Pidilite Ind: Reports 11% volume growth in a tough operating environment - Prabhudas Lilladher

•

1 like•266 views

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Alembic Pharma Q1FY15: EBITDA margins improved by ~285 bps y-o-y; Hold

Alembic Pharma Q1FY15: EBITDA margins improved by ~285 bps y-o-y; Hold

Beware Of These 5 High Returning but High PE Stocks

Beware Of These 5 High Returning but High PE Stocks

Q4FY14 Result: Bajaj Finance continues to reap the benefits of healthy consum...

Q4FY14 Result: Bajaj Finance continues to reap the benefits of healthy consum...

Adamjee Insurance Company Limited: Struggling to gear momentum

Adamjee Insurance Company Limited: Struggling to gear momentum

Ahluwalia Contracts well placed to benefit from opportunities in construction...

Ahluwalia Contracts well placed to benefit from opportunities in construction...

Similar to Pidilite Ind: Reports 11% volume growth in a tough operating environment - Prabhudas Lilladher

Similar to Pidilite Ind: Reports 11% volume growth in a tough operating environment - Prabhudas Lilladher (20)

Crompton Greaves: Ideally places to benefit from an improved economic growth,...

Crompton Greaves: Ideally places to benefit from an improved economic growth,...

KSB Pumps Q3CY14 Result Update: Weak margin performance - Prabhudas Lilladher

KSB Pumps Q3CY14 Result Update: Weak margin performance - Prabhudas Lilladher

Cipla Q2 disappoints, gearing up for strong H2FY15E

Cipla Q2 disappoints, gearing up for strong H2FY15E

Zee Entertainment: Paradigm shift in business model from cyclicality to annui...

Zee Entertainment: Paradigm shift in business model from cyclicality to annui...

State Bank of India: Absolute valuations, accumulate - Prabhudas Lilladher

State Bank of India: Absolute valuations, accumulate - Prabhudas Lilladher

Q2FY15: Hold Federal Bank for a target of Rs156 - Sushil Finance

Q2FY15: Hold Federal Bank for a target of Rs156 - Sushil Finance

IndusInd Bank delivers strong set of numbers in Q4; Accumulate

IndusInd Bank delivers strong set of numbers in Q4; Accumulate

PI Industries: Another strong performance; Sales up 16% in Q1FY15

PI Industries: Another strong performance; Sales up 16% in Q1FY15

Petronet LNG: Reports decent set of numbers, hold - Sushil Finance

Petronet LNG: Reports decent set of numbers, hold - Sushil Finance

Persistent Systems: Acquired RGen Solutions, Strengthening OPD presence

Persistent Systems: Acquired RGen Solutions, Strengthening OPD presence

Voltas Visit Update: Muted near-term outlook - Prabhudas Lilladher

Voltas Visit Update: Muted near-term outlook - Prabhudas Lilladher

Indoco Remedies: Weak domestic growth offsets export revenues in Q1FY16; Hold

Indoco Remedies: Weak domestic growth offsets export revenues in Q1FY16; Hold

Q1FY16 Results: Granules India posts good results at profitability level

Q1FY16 Results: Granules India posts good results at profitability level

MindTree: Sharpened focus on growth, but rich valuation, accumulate - Prabhud...

MindTree: Sharpened focus on growth, but rich valuation, accumulate - Prabhud...

More from IndiaNotes.com

More from IndiaNotes.com (20)

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

Hester Biosciences gets manufacturing licence for 2 additional poultry vaccines

Hester Biosciences gets manufacturing licence for 2 additional poultry vaccines

Vidhi Dyestuffs: To keep its growth story in the coming quarters also

Vidhi Dyestuffs: To keep its growth story in the coming quarters also

Apollo Tyres approves further expansion of the Truck & Bus radial tyre capacity

Apollo Tyres approves further expansion of the Truck & Bus radial tyre capacity

Grasim Industries reports improved performance in Q1FY16

Grasim Industries reports improved performance in Q1FY16

Cummins India: No interest burden being free from long-term or short-term debt

Cummins India: No interest burden being free from long-term or short-term debt

Buy Makers Laboratories, company growing rapidly with strong thrust on brande...

Buy Makers Laboratories, company growing rapidly with strong thrust on brande...

Buy Multibase India, globalisation of the auto component sector to benefit th...

Buy Multibase India, globalisation of the auto component sector to benefit th...

Capital First: Long-term credit rating is rated highly at AA+ by CARE

Capital First: Long-term credit rating is rated highly at AA+ by CARE

Orient Cement: Best placed to benefit from demand revival in AP & Telengana r...

Orient Cement: Best placed to benefit from demand revival in AP & Telengana r...

Canara Bank's operating performance to improve in remaining 9MFY16E

Canara Bank's operating performance to improve in remaining 9MFY16E

Buy Jenburkt Pharmaceuticals; government's amended FDI policy to cover medica...

Buy Jenburkt Pharmaceuticals; government's amended FDI policy to cover medica...

Hexaware Technologies adds 9 clients in Q2CY15, Buy

Hexaware Technologies adds 9 clients in Q2CY15, Buy

PI Industries: Custom synthesis exports deliver growth of ~26% in Q1FY16; Buy

PI Industries: Custom synthesis exports deliver growth of ~26% in Q1FY16; Buy

Torrent Pharma Q1FY16: IndiaNivesh maintain 'buy' for an upgraded price target

Torrent Pharma Q1FY16: IndiaNivesh maintain 'buy' for an upgraded price target

IndiaNivesh maintain 'buy' on this textile scrip with upgraded target after Q...

IndiaNivesh maintain 'buy' on this textile scrip with upgraded target after Q...

Recently uploaded

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Low Rate Call Girls Pune Vedika Call Now: 8250077686 Pune Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Call Girl Srinagar Indira Call Now: 8617697112 Srinagar Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Srinagar Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Srinagar understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7Call Girls in Nagpur High Profile Call Girls

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangements Near You

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9352852248

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 🌐 beautieservice.com 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9352852248

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S020524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9352852248

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

Recently uploaded (20)

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

8377087607, Door Step Call Girls In Kalkaji (Locanto) 24/7 Available

8377087607, Door Step Call Girls In Kalkaji (Locanto) 24/7 Available

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

cost-volume-profit analysis.ppt(managerial accounting).pptx

cost-volume-profit analysis.ppt(managerial accounting).pptx

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

Cybersecurity Threats in Financial Services Protection.pptx

Cybersecurity Threats in Financial Services Protection.pptx

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

Best VIP Call Girls Morni Hills Just Click Me 6367492432

Best VIP Call Girls Morni Hills Just Click Me 6367492432

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Strategic Resources May 2024 Corporate Presentation

Strategic Resources May 2024 Corporate Presentation

Pidilite Ind: Reports 11% volume growth in a tough operating environment - Prabhudas Lilladher

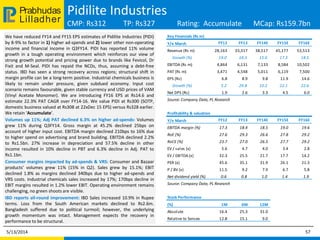

- 1. Lilladher Prabhudas Pidilite Industries CMP: Rs312 TP: Rs327 Rating: Accumulate MCap: Rs159.7bn We have reduced FY14 and FY15 EPS estimates of Pidilite Industries (PIDI) by 8-9% to factor in 1) higher ad-spends and 2) lower other non-operating income and financial income in Q3FY14. PIDI has reported 11% volume growth in a tough operating environment which reinforces our view of strong growth potential and pricing power due to brands like Fevicol, Dr Fixit and M-Seal. PIDI has repaid the NCDs, thus, assuming a debt-free status. IBD has seen a strong recovery across regions; structural shift in margin profile can be a long-term positive. Industrial chemicals business is likely to remain under pressure, given subdued economy. Input cost scenario remains favourable, given stable currency and USD prices of VAM (Vinyl Acetate Monomer). We are introducing FY16 EPS at Rs14.6 and estimate 22.3% PAT CAGR over FY14-16. We value PIDI at Rs300 (SOTP, domestic business valued at Rs308 at 22xDec 15 EPS) versus Rs328 earlier. We retain ‘Accumulate’. Volumes up 11%; Adj PAT declined 6.3% on higher ad-spends: Volumes grew 11% during Q3FY14. Gross margin at 45.2% declined 25bps on account of higher input cost. EBITDA margin declined 210bps to 16% due to higher spend on advertising and brand building. EBITDA declined 2.2% to Rs1.5bn. 27% increase in depreciation and 57.5% decline in other income resulted in 10% decline in PBT and 6.3% decline in Adj. PAT to Rs1.1bn. Consumer margins impacted by ad-spends & VRS: Consumer and Bazaar products’ volumes grew 11% (15% in Q2). Sales grew by 15.1%; EBIT declined 1.8% as margins declined 340bps due to higher ad-spends and VRS costs. Industrial chemicals sales increased by 17%; 170bps decline in EBIT margins resulted in 1.2% lower EBIT. Operating environment remains challenging, no green shoots are visible. IBD reports all-round improvement: IBD Sales increased 10.9% in Rupee terms. Loss from the South American markets declined to Rs2.6m. Bangladesh suffered due to political turmoil; however, the underlying growth momentum was intact. Management expects the recovery in performance to be structural. 5/13/2014 57 Key Financials (Rs m) Y/e March FY12 FY13 FY14E FY15E FY16E Revenue (Rs m) 28,163 33,317 38,517 45,177 53,513 Growth (%) 19.0 18.3 15.6 17.3 18.5 EBITDA (Rs m) 4,864 6,131 7,133 8,584 10,502 PAT (Rs m) 3,471 4,548 5,011 6,119 7,500 EPS (Rs) 6.8 8.9 9.8 11.9 14.6 Growth (%) 5.2 29.8 10.2 22.1 22.6 Net DPS (Rs) 1.9 2.6 3.3 4.5 6.0 Source: Company Data, PL Research Profitability & valuation Y/e March FY12 FY13 FY14E FY15E FY16E EBITDA margin (%) 17.3 18.4 18.5 19.0 19.6 RoE (%) 27.6 29.3 26.6 27.8 29.2 RoCE (%) 23.7 27.0 26.5 27.7 29.2 EV / sales (x) 5.6 4.7 4.0 3.4 2.8 EV / EBITDA (x) 32.3 25.5 21.7 17.7 14.2 PER (x) 45.6 35.1 31.9 26.1 21.3 P / BV (x) 11.5 9.2 7.9 6.7 5.8 Net dividend yield (%) 0.6 0.8 1.0 1.4 1.9 Source: Company Data, PL Research Stock Performance (%) 1M 6M 12M Absolute 16.4 25.3 31.0 Relative to Sensex 12.8 15.1 9.0

- 2. Lilladher Prabhudas Financials Pidilite Industries 5/13/2014 58 Income Statement (Rs m) Y/e March FY12 FY13 FY14E FY15E FY16E Net Revenue 28,163 33,317 38,517 45,177 53,513 Direct Expenses 20,688 24,175 27,863 32,507 38,305 % of Net Sales 73.5 72.6 72.3 72.0 71.6 Employee Cost 2,612 3,010 3,522 4,086 4,707 % of Net Sales 9.3 9.0 9.1 9.0 8.8 SG&A Expenses - - - - - % of Net Sales 0.0 0.0 0.0 0.0 0.0 Other Expenses - - - - - % of Net Sales 0.0 0.0 0.0 0.0 0.0 EBITDA 4,864 6,131 7,133 8,584 10,502 Margin (%) 17.3 18.4 18.5 19.0 19.6 Depreciation 479 532 638 721 809 PBIT 4,385 5,599 6,494 7,863 9,693 Interest Expenses 245 122 111 45 45 PBT 4,567 6,136 6,864 8,498 10,563 Total tax 1,096 1,588 1,853 2,379 3,063 Effective Tax rate (%) 24.0 25.9 27.0 28.0 29.0 PAT 3,345 4,608 4,933 6,119 7,500 Extraordinary Gain/(Loss) (126) 59 (78) - - Adjusted PAT 3,471 4,548 5,011 6,119 7,500 Source: Company Data, PL Research Balance Sheet (Rs m) Y/e March FY12 FY13 FY14E FY15E FY16E Share Capital 508 513 513 513 513 Reserves & Surplus 13,209 16,812 19,795 23,215 27,116 Shareholder's Fund 13,717 17,324 20,308 23,728 27,629 Preference Share Capital - - - - - Total Debt 2,641 602 200 100 100 Other Liabilities(net) - - - - - Deferred Tax Liability 454 484 434 384 334 Total Liabilities 16,812 18,410 20,941 24,211 28,062 Gross Block 9,723 10,607 12,607 14,107 15,857 Less: Depreciation 4,764 5,270 5,908 6,630 7,439 Net Block 4,959 5,337 6,699 7,477 8,418 Capital Work in Progress 3,713 4,087 4,187 4,287 4,387 Cash & Cash Equivalent 5,905 6,838 7,975 10,387 13,223 Total Current Assets 11,913 13,337 15,765 19,829 24,750 Total Current Liabilities 6,193 6,974 8,446 10,219 12,429 Net Current Assets 5,719 6,363 7,319 9,610 12,320 Other Assets 1 (0) (0) (0) (0) Total Assets 16,812 18,410 20,941 24,211 28,062 Source: Company Data, PL Research

- 3. Lilladher Prabhudas Disclaimer 5/13/2014 80 BUY : Over 15% Outperformance to Sensex over 12-months Accumulate : Outperformance to Sensex over 12-months Reduce : Underperformance to Sensex over 12-months Sell : Over 15% underperformance to Sensex over 12-months Trading Buy : Over 10% absolute upside in 1-month Trading Sell : Over 10% absolute decline in 1-month Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to time solicit or perform investment banking or other services for any company mentioned in this document. Prabhudas Lilladher Pvt. Ltd. 3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai 400 018, India. Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209 PL’s Recommendation Nomenclature Rating Distribution of Research Coverage 27.2% 51.5% 21.4% 0.0% 0% 10% 20% 30% 40% 50% 60% BUY Accumulate Reduce Sell %ofTotalCoverage