Bay al dayn

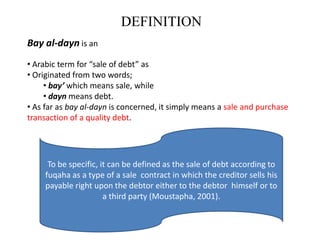

- 1. DEFINITION Bay al-dayn is an • Arabic term for “sale of debt” as • Originated from two words; • bay’ which means sale, while • dayn means debt. • As far as bay al-dayn is concerned, it simply means a sale and purchase transaction of a quality debt. To be specific, it can be defined as the sale of debt according to fuqaha as a type of a sale contract in which the creditor sells his payable right upon the debtor either to the debtor himself or to a third party (Moustapha, 2001).

- 2. BASIC PRINCIPLE The selling of debts is • to avoid the occurrence of riba between two debts and also • to avoid any kinds of gharar and makhatara which may arise at the level of inability of a buyer from possessing what he has bought as it is not permitted that the buyer sold before actual receipt of the purchased item. On 21st August 1996, The Malaysian Securities Commission Shariah Advisory Council passed a resolution unanimously agreed to accept the principle of bay al-dayn as one of the concepts for developing Islamic capital market instruments. This was based on the views of some of the Islamic jurists who allowed this concept subject to certain conditions for instance there is a transparent regulatory system in the capital market to safeguard the maslahah (public interest) of the market participants.

- 3. CLIENT/ BANK CUSTOMERS THIRD PARTY Sukuk -Investment

- 4. SELLING DEBT WITH CASH TYPES OF SELLING DEBT SELLING DEBT FOR SALE

- 6. i.Example sell debt with cash; (a) Example of debt trading in cash to the debtor An example is the creditor to sell debt (incurred by the debtor) of the debtor with a long cash price. (b) Examples of debt with cash sale to third parties An example would be like X says to Y, "I'm selling my debt incurred by Z to you with cash so price '. ii. Examples of debt for sale; Sell one debt can also occur if the debt had been sold to the debtor or to a third party. (a) Examples of debt for sale to third parties Examples of debt for sale to third parties is such that A says to B, I'm selling 10 kilograms of grain to be debt obligations of C of I to thee with a value of RM10 to be paid by you to me in grace. In this way scholars described as "bai 'al-dayn bi al-dayn".

- 7. b) Example sell debt for the debtor An example would be like a buy wheat from B to be delivered after a month with a price of RM10 to be paid after 2 months. Sell this debt as named also as "ibtida' 'al-dayn bi al-dayn". Another example which means debt for sale A book is like buying a commodity in regards of B for RM1, 000 cash. Goods will be delivered within a year. Upon reaching the handover, B tells A that the product ordered can not be met. Then B says to A, "I sold them to the ordered goods to a particular period '. This method is also called a "faskh al-dayn bi al-dayn" because the first debt incurred by the debtor has been settled by the debtor to incur debt in lieu of a second.

- 8. Maliki Mazhab •The Malikis allow bay al-dayn subject to certain conditions as follows: •Expediting the payment; • Debtor present at the place of sale; • Debtor confirms the debt; • Debtor belongs to the group that is bound by law so that he is able to redeem his debt; • Payment is not the same type as dayn, and it fit so, and the rate should be the same to avoid riba; •The debt cannot be created from the sale of currency (gold and silver) to be delivered in future date; • The dayn should be goods that are saleable even before they are received. This is to ensure that the dayn is not of the food type which cannot be traded before qabadh occur; and

- 9. PILLARS OF BAY AL-DAYN * Seller (bai ') * Buyer (Jupiter) * Objects / items (Mabi `) * Price (tsaman) * Ijab qabul (sighat)

- 10. SHARIAH RULE According to several Malaysian scholars whom accept Bai Al Dayn as a valid instrument under the Sharia’h, “Bai Al Dayn means a sale and purchase transaction of a ‘quality debt’ i.e. the default risk of the debtor is low and the debt must be created from a business transaction that conforms with the Sharia’h and Bai Al Dayn can be either monetary or a commodity such as food or metal. Therefore, according to these certain scholars, “Bai Al Dayn can be defined as a sale of payable right either to the debtor himself or to any third party.” (The Law and Practice of Islamic Banking and Finance (2003) by Dr. Nik Norzrul Thani; Mohamed Ridza Mohamed Abdullah; Megat Hizaini Hassan) This type of sale is usually for immediate payment.

- 11. The sale of such a payable right to a third party is a subject of disagreement amongst the scholars. “According to most of the Hanafi, Hanbali and Shafi jurists, the sale of debt to a non-debtor or third party is prohibited based on the forbidden sale of Gharar [v] (uncertain or obscure goods), sale of Al Kali Bil Kali[vi], and the sale of a thing which the seller does not possess. However, there are exceptions to this rule.” (The Law and Practice of Islamic Banking and Finance (2003) by Dr. Nik Norzrul Thani; Mohamed Ridza Mohamed Abdullah; Megat Hizaini Hassan)