FATCA 2014 Brochure

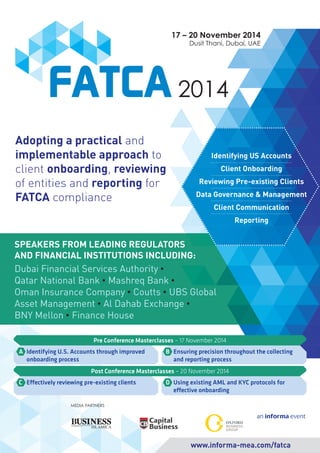

- 1. 17 – 20 November 2014 Dusit Thani, Dubai, UAE SPEAKERS FROM LEADING REGULATORS AND FINANCIAL INSTITUTIONS INCLUDING: Identifying US Accounts Pre Conference Masterclasses – 17 November 2014 Post Conference Masterclasses – 20 November 2014 an informa event Adopting a practical and implementable approach to client onboarding, reviewing of entities and reporting for FATCA compliance Dubai Financial Services Authority • Qatar National Bank • Mashreq Bank • Oman Insurance Company • Coutts • UBS Global Asset Management • Al Dahab Exchange • BNY Mellon • Finance House Client Onboarding Reviewing Pre-existing Clients Data Governance & Management Client Communication Reporting www.informa-mea.com/fatca A Identifying U.S. Accounts through improved onboarding process C Eectively reviewing pre-existing clients B Ensuring precision throughout the collecting and reporting process D Using existing AML and KYC protocols for eective onboarding MEDIA PARTNERS

- 2. Your Compliance Journey Starts Here. e Foreign Account Tax Compliance Act (FATCA), came into effect on 1 July 2014. Failure to comply with the new regulations will expose FFIs to a penalty of 30% withholding tax of U.S. source income, gross proceeds of sales of property that could produce U.S. income, and passthru payments. Are you FATCA ready? FATCA 2014 will help financial institutions to successfully implement and comply with FATCA in their organisation by providing implementable insights and tools for effectively reviewing pre-existing accounts, identifying US accounts, onboarding and reporting to effectively comply with FATCA as per timelines. From Interpreting to IMPLEMENTING! Successfully comply with FATCA in the Middle East! KEY FATCA DEADLINES 2014 December 31, 2014 U.S. Withholding Agents, Participating FFIs, and Registered Deemed-Compliant FFIs need to document pre-existing entity accounts identified as FFIs 2015 January 1, 2015 March 15, 2015 March 31, 2015 March 31, 2015 March 31, 2015 June 30, 2015 Requirement to implement new entity account onboarding Form 1042-S reporting FFIs begin Form Participating FFIs must procedures for U.S. on withholdable USWAs begin Form 8966 U.S. Account FFIs begin Form 8966 document preexisting Withholding Agents, income payments 8966 U.S. Owner information and recalcitrant account high value individual Participating FFIs, and begins reporting balance reporting reporting accounts by June 30, Registered Deemed- 2015 Compliant FFIs 2016 January 1, 2016 March 15, 2016 March 31, 2016 June 30, 2016 June 30, 2016 Deadline for limited FFIs or U.S. Withholding Agents, limited branches to become FFI begin temporary Form Form 8966 reporting on Participating FFIs, and Participating FFIs must participating FFIs and 1042-S aggregate reporting U.S. Account income by Registered Deemed- document all remaining avoid other participating on payments made to non-participating participating FFIs begins Compliant FFIs must preexisting non-high value FFIs within the expanded affiliated group from losing FFIs in addition to account document preexisting entity individual accounts by June information and balance accounts not identified as 30, 2016 their participating FFI status Prima Facie FFIs 2017 January 1, 2017 January 1, 2017 March 15, 2017 March 15, 2017 FATCA withholding on gross Last year for FFI temporary Form Form 8966 reporting on U.S. Account proceeds payments to non-participating Withholding on foreign pass-thru 1042-S aggregate reporting gross proceeds by participating FFIs and recalcitrant payments begins not before January 1, 2017 on payments made to non-participating FFIs begins in addition to account payees begins FFIs information, balance, and income 2018 March 15, 2018 Form 1042-S reporting on gross proceed payments begins Source: Deloitte Who should attend? JOB TITLE BREAKDOWN FROM Chief Compliance Officer Banking Finance Investment Funds Chief Financial Officer Insurance Companies Law Firms Chief Operating Officer Accountancies Partner Compliance 35% Consultancies Tax Audit 33% Ratings Agencies Consultant Finance Operations 11% IT and Solution Providers Internal Audit reporting 9% Intermediary Solution Providers Fund Asset Management 7% Tax Accountant Business Development 5% Compliance Support Companies Tel: +971 4 335 2437 | Fax: +971 4 335 2438 | Email: register-mea@informa.com | Web: www.informa-mea.com/fatca

- 3. Pre Conference Masterclasses A B 08:30 - 12:30 Developing clear strategies for identifying U.S. Accounts through benchmarking your onboarding process e Foreign Account Tax Compliance Act (FATCA) requires you to report information on financial accounts held by U.S. taxpayers, or held by foreign entities in which U.S. taxpayers hold a substantial ownership interest. In order to identify customers who are U.S. taxpayers, FFIs are required to implement due diligence, identification, controls and reporting systems. But categorising U.S. accounts to enable a successful pre-existing account review has been a challenge. is masterclass will enable you to effectively explore and implement set procedures for account review, categorise U.S. and non U.S. accounts and identify against the broad definition of U.S. person in your organisation. Overview: ü Effectively identifying the criteria to categorise U.S. and non U.S. accounts ü Exploring set procedures for efficient pre-existing account analysis operations ü Determining different processes to successfully complete the pre-existing account review and client onboarding ü Analysing the potential risks attached in case of missed accounts ü Definition of a U.S. Person including a Specified U.S. Person under FATCA Leader: Patrick Wilson, Executive, Director, Head of Operational Tax, Wealth Operations, Coutts, UK Post Conference Masterclasses C D 08:30 - 12:30 Devising implementable and hands-on strategies to effectively review pre-existing clients as per FATCA requirements 13:30 - 17:30 FATCA requires FFIs to report information for U.S. accounts. As with withholding, the reporting requirements will be phased in gradually between 2014 and 2017. Only identifying information and account balance or value would be reported in 2014 and 2015. Beginning in 2016, reporting may be required for income and in 2017; it could be expanded to include gross proceeds from the sale of securities. In addition, the proposed regulations provide that the FFI may report information in U.S. dollars or in the currency in which the account is maintained. Overview: ü Managing the application process for registering an FFI ü Exploring strategies for FFIs to ensure cross jurisdictions complex compliance ü Identifying IRS expectations from reporting FFIs ü Ascertaining reportable income and transactions in a system: interest, dividends, gross proceeds and identifying reportable accounts: U.S. Persons, Recalcitrant, NPFFI ü Populating XML files and reporting to the competent authority or the IRS ü Establishing the residence status of a client (particularly entities) and reporting on a single client to various jurisdictions: entity clients with BO residing in multiple countries ü Understanding the implications of a worldwide common model for reporting on financial accounts held by foreign persons, including reciprocal exchange Leader: Karlheinz Moll, Founder, SPIROCO Consulting, Germany 13:30 - 17:30 Monday, 17 November 2014 Exploring practical processes to ensure precision throughout the collecting and reporting process ursday, 20 November 2014 Using existing Anti Money Laundering (AML) and Know Your Customer (KYC) protocols as tools to enable effective onboarding for FATCA compliance FATCA requires identifying customers including individuals and entities who are U.S. taxpayers and hence FFIs will be required to implement due diligence and identification systems as per requirement. is masterclass will provide you with hands on tools to effectively review and identify your existing client base, re-document clients and understand the scope of client review effectively. Overview: ü Exploring the scope of review client files electronically ü Developing means for potential paper review and private banking checks ü Establishing the FATCA status of each client and handling change in circumstances ü Re-documenting existing clients and collecting W-8BEN-E Leader: Zoe Hart, Executive Director, Global Asset Management Tax, UBS Global Asset Management, Switzerland FATCA compliance requires significant changes to customer onboarding and KYC systems, which is likely to delay onboarding and customer service processes. FATCA will further extend this process delays and complications for customers. is masterclass enables you to effectively comply with various regulatory requirements, devise implementable strategies for onboarding new entities and use AML and KYC protocols for effective onboarding. Overview: ü Safeguarding your forensic fraud analysis and reporting systems to meet the FATCA standards ü Know Your Customer: Managing increasing controls and costs to prevent identity theft and comply with the various regulatory requirements ü Identification requirements and proper validation of ID when entering new relationships to ensure compliance ü Devising strategies for onboarding new entity clients and enhancing onboarding procedures: check lists, account opening forms ü Identifying substantial owners of an entity including Passive NFFE Leader: Lorraine White, Managing Director, Head of EMEA Securities Tax US Tax Services, BNY Mellon, UK T e l : + 9T7e1l: 4 + 937315 42 433375 2 |4 3F7a x |: + F9a7x1: 4 + 937315 42 433385 2 |4 3 E8m a| i lE: mregaisl:t reerg-misteear@@iinirfmorem.cao.mco m | W| eWb:e wb:w www.iwir.minef.ocromma/-pmroecau.croem/efnattmcae

- 4. CONFERENCE DAY ONE TUESDAY, 18 NOVEMBER 2014 08:30 Registration and refreshments 09:00 Opening remarks from the Chair Tel: +971 4 335 2437 | Fax: +971 4 335 2438 | Email: register-mea@informa.com | Web: www.informa-mea.com/fatca KEYNOTE FATCA Regulations 09:10 Navigating key FATCA regulations and the latest updates to prepare your business for timely compliance • Where do we come from? Short wrap-up from the HIRE Act, Notices, IGA and where the region is right now • Where are we now? FATCA in effect for individual clients, projects under way, legislation to be provided, uncertainties about reporting • What´s next? Gearing up for Jan 1 deadline for entities, reporting for 2015 and compliance framework in the region • Understanding the impact of FATCA on your business practices: Banks, Credit Unions, Funds and Insurance • Frameworks for compliant client identification: Defining the parameters of the extensive information requirements and knowing the categories of what must be disclosed Inter-Governmental Agreements 09:50 Effectively understanding FATCA Partnerships: How will the various IGA jurisdictions in the GCC affect your compliance strategy? • Recognising exemptions under FATCA IGAs and what this means for Financial Institutions • What is expected to be covered in the UAE’s legislation and guidance notes? • Understanding the implications of other intergovernmental agreements on financial institutions with affiliates in other countries • Implementing practical operational, risk and cost management strategies to seamlessly comply to FATCA compliance across jurisdictions • Determining the impact that IGAs will have on implementing international FATCA compliance Serdar Guner, Director, Supervision, Dubai Financial Services Authority, UAE 10:30 Morning refreshments and networking break FATCA in the Future 11:00 Envisioning the future: Understanding current developments to effectively predict the future impact of FATCA • e global picture: how is the approach to FATCA differing across regions? • What more can firms do to ensure cost-efficiency in multi-jurisdiction operations? • How will FATCA compliance evolve as more countries create IGAs? • How likely is the IRS to update the regulation after an initial period? • e future of FATCA: Will other countries create similar anti-avoidance initiatives? Saleh Nofal, Group Compliance Officer, Qatar National Bank, Qatar Khalid Shaikh, Head of Compliance Bank MLRO, Mashreq Bank, UAE Ali Hussain Ismail, Vice President, Head of Compliance and AML Unit, Oman Insurance Company, UAE Regional Financial Institutions and Compliance 12:20 Meeting FATCA requirements for your organisation: Where do regional FFIs stand now? • What key challenges do FIs in the region face in ensuring U.S. Person identification? • Can the FIs do more to present an industry wide response? • Approaching deadlines: What do timelines for compliance look like now? • How are FFIs tackling the major challenges of FATCA compliance? Bachir El Nakib, Vice President, Head of Compliance, Operational Risk and AML, Coutts, Qatar Sachin Rao, Chief Compliance Officer, Al Dahab Exchange, UAE 13:00 Lunch and networking 14:00 A concise update regarding IGAs and FATCA regulations from the IRS • Strategies for effectively reviewing pre-existing clients as per FATCA regulation • Potential changes existing to KYC and AML procedures • On-boarding of new entity clients starting on Jan 1, 2015 • Self-Certification for W-8IMY, W-8BEN and reporting on U.S. accounts in 2015 • New Qualified Intermediary Agreement FATCA Reporting 14:40 Ensuring precision throughout the collecting and reporting process for financial institutions • Managing the application process for registering an FFI • Exploring strategies for FFIs to ensure cross jurisdictions complex compliance • Identifying IRS expectations from reporting FFIs • Ascertaining and identifying reportable accounts: U.S. Persons, Recalcitrant, NPFFI Lorraine White, Managing Director, Head of EMEA Securities Tax US Tax Services, BNY Mellon, UK 16:00 Afternoon refreshments and networking Review of Pre-Existing Clients 15:20 Exploring implementable strategies to effectively review pre-existing clients as per FATCA requirements • Exploring the scope of reviewing client files electronically • Developing means for potential paper review and private banking checks • Establishing the FATCA status of each client and handling change in circumstances • Re-documenting existing clients and collecting W-8BEN-E Patrick Wilson, Executive, Director, Head of Operational Tax, Wealth Operations, Coutts, UK Identifying U.S. Accounts 16:30 Devising clear strategies for identifying U.S. Accounts: Benchmarking Your Onboarding Process • Effectively identifying the criteria to categorise U.S. and non U.S. accounts • Exploring set procedures for efficient pre-existing account analysis operations • Analysing the potential risks attached in case of missed accounts • Definition of a U.S. Person including a Specified U.S. Person under FATCA Karlheinz Moll, Founder, SPIROCO Consulting, Germany 17:10 Closing remarks from the Chair KEYNOTE REGIONAL FINANCIAL INSTITUTION PANEL REGIONAL FINANCIAL INSTITUTION PANEL INSIGHT INSIGHT INSIGHT IRS INSIGHT

- 5. CONFERENCE DAY TWO WEDNESDAY, 19 NOVEMBER 2014 BOOK BEFORE 25 SEPTEMBER 2014 AND SAVE UPTO US$2,296 www.informa-mea.com/fatca T e l : + 9T7e1l: Tel: 4 + 971 937315 4 42 433375 335 2437 2 |4 3F7a x | |: + Fax: F9a7x1: 4 + 971 937315 4 42 433385 335 2438 2 |4 3 E8m a| | i lE: Email: mregaisl:t register@reerg-misteear@@iinirfmorem.iirme.com cao.mco m | W| Web: eWb:e wb:www.w www.iirme.iwir.minef.ocromma/-com/procurementme pmroecau.croem/efnattmcae INSIGHT INSIGHT INSIGHT REGIONAL FINANCIAL INSTITUTION PANEL INSIGHT INSIGHT INSIGHT INSIGHT 08:30 Registration and refreshments 09:00 Opening remarks from the Chair On-Boarding New Client 09:10 Onboarding FATCA compliance measures using your existing Anti Money Laundering (AML) and Know Your Customer (KYC) protocols • Safeguarding your forensic fraud analysis and reporting systems to meet the FATCA standards • Know Your Customer: Managing increasing controls and costs to prevent identity theft and comply with the various regulatory requirements • Devising strategies for on-boarding new entity clients and enhancing on-boarding procedures: Check lists, account opening forms Zoe Hart, Executive Director, Global Asset Management Tax, UBS Global Asset Management, Switzerland Cost-efficient Implementation 09:50 Devising strategies to successfully implement a cost-efficient FATCA programme in your organisation • Exploring means to ensure cost-efficiency during FATCA implementation for FFIs • Understanding to what extent existing systems can be adapted to enable FATCA compliance • Ensuring non-duplication of internal processes during implementation • Understanding how FFIs can prepare for increased data sharing requirements and also develop a system for the future 10:30 Morning refreshments and break Effective Client Communication 11:00 Setting up a robust client communication network to develop client friendly FATCA compliance and minimise customer inconvenience • Developing a FATCA customer relations strategy through an efficient customer contact • What to include in your initiatives: Documents, language, timing and frequency • How to enable you frontliners to effectively communicate and manage client requirements • A targeted approach: Using existing data to identify likely US citizens and updating the on-boarding process to ensure unobtrusive compliance • What more can be done to improve the customer experience of FATCA? Shagufta Farid, Head of Internal Audit Compliance, Finance House PJSC, UAE Data Governance And Management 11:40 Exploring implementable strategies for data governance and management to ensure superior account due diligence • Determining concrete steps for FATCA Compliance: Steps involved in conducting a FATCA compliance data assessment for your obligations • Understanding the importance of self-assessment: When should you launch and who should be on the team? • Criteria for establishing a dedicated responsible officer/ FATCA leader role • Devising strategy to successfully manage a FATCA implementation project: Pre-requisites, key pointers, balancing systems and operation timelines and coordinating with your IT group • Do you build, buy, or outsource? Technology for FATCA Compliance 12:20 Exploring the latest software, tools, and technologies and outsourcing options to identify the most suitable setup for your organisation • Analysing leading technology and tools available for streamlining your account opening procedures: What is available and how do you choose your best option? • Exploring methods available to monitor citizens who might be subjected to FATCA • Devising plans for managing cloud based platforms to overcome the risks of storing data in foreign based data providers 13:00 Lunch and networking FATCA for Global Organisations 14:00 Determining the effect of FATCA on the global organisation to effectively understand the implementation under multiple agreements • Understanding the final regulations and IGAs: Is there further need for clarity? • Have enough IGAs been confirmed to enable coordinated implementation? • How robust are definitions of customer classifications: Should we expect more change? • Interpreting FATCA for funds: How will the industry be affected? FATCA for Smaller Financial Institutions 14:40 How can Small Financial Institutions and Credit Unions manage more with less? • Managing the impact on smaller banks: What are your options in the reality of insufficient funds or staff to comply? • Exploring the use of efficient technology and data to help streamline account opening and other primary procedures • Strategies to effectively address and minimise fear, uncertainty and doubt concerns from your impacted customer base FATCA for the Insurance Industry 15:20 Is the insurance industry ready? Insight into how the Insurance Industry is preparing for FATCA: Strategies, challenges and the way forward • Understanding the compliance concerns of life insurers and their future predictions • Understanding the role and assistance of the Insurance Authority in paving the way for effective compliance for insurers • Learning from industry leaders: How have the leading insurers been preparing, and what can you adopt in your own organisation? Ali Hussain Ismail, Vice President, Head of Compliance and AML Unit, Oman Insurance Company, UAE 16:00 Closing remarks from the Chair 16:10 End of conference

- 6. AZ3052 17 – 20 November 2014 Dusit Thani, Dubai, UAE 17 November 18 – 19 November 20 November Masterclass A Masterclass B Conference Masterclass C Masterclass D SPONSORSHIP EXHIBITION OPPORTUNITIES Are you a FATCA consultant, technology provider or advisor to the regional financial industry? Position yourself as an expert to this influential audience and help companies implement FATCA efficiently. How can you get involved and what is in it for you? ü Chair the summit to increase your visibility ü Host closed door by-invitation-only meetings with VIP speakers and guests ü Present specific content-driven sessions with professionals and regulators ü Host panel sessions, presentations and round table discussions ü Lead in-depth workshops to solve critical problems and become the preferred thought leader ü Host evening reception to meet and interact with your target market ü Launch reports and tailored research to position yourself as a market intelligence and strategy consultant For sponsorship and exhibition enquiries, please contact Arshed Hussain on +971 4 407 2715 or sponsorship@informa.com REGISTER TODAY Go to www.informa-mea.com/fatca Call +971 4 335 2437 Email register-mea@informa.com For terms and conditions please visit www.informa-mea.com/terms-and-conditions-for-delegates © Copyright Informa Middle East Ltd. Book by 25 September Book by 23 October Final Price Conference 4 Masterclasses $4,199 $4,399 $4,599 Conference 3 Masterclasses $3,699 $3, 899 $4,099 Conference 2 Masterclasses $3,199 $3,399 $3,599 Conference 1 Masterclasses $2,699 $2,899 $3,099 Conference Only $2,099 $2,299 $2,499 Masterclass Only $799 $899 $999 Tel: +971 4 335 2437 | Fax: +971 4 335 2438 | Email: register-mea@informa.com | Web: www.informa-mea.com/fatca