QNBFS Daily Market Report March 2, 2017

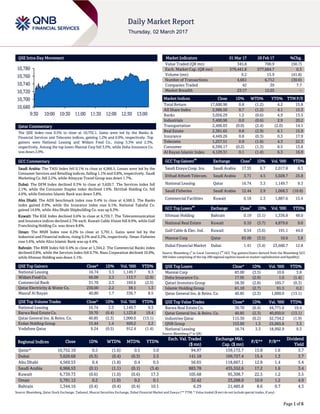

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.5% to close at 10,752.1. Gains were led by the Banks & Financial Services and Telecoms indices, gaining 1.2% and 0.9%, respectively. Top gainers were National Leasing and Widam Food Co., rising 3.3% and 2.3%, respectively. Among the top losers Mannai Corp fell 3.5%, while Doha Insurance Co. was down 2.9%. GCC Commentary Saudi Arabia: The TASI Index fell 0.1% to close at 6,966.5. Losses were led by the Consumer Services and Retailing indices, falling 1.1% and 0.8%, respectively. Saudi Marketing Co. fell 2.2%, while Altayyar Travel Group was down 1.7%. Dubai: The DFM Index declined 0.3% to close at 3,620.7. The Services index fell 2.1%, while the Consumer Staples index declined 1.6%. Ekttitab Holding Co. fell 4.6%, while Emirates Islamic Bank was down 3.8%. Abu Dhabi: The ADX benchmark index rose 0.4% to close at 4,569.5. The Banks index gained 0.9%, while the Insurance index rose 0.1%. National Takaful Co. gained 14.6%, while Abu Dhabi Shipbuilding Co. was up 6.3%. Kuwait: The KSE Index declined 0.6% to close at 6,739.7. The Telecommunication and Insurance indices declined 2.7% each. Kuwait Cable Vision fell 8.9%, while Gulf Franchising Holding Co. was down 8.8%. Oman: The MSM Index rose 0.2% to close at 5,791.1. Gains were led by the Industrial and Financial indices, rising 0.5% and 0.2%, respectively. Oman Fisheries rose 5.6%, while Alizz Islamic Bank was up 4.4%. Bahrain: The BHB Index fell 0.4% to close at 1,344.2. The Commercial Banks index declined 0.8%, while the Services index fell 0.7%. Nass Corporation declined 10.0%, while Ithmaar Holding was down 5.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% National Leasing 16.74 3.3 1,149.7 9.3 Widam Food Co. 66.00 2.3 113.7 (2.9) Commercial Bank 31.70 2.3 169.6 (2.5) Qatar Electricity & Water Co. 230.00 2.2 58.1 1.3 Masraf Al Rayan 40.80 1.7 336.7 8.5 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% National Leasing 16.74 3.3 1,149.7 9.3 Barwa Real Estate Co. 39.70 (0.4) 1,123.8 19.4 Qatar General Ins. & Reins. Co. 40.85 (2.3) 1,000.0 (13.1) Ezdan Holding Group 15.44 1.4 920.2 2.2 Vodafone Qatar 9.24 (0.5) 912.4 (1.4) Market Indicators 01 Mar 17 28 Feb 17 %Chg. Value Traded (QR mn) 345.8 700.9 (50.7) Exch. Market Cap. (QR mn) 579,441.8 577,684.7 0.3 Volume (mn) 9.2 15.9 (41.8) Number of Transactions 4,661 6,712 (30.6) Companies Traded 42 39 7.7 Market Breadth 23:17 12:25 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,600.96 0.8 (1.2) 4.2 15.8 All Share Index 2,986.50 0.7 (1.2) 4.1 15.3 Banks 3,056.29 1.2 (0.6) 4.9 13.5 Industrials 3,400.96 0.0 (0.6) 2.9 20.2 Transportation 2,496.03 (0.0) (2.4) (2.0) 14.1 Real Estate 2,381.65 0.8 (2.9) 6.1 15.9 Insurance 4,449.26 0.8 (0.3) 0.3 17.9 Telecoms 1,257.51 0.9 (1.6) 4.3 22.3 Consumer 6,399.17 (0.2) (1.3) 8.5 13.8 Al Rayan Islamic Index 4,129.31 0.1 (1.4) 6.3 16.9 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Saudi Enaya Coop. Ins. Saudi Arabia 17.55 6.7 2,017.8 8.3 Etihad Atheeb Telecom. Saudi Arabia 3.71 4.5 5,028.7 25.8 National Leasing Qatar 16.74 3.3 1,149.7 9.3 Saudi Fisheries Saudi Arabia 12.44 2.9 1,068.3 (10.8) Commercial Facilities Kuwait 0.18 2.3 1,887.6 15.4 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Ithmaar Holding Bahrain 0.19 (5.1) 1,336.8 48.0 National Real Estate Kuwait 0.10 (3.7) 4,879.6 0.0 Gulf Cable & Elec. Ind. Kuwait 0.54 (3.6) 191.1 44.0 Mannai Corp Qatar 83.00 (3.5) 10.6 3.8 Dubai Financial Market Dubai 1.41 (3.4) 23,660.7 12.8 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Mannai Corp 83.00 (3.5) 10.6 3.8 Doha Insurance Co. 17.95 (2.9) 1.0 (1.4) Qatari Investors Group 58.30 (2.8) 185.7 (0.3) Islamic Holding Group 61.10 (2.7) 91.5 0.2 Qatar General Ins. & Reins. Co. 40.85 (2.3) 1,000.0 (13.1) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Co. 39.70 (0.4) 44,771.6 19.4 Qatar General Ins. & Reins. Co. 40.85 (2.3) 40,850.0 (13.1) Industries Qatar 115.30 (0.2) 32,734.2 (1.9) QNB Group 153.00 1.3 25,065.6 3.3 National Leasing 16.74 3.3 18,992.9 9.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,752.10 0.5 (1.6) 0.5 3.0 94.97 159,172.7 15.8 1.6 3.7 Dubai 3,620.68 (0.3) (0.4) (0.3) 2.5 141.18 109,727.4 15.4 1.3 3.7 Abu Dhabi 4,569.53 0.4 (1.8) 0.4 0.5 56.65 118,667.1 12.8 1.4 5.4 Saudi Arabia 6,966.53 (0.1) (1.1) (0.1) (3.4) 883.78 435,552.6 17.2 1.6 3.4 Kuwait 6,739.73 (0.6) (1.0) (0.6) 17.3 105.68 95,308.7 22.5 1.2 3.5 Oman 5,791.12 0.2 (1.0) 0.2 0.1 32.42 23,288.0 10.9 1.2 4.9 Bahrain 1,344.16 (0.4) (0.4) (0.4) 10.1 6.29 21,485.8 8.6 0.7 4.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,680 10,700 10,720 10,740 10,760 10,780 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.5% to close at 10,752.1. The Banks & Financial Services and Telecoms indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. National Leasing and Widam Food Co. were the top gainers, rising 3.3% and 2.3%, respectively. Among the top losers Mannai Corp fell 3.5%, while Doha Insurance Co. was down 2.9%. Volume of shares traded on Wednesday fell by 41.8% to 9.2mn from 15.9mn on Tuesday. Further, as compared to the 30-day moving average of 9.3mn, volume for the day was 0.6% lower. National Leasing and Barwa Real Estate Co. were the most active stocks, contributing 12.5% and 12.2% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 2016 % Change YoY Operating Profit (mn) 2016 % Change YoY Net Profit (mn) 2016 % Change YoY Allianz Saudi Fransi Coop. Ins. Co.* Saudi Arabia SR 836.3 4.1% – – 3.7 -17.2% Al Alamiya for Coop. Ins. Co.* Saudi Arabia SR 310.8 -22.7% – – 6.1 97.9% Trade Union Coop. Insurance Co.* Saudi Arabia SR 954.5 12.8% – – 0.8 -21.3% Al Sagr Cooperative Insurance Co.* Saudi Arabia SR 176.0 -79.6% – – – – Nat. Shipping Co. of Saudi Arabia* Saudi Arabia SR – – 1,827.1 -7.7% 1,759.1 -3.2% Alahli Takaful Co.* Saudi Arabia SR 356.3 -1.3% – – 4.9 291.3% Saudi United Cooperative Ins. Co.* Saudi Arabia SR 1,016.6 35.0% – – 8.9 146.6% Arabia Insurance Cooperative Co.* Saudi Arabia SR 419.1 -35.9% – – 6.8 -1.7% Malath Coop. Ins. & Reins. Co.* Saudi Arabia SR 2,167.9 16.3% – – 11.7 46.4% Najran Cement Co.* Saudi Arabia SR – – 160.1 -48.2% 124.7 -51.2% Saudi Arabian Amiantit Co.* Saudi Arabia SR – – -65.1 N/A -250.8 N/A Deyaar Development* Dubai AED 428.3 66.6% 218.9 54.8% 216.1 -25.8% Al Ahlia Insurance Company*# Bahrain BHD – – – – 31.8 N/A Bahrain Commercial Facilities Co. * Bahrain BHD 30.0 23.5% 40.4 16.1% 19.9 14.4% Source: Company data, DFM, ADX, MSM, TADAWUL (*FY2016, # Values in ‘000) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/01 US Mortgage Bankers Association MBA Mortgage Applications 24-February 5.8% – -2.0% 03/01 US Markit Markit US Manufacturing PMI February 54.2 54.5 54.3 03/01 UK Markit Markit UK PMI Manufacturing SA February 54.6 55.8 55.7 03/01 EU Markit Markit Eurozone Manufacturing PMI February 55.4 55.5 55.5 03/01 Germany Deutsche Bundesbank Unemployment Change February -14k -10k -25k 03/01 Germany Deutsche Bundesbank Unemployment Claims Rate SA February 5.9% 5.9% 5.9% 03/01 Germany German Federal Statistical Office CPI MoM February 0.6% 0.6% -0.6% 03/01 Germany German Federal Statistical Office CPI YoY February 2.2% 2.1% 1.9% 03/01 France Markit Markit France Manufacturing PMI February 52.2 52.3 52.3 03/01 China China Federation of Logistics Non-manufacturing PMI February 54.2 – 54.6 03/01 China China Federation of Logistics Manufacturing PMI February 51.6 51.2 51.3 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of board meeting No. of days remaining Status MRDS Mazaya Qatar 14-Mar-17 12 Due QFBQ Qatar First Bank 14-Mar-17 12 Due AKHI Al Khaleej Takaful Insurance 14-Mar-17 12 Due AHCS Aamal Company 15-Mar-17 13 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 26.88% 40.36% (46,628,390.83) Qatari Institutions 24.68% 14.79% 34,215,369.77 Qatari 51.56% 55.15% (12,413,021.06) GCC Individuals 0.75% 1.94% (4,123,401.13) GCC Institutions 1.54% 4.03% (8,617,136.24) GCC 2.29% 5.97% (12,740,537.37) Non-Qatari Individuals 18.97% 9.49% 32,809,424.96 Non-Qatari Institutions 27.18% 29.39% (7,655,866.53) Non-Qatari 46.15% 38.88% 25,153,558.43

- 3. Page 3 of 6 News Qatar IQCD’s AGM & EGM endorses items listed on its agenda and approves the distribution of 40% cash dividend – Industries Qatar (IQCD) announced the resolutions of Annual General Assembly and Extraordinary General Assembly Meeting (AGM & EGM) held on February 28, 2017 and approved the proposal of the board of directors to distribute dividend payment of QR4 per share, representing 40% of the nominal share value. (QSE) QGRI to hold its AGM & EGM on March 21 – Qatar General Insurance and Reinsurance Company (QGRI) announced the agenda for its Ordinary and Extraordinary General Assembly Meeting (AGM & EGM), to be held on March 21, 2017. In case the required quorum is not met, a second meeting will be held on March 27, 2017. One of the items of agenda is to approve the board’s recommendation for a dividend payment of QR1.5 per share, representing 15% of the nominal share value. (QSE) QNCD to commission two cement mills; production capacity set to increase by 5,500 tons per day – Qatar National Cement Company (QNCD) plans to “commission two cement mills of its Plant 5 in 1H2017 to increase production capacity” by 5,500 tons per day. The commissioning of the mills are among QNCD’s plans for the year, according to Chairman and Managing Director Salem bin Butti al-Naimi, who addressed shareholders during the company’s AGM held at the Sheraton. Al-Naimi said the company aims to complete the construction of Plant 5 by operating the kiln and other utilities during the 2H2017. To meet market demands and the company’s objectives, QNCD will increase the production capacity of washed sand and calcium carbonate. Al-Naimi said QNCD will dispose Cement Plant 1, including all of its accessories in Umm Bab after it was closed in June 30, 2016 to control the company’s overall cost and maintain its commitment to safety and environmental standards. (Gulf-Times.com) BMI: Building materials demand set to rise in Qatar on strong project pipeline – The demand for building materials in Qatar’s construction sector will continue to accelerate in the run up to the FIFA 2022 World Cup on the back of robust growth and a strong project pipeline, a new report showed. “The government policy will serve to help mitigate bottlenecks with regard to matching growing demand with an adequate supply of building materials,” BMI Research said in a report. Growing amounts of aggregate building materials will be required to “fuel rapid expansion” in Qatar’s construction sector, which, with the upcoming FIFA 2022 World Cup, is expected to drive annualized average real growth of 12%. “We expect that prudent government policy under the auspices of state-owned Qatar Primary Materials Company (QPMC) will help to facilitate building material supplies to the private sector, allowing the government to successfully implement its ambitious infrastructure build out,” BMI said. According to the Fitch Group company, Qatar’s investment program will spur well- diversified growth spanning the country’s infrastructure spectrum, with transport and commercial construction projects in particular set to be major beneficiaries. The country’s construction boom will in turn buoy demand for primary construction materials. (Gulf-Times.com) Qatar population reaches all-time high at 2.67mn – According to the figures released by the Ministry of Development Planning and Statistics (MDPS), Qatar's population has reached an all-time high of 2,673,000 on February 28, 2017, climbing 3.8% compared to the previous month. The previous highest population figure of 2,637,000 was recorded on November 30, 2016. The latest figures also reveal that compared to the population during February 2016, there was a 5% rise last month. The population of February 2016 was a little over 2.5mn. (Gulf-Times.com) CEO: QFC on a mission to create 10,000 jobs in 5 years – Qatar Financial Centre (QFC) is on a mission to create 10,000 jobs in the next five years, its Chief Executive Officer said. The move is part of QFC's bid to aid the government's economic diversification efforts and to encourage private sector participation in the process, Yousuf Mohamed al Jaida said while addressing a business gathering in Doha. "QFC is an integral part of the Qatari economy. In keeping with that general character, we have decided to increase the number of companies on board to 1,000, from the current 340, by 2022,"Jaida said while addressing dignitaries of the Qatar Businessmen Association and a visiting trade delegation from Malta. More firms coming under its fold, the QFC CEO said, would go a long way in expanding the local market and strengthening the private sector, besides generating jobs. He said it would also facilitate the diversification of government's revenues. (Qatar Tribune) QBA, Malta business delegation focuses on mutual investment opportunities – The Qatari Businessmen Association (QBA) welcomed a delegation from the Republic of Malta during a meeting that discussed investment opportunities and partnerships between Qatar and Malta. In a statement, the QBA described the meeting as an important step in a series of events and activities carried out by the association to promote and support economic relations and trade between the two countries. The event also contributed in paving the way for businessmen in Qatar and Malta to set up trade and investment partnerships and open up new areas of business development sectors, as well as a positive reflection on the economy of both countries. The QBA said the meeting comes in the context of the growth in relations between Qatar and Malta to a new level of cooperation, which aims to open channels of communication with businesses in Malta, and to identify investment opportunities to serve the interests of both parties. The QBA said Qatar’s business community is witnessing great developments in all areas, especially in infrastructure projects. The state, it added, has developed in a number of laws and strategies that help investors easily set up companies in Qatar. (Gulf-Times.com) International US small business borrowing falls in January – Borrowing by small US firms fell in January to the lowest level in three months; data released showed a signal that small-business owners are not betting on faster demand for the coming year, at least not yet. The Thomson Reuters/PayNet Small Business Lending Index fell to 123.3 in January from 134 in December, and was the lowest since October, when the index sank to

- 4. Page 4 of 6 119.8. Movements in the index typically correspond with changes in gross domestic product growth a quarter or two ahead. US President Donald Trump has embraced a range of potential new policies, including tax cuts and infrastructure programs, and bets those policies will boost corporate profits have driven US equities to record levels since his election in November. But some of Trump's policies, including on immigration and trade, have increased uncertainty in some sectors. Small business borrowing is a key barometer of growth because small companies tend to do much of the hiring that drives economic gains. (Reuters) US construction spending falls on weak government expenditures – US construction spending unexpectedly fell in January as the biggest drop in public outlays since 2002 offset gains in investment in private projects, pointing to moderate economic growth in the first quarter. The Commerce Department said that construction spending declined 1.0% to $1.18tn. Construction spending in December was revised to show a 0.1% increase rather than the previously reported 0.2% decline. Economists polled by Reuters had forecast construction spending gaining 0.6% in January. Construction spending increased 3.1% from a year ago. In January, public construction spending tumbled 5.0 percent, the largest drop since March 2002. That followed a 1.4% decline in December. Public construction spending has now decreased for three straight months. Outlays on state and local government construction projects dropped 4.8%, also the biggest drop since March 2002. Spending on state and local government construction projects has dropped for three straight months. (Reuters) Weaker Euro helps propel Eurozone factory growth to six-year high – Eurozone manufacturing growth accelerated to a six- year high in February as a weaker euro helped drive strong demand for its exports, with inflationary pressure showing further signs of recovering, a business survey showed. While the upturn in Eurozone factory activity was not shared by all major economies, particularly France, prices rose faster across most countries in the region. The IHS Markit Eurozone manufacturing Purchasing Managers' Index rose to 55.4 in February -- the highest reading since April 2011 - from 55.2 in January, although it inched down from a flash estimate of 55.5. That reading is well above the 50 mark denoting growth and suggests a solid pickup in activity. Optimism among Eurozone manufacturers about future business is also surging. (Reuters) PMI: German manufacturing growth near six-year high – German manufacturing expanded at the strongest rate in nearly six years in February, a survey showed, suggesting factories will push up overall growth in Europe's biggest economy at the start of 2017. Markit's Purchasing Managers' Index (PMI) for manufacturing, which accounts for about a fifth of the economy, rose to 56.8 from 56.4 in January. It was the highest reading since May 2011 and above the 50 line that separates growth from contraction for the 27th consecutive month. The final figure came in slightly weaker than a flash reading, however. "The survey results suggest that manufacturing will contribute to a strengthening in overall economic growth in the first quarter," IHS Markit economist Trevor Balchin said. Germany's quarterly growth rate was likely to rise to "at least" 0.6% in the first three months of 2017 from 0.4% in the final three months of 2016, Balchin added. The survey showed growth rates for output, new orders, exports and purchasing all improved, with manufacturing new orders rising at the strongest rate in just over three years. Companies in the goods- producing sector reported increased demand from both domestic and export customers, with Europe and Asia mentioned as main sources of growth. (Reuters) German unemployment falls more than expected in February – German unemployment fell more than expected in February, data from the Federal Labor Office showed. The seasonally adjusted jobless total fell by 14,000 to 2.592mn, the Labor Office said. That was more than the predicted fall of 10,000 in a Reuters poll. The adjusted unemployment rate remained unchanged at 5.9%, the lowest level since German reunification in 1990. (Reuters) China central bank injects $60.2bn of liquidity in February, down sharply from January – China's central bank injected 413.85bn Yuan ($60.2bn) via short- and medium-term liquidity tools in February, down 35% from the previous month, signaling a bid to rein in rapid credit growth. That followed a 26% drop in January from December. Under its new "prudent and neutral" policy, the People's Bank of China (PBOC) has adopted a modest tightening bias in a bid to cool explosive growth in debt, though it is treading cautiously to avoid hurting economic growth. The central bank raised interest rates on its reverse repurchase agreements (repos) and the SLF on February 3, following a rise in rates on the MLF in late January. The PBOC lent 393.50bn Yuan to financial institutions via its medium- term lending facility (MLF) in February, it said. Of the total, the central bank lent 150bn Yuan for six months and 243.5bn Yuan for one year. Outstanding MLF loans totaled 3.761tn Yuan at the end of February, compared with 3.573tn Yuan at the end of January, implying a net injection of 188.5bn Yuan. (Reuters) Regional Saudi Arabia’s fiscal surplus forecast at SR162bn by 2020 – By the year 2020, planned fiscal measures under the Saudi Arabia government’s Fiscal Balance Program (FBP 2020), will result in the government saving around SR362bn, leading to a fiscal surplus of SR162bn, compared with a deficit of SR200bn if no reforms are implemented. Jadwa forecast that oil revenue will reach SR586bn by 2020, compared to SR520bn implied in FBP’s baseline scenario, noting that its assumptions with regards to growth in expenditure and non-oil revenue are close to the targets in the FBP’s baseline scenario. The reduction in public sector worker allowances and wage freeze will contribute to 55% of 2017 gross savings. A further 29% of these savings will come from energy price reform, whilst new measures to enhance the efficiency of spending and raise non-oil revenue will contribute 12% and 4%, respectively. (GulfBase.com) Utilities projects worth of $84bn under way in UAE – There are currently 401 active projects in the UAE’s utility sector, with an estimated value of $84bn. The utilities sector constitutes 4% of the number of active construction projects and 11% of the total estimated value of ongoing construction. The number of ongoing utility projects increased by 2% in January compared to December 2016, even after considering the recent completion of 12 utility projects that have a combined estimated value of around $87mn. The significant ongoing investment in the

- 5. Page 5 of 6 power sector is one of the best indicators of an aggressive development plan in the years ahead. (GulfBase.com) CEO: Gulf Navigation seeking funds to double or triple fleet – Gulf Navigation Holding’s Chief Executive Officer, Khamis Juma Buamim said that Gulf Navigation Holding may sell shares or Islamic bonds as the Dubai-based ship owner plans to seek funds to double or triple its fleet of oil and chemical ships. The company wants to acquire chemical and product tankers as well as offshore support vessels, after it agreed last month to settle historical liabilities. Gulf Navigation currently owns eight chemical tankers and four crew boats. The company could sell shares or issue short-term Islamic bonds, or Sukuk, to fund the growth. (GulfBase.com) DIB rings bell to celebrate listing $1bn Sukuk on Nasdaq Dubai – Mohamed Abdulla Al Nahdi, Deputy Chief Executive of Dubai Islamic Bank (DIB), rang the market-opening bell to celebrate the listing of a $1bn Sukuk by DIB on Nasdaq Dubai. The listing, carried out under DIB’s $5bn Sukuk Program, was the largest senior Sukuk issuance by a financial institution globally. It brings the total value of DIB’s current Sukuk listings on Nasdaq Dubai to $4.25bn, more than any other UAE issuer. (GulfBase.com) Passenger traffic at Dubai airport hits 8mn in January – Dubai International Airport (DXB) began the New Year in top gear as monthly traffic in January reached an all-time high of 8mn passengers. Passenger traffic rose 9.7% to 8,037,008 in January 2017, up from 7,327,637 in the same month in 2016. This follows DXB’s performance in 2016 during which the airport welcomed a record 83.6mn passengers. Eastern Europe remained the fastest-expanding market in terms of percentage growth (up 32.5%), followed by Asia (up 26.4%), South America (up 18.6%) and Australasia (15.8%). (GulfBase.com) Fitch rates Kuwait's upcoming global medium-term notes 'AA(EXP)' – Fitch Ratings has assigned Kuwait's senior unsecured notes to be issued under the country's upcoming global medium-term note program an expected rating of 'AA(EXP)'. The assignment of the final rating is contingent on the receipt of final documents conforming to information already received. The rating is in line with Kuwait's Long-Term Foreign-Currency Issuer Default Rating (IDR), which was affirmed at 'AA' with a Stable Outlook. The rating of the bonds is sensitive to changes in Kuwait's Long-Term Foreign- Currency IDR. (Reuters) Kuwait hires banks for investor meetings – Kuwait has mandated Citigroup, HSBC and JP Morgan as global coordinators for fixed income investor meetings commencing March 6, 2017. In addition, Deutsche Bank, NBK Capital and Standard Chartered, together with the joint global coordinators, are mandated as joint lead managers and joint book runners. A debut senior unsecured US dollar benchmark bond offering across five and 10 year maturities will follow. (GulfBase.com) Kuwait real estate sales down after a strong December – Following a stellar performance in December, the real estate market softened in January, as monthly sales fell back below KD200mn. According to the National Bank of Kuwait (NBK), the value of sales decreased to KD179.5mn, lagging last year’s performance by 16%. This was despite a slight pickup in transaction volumes, which rose by 2% YoY. January’s price performance, as reflected in NBK’s real estate price indices, indicated further stabilization in the residential sector and convergence of trends across sectors. According to NBK, the residential sector sales were steady, remaining close to the 2016 monthly average. (GulfBase.com) Oman will need external financing support – Oman's continued large twin deficits imply a need for material external financing to prevent sustained erosion in foreign assets and to defend the US dollar peg. Further borrowing is likely to pressure external debt, especially if a downgrade to non-investment grade removes a source of technical support as debt levels increase further. In the absence of material fiscal consolidation, debt dynamics remain adverse and unanchored, despite the low starting level for government debt. The sharp drop in oil prices in 2016 and spending slippage have led to a large widening in the fiscal deficit in 2016. The consolidated government fiscal balance recorded a deficit of OMR5.2bn ($13.5bn, 22.6% of GDP) in 2016, widening from OMR4.2bn ($10.8bn, 16.9% of GDP) in 2015. (GulfBase.com) Oman sets initial price guidance for three-tranche dollar bond – The government of Oman released initial price guidance for a three-tranche US dollar international bond with maturities of 5, 10 and 30 years. Initial price thoughts for the debt sale are in the 215 basis points over mid-swaps area for the five-year tranche, 325 bps over mid-swaps area for the 10-year tranche and 425 bps over mid-swaps area for the 30-year portion. Each tranche would be benchmark size, meaning upwards of $500mn. Bank Muscat, Citi, Deutsche Bank, HSBC, ICBC Standard Bank, JP Morgan, Societe Generale and Standard Chartered are the book runners. (Reuters)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 QSE Index S&P Pan Arab S&P GCC (0.1%) 0.5% (0.6%) (0.4%) 0.2% 0.4% (0.3%) (0.8%) (0.4%) 0.0% 0.4% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,249.48 0.1 (0.6) 8.4 MSCI World Index 1,856.34 1.0 0.8 6.0 Silver/Ounce 18.42 0.6 0.3 15.7 DJ Industrial 21,115.55 1.5 1.4 6.8 Crude Oil (Brent)/Barrel (FM Future) 56.36 1.4 0.7 (0.8) S&P 500 2,395.96 1.4 1.2 7.0 Crude Oil (WTI)/Barrel (FM Future) 53.83 (0.3) (0.3) 0.2 NASDAQ 100 5,904.03 1.3 1.0 9.7 Natural Gas (Henry Hub)/MMBtu 2.60 3.2 4.5 (29.5) STOXX 600 375.69 1.1 1.5 4.1 LPG Propane (Arab Gulf)/Ton 62.25 (4.2) (4.2) (13.2) DAX 12,067.19 1.5 2.2 5.3 LPG Butane (Arab Gulf)/Ton 72.00 (20.0) (26.5) (25.8) FTSE 100 7,382.90 0.8 0.7 3.1 Euro 1.05 (0.3) (0.2) 0.3 CAC 40 4,960.83 1.7 2.3 2.2 Yen 113.73 0.9 1.4 (2.8) Nikkei 19,393.54 (0.1) (0.7) 4.1 GBP 1.23 (0.7) (1.4) (0.4) MSCI EM 938.47 0.2 (0.5) 8.8 CHF 0.99 (0.3) (0.1) 1.0 SHANGHAI SE Composite 3,246.93 (0.1) (0.3) 5.6 AUD 0.77 0.3 0.0 6.5 HANG SENG 23,776.49 0.1 (0.8) 7.9 USD Index 101.78 0.7 0.7 (0.4) BSE SENSEX 28,984.49 0.8 0.2 10.9 RUB 58.32 (0.1) (0.1) (5.2) Bovespa 66,988.88 0.7 0.7 16.7 BRL 0.32 0.7 0.7 5.3 RTS 1,109.39 0.9 (1.7) (3.7) 123.2 102.1 100.4