Canada digital review

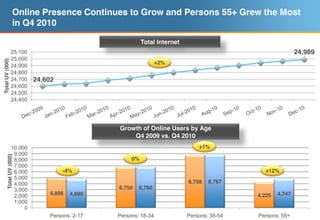

- 1. Online Presence Continues to Grow and Persons 55+ Grew the Most in Q4 2010 Total Internet 25,100 24,989 25,000 Total UV (000) +2% 24,900 24,800 24,700 24,602 24,600 24,500 24,400 Growth of Online Users by Age Q4 2009 vs. Q4 2010 10,000 +1% 9,000 Total UV (000) 8,000 0% 7,000 6,000 -4% +12% 5,000 4,000 8,708 8,767 3,000 6,750 6,760 2,000 4,895 4,690 4,225 4,747 1,000 0 Persons: 2-17 Persons: 18-34 Persons: 35-54 Persons: 55+

- 2. % Composition Unique Visitors % Composition UV by Age Segments Regional Breakout Males Females Atlantic 7% British 2-17 9% 10% Columbia Ontario 13% 38% Praries 18-24 5% 5% 18% Quebec 25-34 9% 9% 24% % Composition 35-44 9% 9% Household Income Breakout 35% 30% 45-54 9% 8% 31% 25% 20% 24% 26% 15% 20% 55+ 9% 10% 10% 5% 0% 0% 5% 10% 15% 20% Less than $40,000 - $75,000 - $100,000 or $40,000 $74,999 $99,999 more © comScore, Inc. Proprietary and Confidential. 9 Source: comScore Inc., Media Metrix, CA, All Locations, Persons: 2+, 3 MO. AVG Q4 2010

- 3. Online Landscape Worldwide in 2010 Canada maintained its position as the most engaged online audience, ranking highest among the top markets in average hours and visits per visitor in Q4 2010. #1 #2 #1 Total Unique Visitors Average Hours/Visitor Average Pages/Visitor Average Visits/Visitor (000) Location Q4 2010 Q4 2009 Q4 2010 Q4 2009 Q4 2010 Q4 2009 Q4 2010 Q4 2009 Worldwide 1,314,031 1,206,146 23.1 23.7 2,133 2,252 53.0 54.6 China 287,451 232,037 13.5 15.6 1,238 1,599 38.6 57.7 U.S. 181,239 172,194 35.3 33.3 2,953 2,822 80.9 70.8 Japan 72,913 69,826 18.4 20.0 1,928 2,108 43.8 47.3 Germany 49,257 45,216 24.1 22.0 2,858 2,654 60.0 58.7 Russia 45,692 36,589 21.8 16.5 2,704 2,399 52.9 44.5 France 41,827 39,137 26.6 28.1 2,752 2,934 68.7 70.3 India 41,170 36,535 11.9 12.1 1,089 1,183 30.6 27.1 Brazil 39,335 32,849 25.8 27.0 2,089 2,672 56.5 58.8 UK 38,581 37,674 32.3 31.3 2,883 2,735 69.4 60.3 South Korea 30,155 29,424 27.7 35.6 4,093 4,986 50.1 72.5 Canada 22,945 23,138 43.5 42.2 3,349 3,793 95.2 88.8

- 4. Top Gaining Site Categories by Total Unique Visitors More Canadians were accessing Community and Entertainment sites in Q4 2010. Political News sites saw the strongest growth, up 47 percent versus year ago. Top Gaining Site Categories 25,000 +18% +25% Q4 2009 Q4 2010 Total Unique Visitors (000) 20,000 +16% +23% +20% +26% 15,000 +29% +29% 10,000 +25% +27% +23% +29% +30% 5,000 +37% +47% 0

- 5. Conversational Media Continues its Climb Even though Social Networking had a strong reach in 2009, we continued to see growth in unique visitors in 2010. Likewise, UV growth was also seen on Blog sites as Canadians spent 58% more time and consumed 36% more pages in Q4 2010 compared to that of Q4 2009. Social Networking Blogs +13% YoY +9% 25,000 Total Unique Visitors (000) 24,000 23,000 22,000 21,000 20,000 19,000 18,000 17,000 16,000 15,000

- 6. Top Conversational Media Sites Total Unique Visitors (000): % Change % Change Most Q4 2010 Q4 2009 Unique Total Conversational Visitors Minutes Media sites saw an +7% -4% Facebook.com increase in unique visitors and time Blogger -3% +11 spent in Q4 2010 Windows Live Profile -25% -34% compared to last Technorati Media +40% +161% year. WordPress -16% -1% Federated Media +31% +138% Twitter.com +11% +26% LinkedIn.com +35% +79% Top gainers included: N/A N/A Gawker Media Technorati Media (40%) Federated Media (31%) HubPages.com +63% +107% Twitter.com (11%) Myspace -42% -76% LinkedIn.com (35%) Squidoo.com +19% +26% BlogHer +1% +34% DeviantArt.com -24% +8% Typepad -25% -2%

- 7. Persons 55+ were the Strongest Drivers of Social Networking Growth Social Networking continues to be consumed by many different demographics of the Canadian population. As this category continues to grow, older age segments are increasingly more engaged in this content. Persons Age: Q4 2010 Social Media Growth Q4 2009 vs. Q4 2010 % Change % Change Persons - Age Unique Total Visits 6% Visitors 17% 2-17 12% 2-17 -9% -18% 18-24 18-24 -1% -7% 25-34 35-44 10% 25-34 14% 15% 45-54 17% 55-64 35-44 12% 15% 65+ 45-54 15% 15% 19% 55-64 36% 48% 19% 65+ 34% 45%

- 8. Ad Dollars Continue to Flow Online in 2010 Total Display Ad Percentage of 2010 Total Display Ad Impressions Impressions (MM) 182,500 180,927 Q4 2010 Q1 2010 27% 24% 180,000 Q2 2010 Q3 2010 24% 177,500 25% 175,970 175,000 The number of total display ad impressions has grown 3% in 2010, with the majority of the ad impressions delivered in the final quarter of the 172,500 year. In 2010, the top two advertisers online were Procter & Gamble, followed by GMAC/Ally. Together they accounted for nearly 17 billion display ad impressions throughout the year. 170,000 Q4 2009 Q4 2010

- 9. A Shift: Where Advertising is Displayed Online Total Display Ad Impressions (000) by Category +15.6 Q4 2009 Q4 2010 billion 60,000,000 50,000,000 40,000,000 30,000,000 -5.1 +11.1 billion billion 20,000,000 +2.2 -1.0 billion billion 10,000,000 0 E-mail Business/Finance Photos Sports Social Networking While the number of total display ad impressions grew 3% in 2010, the Social Networking category has shown the largest increase in ad impressions delivered, accounting for more than 58 billion impressions in Q4 2010. This is the result of increased social media sites that have the ability to deliver ad impressions and shifting ad impressions delivered on categories like: E-mail (-34%) and Business/Finance (-28%).

- 10. Smartphone Penetration by Market % Change Mobile Platforms for Reportable Countries Q4 2009 vs. Q4 2010 Smartphone: Smartphone: Smartphone: Smartphone: Smartphone: Smartphone: +60% +63% +38% +12% +59% +81% Feature Phone: Feature Phone: Feature Phone: Feature Phone: Feature Phone: Feature Phone: -12% -17% -14% -6% -11% -14% Mobile Platforms for Reportable Countries Q4 2010 100% 80% Smartphone Feature Phone % Composition Leader Leader 60% 40% 20% 0% Smartphone Feature Phone Japan United States United Kingdom Spain Italy Germany France

- 11. Platform Share of Smartphone Subscribers RIM Google Apple Microsoft Palm Symbian US 32% 29% 25% 8% 4% 3% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total Subscribers (000s) 100% 4% 7% 12% 90% 19% 10% 13% 20% 32% Total Subscribers (000s) 80% 7% 5% 21% 70% 28% 5% 31% 60% 50% 17% 66% 68% 8% 40% 55% 48% 30% 31% 20% 30% 10% 12% 9% 10% 13% 10% 0% 5% JA UK SP IT GE FR