Elda v. Black Sand

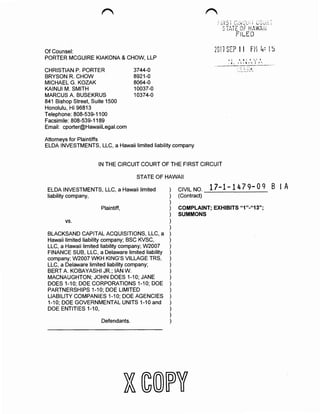

- 1. Of Counsel: PORTER MCGUIRE KIAKONA & CHOW, LLP CHRISTIAN P. PORTER BRYSON R. CHOW MICHAEL G. KOZAK KAINUI M. SMITH MARCUS A BUSEKRUS 841 Bishop Street, Suite 1500 Honolulu, HI 96813 Telephone: 808-539-1100 Facsimile: 808-539-1189 Email: cporter@HawaiiLegal.com Attorneys for Plaintiffs 3744-0 8921-0 8064-0 10037-0 10374-0 ? I •, ., ! ._ '-.' A , 'i • ! ' i ._ ! ' I ,.. __·: i-;,',. ELDA INVESTMENTS, LLC, a Hawaii limited liability company IN THE CIRCUIT COURT OF THE FIRST CIRCUIT STATE OF HAWAII ELDA INVESTMENTS, LLC, a Hawaii limited liability company, Plaintiff, vs. BLACKSAND CAPITAL ACQUISITIONS, LLC, a Hawaii limited liability company; BSC KVSC, LLC, a Hawaii limited liability company; W2007 FINANCE SUB, LLC, a Delaware limited liability company; W2007 WKH KING'S VILLAGE TRS, LLC, a Delaware limited liability company; BERT A KOBAYASHI JR.; IAN W. MACNAUGHTON; JOHN DOES 1-10; JANE DOES 1-1 0; DOE CORPORATIONS 1-1 0; DOE PARTNERSHIPS 1-10; DOE LIMITED LIABILITY COMPANIES 1-10; DOE AGENCIES 1-10; DOE GOVERNMENTAL UNITS 1-10 and DOE ENTITIES 1-10, Defendants. ) CIVIL NO. ) (Contract) 17-1-1479-09 B lA ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) ) COMPLAINT; EXHIBITS "1"-"13"; SUMMONS

- 2. COMPLAINT COMES NOW Plaintiff, ELDA INVESTMENTS, LLC, a Hawaii limited liability company, by and through its attorneys, Porter McGuire Kiakona & Chow, LLP and for its complaint avers and alleges as follows: PARTIES AND JURISDICTIONAL ALLEGATIONS 1. Plaintiff ELDA INVESTMENTS, LLC is a Hawaii limited liability company, registered and doing business in Hawaii ("Eida"). 2. Defendant BLACKSAND CAPITAL ACQUISITIONS, LLC is a Hawaii limited liability company registered to do business in Hawaii ("BiackSand"). 3. Defendant BSC KVSC, LLC was a Hawaii limited liability company, which has been converted to a Delaware limited liability company ("BSC"). 4. Defendant W2007 FINANCE SUB, LLC is a Delaware limited liability company and a subsidiary of Goldman Sachs ("Finance Sub"). 5. Defendant W2007 WKH KING'S VILLAGE TRS, LLC is a Delaware limited liability company and a subsidiary of Goldman Sachs ("TRS"). Finance Sub and TRS are collectively referred to as "the Goldman Sachs Defendants." 6. Defendant BERT A. "BJ" KOBAYASHI JR. is an individual residing in and doing business in Hawaii, and is a principal of Defendant BlackSand ("Kobayashi"). 7. Defendant IAN W. MACNAUGHTON ("MacNaughton") is an individual residing in and doing business in Hawaii, and is a principal of Defendant BlackSand. Kobayashi, MacNaughton, BSC, and BlackSand are collectively referred to as "the BlackSand Defendants." 8. Defendants JOHN DOES 1-10, JANE DOES 1-10, DOE CORPORATIONS 1-10, DOE PARTNERSHIPS 1-10, DOE AGENCIES 1-10, DOE GOVERNMENTAL UNITS 1-10 AND DOE ENTITIES 1-10 are persons, corporations or other entities whose identities cannot be ascertained after a diligent effort. These Doe Defendants may be in some manner liable to Plaintiffs and/or are persons or entities presently unknown to Plaintiffs who may have or who 2

- 3. may claim to have an interest in the subject matter of this lawsuit. Blacksand, BSC, Finance Sub TRS, Kobayashi, MacNaughton and Doe Defendants are collectively referred to as the "Defendants"). 9. The conduct, acts, and/or omissions herein occurred in the City and County of Honolulu, State of Hawaii, and the amount of damages suffered by Plaintiffs as a result thereof is in excess of the jurisdictional requirements of this Court. PREDICATE FACTS The Property 10. The property which is the subject of this legal action is located at 131 Kaiulani Street, fronting on Kaiulani Street and bounded by Koa Street and Prince Edward Street which is further identified by Tax Map Key 1-26-23-29 ("King's Village Property") 11. Prior to 1930, the King's Village Property had been acquired by Ellen Fullard- Leo, who purchased it from Prince Kuhio's estate, to be utilized as the family homestead of the Fullard-Leo family. Until the King's Village Property was purchased from the Fullard-Leo's entity, ELDA by BSC in October 2012, members of the Fullard-Leo family remained as the ultimate principal owners of the King's Village Property directly or through entities owned by them. 12. In November 1968, as lessor, Elda's predecessor-in-interest, Elda Limited Partnership, a Hawaii limited partnership, entered into a ground lease with Kahili Hotel, Ltd. as lessee. That lease was amended on March 12, 1971 to identify Associated Innkeepers, Incorporated as the lessee. The lease as amended ("1968 Lease") is attached hereto and incorporated herein by this reference as Exhibit 1. 13. The 1968 Lease divided the King's Village Property into two separate divisions of real estate, one for the leasehold improvements ("Leasehold Estate) and another for the ground on which those leasehold improvements were situated ("Leased-Fee Estate") 3

- 4. 14. The owner of the Leasehold Estate was the lessee under the 1968 Lease ("Leasehold Owner") and the owner of the Leased-Fee Estate was the lessor under the 1968 Lease ("Fee Owner"). 15. The 1968 Lease was for a term of 57 years beginning on January 1, 1969 and ending on December 31, 2025. 16. At the conclusion of the 1968 Lease term or the earlier termination of the 1968 Lease, the reversionary interest of the Leasehold Estate would again become the property of the Leased-Fee Owner. 17. In 2011 , TRS became the Leasehold Owner. 18. After becoming the Leasehold Owner, TRS remained the lessee under the 1968 Lease until December 10, 2012, when it executed a termination of leasehold interest agreement with the then Fee Owner, BSC. 19. The 1968 Lease prescribed rent increases at specific dates during its term. For the period immediately before January 1, 2000, the annual rent was $300,000. On January 1, 2000, the rent increased to $1 ,000,000 per year. On January 1, 2016, if the Leasehold Owner and Fee Owner could not reach agreement on the rent, the 1968 Lease called for the rent to increase to fair rent value based upon an appraisal of the unencumbered, unimproved, fee value of the King's Village Property. Fair rent value for commercial property in Honolulu of the type at the King's Village Property was approximately 8 percent of the fee-simple, unencumbered, unimproved, land value. 20. The January 1, 2016 rent increase did not occur because the 1968 Lease was terminated on December 10, 2012. Negotiations with TRS 21. Beginning in 2010, on behalf of the Leasehold Owner, Brad Kempson ("Kempson"), a representative of Archon Group, a grouping of Goldman Sachs business entities including TRS, was in contact with Marcus Fullard-Leo ("Fullard-Leo"), who was the 4

- 5. principal representative for Elda, the Fee Owner, regarding the King's Village Property. Kempson was involved in TRS's efforts to improve its financial position as the Leasehold Owner. Kempson communicated to Fullard-Leo that TRS regarded its position as Leasehold Owner as financially unfavorable. Those efforts involved email and telephone contact with Fullard-Leo as well as in-person meetings in Honolulu. In early 2011, Kempson proposed an agreement to extend the term of the 1968 Lease, lower the rents and include the Fee Owner in a split of rental income from a proposed sub-lessee. Offers to purchase the King's Village fee interest 22. Around 2010, the Fullard-Leo family began receiving other inquiries and expressions of interest on an unsolicited basis regarding their willingness to sell Elda's Leased- Fee Estate. These offers clearly reflected the market's assessment of the value of the Leased- Fee Estate, which was owned separately from the Leasehold Estate. Pursuant to the 1968 Lease, the Leasehold Estate would remain separately owned until December 31, 2025 when the 1968 Lease was scheduled to terminate and the Leasehold Estate would be repatriated with the Leased-Fee Estate where the King's Village Property would once again become a singular-owned property estate and the Fee Owner's property interest in the King's Village Property would no longer be encumbered by the Leasehold Estate.. 23. By early 2012, Elda had multiple prospective buyers expressing interest in acquiring the Leased-Fee Estate. On April 6, 2012, Elda received an offer to purchase the Leased-Fee Estate from Walgreens. By late April 2012, Elda and the potential buyer had negotiated the basic terms of the transaction and were exchanging draft documents, which culminated in the parties agreeing on finalized terms of a Purchase and Sales Agreement in mid-May 2012. Tender to TRS under the Lessee's right of first refusal 24. After agreeing on the finalized terms of a Purchase and Sale Agreement with Walgreens, and because the 1968 Lease contained a right of first refusal regarding the 5

- 6. Leased-Fee Estate, Elda notified the ground lessee, TRS, that it had received a bona fide offer to purchase the Leased-Fee Estate. The 1968 Lease provided in part that "If at any time during the term of this demise, the Lessor shall receive a bona fide offer from any third person or corporation to purchase the demised premises, Lessor shall serve on the Lessee a notice in writing of the price and terms of such offer from such third person or corporation and of the intention of the Lessor to accept the same." Exhibit 1, Lessor Covenants, 5. In compliance with Paragraph 5 of the Lessor Covenants, on May 18,2012, along with a written notice of the bona fide offer, Elda sent a copy of the Purchase and Sale Agreement Elda and Walgreens had negotiated. 25. TRS notified Elda by a letter dated May 31, 2012 that pursuant to its right of first refusal it was exercising its right to purchase the Leased-Fee Estate. In that letter, TRS notified Elda that its designee to purchase the Leased-Fee Estate would be Finance Sub, another business entity owned by Goldman Sachs. 26. Elda and Finance Sub went forward with the sale process over the next several months including negotiating specific details of the purchase and sale agreement. These negotiations proceeded through the parties' respective attorneys. Elda and Finance Sub executed a purchase and sale agreement on June 7, 2012 containing essentially the same terms as the final terms negotiated between Elda and Walgreens. That agreement is attached hereto and incorporated herein by this reference as Exhibit 2 ("Eida-Finance Sub PSA"). 27. The Elda-Finance Sub PSA allowed for either party to participate in an IRS Section 1031 tax deferred exchange which during the term of the agreement, Elda elected to do. To facilitate this, Investment Property Exchange Services, Inc. ("IPX") took Elda's position as Seller in the purchase agreement in order to fulfill its role as the exchange accommodator in the 1031 tax deferred exchange. (As a result of IPX's role as exchange accommodator, later transactional documents and amendments to the Elda-Finance Sub PSA identify IPX as the Seller.) 6

- 7. 28. In preparation for the initially scheduled closing date of August 14, 2012, respectively, as "Seller" and "Buyer", Elda and Finance Sub also performed other tasks in June and July 2012, including Finance Sub's due diligence necessary to be ready for the closing of the transaction. Elda's right of first refusal of offers for the King's Village leasehold interest 29. In addition to the right of first refusal over the Leased-Fee Estate, contained in paragraph 5 of the Lessor Covenants, the 1968 Lease contained another right of first refusal provision in paragraph 16 of the Lessee Covenants regarding the Leasehold Estate. This provision required that the lessee provide notice to the lessor if the lessee received a bona fide offer to purchase the demised premises [Leasehold Estate] by assignment, sublease or purchase of a controlling interest in the lessee's stock. 1968 Lease, Lessee Covenants, ,-r 16. The lessor (i.e. Fee Owner), in this case, Elda, would then have 30 days in which to exercise a right of first refusal to purchase the Leasehold Estate. 30. Throughout June and July 2012, the two Goldman Sachs entities, TRS and Finance Sub, gave no indication to Elda that they were involved in any potential transaction involving the transfer of the Leasehold Estate to another party. In fact, TRS and Finance Sub, through Kempson, untruthfully denied any such transaction existed or was even being pursued. 31. On June 27, 2012, Kempson emailed a draft letter to Fullard-Leo. The letter proposed a bargain which it claimed would be beneficial to both Elda and Finance Sub. Specifically, the Elda-Finance Sub PSA contained a provision that required Elda as Seller to obtain an Estoppel Certificate from the Leasehold Owner, TRS. The letter made the value- proposition that Finance Sub would waive its right to demand the Estoppel Certificate at closing in exchange for Elda waiving its right of first refusal to acquire the Leasehold Estate contained in Paragraph 16(1) of the 1968 Lease. The proposal was of no benefit to Elda since Elda would not have had any problem with getting the Estoppel Certificate as long as Finance Sub intended to complete the purchase since Finance Sub and TRS were both Goldman Sacs 7

- 8. entities and ultimately controlled by the same principals. The proposal was simply a gambit to induce Elda to waive its right of first refusal in the Leasehold Estate. 32. Kempson talked to Fullard-Leo on or before sending the June 27, 2012 email, and he assured Fullard-Leo that there was no potential buyer for the Leasehold Estate and that TRS was not actively marketing the Leasehold Estate, but wanted the right of first refusal in the Leasehold Estate waived in case such an offer were received so that it would not hold up the sale of the Leased-Fee Estate contemplated in the Elda-Finance Sub PSA. On information and belief, Kempson's representations were false when they were made. 33. Fullard-Leo replied to Kempson's June 27, 2012 email on June 29, 2012. In his reply, Fullard-Leo first noted that there seemed to be no need for Elda to waive its right of first refusal to the leasehold because there was no current buyer of the lease interest (as Kempson had represented). He then made clear to Kempson that if, prior to closing on the sale of the fee interest, TRS did receive an offer for the leasehold interest, Elda would quickly evaluate it and be prepared either to waive its right of first refusal or exercise that right. Fullard-Leo's June 29, 2012 communication to Kempson clearly informed TRS that Elda regarded its right of first refusal in Paragraph 16 of the Lessee Covenants in the 1968 Lease as something of value and that Elda expected TRS to fully comply with the notification requirements of Paragraph 16. 34. When Elda had decided to sell the fee interest in the King's Village property, it had not actively evaluated the benefit of possessing the Leasehold Estate without also possessing the Leased-Fee Estate. Kempson's Jetter and other communication to Fullard-Leo, however, raised the possibility that the Goldman Sachs companies were in negotiation with an unknown third-party to transfer the Leasehold Estate. If a third-party was involved trying to reunite the Leasehold Estate with the Leased-Fee Estate many years prior to the scheduled expiration of the 1968 Lease, then Elda's right of first refusal over offers for the Leasehold Estate could be of significant value to Elda. 8

- 9. 35. As a consequence of these developments, Elda placed substantial value on its right of first refusal to acquire the Leasehold Estate which was provided in the 1968 Lease, Lessee Covenants, 1f16. 36. During the further course of the sale of the Leased-Fee Estate, Elda reasonably relied on TRS to comply with its contractual duty created in the 1968 Lease to notify Elda of any offer to obtain the Leasehold Estate. The hidden transaction 37. During April, May, June and July 2012, at the same time that Kempson was assuring Fullard-Leo that TRS was not marketing the Leasehold Estate and had no offers for it, TRS and Finance Sub in fact were actively negotiating a transaction for the effective transfer of the Leasehold Estate for valuable consideration with a third party, BlackSand. 38. BlackSand is a Hawaii-based real estate acquisition company involved in real estate development and redevelopment in high-demand areas. The managing partners of BlackSand are Kobayashi and MacNaughton. 39. Scott Gradisnik ("Gradisnik") was and is a financial manager working for a number of Fullard-Leo business entities. Gradisnik knew Kobayashi from high school. On March 28, 2012, Gradisnik and Kobayashi spoke by telephone at length about the King's Village Property and a 3rd party offer that Elda had received for the Leased-Fee Estate. Part of this and subsequent communications between Elda and BlackSand involved BlackSand's interest in purchasing the Leased-Fee Estate; however Blacksand's interest was tempered by the existence of the 1968 Lease which encumbered the Leased-Fee Estate from being redeveloped until December 31, 2025 when on its own terms, the 1968 Lease ended and the Leasehold Estate and the Leased-Fee Estate would be reunited into a single property interest under the Fee Owner. Gradisnik relied on Kobayashi's knowledge and experience in Hawaiian real estate to better understand market conditions for the King's Village Property. Kobayashi 9

- 10. gave Gradisnik his personal assurance that the information shared about the King's Village Property between the two would be confidential. 40. On April6, 2012, Gradisnik emailed the 1968 Lease and the December 14, 2000 Lease Rent Agreement (an agreement memorializing the change of rent allowed under the terms of the 1968 Lease) to Kobayashi. Gradisnik asked and Kobayashi agreed to keep the information confidential. As a result, no later than early April 2012, in addition to their prior conversation on the matter, Kobayashi had written confirmation of and was fully aware of the contents of the 1968 Lease, including the provisions creating rights of first refusal for the Leased-Fee Estate and the Leasehold Estate. 41. Kobayashi and Gradisnik spoke on April 9, 2012 with the understanding that the information relating to the King's Village Property would be confidential. In their conversation, Kobayashi learned many more details about the King's Village Property and about the offers to acquire the Leased-Fee Estate that Elda had received. 42. As a result of these telephone conversations and Kobayashi's offer to help advise Elda on the interest they were receiving on the King's Village Property, Gradisnik facilitated a meeting between Fullard-Leo, Kobayashi and MacNaughton for breakfast on April 17, 2012 to discuss the King's Village Property and the interest in the property Elda had been receiving. Fullard-Leo and Gradisnik had another meeting soon after with Kobayashi in which Kobayashi learned still more about Elda's needs and financial goals pertaining to the offer to acquire the Leased-Fee Estate. Kobayashi and MacNaughton also gained significant information about TRS in these contacts with Elda. In these meetings, Fullard-Leo and Gradisnik relied on Kobayashi's earlier pledges of confidentiality when discussing information about the King's Village Property. 43. On information and belief, Kobayashi and MacNaughton used the information they had obtained from Gradisnik and Fullard-Leo to contact TRS, Finance Sub and/or other Goldman Sachs-related entities in order to obtain the King's Village property for BlackSand by 10

- 11. among other things secretly negotiating an early termination of the Leasehold Estate which delayed the ability to redevelop the property for a profit until after the lease termination scheduled for December 31, 2025. 44. Between April6, 2012 and July 2, 2012, Kobayashi and/or others representing BlackSand put in place a plan to purchase the Leased-Fee Estate and to secretly secure the Leasehold Estate without offering Elda the right of first refusal to acquire the Leasehold Estate as was required by the 1968 Lease. 45. The Leased-Fee Estate would provide considerably more value to BlackSand if it were able to acquire and terminate the Leasehold Estate years earlier than the scheduled end of the lease term found in the 1968 Lease. If BlackSand were able to become the Fee Owner as well as the Leasehold Owner, then it would be able to terminate the Leasehold Estate approximately 13 years earlier than called for in the 1968 Lease. The repatriation of the Leasehold Estate with the Leased-Fee Estate into a single King's Village Property interest owned by one party would permit the very lucrative redevelopment of the King's Village Property years earlier than the December 31, 2025 scheduled end date of the 1968 Lease. 46. Between April 6, 2012 and July 2, 2012, Kobayashi and/or others representing BlackSand began negotiating with TRS, Finance Sub and/or other Goldman Sachs-related entities to become the ultimate purchaser of the Leased-Fee Estate. An essential element of BlackSand's negotiations with TRS, Finance Sub and/or other Goldman Sachs-related entities was that the Leasehold Estate would concurrently be sold to BlackSand without giving notice to Elda. Indeed, without the secret agreement for BlackSand to purchase the Leasehold Estate being concealed from Elda, BlackSand would not have entered into the purchase of the Leased-Fee Estate. On information and belief, those negotiations were ongoing prior to and at the same time that Kempson represented to Elda that TRS and Finance Sub had no purchaser for the Leasehold Estate and was not marketing the Leasehold Estate. 11

- 12. 47. By July 2, 2012, Finance Sub had entered into a letter of intent with BlackSand regarding the purchase of the Elda-Finance Sub PSA which pertained to the acquisition of the Leased-Fee Estate ("July 2, 2012 LOI - Fee PSA Acquisition Agreement"). At the same time, TRS had entered into a letter agreement with BlackSand for the purchase of the Leasehold Estate ("July 2, 2012 Leasehold Letter Agreement"). Both of these agreements ("July 2, 2012 Agreements") were hidden from Elda. On information and belief, the Goldman Sachs entities, TRS and Finance Sub, along with other Goldman Sachs business entities not yet known, had been negotiating with BlackSand and/or related entities for an extended period of time before the execution of the July 2, 2012 Agreements which had been designed to make BlackSand the ultimate owner of the entire King's Village Property (i.e. both the Leased-Fee Estate and the Leasehold Estate). 48. When TRS executed the July 2, 2012 Leasehold Letter Agreement, the document was actually executed by a string of managing members, including W2007 WKH Owner, LLC; W2007WKH Senior Borrower, LLC; W2007 WKH Mezzanine Borrower, LLC; and W2007 WKH REII, Inc. The signatories for TRS and this chain of managers included Thomas D. Ferguson, Alan Kava, and Peter Weidman. These parties and signatories, or most of them, can be found on the later documents identified in this complaint as executed by TRS. 49. When Finance Sub executed most of the documents identified in this complaint, the documents were also executed by Whitehall Street Global Real Estate Limited Partnership 2007, and by WH Advisors, LLC, 2007. Signatories included Thomas D. Ferguson, Alan Kava and Peter Weidman. 50. The role of these others parties and signatories for the wrongful acts of the Defendants has not yet been determined. 51. The July 2, 2012 Leasehold Letter Agreement is attached hereto and incorporated herein by this reference as Exhibit 3. The letter was dated June 29, 2012 and was signed by a representative ofTRS on July 2, 2012. The letter agreement has enforceable 12

- 13. terms regarding (i) the amount of rent to be paid by the lessee should either TRS or BlackSand not follow through on a purchase transaction, (ii) a minimum payment to TRS for purchasing the leasehold of $1.7 million, (iii) an option for certain parking spaces, and (iv) an obligation on both parties to negotiate additional purchase terms. As such, the July 2, 2012 Leasehold Letter Agreement was a bona fide offer to purchase the Leasehold Estate and triggered Elda's right of first refusal. 52. Despite Elda's right of first refusal afforded by the 1968 Lease to acquire the Leasehold Estate, the July 2, 2012 - Leasehold Letter Agreement was never disclosed to Elda prior to BlackSand's affiliate BSC closing the Elda-Finance Sub PSA and becoming the Fee Owner. 53. The King's Village Property, because of its location in a prime area of Waikiki, was ripe for redevelopment but for the encumbrance over the Leased-Fee Estate posed by the Leasehold Estate. Redevelopment could bring tens of millions of dollars in profit to the developer, but such a project would only be economically viable if the developer could be assured that the Leased-Fee Estate and the Leasehold Estate could be reunited under the same ownership approximately 13 years before the 2025 expiration date found in the 1968 Lease. In fact, without such assurance of being able to contemporarily reunite the Leasehold Estate with the Leased-Fee Estate under common ownership, an acquisition of the lease- encumbered Leased-Fee Estate alone would be untenable to a developer such as BlackSand. 54. If BlackSand wanted to redevelop the King's Village Property, Elda's right of first refusal to purchase the Leasehold Estate presented BlackSand a problem. If BlackSand had acquired the Leased-Fee Estate while it remained encumbered by the 1968 Lease and Elda had become the owner of the Leasehold Estate, then BlackSand would either have to wait 13 years for the end of the 1968 Lease to develop the King's Village Property, or it would have to negotiate with Elda to purchase the Leasehold Estate. In that situation, Elda would have been 13

- 14. in a strong bargaining position and would be able to demand a very lucrative purchase price for the Leasehold Estate. 55. In order to avoid dealing with Elda as the Leasehold Owner, BlackSand, together with others, including, but not limited to TRS, Finance Sub and other Goldman Sachs entities, conspired and chose to structure a scheme whereby Elda would be wrongfully deprived of its right of first refusal to acquire the Leasehold Estate., 56. The transfer of the Leasehold Estate to BlackSand and/or its related entities was to be accomplished by secret payments to TRS and/or Finance Sub in exchange for their cooperation in a purchase of the Leasehold Estate facilitated by way of a sham "termination". 57. In these negotiations and agreements with BlackSand over the purchase of the Leased-Fee Estate and the Leasehold Estate, TRS and Finance Sub essentially acted as one entity, so that a thing of value (i.e. the Leasehold Estate and the promise to either transfer or terminate it) provided by TRS to BlackSand was compensated for by BlackSand paying Finance Sub. 58. On or about July 13, 2012, Finance Sub and BSC, another BlackSand company, replaced the July 2, 2012 LOI -Fee PSA Acquisition Agreement by entering into a separate agreement regarding the Leased-Fee Estate. That purchase agreement is attached hereto and incorporated herein by this reference as Exhibit 4 ("Finance Sub-BSC Agreement"). The Finance Sub-BSC Agreement contained an intentionally untrue seller's warranty and representation that Finance Sub owned the Leased-Fee Estate "free and clear of any claims, liens or encumbrances" as of the agreement's execution on July 13, 2012. Finance Sub-BSC Agreement, ,-r (5)(d). 59. The Finance Sub-BSC Agreement also contained a confidentiality provision which prevented the parties from disclosing the existence of the agreement or any of its provisions to Elda. Finance Sub-BSC 29. The Finance Sub-BSC Agreement 14

- 15. was not in any way disclosed to Elda until November 21, 2012 after Elda had sold the Leased- Fee Estate and had been deprived of its right of first refusal to acquire the Leasehold Estate. 60. BSC continued its secret communications with TRS and Finance Sub in July and August 2012. It negotiated two amendments to the Finance Sub-BSC Agreement that were executed on July 27 and August 3 of 2012 respectively. The First and Second Amendments are attached hereto and incorporated herein by this reference as Exhibits 5 and 6, respectively. Both of these amendments were covered by the confidentiality provision of the original Finance Sub-BSC Agreement, so they too were hidden from Elda. 61. The Defendants cooperated and collaborated in an attempt to transfer the Leasehold Estate to BSC while keeping that transfer secret from Elda, in violation of Paragraph 16 of the Lessee's Covenants of the 1968 Lease. 62. On or about August 3, 2012, BSC sent two communications to TRS and two more communications to Finance Sub. Each of these communications furthered the Defendants' purposes of transferring value to TRS and its sister entity Finance Sub in exchange for the Leasehold Estate. First, a proposed third amendment to the Finance Sub- BSC Agreement was delivered to Finance Sub by BSC. The most notable change included in the third amendment was a provision granting Finance Sub options on certain parking spaces. Those options were potentially worth millions of dollars to Finance Sub. The parking space provision included the following statement "Purchaser [BSC] currently plans to terminate the [1968] Lease and demolish the existing improvements after the Closing and construct a mixed- use high-rise condominium project, with retail space, parking, and residential units." Third Amendment to Finance Sub-BSC Agreement, 1J6. BSC and Finance Sub subsequently executed the Third Amendment to the Finance Sub-BSC Agreement. This executed amendment is attached hereto and incorporated herein by this reference as Exhibit 7. The parking space provision is one instance of TRS arranging to let its valuable position as the Leasehold Owner become worthless in exchange for a valuable economic opportunity being 15

- 16. conferred on Finance Sub by SSC. It also was a bona fide offer for SSC to acquire the Leasehold Estate, and its acceptance was a breach of TRS's obligations under the 1968 Lease. 63. sse also sent TRS a letter agreement on August 3, 2012 that furthered the secret agreement for SSC to obtain the Leasehold Estate. It contained an "exclusivity" agreement between SSC and TRS in which 'Tenant [TRS] agrees that it will negotiate exclusively with SlackSand with respect to the terms of a sale or transfer of the [1968] Lease [and] shall not engage in any negotiations with any person or persons or respond to any offers regarding the sale or transfer of the [1968] Lease." This letter was subsequently executed on behalf of TRS, and the fully-executed agreement is attached hereto and incorporated herein by this reference as Exhibit 8 ("Rent Reset Agreement"). The exclusivity agreement is a direct breach of TRS's notice and right of first refusal duties pertaining to the Leasehold Estate which are owed to Elda under Paragraph 16 of the Lessee's Covenants in the 1968 Lease. 64. The Rent Reset Agreement also contained a confidentiality provision preventing the parties from revealing to Elda (1) that SSC would be purchasing the Leased-Fee Estate, (2) the existence of the Rent Reset Agreement, and (3) that TRS and SSC were exchanging information related to the Leased-Fee Estate and the Leasehold Estate. The confidentiality provision is a further direct breach of TRS's obligations as Lessee under the 1968 Lease. 65. The Rent Reset Agreement also contained an agreement between SSC and TRS resetting the annual rent on the Ground Lease for each year of the period beginning in 2012 and ending December 31, 2015 from $1,000,000 to $3,200,000. Agreeing to a rent of $3,200,000 per year would have guaranteed that TRS could no longer profit as the Lessee. There was no financially supportable, rational reason for TRS to agree to the premature increase in annual rent other than to ensure that TRS would cooperate in abandoning the Leasehold Estate to BSC or another BlackSand entity. 16

- 17. 66. It was important to BlackSand and BSC that if they paid $41,250,000 to acquire the Leased-Fee Estate, that TRS would be sufficiently motivated and obligated to abandon the Leasehold Estate to BSC or another BlackSand entity so that BlackSand or one of its affiliates could develop the King's Village Property immediately, rather than waiting for the December 31, 2025 end date of the 1968 Lease. 67. The rent increase called for in the Rent Reset Agreement was directly against TRS's economic interests. Rather than an arm's-length business transaction between TRS and BSC, the Rent Reset Agreement was one element of the secret transaction created to deprive Elda of its right of first refusal in the Leasehold Estate, and guarantee a termination of the Leasehold Estate. 68. BSC sent another letter agreement to TRS on August 3, 2012. This agreement was an acknowledgment by TRS that BSC had given proper notice of TRS's default on certain obligations under the 1968 Lease. At the time of this letter agreement and BSC's notice of default to TRS, BSC had not yet acquired the Leased-Fee Estate and as such was not a party to the 1968 Lease for which it was issuing the default notice to TRS. This letter agreement was timely executed upon its receipt, and the fully-executed agreement is attached hereto and incorporated herein by this reference as Exhibit 9 (the "Default Notice Agreement"). 69. BSC sent a third letter agreement on August 3, 2012, this one to Finance Sub, which neatly tied all of the parts of the hidden transaction together. The fully-executed letter agreement is attached hereto and incorporated herein by this reference as Exhibit 10 (the "Indemnity Agreement"). In the Indemnity Agreement, BSC promised to indemnify Finance Sub and its affiliates (apparently including TRS) if BSC decided to terminate the 1968 Lease. 70. The indemnity included claims of any kind arising out of or relating to any termination of the 1968 Lease. The indemnity was written broadly enough to include any claim by Elda that TRS (with or without Finance Sub) breached its duties, covenants and obligations under the 1968 Lease. On information and belief, the indemnity's essential purpose was to 17

- 18. allay the concerns of TRS and Finance Sub of a lawsuit which might potentially be brought by Elda if it learned of the conspiracy between the parties to deprive Elda of its right of first refusal to acquire the Leasehold Estate. The Indemnity Agreement was a necessary assurance to TRS, Finance Sub, their parent companies and principals which was issued in order to induce them to complete the secret transaction which wrongly denied Elda its right of first refusal to acquire the Leasehold Estate. The indemnity represents the promise of substantial value in exchange for BSC acquiring the Leasehold Estate. In fact, the indemnity was a pledge of protection to Finance Sub, TRS and their affiliates which was backed by no less than $20,000,000 of actual equity required to be held by BSC as indemnitor. Because the Indemnity Agreement offered valuable consideration in exchange for TRS and Finance Sub cooperating with BSC to obtain the Leasehold Estate, it is a breach of TRS's obligations under the 1968 Lease. 71. A final letter agreement was sent from BSC to Finance Sub on August 6, 2012. The fully-executed August 61 h agreement is attached hereto and incorporated herein by this reference as Exhibit 11 (the "Default Payment Agreement"). The Default Payment Agreement accomplished three goals of the Defendants. First, it confirmed that TRS, against its own economic interests, would allow the Leasehold Estate which it owed to be purchased and reunited with the Leased-Fee Estate by way of a voluntary default and termination on August 23, 2012. Second, in addition to the other valuable consideration being received by Finance Sub and TRS in exchange for their cooperation to transfer the leasehold interest to BSC by way of a default, BSC agreed to pay TRS $100,000. Supposedly the $100,000 payment was for personal property of TRS; however, in reality, the personal property (if any) was integrated into the Leasehold Estate in a way that it would not have been feasible to remove it. Third, BSC agreed to pay Finance Sub $1,000,000 if the lease interest was terminated on or about August 23, 2012. The $100,000 payment to TRS and the $1 ,000,000 payment to Finance Sub were both offers by BSC to take control of the Leasehold Estate which encumbered the Leased-Fee 18

- 19. Estate in exchange for money payments, and so constituted a bona fide offer on the Leasehold Estate. Because TRS did not notify Elda of this offer, TRS again breached its obligations under the 1968 Lease. 72. Together, the Default Notice Agreement, the Indemnity Agreement and the Default Payment Agreement contained the principal terms of the purchase of the Leasehold Estate in violation of Elda's right of first refusal, but was disguised as a sham "termination" of. . the 1968 Lease. TRS acknowledged the default, BSC promised to indemnify Finance Sub and TRS if they were sued as a result of the sham "termination" of the Leasehold Estate, and BSC promised to pay TRS and Finance Sub for cooperating in the sham "termination." 73. Only after all of these secret agreements were in place did the Defendants inform Elda that a third-party purchaser for the Leased-Fee Estate was in place and would be assigned Finance Sub's position in the Elda-Finance Sub PSA. 74. Elda was notified that BSC would take the place of Finance Sub in the closing of the sale of the fee interest on or about mid-July 2012. With the sole exception of an assignment of Finance Sub's interest in the purchase of the fee interest, none of the documents described in Paragraphs 37 to 73 above, nor the contents or existence of those documents, were disclosed to Elda at any time prior to the closing of Elda's sale of Leased-Fee Estate to BSC on October 12, 2012. The secret transactions and agreements between and among BlackSand, BSC, TRS and Finance Sub, and, on information and belief, other Goldman Sachs business entities and principals, were an essential element in depriving Elda of its right of first refusal to purchase the Leasehold Estate. 75. The Defendants have been or will be richly rewarded for their deceitful conduct. Finance Sub will be unjustly enriched by over $40 million unless it is compelled to honor its contractual commitments to Elda. See Count II. 76. After BSC obtained title to the Leased-Fee Estate in October 2012, it assembled additional properties adjacent to the King's Village Property. First, on October 10, 19

- 20. 2012, BSC purchased the real estate parcel with a street address of 2410 Koa Ave., Honolulu HI 96815. The parcel is adjacent to the King's Village Property on the Diamond Head side on Koa Avenue, and is 4,372 square feet in area. BSC paid $4,875,000 for the 2410 Koa Ave. parcel. 77. BSC next purchased the parcel at 2413 Prince Edward St., Honolulu HI 96815 on September 25, 2013, for $3,250,000. This 4,125 square foot parcel, is also adjacent to the King's Village Property on its Diamond Head side. 78. Finally, BSC acquired a small parking lot mauka from the King's Village Property, just across Prince Edward St., with a street address of 2400 Prince Edward St., Honolulu HI 96815 BSC paid $866,300 to acquire it. In total, BSC spent $50,241,300 in real estate purchases (excluding any of the secret transactions) to assemble the King's Village Property and surrounding properties for a high-rise development. Without first acquiring the Leasehold Estate through termination of the Leasehold Estate, BSC would not have acquired these other surrounding properties. COUNT I (BREACH OF CONTRACT) Against TRS 79. Elda realleges the allegations contained in the paragraphs hereinabove and by this reference incorporates them herein. 80. During the period beginning shortly after Elda's May 18, 2012 notice of bona fide offer to TRS until the closing of the Leased-Fee Estate as called for in the Elda-Finance Sub PSA, which occurred on October 12, 2012, TRS and Finance Sub acted in close concert, with Finance Sub acting at times as TRS's agent and TRS acting at times as Finance Sub's agent. 81. TRS was obligated under Paragraph 16 of the Lessee's Covenants in the 1968 Lease to notify Elda ("Eida's right of first refusal") of any bona fide offer to acquire the Leasehold Estate. 20

- 21. 82. The July 2, 2012 - Leasehold Letter Agreement between BlackSand and TRS was a bona fide offer to purchase the Leasehold Estate. That offer triggered TRS's obligations pursuant to Elda's right of first refusal. TRS refused to inform Elda of the offer and thereby materially breached its obligations under the 1968 Lease. 83. After July 2, 2012, BlackSand and/or its related entities made a number of additional promises of things of value to TRS and Finance Sub to induce TRS to violate its duty to notify Elda of a sale of the Leasehold Estate. TRS and Finance Sub accepted these promises of things of value in exchange for their cooperation in a scheme culminating in the transfer of the Leasehold Estate by way of sham "termination" based on manufactured and spurious facts. The effect of the so-called "termination" was in fact a purchase of the Leasehold Estate to BlackSand and/or its related entities. The effective purchase was a bona fide offer to purchase, triggering TRS's obligation pursuant to the 1968 Lease to offer Elda the right of first refusal to acquire the Leasehold Estate. TRS (together with all other participants) refused to inform Elda of the offer and thereby materially breached its obligations under the 1968 Lease. 84. The parking spaces provision in Third Amendment to the Finance Sub-BSC Agreement constituted an offer of payment (and benefit to TRS and its related entity) by BSC to acquire the Leasehold Estate. By failing to notify Elda of this offer, TRS violated/breached its obligations under the 1968 Lease. 85. By entering into the exclusivity agreement between BSC and TRS contained in the Rent Reset Agreement, TRS violated/breached its obligations under the 1968 Lease. 86. By entering into the confidentiality agreement between BSC and TRS contained in the Rent Reset Agreement, TRS violated/breached (and conspired to breach) its obligations under the 1968 Lease. 87. TRS's agreement in the Rent Reset Agreement to allow a reset of the rent in the 1968 Lease was made so that it would be impossible for TRS to earn a profit. That agreement was part of a collusive arrangement (i.e., the continuing scheme) between the Defendants to 21

- 22. transfer the Leasehold Estate, "hide" the fact that there was a transaction to sell that interest, and all without giving notice to Elda. As such, TRS's participation in the Rent Reset Agreement was, among other things, a breach of its obligations under the 1968 Lease. 88. TRS accepted BSC's offer of a $20,000,000 indemnity against claims arising out of the termination of the ground lease in the Indemnity Agreement. The indemnity secured by $20,000,000 in equity was a thing of substantial value and was offered to TRS as an inducement so that BSC to could acquire the Leasehold Estate in secret from Elda. As such, it was a bona fide offer subject to Elda's right of first refusal. By failing to notify Elda, TRS breached its obligations under the 1968 Lease. 89. TRS agreed to an offer of $100,000, purportedly for "personal property," but only if TRS cooperated in allowing the Leasehold Estate to terminate. This agreement was also part of a bona fide offer regarding the Leasehold Estate, and by failing to notify Elda, TRS breached its obligations under the 1968 Lease. · 90. Finance Sub accepted an offer of $1,000,000, available to it only as a result of TRS' cooperation and active participation in the scheme to allow the Leasehold Estate to terminate. Upon information and belief, TRS and Finance Sub operated as a single entity in their secret dealings with BCS. Accordingly, TRS's failure to notify Elda of the $1,000,000 offer is a breach of TRS's duties under the 1968 Lease. 91. TRS's conduct described above constitutes multiple breaches of its obligations under the 1968 Lease, Lessee Covenants, 1J16. Collectively and individually, these breaches deprived Elda of its right of first refusal regarding the Leasehold Estate as called for under the 1968 Lease. 92. Elda has been damaged by TRS's breaches in an amount to be determined at trial including, but not limited to, prejudgment interest, attorneys' fees and costs. COUNT II (BREACH OF CONTRACT) 22

- 23. Against Finance Sub 93. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 94. The Purchase and Sale Agreement between Elda and Finance Sub (Exhibit 2- "Eida-Finance Sub PSA") contains the following provision: "11.01 Assignability. Purchaser shall have the absolute right and authority to assign this Agreement and all of its rights hereunder to any person. Firm, corporation or other entity, and upon such assignment, the assignee shall succeed to all of the rights and obligations of Purchaser hereunder, provided that the Purchaser shall remain liable for the obligations hereunder. If such an assignment by Purchaser is to an entity or person not affiliated with Purchaser, then any net profit realized by Purchaser as a result of such assignment shall be paid to Seller as an assignment fee." 95. Finance Sub was the Purchaser under the Elda-Finance Sub PSA. 96. Finance Sub assigned its rights under the Elda-Finance Sub PSA to BSC by agreement on August 3, 2012. 97. BSC is not affiliated with Finance Sub as the term "affiliated" is intended under Paragraph 11.01 of the Elda-Finance Sub PSA (Exhibit 2). 98. All net profit realized by Finance Sub as a result of Finance Sub's assignment of its rights under the Elda-Finance Sub PSA to BSC are required to be paid to Elda. 99. Finance Sub has failed to pay Elda the profits it realized by assigning its rights under the Elda-Finance Sub PSA to BSC. Those profits derive from three different agreements between Finance Sub and either Blacksand or BSC. 100. The first source of Finance Sub's profit from assigning its rights under the Elda- Finance Sub PSA is the August 6, 2012 Default Payment Agreement (Exhibit 11). In the Default Payment Agreement, BSC agreed to pay Finance Sub the sum of $1,000,000 if two conditions were met: First, that TRS deliver to BSC a written acknowledgment in recordable form of the termination of the Lease and Sublease of the King's Village property; and second, that TRS accept BSC's offer to acquire certain personal and intangible property in exchange for a 23

- 24. payment of $100,000. On information and belief, TRS fulfilled the two conditions described in the August 6, 2012 Default Payment Agreement. 101. On information and belief, SSC paid Finance Sub the sum of $1,000,000 as described in the August 6, 2012 Default Payment Agreement. 102. Finance Sub was able to be paid the funds described in the Default Payment Agreement only because it assigned itsrights under the Elda-Finance Sub PSA to SSC. Consequently, Finance Sub's receipt of $1,000,000 pursuant to the August 6, 2012 Default Payment Agreement is net profit realized by Finance Sub under Paragraph 11.01 of the Elda- Finance Sub PSA, and is payable to Elda. Finance Sub has failed or refused to pay Elda the $1,000,000 of realized net profit as required under Paragraph 11.01 of the Elda-Finance Sub PSA, and is liable in damages to Elda in that amount. 103. The second source of Finance Sub's profit from assigning its rights under the Elda-Finance Sub PSA is first recorded in the July 2, 2012 Leasehold Letter Agreement (Exhibit 3). That document described an option for Finance Sub to purchase certain parking stalls for $75,000 each (the "Parking Option").' 104. The Parking Option was later made part of the Finance Sub-SSC Purchase Agreement (Exhibit 4) by the third amendment to that agreement dated August 3, 2012 (Third Amendment to Purchase Agreement; Exhibit 7). The Third Amendment provides certain notice requirements and definitional limitations on the option. 105. A condition precedent to the exercise of the Parking Option was agreed to in the Indemnity Agreement. That restriction voided the Parking Option if the Leasehold Owner (TRS) failed to execute a written acknowledgement in recordable form that the 1968 Lease had been terminated. Finance Sub and TRS satisfied this requirement by supplying such a written 1 The July 2, 2012 Leasehold Letter Agreement was cancelled by another August 3, 2012 letter agreement. A true and correct copy of the August 3, 2012 letter agreement which cancels the July 2 agreement is attached hereto and incorporated herein by this reference as Exhibit 12. 24

- 25. acknowledgement. A true and correct copy of a from entitled "Cancellation of Lease and Sublease; Release of Short Form Lease and Short Form Sublease," executed by BSC and by TRS and recorded in State of Hawaii Department of Conveyances on December 17, 2012 as "Doc A-47340473" is attached hereto and incorporated herein by this reference as Exhibit 13. As a result, the condition precedent to Finance Sub exercising its Parking Option was satisfied. 106. Pursuant to Paragraph 39 of the Third Amendment to the Finance Sub-BSC Purchase Agreement, the Parking Option could be exercised after the October 12, 2012 closing of the sale of the Leased-Fee Estate since the closing date, the Parking Option has been a valuable property right that Finance Sub acquired only because it assigned its rights under the Elda-Finance Sub PSA to BSC. 107. The purchase price under the Parking Option for 365 parking stalls at $75,000 per stall is $27,375,000. Elda estimates the range of gross value of 365 parking stalls at between $66,000,000 and $79,000,000. After subtracting the acquisition costs, the net equity of 365 parking stalls which remains as Finance Sub's profit from the Parking Option is estimated to be between $39 million and $52 million. The exact amount is to be determined at trial. Finance Sub would not be entitled to its Parking Option profit had it not assigned its rights under the Elda-Finance Sub PSA to BSC. Finance Sub is liable in damages to Elda for the entire Parking Option profit. 108. The third source of Finance Sub's profit from assigning its rights under the Elda-Finance Sub PSA is the $20,000,000 indemnity pledge made in the August 3, 2012 "Indemnity Agreement." (Exhibit 10) Under the terms of the Indemnity Agreement, Finance Sub would be indemnified against loss by BSC for any claims arising out of or relating to the termination of the 1968 Lease (Exhibit 1). The Indemnity Agreement, by its terms, is backed by at least $20 million in equity from BSC. 109. The existence of the Indemnity Agreement shows that the decision-makers at Finance Sub knew that the hidden transaction they were entering into was filled with 25

- 26. tremendous economic risk, if Elda discovered the hidden transaction and sought redress for its injuries. On information and belief, Finance Sub, the entities which own it and their principals were only willing to take part in the hidden transaction if they were protected from the risk of having to compensate Elda for the injuries caused by that hidden transaction. 110. Without the Indemnity Agreement, Finance Sub, the entities which own it and their principals would have had to insure themselves against the risk of Elda discovering the hidden transaction and from having to pay Elda for its injuries. The Indemnity Agreement directly profited Finance Sub by freeing it from the expenses of Elda's claims. Finance Sub has profited under the Indemnity Agreement by an amount equal to as much as the $20,000,000 in pledged equity which protects them from any of Elda's claims. 111. Finance Sub was able to obtain the indemnity of BSC and avoid paying up to $20,000,000 to ELDA only because it assigned its rights under the Elda-Finance Sub PSA to BSC. Consequently, the $20,000,000 in savings is net profit realized by Finance Sub under Paragraph 11.01 of the Elda-Finance Sub PSA, and is payable to Elda. 112. On information and belief, Finance Sub recently has profited from the Indemnity Agreement in a more direct way. Representatives of Elda began communicating with representatives of Kobayashi, Blacksand and BSC in October 2016. In 2017, those communications have included representatives of other interested parties, including, on information and belief, TRS and Finance Sub. Some of those communications have involved attorneys representing the various parties. To the extent that Finance Sub has had its expenses of attorney fees, other professional fees, and out-of-pocket costs paid pursuant to the Indemnity Agreement, those payments are profits realized only because Finance Sub assigned its rights under the Elda-Finance Sub PSA to BSC. Consequently, those payments are payable to Elda. COUNT Ill (BREACH OF COVENANT OF GOOD FAITH AND FAIR DEALING} Against TRS and Finance Sub 26

- 27. 113. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 114. In Hawaii, every contract contains an implied covenant of good faith and fair dealing, which is an enforceable right, separate and apart from the contract itself, that neither party will do anything that will deprive the other of the benefits of the agreement. 115. As set forth herein above, Defendant TRS was a party to the 1969 Lease. TRS had an existing contractual relationship with Elda, and accepted the tender that Elda made under the terms of the 1968 Lease, creating an additional contractual relationship between TRS and Elda. As TRS' designee, Finance Sub entered into a Purchase and Sale Agreement with Elda for the Leased-Fee Estate, creating its own contractual relationship between Finance Sub and Elda. In addition, Finance Sub was also a party to the Elda-Finance Sub PSA. 116. As a result of these agreements, Defendants TRS and Finance Sub were subject to a duty of good faith and fair dealing to provide Elda with that for which Elda had bargained under the 1968 Lease, and the Purchase and Sale Agreement. 117. Paragraph 16 of the Lessee Covenants in the 1968 Lease requires that Lessee provide notice to the Lessor if the Lessee received a bona fide offer to purchase the demised premises [Leasehold Estate] by assignment, sublease, or purchase of a controlling interest in the Lessee's stock, whereby the Lessor, here Elda, would have 30 days in which to exercise a right of first refusal. 118. On information and belief, Defendants TRS and Finance Sub unlawfully deprived Elda of its right of first refusal by colluding with each other, BlackSand, BSC, and/or Kobayashi to conclude secret deals to transfer/sell the Leasehold Estate without notifying Elda, so Elda would not learn that its right of first refusal as to the Leasehold Estate had been triggered. 119. Defendants TRS and Finance Sub did so in willful, wanton disregard for the contractual rights of Elda and for the purpose of depriving Elda of the benefit of its bargain so that Defendants TRS and Finance Sub could maximize the profits from the sale. 27

- 28. 120. As a result of Defendants TRS and Finance Sub Finance Sub's breach of the duty of good faith and fair dealing, Elda was deprived of the right of first refusal, which is an interest in real property; thus Elda is entitled to the remedy of specific performance as to the Leasehold Estate. 121. Elda has also been damaged in an amount to be proven at trial, including, but not limited to, prejudgmentinterest attorneys' fees and costs. COUNT IV (FRAUD) Against All Defendants 122. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 123. Elda possessed a valuable right of first refusal for any offer to purchase the Leasehold Estate, under the 1968 Lease, Lessee's Covenants, 16. 124. Each of the offers of valuable consideration, including those alleged in Paragraphs 111 to 115 (the Parking Option), 116 to 120 (the Indemnity Agreement), and 108 to 110 (the offers of $100,000 to TRS and $1,000,000 to Finance Sub) above as well as the July 2, 2012 Leasehold Letter Agreement between BlackSand and TRS constituted bona fide offers to purchase the Leasehold Estate. 125. When each of the offers for the Leasehold Estate alleged above were made to TRS and/or Finance Sub, TRS had an affirmative duty to give prompt notice of the offer, including all of the terms and conditions of the offer, to Elda. 126. The assurances by Kempson to Fullard-Leo in June 2012 that there was no potential buyer for the Leasehold Estate and that TRS was not marketing the Leasehold Estate were materially false at the time they were made. 127. Among others, TRS and Finance Sub knew of the falsity of Kempson's assurances at the time that the assurances were given. 28

- 29. 128. TRS and Finance Sub intended that Elda rely on Kempson's false assurances to lull Elda into believing that there would be no offer which would trigger Elda's right of first refusal on the Leasehold Estate. 129. Elda was ignorant of the falsity of Kempson's assurances when they were given. Elda relied on Kempson, TRS and Finance Sub to provide truthful information about any offers for the Leasehold Estate and any marketing of that interest by TRS. Elda's reliance was reasonable under the circumstances. 130. From sometime shortly after TRS was notified of the Walgreens offer on the Leased-Fee Estate and continuing until after the purchase and sale transaction for the Leased- Fee Estate closed on October 12, 2012, TRS violated its contractual duty to notify Elda of a bona fide offer to exchange something of value for the Leasehold Estate. As alleged above this was a material omission which concealed material facts from Elda. 131. TRS and Finance Sub knew that each of these alleged omissions concealed material facts from Elda. 132. Each of the omissions were intended by TRS and Finance Sub to deceive Elda and induce Elda to believe that there was no offer for the Leasehold Estate which would trigger Elda's right of first refusal. 133. Elda was ignorant of the fact that the omissions concealed the existence of bona fide offers to purchase the Leasehold Estate. Elda relied on TRS and Finance Sub to provide truthful information about any offers for the Leasehold Estate and any marketing of that interest by TRS. Elda's reliance was reasonable under the circumstances. 134. BlackSand and/or its related entities were directly and intentionally involved in both the Kempson assurances and the series of omissions, and knew of their materiality and their falsity. BlackSand (including its principals) and/or its related entities developed the scheme together with TRS and Finance Sub with the intent of having Elda rely on the assurances and 29

- 30. the omissions to believe that there would be no offer for the Leasehold Estate which would trigger Elda's right of first refusal. 135. Elda has been damaged by Defendants' fraudulent assurances, intentional scheme and omissions in an amount to be determined at trial including, but not limited to, prejudgment interest, attorneys' fees and costs. 136. In addition, through the actions described above, these Defendants' conduct was wanton and/or oppressive and/or was done with such malice as implies a spirit of mischief or criminal indifference to civil obligations, thereby entitling Elda to punitive damages. 137. Moreover, Defendants' conduct involved an entire want of care on the part of Defendants, which would raise the presumptions of a conscious indifference to the consequences of their actions, thereby entitling Elda to punitive damages against these Defendants. COUNTV (CONSTRUCTIVE FRAUD) Against Kobayashi, BlackSand, and BSC 138. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 139. Constructive fraud arises from a breach of a confidential or trust relationship. 140. Kobayashi and Gradisnik (and by Gradisnik's introduction of Kobayashi to Fullard-Leo, Kobayashi and Fullard-Leo) had a relationship of trust whereby both agreed to keep information regarding King's Village Property confidential and Gradisnik and Fullard-Leo on behalf of Elda relied on Kobayashi's knowledge and experience in Hawaii real estate to better understand the market conditions for the King's Village Property. 141. Through Kobayashi's relationship of trust with Gradisnik and Fullard-Leo, Kobayashi learned many details about the 1968 Lease that Gradisnik and Fullard-Leo on behalf of Elda asked Kobayashi to keep confidential, and to which Kobayashi agreed. 30

- 31. 142. Kobayashi, BlackSand, and/or BSC used the confidential information obtained from Gradisnik and Fullard-Leo to secretly negotiate with TRS, Finance Sub, and/or other Goldman Sachs-related entities to purchase the Leasehold Estate without notifying Elda, thereby depriving Elda of its right of first refusal. 143. By using the confidential information to secretly negotiate with TRS and Finance Sub and/or other Goldman· Sachs-related entities to circumvent Elda's right of first refusal, and using it for financial gain at Elda's expense, Kobayashi violated his equitable duty of trust with Elda, which was contrary to good conscience and caused injury to Elda. 144. Kobayashi knew that Elda would rely on his promise to keep the information provided by Gradisnik and Fullard-Leo confidential, and Kobayashi expected he would be able to keep Elda from discovering the secret negotiation and agreement between BlackSand and TRS and Finance Sub. 145. Elda did in fact rely on Kobayashi's promises and did not discover the secret negotiations to circumvent Elda's right of first refusal, and as a result, Elda has suffered damages. 146. By virtue of the foregoing, Kobayashi, BlackSand, and/or BSC constructively defrauded Elda. 147. As a direct and proximate result of this constructively fraudulent activity by these Defendants, Elda has suffered, and will continue to suffer, damages in an amount to be proven at trial, including, but not limited to, punitive damages, prejudgment interest, attorneys' fees and costs. COUNT VI (NEGLIGENT MISREPRESENTATION) Against all Defendants 148. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 31

- 32. 149. Defendants supplied false information regarding the status of the Leasehold Estate and their respective intentions regarding the Leasehold Estate and/or failed to provide material information to Elda from the time of Elda's notice to TRS of the Walgreens offer to the time the purchase and sales transaction for the Leased-Fee Estate closed on October 12, 2012. 150. Elda was the person, party, or entity for whose benefit the information was supplied. 151. Despite having a duty to the contrary, each Defendant failed to exercise reasonable care or competence in communicating this information to Elda. 152. Each Defendant knew that the representations were false and/or that material information was omitted. 153. Each Defendant contemplated that Elda would rely on the false representations and/or omissions. 154. Elda did in fact rely on the false representations and/or omissions. 155. As a direct and proximate result of these representations and/or omissions, Elda has suffered, and continues to suffer, damages in an amount to be proven at trial and is entitled to recover said damages from Defendants TRS, Finance Sub, BSC, and, on information and belief, other business entities and persons, jointly and severally, together with prejudgment interest. 156. Through the actions described above, Defendants' conduct was wanton and/or oppressive and/or was done with such gross negligence as implies a spirit of mischief or criminal indifference to civil obligations, thereby entitling Elda to punitive damages. 157. Moreover, Defendants' conduct involved an entire want of care on the part of Defendants, which would raise the presumptions of a conscious indifference to the consequences of their actions, thereby entitling Elda to punitive damages. COUNT VII (FRAUDULENT CONCEALMENT) Against all Defendants 32

- 33. 158. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 159. BlackSand and/or its related entities and TRS, Finance Sub, and/or other Goldman Sachs-related business entities, together created an artifice in which the Leasehold Estate was supposedly terminated. This termination and all related "contracts, promises, terms and conditions", however, were a sham transaction. In reality, the communications and agreements within the Defendants were deliberately designed to provide money and other things of value to TRS and Finance Sub in exchange for reuniting the leasehold and fee realty interests (i.e., the Leasehold Estate and Leased Fee Estate) thirteen years before the leasehold encumbrance created by the 1968 Lease was set to expire all with the premeditated consequence of depriving Elda of its rights of first refusal over the Leasehold Estate and for the purpose of the additional financial gain of all of the Defendants. 160. Each of the agreements executed by the Defendants, including TRS and/or Finance Sub to keep the negotiations taking place regarding the Leasehold Estate confidential and hidden from Elda was not only a separate breach of TRS's contractual obligations under the 1968 Lease, giving rise to a separate right of action, but also constituted an intentional concealment of information for the purpose of depriving Elda of its contractual rights. 161. The agreement for TRS to exclusively negotiate with BCS regarding the transfer of the Leasehold Estate was a separate breach of TRS's contractual obligations under the 1968 Lease, giving rise to a separate right of action. 162. Each offer of something of value to either TRS or Finance Sub in exchange for cooperation in the purchase of the Leasehold Estate facilitated by the sham "termination" of the 1968 Lease and the Leasehold Estate created by the lease was a bonafide offer to purchase the Leasehold Estate, triggering TRS's duty under the 1968 Lease to notify Elda. Each time TRS failed to so notify Elda, that failure was a separate breach of TRS's contractual obligations under the 1968 Lease, giving rise to a separate right of action. 33

- 34. 163. The Defendants knowingly and purposefully schemed and collaborated to keep Elda from learning of the facts that constituted Elda's rights of action. To accomplish their scheme, the Defendants and each of them employed artifices and created plans to prevent Elda from inquiring about the facts giving rise to its rights of action. They employed those plans and artifices to mislead Elda regarding those facts, and actively hindered Elda from acquiring the information needed to discover that Elda possessed those rights of action. 164. Elda reasonably relied on the Defendants, and their representations and omissions concealed relevant and material information from Elda so as to prevent it from exercising its rights of action. 165. Defendants' fraudulent concealment of the cause of action created an injustice by delaying judgment. 166. The delay in judgment damaged Plaintiff by denying it interest on the damage award that that accrued from the time of breach of contract. 167. The commencement date of interest begins at the time of the breach of contract-here, the breach of the provision in the1968 lease provision giving Elda the right of first refusal-the date of said breach to be determined at trial. 168. Elda has been damaged by the Defendants' representations and omissions in an amount to be determined at trial including, but not limited to, prejudgment interest, attorneys' fees and costs. COUNT VIII (TORTIOUS INTERFERENCE WITH CONTRACT) Against BSC, BlackSand and Kobayashi 169. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 170. Prior to and including in May 2012, Elda had a valid existing contractual relationship with TRS, respectively as lessor and lessee, based upon the 1968 Lease. After Elda gave TRS notice of the Walgreens offer in May 2012, Elda continued to have a valid and 34

- 35. enforceable contractual relationship with TRS, including Elda's right of first refusal over the Leasehold Estate regarding any offer made to TRS for the purchase of the Leasehold Estate. 171. BlackSand knew of Elda's existing contractual relationship with TRS no later than April 6, 2012, the date of Kobayashi and Gradisnik's first lengthy telephone call regarding the King's Village Property. Also through Kobayashi's discussions with Gradisnik and Fullard-Leo, it was aware that Elda was considering Walgreen's offer and others interested in acquiring the Leased-Fee Interest. On information and belief, Kobayashi shared his knowledge of Elda's relationship with TRS with BSC and possibly other BlackSand-related entities shortly thereafter. 172. On information and belief, the leadership of BlackSand, and/or its related entities, including BSC, determined quickly after Kobayashi learned about the purchase interest Elda had received and Elda's willingness to consider a sale of the fee interest, that the Leased-Fee Estate would be a valuable acquisition, but that it only fit into BlackSand's and/or its related entities' mission of real estate redevelopment in high-demand areas which required that BlackSand and/or its affiliates also obtain the Leasehold Estate simultaneously, or nearly simultaneously, with its acquisition of the Leased-Fee Estate. The acquisition would not have fit within BlackSand's redevelopment parameters if BlackSand had to wait approximately 13 years for the 1968 Lease to expire before the Leasehold Estate and Lease-Fee Estate were reunited into a single piece of real estate. 173. BlackSand and/or its related entities, through their principal Kobayashi, saw the potential for a redevelopment project that would easily return tens of millions of dollars of profit if the Leased-Fee Estate and Leasehold Estate could be reunited quickly. The leadership of BlackSand and/or its related entities reached the conclusion that the only way to be assured of obtaining the two interests together would be to negotiate for the Leasehold Estate with TRS secretly. This secrecy was necessary because they knew that Elda would exercise its right of first refusal regarding the Leasehold Estate if it learned that a prominent development company was acquiring the Leased-Fee Estate. Only secret negotiations would prevent Elda from 35

- 36. learning of the potential acquisition of the Leasehold Estate, and hopefully prevent Elda from exercising its right of first refusal. 174. BlackSand and/or its related entities knew that TRS and/or Finance Sub had a contractual duty to inform Elda of any bona fide offer for the acquisition of the Leasehold Estate. That duty, if performed, would likely spoil BlackSand's redevelopment plans for the King's Village Property, and the prospect of a relatively quick return of tens of millions, and possibly many tens of millions of dollars, would evaporate (or need to be shared with Elda). In light of these circumstances, the leadership of BlackSand and/or its related entities decided to interfere with the contractual relationship between Elda and TRS, and specifically to interfere with Elda's contract right to be notified of a bona-fide offer to acquire the Leasehold Estate. In other words, Blacksand and/or its related entities decided to interfere with Elda's right of first refusal in the Leasehold Estate promised in the 1968 Lease. 175. Beginning in April of 2012, BlackSand and/or its related entities, through their principal Kobayashi, began negotiating with TRS and Finance Sub regarding the Leased-Fee Estate and the Leasehold Estate. BlackSand and/or its related entities began proposing and promising payment of things of value to TRS and/or Finance Sub in order to have them breach the contractual obligation to promptly notify Elda of any bona fide offer for the Leasehold Estate. BlackSand and/or its related entities did so, in secret, knowing and intending that its efforts would interfere with and undermine the contractual relationship between Elda and TRS founded in the 1968 Lease. 176. Specifically, BlackSand and Kobayashi obtained TRS's agreement to the July 2, 2012 Leasehold Letter Agreement, which contained a confidentiality provision. By entering into and obeying the duty of confidentiality in the July 2, 2012 Leasehold Letter Agreement, TRS violated its contractual duty to notify Elda of the July 2, 2012 Leasehold Letter Agreement, which constituted a bona fide offer to purchase the Leasehold Estate and as such triggered Elda's right of first refusal promised in the 1968 Lease. 36

- 37. 177. BlackSand and/or its related entities continued its interference with the contract between Elda and TRS until the time of closing of the purchase and sale transaction for the Leased-Fee Estate on October 12, 2012. It did so in part by entering into a succession of written agreements with both TRS and Finance Sub in which it promised things of value for the Leasehold Estate and demanded exclusive negotiating rights for the Leasehold Estate and secrecy for the evolving transaction for the Leasehold Estate. These actions by BlackSand and/or its related entities were intended to interfere with Elda's contract with TRS, including Elda's right of first refusal, and were the direct and proximal cause for Elda not to be informed of BlackSand and/or its related entities' successive offers of valuable consideration for the Leasehold Estate. 178. There was no justification on Blacksand's part for its actions. 179. TRS did in fact breach its contract when it failed to inform Elda of the bona fide offer(s) for the Leasehold Estate. 180. Ultimately, the interference by BlackSand and/or its related entities led to a scheme in which TRS and Finance Sub received substantial payments and other valuable consideration from BlackSand and/or its related entities to cooperate with BSC to transfer and reunite the Leasehold Estate with the Leased-Fee Estate by way of, among other things, the sham "termination." 181. The intentional and prolonged interference by BlackSand and/or its related entities, through their principal Kobayashi, directly and proximately caused Elda substantial damages, in that Elda was deprived of its right to exercise its right of first refusal and acquire the Leasehold Estate to either (i) become the Leasehold Owner and earn continuing profits through subleases of the Leasehold Estate or, (ii) earn a one-time profit by selling the Leasehold Estate to BlackSand and/or its related entities. 37

- 38. 182. Elda has been damaged by BSC's interference with Elda's contractual relationship with TRS in an amount to be determined at trial including, but not limited to, prejudgment interest, attorneys' fees and costs. 183. In addition, through the actions described above, Defendants' conduct was wanton and/or oppressive and/or was done with such malice as implies a spirit of mischief or criminal indifference to civil obligations, thereby entitling Elda to punitive damages against these Defendants. 184. Moreover, Defendants' conduct involved an entire want of care on the part of Defendants, which would raise the presumptions of a conscious indifference to the consequences of their actions, thereby entitling Elda to punitive damages against these Defendants. COUNT IX (TORTIOUS INTERFERENCE WITH PROSPECTIVE BUSINESS EXPECTANCY) Against all Defendants 185. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 186. From the time it became the lessee under the 1968 Lease until the purchase and sales transaction for Elda's Leased-Fee Estate closed on or about October 12, 2012, TRS had business relationships with its sub-lessees at the King's Village Property. Most of these relationships were profitable for TRS. 187. If Elda had been allowed to exercise its right of first refusal after receiving the notice that TRS should have provided pursuant to the 1968 Lease, Elda would have succeeded TRS as the sub-lessor in those relationships. Elda would have been in a position to earn profits as landlord to the sub-lessors. 188. Defendants had knowledge of the expected business relationships and expectancy of Elda to earn profits as the Leasehold Owner as sublessor. 38

- 39. 189. Absent the interference perpetrated by the leadership of BlackSand and/or its related entities, TRS, Finance Sub, and, on information and belief, other Goldman Sachs- related business entities, Elda's business relationships with the sub-lessees was substantially certain to develop, because the subleases on which those relationships were based already existed. 190. Defendants had a purposeful intent to interfere with Elda's expected business relationships and expectancy to earn profits as the Leasehold Owner and sub-lessor. 191. Elda has been damaged by Defendants' interference with Elda's business expectancy with the King's Village sub-lessees in an amount to be determined at trial including, but not limited to, prejudgment interest, attorneys' fees and costs. 192. In addition, through the actions described above, Defendants' conduct was wanton and/or oppressive and/or was done with such malice as implies a spirit of mischief or criminal indifference to civil obligations, thereby entitling Elda to punitive damages against these Defendants. 193. Moreover, Defendants' conduct involved an entire want of care on the part of Defendants, which would raise the presumptions of a conscious indifference to the consequences of their actions, thereby entitling Elda to punitive damages against these Defendants. COUNT X (TORTIOUS INTERFERENCE WITH PROSPECTIVE BUSINESS EXPECTANCY) Against TRS and Finance Sub 194. Elda realleges the allegations contained in the paragraphs hereinabove, and by this reference incorporates them herein. 195. If Elda had been allowed to exercise its right of first refusal to acquire the Leasehold Estate, after receiving the notice that TRS should have provided pursuant to the 1968 Lease, Elda would have succeeded TRS as the lessee. Then, Elda would have been in a position to negotiate with BlackSand and/or its related entities for the sale of the Leasehold 39