PART 1 In this section of the report, your job is to explain cost.docx

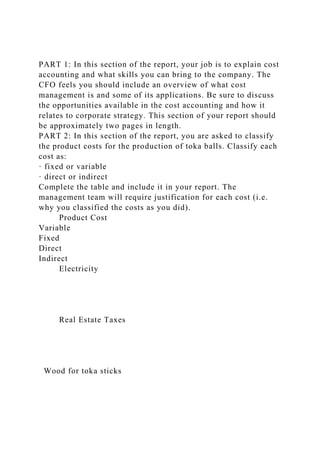

- 1. PART 1: In this section of the report, your job is to explain cost accounting and what skills you can bring to the company. The CFO feels you should include an overview of what cost management is and some of its applications. Be sure to discuss the opportunities available in the cost accounting and how it relates to corporate strategy. This section of your report should be approximately two pages in length. PART 2: In this section of the report, you are asked to classify the product costs for the production of toka balls. Classify each cost as: · fixed or variable · direct or indirect Complete the table and include it in your report. The management team will require justification for each cost (i.e. why you classified the costs as you did). Product Cost Variable Fixed Direct Indirect Electricity Real Estate Taxes Wood for toka sticks

- 2. Leather to tie wood together Manufacturing Labor Water Lubricants for Machinery Equipment depreciation Use Microsoft Excel to calculate your answers for Parts 3 and 4 and cut and paste the calculations from Excel into your report to show your work. PART 3: The third section of the report should contain your computations for the month of July based on the information given below. The following information is available for a GFI division that produces electronic scoreboards. These are special order products that use a job order cost accounting system. The management team wants to see your calculations in your

- 3. responses. June 30 July 31 Inventories Raw materials 62,000 75,000 Goods in process 85,000 95,000 Finished goods 103,000 58,000 Activities and information for July Raw materials purchases by cash 510,000 Factory payroll by cash 745,000 Factory overhead Indirect materials 24,000 Indirect labor

- 4. 132,000 Other overhead costs 220,000 Sales in cash 3,500,000 Predetermined overhead rate based on direct labor cost 52% Compute the following amounts for the month of July. 1. Cost of direct materials used. 2. Cost of direct labor used 3. Cost of goods manufactured. 4. Cost of goods sold. (Do not consider any underapplied or overapplied overhead.) 5. Gross profit. 6. Overapplied or underapplied overhead. PART 4: In the last section of the report, the management team would like to know the profits they can expect from the two models of pitching machines they currently manufacture. The softball pitching machine and the hardball machine make up the entire product line. To help determine the profit of each individual product, the CFO wants overheads to be allocated back to the products. Total inspection costs are $40,000. The estimated production budget is as follows. Softball pitching machine Units 20 units Direct labor hours per unit 200 hours per unit Number of inspections 5 per unit Hardball pitching machine Units

- 5. 20 units Direct labor hours per unit 200 hours per unit Number of inspections 15 per unit 1. Under a costing system that uses direct labor hours as a driver for the allocation, how much of the inspection costs would be allocated to softball machine? 2. Repeat the same question for hardball machine. 3. Using ABC and the number of inspections as a driver for allocation, recalculate the allocation for the softball machine. 4. Repeat the activity mentioned in question 3 for hardball machine. You know that your report will be shared with senior level managers and eventually to the board of directors. However, you are uncertain whether or not you will be allowed to present your work at a later time or in a different manner. Therefore it is important that your report is well written, professional, includes an introduction and a conclusion, and follows APA standards. PART 1: In this section of the report, your job is to explain cost accounting and what skills you can bring to the company. The CFO feels you should include an overview of what cost management is and some of its applications. Be sure to discuss the opportunities a vailable in the cost accounting and how it relates to corporate strategy. This section of your report should be approximately two pages in length.

- 6. PART 2: In this section of the report, you are asked to classify the product costs for the production of toka balls. Classify each cost as: · fixed or variable · direct or indirect Complete the table and include it in your report. The management team will require justification for each cost (i.e. why you classified the costs as you did). Product Cost Variable Fixed

- 7. Direct Indirect Electricity Real Estate Taxes Wood for toka sticks

- 8. Leather to tie wood together Manufacturing Labor Water

- 9. Lubricants for Machinery Equipment depreciation Use Microsoft Excel to calculate your answers for Parts 3 and 4 and cut and paste the calculations from Excel into your report to show your work. PART 3: The third section of the report should contain your computations for the month of July based on the information given below. The following information is available for a GFI division that produces electronic

- 10. scoreboards. These are special order products th at use a job order cost PART 1: In this section of the report, your job is to explain cost accounting and what skills you can bring to the company. The CFO feels you should include an overview of what cost management is and some of its applications. Be sure to discuss the opportunities available in the cost accounting and how it relates to corporate strategy. This section of your report should be approximately two pages in length. PART 2: In this section of the report, you are asked to classify the product costs for the production of toka balls. Classify each cost as: Complete the table and include it in your report. The management team will require justification for each cost (i.e. why you classified the costs as you did). Product Cost Variable Fixed Direct Indirect Electricity Real Estate Taxes Wood for toka sticks Leather to tie wood together Manufacturing Labor Water Lubricants for Machinery Equipment depreciation Use Microsoft Excel to calculate your answers for Parts 3 and 4 and cut and paste the calculations from Excel into your report to show your

- 11. work. PART 3: The third section of the report should contain your computations for the month of July based on the information given below. The following information is available for a GFI division that produces electronic scoreboards. These are special order products that use a job order cost