Report

Share

Download to read offline

Recommended

ABC Capital Corp's December Rate Indications for Mutifamily and Mixed-Use Commercial Mortgage Loans,. Includes additional property type information, including Stated Income LoansAbc Capital Corp Wholesale Multifamily, Mixed-use, Commercial Rate Indications

Abc Capital Corp Wholesale Multifamily, Mixed-use, Commercial Rate IndicationsNorman M. Carniol, Esq

Structuring a Performax Gold illustration as a 10-pay solution using the Cost for 15 year guaranteed paymentduration with Deposit Option underscores Performax Gold’s built-in stability in the event of declining rates. Even ifrates decline, the payment period for a 10-pay solution will never exceed 10 years.The same cannot be said of some of our competitors’ products. As you can see below, because the shortestguaranteed payment duration offered by the competitors is 20 years, using a 10-pay solution on this structure makes it more sensitive to changes in rates than Performax Gold. Should dividend interest rates decline due to aprolonged period of low interest rates such as the one we are experiencing, the number of annual payments forcompetitive plans could be as high as 20. Your client’s Performax Gold policy, on the other hand, would still require only 10 paymentsFor clients looking for a 10-pay whole life solution, Performax Gold is the a...

For clients looking for a 10-pay whole life solution, Performax Gold is the a...Francois S. Beauregard B.A., CFP®, Pl.Fin.

Recommended

ABC Capital Corp's December Rate Indications for Mutifamily and Mixed-Use Commercial Mortgage Loans,. Includes additional property type information, including Stated Income LoansAbc Capital Corp Wholesale Multifamily, Mixed-use, Commercial Rate Indications

Abc Capital Corp Wholesale Multifamily, Mixed-use, Commercial Rate IndicationsNorman M. Carniol, Esq

Structuring a Performax Gold illustration as a 10-pay solution using the Cost for 15 year guaranteed paymentduration with Deposit Option underscores Performax Gold’s built-in stability in the event of declining rates. Even ifrates decline, the payment period for a 10-pay solution will never exceed 10 years.The same cannot be said of some of our competitors’ products. As you can see below, because the shortestguaranteed payment duration offered by the competitors is 20 years, using a 10-pay solution on this structure makes it more sensitive to changes in rates than Performax Gold. Should dividend interest rates decline due to aprolonged period of low interest rates such as the one we are experiencing, the number of annual payments forcompetitive plans could be as high as 20. Your client’s Performax Gold policy, on the other hand, would still require only 10 paymentsFor clients looking for a 10-pay whole life solution, Performax Gold is the a...

For clients looking for a 10-pay whole life solution, Performax Gold is the a...Francois S. Beauregard B.A., CFP®, Pl.Fin.

More Related Content

What's hot

What's hot (6)

Similar to Impac libor option arm 2nd matrix

Similar to Impac libor option arm 2nd matrix (20)

Fha Home Improvement Lending Admirals Powerpoint Eric Pdf

Fha Home Improvement Lending Admirals Powerpoint Eric Pdf

Fha Home Improvement Lending Admirals Powerpoint Eric Pdf

Fha Home Improvement Lending Admirals Powerpoint Eric Pdf

The CFPB’s Proposed Rule Outline and Preparing for a CFPB Examination

The CFPB’s Proposed Rule Outline and Preparing for a CFPB Examination

More from Bitsytask

More from Bitsytask (20)

New Century Subprime Mortgage Matrix (Stated Doc / 80%, 550 FICO, 50% DTI) 7-...

New Century Subprime Mortgage Matrix (Stated Doc / 80%, 550 FICO, 50% DTI) 7-...

Countrywide Option Arm Loans (Negative Amortization) July 26 2006

Countrywide Option Arm Loans (Negative Amortization) July 26 2006

Credit Suisse sellers guide (secondary market) August 2006

Credit Suisse sellers guide (secondary market) August 2006

Subprime Underwriting Matrix, 100% LTV down to 580 FICO

Subprime Underwriting Matrix, 100% LTV down to 580 FICO

Impac libor option arm 2nd matrix

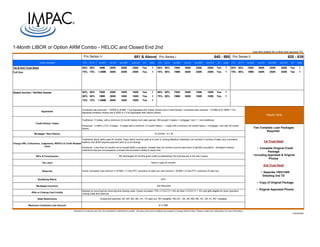

- 1. 681 & Above 640 - 680 620 - 639 Owner LTV CLTV 1st AMT 1st C/O 2nd AMT 2nd C/O I/O UNITS LTV CLTV 1st AMT 1st C/O 2nd AMT 2nd C/O I/O UNITS LTV CLTV 1st AMT 1st C/O 2nd AMT 2nd C/O I/O UNITS 1st & 2nd Trust Deed 80% 90% 1MM 300K 250K 250K Yes 1 80% 90% 750K 300K 250K 250K Yes 1 80% 90% 750K 300K 250K 250K Yes 1 Full Doc 75% 75% 1.5MM 300K 250K 250K Yes 1 75% 90% 1MM 300K 250K 250K Yes 1 75% 90% 1MM 300K 250K 250K Yes 1 Stated Income / Verified Assets 80% 90% 750K 300K 100K 100K Yes 1 80% 90% 750K 300K 100K 100K Yes 1 80% 80% 1MM 300K 100K 100K Yes 1 75% 80% 1MM 300K 100K 100K Yes 1 75% 75% 1.5MM 300K 100K 100K Yes 1 Appraisals Mortgage / Rent History Charge Offs, Collections, Judgments, REPO's & Credit Related BK's & Foreclosures Tax Liens Reserves Qualifying Ratios Mortgage Insurance Gifts or Closing Cost Credits State Restrictions Maximum Combined Loan Amount Use this matrix for a first and second TD. Combined loan amounts > $750K to $1MM 1 Full Appraisal with interior photos and a Field Review; Combined loan amounts > $1MM to $1.5MM 1 Full Appraisal w/interior photos and a 2055 or 2 Full Appraisals with interior photos. Traditional: 5 trades, with a minimum 24 month history from date opened. Will accept 3 trades + mortgage / rent + 1 non-traditional. Traditional: None within past 24 months. Open items must be paid at or prior to closing.(Medical collections not counted in number of lates; any cumulative balance over $500 requires payment prior to or at closing). Enhanced: Less than 24 months not to exceed $500 cumulative. Greater than 24 months must be paid down to $2,000 cumulative. Disregard medical collections that are not excessive or impact the borrower's ability to repay loan. BK discharged 24 months good credit re-established; No foreclosures in the last 3 years None in past 24 months Owner Occupied, loan amount <= $750K = 2 mos PITI, exclusive of cash-out; loan amount > $750K = 6 mos PITI, exclusive of cash-out. Not Required Closed-end seconds: AK, AR, MA, ME, NY, TX cash-out, WV ineligible. HELOC: AK, AR, MA, ME, NY, OK,TX, WV ineligible. Credit History Trades Enhanced: (<=80% LTV/): 4 trades. 2 trades with a minimum 12 month history + 1 trade with a minimum 24 month history + mortgage / rent with 24 month history. 12 months - 0 x 30 Helpful © 8/25/2006 40% $1.5 MM Intended for Customer use only. Not intended for distribution to public. All rates, terms and conditions are subject to change without notice. Please contact your Sales Rep. for more information. Liens Allowed on recurring/non-recurring and closing costs. Owner-occupied: 75% LTV/CLTV = 9% all other LTV/CLTV = 6% and gifts eligible for down payment, closing costs and reserves. Two Complete Loan Packages Required: 1st Trust Deed • Complete Original Credit Package • Including Appraisal & Original Photos 2nd Trust Deed • Separate 1003/1008 Detailing 2nd TD • Copy of Original Package • Original Appraisal Photos Pro Series I+ Pro Series I Pro Series II Owner Occupied 1st 1st 2nd 2nd Units CLTV 1st C/O 2nd 2nd O Units 1st 1st O 2nd C/O Units Helpful Hints 1-Month LIBOR or Option ARM Combo - HELOC and Closed End 2nd