Payroll configuration

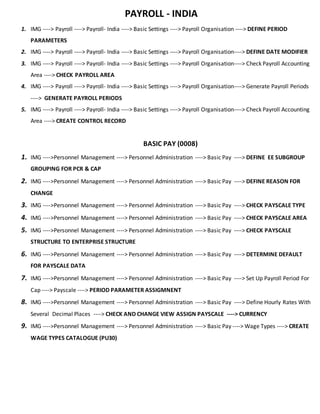

- 1. PAYROLL - INDIA 1. IMG ----> Payroll ----> Payroll- India ----> Basic Settings ----> Payroll Organisation ----> DEFINE PERIOD PARAMETERS 2. IMG ----> Payroll ----> Payroll- India ----> Basic Settings ----> Payroll Organisation----> DEFINE DATE MODIFIER 3. IMG ----> Payroll ----> Payroll- India ----> Basic Settings ----> Payroll Organisation----> Check Payroll Accounting Area ----> CHECK PAYROLL AREA 4. IMG ----> Payroll ----> Payroll- India ----> Basic Settings ----> Payroll Organisation----> Generate Payroll Periods ----> GENERATE PAYROLL PERIODS 5. IMG ----> Payroll ----> Payroll- India ----> Basic Settings ----> Payroll Organisation----> Check Payroll Accounting Area ----> CREATE CONTROL RECORD BASIC PAY (0008) 1. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> DEFINE EE SUBGROUP GROUPING FOR PCR & CAP 2. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> DEFINE REASON FOR CHANGE 3. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> CHECK PAYSCALE TYPE 4. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> CHECK PAYSCALE AREA 5. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> CHECK PAYSCALE STRUCTURE TO ENTERPRISE STRUCTURE 6. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> DETERMINE DEFAULT FOR PAYSCALE DATA 7. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> Set Up Payroll Period For Cap ----> Payscale ----> PERIOD PARAMETER ASSIGMNENT 8. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> Define Hourly Rates With Several Decimal Places ----> CHECK AND CHANGE VIEW ASSIGN PAYSCALE ----> CURRENCY 9. IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ----> Wage Types ----> CREATE WAGE TYPES CATALOGUE (PU30)

- 2. 10.IMG ---->Personnel Management ----> Personnel Administration ----> Basic Pay ---->Wage Type ----> CHECK WAGE TYPE GROUP "BASIC PAY" 11.IMG --->Personnel Management ----> Personnel Administration ----> Basic Pay ---->Wage Type ----> Check Wage Type Catalogue ----> CHECK WAGE TYPE TEXT 12.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay ----> Wage Type ----> Check Wage Type Catalogue ----> CHECK ENTRY PERMISSIBILITY FOR INFOTYPE LEVEL 13.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay ----> Wage Type ----> Check Wage Type Catalogue ----> DEFINE WAGE TYPE PERMISSIBILITY FOR PSG & ESG 14.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay ----> Wage Type ----> EMPLOYEE SUB GROUP FOR PRIMARYE WAGE TYPE 15.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay ----> Wage Type ----> PERSONNEL SUB AREAS FOR PRIMARYE WAGE TYPE 16.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay----> Wage Type ----> Check Wage Type Catalogue ----> CHECK WAGE TYPE CHARACTERISTICS 17.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay ---->Wage Type ----> REVISE DEFAULT WAGE TYPES 18.IM---->Personnel Management ----> Personnel Administration ----> Basic Pay ---->Wage Type ----> ENTERPRISE STRUCTURE FOR WAGE TYPE MODEL 19.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay ---->Wage Type ----> REVISE PAYSCALE GROUPS & LEVELS 20.IMG--->Personnel Management ----> Personnel Administration ----> Basic Pay ---->REVISE PAYSCALE GROUPS & LEVELS(V_T510)

- 3. RECURRING PAYMENTS & DEDUCTIONS(0014) 1. IMG ---->Personnel Management ----> Personnel Administration ----> Recurring Payments & Deductions----> Wage Types ----> CREATE WAGE TYPES CATALOGUE (PU30) 2. IMG ---->Personnel Management ----> Personnel Administration ----> Recurring Payments & Deductions ----> Wage Type ----> CHECK WAGE TYPE GROUP " RECURRING PAYMENTS & DEDUCTIONS " 3. IMG ---->Personnel Management ----> Personnel Administration ----> Recurring Payments & Deductions ----> Wage Type ----> Check Wage Type Catalogue ----> CHECK WAGE TYPE TEXT 4. IMG ---->Personnel Management ----> Personnel Administration ----> Recurring Payments & Deductions ----> Wage Type ----> Check Wage Type Catalogue ----> CHECK ENTRY PERMISSIBILITY FOR INFOTYPE LEVEL 5. IMG ---->Personnel Management ----> Personnel Administration ----> Recurring Payments & Deductions ----> Wage Type ----> Check Wage Type Catalogue ----> DEFINE WAGE TYPE PERMISSIBILITY FOR PSG & ESG 6. IMG ---->Personnel Management ----> Personnel Administration ----> Recurring Payments & Deductions ----> Wage Type ----> Check Wage Type Catalogue ----> CHECK WAGE TYPE CHARACTERISTICS ADDITIONAL PAYMENTS (0015) 1. IMG---->Personnel Management---->Personnel Administration----> Additional Payments----> Wage Types ----> CREATE WAGE TYPES CATALOGUE (PU30) 2. IMG ---->Personnel Management ----> Personnel Administration---->Additional Payments---->Wage Type ----> CHECK WAGE TYPE GROUP "ADDITIONAL PAYMENTS 3. IMG--->Personnel Management ----> Personnel Administration ---->Additional Payment----> Wage Type ----> Check Wage Type Catalogue ----> CHECK WAGE TYPE TEXT 4. IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments ----> Wage Type --- -> Check Wage Type Catalogue ----> CHECK ENTRY PERMISSIBILITY FOR INFOTYPE LEVEL 5. IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments ----> Wage Type --- -> Check Wage Type Catalogue ----> DEFINE WAGE TYPE PERMISSIBILITY FOR PSG & ESG 6. IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments ----> Wage Type --- -> Check Wage Type Catalogue ----> CHECK WAGE TYPE CHARACTERISTICS PAYROLL CONFIGURATION 1. IMG ----> Payroll ----> Payroll- India ----> DEFINE PAYSCALE GROUPS FOR ALLOWANCES 2. IMG ----> Payroll ----> Payroll- India ----> ASSIGN PAYSCALE GROUPS FOR ALLOWANCES 3. IMG ----> Payroll ----> Payroll- India ----> Basic Salary For India ---->ASSIGN BASIC WAGE TYPES TO GROUPINS FOR ALLOWANCE

- 4. REIMBURSEMENT, ALLOWANCES & PERKS(RAP) 1. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perks----> ASSIGN WAGE TYPE MODEL FOR PAYSCALE GROUPING FOR ALLOWANCES 2. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perks----> MAINTAIN DEFAULT WAGE TYPES FOR BASIC PAY 3. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perks----> MAINTAIN WAGE TYPE CHARACTERISTICS 4. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perks----> MAINTAIN PAYSCALE GROUPS & LEVELS 5. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perks----> MAINTAIN VALUATION OF BASIC WAGE TYPES 6. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perk----> MAINTAIN ALLOWANCES RULES BASED ON SLABS 7. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perks----> CALCULATE ELIGIBILITY FOR RAP'S 8. IMG ----> Payroll ----> Payroll- India ----> Reimbursement, Allowances & Perk----> MAIN EXTRA ELIGILIBITY CRITERIA FOR RAP’S(40ECS) PROFESSIONAL TAX 1. IMG ----> Payroll ----> Payroll- India ----> Professional Tax---->DEFINEPROFESSIONAL TAXGROUPING DETAILS 2. IMG ----> Payroll ----> Payroll- India ----> Professional Tax---->ASSIGNPTAX GROUPNGSFORPA/PSA 3. IMG ----> Payroll ----> Payroll- India ----> Professional Tax---->ASSIGNAMOUNTSFOR PROFESSIONAL TAXDEDUCTION 4. IMG ----> Payroll ----> Payroll- India ----> Professional Tax---->MAINTAINMETHODANDFORM LAYOUT FOR PTAX GROUPING 5. IMG ----> Payroll ----> Payroll- India ----> Professional Tax---->PROFESSIONALTAXBASISFOR THE STATE OF MP INCOME TAX 1. IMG ----> Payroll ----> Payroll- India ---->Taxation ---->DEFINE TAXATION METHOD FOR COMPANY 2. IMG ----> Payroll ----> Payroll- India ----> Taxation ---->DEFINE PERSONNEL AREA & SUB AREA GROUPINGS FO TAX 3. IMG ----> Payroll ----> Payroll- India ----> Taxation ---->ASSIGN TAX GROUPINGS FO PA & PSA 4. IMG ----> Payroll ----> Payroll- India ----> Taxation ---->MAINTAIN FEATURE TO RETURN EMPOLYER INCOME TAX RELATED DETAILS (40ECC) 5. IMG ----> Payroll ----> Payroll- India ----> Taxation ---->MAINTAIN24 Q E- FILE SUBMISSION ACKNOWLEDGEMENT (40ACK)

- 5. STATUATORY OTHER COMPONENTS (V_T511P) PROVIDENT FUND ESI LABOUR WELFARE FUND GRATUTITY SUPPER ANNUATION PROVIDENT FUND(0587) 1. IMG ----> Payroll ----> Payroll- India ---->Statutory social contribution ---->Provident Fund---->DEFINE TRUST DETAILS FOR PROVIDENT FUND 2. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution ----->Provident Fund ---->ASSIGN COMPANY RATES FOR PROVIDENT FUND 3. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution ----->Provident Fund ----> DEFINE TRUST VALIDITY PERIOD 4. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution ----->Provident Fund ---->MAINTAIN CONTRIBUTION DETAILS FOR PROVIDENT FUND 5. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution ----->Provident Fund ---->DEFINE CONTRIBUTION TYPE FOR STATUTORY RATES FOR PROVIDENT FUND EMPLOYEE STATE INSURANCE (ESI)(0588—0001) 1. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> ESI ---->MAINTAIN ESI ELIGIBILITY LIMIT 2. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> ESI ----> MAINTAIN NUMBER OF WORKING DAYS IN A MONTH 3. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> ESI ---->DEFINE PER AREA & SUB AREA GROUPINGS FOR ESI 4. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> ESI ---->DEFINE PER AREA & SUB AREA GROUPINGS FOR ESI 5. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> ESI ---->ASSIGN ESI GROUPING FOR PER AREA & SUB AREA 6. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> ESI ----> MAINTAIN CONTRIBUTION RATES FOR ESI.

- 6. LABOUR WELFARE FUND (0588—0002) 1. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> Labor welfare fund ---->DEFINE PER AREA & SUB AREA GROUPING FOR LWF 2. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> Labor welfare fund ---->ASSIGN LWF GROUPING FOR PER AREA & SUB AREA 3. IMG ----> Payroll ----> Payroll- India ----> Statutory social contribution -----> Labor welfare fund ---->DEFINE CONTRIBUTION RATES FOR LWF SUPERANNUATION 1. IMG----->Payroll----->Payroll India----->Retirement benefits ----->Superannuation----->MAINTAIN SUPERANNUATION TRUST ID 2. IMG----->Payroll----->Payroll India----->Retirement benefits ----->Superannuation----->MAINTAIN SUPERANNUATION CONTRIBUTION FREQUENCY & RELEVANT WAGE TYPE 3. IMG----->Payroll----->Payroll India----->Retirement benefits ----->Superannuation-----> DEFINE CONTRIBUTION RATES FOR SUPERANNUATION 4. IMG----->Payroll----->Payroll India----->Retirement benefits --------->Superannuation-----> MAINTAIN ELIGIBILITY DETAILS FOR SUPERANNUATION GRATUITY 1. IMG----->Payroll---->Payroll India---->Retirement benefits----->GRATUITY----->MAINTAIN GRATUITY TRUST ID 2. IMG----->Payroll----->Payroll India----->Retirement benefits -----> GRATUITY----->MAINTAIN GRATUITY CONTRIBUTION FREQUENCY & RELEVANT WAGE TYPE 3. IMG----->Payroll----->Payroll India----->Retirement benefits -----> Gratuity-----> Define contribution rates for Gratuity 4. IMG----->Payroll----->Payroll India----->Retirement benefits -----> Gratuity----->Maintain the eligibility year for Gratuity INDIA COMPANY LOANS 1. IMG----->Payroll----->Payroll India----->Company Loans----->Master Data----->CREATE A LOAN TYPE 2. IMG----->Payroll----->Payroll India----->Company Loans----->Master Data----->ASSIGN REPAYMENT TYPE 3. IMG----->Payroll----->Payroll India----->Company Loans----->Master Data----->CREATE LOAN CONDITIONS 4. IMG----->Payroll----->Payroll India----->Company Loans----->Master Data----->MAINTAIN LOAN ELIGIBILITY CHECKS AND LIMITS

- 7. BANKING 1. IMG----->Payroll----->Payroll India----->Data Medium Exchange-----> Preliminary program for Data Medium Exchange ----->SET UP HOUSE BANKS 2. IMG----->Payroll----->Payroll India----->Data Medium Exchange-----> Preliminary program for Data Medium Exchange ----->DEFINE SENDING BANKS 3. IMG----->Payroll----->Payroll India----->Data Medium Exchange-----> Preliminary program for Data Medium Exchange ----->CHECK TEXT KEYS FOR PAYMENT TRANSCATIONS. GENERAL LEDGER/SYMBOLIC ACCOUNT CONFIGURATIONS IN HR SYSTEM 1. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Activities in HR System----->Employee Grouping and Symbolic Accounts----->Define Employee Grouping Account Determination 2. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Activities in HR System----->Employee Grouping and Symbolic Accounts----->Define Symbolic Accounts 3. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Activities in HR System----->Maintain Wage Types----->Define Posting Characteristics for Wage Types 4. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Activities in HR System----->Maintain Wage Types----->Maintain Posting Periods for Payroll Periods 5. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Activities in HR System----->Create Posting Variants 6. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Activities in AC System----->Assigning Accounts---> Assign Expense Accounts 7. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Activities in AC System-----> Activities in HR System----->Assigning Accounts----->Assign Expense Accounts 8. IMG----->Payroll----->Payroll India---->Reporting for Posting Results to Accounting Activities in AC System-----> Assigning Accounts----> Assign Balance Sheet Accounts 9. IMG----->Payroll----->Payroll India----->Reporting for Posting Results to Accounting-----> Check Customizing for Account Determination 10.IMG----->Payroll----->Payroll India----->Payroll Calendar----->Define Schedule for Payroll Calendar

- 8. BANK TRANSFER (0009) Data Medium Exchange Process (DME) FBZP T.code for Payment methods for bank details (0009) F501 T.code for Bank Details F110 T. code for Automatic Payment Status FEATURE (PE03) ZLSCH - Default value for payment method DTAKT - Default Emp Account Number 1. Pre DME Program PC00_M40_DTA / HINDTAQ (SE38) 2. DME PPRAGRAM PC00_M40_FFOM / RFFOM100 PAYSLIP (PE51) 1. Easy Access -----> PE51-----> country grouping -----> Form Name (IN01) -----> click on copy as custom Form name 2. Target ------> Country groping ------> form name -----> click on copy 3. Subjects------> Attributes------> Click on change (Change the Payslip Mame) 4. Background ------> Click on change ------>Headline of Payslip 5. Single Field-----> Click on change ------>Select the preferable (double Click) ------>Additional Information ------> identifier 1559 --------> Bank Transfer (Save) 6. Window ------> Click on change ------> S.no. W1 doble Click @ window 1 ------> Group (01) & Double click it -- -----> Insert “+” (earnings) wage types 7. Window --------> Click on change -----> S.no. W2 doble Click @ window 2 -----> Group (02) & Double click it -- -----> Insert “—“ (Deductions) wage types 8. Cumulaton ID’s -----> ID Last Text Text (Select the IN01) -----> Doble Click on IN01 -----> Add All out Custom Wage types ( + Earnings & “—“ Deductions)

- 9. REMUARATION STATEMENT VARIENT 1. Easy Access -----> PE01-----> IN00 copy custom Schemaas ZN00 2. Easy Access -----> SE38 ----->HINCEDT -----> Click @ (Menu bar) Varients 3. Program HINCEDT0 Varient RL Slip (Click Here) & Create 4. Selection Payroll Area A1 Form Name ZZIN (Enter) 5. Attributes -----> Varient Name RL Payslip Meaning Reliance Paysilp click ON Protect Varient (Save) 6. Easy Access-----> FI01 -----> Bank Country IN Bank Key 123456 OFF CYCLE PAYROLL 1. 2 Types Regular Payroll Drive - PC00_M40_CALC / HINCALC (Run for Multiple Employees) T.Code for Payroll PUOC_40 (Off cycle work Bench) At a time single employee History of employee off cycle payroll 2. Reasons of off cycle Bonus payment Salary corrections (Retroactive Account) Regular payroll (on demand) Advance Payment 7. IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments - Off Cycle----> Wage Types ----> CREATE WAGE TYPES CATALOGUE (PU30) 8. IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments - Off Cycle ----> Wage Type ----> CHECK WAGE TYPE GROUP " ADDITIONAL PAYMENTS - OFF CYCLE " 9. IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments - Off Cycle ----> Wage Type ----> Check Wage Type Catalogue ----> CHECK WAGE TYPE TEXT 10.IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments - Off Cycle ----> Wage Type ----> Check Wage Type Catalogue ----> CHECK ENTRY PERMISSIBILITY FOR INFOTYPE LEVEL 11.IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments - Off Cycle ----> Wage Type ----> Check Wage Type Catalogue ----> DEFINE WAGE TYPE PERMISSIBILITY FOR PSG & ESG

- 10. 12.IMG ---->Personnel Management ----> Personnel Administration ----> Additional Payments - Off Cycle ----> Wage Type ----> Check Wage Type Catalogue ----> CHECK WAGE TYPE CHARACTERISTICS 13.IMG----->Payroll----->Payroll India-----> 14.IMG----->Payroll----->Payroll India-----> 15.IMG----->Payroll----->Payroll India-----> 16.IMG----->Payroll----->Payroll India-----> 17.IMG----->Payroll----->Payroll India-----> PAYROLL DRIVER Easy Access -----> Human Resources-----> Payroll -----> Asia / Pacific -----> India-----> Payroll Accounting Simulation Release payroll Start payroll Check payroll Corrections Exit payroll Remuneration statement PAYROLL SCHEMA 1. Initialization : - Check payroll status PA03 (Pyroll Driver data base update) 2. Read Basic Data: - Read all relavant dat work center, basic pay,(0001, 0007, 0008, 0027) 3. Read last payroll results: Previous Period payresults 4. Time data processing 5. Red payments / deductions 6. Prorate & cumulate gross 7. Process deductions & benefits 8. Calculate taxes 9. Calculate net 10.Process retroactive accounting 11.Net processing 12.Final processing