Casushandelsgeestblanco

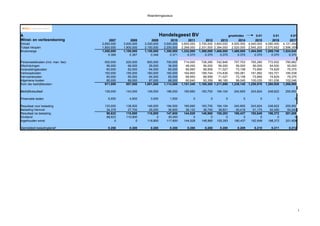

- 1. Waarderingscasus A Handelsgeest BV groeiindex 0.01 0.01 0.01 Winst- en verliesrekening 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Omzet 2,850,000 3,000,000 3,300,000 3,500,000 3,600,000 3,700,000 3,800,000 4,000,000 4,040,000 4,080,400 4,121,204 Totaal inkopen 1,800,000 1,900,000 2,150,000 2,200,000 2,268,000 2,331,000 2,394,000 2,520,000 2,545,200 2,570,652 2,596,359 Brutomarge 1,050,000 1,100,000 1,150,000 1,300,000 1,332,000 1,369,000 1,406,000 1,480,000 1,494,800 1,509,748 1,524,845 0.368 0.367 0.348 0.371 0.370 0.370 0.370 0.370 0.370 0.370 0.370 Personeelskosten (incl. man. fee) 500,000 520,000 600,000 700,000 714,000 728,280 742,846 757,703 765,280 772,932 780,662 Afschrijvingen 56,000 66,000 26,000 36,000 48,000 56,000 56,000 56,000 56,000 54,000 50,000 Huisvestingskosten 60,000 62,000 64,000 65,000 66,950 68,959 71,027 73,158 73,890 74,629 75,375 Verkoopkosten 150,000 155,000 160,000 160,000 164,800 169,744 174,836 180,081 181,882 183,701 185,538 Vervoerskosten 60,000 65,000 64,000 65,000 66,950 68,959 71,027 73,158 73,890 74,629 75,375 Algemene kosten 85,000 89,000 87,000 88,000 90,640 93,359 96,160 99,045 100,035 101,036 102,046 Som der bedrijfskosten 911,000 957,000 1,001,000 1,114,000 1,151,340 1,185,300 1,211,896 1,239,145 1,250,976 1,260,926 1,268,995 Bedrijfsresultaat 139,000 143,000 149,000 186,000 180,660 183,700 194,104 240,855 243,824 248,822 255,850 Financiele lasten 6,000 4,500 3,000 1,500 0 0 0 0 0 0 0 Resultaat voor belasting 133,000 138,500 146,000 184,500 180,660 183,700 194,104 240,855 243,824 248,822 255,850 Belasting hierover 34,378 27,700 29,200 36,900 36,132 36,740 38,821 50,418 51,175 52,450 54,242 Resultaat na belasting 98,622 110,800 116,800 147,600 144,528 146,960 155,283 190,437 192,649 196,372 201,608 Dividend 98,622 110,800 0 30,000 0 0 0 0 0 0 0 Ingehouden winst 0 0 116,800 117,600 144,528 146,960 155,283 190,437 192,649 196,372 201,608 Gemiddeld belastingtarief 0.258 0.200 0.200 0.200 0.200 0.200 0.200 0.209 0.210 0.211 0.212 1

- 2. Waarderingscasus B Handelsgeest BV Balans Activa 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Vaste activa 100,000 74,000 58,000 82,000 96,000 60,000 30,000 10,000 0 0 0 0 Voorraad 225,000 255,000 270,000 330,000 350,000 385,249 415,110 426,329 448,767 453,255 457,787 462,365 Debiteuren 240,000 276,000 290,000 360,000 400,000 443,836 456,164 468,493 493,151 498,082 503,063 508,094 Overlopende activa 50,000 40,000 60,000 40,000 50,000 54,000 55,500 57,000 60,000 60,600 61,206 61,818 Liquide middelen 120,000 90,000 47,000 53,800 98,400 Totaal activa 735,000 735,000 725,000 865,800 994,400 943,085 956,774 961,822 1,001,918 1,011,937 1,022,056 1,032,277 Passiva 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Geplaatst kapitaal 18,000 18,000 18,000 18,000 18,000 18,000 18,000 18,000 18,000 18,000 18,000 18,000 Winstreserve 332,000 332,000 332,000 448,800 566,400 701,895 839,670 985,248 1,165,889 1,348,757 1,535,373 1,727,260 Voorzieningen Vreemd vermogen lening 100,000 75,000 50,000 25,000 0 0 0 0 0 0 0 0 Vreemd vermogen rekening courant 0 0 0 0 0 0 0 0 0 Crediteuren 240,000 250,000 270,000 330,000 350,000 364,019 336,824 346,075 363,137 366,768 370,436 374,140 Overlopende passiva 45,000 60,000 55,000 44,000 60,000 54,000 55,500 57,000 60,000 60,600 61,206 61,818 Totaal passiva 735,000 735,000 725,000 865,800 994,400 1,137,914 1,249,994 1,406,323 1,607,026 1,794,125 1,985,015 2,181,218 2

- 3. Waarderingscasus C Handelsgeest BV Samenvatting winst en verlies 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Omzet 2,850,000 3,000,000 3,300,000 3,500,000 3,600,000 3,700,000 3,800,000 4,000,000 4,040,000 4,080,400 4,121,204 Inkoop 1,800,000 1,900,000 2,150,000 2,200,000 2,268,000 2,331,000 2,394,000 2,520,000 2,545,200 2,570,652 2,596,359 Marge 1,050,000 1,100,000 1,150,000 1,300,000 1,332,000 1,369,000 1,406,000 1,480,000 1,494,800 1,509,748 1,524,845 Operationele kosten 911,000 957,000 1,001,000 1,114,000 1,151,340 1,185,300 1,211,896 1,239,145 1,250,976 1,260,926 1,268,995 EBITDA 195,000 209,000 175,000 222,000 228,660 239,700 250,104 296,855 299,824 302,822 305,850 Afschrijvingen 56,000 66,000 26,000 36,000 48,000 56,000 56,000 56,000 56,000 54,000 50,000 EBIT 139,000 143,000 149,000 186,000 180,660 183,700 194,104 240,855 243,824 248,822 255,850 Rente 6,000 4,500 3,000 1,500 0 0 0 0 0 0 0 Winst 133,000 138,500 146,000 184,500 180,660 183,700 194,104 240,855 243,824 248,822 255,850 Belasting 33,250 34,625 36,500 46,125 45,165 45,925 48,526 60,214 60,956 62,205 63,962 Netto winst 99,750 103,875 109,500 138,375 135,495 137,775 145,578 180,641 182,868 186,616 191,887 Dividend 99,750 103,875 0 30,000 Ingehouden winst 0 0 109,500 108,375 135,495 137,775 145,578 180,641 182,868 186,616 191,887 Samenvatting balans 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Activa 735,000 735,000 725,000 865,800 994,400 943,085 956,774 961,822 1,001,918 1,011,937 1,022,056 1,032,277 Netto werkkapitaal 130,000 186,000 245,000 331,000 390,000 465,066 534,450 548,747 578,781 584,569 590,414 596,319 Geinvesteerd kapitaal 605,000 549,000 480,000 534,800 604,400 478,019 422,324 413,075 423,137 427,368 431,642 435,958 Eigen vermogen 350,000 350,000 350,000 466,800 584,400 719,895 857,670 1,003,248 1,183,889 1,366,757 1,553,373 1,745,260 Vreemd vermogen 100,000 75,000 50,000 25,000 0 0 0 0 0 0 0 0 - liquide middelen 120,000 90,000 47,000 53,800 98,400 Gefinancierd door 3

- 4. Waarderingscasus Free Cash Flow 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Ebit 139,000 143,000 149,000 186,000 180,660 183,700 194,104 240,855 243,824 248,822 255,850 - Belasting over ebit 34,750 35,750 37,250 46,500 45,165 45,925 48,526 60,214 60,956 62,205 63,962 Noplat (netto operationeel resultaat minus belasting) 104,250 107,250 111,750 139,500 135,495 137,775 145,578 180,641 182,868 186,616 191,887 Afschrijvingen 56,000 66,000 26,000 36,000 48,000 56,000 56,000 56,000 56,000 54,000 50,000 - Investeringen in activa -26,000 -16,000 24,000 14,000 -36,000 -30,000 -20,000 -10,000 0 0 0 +/- Mutatie netto werkkapitaal 56,000 59,000 86,000 59,000 75,066 69,384 14,297 30,034 5,788 5,845 5,905 +/- Mutatie voorzieningen 0 0 0 0 0 0 0 0 0 0 0 Free Cash Flow 190,250 216,250 247,750 248,500 222,561 233,159 195,875 256,675 244,656 246,461 247,792 Financial Cash Flow 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 - Rente 6,000 4,500 3,000 1,500 0 0 0 0 0 0 0 Belastingvoordeel op rente 1,500 1,125 750 375 0 0 0 0 0 0 0 +/- Mutatie vreemd vermogen -25,000 -25,000 -25,000 -25,000 0 0 0 0 0 0 0 - Dividend 99,750 103,875 0 30,000 0 0 0 0 0 0 0 Financial Cash Flow 82,250 84,500 -21,250 6,875 0 0 0 0 0 0 0 Mutatie liquide middelen (FCF+FinCF) 272,500 300,750 226,500 255,375 222,561 233,159 195,875 256,675 244,656 246,461 247,792 Mutatie liquide middelen balans -30,000 -43,000 6,800 44,600 -98,400 0 0 0 0 0 0 check 302,500 343,750 219,700 210,775 320,961 233,159 195,875 256,675 244,656 246,461 247,792 check belastingen Belastingen P&L 33,250 34,625 36,500 46,125 45,165 45,925 48,526 60,214 60,956 62,205 63,962 Belastingen FCF -34,750 -35,750 -37,250 -46,500 -45,165 -45,925 -48,526 -60,214 -60,956 -62,205 -63,962 Belastingen FiCF -1,500 -1,125 -750 -375 0 0 0 0 0 0 0 check 69,500 71,500 74,500 93,000 90,330 91,850 97,052 120,428 121,912 124,411 127,925 4

- 5. Waarderingscasus D Handelsgeest BV Netto werkkapitaal analyse 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Voorraaddagen 52 52 56 58 62 65 65 65 65 65 65 Debiteurendagen 35 35 40 42 45 45 45 45 45 45 45 Crediteurendagen 42 43 48 50 50 45 45 45 45 45 45 Operationele vorderingen % omzet 1.40% 2.00% 1.21% 1.43% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% Operationele schulden % omzet 1.58% 2.00% 1.67% 1.26% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% Netto werkkapitaal 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Voorraad 225,000 255,000 270,000 330,000 350,000 385,249 415,110 426,329 448,767 453,255 457,787 462,365 Debiteuren 240,000 276,000 290,000 360,000 400,000 443,836 456,164 468,493 493,151 498,082 503,063 508,094 Crediteuren 240,000 250,000 270,000 330,000 350,000 364,019 336,824 346,075 363,137 366,768 370,436 374,140 Operationele vorderingen 50,000 40,000 60,000 40,000 50,000 54,000 55,500 57,000 60,000 60,600 61,206 61,818 Operationele schulden 45,000 60,000 55,000 44,000 60,000 54,000 55,500 57,000 60,000 60,600 61,206 61,818 Totaal netto werkkapitaal 230,000 261,000 295,000 356,000 390,000 465,066 534,450 548,747 578,781 584,569 590,415 596,319 5

- 6. Waarderingscasus E Handelsgeest BV Investeringen en afschrijvingen 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Investering in activa 30,000 50,000 50,000 50,000 Boekwaarde activa ultimo 2006 100,000 Restant afschrijvingen activa 50,000 50,000 Afschrijvingen investeringen 6,000 6,000 6,000 6,000 6,000 5 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 Saldo afschrijvingen 56,000 66,000 26,000 36,000 36,000 30,000 20,000 10,000 0 0 0 Boekwaarde activa 100,000 74,000 58,000 82,000 96,000 60,000 30,000 10,000 0 0 0 0 2011 2012 2013 2014 2015 2016 2017 Investeringen vanaf 1/1 2011 60,000 70,000 50,000 50,000 50,000 50,000 50,000 afschrijvingen over investeringen 12,000 12,000 12,000 12,000 12,000 5 14,000 14,000 14,000 14,000 14,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 Totaal afschrijvingen 48,000 56,000 56,000 56,000 56,000 54,000 50,000 Boekwaarde activa 108,000 122,000 116,000 110,000 104,000 100,000 100,000 6

- 7. Waarderingscasus F F Handelsgeest BV Groei in restperiode 0.01 Waardering onderneming Rendementseis unlevered 0.18 Adjusted Present Value Methode (APV) Waardering per ultimo 2010 1) Waardering Free Cash Flow 1 2 3 4 5 6 7 2010 2011 2012 2013 2014 2015 2016 2017 2018 Free cash flow 222,561 233,159 195,875 256,675 244,656 246,461 247,792 250,270 keu 18.00% 18.00% 18.00% 18.00% 18.00% 18.00% 18.00% Disconteringfactor 1.1800 1.3924 1.6430 1.9388 2.2878 2.6996 3.1855 Contante waarde FCF 188,611 167,451 119,215 132,390 106,941 91,297 77,788 Restwaarde op 31/12/2017 1,390,390 Som contante waarde scenarioperiode op 31/12/2010 883,694 Restwaarde op 31/12/2010 436,478 Waarde onderneming zonder vreemd vermogen 1,320,173 1,335,243 1,342,427 1,388,190 1,381,388 1,385,383 1,388,290 1,390,390 2) Waardering belastingvoordeel vreemd vermogen 2010 2011 2012 2013 2014 2015 2016 2017 2018 Netto werkkapitaal 390,000 465,066 534,450 548,747 578,781 584,569 590,414 596,319 Financiering NWK 65.00% 253,500 302,293 347,392 356,686 376,208 379,970 383,769 387,607 Rente RC 7.00% 17,745 21,160 24,317 24,968 26,335 26,598 26,864 Overname financiering bank 75,000 60,000 45,000 30,000 15,000 0 0 0 Rente banklening 6.00% 4,500 3,600 2,700 1,800 900 0 0 Lening verkoper 150,000 150,000 150,000 100,000 50,000 0 0 0 Rente lening 6.00% 9,000 9,000 9,000 6,000 3,000 0 0 Totaal rente 31,245 33,760 36,017 32,768 30,235 26,598 26,864 Belastingvoordeel over rente 6,249 6,752 7,203 6,859 6,346 5,607 5,695 5,752 Disconteringsfactor 1.1800 1.3924 1.6430 1.9388 2.2878 2.6996 3.1855 Contante waarde belastingvoordeel 5,296 4,849 4,384 3,538 2,774 2,077 1,788 Restwaarde belastingvoordeel op 31/12/2017 31,957 Som contante waarde scenarioperiode op 31/12/2010 24,706 Restwaarde op 31/12/2010 10,032 Waarde belastingvoordeel op 31/12/2010 34,738 34,742 34,243 33,203 32,321 31,793 31,909 31,957 3) Totale waarde onderneming 1,354,910 1,369,984 1,376,671 1,421,393 1,413,709 1,417,175 1,420,199 1,422,347 7

- 8. Waarderingscasus G Handelsgeest BV Waardering aandelen 2010 Waarde onderneming 1,354,910 Af: over te nemen vreemd vermogen 0 Bij: over te nemen liquide middelen 0 Waarde aandelen 1,354,910 8

- 9. Waarderingscasus H Handelsgeest BV Waardeontwikkeling en ratio's Totaal overzicht waardeontwikkeling 2010 2011 2012 2013 2014 2015 2016 2017 Totaal waarde 1,354,910 1,369,984 1,376,671 1,421,393 1,413,709 1,417,175 1,420,199 1,422,347 Vreemd vermogen 478,500 512,293 542,392 486,686 441,208 379,970 383,769 387,607 Eigen vermogen 876,410 857,692 834,278 934,707 972,501 1,037,205 1,036,429 1,034,740 Ratio's VV/EV 54.60% 59.73% 65.01% 52.07% 45.37% 36.63% 37.03% 37.46% VV/TV 35.32% 37.39% 39.40% 34.24% 31.21% 26.81% 27.02% 27.25% EV/TV 64.68% 62.61% 60.60% 65.76% 68.79% 73.19% 72.98% 72.75% Keu 18.00% 18.00% 18.00% 18.00% 18.00% 18.00% 18.00% Kvv 6.53% 6.59% 6.64% 6.73% 6.85% 7.00% 7.00% tax 20.00% 20.00% 20.00% 20.93% 20.99% 21.08% 21.20% Kel (= keu+(keu-kvv)*(VV/EV)) 24.85% 25.42% 23.91% 23.11% 22.08% 22.07% 22.12% wacc (=kel*(EV/TV)+(KVV*(VV/TV)*(1-T)) 17.39% 17.35% 17.43% 17.47% 17.54% 17.53% 17.52% wacc (=keu-(KVV*(VV/TV)*T) 17.39% 17.35% 17.43% 17.47% 17.54% 17.53% 17.52% 9

- 10. Waarderingscasus I Handelsgeest BV Waardering onderneming WACC methode WACC waardering 2010 2011 2012 2013 2014 2015 2016 2017 2018 Free Cash Flow 222,561 233,159 195,875 256,675 244,656 246,461 247,792 250,270 wacc 17.39% 17.35% 17.43% 17.47% 17.54% 17.53% 17.52% disconteringsfactor 0.8519 0.7259 0.6182 0.5262 0.4477 0.3809 0.3241 contante waarde FCF 189591.81 169252.86 121081.43 ### 109527.27 93881.01 80314.36 Restwaarde op 31/12 2017 1,428,230 Som contante waarde scenarioperiode op 31/12 2010 898,713 Restwaarde op 31/12 2010 462,917 Waarde onderneming 1,361,630 1,375,851 1,381,414 1,426,342 1,418,915 1,423,146 1,426,121 1,428,230 check met APV 6,720 10

- 11. Waarderingscasus J Handelsgeest BV Waardering eigen vermogen Cash to Equity methode 2010 2011 2012 2013 2014 2015 2016 2017 2018 Cash to Equity waardering Free Cash Flow 222,561 233,159 195,875 256,675 244,656 246,461 247,792 Rente 31,245 33,760 36,017 32,768 30,235 26,598 26,864 Belastingvoordeel 7,811 8,440 9,004 8,192 7,559 6,649 6,716 Mutatie vreemd vermogen 33,793 30,099 -55,707 -45,478 -61,238 3,800 3,838 Cash to Equity 232,920 237,938 113,155 186,621 160,742 230,313 231,482 233,797 kel 24.85% 25.42% 23.91% 23.11% 22.08% 22.07% 22.12% Disconteringsfactor 0.8010 0.6386 0.5154 0.4186 0.3429 0.2809 0.2300 Contante waarde cash to Equity 186,558 151,954 58,318 78,125 55,118 64,694 53,245 Restwaarde op 31/12 2017 1,056,923 Som contante waarde scenarioperiode op 31/12 2010 648,012 Restwaarde op 31/12 2010 243,110 Waarde eigen vermogen 891,122 879,655 865,307 959,088 994,128 1,052,926 1,055,027 1,056,923 check met APV 14,711 11

- 12. Waarderingscasus K Handelsgeest BV Opbouw vermogenskostenvoet & multiple analyse Opbouw vermogenskostenvoet 1,354,910 Build-Up Waarde impact Waarde 2010 1,354,910 Multiple 4% 1,354,910 Risk Free Gemm ebit 2007 t/m 2010 154,250 8.78 10% 1,354,910 Market Premium 0 Gemm EBITDA 2007 t/m 2010 200,250 6.77 12% 1,354,910 Small Firm Premium 0 Gemm netto winst 2007 t/m 2010 112,875 12.00 14% 1,354,910 Afhankelijkheid huidige ADH 0 Gemm omzet 2007 t/m 2010 3,162,500 0.43 16% 1,354,910 Afhankelijkheid klanten 0 18% 1,354,910 Afhankelijkheid leveranciers 0 12

- 13. Waarderingscasus L Handelsgeest BV Debt Service Coverage Financieringsstructuur Waarde onderneming 1,354,910 Liquide middelen 98,400 Over te nemen VV 0 Waarde aandelen 1,453,310 Financiering excl. financiering liquide middelen 2010 2011 2012 2013 2014 2015 2016 2017 RC in werkmij 253,500 302,293 347,392 356,686 376,208 379,970 383,769 387,607 Bancaire overnamefinanciering 75,000 60,000 45,000 30,000 15,000 0 0 0 Lening verkoper 150,000 150,000 150,000 100,000 50,000 0 0 0 Totaal vreemd vermogen 478,500 512,293 542,392 486,686 441,208 379,970 383,769 387,607 Eigen inbreng koper 876,410 Ebitda-VPB-Investering+/-Mut. NWK 230,372 241,599 204,879 264,867 252,214 253,111 254,508 Rente + Aflossing -16,245 -18,760 28,983 32,232 34,765 -26,598 -26,864 Debt Service Coverage -14.18 -12.88 7.07 8.22 7.25 -9.52 -9.47 13