More Related Content

Similar to 20150209_AFPEconWatch-2 (20)

20150209_AFPEconWatch-2

- 1. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 1

Weekly Economic Newsletter for Treasury and Finance > > February 9, 2015

Weekly Economic Newsletter Update

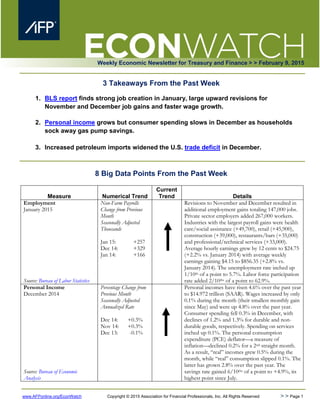

3 Takeaways From the Past Week

1. BLS report finds strong job creation in January, large upward revisions for

November and December job gains and faster wage growth.

2. Personal income grows but consumer spending slows in December as households

sock away gas pump savings.

3. Increased petroleum imports widened the U.S. trade deficit in December.

8 Big Data Points From the Past Week

Measure Numerical Trend

Current

Trend Details

Employment

January 2015

Source: Bureau of Labor Statistics

Non-Farm Payrolls

Change from Previous

Month

Seasonally Adjusted

Thousands

Jan 15: +257

Dec 14: +329

Jan 14: +166

Revisions to November and December resulted in

additional employment gains totaling 147,000 jobs.

Private sector employers added 267,000 workers.

Industries with the largest payroll gains were health

care/social assistance (+49,700), retail (+45,900),

construction (+39,000), restaurants/bars (+35,000)

and professional/technical services (+33,000).

Average hourly earnings grew by 12 cents to $24.75

(+2.2% vs. January 2014) with average weekly

earnings gaining $4.15 to $856.35 (+2.8% vs.

January 2014). The unemployment rate inched up

1/10th of a point to 5.7%. Labor force participation

rate added 2/10ths of a point to 62.9%.

Personal Income

December 2014

Source: Bureau of Economic

Analysis

Percentage Change from

Previous Month

Seasonally Adjusted

Annualized Rate

Dec 14: +0.3%

Nov 14: +0.3%

Dec 13: -0.1%

Personal incomes have risen 4.6% over the past year

to $14.972 trillion (SAAR). Wages increased by only

0.1% during the month (their smallest monthly gain

since May) and were up 4.8% over the past year.

Consumer spending fell 0.3% in December, with

declines of 1.2% and 1.3% for durable and non-

durable goods, respectively. Spending on services

inched up 0.1%. The personal consumption

expenditure (PCE) deflator—a measure of

inflation—declined 0.2% for a 2nd straight month.

As a result, “real” incomes grew 0.5% during the

month, while “real” consumption slipped 0.1%. The

latter has grown 2.8% over the past year. The

savings rate gained 6/10ths of a point to +4.9%, its

highest point since July.

- 2. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 2

International Trade

December 2014

Source: Bureau of Economic

Analysis/Census Bureau

Trade Balance

Seasonally Adjusted

Billions $

Dec 14: -$46.6

Nov 14: -$39.8

Dec 13: -$37.4

Exports declined by $1.5 billion to $194.9 billion

(+1.1% vs. December 2013) while imports grew by

$5.2 billion to $241.4 billion (+4.9% vs. December

2013). The goods deficit blossomed by $6.9 billion

to -$66.0 billion (its largest since March 2012). The

petroleum deficit surged 27.0% during December to

-$14.7 billion, with petroleum imports growing by

$1.8 billion to $25.0 billion (-13.4% vs. December

2013) and petroleum exports shrinking $1.3 billion

to $10.3 billion (-26.9% vs. December 2013).

Factory Orders

December 2014

Source: Census Bureau

Percentage Change from

Previous Month

Seasonally Adjusted

Dec 14: -3.4%

Nov 14: -1.7%

Dec 13: -1.7%

New factory orders totaled $471.5 billion (-3.6% vs.

December 2013, its worst 12-month comparable in

5 years). Durable and non-durable goods orders fell

0.9% and 0.5%, respectively. Core capital goods

orders (civilian, non-aircraft) slid 0.1% for its 5th

drop in 6 months. Shipments slowed for a 4th time

in 5 months (-1.1%, -0.9% vs. a year earlier).

Unfilled orders fell 0.8% while inventories shrank

0.3%.

ISM Report on Business—

Manufacturing

January 2015

Source: Institute for Supply

Management

PMI (>50 = Growth)

Seasonally Adjusted

Jan 15: 53.5

Dec 14: 55.1

Jan 14: 51.3

This was the PMI’s lowest reading in a year, but the

index has remained above 50.0 for 20 consecutive

months. Only 1 of 5 index components improved

during the month: inventories (up 5.5 points to

51.0). Declining were indices for supplier deliveries

(-5.7 points to 52.9), new orders (-4.9 points to

52.9), employment (-1.9 points to 54.1) and

production (-1.2 points to 56.5). 14 of 18 tracked

industries segments grew during the month.

ISM Report on Business—

Non-Manufacturing

January 2015

Source: Institute for Supply

Management

Index (>50 = Growth)

Seasonally Adjusted

Jan 15: 56.7

Dec 14: 56.5

Jan 14: 54.0

The service sector has expanded for 60 straight

months. 3 of 4 index components improved during

the month: business activity (up 2.9 points to 61.5),

supplier deliveries (up 1.5 points to 54.0) and new

orders (up 3/10ths of a point to 59.5). The

employment index dropped 4.1 points to 51.6. Only

8 of 18-tracked industry segments expanded during

the month.

Construction Spending

December 2014

Source: Census Bureau

Percentage Change from

Previous Month

Seasonally Adjusted

Annualized Rate

Dec 14: +0.4%

Nov 14: -0.2%

Dec 13: +0.9%

At a SAAR of $982.1 billion, construction spending

was 2.2% above year ago levels. Private spending

inched up 0.1% during the month to $698.6 billion

(+0.5% vs. December 2013)—residential spending

grew 0.3% during the month while non-residential

spending slipped 0.2%. The 12-month comparables

for each were -4.0% and +5.3%, respectively.

Public construction spending grew 1.1% to $265.7

billion (+6.7% vs. December 2013).

Productivity

Fourth Quarter 2014

Source: Bureau of Labor Statistics

Non-farm

Percentage Change from

Previous Quarter

Seasonally Adjusted

Annualized Rate

14:Q4 -1.8%

14 Q3: +3.7%

13 Q4: +3.3%

A 5.1% jump in hours worked led to a 3.2% gain in

non-farm business output. Unit labor costs grew

2.7%. Over the past year, non-farm productivity

was unchanged while unit labor costs gained 1.9%.

Manufacturing sector production increased 1.3%

during Q4 (+2.8% year-to-year), with a 5.7% gain in

output and a 4.3% increase in hours worked.

Durable manufacturing productivity grew 1.5% in

Q4 and 3.1% for the year—that same metrics for

non-durables were +0.2% and +2.9%, respectively.

- 3. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 3

Economic Commentary edited by Kevin Roth

Allaying some fears for now of a slowdown

in business activity during the first quarter,

U.S. non-farm employers added 257,000

workers to their payrolls during January.

This was a decline from the 423,000 and

329,000 jobs added during November and

December, respectively. But at the same

time, the three-month moving average of

job gains grew by 8,000 to 336,333 and the

six-month average improved by 1,334 to

282,167. These were the best readings for

the moving averages since 1997 and 2000,

respectively.

Job creation was widespread through the

economy, according to the Bureau of Labor

Statistics. Private sector employers added

267,000 jobs during the month, split by

209,000 in the service sector and 58,000 on the goods producing side. With the former, the biggest gains were

seen in health care/social assistance, retail, professional/business services and leisure/hospitality. For the latter,

the construction and manufacturing sectors added 39,000 and 22,000 workers, respectively. Meanwhile, mining

employment slipped by 3,500 workers, which included a drop of 1,900 jobs in oil & gas extraction.

The same report also hints that wages, which have lagged behind for most of the current economic recovery,

may be picking up. Average private sector hourly wages increased by 12 cents during the month to $24.75.

While 12 cents may not sound like a lot, it represented the biggest hourly wage gain going back to the 2006 start

of the BLS data series with wages up 2.2 percent from a year earlier. Average weekly earnings were at $852.20,

up $4.15 for the month (its largest gain since December 2012) and was 2.8 percent above year ago levels.

The separate household survey puts the unemployment rate at 5.7 percent, up a tenth of a percentage point

from December but still below the 6.6 percent rate of a year earlier. 157.180 million people were in the labor

force (this was up by more than a million for December, but month-to-month comparisons are tricky because

this report reflects updated data benchmarks) with the labor force participation rate at a still weak 62.9 percent.

Net Job Gains

Employment—Source: Bureau of Labor Statistics

-1000

-800

-600

-400

-200

0

200

400

600

NetJobGains(Thousands,SeasonallyAdjusted) Net Non-Farm Job Gains 3-month MA

- 4. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 4

While the typical length of unemployment jumped by 8/10ths

of a week to 13.4 weeks, it was still below the 15.9

week median from a year earlier. The count of part-time workers seeking a full-time job was virtually unchanged

at 6.810 million workers (down 6.4 percent from a year earlier). Finally, the broadest measure of labor

underutilization (the “U-6” series) inched up 1/10th

of a point to 11.3 percent. This nevertheless remained

below the 12.7 percent rate reported for

January 2014.

Other labor market data released last

week includes:

Gallup’s measure of the

unemployment rate jumped 1.3

percentage points to 7.1 percent.

(Unlike the case with the BLS

report, the Gallup data is not

adjusted for seasonal variation).

This was below the 8.6 percent

unemployment rate from a year

earlier. The press release links

January’s increase to seasonal

effects and people re-entering

the labor force. Gallup’s

underemployment rate, which

combines unemployment and

part-time workers seeking a full-time job, gained 7/10ths

of a point to 15.8 percent. The same measure

was at 18.6 percent a year earlier.

While the number of first-time jobless claims grew by 11,000 during the final week of January, the

seasonally adjusted 278,000 reading was the 21st

time over the past 29 weeks in which the Department of

Labor’s data series was below 300,000. The four-week moving average dropped by 6,500 claims to

292,750.

Lower oil and gasoline prices were responsible for the largest count of announced job cuts in two years

as measured by Challenger, Gray & Christmas. The group tracked 53,041 announced job cuts during

January, 40 percent of which it says is “directly related to oil prices.” The number of announced job cuts

was up 62.5 percent from a month earlier with the industries making the most job cut announcements

being energy, retail, financial, industrial goods and computers.

Length of Unemployment

Employment—Source: Bureau of Labor Statistics

0

5

10

15

20

25

30

35

40

45

WeeksofUnemployment(SeasonallyAdjusted)

Average Median

- 5. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 5

The U.S. trade deficit blossomed in December thanks in part to greater petroleum imports. The Census

Bureau/Bureau of Economic Analysis estimates the trade deficit grew by $6.8 billion to -$46.6 billion during the

month, its widest since November 2012.

Exports slowed by $1.5 billion to $194.9

billion (+1.1 percent versus a year earlier)

while import activity increased by $5.2

billion to $241.4 billion (+4.9 percent

versus December 2013). The goods deficit

widened $6.9 billion to -$66.0, including a

petroleum deficit of $14.7 billion (an

increase of $3.1 billion from November).

Using 2009 chained dollars, the “real”

trade deficit jumped $6.0 billion to $54.7

billion, with the increase entirely due to

greater import activity. “Real” petroleum

imports grew by $2.8 billion to $18.8 while

real petroleum exports eked out a small

$0.1 billion gain to $8.3 billion. For all of

2014, the U.S. trade deficit was $505.0

billion, up 6.0 percent from 2013 but

below the 2012 and 2011 deficits.

Consumers are taking some of the money they were saving at the gas pump and putting it away for another day.

Consumer spending fell 0.3 percent during December, according to the Census Bureau. Some of the decline

reflects the recent drop in prices, particularly for gasoline and other energy products. The personal consumption

expenditure (PCE) deflator fell 0.2 percent for a second straight month. Controlling for price variation, “real”

consumer spending inched down 0.1 percent, with declines of 0.7 percent and 0.1 percent for durable and non-

durable goods, respectively. Real spending on services was unchanged for the month. The drop in spending

occurred despite a 0.5 percent gain in real personal incomes. As a result, the savings rate grew to its highest

point since last summer with a 6/10ths

of a percentage point gain to +4.9 percent. The drop in spending came as

consumer sentiment measures have surged to post-recession highs, suggesting that the spending should pick up

in 2015.

The full factory orders report for December mimicked trends from the durable goods report released the

previous week, with the Census Bureau reporting new orders fell 3.4 percent during the month. Trends do not

Trade Balance

International Trade—Source: Bureau of Economic Analysis/Census Bureau

-$100,000

-$50,000

$

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

Millions$(SeasonallyAdjusted)

Exports Imports Trade Deficit

- 6. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 6

appear to be particularly favorable for January either. The Purchasing Managers Index (PMI) from the Institute

for Supply Management lost 1.6 points to a seasonally adjusted 53.5. While this was the 20th

straight month in

which the index was above a reading of 50, consistent with an expanding manufacturing sector, it also was the

PMI’s lowest reading in a year. Four of five index components fell during the month: supplier deliveries, new

orders, employment and production. Fourteen of 18 tracked manufacturing industries expanded during the

month, with the leaders being primary metals, wood products and printing. While survey respondents from

most industries said they were “experiencing strong demand,” the press release warned that the dock slowdown

at west coast ports were “negatively impacting both exports and imports as well as inventories.”

ISM’s measure of service sector activity improved slightly during January. The headline index from the non-

manufacturing Report on Business added 2/10ths

of a point to 56.7, the measure’s 60th

consecutive month above

a reading of 50.0. While three of the four index components—business activity, supplier deliveries and new

orders—improved from their December readings, the employment measure fell sharply. A 4.1 point drop

pushed the employment down to a still expansionary reading of 51.6 with just six of the 18 tracked industries

reporting payroll gains. Only eight of the tracked industries reported overall growth during the month, led by

accommodation/food services, finance/insurance and management of companies/support services. The press

release noted that feedback received from survey respondents “vary by industry and company” but that “they

are mostly positive and/or reflect stability about business conditions.”

The public sector led a 0.4 percent increase in construction activity during December. Construction spending

was at a seasonally adjusted annualized rate of $982.1 billion, up 2.2 percent from a year earlier. Public sector

construction spending grew 1.1 percent

during the month and has risen 6.7 percent

over the past year. Meanwhile, public

sector spending grew a paltry 0.1 percent

in December and was up a mere 0.5

percent from a year earlier. Construction

spending for all of 2014 totaled $961.4

billion, up 5.6 percent from 2013. For the

year, private sector spending was up 7.2

percent—residential spending increased

4.1 percent while non-residential spending

blossomed 10.5 percent—while public

sector spending gained 1.8 percent.

Cheaper gasoline prices sparked greater

demand for light trucks and SUVs during

the opening month of 2015. Vehicle sales

slowed 1.5 percent during January to a

seasonally adjusted annualized rate of

16.66 million units. Sales of light trucks and SUVs gained 4.0 percent to 9.12 million units. This was up 14.2

percent from the sale pace of a year earlier. Sales of automobiles slowed 7.5 percent in January to 7.54 million

units. Even with the decline, auto sales remained 3.1 percent above year ago levels. January was the 11th

straight

month in which the overall vehicle sales topped the 16 million units SAAR, with sales up 8.9 percent from a

year earlier. Data collected by Autodata finds a number of major manufacturers enjoyed double digit percentage

gains from a year earlier; including, General Motors, Ford, Toyota, Fiat/Chrysler, Nissan and Honda.

Consumers used their credit cards more frequently during December, according to the Federal Reserve.

Outstanding revolving credit balances increased by $5.8 billion to $887.9 billion. This was the biggest increase in

revolving credit balances since last May and put outstanding balances 3.5 percent above December 2013 levels.

Vehicle Sales

Vehicle Sales—Source: Individual automakers via Autodata

0

2

4

6

8

10

12

14

16

18

Jan '14 Feb '14 Mar '14 Apr '14 May '14 Jun '14 Jul '14 Aug '14 Sep '14 Oct '14 Nov '14 Dec '14 Jan. '15

SeasonallyAdjustedAnnualizedSalesRate(Millions)

Vehicle Sales Cars only Light Trucks/SUVs

- 7. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 7

Non-revolving credit balances—e.g., college loans, auto loans—increased by $9.0 billion, its smallest single-

month increase since March 2012. Nevertheless, non-revolving credit balances grew 8.2 percent during the year

to $2.424 billion. Overall consumer credit balances, not including real estate backed loans, grew 6.9 percent for

all of 2014 to end the year at $3.312 billion.

So, what does it all mean?

The January employment report was a pleasant surprise for not only suggesting that economic activity had not slowed down in

January, but also because the labor market was even stronger in November and December than previously believed. A lot of

attention is being paid to wage growth, which has been weak since before the start of the last recession. The January wage data are

promising, but one month does not make a trend. So, do the labor market trends sufficiently counterbalance last week’s so-so GDP

report and continued weakness in the manufacturing sector to prompt the Federal Reserve to raise short-term rates by mid-year? It is

not clear what the answer to that question is, as we will see several more employment reports before the earliest date the Fed is likely

to act.

Corporate Finance Week edited by Brian Kalish

The recent employment report was the capstone piece of information for those who believe the U.S. economy

has achieved escape velocity from the economic doldrums of the past 6-plus years. Reporting a gain of +257k

jobs in January, the U.S. economy has now averaged a gain of +336k over the past three months, the strongest

3-month average since November 1997 (think The Verve Pipe’s The Freshman). Both the November and

December reports were revised significantly higher, with the November report coming in at +423k, the

strongest month of the recovery to date.

Following that, with the belief the U.S. economy has fully recovered and has passed the point of precarious

balance, the market is beginning to price in “when” the Fed will tighten rather than “if” the Fed will tighten. As

a result, the U.S. Treasury market bore the brunt of that sea change in belief.

For the week, the 2-year note yield is up 15bps to 62bps; the 5-year note yield is up 26bps to 1.45 percent; the

10-year note yield is up 26bps to 1.93 percent (after touching a near 2 year low of 1.67); and the 30-year bond

yield is up 29bps to 2.51 percent, (after falling to its all-time low yield of 2.22 percent).

With all this positive news acting as a tailwind, the stock market returned to its winning ways. The Dow is up

4.6 percent on the week and is closing in on its all-time high of 18,103 reached back in late December. Over the

past year, the Dow is up 14.72 percent. The S&P 500 is up 3.86 percent this week and now is only about one

- 8. www.AFPonline.org/EconWatch Copyright © 2015 Association for Financial Professionals, Inc. All Rights Reserved > > Page 8

percent away from its all-time high of 2,093, also reached in late December. The S&P is now up 16.77 percent

over the past 12 months. The NASDAQ is up 3.3 percent this week, within whiskers of its 15-year high of

4,814, also reached back in late December. The index is up 17.54 percent over the past 365 days.

Even with all the headwinds Europe is facing (little to no growth, possible deflation, and high unemployment),

their equity markets continue to perform well. The German DAX reached a new all-time high of 10,984 and it is

up 17.17 percent over the past year. The British FTSE continues to trade near its all-time high of 6,950 (which

was reached in December 1999). Over the past 12 months, the FTSE is up 4.50 percent. The French CAC

touched a 52-week high this week of 4,707 and the index is up 12.01 percent over the past 365 days, but remains

far way off from its all-time of 6,922 reached back in September 2000, during the dot-com boom.

The Japanese Nikkei continues to perform well, it is up 24.68 percent over the past year but it still is only

trading at about fifty cents on the dollar versus its all-time high of 38,937, reached back in December 1989.

Oil has bounced back from its recent multi-year lows. WTI is up 18.4 percent from last week, but it is still down

42.21 percent from a year ago, while Brent is up +23.8 percent, but remains 43.91 percent below year ago levels.

What to Watch for Over the Next Week

Monday, February 9, 2015

No Major Releases

Tuesday, February 10, 2015

Job Openings and Labor Turnover (December 2014)

Wholesale Trade (December 2013)

NFIB Small Business Economic Trends (January 2014)

Wednesday, February 11, 2015

Treasury Budget (January 2014)

Thursday, February 12, 2015

Retail Sales (January 2014)

Business Inventories (December 2014)

Friday, February 13, 2015

Import/Export Prices (January 2014)

AFP EconWatch—Weekly Economic Newsletter by:

Brian T. Kalish, Director, Finance Practice (Twitter: @AFPFPandA)

Kevin A. Roth, Ph.D., Managing Director, Research & Strategic

Analysis (Twitter: @KevinRothAFP)

Update your profile (AFPonline.org/newsletters) to receive

AFP EconWatch every Monday via e-mail inbox.

We welcome your comments: HUResearch@AFPonline.orgU

NOTE: This information is from sources believed to be reliable but accuracy cannot be

guaranteed. AFP is not a registered investment advisor and under no circumstances

shall this information be construed as investment advice of any kind.