QNBFS Daily Market Report April 17, 2019

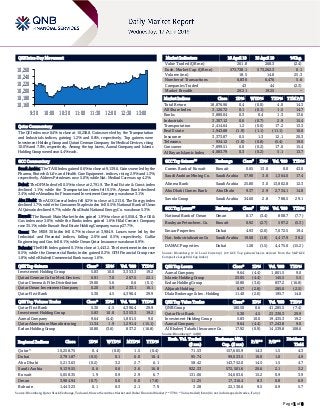

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.4% to close at 10,258.8. Gains were led by the Transportation and Industrials indices, gaining 1.2% and 0.6%, respectively. Top gainers were Investment Holding Group and Qatari German Company for Medical Devices, rising 10.0% and 7.0%, respectively. Among the top losers, Aamal Company and Islamic Holding Group were down 4.4% each. GCC Commentary Saudi Arabia: The TASI Index gained 0.6% to close at 9,139.6. Gains were led by the Pharma, Biotech & Life. and Health Care Equipment. indices, rising 2.9% and 1.3%, respectively. Aldrees Petroleum. rose 5.0%, while Nat. Medical Care was up 4.2%. Dubai: The DFM Index fell 0.5% to close at 2,791.9. The Real Estate & Const. index declined 1.1%, while the Transportation index fell 0.5%. Ajman Bank declined 3.4%, while Almadina for Finance and Investment Company was down 3.1%. Abu Dhabi: The ADX General Index fell 0.2% to close at 5,213.6. The Energy index declined 1.7%, while the Consumer Staples index fell 0.5%. National Bank of Umm Al Qaiwain declined 9.7%, while Abu Dhabi National Energy Co. was down 5.3%. Kuwait: The Kuwait Main Market Index gained 1.9% to close at 5,058.4. The Oil & Gas index rose 3.0%, while the Banks index gained 1.6%. Hilal Cement Company rose 35.1%, while Kuwait Real Estate Holding Company was up 27.7%. Oman: The MSM 30 Index fell 0.7% to close at 3,984.9. Losses were led by the Industrial and Financial indices, falling 2.0% and 0.5%, respectively. Galfar Engineering and Con. fell 8.1%, while Oman Qatar Insurance was down 6.9%. Bahrain: The BHB Index gained 0.1% to close at 1,443.2. The Investment index rose 0.5%, while the Commercial Banks index gained 0.2%. GFH Financial Group rose 1.8%, while Khaleeji Commercial Bank was up 1.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Investment Holding Group 5.83 10.0 3,353.3 19.2 Qatari German Co for Med. Devices 6.91 7.0 267.5 22.1 Qatar Cinema & Film Distribution 19.00 5.6 0.6 (0.1) Qatar Oman Investment Company 6.20 4.9 233.1 16.1 Qatar First Bank 5.30 4.5 4,396.4 29.9 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 5.30 4.5 4,396.4 29.9 Investment Holding Group 5.83 10.0 3,353.3 19.2 Aamal Company 9.64 (4.4) 1,801.5 9.0 Qatar Aluminium Manufacturing 11.34 1.9 1,291.4 (15.1) Ezdan Holding Group 10.80 (3.6) 837.2 (16.8) Market Indicators 16 April 19 15 April 19 %Chg. Value Traded (QR mn) 261.8 268.3 (2.4) Exch. Market Cap. (QR mn) 573,738.1 573,262.3 0.1 Volume (mn) 18.5 14.8 25.3 Number of Transactions 6,836 6,476 5.6 Companies Traded 43 44 (2.3) Market Breadth 20:21 19:25 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,876.96 0.4 (0.0) 4.0 14.3 All Share Index 3,126.72 0.1 (0.1) 1.5 14.7 Banks 3,880.04 0.3 0.4 1.3 13.6 Industrials 3,307.12 0.6 (0.7) 2.9 15.4 Transportation 2,414.64 1.2 (0.0) 17.2 13.3 Real Estate 1,943.88 (1.9) (1.1) (11.1) 16.0 Insurance 3,373.87 0.5 1.3 12.1 20.3 Telecoms 934.12 (1.0) (0.8) (5.4) 19.0 Consumer 7,899.51 0.0 (0.2) 17.0 15.4 Al Rayan Islamic Index 4,083.79 0.3 (0.2) 5.1 13.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Comm. Bank of Kuwait Kuwait 0.65 13.0 0.0 43.0 Saudi Arabian Mining Co. Saudi Arabia 57.90 3.8 1,364.0 17.4 Alinma Bank Saudi Arabia 25.80 3.0 13,802.8 12.3 Abu Dhabi Comm. Bank Abu Dhabi 9.37 2.9 2,734.1 14.8 Savola Group Saudi Arabia 34.60 2.8 788.5 29.1 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% National Bank of Oman Oman 0.17 (3.4) 808.7 (7.7) Boubyan Petrochem. Co. Kuwait 0.92 (2.7) 597.2 (5.3) Emaar Properties Dubai 4.93 (2.0) 7,072.5 19.4 Nat. Industrialization Co Saudi Arabia 19.68 (1.8) 4,417.9 30.2 DAMAC Properties Dubai 1.28 (1.5) 4,475.0 (15.2) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Aamal Company 9.64 (4.4) 1,801.5 9.0 Islamic Holding Group 23.05 (4.4) 145.5 5.5 Ezdan Holding Group 10.80 (3.6) 837.2 (16.8) Alijarah Holding 8.57 (2.8) 285.0 (2.5) Dlala Brokerage & Inv. Holding 11.40 (2.6) 195.7 14.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 180.50 0.6 41,285.5 (7.4) Qatar First Bank 5.30 4.5 23,330.3 29.9 Investment Holding Group 5.83 10.0 19,435.3 19.2 Aamal Company 9.64 (4.4) 17,243.8 9.0 Al Khaleej Takaful Insurance Co. 17.92 (0.9) 14,539.8 108.6 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,258.75 0.4 (0.0) 1.5 (0.4) 71.53 157,605.9 14.3 1.5 4.3 Dubai 2,791.87 (0.5) 0.1 6.0 10.4 95.74 99,023.5 10.0 1.0 4.9 Abu Dhabi 5,213.63 (0.2) 3.2 2.7 6.1 58.42 143,752.0 14.5 1.5 4.7 Saudi Arabia 9,139.55 0.6 0.6 3.6 16.8 922.33 572,501.6 20.6 2.1 3.2 Kuwait 5,058.35 1.9 0.9 2.9 6.7 131.06 34,603.6 15.2 0.9 3.9 Oman 3,984.94 (0.7) 0.0 0.0 (7.8) 11.25 17,316.4 8.3 0.8 6.9 Bahrain 1,443.23 0.1 0.3 2.1 7.9 3.28 22,130.6 9.5 0.9 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,160 10,180 10,200 10,220 10,240 10,260 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index rose 0.4% to close at 10,258.8. The Transportation and Industrials indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Investment Holding Group and Qatari German Company for Medical Devices were the top gainers, rising 10.0% and 7.0%, respectively. Among the top losers, Aamal Company and Islamic Holding Group were down 4.4% each. Volume of shares traded on Tuesday rose by 25.3% to 18.5mn from 14.8mn on Monday. Further, as compared to the 30-day moving average of 12.8mn, volume for the day was 44.4% higher. Qatar First Bank and Investment Holding Group were the most active stocks, contributing 23.8% and 18.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2019 % Change YoY Operating Profit (mn) 1Q2019 % Change YoY Net Profit (mn) 1Q2019 % Change YoY Oman Oil Marketing Oman OMR 141.4 -2.7% – – 1.1 -37.7% Dhofar Fisheries & Food Industries Co. Oman OMR 3.1 264.5% – – 0.1 N/A Muscat Gas Oman OMR 2.2 -14.8% – – 0.1 -27.1% Source: Company data, DFM, ADX, MSM, TASI, BHB. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/16 US Federal Reserve Industrial Production MoM March -0.1% 0.2% 0.1% 04/16 UK UK Office for National Statistics Jobless Claims Change March 28.3k – 26.7k Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status MARK Masraf Al Rayan 17-Apr-19 0 Due QIBK Qatar Islamic Bank 17-Apr-19 0 Due CBQK The Commercial Bank 17-Apr-19 0 Due ABQK Ahli Bank 18-Apr-19 1 Due NLCS Alijarah Holding 18-Apr-19 1 Due QIIK Qatar International Islamic Bank 21-Apr-19 4 Due QISI Qatar Islamic Insurance Company 21-Apr-19 4 Due GWCS Gulf Warehousing Company 21-Apr-19 4 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 21-Apr-19 4 Due WDAM Widam Food Company 22-Apr-19 5 Due DBIS Dlala Brokerage & Investment Holding Company 23-Apr-19 6 Due QFBQ Qatar First Bank 23-Apr-19 6 Due QIGD Qatari Investors Group 23-Apr-19 6 Due QIMD Qatar Industrial Manufacturing Company 24-Apr-19 7 Due UDCD United Development Company 24-Apr-19 7 Due QCFS Qatar Cinema & Film Distribution Company 25-Apr-19 8 Due QAMC Qatar Aluminum Manufacturing Company 28-Apr-19 11 Due QNNS Qatar Navigation (Milaha) 28-Apr-19 11 Due IGRD Investment Holding Group 28-Apr-19 11 Due QFLS Qatar Fuel Company 28-Apr-19 11 Due MERS Al Meera Consumer Goods Company 28-Apr-19 11 Due BRES Barwa Real Estate Company 29-Apr-19 12 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 40.51% 52.12% (30,386,599.88) Qatari Institutions 14.48% 14.89% (1,082,737.76) Qatari 54.99% 67.01% (31,469,337.64) GCC Individuals 1.48% 1.98% (1,297,398.99) GCC Institutions 6.24% 0.87% 14,061,921.22 GCC 7.72% 2.85% 12,764,522.23 Non-Qatari Individuals 14.31% 12.62% 4,406,677.03 Non-Qatari Institutions 22.98% 17.52% 14,298,138.38 Non-Qatari 37.29% 30.14% 18,704,815.41

- 3. Page 3 of 8 Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status AHCS Aamal Company 29-Apr-19 12 Due SIIS Salam International Investment Limited 29-Apr-19 12 Due ZHCD Zad Holding Company 29-Apr-19 12 Due QGRI Qatar General Insurance & Reinsurance Company 29-Apr-19 12 Due AKHI Al Khaleej Takaful Insurance Company 29-Apr-19 12 Due MCCS Mannai Corporation 29-Apr-19 12 Due QOIS Qatar Oman Investment Company 29-Apr-19 12 Due DOHI Doha Insurance Group 29-Apr-19 12 Due ORDS Ooredoo 29-Apr-19 12 Due KCBK Al Khalij Commercial Bank 29-Apr-19 12 Due VFQS Vodafone Qatar 30-Apr-19 13 Due QGMD Qatari German Company for Medical Devices 30-Apr-19 13 Due DHBK Doha Bank 30-Apr-19 13 Due Source: QSE Stock Split Dates for Listed Qatari Companies Source: QSE

- 4. Page 4 of 8 News Qatar QSE announced stock split days for listed Qatari companies – Please refer to the table above (QSE) QNCD's net profit declines 26.4% YoY and 48.5% QoQ in 1Q2019 – Qatar National Cement Company's (QNCD) net profit declined 26.4% YoY (-48.5% QoQ) to QR66.5mn in 1Q2019. The company's revenue came in at QR213.1mn in 1Q2019, which represents a decrease of 11.7% YoY (-1.0% QoQ). EPS decreased to QR1.02 in 1Q2019 from QR1.38 in 1Q2018. (QSE) S&P publishes its report on the Qatari banking system – S&P Global Ratings (S&P) published its report on Qatar, ‘Banking Industry Country Risk Assessment: Qatar’. In its report, S&P stated, “We classify the banking sector of Qatar (AA- /Stable/A-1+) in group '5' under our Banking Industry Country Risk Assessment (BICRA). Qatar has a wealthy economy, with high GDP per capita, at about $69,700 in 2018. It holds the third- largest proven natural gas reserves in the world, and is one of the largest exporters of Liquefied Natural Gas globally. We believe Qatar has effectively managed the ongoing boycott's impact on its economy. (Bloomberg) GDI sells its ‘Al-Doha’ jack-up rig to India's Star Matrix for $1.9mn – Gulf Drilling International (GDI), a subsidiary of Gulf International Services (GISS), has sold the ‘Al-Doha’ jack-up rig to India’s Star Matrix for $1.9mn, the company announced. Delivered in 1981 by Mitsubishi Heavy Industries, the Mitsubishi MD T76J-Viii self-elevating, independent-leg cantilever jack-up drilling rig, Al-Doha has a long and successful operational history offshore Qatar. GDI has impaired the drilling rig Al-Doha as declared in its 2018 financial statements due to being off contract and unmarketable in its present technical conditions. GDI, as part of its efforts to modernize its fleet and provide the most modern and efficient assets to its clients, decided to recycle Al-Doha in an environmentally-responsible manner and in compliance with the Hong Kong International Convention for the safe and environmentally sound recycling of ships. With the sale of the Al-Doha complete, the company will continue to operate eight jack-ups, eight land rigs, two lift-boats, and one accommodation barge. (Qatar Tribune) GWCS announces the establishment of its subsidiary in India – Gulf Warehousing Company (GWCS) announced the establishment of its subsidiary in India, LEDD Technologies India Private Limited, established on April 3, 2019. GWCS also established Prime Container Services, a Qatar-based limited liability company, with a capital of QR300,000 and 100% owned by GWCS. (QSE) AKHI announces the end of service of Ali Reza Al Bannai as CEO of the company – Al Khaleej Takaful Insurance Company (AKHI) announced the end of service of Ali Reza Al Bannai, as CEO of the company as of April 17, 2019. The board of directors decided to delegate the board member Abdullah Ali Al Ansari to the duties of the temporary basis. (QSE) MRDS’ AGM approves the distribution of 5% cash dividend and postpones its EGM – Mazaya Qatar Real Estate Development (MRDS) held its Ordinary General Assembly Meeting (AGM) on April 16, 2019, and endorsed items on its agenda. The company’s shareholders approved board of directors’ recommendation to distribute cash dividend of 5% (i.e. QR0.5 per share). MRDS postponed its Extraordinary General Assembly Meeting (EGM), which scheduled on April 16, 2019, due to lack of quorum. (QSE) IGRD’s EGM endorses items on its agenda – Investment Holding Group’s (IGRD) EGM endorsed items on its agenda held on April 16 2019 and ratified in its meeting the following: (i) Amended the Article 5 of the Memorandum of Association by splitting the nominal value of the share to become QR1, in alignment with the decision of Qatar Financial Markets Authority in its fourth meeting in 2018 convened on December 16, 2018, (ii) Amended the Article 27 of the Memorandum of Association whereby the member of the board of directors has to own 100,000 of the company shares, in lieu of 10,000 shares, and (iii) Delegated the Chairman, Ghanim Sultan Al Hodaifi Al Kuwari or whoever he may delegate, to sign singly, on the official necessary procedures to sign, authenticate and register the amendment of the Memorandum of Association of the company. (QSE) QIA's Project Maple II completes GBP625mn project refinancing – Qatar Investment Authority’s (QIA) Project Maple II BV subsidiary stated it completed GBP625mn refinancing of 8 Canada Square in London’s Canary Wharf area. Refinancing was completed with a syndicate of six banks, Crédit Agricole CIB, DekaBank, Deutsche Bank, DBS Bank, HSBC and Intesa Sanpaolo. The building serves as HSBC’s global headquarters. (Bloomberg) Qatar Petroleum wins exploration rights in five offshore blocks in Argentina – Qatar Petroleum (QP) has won exploration rights in five offshore blocks in the North Argentina, and Malvinas West basins in Argentina. The winning bids were announced by Argentina’s Secretariat of Government of Energy (SGE) at the end of a public tender process that started in November 2018. They will be subject to customary confirmation and regulatory approvals by the Argentinean authorities. QP won the exploration rights for blocks MLO-113, MLO-117, and MLO-118 in the Malvinas West basin as part of a consortium comprising an ExxonMobil affiliate (operator with a 70% interest) and a QP affiliate (with a 30% interest). QP also won the exploration rights for blocks CAN-107 and CAN-109 in the North Argentina basin as part of a consortium comprising an affiliate of Shell (operator with a 60% interest) and an affiliate of QP (with a 40% interest). Minister of State for Energy Affairs, and President and CEO of QP, HE Saad bin Sherida Al-Kaabi said, “We are pleased to have been awarded these offshore exploration blocks, which further strengthen QP’s footprint within Argentina along with our existing Neuquén basin unconventional assets. This important result marks yet another step towards implementing our international growth strategy, and maximizing synergies with our existing strong base in Latin America.” The exploration blocks offered during the public tender included 38 shallow, deep and ultra-deep water offshore blocks in the Austral, North Argentina, and Malvinas West basins. QP participated in the bid round as a non-operating partner. (Gulf-Times.com) QGRI sets to open major project in Algeria – Qatar General Insurance & Reinsurance Company (QGRI) is to open its flagship real estate project in Algeria within six months,

- 5. Page 5 of 8 according to a top official of the group. QGRI is developing one of the biggest mixed-use real estate projects in the capital city of Algiers. It’s a project consisting of 11 buildings, including a luxury hotel (Marriot), office buildings, a mall and shopping centers, which are on the verge of completion. QGRI’s CEO, Hassan Ahmed Hassan Al Efrangi said, “Our investment in Algeria, especially the real estate project, is one of the best in our investment portfolio. It is a very huge project which is almost ready, and we will start opening it within six months.” Al Efrangi added, “In addition to this project we have many other projects within Algeria and Oman in many other areas.” (Peninsula Qatar) Qatari investments in Amman Stock Exchange amount to $1.3bn – The volume of Qatari investment in Amman Stock Exchange at the end of March reached $1.3bn. The statistical data released by the Jordan Securities Depository Center showed that the volume of Qatari investment ranked second in the list of Arab investments in Amman Stock Exchange, in terms of ownership of securities by nationality. The center pointed out that the number of securities owned by Qatari investors amounted to about 183.197mn securities last month. Statistics showed that the number of Qatari investment contributions in securities ownership reached 377,000 contributions in that period. (Peninsula Qatar) Albania open to investments in tourism, energy, and infrastructure development – Albania is offering Qatar a wide range of investment opportunities in tourism, energy, and infrastructure development, as well as Public Private Partnership (PPP) schemes, according to Albanian Prime Minister, Edi Rama. Rama made the statement in a meeting with Qatar Chamber officials led by First Vice Chairman Mohamed bin Towar Al-Kuwari. The Prime Minister said Albania has a strong energy sector and is the second source of water in Europe after Norway. He said the Southeastern European country has a lot of potential in hydrocarbons and, at the same time, it is part of the new Trans Adriatic Pipeline, which brings gas to Europe through Azerbaijan. Al-Kuwari said, “The door is open to Albanian companies to cooperate with their Qatari counterparts in the projects that are being implemented in Qatar, especially in the fields of infrastructure and preparation for the 2022 FIFA World Cup. There are many investment opportunities for Albanian companies in the Qatari market, and the government is working to attract FDI and to promote the business and investment climate, and to facilitate the establishment of new projects in all areas.” (Gulf- Times.com) Qatari tour operators upbeat as industry makes post-blockade recovery – Doha-based tour operators are upbeat with the country’s tourism sector showing post-blockade recovery trends. The number of foreign tourists who have visited Qatar in the first two months of the year has increased by 8% to 376,106 visitors in January and February this year from 347,624 visitors during the same period in 2018. Qatar International Adventures’ (QIA) Managing Director and Owner, Walid Al Jaouni said, “The number of foreign visitors is increasing and more people are getting to know about the country. Following the government’s strategy, we have also opened new marketing strategies to attract the Chinese, Indian, Russian, and Iranian markets. We’re bringing in more foreign tour operators to show them what we have here in Qatar so they can start sending tourist groups. And that is already working.” Jaouni added, “This year is going to be much better than 2018. While there are new and emerging big markets, we are actively pursuing all markets. We’re developing our self internally by adding more tours with more guides. Because what we got now is enough, but the number of tourists is increasing so we need to make more attractions and expand our operations.” (Peninsula Qatar) Fendercare Marine expands marine product supply network with Craig International in Qatar – Fendercare Marine, part of James Fisher and Sons plc, has signed a new distribution agreement with one of the global leaders in oilfield procurement services, Craig International - a member of the Craig Group, helping to improve customer service through the local stock and supply of high-quality marine products. With the aim of supporting customers locally in Qatar and adding value to the procurement processes, the agreement with Craig International means Fendercare Marine now offers a comprehensive range of high-quality marine products from Doha, enhancing customer service by increasing product availability and improving efficiency. (Zawya) International US manufacturing mired in soft patch in the first quarter – The US manufacturing output was unchanged in March after two straight monthly declines, resulting in the first quarterly drop in production since President, Donald Trump was elected. The weakness in manufacturing reported by the Federal Reserve is in tandem with a moderation in the broader economy, and is despite the White House’s America First policies, including trade tariffs aimed at protecting domestic factories from what Trump says in unfair foreign competition. Manufacturing output last month was restrained by weak motor vehicle and wood products production after falling 0.3% in February. Economists polled by Reuters had forecasted manufacturing production edging up 0.1% in March. Production at factories dropped at 1.1% annualized rate in the first quarter. That was the first quarterly drop since the third quarter of 2017 and followed 1.7% pace of increase in the October-December period. (Reuters) UK’s wage growth at new decade high as employers hire in the face of Brexit – British workers’ pay grew at its joint fastest pace in over a decade as employers extended their hiring spree, adding to signs that uncertainty about Brexit is prompting firms to take on workers rather than commit to longer-term investments. Contrasting with other sluggish readings of Britain’s economy, total earnings, including bonuses, rose by an annual 3.5% in the three months to February, official data showed, in line with a Reuters poll of economists. That was the joint highest rate since mid-2008 although in the month of February on its own the pace of wage growth slowed. Employment grew by 179,000 in the three months to February, in line with the Reuters poll forecast, helping to keep the unemployment rate at 3.9%, its lowest since early 1975, the Office for National Statistics stated. (Reuters) UK’s marketing spending rises despite Brexit, uncertainty clouds forecast – British companies spent more on marketing in

- 6. Page 6 of 8 the opening quarter of 2019 despite uncertainty around Brexit, but their budgets for the rest of the year could be the most subdued since after the financial crisis, a survey showed. The IPA Bellwether survey, conducted by IHS Markit, showed on Wednesday that 21.6% of marketing executives raised their budgets during the quarter, while just under 12.8% of executives who took part in the survey cut their marketing budgets. (Reuters) Germany's public debt to fall below EU ceiling this year – The German government expects the country’s public sector debt to fall below the European Union’s (EU) debt ceiling this year, a draft document seen by Reuters showed. The document shows debt is expected to fall to 58.75% of economic output in 2019, below the 60% mark set by the bloc. It would be the first time since 2002 that German debt falls below that mark. Finance Minister Olaf Scholz said last year that Germany would achieve this milestone by the end of 2018. However the document showed that the government estimates public debt stood at 60.9% last year. (Reuters) Japan’s exports hit by weak China demand, raising risk of economic contraction – Japan’s exports fell for a fourth straight month in March as China-bound shipments slumped again, reinforcing growing anxiety that weak external demand may have knocked the economy into contraction in the first quarter. Ministry of Finance data showed exports fell 2.4% in March from a year earlier, compared with 2.7% drop predicted by economists in a Reuters poll, and followed 1.2% decline in February. The data reinforces worries that weak external demand may hurt company profits and in turn curb business expenditures, workers’ wages and consumer spending in a broad hit to growth. The spectre of a first quarter contraction would pile pressure on Prime Minister Shinzo Abe to once again delay a planned sales tax hike in October needed to fix the world’s heaviest public debt burden at twice the size of its economy. The economy grew at an annualized rate of 1.9% in the fourth quarter driven by business and consumer spending. Bank of Japan’s (BoJ) Governor, Haruhiko Kuroda last week stuck to his optimism that Japan’s export-dependent economy will soon climb out of its doldrums as global growth recovers. Kuroda, however, did warn of lingering risks to the global outlook, including the outcome of U.-China trade talks and Britain’s potentially messy departure from the European Union. Markets expect the BoJ to stand pat at a rate review next week, though some investors say the recent batch of soft indicators may pile pressure on policymakers to add to the central bank’s already massive stimulus later in the year. (Reuters) China’s first-quarter GDP growth steady at 6.4% beats expectations for slowdown – China’s economy grew at a steady 6.4% pace in the first quarter from a year earlier, defying expectations for a slowdown, as industrial output jumped sharply. The upbeat readings, which also showed faster growth in retail sales and investment, are likely to add to optimism that China’s cooling economy may be starting to stabilize, relieving some investor anxiety over sputtering global demand. However, analysts said it is too early to call a sustainable turnaround, and further policy support is likely needed. Analysts polled by Reuters had expected growth to slow slightly to 6.3% in the January-March quarter, the slowest pace in at least 27 years. Industrial production jumped 8.5% in March from a year earlier, the fastest pace in over four-and-a-half years. The reading easily beat analysts’ estimates of 5.9% and the 5.3% seen in the first two months of the year. Retail sales rose 8.7% in March, also beating analyst’s estimates of 8.4% growth and the previous 8.2%. Fixed-asset investment expanded 6.3% in January-to-March from the same period a year earlier, in line with estimates of 6.3%. Real estate investment rose 11.8% in the first three months, quickening slightly from the 11.6% gain in the January-to-February. Analysts polled by Reuters expect China’s economic growth to slow to a near 30-year low of 6.2% this year, as sluggish demand at home and abroad and the Sino-US trade war continues to weigh on activity despite a flurry of policy support measures. The government aims for economic growth of 6.0%- 6.5% in 2019. On a quarterly basis, GDP in the first quarter grew 1.4%, as expected, but dipping from 1.5% in October-December. (Reuters) China's economy still faces pressure, policy steps starting to help – China’s economy still faces downward pressure, while policy steps to support the economy are starting to bear fruit, statistics bureau stated. Mao Shengyong, Spokesman for the bureau, made the comments after official data showed China’s economy grew at a steady 6.4% pace in the first quarter from a year earlier, defying expectations for a slowdown, as industrial output jumped sharply. There are favorable factors for supporting industrial output growth and it is expected to maintain a steady pace, Mao said. (Reuters) Regional Saudi wealth fund unit to buy Jadwa's waste management business – Saudi Investment Recycling, a wholly-owned subsidiary of the Public Investment Fund (PIF), has agreed to acquire Global Environmental Management Services from Jadwa Investment, according to a statement. The business has been sold for an undisclosed amount. The deal is expected to close in 2Q2019. (Bloomberg) Saudi Aramco in talks for 25% of Reliance's refining and petrochemical units – Saudi Aramco is in discussions to acquire up to a 25% stake in Reliance Industries’ refining and petrochemicals businesses, the Times of India (TOI) reported. A minority stake sale could fetch around $10bn to $15bn, valuing the Indian company's refining and petrochemicals businesses at around $55bn to $60bn, the report stated. The agreement on valuation could be reached around June, TOI reported, citing sources. Goldman Sachs is said to have been mandated to advise on the proposed deal, the report added. Saudi Aramco’s interest in the operator of the world’s biggest refining complex comes after Saudi Arabia’s Crown Prince, Mohammed bin Salman’s visit in February, when he said that he expects investment opportunities worth more than $100bn in India over the next two years. Separately, Saudi Aramco’s CEO, Amin Nasser has met Reliance Chairman Mukesh Ambani to discuss Saudi Aramco’s businesses including crude, chemicals and non- metallic. (Reuters) Saudi Arabia's Al Rajhi Bank sees boost to loans and margins – Saudi Arabia’s second-biggest bank expects a pickup in loan growth and improvement in margins this year as it seeks to boost transparency for investors. Al Rajhi Bank sees assets

- 7. Page 7 of 8 growing in the mid-single digits and corporate lending rising after its financing book gained just 0.2% in 2018, according to CEO, Steve Bertamini. The bank also sees a sustained double- digit growth in mortgages over the next few years after home financing grew 27% last year. “Demand for corporate loans was lower than what was expected and the pricing often was not great, so we decided it was better to wait for pricing margins to improve,” he said. “We have seen a good pick up in corporate lending demand already this year, which is good start,” he added. Al Rajhi Bank is seeking to boost home and corporate financing as a key part of its growth plan to diversify away from retail banking, which accounts for 72% of its loan book. Still, the bank’s decision to hold off on some deals because of low pricing meant that its market share in corporate loans fell to 7.3% last year, from 7.7% in 2017, according to a presentation on its website. Market share for mortgages rose to 27.9% from 25.4%. (Bloomberg) `Unsustainable' UAE rate climb seen reversing on tax giveaway – An ‘unsustainable’ increase in the UAE’s lending benchmark will reverse once the government doles out the tax revenue whose withdrawal from deposits spurred the rise, according to the biggest bank in Dubai. The three-month EIBOR has climbed in the past three weeks despite a decline in a similar Dollar rate, an oddity because the Dirham is pegged to the US currency. The spread with the three-month LIBOR widened to 36bps last week, the biggest differential in more than two years, according to data compiled by Bloomberg. The federal government’s “sudden withdrawal of cash from the large EIBOR-fixing banks” is probably to blame, the Head of fixed-income research at Emirates NBD, Anita Yadav said in a report. As banks came under funding pressure, they responded by paying high interbank rates to lure money ahead of quarter-end reporting, she said. The government probably held as much as $11bn in bank deposits following the introduction of a 5% value-added tax (VAT) in early 2018, and cash built up because the distribution of the proceeds to individual Emirates is yet to be finalized, she added. EIBOR’s rise and its widening spread with LIBOR came after the federal government is believed to have withdrawn these deposits and placed them with the Ministry of Finance, according to Emirates NBD. “This phenomenon is likely to reverse once the money is distributed,” she said. The widening EIBOR-LIBOR spread is unsustainable and likely to mean-revert to lower levels within this quarter. The outlook for interest rates in the US is another factor that should push borrowing costs lower in the UAE, she said. (Bloomberg) UAE's Finablr to list on London Stock Exchange – UAE-based payments and foreign exchange company Finablr has confirmed plans to proceed with an Initial Public Offering (IPO) on the London Stock Exchange, a week after the company revealed it was considering a flotation. Finablr, whose brands include UAE Exchange, Travelex Holdings and Xpress Money, stated that the final offer price will be determined following a book-building process, with the listing expected in May. Finablr stated that it is planning to raise $200mn from the sale of new stock, with some existing shares also being offered for sale. It plans to sell at least 25% of its equity. Sources earlier told Reuters the company intends to raise a total of about $500mn from the offering. The sale prospectus is expected to be published on or around May 1, 2019. (Reuters) Dubai's Majid Al Futtaim said to plan bond sale for refinancing – Majid Al Futtaim Holding is planning a bond sale as the operator of Carrefour SA stores in the Middle East seeks funds to help repay debt, according to sources. The Dubai-based owner of the City Centre malls is talking to banks for the potential sale, sources said. The company could raise about $500mn, they said. Majid Al Futtaim has a $500mn five-year bond due in July, according to data compiled by Bloomberg. The company, which has the second-lowest investment grade rating at S&P Global, last sold bonds in March 2018 when it raised $400mn from the sale of perpetual securities. (Bloomberg) Dubai’s Al Khaleej Sugar said to halt production amid supply glut – Al Khaleej Sugar, the world’s largest port-based sugar refinery, has halted production at its Dubai facility again in recent months amid a global glut, sources said. The refinery, which processes raw sugar into the white variety, is currently closed, sources said. The stoppage follows a halt in production that lasted from mid-December to early February as a flood of sugar from India resulted in weak demand for the sweetener produced by Al Khaleej. Refining profits have also fallen, with white sugar’s premium over raw at the lowest for this time of year since 2003. (Bloomberg) Mubadala plans to invest in logistics as property `gets pricey' – Mubadala Investment Company is turning its attention to logistics in the US and Asia after years of residential and commercial real estate investments. The Abu Dhabi wealth fund plans to invest in assets such as warehouses to diversify its portfolio and achieve better returns, Mubadala’s Executive Director of real estate and infrastructure, Ali Eid Almheiri said. “Commercial and residential investments are starting to get pricey from a yield perspective, there’s still opportunities in the logistics sector to give us those returns, that’s what we’re focusing on,” he said. (Bloomberg) SIB posts 6.0% YoY rise in net profit to AED151.7mn in 1Q2019 – Sharjah Islamic Bank (SIB) recorded net profit of AED151.7mn in 1Q2019, an increase of 6.0% YoY. Total income rose 17.8% YoY to AED472.1mn in 1Q2019. Net operating income rose 29.2% YoY to AED329.2mn in 1Q2019. Total assets stood at AED44.72bn at the end of March 31, 2019 as compared to AED44.75bn at the end of March 31, 2018. Investment in Islamic financing stood at AED24.5bn (+1.5% YoY), while customers’ deposits stood at AED26.4bn (+0.01% YoY) at the end of March 31, 2019. EPS remained flat YoY at AED0.05 in 1Q2019. (ADX) Oman sells OMR54.5mn 28-day bills at yield of 2.482% – Oman sold OMR54.5mn 28 day bills due on May 15, 2019 on April 15, 2019. The bills were sold at a price of 99.81, having a yield of 2.482% and will settle on April 17, 2019. (Bloomberg) Investcorp to raise at least $7bn for buyouts this year – Bahrain-based alternative investment firm Investcorp intends to raise at least $7bn this year for acquisitions, about the same as it did last year, The National reported, citing Co-CEO, Rishi Kapoor. China and India will be the two biggest Asian markets for Investcorp. The company expects its GCC portfolio to rise to between $1.5bn-$2bn in the next five years from $1bn, driven by investments in social infrastructure such as healthcare, education and entertainment. (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 QSEIndex S&P Pan Arab S&P GCC 0.6% 0.4% 1.9% 0.1% (0.7%) (0.2%) (0.5%)(1.0%) 0.0% 1.0% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,276.84 (0.9) (1.0) (0.4) MSCI World Index 2,163.08 0.1 0.2 14.8 Silver/Ounce 15.00 0.1 0.2 (3.2) DJ Industrial 26,452.66 0.3 0.2 13.4 Crude Oil (Brent)/Barrel (FM Future) 71.72 0.8 0.2 33.3 S&P 500 2,907.06 0.1 (0.0) 16.0 Crude Oil (WTI)/Barrel (FM Future) 64.05 1.0 0.3 41.0 NASDAQ 100 8,000.23 0.3 0.2 20.6 Natural Gas (Henry Hub)/MMBtu 2.66 (1.1) (3.3) (16.5) STOXX 600 389.21 0.1 0.3 13.6 LPG Propane (Arab Gulf)/Ton 63.25 (1.7) (4.9) (1.2) DAX 12,101.32 0.5 0.7 13.0 LPG Butane (Arab Gulf)/Ton 66.50 (1.3) (1.8) (4.3) FTSE 100 7,469.92 0.0 0.2 13.7 Euro 1.13 (0.2) (0.2) (1.6) CAC 40 5,528.67 0.2 0.3 15.2 Yen 112.00 (0.0) (0.0) 2.1 Nikkei 22,221.66 0.2 1.6 9.5 GBP 1.30 (0.4) (0.2) 2.3 MSCI EM 1,093.55 0.7 0.4 13.2 CHF 0.99 (0.4) (0.5) (2.6) SHANGHAI SE Composite 3,253.60 2.3 1.9 33.7 AUD 0.72 0.0 0.0 1.8 HANG SENG 30,129.87 1.0 0.7 16.4 USD Index 97.04 0.1 0.1 0.9 BSE SENSEX 39,275.64 0.7 0.9 9.1 RUB 64.10 (0.3) (0.4) (8.0) Bovespa 94,333.31 0.6 1.6 6.7 BRL 0.26 (0.9) (0.6) (0.6) RTS 1,255.45 0.7 0.2 17.5 102.7 96.0 82.4