Realtor sherrell charlotte nc housing market facts q1 2010

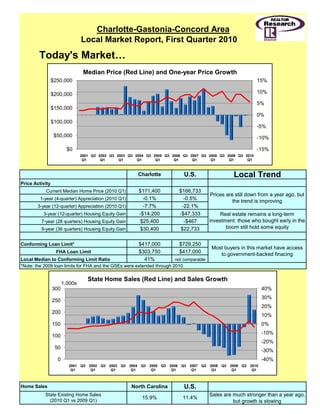

- 1. Charlotte-Gastonia-Concord Area Local Market Report, First Quarter 2010 Today's Market… Median Price (Red Line) and One-year Price Growth $250,000 15% $200,000 10% 5% $150,000 0% $100,000 -5% $50,000 -10% $0 -15% 2001 Q3 2002 Q3 2003 Q3 2004 Q3 2005 Q3 2006 Q3 2007 Q3 2008 Q3 2009 Q3 2010 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Charlotte U.S. Local Trend Price Activity Current Median Home Price (2010 Q1) $171,400 $166,733 Prices are still down from a year ago, but 1-year (4-quarter) Appreciation (2010 Q1) -0.1% -0.5% the trend is improving 3-year (12-quarter) Appreciation (2010 Q1) -7.7% -7 7% -22 1% -22.1% 3-year (12-quarter) Housing Equity Gain -$14,200 -$47,333 Real estate remains a long-term 7-year (28 quarters) Housing Equity Gain $25,400 -$467 investment: those who bought early in the 9-year (36 quarters) Housing Equity Gain $30,400 $22,733 boom still hold some equity Conforming Loan Limit* $417,000 $729,250 Most buyers in this market have access FHA Loan Limit $303,750 $417,000 to government-backed finacing Local Median to Conforming Limit Ratio 41% not comparable *Note: the 2009 loan limits for FHA and the GSEs were extended through 2010. State Home Sales (Red Line) and Sales Growth 1,000s 300 40% 30% 250 20% 200 10% 150 0% -10% 100 -20% 50 -30% 0 -40% 2001 Q3 2002 Q3 2003 Q3 2004 Q3 2005 Q3 2006 Q3 2007 Q3 2008 Q3 2009 Q3 2010 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Q1 Home Sales North Carolina U.S. State Existing Home Sales Sales are much stronger than a year ago, 15.9% 11.4% (2010 Q1 vs 2009 Q1) but growth is slowing

- 2. Drivers of Local Supply and Demand… Local Economic Outlook Charlotte U.S. Not 12-month Job Change (Mar) -20,900 Job losses are a problem and will weigh Comparable on demand, but layoffs are declining Not 12-month Job Change (Feb) -27,500 which could help buyer confidence Comparable Not 36-month Job Change (Mar) -53,700 Charlotte's unemployment situation is Comparable worse than the national average and Current Unemployment Rate (Mar) 11.9% 9.7% weighs on confidence Year-ago Unemployment Rate 11.1% 8.6% Weak, but better than most markets 1-year (12 month) Job Growth Rate -2.5% -4.0% Share of Total Employment by Industry Charlotte-Gastonia-Concord Area U.S. Governmen Governmen t Trade/Tran t Trade/Trans Other 4.1% sportation/U Natural Resour 16.4% 4.8% 35.2 portation/Uti 13.6% Natural Services tilities lities 10.0% 8.9% #N/AOther #N/A 22.9% Natural #N/A Services #N/A 4.2% #N/A Constru #N/A Information Trade/Transpo 22.9% 168 Trade/T 8.9% 18.8% Information Leisure & Information 2.9% 21.1 2.9% Hospitality Informa18.8% Leisure & 15.1% Financial Act Hospitality 9.2% 67.6 Financi 2.1% Financial Prof. & 11.4% Busin 17.0% 124.5 Financial Profess5.8% Activities 2.1% Educ. & Heal 11.3% 82.9 Activities Educat 12.8% Educ. & 9.2% Leisure & Health 11.4% Ho 83.3 Leisure15.1% Educational Professiona Services & Health l& Other Service Prof. & Other S10.0% Business 11.3% 4.2% 30.5 Business Services 12.8% Services Government 16.4% 120.2 Services Govern4.1% 5.8% 17.0% 12-month Employment Change by Industry in the Charlotte-Gastonia-Concord Area Natural Resources/Mining/Construct -9,100 Prof. & Business Services -1,300 Natural Resources and Mining NA Educ. & Health Services 2,200 Construction NA Leisure & Hospitality -2,200 Trade/Transportation/Utilities -1,600 Other Services -800 Information -400 Government 1,200 Financial Activities -3,900 State Economic Activity Index North Carolina U.S. -1.3% -1.2% The economy of North Carolina is weaker 12-month change (2010 - Mar) than the rest of the nation, but improved 36-month change (2010 - Mar) -6.7% -4.3% modestly from last month

- 3. Construction Local Fundamentals Charlotte U.S. 12-month Sum of 1-unit Building Permits through The current level of construction is 65.6% 5,120 not comparable Mar 2010 below the long-term average Reduced construction will limit new Long-term average for 12-month Sum of 1-Unit supply to the market, allowing demand to 14,899 not comparable Building Permits catch up with current supply and foreclosures more quickly Single-Family Housing Permits (Mar 2010) Construction is down from last year, but -11.4% -6.1% 12-month sum vs. a year ago appears to have bottomed. Construction: 12-month Sum of Local Housing Permits (Historical Average Shown in Red Dashed Line) 25,000 20,000 15,000 10,000 5,000 0

- 4. Affordability Ratio of Local Mortgage Servicing Cost to Income (Local Historical Average Shown in Red, U.S. Average in Green) 30% 25% 20% 15% 10% 5% 0% 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 Monthly Mortgage Payment to Income Charlotte U.S. Ratio for 2008 11.6% 15.3% Historically strong and an improvement Ratio for 2010 Q1 10.4% 14.4% over the fourth quarter of 2009 Historical Average 14.1% 22.6% More affordable than most markets Recent Trend - Local Mortgage Servicing Cost to Income (Historical Average Shown in Red Dashed Line) 16% 14% 12% 10% 8% 6% 4% 2% 0% 2008 Q2 2008 Q3 2008 Q4 2009 Q1 2009 Q2 2009 Q3 2009 Q4 2010 Q1 Median Home Price to Income Charlotte U.S. Ratio for 2009 1.8 2.4 Local affordability has improved and is Ratio for 2010 Q1 1.6 2.2 below the historical average Historical Average 1.8 2.7 Affordable compared to most markets

- 5. Ratio of Local Median Home Price to Local Average Income (Local Historical Average Shown in Red, U.S. Average in Green) 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 The Mortgage Market 30-year Fixed Mortgage Rate and Treasury Bond Yield (%) 3.0 7.0 6.5 2.5 25 6.0 2.0 5.5 5.0 1.5 4.5 4.0 1.0 3.5 0.5 3.0 2.5 0.0 2.0 2005 Q1 Q3 2006 Q1 Q3 2007 Q1 Q3 2008 Q1 Q3 2009 Q1 Q3 2010 Q1 Spread (left axis) 30-Year FRM (Right axis) 10-Year Treasury Bond (Right Axis) Signs of economic strength during the first quarter pressed up on the 10-year Treasury yield, while Fed purchases of mortgage backed securities helped to keep long-term mortgage rates low. The spread between the 30-year fixed rate mortgage and the 10-year Treasury continued to shrink through the first quarter of 2010 as a result. In the first two months of the second quarter, new concerns about domestic employment growth and international banking issues have sent investors clamoring to long-term Treasuries for safety, easing inflation concerns (temporarily) and sending the yield sliding. Private demand for mortgage backed securities rose in wake of the Treasury's cessation of its mortgage purchase program, muting upward pressure on long-term mortgage rates. Figures for the second quarter, due out in a few months, will likely show a flat or slightly wider spread between the 10-year Treasury and 30-year FRM. The debt crisis in Greece and fear of a contagion have caused long-term Treasury yields to tumble as nervous investors sought a shelter. The decline in the Treasury yield has not been matched by moderating mortgage rates leading to a increase in the spread.

- 6. Looking Deeper…. State Total Foreclosure Rate vs. U.S Average (U.S. Average in Blue Dashed Line) 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Source: Mortgage Bankers' Association Foreclosures by Type Monthly Market Data - February 2010 Charlotte U.S. Delinquencies by Type 4.0% 5.1% 5.2 6.3 Market Share: % % Suprime mortgages make up a larger Prime (blue), Alt-A 91.0% 4.0% 5.1% 88.5% 5.2% 6.3% than average share of the Charlotte (green), and Subprime 91.0 88.5 market, but rising prime foreclosures are (red) % % also becoming a problem There was a substantial increase versus 1.9 1.9% 2.7% PRIME: 1.4 2.7% August of this year Foreclosure + REO % % 2.3% Rate Compared to the national average, 1.4% 2.3% Aug-09 Feb-10 Aug-09 Feb-10 today's local rate is low There has been little change locally 10.6% 17.9% SUBPRIME: 10.6 18.0 compared to August 10.2 % % 17.9 Foreclosure + REO % % Rate Locally, today's foreclosure rate is low 10.2% 18.0% Aug-09 Feb-10 Aug-09 Feb-10 relative to the national average A large local increase occurred compared ALT-A: 8.1% 14.8% 14.8 8.1% 14.5 to August of last year % Foreclosure + REO 7.0% % Rate The February rate for Charlotte is low 7.0% 14.5% Aug-09 Feb-10 Aug-09 Feb-10 compared to the national average The "foreclosure + REO rate" is the number of mortgages, by metro area, that are either in the foreclosure process or have completed the foreclosure process and are owned by banks divided by the total number of mortgages for that area. Source: First American CoreLogic, LoanPerformance data

- 7. Prime Foreclosures and Delinquencies in Process Monthly Market Data - February 2010 Charlotte U.S. 7.8% 6.2% 4.5% 7.6% 6.3% 4.9% The share of local 60-day delinquencies 6.2 7.8 Prime: 60-day 4.5 % 6.3% 7.6% rose suggesting that the 90-day % % 4.9% delinquency rate is likely to rise in the Delinquent near future Feb-09 Aug-09 Feb-10 Feb-09 Aug-09 Feb-10 6.3% 4.6% 3.2% 6.5% 5.2% 3.8% Charlotte's 90-day delinquency rate Prime: 90-day 4.6% 6.3% 5.2% 6.5% climbed faster than the national average 3.2% 3.8% Delinquent suggesting a bulge of foreclosures in the future Feb-09 Aug-09 Feb-10 Feb-09 Aug-09 Feb-10 1.9% 1.4% 0.7% 2.7% 2.3% 1.7% Prime: 1.9 Rising 60 and 90-day delinquency rates 0.7 1.4 2.3% 2.7% % Foreclosure + % % 1.7% will press up on local prime foreclosures REO Rate rates in the near future. Feb-09 Aug-09 Feb-10 Feb-09 Aug-09 Feb-10 Source: First American CoreLogic, LoanPerformance data CoreLogic Geographic Coverage The Charlotte area referred to in this report covers the geographic area of the Charlotte-Gastonia-Concord metro area as officially defined by the Office of Management and Budget of the U.S. Government. The official coverage area includes the following counties: Anson County, Cabarrus County, Gaston County, Mecklenburg County, Union County, and York County More information on the OMB's geographic definitions can be found at http://www.whitehouse.gov/omb/inforeg_statpolicy/