NPI Evaluation of Global Partnerships

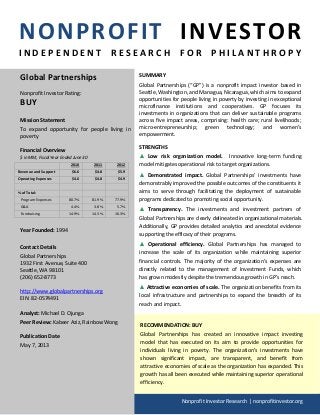

- 1. NONPROFIT INVESTOR I N D E P E N D E N T R E S E A R C H F O R P H I L A N T H R O P Y Nonprofit Investor Research | nonprofitinvestor.org SUMMARY Global Partnerships (“GP”) is a nonprofit impact investor based in Seattle, Washington, and Managua, Nicaragua, which aims to expand opportunities for people living in poverty by investing in exceptional microfinance institutions and cooperatives. GP focuses its investments in organizations that can deliver sustainable programs across five impact areas, comprising: health care; rural livelihoods; micro-entrepreneurship; green technology; and women’s empowerment. STRENGTHS ▲ Low risk organization model. Innovative long-term funding model mitigates operational risk to target organizations. ▲ Demonstrated impact. Global Partnerships’ investments have demonstrably improved the possible outcomes of the constituents it aims to serve through facilitating the deployment of sustainable programs dedicated to promoting social opportunity. ▲ Transparency. The investments and investment partners of Global Partnerships are clearly delineated in organizational materials. Additionally, GP provides detailed analytics and anecdotal evidence supporting the efficacy of their programs. ▲ Operational efficiency. Global Partnerships has managed to increase the scale of its organization while maintaining superior financial controls. The majority of the organization’s expenses are directly related to the management of Investment Funds, which has grown modestly despite the tremendous growth in GP’s reach. ▲ Attractive economies of scale. The organization benefits from its local infrastructure and partnerships to expand the breadth of its reach and impact. RECOMMENDATION: BUY Global Partnerships has created an innovative impact investing model that has executed on its aim to provide opportunities for individuals living in poverty. The organization’s investments have shown significant impact, are transparent, and benefit from attractive economies of scale as the organization has expanded. This growth has all been executed while maintaining superior operational efficiency. Global Partnerships Nonprofit Investor Rating: BUY Mission Statement To expand opportunity for people living in poverty Financial Overview $ in MM, Fiscal Year Ended June 30 2010 2011 2012 Revenue and Support $6.6 $4.8 $5.9 Operating Expenses $4.6 $4.8 $4.9 % of Total: Program Expenses 80.7% 81.9% 77.9% G&A 4.4% 3.8% 5.7% Fundraising 14.9% 14.3% 16.3% Year Founded: 1994 Contact Details Global Partnerships 1932 First Avenue, Suite 400 Seattle, WA 98101 (206) 652-8773 http://www.globalpartnerships.org EIN: 82-0574491 Analyst: Michael D. Ojunga Peer Review: Kabeer Aziz, Rainbow Wong Publication Date May 7, 2013

- 2. Global Partnerships | Nonprofit Investor Research 2 OVERVIEW OF GLOBAL PARTNERSHIPS’ ACTIVITIES Founded in 1994, Global Partnerships is a nonprofit social investor whose mission is to expand opportunity for people living in poverty. GP carries out its mission by identifying and investing in microfinance organizations and cooperatives which collectively serve individuals in need by providing micro-loans and other life-changing services. The GP platform has evolved since its inception in 1994, when the organization was founded to support microfinance work in Central America. GP has since recognized that impoverished people face multiple challenges beyond access to credit and as a result the organization now prioritizes partners that provide a holistic package of loans and other essential goods and services. Since 2005, GP has formed investment funds designed to provide low-cost loans to a select group of socially-focused partners while providing investors with both financial and social returns. Global Partnerships investor base (provider of fund capital) includes foundations, development banks, and accredited individual and institutional investors. In addition to providing investors with a fixed-income financial return, GP’s funds are also structured to deliver positive social returns – defined by Global Partnerships as a “positive impact on the lives of people living in poverty.” Global Partnerships focuses its investments in cooperatives and microfinance institutions in five designated impact areas, consisting of: health care; rural livelihoods; micro-entrepreneurship; green technology; and women’s empowerment. Global Partnerships has an extensive risk management process, placing particular emphasis on due-diligence, monitoring, innovative fund structuring, and geographic diversification. As a result, according to Global Partnerships, 100 percent of principal and preferred return payments have been made on-time to investors over the life of GP’s funds. Global Partnerships was recognized in 2011 by ImpactAssets 50 as a leading private debt manager that delivers social and environmental value in addition to financial returns. As of September 30, 2012, Global Partnerships has $42.2 million in fund capital deployed in eleven countries with 33 partners, serving approximately 97,527 people. Current Funds Overview Global Partnerships has two active funds investing as of September 30, 2012: Microfinance Fund 2008 and Social Investment Fund 2010. Microfinance Fund 2008 - $20MM Fund Capital (103% Invested) Microfinance Fund 2008 was launched on October 31, 2008, with total fund capital of $20,000,000. As of September 30, 2012, $20,534,960 is currently invested. The fund is structured to pay interest in the amount of 3.00%, 3.25%, 4.00%, 4.69%, and 4.75% per annum over the life of the fund, payable quarterly, and maturing in October of 2014. Percent of Investible Assets (Distribution by Country and Institution) Equador (30%) Nicaragua (15%) FINCA Equador (10%) FDL (10%) FODEMI (10%) Pro Mujer in Nicaragua (5%) Banco D-MIRO (5%) Peru (14%) Fundación Alternativa (3%) Credivision (6%) Fundación Faces (2%) Pro Mujer in Peru (6%) Bolivia (25%) Arariwa (2%) CRECER (10%) El Salvador (5%) Pro Mujer in Bolivia (10%) ENLACE (5%) FONDECO (5%) Guatemala (1%) Mexico (9%) Friendship Bridge (1%) FRAC (2%) Cash (1%) Pro Mujer in Mexico (7%) Bolivia 25% Equador 30% Cash 1%Guatemala 1% El Salvador 5% Mexico 9% Peru 14% Nicaragua 15%

- 3. Global Partnerships | Nonprofit Investor Research 3 Social Investment Fund 2010 - $25MM Fund Capital (94% Invested) Microfinance Fund 2008 was launched on October 31, 2010. As of September 30, 2012, $23,444,114 is currently invested out of total fund capital of $25,000,000. The fund is structured to pay interest payable quarterly at rates ranging from 2.715% and 4.59% per annum, maturing in October 2015 and June 2016, respectively. Included in the provision of the fund, are terms necessitating the payment of interest contingent on surplus cash remaining at the close of the fund. Percent of Investible Assets (Distribution by Country and Institution) Peru (30%) Colombia (12%) ADRA (4%) Fundación Amanecer (6%) Pro Mujer in Peru (8%) Contactar (6%) Arariwa (3%) Equador (10%) Crediflorida (7%) ESPOIR (4%) Los Andes (2%) Fundación Faces (3%) NORANDINO (3%) Banco D-MIRO (3%) FONDESURCO (2%) Mexico (10%) APROCASSI (1%) FRAC (4%) Bolivia (17%) Pro Mujer in Mexico (2%) CRECER (4%) CONSERVA (4%) Pro Mujer in Bolivia (5%) El Salvador (10%) FONDECO (3%) ENLACE (4%) Sembrar Sartawi (5%) Fundación Campo (6%) Honduras (5%) Cash (3%) COMIXMUL (5%) Dominican Republic (1%) Nicaragua (2%) Esperanza (1%) Pro Mujer in Nicaragua (2%) PROGRAM RESULTS AND EFFECTIVENESS Microfinance Fund 2008 Global Partnerships’ Microfinance Fund 2008 has exhibited robust total partner loan portfolio growth over the last four years, climbing from less than $200MM to over $400MM during that time period. Additionally, the fund continues to expand the amount of borrowers served, as it has demonstrated an approximately 20% compounded annual growth rate from the beginning of Fiscal Year 2009 to present. During this time period, the Fund has also maintained stringent operational self-sufficiency as total revenues / total expenses have consistently exceeded 100% by a healthy margin – four year average of approximately 115%. The portfolio quality of the fund’s investment partners is of a high level, as delinquent loans (loans past due greater than 30 days) represent less than 5% of total loans outstanding and the fund has experienced minimal asset write-offs. GP has recently made a new investment in Friendship Bridge, a Guatemalan microfinance institution that provides small working capital loans through a group lending methodology to women in mostly rural areas. The organization also provides clients with education focuses in health, business, agriculture, and self-esteem. Nicaragua 2% Dominican Republic 1% Bolivia 17% Peru 30% Cash 3% Honduras 5% El Salvador 10% Mexico 10% Equador 10% Colombia 12% 17 Number of partners $663 Average loan size 82% Percentage of borrowers served who are women 48% Percentage of borrowers served living in rural areas

- 4. Global Partnerships | Nonprofit Investor Research 4 Social Investment Fund 2010 Global Partnerships’ Social Investment Fund 2010 has grown rapidly in terms of partner loan portfolio over the last two years, rising from approximately $100MM to greater than $500MM during that time period. Over that time, the amount of borrowers served has increased commensurately, from approximately 100,000 to over 700,000. During this time period, the Fund has also maintained stringent operational self-sufficiency as total revenues / total expenses have consistently exceeded 100% by a healthy margin – a two year average exceeding 120%. The portfolio quality of the fund’s investment partners is of a high level, as delinquent loans (loans past due greater than 30 days) represent less than 3% of total loans outstanding and the fund has experienced minimal asset write-offs. GP has recently made a new investment in CONsultores de SERvicios VArios (CONSERVA), a microfinance institution (MFI) that utilizes the solidarity group methodology to provide small working capital loans and health services to entrepreneurs living in poverty. The organization concentrates its services on the lower segments of the market, serving roughly 100% women in the rural, urban, and peri-urban areas in the southeast region of the country. TRANSPARENCY Global Partnerships’ website provides information about the organization’s programs, leadership and financial situation. Program services expenses are well documented in their audited financial statements. Additionally, Global Partnerships’ publishes comprehensive quarterly fund updates in concert with their annual report. These publications delineate the organization’s program offerings, efficacy, financial performance, operating metrics and often a case study on a particular partner organization. From a direct impact perspective, GP lists numerous “success stories” on its website, highlighting the individuals that it aims to reach through its various funds. Global Partnerships files its Form 990 with the IRS each year and its financial statements are regularly audited by the accounting firm Clark Nuber. FINANCIAL OVERVIEW STRUCTURE The consolidated financial statements of Global Partnerships and subsidiaries include the activities of Global Partnerships and its subsidiaries, Global Partnerships Microfinance Fund 2006, LLC (“MFF2006”); Global Partnerships Microfinance Fund 2008, LLC (“MFF2008”); Global Partnerships Social Investment Fund 2010, LLC (“SIF2010”); and GP Fund Management, LLC. Investment funds MFF2006, MFF2008, and SIF2010 (collectively, the “Funds”) were formed in March 2007, October 2008, and August 2010, respectively, to serve as investment vehicles to make unsecured term loans to qualified partner institutions in Latin America and the Caribbean. Investors in the Funds have purchased notes payable from the Funds or made loans to the Funds. The Funds’ investor base includes accredited private investors, development banks, and institutions. At the time of formation, GP contributed $255,000 in cash to MFF2006, $1,500,000 in cash to MFF2008 and $1,500,000 in cash to SIF2010, as capital contributions. GP Fund Management, LLC (the “Fund Management”) was formed in June 2005 to provide investment fund management services. Wholly owned by GP, the management responsibilities for the Fund Management are assigned to 25 Number of partners $735 Average loan size 81% Percentage of borrowers served who are women 48% Percentage of borrowers served living in rural areas

- 5. Global Partnerships | Nonprofit Investor Research 5 GP according to the Investment Advisory Services Agreement. GP contributed $100 in capital contributions at the formation. REVENUES AND OTHER SUPPORT Global Partnerships’ main source of revenue has fluctuated over time, however, Earned Income has generally contributed to a significant portion of the organizations funding. GP derives Earned Income from the creation and management of its investment funds. Fund management fees are earned based on the outstanding loan balances in each fund for which GP provides servicing and monitoring. Additionally, fund closing fees are earned upon each close of a new fund. GP also receives loan and commitment fees from partner organizations which are recognized at the time of loan commitment. In the 2012 Fiscal Year, 55% of GP’s total consolidated revenue was generated through Earned Income. Net Assets Released from Restrictions, which have historically comprised a considerable amount of GP’s total consolidated revenue, represent reclassifications between the applicable classes of net assets (e.g. restricted assets versus unrestricted assets). These reclassifications take place due to the expiration of temporary restrictions on assets, generally due to donor-stipulated purposes being fulfilled or the stipulated time period lapsing. In the 2009 Fiscal Year, Global Partnerships recognized approximately $2.2MM in Recoverable Grant Income, which contributed to such a large percentage of total revenues being attributed to Other Income. Global Partnerships’ total consolidated revenue has maintained relatively stable over the past four years, with 2011 being an outlier primarily due to a structural decrease in assets released from restrictions. However, 2011 was also the only year during the period in which contributions decreased. Despite the softness in 2011 revenue, Global Partnerships has managed to grow Earned Income each year throughout the four year period. Revenue Mix Over Time 2012 Revenue Mix $ in MM EXPENSES Global Partnerships has spent an average of 4% of operating expenses through administrative costs over the past four years. While approximately 12% of operating expenses have been spent on Fundraising over the same period of time, the organization has maintained effective cost controls and operating efficiency to allow for an 84% four year average of expenditures allocated towards Program Costs. As a manager of impact investment funds, GP’s Program Expenses generally encompass compensation and operational expenses relating to the management of the organization’s funds. $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 2009 2010 2011 2012 Earned Income In-kind Contributions Contributions Other Income Net Assets Released from Restrictions $6.6 $4.8 $5.9$6.0 55% 23% 14% 7%1% Earned Income Net Assets Released from Restrictions Contributions In-kind Contributions Other Income

- 6. Global Partnerships | Nonprofit Investor Research 6 Global Partnerships clearly delineates management compensation in the Form 990, and it is consistent with the individuals’ respective experience level and industry practices. Expense Breakdown Total Impact Investments Growth $ in MM MISCELLANEOUS Global Partnerships maintains a healthy balance sheet with over $7MM in Net Assets partly driven by successfully managing its liabilities (GP has returned all principal and preferred return payments to its Fund investors since inception). In addition, Global Partnerships has been able to consistently grow the amount of dollars allocated towards total impact investments since 2006. In Fiscal Year 2012, 94% of Global Partnership’s total cash outflows went to support and expand Global Partnership’s impact investments. KEY PERSONNEL BIOS Rick Beckett – President and Chief Executive Officer Rick is the president and CEO of Global Partnerships and has led the organization's strategic expansion as a social investor since 2006. Prior to joining Global Partnerships, Rick was managing director of a $112 million private equity fund investing in middle-market companies and early stage ventures. Rick spent 10 years at McKinsey & Company where he served financial institution and healthcare clients on strategy and performance. He specialized in helping not-for- profit organizations achieve superior results in competitive markets. Rick has served on the boards of directors of numerous privately held portfolio companies and not-for-profit organizations, including Direct Relief International and The Initiative for Global Development. He holds a B.A. with distinction in economics from Stanford University, and an M.B.A. as an Arjay Miller Scholar from the Stanford Graduate School of Business. Mark Coffey – Chief Investment and Operating Officer Mark oversees Global Partnerships' social investment funds, directing both the capitalization of GP investment funds and the lending of capital to GP's microfinance and cooperative partners. Prior to his work at Global Partnerships, he served as President of ShoreBank Pacific, the first commercial bank in the United States with a focus on environmentally sustainable community development. Mark has more than 25 years experience in banking and lending, including serving in executive roles at Homestead Capital, Bank of the Northwest, First Interstate Securities and First Interstate Bank of Texas. Mark has served as a member of the Board of Directors of BRAC Bank, a development bank known for its work with small business lending in Bangladesh, as a representative to the Board of BRAC Bank Afghanistan, and on the Board of Directors of XacBank, a microfinance bank in Mongolia. 83.7%85.7%85.1% $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 2010 2011 2012 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Program Services Management and General Fundraising Program Expense % of Total $4.8 $4.9 $4.6 $3.9 $8.6 $12.1 $22.5 $32.3 $48.8 $69.6 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 2006 2007 2008 2009 2010 2011 2012

- 7. Global Partnerships | Nonprofit Investor Research 7 Detailed Financial Statements (GAAP Basis) Fiscal Year Ended June 30 2010 2011 2012 Consolidated Revenue and Expenses (GAAP Accounting Basis) Operating Revenue: Contributions $1,017,263 $723,127 $820,654 In-kind Contributions 379,786 445,724 410,923 Earned Income 2,203,425 2,456,101 3,264,727 Other Income 48,112 86,822 77,990 Net Assets Released from Restrictions 2,933,631 1,124,435 1,369,989 Total Unrestricted Revenue and Other Support $6,582,217 $4,836,209 $5,944,283 % Growth 10.6% (26.5%) 22.9% Expenses: Program Services $3,711,598 $3,927,786 $3,824,651 Supporting Services: Management and General 200,700 182,103 281,232 Fundraising 684,588 686,941 801,319 Total Expenses: $4,596,886 $4,796,830 $4,907,202 % of Revenue 69.8% 99.2% 82.6% Change in Unrestricted Net Assets $1,985,331 $39,379 $1,037,081 Changes in Temporarily Restricted Net Assets Contributions $766,180 $830,953 $2,491,860 Net Assets Released from Restrictions (2,933,631) (1,124,435) (1,369,989) Changes in Temporarily Restricted Net Assets ($2,167,451) ($293,482) $1,121,871 Change in Net Assets ($182,120) ($254,103) $2,158,952 KEY BALANCE SHEET INFORMATION Cash and Cash Equivalents $5,039,544 $13,933,537 $8,602,554 Pledges Receivable, Current 555,346 261,844 886,703 Social Investment Loans Receivable, Current Portion 5,383,896 15,762,993 17,992,058 Other 90,941 240,286 370,005 Total Current Assets $11,069,727 $30,198,660 $27,851,320 Pledges Receivable $171,265 $193,786 $739,546 Social Investment Loans Receivable, Long-Term Portion 19,067,847 19,386,350 21,275,859 Investments 50,000 63,634 63,759 Property, Plant and Equipment 43,299 166,944 155,068 Total Assets $30,402,138 $50,009,374 $50,085,552 Accounts Payable $52,032 $51,285 $93,229 Long-Term Debt, Current Portion 3,521,771 2,472,803 - Accrued Liabilities 129,563 234,452 288,068 Total Current Liabilities $3,703,366 $2,758,540 $381,297 Deferred Rent Liability $0 $60,219 $79,688 Long-Term Debt 20,914,337 41,660,283 41,935,283 Total Liabilities $24,617,703 $44,479,042 $42,396,268 Accumulated Deficit ($983,534) ($1,233,107) ($358,924) Unrestricted Net Assets 5,576,607 5,865,559 6,028,457 Temporarily Restricted Net Assets 1,191,362 897,880 2,019,751 Total Net Assets $5,784,435 $5,530,332 $7,689,284 Program Costs as a % of Total Expenses 80.7% 81.9% 77.9% G&A as a % of Total Expenses 4.4% 3.8% 5.7% Fundraising as a % of Total Expenses 14.9% 14.3% 16.3% Source: Audited Financial Statements (GAAP Acccounting Basis)

- 8. Global Partnerships | Nonprofit Investor Research 8 OTHER THIRD PARTY RATINGS BBB Wise Giving Alliance indicates that a review of Global Partnerships is in progress. Global Partnerships is not currently covered by Charity Navigator, GreatNonprofits, Philanthropedia, or GiveWell. GET INVOLVED Global Partnerships Involvement Opportunities Make a financial donation Join the team Donate Employment Come to an Event Purchase Opportunity Blend Coffee Attend Drink Partner trips Corporate Partnerships Travel Partner Support the Development team Mailing List Volunteer Connect DISCLOSURES Michael D. Ojunga certifies that he does not have any affiliation with Global Partnerships and has never made a donation to the organization. Additionally, Michael D. Ojunga has not supported directly competing organizations in a greater capacity than a nominal donation. NPI analysts and NPI as an organization do not receive any form of compensation from reviewed charities. This report is for informational purposes only and does not constitute a solicitation for donations. While the reliability of information contained in this report has been assessed by NPI, NPI makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. NPI has no obligation to update, modify or amend any report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate, or if research on the subject organization is withdrawn. Opinions and recommendations in our reports do not take into account specific reader circumstances, objectives, or needs. The recipients of our reports must make their own independent decisions regarding any organization mentioned by NPI. ABOUT NONPROFIT INVESTOR Nonprofit Investor is a nonprofit organization with the mission of improving philanthropic capital allocation and nonprofit effectiveness through research and analysis. NPI brings together volunteers with professional due diligence skills to produce independent, in‐depth evaluations of nonprofits. NPI research is available for free, public download here: www.nonprofitinvestor.org/research. To suggest a charity for NPI to review or to apply as a volunteer, please contact us: www.nonprofitinvestor.org/contact. NPI is a tax‐exempt charity under section 501(c)(3) of the Internal Revenue Code (EIN: 45‐3627609). Follow Nonprofit Investor on Twitter: @nonprofitinvest