Power of proactivity

- 1. When it comes to investing, being patient is generally a good thing. Being passive may not be. When conditions are uncertain and markets are volatile, it can be easy to confuse the two. Today, Morgan Stanley Smith Barney's Global Investment Committee believes there are signs that investors may be too passive. Some are choosing so-called safe strategies—loading up on cash, for example, or backing away from investing overseas—that in reality may be fraught with risk. Often, times like these present significant opportunities to those who are proactive about defining and meet- ing their needs. Knowing where you stand and putting the appropriate strategies in place can create value for you now and in the future. september 2010 summary in brief The Power of ProactivityThe Unintended Risks of Inaction Waiting Until the Time Is Just Right Timing the market can be an alluring trap. Market rallies historically record an impressive 45% average return in the first year coming off recession-related market bottoms. Fewer Stocks Equal Less Risk The American Association of Individual Investors reports that individuals’ allocation to stocks and stock funds in July 2010 stood at 51.7% of their holdings—below the historical average of 60%. When in Doubt, Stay Home A home-country bias persists even though growth in global markets has dramatically expanded investment opportunity. One Portfolio Brings Retirement Security The traditional approach treats money that will be spent in 10 years in just the same way as money you will need in 10 months. Watch for these four signs of investor passivity:

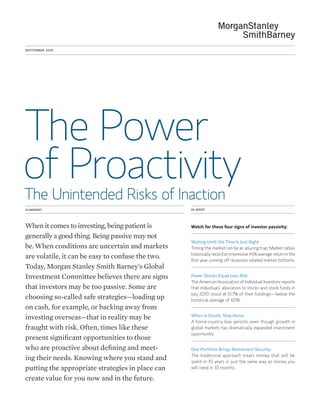

- 2. 2 morgan stanley smith barney | 2010 the power of proactivity Unfortunately, what often happens is that investors suffer the worst of the market decline and then miss out on much of the recovery, which typically kicks off with a steep upturn. Market rallies historically record an im- pressive 45% average return in the first year coming off recession- related market bottoms. Signifi cantly, 10% of that return happens in the first month and 28% happens in the first six months. Fewer Stocks Equal Less Risk. In an effort to reduce exposure to a volatile stock market, some investors may have overloaded their portfolios with perceived safe haven assets. The American Association of Individual Investors reports that individuals’ allo- cation to stocks and stock funds in July 2010 stood at 51.7% of their holdings —below the historical average of 60%. Bond holdings came in at 24% of the total—significantly above the historical average of 15%. Are investors shielding themselves from risk effectively? That depends. Investors who have upped their bond I t’s worth taking a close look at the strategies investors are using in the hope of mitigating risk. Most often, the temptation is to focus on short- term market moves rather than the longer, more comprehensive view that is vital to the creation and preservation of wealth over time. For those who are willing to be proactive, we believe times like these are full of opportunity. WaitING Until the Time Is Just Right. Many people are waiting for the stock market to stabilize and gather upward momentum be- fore jumping back in. Timing the market can be an alluring trap. Time To Rethink What Risk Is All About *MSCI All Country World Index used after 1987. MSCI The World Index (excludes emerging markets) used for period before 1987. For MSCI The World Index, only monthly data are available before 1980. Local currency, price index used in all cases. Daily data used where available. From the Morgan Stanley Smith Barney Global Investment Committee Chartbook, July 2010. Data as of August 2010. Source: Ibbotson Associates, Standard and Poor's and Bloomberg. Analysis: Morgan Stanley Smith Barney Global Investment Committee. The indexes shown are not available for direct investment. The performance depicted does not reflect the deduction of any investment- related fees or expenses. Past performance is not indicative of future results. For index definition, refer to page 4. Strong Recoveries Follow Steep Troughs Market rallies historically record impressive returns—45% on average—in the first year coming off recession-related market bottoms, with 10% of it occurring in the first month and 28% coming in the first six months. S&P 500 Index Returns 125% 100% 75% 50% 25% 0% 1 Month After Trough 6 Months After Trough 12 Months After Trough 6/32 3/38 4/42 6/49 9/53 10/57 10/60 5/70 10/74 3/80 8/82 10/90 10/02 10% 28% 45% Avg 3/09 Date of Market Bottom

- 3. morgan stanley smith barney | 2010 3 holdings after evaluating both their risk preferences and their long-term goals have probably made the appro- priate decision. If the shift only reflects a desire to flee from the stock market, however, or if you’ve made a move into bonds without understanding just what you own, you may well have raised rather than lowered the risk in your portfolio. When in Doubt, Stay Home. In times of uncertainty, investors often take refuge in their own market, and Americans are no exception. This home-country bias persists even though growth in global markets has dramatically expanded investment opportunity in faster-growing parts of the world, particularly the emerg- ing market economies. Staying away from the emerging markets may be a costly mistake. In fact, the 10% annualized return for the MSCI Emerging Markets Index over the past decade eclipsed the slightly negative return for U.S. stocks, accord- ing to research from the Global Invest- ment Committee. Looking ahead, we expect continued strong growth in emergingmarketeconomiesandacon- current expansion in their share of the global equity market. By 2020, these markets could account for one-third of the global equity market value—up from just 2% in 1990 and more than double their current 15% share, ac- cording to projections from the Global Investment Committee. One Portfolio Brings Retire- ment Security. A single portfolio that is frequently rebalanced has long been viewed as the smartest, safest way to prepare for your income needs in retirement. The problem is that this approach treats money that will be spent in 10 years in just the same way as money you will need in 10 months. An alternative, comprehensive ap- proach looks at income needs over the span of your retirement and segments your investments accordingly. The money you need in 20 years is invested for growth, and the money you need in the first few years of retirement is invested conservatively. This approach may help you avoid having to make ill- timed sales in your portfolio to meet immediate cash needs. Avoiding the Perils. Investor un- certainty appears to be as high as it has ever been. It is tempting to go on the defense—or simply freeze in place. We encourage you to be proactive about wealth creation and preservation. Create—or revisit—a comprehensive wealth plan that may help meet the goalsthatareimportanttoyouandyour family over time. Step back and evalu- ate whether your investment strategy is appropriately diversified. Ask whether your retirement portfolio is invested to meet your needs now and in the future. Maybe you’ll decide to hold more bonds but strategically structure the portfolio to capture better returns— or you could raise your exposure to emerging market economies but focus on the countries that seem to repre- sent the least risk. You might even con- clude that your portfolio is positioned just the way it should be. Morgan Stanley Smith Barney has the intellectual capital and a full range of planning and investment resources to help you manage your wealth. Just as important, the advice you will receive is informed by the experi- ence of millions of clients operating in every major market of the world. We understand both the temptation to be passive—and the potential rewards of being proactive. Looking ahead, we expect continued strong growth in emerging market economies and a concurrent expansion in their share of the global equity market.

- 4. Morgan Stanley Smith Barney is a global leader in wealth management, providing essential investment advice to individuals, families and institutions. Operating in locations around the world, the firm’s 18,000 Financial Advisors employ one of the industry’s broadest and most objective set of offerings to help clients meet their most important financial goals. The securities/instruments discussed in this material may not be suitable for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Morgan Stanley Smith Barney recommends that investors independently evaluate specific investments and strategies, and encourages investors to seek the advice of a Financial Advisor. International investing entails greater risk, as well as greater potential rewards compared to U.S. investing. These risks include political and economic uncertainties of foreign countries as well as the risk of currency fluctuations. These risks are magnified in countries with emerging markets, since these countries may have relatively unstable governments and less established markets and economies. Bonds are subject to interest rate risk. When interest rates rise, bond prices fall; generally the longer a bond’s maturity, the more sensitive it is to this risk. Bonds may also be subject to call risk, which is the risk that the issuer will redeem the debt at its option, fully or partially, before the scheduled maturity date. The market value of debt instruments may fluctuate, and proceeds from sales prior to maturity may be more or less than the amount originally invested or the maturity value due to changes in market conditions or changes in the credit quality of the issuer. Bonds are subject to the credit risk of the issuer. This is the risk that the issuer might be unable to make interest and/ or principal payments on a timely basis. Bonds are also subject to reinvestment risk, which is the risk that principal and/ or interest payments from a given investment may be reinvested at a lower interest rate. The SP 500 Index is designed to measure the performance of 500 large cap common stocks actively traded in the U.S. MSCI World is a stock market index of 1,500 'world' stocks and is often used as a common benchmark for 'world' or 'global' stock funds. The index includes a collection of stocks of all the developed markets in the world, as defined by MSCI. MSCI EMERGING MARKETS INDEX. This free-float-adjusted market capitalization- weighted index is designed to measure the performance of 22 emerging equity markets. The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Growth investing does not guarantee a profit or eliminate risk. The stocks of these companies can have relatively high valuations. Because of these high valuations, an investment in a growth stock can be more risky than an investment in a company with more modest growth expectations. Equity securities may fluctuate in response to news on companies, industries, market conditions and general economic environment. Asset allocation and rebalancing do not protect against a loss in declining financial markets. There may be a potential tax implication with a rebalancing strategy. Please consult your tax advisor before implementing such a strategy. Morgan Stanley Smith Barney and its Financial Advisors do not provide tax or legal advice. Individuals should consult their personal tax and legal advisors before making any tax or legal related decisions. Diversification does not guarantee a profit or protect against a loss. Past performance is not a guarantee of future results. © 2010 Morgan Stanley Smith Barney LLC. Member SIPC. 2010-PS-1653 CLF# 36380 JV6389062 09/10