LBS Bina Group's Financial Trends

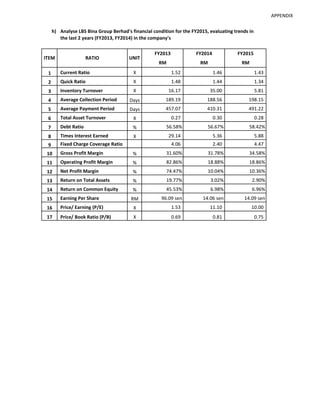

- 1. APPENDIX h) Analyse LBS Bina Group Berhad's financial condition for the FY2015, evaluating trends in the last 2 years (FY2013, FY2014) in the company's FY2013 FY2014 FY2015 RM RM RM 1 Current Ratio X 1.52 1.46 1.43 2 Quick Ratio X 1.48 1.44 1.34 3 Inventory Turnover X 16.17 35.00 5.81 4 Average Collection Period Days 189.19 188.56 198.15 5 Average Payment Period Days 457.07 410.31 491.22 6 Total Asset Turnover X 0.27 0.30 0.28 7 Debt Ratio % 56.58% 56.67% 58.42% 8 Times Interest Earned X 29.14 5.36 5.88 9 Fixed Charge Coverage Ratio 4.06 2.40 4.47 10 Gross Profit Margin % 31.60% 31.78% 34.58% 11 Operating Profit Margin % 82.86% 18.88% 18.86% 12 Net Profit Margin % 74.47% 10.04% 10.36% 13 Return on Total Assets % 19.77% 3.02% 2.90% 14 Return on Common Equity % 45.53% 6.98% 6.96% 15 Earning Per Share RM 96.09 sen 14.06 sen 14.09 sen 16 Price/ Earning (P/E) X 1.53 11.10 10.00 17 Price/ Book Ratio (P/B) X 0.69 0.81 0.75 ITEM UNITRATIO

- 2. APPENDIX h) Analyse LBS Bina Group Berhad's financial condition for the FY2015, evaluating trends in the last 2 years (FY2013, FY2014) in the company's FY2013 FY2014 FY2015 RM RM RM 1 925,492,766 1,223,704,038 1,332,051,755 609,599,483 839,094,406 934,070,044 X = 1.52 = 1.46 = 1.43 2 902,917,650 1,210,679,947 1,255,514,483 609,599,483 839,094,406 934,070,044 X = 1.48 = 1.44 = 1.34 3 364,955,568 455,874,300 445,041,756 22,575,116 13,024,091 76,537,272 X = 16.17 = 35.00 = 5.81 4 174,316,241 181,575,618 196,123,831 921,404.123 962,933.951 989,786.784 Days = 189.19 = 188.56 = 198.15 5 Days = 457.07 = 410.31 = 491.22 6 533,532,722 668,265,030 680,295,861 2,009,812,670 2,219,634,894 2,434,777,794 X = 0.27 = 0.30 = 0.28 7 1,137,172,437 1,257,780,460 1,422,405,095 2,009,812,670 2,219,634,894 2,434,777,794 % = 56.58% = 56.67% = 58.42% 8 442,098,118 126,171,744 128,300,833 15,170,850 23,533,952 21,831,551 X = 29.14 = 5.36 = 5.88 9 566,601,544 176,019,511 137,193,748 139,674,276 73,383,719 30,724,466 = 4.06 = 2.40 = 4.47 10 168,577,154 212,390,730 235,254,105 533,532,722 668,265,030 680,295,861 % = 31.60% = 31.78% = 34.58% 11 442,098,118 126,171,744 128,300,833 533,532,722 668,265,030 680,295,861 % = 82.86% = 18.88% = 18.86% 12 397,323,654 67,093,761 70,495,985 533,532,722 668,265,030 680,295,861 % = 74.47% = 10.04% = 10.36% 13 397,323,654 67,093,761 70,495,985 2,009,812,670 2,219,634,894 2,434,777,794 % = 19.77% = 3.02% = 2.90% = = = = = = = = = = = = = = = = = = = = = = = = : ITEM Average Payment Period : Total Asset Turnover : RATIO Inventory Turnover : : Operating Profits Interest Expense Operatings Profits Sales Net Income Debt Ratio : Times Interest Earned : Net Profit Margin : Return on Total Assets (ROA) : Earning Available for Common Stockholders Total Assets Sales Fixed-Charge Coverage Ratio : Gross Profit Margin : Operating Pofit Margin UNITFORMULA EBIT + Fixed Charge (before taxes) Fixed Charge (before taxes) + Interest Sales - Cost of Good Sold Sales = = = = = = = Current Assets Current Liabilities Cost of Good Sold Inventory Sales Total Assets Total Debt Total Assets Account Receivable Annual Credit Sales / 365 Current Assets - Inventory Average Collection Period Account Payble Account Purchase x 365 = =Current Ratio : Quick Ratio : Current Liabilities = = = = = = 457,014,224 364,955,568 x 365 512,464,914 455,874,300 𝑥 365 598,944,944 445,041,756 𝑥 365

- 3. APPENDIX h) Analyse LBS Bina Group Berhad's financial condition for the FY2015, evaluating trends in the last 2 years (FY2013, FY2014) in the company's FY2013 FY2014 FY2015 RM RM RM ITEM RATIO UNITFORMULA 14 397,323,654 67,093,761 70,495,985 872,640,233 961,854,434 1,012,372,699 % = 45.5% = 7.0% = 7.0% 15 392,662,537 69,929,925 76,074,430 408,618,153 497,413,874 539,759,293 RM = 0.9610 = 0.1406 = 0.1409 16 1.47 1.56 1.41 0.96 0.14 0.14 X = 1.53 = 11.10 = 10.00 17 1.47 1.56 1.41 2.14 1.93 1.88 X = 0.69 = 0.81 = 0.75 = = = = = = = = = = == Market Price Per Share Earnings Per Share Market Price Per Share Equity Book Value Per Share Number of Share of Common Stock Outstanding Return on Common Equity : Earning Per Share : Price/ Earning (P/E) : Price/ Book Ratio (P/B) : Earning Available for common stockholders Net Income Total Common Equity

- 4. APPENDIX Balance Sheet FY2013 FY2014 FY2015 RM RM RM Non-Current Assets Property, plant and equipment 212,749,463 214,444,731 240,941,611 Capital work-in-progress 3,306,077 208,447 6,229,079 Land and property development costs 392,462,614 347,549,001 515,026,439 Investment properties 6,524,170 33,197,563 33,767,090 Investment in subsidiary compaines - - - Investment in associated companies 2,993,256 13,868,068 13,879,340 Trade receivables 13,726,217 - - Promissory notes 219,098,880 159,661,639 100,498,924 Other investments 138,449,101 136,869,815 94,983,631 Goodwill on consolidation 94,154,754 87,142,327 84,217,235 Deferred tax assets 855,372 2,989,265 13,182,690 Total Non-Current Assets 1,084,319,904 995,930,856 1,102,726,039 Current Assets Land and property development costs 237,730,432 383,729,714 437,734,614 Inventories 22,575,116 13,024,091 76,537,272 Amount owing by customers on contracts - 3,693,953 56,017 Accrued bulling in respect of propety development cost 71,047,149 123,689,261 149,080,582 Trade receivables 174,316,241 181,575,618 196,123,831 Others receivables 23,496,646 63,631,041 92,873,289 Promissory note 100,573,440 85,866,581 105,523,704 Other investments - 27,070,770 38,488,161 Amount owing by subsidiary companies - - - Tax recoverable 5,712,285 8,984,728 8,042,029 Fixed deposits with licensed banks 152,756,932 160,983,954 33,471,075 Cash held under Housing Developmeny Accounts 57,977,521 89,132,344 87,735,381 Cash and bank balances 78,610,013 82,321,983 106,385,800 924,795,775 1,223,704,038 1,332,051,755 Non-Current asstes classified as held for sale 696,991 - Total Current Assets 925,492,766 1,223,704,038 1,332,051,755 Total Assets 2,009,812,670 2,219,634,894 2,434,777,794 Equity Share capital 479,651,357 538,298,257 551,437,117 Share premium 26,641,899 44,586,608 48,298,035 Treasury Shares (9,541,438) (14,678,685) (8,634,411) Other reserves (42,942,110) (38,422,577) (24,605,115) Retained profits/ (Accumulated losses) 415,847,590 439,277,991 465,165,545 Equity attributable to owners of the Parent 869,657,298 969,061,594 1,031,661,171 Non-controlling interest 2,982,935 (7,207,160) (19,288,472) Total Equity 872,640,233 961,854,434 1,012,372,699

- 5. APPENDIX Balance Sheet FY2013 FY2014 FY2015 RM RM RM Non-Current Liabilities Islamic Securities 30,000,000 - - Bank borrowings 287,969,337 274,566,258 287,939,163 Trade payables 119,328,319 50,854,138 93,613,370 Other payables 47,432,572 48,591,303 56,228,935 Finance lease payables 3,303,044 3,688,384 5,099,292 Amount owing to a subsidiary company - - - Deferred tax liabilities 39,539,682 40,985,971 45,454,291 Total Non-Current Liabilities 527,572,954 418,686,054 488,335,051 Current Liabilities Amount owing to customers on Contracts 3,612,851 5,093,951 5,602,800 Progress billing in respect of property development costs 77,221,417 116,799,940 45,209,124 Trade payables 199,457,872 277,401,479 315,942,280 Other payables 256,536,875 234,037,527 281,302,004 Bank overdrafts 761,587 13,263,668 43,665,940 Finance lease payables 1,019,477 1,025,908 1,700,660 Islamic Securities - 10,000,000 - Bank borrowings 60,035,307 173,964,415 229,765,752 Amount owing to subsidiary companies - - - Tax payables 10,954,097 7,507,518 10,881,484 Total Current Liabilities 609,599,483 839,094,406 934,070,044 Total Liabilities 1,137,172,437 1,257,780,460 1,422,405,095 Total Equity and Liabilities 2,009,812,670 2,219,634,894 2,434,777,794

- 6. APPENDIX Income Statement FY2013 FY2014 FY2015 RM RM RM Revenue 533,532,722 668,265,030 680,295,861 Cost of sales (364,955,568) (455,874,300) (445,041,756) Gross Profit 168,577,154 212,390,730 235,254,105 Other income 359,117,909 29,795,333 28,072,285 Admistrative and operating expenses (85,596,945) (116,014,319) (135,025,557) Profit from operations 442,098,118 126,171,744 128,300,833 Finance costs (15,170,850) (23,533,952) (21,831,551) Share of profit in associated companies (25,347) 1,493,262 1,618,371 Profit before taxation 426,901,921 104,131,054 108,087,653 Taxation (32,886,164) (37,035,293) (37,591,668) Profit from continuing operations 394,015,757 67,095,761 70,495,985 Discontinued operations Profit from discontinued operations 3,307,897 - - Net profit for the financial year 397,323,654 67,095,761 70,495,985 Other comprehensive income, net of tax: Exchange transiation differences for foreign operations 13,682,663 29,514,783 64,911,675 Transactions with non-controlling interests 271,036 - - (Loss)/ Gain on revaluation of available-for- sale financial asstes - 4,646,143 (21,232,278) Reclassification adjustment for disposal of available-for-sale-financial asstes - 1,465,100 1,888,206 13,953,699 35,626,026 45,567,603 Total comprehensive income for the financial year 411,277,353 102,721,787 116,063,588 Net profit for the financial year attributable to : Owners of the Parent 392,662,537 69,929,925 76,074,430 Non-controlling interests 4,661,117 (2,836,164) (5,578,445) 397,323,654 67,093,761 70,495,985

- 7. APPENDIX Income Statement FY2013 FY2014 FY2015 RM RM RM Total comprehensive income for the financial year attributable to: Owners of the Parent 399,978,862 106,711,661 126,835,601 Non-controlling interest 11,298,491 (3,991,874) (10,772,013) 411,277,353 102,719,787 116,063,588 Earnings per share attributable to owners of the Parent (sen) Basic earnings per share Profit from continuing operations 95.40 14.06 14 Profit from discontinued operations 0.69 - - Total 96.09 14.06 14.09 Diluted earnings per share Profit from cotinuing operations 91.39 13.45 13.13 Profit from discontinued operations 0.66 - - Total 92.05 13.45 13.13

- 8. APPENDIX Earning Per Share FY2013 FY2014 FY2015 RM RM RM Net profit for the financial year attributable to owners of the Parent (RM) - continuing operations 389,839,892 69,929,925 76,074,430 - discontinued operations 2,822,645 - - 392,662,537 69,929,925 76,074,430 Weighted average number of ordinary shares in issue Ordinary shares in issue as at 1 January 386,552,557 479,651,357 538,298,257 Effect of ordinary shares issed during the year 29,858,404 27,097,602 7,650,033 Effect of trasury shares held (7,792,808) (9,335,085) (6,188,997) Weighted average number of ordinary shares 408,618,153 497,413,874 539,759,293 as at 31 December Basic earning per share (sen) - continuing operations 95.40% 14.06% 14.09% - discontinued operations 0.69% - - 96.10% 14.06% 14.09%

- 9. APPENDIX Share Capital FY2013 FY2014 FY2015 Number of Sharholders Issued and fully paid-up capital : RM498,287,257* RM530,066,257* RM551,613,617* No.of Shareholders : 6,301 6,127 5,966 Share Market Price per Share * : 1.47 1.56 1.41 Equity Book Value per Share : 2.14 1.93 1.88 *Source from : https://finance.yahoo.com/quote/5789.KL/history?period1=1356969600&period2= 1388419200&interval=1d&filter=history&frequency=1d Cash Flow Changes in working capital Trade receivables 27,239,262 18,147,184 16,427,273