Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Financial Ratios Analysis of Square Pharmaceuticals

Financial Ratios Analysis of Square Pharmaceuticals

A Term Paper on Financial Statement Analysis of Square Pharmaceuticals Ltd

A Term Paper on Financial Statement Analysis of Square Pharmaceuticals Ltd

A Study on Financial Statement Analysis of Ultratech Cement Limited

A Study on Financial Statement Analysis of Ultratech Cement Limited

Analysis of financial statement of asianpaints ltd

Analysis of financial statement of asianpaints ltd

Financial rario analysis of square pharmaceutical limited

Financial rario analysis of square pharmaceutical limited

Financial statement analysis of beximco pharmaceuticals limited

Financial statement analysis of beximco pharmaceuticals limited

Similar to Smc asian paints_29oct_2014

Similar to Smc asian paints_29oct_2014 (20)

Q2FY15: Cairn India reports 14% decrease in revenue

Q2FY15: Cairn India reports 14% decrease in revenue

Tata Power Company Q2FY15: Results as per estimates

Tata Power Company Q2FY15: Results as per estimates

Buy Britannia Industries for a target of Rs1110 - Prabhudas Lilladher

Buy Britannia Industries for a target of Rs1110 - Prabhudas Lilladher

Sun Pharma: Registers disappointing numbers in Q4FY15

Sun Pharma: Registers disappointing numbers in Q4FY15

Q2FY15: Kotak Mahindra Bank reports 23% growth in net profit

Q2FY15: Kotak Mahindra Bank reports 23% growth in net profit

Q4FY15 result update: IDFC profits trail street expectations

Q4FY15 result update: IDFC profits trail street expectations

More from IndiaNotes.com

More from IndiaNotes.com (20)

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

GSK Consumer: Horlicks strengthens its position as No.1 brand across India

Hester Biosciences gets manufacturing licence for 2 additional poultry vaccines

Hester Biosciences gets manufacturing licence for 2 additional poultry vaccines

Vidhi Dyestuffs: To keep its growth story in the coming quarters also

Vidhi Dyestuffs: To keep its growth story in the coming quarters also

Apollo Tyres approves further expansion of the Truck & Bus radial tyre capacity

Apollo Tyres approves further expansion of the Truck & Bus radial tyre capacity

Grasim Industries reports improved performance in Q1FY16

Grasim Industries reports improved performance in Q1FY16

Cummins India: No interest burden being free from long-term or short-term debt

Cummins India: No interest burden being free from long-term or short-term debt

Buy Makers Laboratories, company growing rapidly with strong thrust on brande...

Buy Makers Laboratories, company growing rapidly with strong thrust on brande...

Buy Multibase India, globalisation of the auto component sector to benefit th...

Buy Multibase India, globalisation of the auto component sector to benefit th...

Capital First: Long-term credit rating is rated highly at AA+ by CARE

Capital First: Long-term credit rating is rated highly at AA+ by CARE

Orient Cement: Best placed to benefit from demand revival in AP & Telengana r...

Orient Cement: Best placed to benefit from demand revival in AP & Telengana r...

Canara Bank's operating performance to improve in remaining 9MFY16E

Canara Bank's operating performance to improve in remaining 9MFY16E

Buy Jenburkt Pharmaceuticals; government's amended FDI policy to cover medica...

Buy Jenburkt Pharmaceuticals; government's amended FDI policy to cover medica...

Hexaware Technologies adds 9 clients in Q2CY15, Buy

Hexaware Technologies adds 9 clients in Q2CY15, Buy

Indoco Remedies: Weak domestic growth offsets export revenues in Q1FY16; Hold

Indoco Remedies: Weak domestic growth offsets export revenues in Q1FY16; Hold

PI Industries: Custom synthesis exports deliver growth of ~26% in Q1FY16; Buy

PI Industries: Custom synthesis exports deliver growth of ~26% in Q1FY16; Buy

Recently uploaded

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangements Near You

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9352852248

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 🌐 beautieservice.com 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9352852248

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S020524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9352852248

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai Escorts

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Today call girl service available 24X7*▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 CALL 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓 SERVICE ✅

⭐➡️HOT & SEXY MODELS // COLLEGE GIRLS

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

★ SAFE AND SECURE HIGH CLASS SERVICE AFFORDABLE RATE

★ 100% SATISFACTION,UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL 24x7 :: #S07 3 * 5 *7 *Star Hotel Service .In Call & Out call SeRvIcEs :

★ A-Level (5 star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob)Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

100% SAFE AND SECURE 24 HOURS SERVICE AVAILABLE HOME AND HOTEL SERVICES

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...roshnidevijkn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Taloja 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Taloja 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Taloja 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S030524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Call Girls

Booking Now open +91- 9352852248

Why you Choose Us- +91- 9352852248

HOT⇄ 8005736733

Mr ashu ji

Call Mr ashu Ji +91- 9352852248

𝐇𝐨𝐭𝐞𝐥 𝐑𝐨𝐨𝐦𝐬 𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐑𝐚𝐭𝐞 𝐒𝐡𝐨𝐭𝐬/𝐇𝐨𝐮𝐫𝐲🆓 .█▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓

Hello Guys ! High Profiles young Beauties and Good Looking standard Profiles Available , Enquire Now if you are interested in Hifi Service and want to get connect with someone who can understand your needs.

Service offers you the most beautiful High Profile sexy independent female Escorts in genuine ✔✔✔ To enjoy with hot and sexy girls ✔✔✔$s07

★providing:-

• Models

• vip Models

• Russian Models

• Foreigner Models

• TV Actress and Celebrities

• Receptionist

• Air Hostess

• Call Center Working Girls/Women

• Hi-Tech Co. Girls/Women

• HousewifeCall Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...roshnidevijkn ( Why You Choose Us? ) Escorts

Call Girl Srinagar Indira Call Now: 8617697112 Srinagar Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Srinagar Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Srinagar understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Recently uploaded (20)

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

Diva-Thane European Call Girls Number-9833754194-Diva Busty Professional Call...

Diva-Thane European Call Girls Number-9833754194-Diva Busty Professional Call...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Independent Call Girls in Taloja 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Taloja 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

Cybersecurity Threats in Financial Services Protection.pptx

Cybersecurity Threats in Financial Services Protection.pptx

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

(INDIRA) Call Girl Srinagar Call Now 8617697112 Srinagar Escorts 24x7

Strategic Resources May 2024 Corporate Presentation

Strategic Resources May 2024 Corporate Presentation

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Smc asian paints_29oct_2014

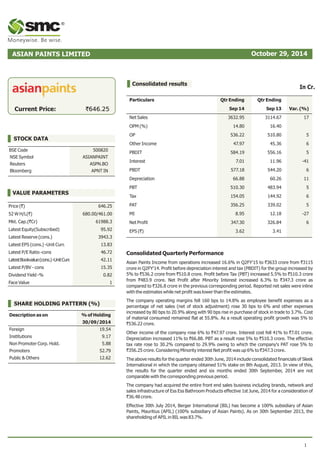

- 1. ASIAN PAINTS LIMITED October 29, 2014 Current Price: VALUE PARAMETERS Price (`) 646.25 52 W H/L(`) 680.00/461.00 Mkt. Cap.(`Cr) 61988.3 Latest Equity(Subscribed) 95.92 Latest Reserve (cons.) 3943.3 Latest EPS (cons.) -Unit Curr. 13.83 Latest P/E Ratio -cons 46.72 Latest Bookvalue (cons.) -Unit Curr. 42.11 Latest P/BV - cons 15.35 Dividend Yield -% 0.82 Face Value 1 Consolidated results In Cr. `646.25 STOCK DATA BSE Code 500820 NSE Symbol ASIANPAINT Reuters ASPN.BO Bloomberg APNT IN SHARE HOLDING PATTERN (%) Description as on % of Holding 30/09/2014 Foreign 19.54 Institutions 9.17 Non Promoter Corp. Hold. 5.88 Promoters 52.79 Public & Others 12.62 Consolidated Quarterly Performance Asian Paints Income from operations increased 16.6% in Q2FY'15 to `3633 crore from `3115 crore in Q2FY'14. Profit before depreciation interest and tax (PBDIT) for the group increased by 5% to `536.2 crore from `510.8 crore. Profit before Tax (PBT) increased 5.5% to `510.3 crore from `483.9 crore. Net Profit after Minority Interest increased 6.3% to `347.3 crore as compared to `326.8 crore in the previous corresponding period. Reported net sales were inline with the estimates while net profit was lower than the estimates. The company operating margins fell 160 bps to 14.8% as employee benefit expenses as a percentage of net sales (net of stock adjustment) rose 30 bps to 6% and other expenses increased by 80 bps to 20.9% along with 90 bps rise in purchase of stock in trade to 3.7%. Cost of material consumed remained flat at 55.8%. As a result operating profit growth was 5% to `536.22 crore. Other income of the company rose 6% to `47.97 crore. Interest cost fell 41% to `7.01 crore. Depreciation increased 11% to `66.88. PBT as a result rose 5% to `510.3 crore. The effective tax rate rose to 30.2% compared to 29.9% owing to which the company's PAT rose 5% to `356.25 crore. Considering Minority interest Net profit was up 6% to `347.3 crore. The above results for the quarter ended 30th June, 2014 include consolidated financials of Sleek International in which the company obtained 51% stake on 8th August, 2013. In view of this, the results for the quarter ended and six months ended 30th September, 2014 are not comparable with the corresponding previous period. The company had acquired the entire front end sales business including brands, network and sales infrastructure of Ess Ess Bathroom Products effective 1st June, 2014 for a consideration of `36.48 crore. Effective 30th July 2014, Berger International (BIL) has become a 100% subsidiary of Asian Paints, Mauritius (APIL) (100% subsidiary of Asian Paints). As on 30th September 2013, the shareholding of APIL in BIL was 83.7%. 1 Particulars Qtr Ending Qtr Ending Sep 14 Sep 13 Var. (%) Net Sales 3632.95 3114.67 17 OPM (%) 14.80 16.40 OP 536.22 510.80 5 Other Income 47.97 45.36 6 PBDIT 584.19 556.16 5 Interest 7.01 11.96 -41 PBDT 577.18 544.20 6 Depreciation 66.88 60.26 11 PBT 510.30 483.94 5 Tax 154.05 144.92 6 PAT 356.25 339.02 5 MI 8.95 12.18 -27 Net Profit 347.30 326.84 6 EPS (`) 3.62 3.41 ®

- 2. Management Comments K.B.S. Anand, Managing Director & CEO said: "Double digit volume growth was witnessed across regions in the decorative paint segment. The Automotive coatings JV (PPG-AP), saw good growth in the General Industrial and Auto Refinish segment. The Industrial Coatings JV (AP-PPG), which had seen a decline in the previous years, saw good volume growth in the current year. The international business was led by good growth in markets like Bangladesh, Nepal & Oman." We continue to work on our plans for network expansion and streamlining of operations for the Sleek Business. The ESS ESS Bathroom products business which was acquired in the last quarter performed as per our expectations" he added. E-mail: researchfeedback@smcindiaonline.com SMC Global Securities Limited is proposing, subject to receipt of requisite approvals, market conditions and other considerations, a further public offering of its equity shares and has filed the Draft Red Herring Prospectus with the Securities and Exchange Board of India (“SEBI”) and the Stock Exchanges. The Draft Red Herring Prospectus is available on the website of SEBI at www.sebi.gov.in and on the websites of the Book Running Lead Manager i.e., ICICI Securities Limited at www.icicisecurities.com and the Co- Book Running Lead Manager i.e., Elara Capital (India) Private Limited at www.elaracapital.com . Investors should note that investment in equity shares involves a high degree of risk and for details relating to the same, please see the section titled “Risk Factors” of the aforementioned offer document. 2 ® SMC Research also available on Reuters Corporate Office: 11/6B, Shanti Chamber, Pusa Road, New Delhi - 110005 Tel: +91-11-30111000 www.smcindiaonline.com Mumbai Office: Dheeraj Sagar, 1st Floor, Opp. Goregaon sports club, link road Malad (West), Mumbai - 400064 Tel: 91-22-67341600, Fax: 91-22-28805606 Kolkata Office: 18, Rabindra Sarani, "Poddar Court", Gate No. 4, 4th Floor, Kolkata - 700001 Tel: 91-33-39847000, Fax: 91-33-39847004 ® DISCLAMIER: This report is for the personal information of the authorized recipient and doesn't construe to be any investment, legal or taxation advice to you. It is only for private circulation and use .The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. No action is solicited on the basis of the contents of the report. The report should not be reproduced or redistributed to any other person(s)in any form without prior written permission of the SMC. The contents of this material are general and are neither comprehensive nor inclusive. Neither SMC nor any of its affiliates, associates, representatives, directors or employees shall be responsible for any loss or damage that may arise to any person due to any action taken on the basis of this report. It does not constitute personal recommendations or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/s. All investments involve risk and past performance doesn't guarantee future results. The value of, and income from investments may vary because of the changes in the macro and micro factors given at a certain period of time. The person should use his/her own judgment while taking investment decisions. Please note that we and our affiliates, officers, directors, and employees, including persons involved in the preparation or issuance if this material;(a) from time to time, may have long or short positions in, and buy or sell the commodities thereof, mentioned here in or (b) be engaged in any other transaction involving such commodities and earn brokerage or other compensation or act as a market maker in the commodities discussed herein (c) may have any other potential conflict of interest with respect to any recommendation and related information and opinions. All disputes shall be subject to the exclusive jurisdiction of Delhi High court.