Daily Commodity Report Highlights Gold, Silver, Crude Prices

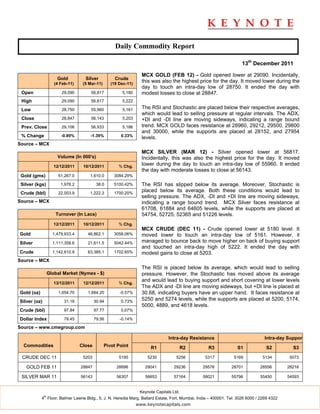

- 1. Daily Commodity Report 13th December 2011 MCX GOLD (FEB 12) - Gold opened lower at 29090. Incidentally, Gold Silver Crude (4 Feb-11) (5 Mar-11) (19 Dec-11) this was also the highest price for the day. It moved lower during the day to touch an intra-day low of 28750. It ended the day with Open 29,090 56,817 5,180 modest losses to close at 28847. High 29,090 56,817 5,222 Low 28,750 55,960 5,161 The RSI and Stochastic are placed below their respective averages, which would lead to selling pressure at regular intervals. The ADX, Close 28,847 56,143 5,203 +DI and -DI line are moving sideways, indicating a range bound Prev. Close 29,106 56,933 5,186 trend. MCX GOLD faces resistance at 28960, 29212, 29500, 29800 and 30000, while the supports are placed at 28152, and 27954 % Change -0.89% -1.39% 0.33% levels. Source – MCX MCX SILVER (MAR 12) - Silver opened lower at 56817. Volume (In 000's) Incidentally, this was also the highest price for the day. It moved 12/12/2011 10/12/2011 % Chg. lower during the day to touch an intra-day low of 55960. It ended the day with moderate losses to close at 56143. Gold (gms) 51,267.0 1,610.0 3084.29% Silver (kgs) 1,976.2 38.0 5100.42% The RSI has slipped below its average. Moreover, Stochastic is Crude (bbl) 22,003.9 1,222.3 1700.20% placed below its average. Both these conditions would lead to selling pressure. The ADX, -DI and +DI line are moving sideways, Source – MCX indicating a range bound trend. MCX Silver faces resistance at 61708, 61884 and 64605 levels, while the supports are placed at Turnover (In Lacs) 54754, 52725, 52365 and 51226 levels. 12/12/2011 10/12/2011 % Chg. MCX CRUDE (DEC 11) - Crude opened lower at 5180 level. It Gold 1,479,933.4 46,862.1 3058.06% moved lower to touch an intra-day low of 5161. However, it Silver 1,111,358.6 21,611.5 5042.44% managed to bounce back to move higher on back of buying support and touched an intra-day high of 5222. It ended the day with Crude 1,142,610.9 63,385.1 1702.65% modest gains to close at 5203. Source – MCX The RSI is placed below its average, which would lead to selling Global Market (Nymex - $) pressure. However, the Stochastic has moved above its average and would lead to buying support and short covering at lower levels 13/12/2011 12/12/2011 % Chg. The ADX and -DI line are moving sideways, but +DI line is placed at Gold (oz) 1,654.70 1,664.20 -0.57% 30.68, indicating buyers have an upper hand. It faces resistance at Silver (oz) 31.16 30.94 0.73% 5250 and 5274 levels, while the supports are placed at 5200, 5174, 5000, 4889, and 4618 levels. Crude (bbl) 97.84 97.77 0.07% Dollar Index 79.45 79.56 -0.14% Source – www.cmegroup.com Intra-day Resistance Intra-day Support Commodities Close Pivot Point R1 R2 R3 S1 S2 S3 CRUDE DEC 11 5203 5195 5230 5256 5317 5169 5134 5073 GOLD FEB 11 28847 28896 29041 29236 29576 28701 28556 28216 SILVER MAR 11 56143 56307 56653 57164 58021 55796 55450 54593 Keynote Capitals Ltd. th 4 Floor, Balmer Lawrie Bldg., 5, J. N. Heredia Marg, Ballard Estate, Fort, Mumbai, India – 400001. Tel: 3026 6000 / 2269 4322 www.keynotecapitals.com

- 2. US Economic Calendar: Tuesday Wednesday Thursday Friday Monday Dec. 13 Dec. 14 Dec. 15 Dec. 16 Dec. 19 FOMC Meeting EIA Petroleum Status Jobless Claims Data Consumer Price Index Housing Market Index Announcement Report Import and Export 4-Week Bill Retail Sales Data Producer Price Index Prices Announcement Bank Reserve Business Inventories Industrial Production 2-Yr Note Auction Settlement Keynote Capitals Ltd. th 4 Floor, Balmer Lawrie Bldg., 5, J. N. Heredia Marg, Ballard Estate, Fort, Mumbai, India – 400001. Tel: 3026 6000 / 2269 4322 www.keynotecapitals.com

- 3. Disclaimer This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Keynote Capitals Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Keynote Capitals Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock’s price movement and trading volume, as opposed to focusing on a company’s fundamentals and as such, may not match with a report on a company’s fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Keynote Capitals Ltd’s., prior written consent. Keynote Capitals Ltd. th 4 Floor, Balmer Lawrie Bldg., 5, J. N. Heredia Marg, Ballard Estate, Fort, Mumbai, India – 400001. Tel: 3026 6000 / 2269 4322 www.keynotecapitals.com