Gst list of changes

•

0 likes•172 views

The document summarizes key changes made to GST bills introduced in the Lok Sabha. Some of the key points include: - GST will not apply to the state of Jammu and Kashmir. Certain supplies by employers to employees up to Rs. 50,000 will also be exempt. - Sale of land and existing buildings will not be considered supply of goods or services except for under-construction buildings. - The upper limit of GST rates has been increased to 20% for CGST and 40% for IGST. - Composition scheme has been expanded to the restaurant sector at 2.5% and reduced rates for manufacturers and traders.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Budget 2016 proposals under Central Excise, Customs and Service Tax lawsBudget 2016 Proposals under Central Excise, Customs and Service Tax laws

Budget 2016 Proposals under Central Excise, Customs and Service Tax lawsSBS AND COMPANY LLP, CHARTERED ACCOUNTANTS

More Related Content

What's hot

Budget 2016 proposals under Central Excise, Customs and Service Tax lawsBudget 2016 Proposals under Central Excise, Customs and Service Tax laws

Budget 2016 Proposals under Central Excise, Customs and Service Tax lawsSBS AND COMPANY LLP, CHARTERED ACCOUNTANTS

What's hot (20)

Budget 2016 Proposals under Central Excise, Customs and Service Tax laws

Budget 2016 Proposals under Central Excise, Customs and Service Tax laws

GST- who can issue Tax Invoice, Credit Note, Debit Note, Payment Voucher, De...

GST- who can issue Tax Invoice, Credit Note, Debit Note, Payment Voucher, De...

Budget 2016-2017 - analysis of indirect tax proposals - general

Budget 2016-2017 - analysis of indirect tax proposals - general

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

A Presentation on Service Tax Overview and Recent Developments dated 06.07....

A Presentation on Service Tax Overview and Recent Developments dated 06.07....

Analysis of Proposed Amendments in GST Law in Budget 2021

Analysis of Proposed Amendments in GST Law in Budget 2021

Viewers also liked

Viewers also liked (14)

CEO's Guide to Sound Decision Making in 21st Century

CEO's Guide to Sound Decision Making in 21st Century

AMIA Joint Summits 2017 - Electronic phenotyping with APHRODITE and the Obser...

AMIA Joint Summits 2017 - Electronic phenotyping with APHRODITE and the Obser...

MERI NAZAR--Contribution of Solcrats in my SBL Journey

MERI NAZAR--Contribution of Solcrats in my SBL Journey

Ecrinal - Beauty for Nails and Eyelashes. Shop Now!

Ecrinal - Beauty for Nails and Eyelashes. Shop Now!

Best practices for automating your import processes

Best practices for automating your import processes

Who will be taking decisions in the boardroom of the future?

Who will be taking decisions in the boardroom of the future?

5 Reasons a Forklift Preventative Maintenance Plan Makes Sense

5 Reasons a Forklift Preventative Maintenance Plan Makes Sense

How Can PHP Web Development Benefits to My Business?

How Can PHP Web Development Benefits to My Business?

Gaceta de Ciudades Sustentables - Centro Mario Molina

Gaceta de Ciudades Sustentables - Centro Mario Molina

Similar to Gst list of changes

Similar to Gst list of changes (20)

Appliacbility Issues & Solutions under GST by CA. VInay Bhushan

Appliacbility Issues & Solutions under GST by CA. VInay Bhushan

Gst Alert 10 : Changes in registration and return filing norms

Gst Alert 10 : Changes in registration and return filing norms

GST Alert 10 Changes in Registration and Return filing norms

GST Alert 10 Changes in Registration and Return filing norms

Critical compliance under GST to be taken care of before 30 September 2018

Critical compliance under GST to be taken care of before 30 September 2018

DECODING GST- INPUT TAX CREDIT OF CGST, SGST AND IGST

DECODING GST- INPUT TAX CREDIT OF CGST, SGST AND IGST

GST DRAFT key points by CA Firm Challani Agarwal & Associates, Pune.

GST DRAFT key points by CA Firm Challani Agarwal & Associates, Pune.

More from Karan Puri

More from Karan Puri (20)

India Signs the Multilateral Convention to Implement Tax Treaty Related Measu...

India Signs the Multilateral Convention to Implement Tax Treaty Related Measu...

CBDT has notified cost inflation index (CII) for FY 2017-18 with new base yea...

CBDT has notified cost inflation index (CII) for FY 2017-18 with new base yea...

Clarification on removal of Cyprus from the list of notified jurisdictional a...

Clarification on removal of Cyprus from the list of notified jurisdictional a...

CBDT clarifies - lease rentals in industrial park/ SEZ to be treated as busin...

CBDT clarifies - lease rentals in industrial park/ SEZ to be treated as busin...

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

Budget 2017 takes Steps to discourage Cash transactions & curb Black Money

CBDT Issues Dreaft Notification for Taxability on Non-stt-shares

CBDT Issues Dreaft Notification for Taxability on Non-stt-shares

CBDT notice-to-taxpayers re cash-deposit-verifications

CBDT notice-to-taxpayers re cash-deposit-verifications

Recently uploaded

Recently uploaded (20)

BDSM⚡Call Girls in Sector 135 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 135 Noida Escorts >༒8448380779 Escort Service

2024 03 13 AZ GOP LD4 Gen Meeting Minutes_FINAL.docx

2024 03 13 AZ GOP LD4 Gen Meeting Minutes_FINAL.docx

Enjoy Night ≽ 8448380779 ≼ Call Girls In Palam Vihar (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Palam Vihar (Gurgaon)

Nurturing Families, Empowering Lives: TDP's Vision for Family Welfare in Andh...

Nurturing Families, Empowering Lives: TDP's Vision for Family Welfare in Andh...

THE OBSTACLES THAT IMPEDE THE DEVELOPMENT OF BRAZIL IN THE CONTEMPORARY ERA A...

THE OBSTACLES THAT IMPEDE THE DEVELOPMENT OF BRAZIL IN THE CONTEMPORARY ERA A...

Group_5_US-China Trade War to understand the trade

Group_5_US-China Trade War to understand the trade

KAHULUGAN AT KAHALAGAHAN NG GAWAING PANSIBIKO.pptx

KAHULUGAN AT KAHALAGAHAN NG GAWAING PANSIBIKO.pptx

Verified Love Spells in Little Rock, AR (310) 882-6330 Get My Ex-Lover Back

Verified Love Spells in Little Rock, AR (310) 882-6330 Get My Ex-Lover Back

BDSM⚡Call Girls in Greater Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Greater Noida Escorts >༒8448380779 Escort Service

Transformative Leadership: N Chandrababu Naidu and TDP's Vision for Innovatio...

Transformative Leadership: N Chandrababu Naidu and TDP's Vision for Innovatio...

BDSM⚡Call Girls in Sector 143 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 143 Noida Escorts >༒8448380779 Escort Service

2024 02 15 AZ GOP LD4 Gen Meeting Minutes_FINAL_20240228.docx

2024 02 15 AZ GOP LD4 Gen Meeting Minutes_FINAL_20240228.docx

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 47 (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 47 (Gurgaon)

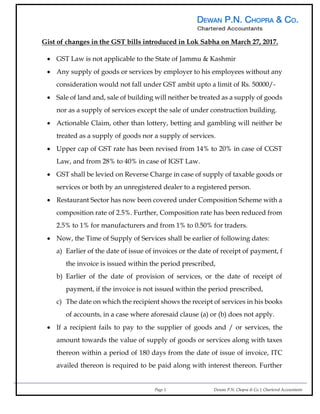

Gst list of changes

- 1. Page 1 Dewan P.N. Chopra & Co.| Chartered Accountants Gist of changes in the GST bills introduced in Lok Sabha on March 27, 2017. GST Law is not applicable to the State of Jammu & Kashmir Any supply of goods or services by employer to his employees without any consideration would not fall under GST ambit upto a limit of Rs. 50000/- Sale of land and, sale of building will neither be treated as a supply of goods nor as a supply of services except the sale of under construction building. Actionable Claim, other than lottery, betting and gambling will neither be treated as a supply of goods nor a supply of services. Upper cap of GST rate has been revised from 14% to 20% in case of CGST Law, and from 28% to 40% in case of IGST Law. GST shall be levied on Reverse Charge in case of supply of taxable goods or services or both by an unregistered dealer to a registered person. Restaurant Sector has now been covered under Composition Scheme with a composition rate of 2.5%. Further, Composition rate has been reduced from 2.5% to 1% for manufacturers and from 1% to 0.50% for traders. Now, the Time of Supply of Services shall be earlier of following dates: a) Earlier of the date of issue of invoices or the date of receipt of payment, f the invoice is issued within the period prescribed, b) Earlier of the date of provision of services, or the date of receipt of payment, if the invoice is not issued within the period prescribed, c) The date on which the recipient shows the receipt of services in his books of accounts, in a case where aforesaid clause (a) or (b) does not apply. If a recipient fails to pay to the supplier of goods and / or services, the amount towards the value of supply of goods or services along with taxes thereon within a period of 180 days from the date of issue of invoice, ITC availed thereon is required to be paid along with interest thereon. Further

- 2. Page 2 Dewan P.N. Chopra & Co.| Chartered Accountants provision has also been made for reavailing the credit reversed earlier at the time of actual payment. Credit of Rent-a-cab, life insurance, and health insurance allowed, if used for making an outward taxable supply of same category or as a part of taxable composite or mixed supply. The demand of centralized registration by large service providers seems to be rejected and registration shall be required to be taken in every State from where supply of goods and /or services is made. ITC on pipeline outside factory premises and telecommunication towers shall not be available even if used in the course or furtherance of business. Now a registered person, whose aggregate turnover in the preceding financial year did not exceed Rs. 50 Lakhs, may OPT to pay under composition scheme without any requirement to seek permission from the proper officer. The Compensation Law provides for levy of cess over and above the peak rate on paan masala, tobacco, aerated waters, luxury cars and coal.