SAMIM_CONSULTANCY_PROFILE-1

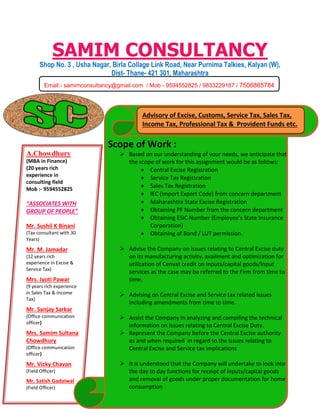

- 1. SAMIM CONSULTANCY Shop No. 3 , Usha Nagar, Birla Collage Link Road, Near Purnima Talkies, Kalyan (W), Dist- Thane- 421 301, Maharashtra a Scope of Work : Email:- samimconsultancy@gmail.com / Mob - 9594552825 / 9833229167 / 7506865784 A.Chowdhury (MBA in Finance) (20 years rich experience in consulting field Mob :- 9594552825 “ASSOCIATES WITH GROUP OF PEOPLE” Mr. Sushil K Binani (Tax consultant with 30 Years) Mr. M. Jamadar (12 years rich experience in Excise & Service Tax) Mrs. Jyoti Pawar (9 years rich experience in Sales Tax & Income Tax) Mr. Sanjay Sarkar (Office communication officer) Mrs. Samim Sultana Chowdhury (Office communication officer) Mr. Vicky Chavan (Field Officer) Mr. Satish Gadaiwal (Field Officer) Scope of Work : Based on our understanding of your needs, we anticipate that the scope of work for this assignment would be as follows: Central Excise Registration Service Tax Registration Sales Tax Registration IEC (Import Export Code) from concern department Maharashtra State Excise Registration Obtaining PF Number from the concern department Obtaining ESIC Number (Employee’s State Insurance Corporation) Obtaining of Bond / LUT permission. Advise the Company on issues relating to Central Excise duty on its manufacturing activity, availment and optimization for utilization of Cenvat credit on Inputs/capital goods/Input services as the case may be referred to the Firm from time to time. Advising on Central Excise and Service tax related issues including amendments from time to time. Assist the Company in analyzing and compiling the technical information on issues relating to Central Excise Duty. Represent the Company before the Central Excise authority as and when required in regard to the issues relating to Central Excise and Service tax implications It is understood that the Company will undertake to look into the day to day functions for receipt of inputs/capital goods and removal of goods under proper documentation for home consumption Advisory of Excise, Customs, Service Tax, Sales Tax, Income Tax, Professional Tax & Provident Funds etc.

- 2. Initial visit to each location for verification of statutory records, documents and advise the field staff for additional requirements if any to be complied with Advise for making PLA deposits if any timely and ensure that at no point of time company indulge in paying of interest for delayed payments Ensure timely filing of required returns viz. ER-1, ER-5, ER-6, ER-4, ER-7, ST-3 return on half yearly basis electronically Ensure timely filing of Sales Tax return, Income Tax return, PF challan paid, PF intimation, Professional Tax filing etc. MIS to the Management on monthly basis If required physical assistance to the unit as and when any Audit party visits for audit of records 02. Scope of correspondence and documentation Work : We are also providing services as described herein below. Submission of Audit related compliance like EA2000 Audit, Customs Audit, CERA Audit, Special Audit & Service Tax Audit etc. Submission of Audit profile (Assessee profile Annexure- B) Filing of Refund and Rebate claim within the time frame. Attending the Sales Tax assessment and do the needful correspondence. Scope of physical work at client place described herein below. Verification of records (Cenvat records, Service Tax records, Sales records, all returns etc.) Maintaining computerize records of all Central Excise, Service Tax, Sales Tax & Income Tax etc. Maintaining Provident Fund & ESIC records. We would like to mention the following to understand better our concept. Charges are very reasonable compare to others in these industries. Our commitment to complete the work as per time period given by customer. Our commitment to Service at Client’s place as per their convenience. -: SERVICE PROVIDED :- All type of Central Excise, State Excise, DGFT, Service Tax, Sales Tax, Income Tax, Refund Claim, Professional Tax and Provident Fund etc. -:OUR AIM:- All solution under one roof Services at Client place

- 3. WHY YOU WILL PREFER TO WORK WITH SAMIM CONSULTANCY All Services Under One Roof MPCB Excise Customs Sales Tax Income Tax Professional Tax Labour License Provident Fund Service Tax Factory License e SUMMARY OF SERVICE PROVIDED You can take benefit of all services under one roof All our activities / job done will be supported by documentation. Our Services as per your requirement. Our commitment is as per your satisfaction. We stretched our responsibility up to Audit and providing personal assistance during the Audit if required. Every activities / Services will be executed by professional and dedicated personnel.

- 4. WHY YOUR COMPANY WILL GIVE AN OPPORTUNITY 1… Overall Cost will be less for the job given to us. 1… If the same is done by your permanent staff, cost will be more. FOR MIDDLE SIZE COMPANY COMPARISON CHART AT A GLANCE 2… Job satisfaction as well the entire activities will be done by professional, experienced team in time. 2… Whereas you have to train your staff or pay more for your experienced staff. 3… Our services always available at your workplace and it will be as per your requirement in time. 3… In Small / Medium scale Industries staff are limited and May be busy with other activities. Your important Excise and other taxation related work will be kept pending. 4… If required, we are providing experience staff for assistance of your day to day activities like Export Documentation, Fulfillment of Container staffing formalities along with Excise Authority, Refund and rebate claim filing etc. 4… Whereas you have to appoint an experience staff for fulfillment of these activities and for that will be paid for more. THANKING YOU A Chowdhury and Associates Mob- 9594552825 / 9833229167 SAMIM CONSULTANCY OTHER SMALL / MEDIUM SIZE FIRM