New base 31 january 2018 energy news issue 1134 by khaled al awadi

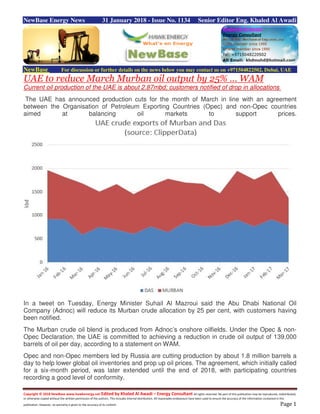

- 1. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 31 January 2018 - Issue No. 1134 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE to reduce March Murban oil output by 25% … WAM Current oil production of the UAE is about 2.87mbd; customers notified of drop in allocations The UAE has announced production cuts for the month of March in line with an agreement between the Organisation of Petroleum Exporting Countries (Opec) and non-Opec countries aimed at balancing oil markets to support prices. In a tweet on Tuesday, Energy Minister Suhail Al Mazroui said the Abu Dhabi National Oil Company (Adnoc) will reduce its Murban crude allocation by 25 per cent, with customers having been notified. The Murban crude oil blend is produced from Adnoc’s onshore oilfields. Under the Opec & non- Opec Declaration, the UAE is committed to achieving a reduction in crude oil output of 139,000 barrels of oil per day, according to a statement on WAM. Opec and non-Opec members led by Russia are cutting production by about 1.8 million barrels a day to help lower global oil inventories and prop up oil prices. The agreement, which initially called for a six-month period, was later extended until the end of 2018, with participating countries recording a good level of conformity.

- 2. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 In December 2017, Opec and non-Opec producing countries achieved an conformity level of 129 per cent, the highest since the start of the Declaration of Cooperation in 2016, according to a statement by Opec earlier this month. “Conformity levels have increased on a monthly basis, from 87 per cent in January to the outstanding current level,” Opec said. Brent, the global benchmark, is currently trading above $69 per barrel while West Texas Intermediate (WTI) is about $65 per barrel. Speaking at the Gulf Intelligence UAE forum recently, Al Mazroui said that the oil market is balancing but still has some room for improvement. “We are continuing to see market correction, as we move into 2018 and we will see more correction happening. We still have 100 million [barrels of oil] that need to be removed,” he said. Mazroui, who is also the Opec president for 2018, expects more investments to come onto the market next year due to stronger demand for oil. Adnoc announced investment of almost $109 billion throughout the value chain over the next four years and Saudi Aramco is also planning new investments in the next three years, he added. The UAE’s crude oil production in December reached 2.87 million barrels per day.

- 3. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Sipchem Mulls First U.S. Petrochemicals Investment Bloomberg - Abbas Al Lawati Saudi International Petrochemical Co CEO and Vice Chairman Ahmad Al Ohali discusses the company’s earnings. Saudi Arabia’s Sipchem is considering investing in petrochemical production in the U.S. based on shale gas in what would be the company’s first foreign venture, as it faces higher costs and a shortage of feedstock at home in Saudi Arabia. Saudi International Petrochemical Co., may seek a U.S. partner in its effort to tap into the booming shale industry, Chief Executive Officer Ahmad Al Ohali said in a Bloomberg television interview. Sipchem would initially use cash to pay for the project instead of borrowing money, he said. “Our really big potential is more into the basics in the United States based on shale gas, and we are looking into this area,” Al Ohali said. “It’s not going to be easy because we don’t know the business landscape in the U.S., but definitely we are targeting hopefully to do something this year.” The surge in U.S. shale oil and gas output in recent years has slashed America’s reliance on imported energy, threatening the market share of the Organization of Petroleum Exporting Countries and the group’s biggest member, Saudi Arabia. OPEC’s Saudi-led drive to squeeze rival producers by opening the taps on supply led prices to plummet from more than $115 a barrel in 2014. The effort failed to stop shale drillers. While OPEC and allied producers changed course and began cutting supply last year, prices haven’t risen much past $70. ‘Limited’ Growth Sipchem is seeking international opportunities amid “very limited” growth prospects in the kingdom due to a lack of feedstock for basic products, Al Ohali said. The Saudi government’s increase in feedstock prices two years ago was “a wakeup call for our industry,” he said. The company, which has a market value of 6.9 billion riyals ($1.84 billion), reported a fourth quarter profit of 164.4 million riyals on revenue of 1.28 billion riyals, beating estimates. Its shares have gained 7.3 percent this month, compared with a 4.9 percent rise in the Tadawul benchmark All Share Index, and were little changed at 18.72 riyals in Riyadh at 11:55 a.m. local time. Sipchem should benefit from a shortage of methanol in China, he said. “That’s going to make some imbalance in supply and demand globally despite the new capacity that came in the United States.”

- 4. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Ethiopia Oil Refinery Planned as Blackstone Pipeline Shelved Bloomberg + NewBase Ethiopia’s fast-growing economy has Asian investors lining up to build a new $4 billion oil refinery, even as a Blackstone Group LP-backed fuel pipeline project is shelved. The proposed 120,000 barrels-a-day plant has generated interest from Japanese, South Korean and Indian investors, said Zemedeneh Negatu, chairman of U.S.-based Fairfax Africa Fund. The refinery in Awash, east of the capital Addis Ababa, would import crude through neighboring Djibouti and along a railway recently completed by Chinese state enterprises, he said. The Asians are “very excited,” said Zemedeneh, declining to name the potential investors who have signed memorandums of understanding. “Some are big commodity trading houses.” Half of the refinery’s output would be directed to the Ethiopian market, with the remainder exported to neighboring countries in East Africa, according to Zemedeneh. Fairfax Africa has plans to eventually double the plant’s capacity amid industrial expansion and increased demand for motor vehicles. Ethiopia recorded annual average economic growth of about 10 percent over the past decade, and the International Monetary Fund estimates expansion at 8.5 percent in the current fiscal year.

- 5. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 There has also been interest from a U.S. financial firm in a project in which the Ethiopian government would be the sole fuel distributor, Zemedeneh said. Pipeline On Hold In 2015, Ethiopia and Djibouti signed framework agreements for the construction of a 550- kilometer (340-mile) pipeline to transport diesel, gasoline and jet fuel to Awash from a port on the Gulf of Aden. The work on that $1.6 billion Blackstone-backed fuel pipeline was put on hold “early last year,” Black Rhino Chief Executive Officer Brian Herlihy said in an emailed response to questions. Minister of Mines, Petroleum and Natural Gas Motuma Mekassa didn’t respond to requests for comment. The proposed Fairfax Africa refinery faces competition. In Ethiopia, the Oromia region’s government has been planning a petroleum company to import oil via Djibouti and process it at a planned refinery linked to the new railway. The company is targeting a 21 percent share of Ethiopia’s fuel market within five years, according to a feasibility study. Neighboring South Sudan expects operations to begin in 2020 on a 120,000-barrel-a-day refinery with more facilities to follow. To the south, Uganda is moving ahead with a 60,000 barrels-a-day plant that will be supplied with crude from fields being developed by Total SA, Tullow Oil Plc and China’s Cnooc Ltd.

- 6. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Norway: where a luxury Tesla has become the budget option David Reid | @cnbcdavy Marte Skogstad Allgot moved back to Oslo, Norway, from London two years ago and soon found that running a car on gas was prohibitively expensive. To her surprise, Allgot discovered it was cheaper to run a fully-electric Tesla Model S car than it was to drive a hybrid Toyota Prius. "When we added up how much we were spending on tolls and fuel it was the equivalent of buying a Model S," she told CNBC. "I still can't believe that buying what I consider to be an expensive, luxury car makes more economic sense than owning a Prius." Only full-electric vehicles in Norway don't pay tolls erected on city boundaries, and Allgot said the costs soon add up. "The toll system is electronic so you don't notice the 54 Norwegian crowns ($7) every time, but when you see that bill at the end of the month you have to ask whether it is worth it," she said. Allgot's solution was to buy a Tesla Model S, which retails for the equivalent of $80,000 in Norway. Incredibly, the country's fourth most popular car is the more expensive Model X, with a list price of $125,000. Tesla isn't the only popular electric or hybrid vehicle in the northern European country. Across 2017, and for the first time ever, electric and hybrid cars accounted for more than half of all new vehicle sales in Norway. Tesla Motors CEO Elon Musk introduces the "falcon wing" door on the Model X electric sports- utility vehicle during a presentation in Fremont, California, on September 29, 2015. The shift away from pure fossil-fuel engines has been so fast that 2017 sales of cars using some form of electric battery power topped out at 52 percent, according to the Norwegian Road Federation (OFV). Norway is an oil-rich economy that does allow for high wages, but the real push toward luxury electric vehicles (EVs) has been made possible by a huge sales tax exemption. Bent Erik Bakken, a senior principal scientist at the global assurance and risk management company DNV GL, told CNBC via telephone that Norwegian taxes on full petrol cars are about 100 percent, thus doubling the showroom price. "So then you just take that away for electric vehicles and suddenly EVs in Norway are, on average, cheaper," he said. Bakken is a co-author of a global forecast on energy that predicts almost all new sales of cars across Europe to be electric or hybrid within 20 years. The report, titled the Energy Transition

- 7. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Outlook, says for the United States, the report estimated a similar situation will be in place by the 2040s. Source: DNV GL Market share of electric vehicles in new light vehicle sales Rapid uptake in North America and India is also expected while sub-Saharan Africa, Middle East and North Africa, Latin America and North East Eurasia are identified as laggards. Denmark illustrates why subsidies are not only important to EV growth but also retain existing market appetite. For a long time, electric car buyers were spared the 180 percent import tax that Denmark applies to vehicles fueled by an internal combustion engine. Under pressure from traditional manufacturers, those tax breaks were originally set to be phased out from 2016 to 2020. But as soon as the new regime was introduced in the first three months of 2016, sales of electric vehicles dropped from nearly 2,500 units to just over 200. Shocked by the drop-off, Denmark reversed course but said it would usher in a new post-subsidy era from 2019. The ultimate aim is to have a 100 percent tax on electric vehicles by 2022. Bakken claimed the cost barrier of electric vehicles is melting away fast and that meant subsidies would lose their importance. He said he expected EVs to reach lifecycle cost parity with traditional light vehicles by 2022. The scientist also predicted that recharging infrastructure would not prove a barrier as it was no more expensive to install than traditional gas stations. "For example, when it is minus 20 degrees, it is said that the battery does not perform so well as the chemicals freeze. And there are many stories. I hear people say that they heard of someone who thought they had lots of battery charge and then two kilometers down the road, the car has no power." On concerns about power use, Bakken said his personal electricity bill had risen 5 percent from charging his car at home and fears of surge demand were overblown. "In households, you will find that there will be a demand response pricing mechanism so people will charge when it is cheaper," he said.

- 8. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 U.K: BP makes two discoveries in UK North Sea Reuters + NewBase BP has made two new oil and gas discoveries in the UK North Sea, it said on Wednesday, giving new impetus to its plans to boost production in the ageing basin into the middle of the century. The new discoveries are also the latest bright spot for the North Sea after a number of large new fields started up in recent years, helping to reverse a long and gradual decline in output since the late 1990s. “These are exciting times for BP in the North Sea as we lay the foundations of a refreshed and revitalized business that we expect to double production to 200,000 barrels a day by 2020 and keep producing beyond 2050,” Mark Thomas, BP North Sea regional president, said.

- 9. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 London-based BP said it had made one discovery in Block 29/4e in the central North Sea, named Capercaillie, and another in Block 206/9b west of Shetland, branded Achmelvich. Both wells were drilled by the Paul B Loyd Junior rig in summer 2017. The size of the resource was not disclosed. The discoveries will help boost production from BP’s recently-launched Quad 204 field in the West Shetlands as well as the Clair Ridge field, which is due to come into production this year, Thomas said. With seven field start-ups in 2017, and five set to start in 2018, BP plans to boost its production by 800,000 barrels per day (bpd) by 2020, which will be mostly gas. It produced around 3.5 million bpd last year. The company will nevertheless not change its spending plans because of rising global oil prices and is preparing to approve projects this year that can make money with prices below $40 a barrel, the head of its oil and gas division Bernard Looney told Reuters on Tuesday. NEW FIELDS And as oil prices recover to around $70 a barrel after a three-year downturn, so is activity in the North Sea. “The UK offshore oil and gas industry is stirring back to life, fueled by a robust uptick in the number of field development projects,” Oslo-based consultancy Rystad Energy said. Up to 13 fields in the UK North Sea are expected to get the go-ahead for development in 2018, compared with only four in the past two years, Rystad said. BP is 100 percent owner of Capercaillie while the Achmelvich well is operated by BP, with a 52.6 percent stake, together with Royal Dutch Shell, 28 percent, and Chevron, 19.4 percent, BP said in a statement. The Capercaillie well was drilled to a total depth of 3,750 meters and encountered light oil and gas-condensate in Paleocene and Cretaceous-age reservoirs. The well data is currently under evaluation. Options are expected to be considered for a possible tie-back development to existing infrastructure. The Achmelvich well was drilled to a total depth of 2,395 meters and encountered oil in Mesozoic- age reservoirs. Evaluation and interpretation of the well results is ongoing to assess future options.

- 10. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 U.K :Western Europe's Biggest Oil Producer Is Getting Another Fix Bloomberg + NewBase With crude back at $70 a barrel, and a petroleum industry that cut costs to the bone after the oil crash, the stage is now set for another boom. But the good times could hamper Prime Minister Erna Solberg’s main aim of moving the economy away from a reliance on oil. As optimism now returns to the economy, signs of real progress on that project are few. “Ideally, in terms of long-term sustainability, we would like to see a substantial increase in mainland investments, that the new industries that have lived in the shadow of the oil sector get a real boost,” said Kjersti Haugland, chief economist at DNB ASA, Norway’s largest bank. “Based on the macro data that we now have, we can’t say that the Norwegian economy has gone through a massive transitioning.” Half the Kingdom Offshore industry accounted for more than half of Norway's exports of goods in 2017 Source: Statistics Norway Norway’s Petroleum Directorate now predicts oil investments will rise this year for the first time since 2014 and that output will test another peak in 2023 as new fields start pumping. The real economic risks will appear after that, if the economic transformation hasn’t seen more progress. After 40 years of production, Norway’s biggest oilfields are being depleted and recent exploration in its Arctic waters has been disappointing. Here’s What’s Ahead for Western Europe’s Biggest Oil Nation “We know that the force of the oil industry in the Norwegian economy has been reduced and will be lower than what we’ve been used to,” Finance Minister Siv Jensen said in an interview this month in Oslo. “Yes, it’s an important industry for Norway, but it’s definitely important that we get more legs to stand on.” Mainland Momentum? Mainland investments have had a hard time gathering pace amid oil drop

- 11. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Source: Statistics Norway Norway was hit by an economic shock in 2014 when the price of oil more than halved in less than a year, prompting central bank Governor Oystein Olsen to warn that “winter is coming.” More than 50,000 jobs were lost in the offshore sector, but the government kept the economy afloat by dipping directly into the nation’s $1 trillion sovereign wealth fund for the first time to stimulate growth and plug budget holes. The mainland economy is also dependent on currency traders. Selling off along with oil prices over the past few years, the weakening currency has been key in boosting exports. “It’s important to keep the currency fairly weak, it’s a supporting factor along the way,” said Haugland. “We’ll see an upturn in the oil industry now, but there’s no reason to expect that we’ll return to the massive lift that we saw before the oil price drop.” Rising Again Petroleum sector share of Norway's economy and state revenue is recovering Sources: Statistics Norway (National accounts), Finance Ministry (National budget 2018), www.norskpetroleum.no

- 12. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 The hardest blow from the downturn was felt in the oil region stretching along the country’s southwest coast. From its headquarters in the oil capital Stavanger, the region’s biggest bank SpareBank 1 SR-Bank, is seeing some local companies rejigging their businesses away from oil. For example, Statoil ASA, now plans plan to plow one third of its investments into renewable energy by 2030. “What Statoil is now doing by expanding its business model is interesting, it’s easy to look at Norway as an oil and gas nation, but we’re really an energy nation,” said Kyrre Knudsen, chief economist at SpareBank 1 SR-Bank. Also searching for more legs to stand on is a company like Coast Center Base. Established at the beginning of the Norwegian oil adventure in the 1970s, the company has catered to offshore operations by supplying goods and repairing rigs. It’s now looking to get into businesses such as carbon capture and wind power. “Instead of fighting against changes, you need to swim with the current,” Kurt Rune Andreassen, the company’s chief executive officer, said in an interview this month. The head of lending to large companies at DNB says the last few years should be viewed as a wake-up call. “I think in many ways that the oil price drop three years ago was a blessing in disguise,” Harald Serck-Hanssen said in an interview. “It gave us a warning of how it will be like living in a less oil- dependent economy, and it gave many companies the opportunity to adapt.”

- 13. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase January 31 - 2018 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices fall for third day on inventory build Reuters + NewBase + Bloomberg U.S. oil prices fell for a third day on Wednesday after data from an industry body showed crude stocks rose more than expected last week, while a selloff in other commodities, stocks and bonds added to the bearish tone. U.S. West Texas Intermediate futures were down 1 percent, pushed below $64 at $63.87 by 0012 GMT. Brent crude was yet to trade. On Tuesday, U.S. crude fell 1.6 percent to close at $64.50 a barrel, the contract's decline far outpacing a 0.6 percent drop in the price of Brent. "Increasing concerns over the rising U.S. production continue to mount pressure on the commodity," Mihir Kapadia, chief executive of Sun Global Investments, said. "Over the past couple of years, U.S. producers have gained significant inroads in the global oil market industry," he said. Oil price special coverage

- 14. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 The U.S. benchmark touched a low of $63.70, its weakest level in more than aweek after rising strongly in recent months. Prices on both WTI and Brent are still on track for a fifth month of gains. But the report from the American Petroleum Institute late on Tuesday showing crude stocks rose by 3.2 million barrels last week cast a bearish pall over the market. Oil Dips as Industry Data Shows First Crude Build Since November/ Futures in New York declined further after taking its biggest tumble since early December during Tuesday’s session. The American Petroleum Institute was said to have reported crude stockpiles increased 3.23 million barrels last week. Inventories probably rose by 900,000 barrels last week, according to the median estimate of analysts surveyed by Bloomberg. Weakness in the stock market also led to crude’s decline. A build in crude is “fairly realistic,” James Williams, president of London, Arkansas- based energy researcher WTRG Economics, said by telephone. “Either this week or next week, we are going to see builds,” as refiners enter seasonal maintenance. The API report was also said to show that gasoline stockpiles climbed by 2.69 million barrels last week, which would make twelve consecutive weeks of increases if EIA data confirms it. As the Organization of Petroleum Exporting Countries works to reduce output, concern that U.S. crude production will hit new records remains on investors’ minds. Yet, OPEC and Russia will let oil prices climb as high as the market can bear, according to Gary Ross, global head of oil analytics at S&P Global Platts. While crude stockpiles have dropped for 10 straight weeks, gasoline supplies have been on the rise since early November, and analysts estimate they rose by another 2

- 15. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 million barrels last week. Inventory figures will be released by the Energy Information Administration on Wednesday. At the same time, U.S. crude output could top 10 million barrels a day at any time. Production reached 9.88 million barrels a day last week, the highest in weekly government data going back to 1983. West Texas Intermediate crude for March delivery traded at $64.07 at 4:38 p.m. after settling at $64.50 a barrel on the New York Mercantile Exchange. Total volume traded was about 7 percent above the 100-day average. Brent for March settlement slid 44 cents to end the session at $69.02 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a premium of $4.52 to WTI, after reaching the smallest premium since August on Monday. As the spread tightens between WTI and Brent, crude exports from the U.S. may become less attractive, leading to storage buildups. “Exports are being hurt a bit by the reduction in the Brent-WTI spread, which should also help inventories replenish. This is the slack demand period,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund. It’s also “registering with folks that crude oil output is just soaring.” The S&P 500 Energy Index fell as much as 2.1 percent, with Chesapeake Energy Corp. falling 6.4 percent. Noble Energy Inc., Newfield Exploration Co. and Apache Corp. all tumbled more than 4 percent. Front-month gasoline futures briefly jumped as much as 0.9 percent before settling 2 percent lower at $1.8954 a gallon, the biggest drop since mid-December. The quick rise was seen as potentially a “fat finger” trade. The February contract expires Wednesday. The Dow Jones Industrial Average tumbled 362 points, helping to send U.S. stocks to the biggest two-day decline since May. “The crude market is looking at the weakness in stock market. That’s making the oil traders a little nervous,” Phil Flynn, senior market analyst at Price Futures Group Inc. in Chicago, said by telephone. At the same time, “there is an expectation that we will see the first increase in supply in a long time.”

- 16. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Special Coverage News Agencies News Release January 31-2017 As Oil Majors Escape the Rout, Key Questions Emerge for 2018 By Kelly Gilblom and Kevin Crowley Crude prices are on the rise as OPEC curbs production for a second year. New efficiencies have dropped the cost of drilling in America’s fertile shale basins, pushing U.S. drillers to record output. Investors are insisting on higher returns. And companies are dealing with changing U.S. tax rules. The first hints showing how Big Oil -- an elite clique of companies so massive their combined annual sales dwarfs the economies of all but 15 of the world’s nations -- is preparing to deal with these changes will come in fourth-quarter earnings reports starting this week. First up, Royal Dutch Shell Plc, Exxon Mobil Corp. and Chevron Corp. These are the key questions investors will be asking: 1. Who gets the cash? The question everyone is asking is what will oil companies do with the additional cash with Brent at $70 barrel. Will more money go to shareholders in the form of dividend increases and buybacks, or will spending pick up? The supermajors slashed expenditures during the downturn and focused on efficiency. Some analysts are worried the companies will waver from their hard- earned financial discipline now that they are once again flush with cash. Years of cost cuts mean explorers are starting to repair balance sheets and allay concerns about fully funding dividends. Exxon and Shell have said they are generating enough cash to cover the payouts. Chevron may raise its dividend this week for the first time since late 2016, according to Bloomberg estimates. BP, which said it will reduce its cash breakeven to $40 a barrel oil by the end of the decade, has some way to go as it is still paying penalties related to the 2010 Deepwater Horizon disaster.

- 17. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 There are many reasons for the industry to feel sunny this earnings season. It is no longer lagging the broader market. Still, there’s some catching up to do with oil’s surge. The companies are facing long-term questions about the sustainability of fossil fuels with the world increasingly focusing more on cleaner energy and electric vehicles. 2. Tax overhaul impacts? Corporate America is cheering President Donald Trump’s tax overhaul but the impact on oil companies is likely to be more muted. U.S. upstream operations typically aren’t big taxpayers because they invest heavily in projects over many years before turning a profit, so they won’t benefit as much as other industries. Other provisions such as lowering deductions for interest payments and reducing the ability to amortize exploration costs also minimize the benefits. The Taxman Cometh The tax law could limit write-offs of billions in oil exploration costs, like these 2016 outlays Source: Bloomberg Intelligence analysis of corporate filings

- 18. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 BP and Shell said they may write off as much as $4 billion in American tax assets as a result of the reform. But investors should be wary about reading across to other companies: shale explorer EOG Resources Inc. said it would post a one-time gain of $2.2 billion. Exxon and Chevron have yet to comment. 3. Pushing the Permian? U.S. shale production, which will reach a record this year, has upended energy markets, geopolitics and major oil companies’ capital spending. Once overlooked as niche and inconsequential, the Permian Basin, the most prolific U.S. field, is now a key part of Exxon and Chevron’s planning for the next decade. Chevron has committed to investing $3.3 billion in the region this year and sees production rising at least 50 percent by the early 2020s. Exxon last year spent as much as $6.6 billion on drilling rights in New Mexico and on Tuesday announced plans to triple output in the region by 2025. There have been few further details so investors will be looking closely for commentary around whether they will be able to reverse recent net losses at their U.S. upstream divisions. Shell entered the Permian six years ago with the $1.9 billion purchase of rights to more than half a million acres from Chesapeake Energy Corp. Now, the European giant is considered a potential suitor for the Permian assets BHP Billiton Ltd. is seeking to unload because Shell’s existing holdings are nearby. Home Headache Exxon and Chevron have lost money in U.S. upstream in most of the last 10 quarters

- 19. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 4. Downstream & chemicals? In a world where some forecasters are seeing oil demand peaking as early as 2030 due to growth in electric vehicles, oil majors know they must adapt to survive. The CEOs of Exxon and Shell both came from their downstream divisions as did Chevron’s incoming boss, raising the question of whether the companies’ boards see a long-term necessity of thinking beyond oil and gas production. BP’s upstream boss Bernard Looney on Tuesday said alternative energies will make petroleum obsolete -- the only question is when. Chemical manufacturing provides a natural hedge to energy prices because they benefit from lower input costs when oil or gas are cheap. Exxon’s chemicals division provided more than half its net income in 2016. Meanwhile Shell and Total has been vocal about investing in renewable energy sources. Will companies increase investments in chemicals, or commit to new renewable energy ventures?

- 20. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 28 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase January 2018 K. Al Awadi

- 21. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21

- 22. Copyright © 2018 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 For Your Recruitments needs and Top Talents, please seek our approved agents below