Islamic financial institutions and markets ge30003

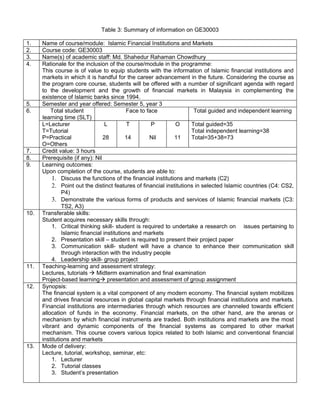

- 1. Table 3: Summary of information on GE30003 1. Name of course/module: Islamic Financial Institutions and Markets 2. Course code: GE30003 3. Name(s) of academic staff: Md. Shahedur Rahaman Chowdhury 4. Rationale for the inclusion of the course/module in the programme: This course is of value to equip students with the information of Islamic financial institutions and markets in which it is handful for the career advancement in the future. Considering the course as the program core course, students will be offered with a number of significant agenda with regard to the development and the growth of financial markets in Malaysia in complementing the existence of Islamic banks since 1994. 5. Semester and year offered: Semester 5, year 3 6. Total student Face to face Total guided and independent learning learning time (SLT) L=Lecturer L T P O Total guided=35 T=Tutorial Total independent learning=38 P=Practical 28 14 Nil 11 Total=35+38=73 O=Others 7. Credit value: 3 hours 8. Prerequisite (if any): Nil 9. Learning outcomes: Upon completion of the course, students are able to: 1. Discuss the functions of the financial institutions and markets (C2) 2. Point out the distinct features of financial institutions in selected Islamic countries (C4: CS2, P4) 3. Demonstrate the various forms of products and services of Islamic financial markets (C3: TS2, A3) 10. Transferable skills: Student acquires necessary skills through: 1. Critical thinking skill- student is required to undertake a research on issues pertaining to Islamic financial institutions and markets 2. Presentation skill – student is required to present their project paper 3. Communication skill- student will have a chance to enhance their communication skill through interaction with the industry people 4. Leadership skill- group project 11. Teaching-learning and assessment strategy: Lectures, tutorials Midterm examination and final examination Project-based learning presentation and assessment of group assignment 12. Synopsis: The financial system is a vital component of any modern economy. The financial system mobilizes and drives financial resources in global capital markets through financial institutions and markets. Financial institutions are intermediaries through which resources are channeled towards efficient allocation of funds in the economy. Financial markets, on the other hand, are the arenas or mechanism by which financial instruments are traded. Both institutions and markets are the most vibrant and dynamic components of the financial systems as compared to other market mechanism. This course covers various topics related to both Islamic and conventional financial institutions and markets 13. Mode of delivery: Lecture, tutorial, workshop, seminar, etc: 1. Lecturer 2. Tutorial classes 3. Student’s presentation

- 2. 14. Assessment methods and types: The assessment of this course will be based on the following:

- 4. 15. Mapping of the course/module to the programme aims: Refer to attached Program Summary Matrix 16. Mapping of the course/module to the programme learning outcomes: Refer to attached Program Summary Matrix 17. Content outline of the course/module and the SLT per topic (Please refer Appendix A):

- 5. No. of week(s) Topic(s) 1 The functions of financial institutions and markets Introducti on History and developm ent Creating and transferri ng money Accumula ting and lending savings Marketing and transferri ng financial assets Financial planning 2-3 An overview of the global financial system Introducti on The Internatio nal Monetary Fund (IMF) The world bank The regional developm ent banks The Bank of Internatio nal Settleme nts

- 6. 18. • Main references supporting course: Books: 1. International Centre for Education in Islamic Finance. (2006).Islamic Financial Institutions and Markets..Kuala Lumpur: INCEIF. 2. Ismail, Abdul Ghafar. (2010). Money, Islamic Banks and the Real Economy. Cengage Learning Asia Pte. Ltd. 3. Ayub, M. (2007). Understanding Islamic Finance. John Wiley and Sons (Asia) Pte. Ltd. 4. Iqbal, Z., & Abbas, M. (2007). An Introduction to Islamic Finance: Theory and Practice. John Wiley and Sons (Asia) Pte. Ltd. 5. Rosly, S.A. (2005). Critical Issues on Islamic Banking and Financial Markets. AuthorHouse, United States. 6. Ahmed, S. (2006). Islamic Banking Finance and Insurance: A Global Overview. A.S. Noordeen. • Additional references supporting the course: Databases: 1. Emerald Management Extra, Emerald Publishing UK 2. SpringerLink Databases 3. EbsCohost Research Databases 4. ScienceDirect All of the above named databases are accessible at http://www.ums.edu.my/library/indexbm.htm 19. Other additional information: This course provided students with a balanced skill and knowledge with respect to Islamic financial institutions and markets in Islamic finance specifically for banking in the Islamic finance. This course is one of many courses in Islamic finance considers as a prerequisite for students in preparation for their career advancement in the field of Islamic banking and finance industry and education.

- 7. Face To Face Learning (F2F) Self Learning Activity Formal Evaluation Lecture Student Centered Centered Total Learning Learning Non Face To Face Credit Course Mid- Student No Course Name Learning / Self Centered Assessment Final Code Revision term/Quiz/Continuous Learning Learning [Ex: Modules, Preparation Exam Time Evaluation Lecture Assignments and etc] Practical / SCL Centered Tutorial Activity Learning SCHOOL COURSE Islamic Financial 1 GE30003 Institutions and 3 28 14 11 24 28 10 2 3 120 Markets