doctors to make decisions • High use of online resources — wants quality/price details • High use of and interest in health technologies • Interested in communicating electronically with doctors Sick and Savvy • Heavy users of health care • High trust in doctors • Partners with doctors to make decisions • Most prepared financially to handle future costs • Some use of online resources • Some use of and interest in health technologies Out and About • Independent — tends to rely on self when making decisions, but raises questions • Prefers providers who use or integrate alternative medicine and treatment approaches • High use of online resources • Some use of and interest in health technologies Shop and Save • Partners with doctors, but raises questions • Actively seeks options and switches plans, doctors, and medications for better value • High use of online resources — wants quality/price details • High use of and interest in health technologies • Saves for future health care costs 6health care consumer segments 34% 22% 19% 6% 8% 11% Some groups are transforming into engaged consumers faster than others Consumer engagement is increasing in three important areas Tech-based monitoring among consumers with major chronic conditions has nearly doubled in the last two years — from 22% to 39% Use of electronic treatment alerts or reminders is increasing quickly among Millennial prescription medication users (14% in 2013 to 29% in 2015), more gradually among users overall (9% in 2013 to 13% in 2015) Consumers trust physicians the most for reliable information about treatment options, but their trust in pharmacies, health plans, and life sciences companies is increasing Physicians Pharmacies Health plans Life sciences companies Chart shows growth from 2012 to 2015 49% 32% 21% 18% 44% 27% 14% 12% 29%14% 72% are interested in doing so 21%of consumers surveyed say they have communicated with a provider using secure messaging, texting, or email 2 3 Deloitte Center for Health Solutions