Financial Resources Management Exercises

Finance is perceived as a key factor of business organisations and all activities that an organisation implements requires a commitment of financial resources (Caralli et al., 2010). Therefore, Financial Resources Management (FRM) is formed for the purpose to request, receive, manage, and apply financial resources, such as external sources or internal sources, to support resilience objectives and requirements. The aim of this essay assignment refers to the importance of FRM in business and it is divided into two parts. The first part focuses on analysing the financial statement of Apollo Group Plc retailer, and brings out comments as assessments on this company's financial management after calculating and interpreting the ratios in their report reasonably. The second part focuses on considering the directors' investment of Delos Ltd (Media Division). By calculating the costs, capital as net cash flows, accounting rate and so on carefully, this part will identify whether the project should be accepted or not and also give some discussion on that.

Recommended

Recommended

More Related Content

What's hot

What's hot (12)

Viewers also liked

Viewers also liked (12)

Similar to Financial Resources Management Exercises

Similar to Financial Resources Management Exercises (20)

More from Maxie Tran

More from Maxie Tran (13)

Recently uploaded

Recently uploaded (20)

Financial Resources Management Exercises

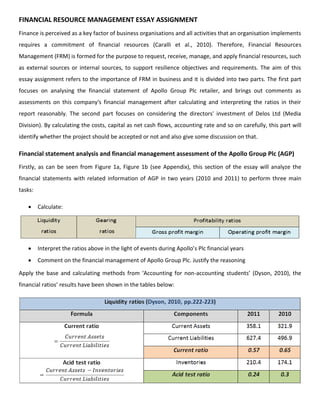

- 1. FINANCIAL RESOURCE MANAGEMENT ESSAY ASSIGNMENT Finance is perceived as a key factor of business organisations and all activities that an organisation implements requires a commitment of financial resources (Caralli et al., 2010). Therefore, Financial Resources Management (FRM) is formed for the purpose to request, receive, manage, and apply financial resources, such as external sources or internal sources, to support resilience objectives and requirements. The aim of this essay assignment refers to the importance of FRM in business and it is divided into two parts. The first part focuses on analysing the financial statement of Apollo Group Plc retailer, and brings out comments as assessments on this company's financial management after calculating and interpreting the ratios in their report reasonably. The second part focuses on considering the directors' investment of Delos Ltd (Media Division). By calculating the costs, capital as net cash flows, accounting rate and so on carefully, this part will identify whether the project should be accepted or not and also give some discussion on that. Financial statement analysis and financial management assessment of the Apollo Group Plc (AGP) Firstly, as can be seen from Figure 1a, Figure 1b (see Appendix), this section of the essay will analyze the financial statements with related information of AGP in two years (2010 and 2011) to perform three main tasks: Calculate: Interpret the ratios above in the light of events during Apollo’s Plc financial years Comment on the financial management of Apollo Group Plc. Justify the reasoning Apply the base and calculating methods from ‘Accounting for non-accounting students’ (Dyson, 2010), the financial ratios’ results have been shown in the tables below:

- 2. Based on the calculations and results above, it can be assessed that in order to pay the current liabilities, AGP company was only operating in short-term for its current assets; because the value of the two current ratios in 2010 and 2011 were both less than 1 (0.65 and 0.57 respectively). It also can be argued that if the company could not increase its current assets significantly during the year, it would not be able to pay its debts at the end of this year. As a consequence, this might put the company into a risky condition. Also, when looking at the reduction of the acid test ratio (from 0.3 to 0.24), it seems to certify the financial management of AGP unsafely. In addition, the ability of company to cover its short-term liabilities, with its current assets, will be lower if there is no storage of its inventory, which is not converted into cash easily and speedily. Generally speaking, the insolvency risk of the company which based on data of the liquidity ratios shows a negative effect on both itself and its shareholders. As can be seen, although there was a slow increase of (84.62%) to (11.86%), the gearing ratio is still negative. This indicates that the company's equity was lower than its long-term loans and the company was dependent on long-term liabilities that could create a potential risk to the structure and organization of its capital. Besides, interest cover ratio also fell (20.25 to 4.16) which illustrated that the company's budgets were shrinking after its payment of interest. If this trend continues, AGP can face many more financial difficulties in the near future.

- 3. These profitability ratios figured out a significant reduction in the AGP's sale of its goods. Indeed, it cannot be denied that company's operations were showing the signs of going down; the gross profit margin ratio was dropped (10.39% to 7.74%). At the same time, operating profit margin ratio had a deficit by more than 2 times (4.88% to 2:02%) which showed the reduction of AGP's net profit compared to its amount of sales excessively. Taking everything into consideration with the additional notes about a subsidiary, Ottakar Plc (see Appendix), the acquisition of Ottakar would not bring real value to AGP; because of AGP’s financial resources management issues. Moreover, the assessment of financial statements through the ratios above led to an observation that this acquisition would bring more harm than good. As the third column as additional column in balance sheet and income statement (see Figure 1a, Figure 1b in Appendix), it shows the difference in value in 2 years, 2010 and 2011, after AGP acquired Ottakar. Although total assets, inventories, plants and equipment of AGP were all increased (£110.7m, £36.3m and £7.3m respectively) when two companies merged, all of these cannot be converted into cash to cover AGP's liabilities speedily. In addition to this, most AGP’s borrowing were in short-term. It can be argued that the AGP has used the short-term loans to buy Ottakar; and based on the results from the financial statements, AGP must take risks to face the problems of solving and paying its debts. Furthermore, AGP challenged other difficulties as the reduction its net profit (£40.1m) and even its turn-over has increased (£68.6m), it might not compensate for the increase in the negative value of its cost-of-sales. The collapse of stock prices (decreased from 178p to 113p) illustrated that AGP was not only less profitable than but its shareholders also got profit less that reduced its attractiveness on the investors. In summary, the decision of Apollo Group Plc (AGP) to acquire Ottakar did not help it to promote its business activities, but also brought the risk of pushing it into bankruptcy. It can be suggested that AGP's problems could have been mitigated, if AGP has chosen carefully for the acquisitions by non-current liabilities (e.g. shares or long-term loans). Investment rating of the directors of Delos Ltd (Media Division) Secondly, the task of this essay's part is to review and evaluate the investment of Delos directors and with the calculations, it indicated that this is an unreasonable project. The work proposed for this section is: Calculate the following and advice the board of directors of Delos Ltd whether the project should be accepted or not on the basis of these calculations: Discuss the advantages and disadvantages of discounted payback period, net present value (NPV) and internal rate of return (IRR)

- 4. As consider the input data of this project, it can be seen it is not necessary to assess the £30,000 which paid for feasibility; because it is a sunk cost that not affects the process of investment evaluation. Also, the customer database has no more value or residual value of this project is zero after four years. Similarly, apply the calculating methods which are outlined in Dyson (2013), combine with the table of net cash flows of this investment and use the Present Value Table for the cost of capital of 8% (see Figure 2&3 in Appendix), the tables and formulas below will figure out the results of the tasks' requirements above:

- 5. According to the above results, the Delos directors should make this investment; because the net present value (NPV) is positive and the accounting rate of return (ARR) is greater than the Delos's minimum target of earnings for each division of 10% & return on average capital employed. Nonetheless, they should not take this project; because the payback period as also discounted payback period is longer than their target of payback for three years. Eventually, by using the different assessing methods as applied above, the results which are recorded can conflict with each other. Therefore, the main point is to know which method will be used effectively. Finally, as also synthesizing the knowledge from Dyson (2010), this table below will give a discussion on the advantages and disadvantages of some investment appraisal techniques.

- 6. BIBLIOGRAPHY Caralli, R. A., Allen, J. H., Curtis, P. M., White, D.W. and Young, L. R. (2010) ‘CERT® Resilience Management Model, Version 1.0’, CERT Program, May 2010 [Online]. Available at: http://www.cert.org/resilience/ download/FRM_PA.pdf [Accessed at: 28th October 2013] Collis, J. & Hussey, R. (2007) Business Accounting, 1st Edition. Basingstoke: Palgrave Macmillan Dyson, J. R. (2010) ‘Accounting for non-accounting students’, 8th Edition. Pearson Education Limited [Online]. Available at: http://web.kku.ac.th/chrira/Non%20Acct.%20Dyson.pdf [Accessed at: 28th October 2013] McGraw-Hill (2005) ‘Brealey-Myers-Allen: Principles of Corporate Finance’, 8th Edition [Online]. Available at: http://jcooney.ba.ttu.edu/fin3322/Brealey%20Files/Appendix%20A%20-%20Present%20Value%20Ta bles.pdf [Accessed at: 28th October 2013] Thomas, A. & Ward, A. M. (2009) Introduction to Financial Accounting, 6th Edition. New York: McGraw-Hill

- 7. APPENDIX Figure 1a. Balance sheet as at 30 April in 2010 and 2011 years of Apollo Group Plc

- 8. Figure 1b. Income statement as at 30 April in 2010 and 2011 years of Apollo Group

- 9. Figure 2. Net Cash flows of Delos Ltd directors’ investment Figure 3. Present Value Tables (McGraw-Hill, 2005)