The Increasing Likelihood of a Greek Exit Poses Acute Risks to the Global Economy

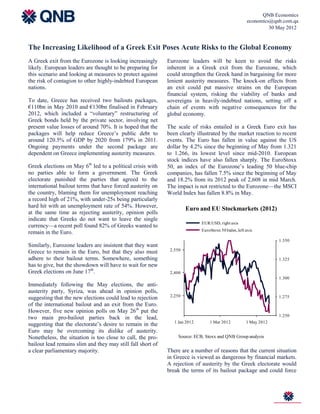

- 1. QNB Economics economics@qnb.com.qa 30 May 2012 The Increasing Likelihood of a Greek Exit Poses Acute Risks to the Global Economy A Greek exit from the Eurozone is looking increasingly Eurozone leaders will be keen to avoid the risks likely. European leaders are thought to be preparing for inherent in a Greek exit from the Eurozone, which this scenario and looking at measures to protect against could strengthen the Greek hand in bargaining for more the risk of contagion to other highly-indebted European lenient austerity measures. The knock-on effects from nations. an exit could put massive strains on the European financial system, risking the viability of banks and To date, Greece has received two bailouts packages, sovereigns in heavily-indebted nations, setting off a €110bn in May 2010 and €130bn finalised in February chain of events with negative consequences for the 2012, which included a “voluntary” restructuring of global economy. Greek bonds held by the private sector, involving net present value losses of around 70%. It is hoped that the The scale of risks entailed in a Greek Euro exit has packages will help reduce Greece’s public debt to been clearly illustrated by the market reaction to recent around 120.5% of GDP by 2020 from 179% in 2011. events. The Euro has fallen in value against the US Ongoing payments under the second package are dollar by 4.2% since the beginning of May from 1.321 dependent on Greece implementing austerity measures. to 1.266, its lowest level since mid-2010. European stock indices have also fallen sharply. The EuroStoxx Greek elections on May 6th led to a political crisis with 50, an index of the Eurozone’s leading 50 blue-chip no parties able to form a government. The Greek companies, has fallen 7.5% since the beginning of May electorate punished the parties that agreed to the and 18.2% from its 2012 peak of 2,608 in mid March. international bailout terms that have forced austerity on The impact is not restricted to the Eurozone—the MSCI the country, blaming them for unemployment reaching World Index has fallen 8.8% in May. a record high of 21%, with under-25s being particularly hard hit with an unemployment rate of 54%. However, Euro and EU Stockmarkets (2012) at the same time as rejecting austerity, opinion polls indicate that Greeks do not want to leave the single EUR:USD, right axis currency—a recent poll found 82% of Greeks wanted to EuroStoxx 50 Index, left axis remain in the Euro. 1.350 Similarly, Eurozone leaders are insistent that they want 2,550 Greece to remain in the Euro, but that they also must adhere to their bailout terms. Somewhere, something 1.325 has to give, but the showdown will have to wait for new Greek elections on June 17th. 2,400 1.300 Immediately following the May elections, the anti- austerity party, Syriza, was ahead in opinion polls, 2,250 1.275 suggesting that the new elections could lead to rejection of the international bailout and an exit from the Euro. However, five new opinion polls on May 26th put the 1.250 two main pro-bailout parties back in the lead, 1 Jan 2012 1 Mar 2012 1 May 2012 suggesting that the electorate’s desire to remain in the Euro may be overcoming its dislike of austerity. Nonetheless, the situation is too close to call, the pro- Source: ECB, Stoxx and QNB Group analysis bailout lead remains slim and they may still fall short of a clear parliamentary majority. There are a number of reasons that the current situation in Greece is viewed as dangerous by financial markets. A rejection of austerity by the Greek electorate would break the terms of its bailout package and could force

- 2. QNB Economics economics@qnb.com.qa 30 May 2012 the troika (the ECB, EC and IMF) to cease making of the Greek general government was €178bn at the end bailout payments. This would result in Greece of September 2011, although this fell to €157bn by the defaulting on its bonds, initiating a damaging chain of end of the year, mainly owing to support packages. events. Lending would be held back and borrowing costs would The value of Greek bonds would collapse leading to rise, making it harder for Europe to escape recession. In losses for Eurozone and global banks. Greek banks are countries where banking systems are already fragile, heavily exposed to their sovereign’s debt—lending of banks may require government support to stay afloat. Greek financial institutions to the government was Higher borrowing costs and potential bailouts would €35bn in March 2012—making a total collapse of the make it harder for heavily-indebted nations, such as domestic banking system inevitable, wiping out savings Portugal, Ireland, Spain and Italy, to meet payments on and the ability of the populace to withdraw cash or their sovereign debt, leading to more sovereign make payments. bailouts. All these factors would undermine the Eurozone and global economy, making it yet harder for The default would also be likely to upset the indebted nations to overcome their financial burdens. functioning of the government while a new form of financing was arranged. The country would lose access Bank Exposure to Greek Debt* to Euros and would most probably need to issue a new (December 2011) currency to enable any form of functioning government (€bn) and banking system to re-emerge. The disruption to lending from banks and the absence of government 34.3 support would lead to an economic collapse, higher unemployment and increased social misery. Imports of goods would be interrupted by the lack of currency, leading to shortages of oil, medicine and some foodstuffs. 10.3 8.1 However, once through the initial shock, Greece would 6.3 3.5 2.7 most likely emerge with less debt, more independence 1.8 1.7 and a more competitive exchange rate. Analysts expect France Germany UK Portugal US Netherlands Austria Italy that a new Greek currency would immediately depreciate by around 50% and would remain depreciated by 50%-60% for the next five years. The initial shock would lead to a double-digit contraction in GDP but in the longer term, growth would rebound to Source: BIS, Reuters and QNB Group analysis, *consolidated claims of BIS reporting banks on Greece over 4% as gains in competitiveness from the lower exchange rate would revive exports and tourism. The Greeks will either have to face this kind of shock or A number of steps to mitigate the risks of a Greek adhere to the existing or renegotiated austerity terms of default have been put forward: shoring up the region’s the troika, which are likely to involve years of banks through recapitalisations from European rescue economic repression. funds; implementing a Eurozone deposit guarantee to try and avoid a potential bank run; and jointly A Greek default and exit from the Euro would have an guaranteed Eurobonds. However, at a summit on 23rd impact beyond Greece. Banks across the Eurozone, and May, European leaders put off any decisions. It is beyond, would be impaired by their exposure to Greek therefore likely that uncertainty will continue to repress sovereign debt. Some of Europe’s largest banks face financial markets until the situation is clarified by the exposures of over €3.0bn each to Greek debt. The total Greek elections on June 17th. exposure of European banks to the Greek public sector was €31bn and for non-European banks it was €1.6bn in September 2011, according to the Bank of International Settlements (BIS). The total external debt